The Western Investment Company of Canada Limited (TSXV: WI)

(“

Western” or the “

Corporation”)

today reported its financial and operating results for the three

and six months ended June 30, 2024. Western also announced that it

will delay its Annual General and Special Meeting of shareholders

(the “

Meeting”) to amend the terms of the

transaction with Tevir Capital Corp. ("

Tevir"),

and other affiliates of Paul Rivett, that was previously announced

on March 22, 2024 (the “

Transaction”).

Transaction and Annual General and Special Meeting

UpdateWestern is in the process of amending the

Transaction terms and, once finalized, the new terms will be

announced in a subsequent news release. As such, Western will delay

its Shareholder Meeting which was to take place on August 30th,

2024. Western will provide the details of its revised meeting and

record date in a subsequent news release and post a revised Notice

of Meeting and Record Date to Sedar+ (www.sedarplus.ca) at that

time.

Second Quarter of 2024 Financial ResultsThe

interim financial statements and management’s discussion and

analysis have been filed on SEDAR+. Unless otherwise indicated,

financial figures are expressed in Canadian dollars and comparisons

are to the prior periods ended June 30, 2023.

Western’s associate companies (the

“Associates”) are operating in-line with

expectations as both of the seasonal Associates, GlassMasters and

Foothills, prepare for peak revenues through the summer season.

Equity income from Foothills was significantly lower than in 2023

due to the impact of a one-time gain on the sale of real estate

that positively impacted their results in 2023. Removing this

one-time gain would have resulted in equity earnings from Foothills

comparable to the prior period.

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

($ unless otherwise noted) |

2024 |

|

2023 |

|

% Change |

|

2024 |

|

2023 |

|

% Change |

|

|

Income from equity investments |

442,152 |

|

|

750,033 |

|

|

-41 |

% |

|

170,401 |

|

|

1,098,421 |

|

|

-84 |

% |

|

|

Finance income |

187,329 |

|

|

144,725 |

|

|

29 |

% |

|

377,745 |

|

|

303,074 |

|

|

25 |

% |

|

|

Management fees |

37,500 |

|

|

37,500 |

|

|

0 |

% |

|

75,000 |

|

|

75,000 |

|

|

0 |

% |

|

|

Income |

666,981 |

|

|

932,258 |

|

|

-28 |

% |

|

623,146 |

|

|

1,476,495 |

|

|

-58 |

% |

|

|

Remove extraordinary gain |

|

|

|

|

|

|

|

|

|

|

|

|

(554,934 |

) |

|

|

|

|

|

Normalized Income |

666,981 |

|

|

932,258 |

|

|

-28 |

% |

|

623,146 |

|

|

931,561 |

|

|

-33 |

% |

|

| |

“While a cooler start to the summer impacted both of our

seasonal businesses, Western was still able to post a modest second

quarter, with equity income only slightly below expectations,” said

Scott Tannas, President and Chief Executive Officer of Western.

“Early indications are that the hot weather in July and August will

help offset this with total revenues for the month of July at both

GlassMasters and Foothills increasing 30% and 10% respectively over

the prior year. We continue to make operational investments to

drive long-term growth at our Associates, and all of them are

running very smoothly and close to plan.”

Portfolio Company Report for the Six Months Ended June

30, 2024

Fortress Insurance Company (“Fortress”)

Business at Fortress continues to grow rapidly, with a 44% increase

in gross written premiums from the comparative period of 2023.

Overall, insurance service results at Fortress are comparable to

the comparative period in 2023, as the company manages this growth

with the increase in administrative expenses that come with it.

Fortress is focused on diversification, expanding its product

offerings into liability insurance and the Ontario market. Fortress

is primed to become the key focus of Western.

Key Highlights:

- Gross written premiums grew 44% to $15.8 million in the first

six months of 2024 compared with $11.0 million in the comparative

period 2023.

- 2024 results include three new programs which didn’t exist in

2023. Such programs add geographic diversity and class of insurance

to the portfolio.

- Fortress’s investment portfolio, including cash, grew 20% to

$18.4 million compared to $15.4 million as at June 30, 2023.

For the six months ending June 30, 2024, Western recognized

equity income of $31,604 from Fortress compared to $90,552 in

equity income for the comparative period ended June 30, 2023.

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

Financial results ($) |

2024 |

|

2023 |

|

% Change |

|

2024 |

|

2023 |

|

% Change |

|

|

Insurance revenue |

5,852,846 |

|

|

5,036,753 |

|

|

16 |

% |

|

11,571,504 |

|

|

9,682,871 |

|

|

20 |

% |

|

|

Insurance service result |

888,982 |

|

|

639,083 |

|

|

39 |

% |

|

1,081,466 |

|

|

1,099,380 |

|

|

-2 |

% |

|

|

Investment income (loss) |

222,233 |

|

|

46,750 |

|

|

375 |

% |

|

487,511 |

|

|

355,195 |

|

|

37 |

% |

|

|

Net income (loss) |

52,634 |

|

|

224,752 |

|

|

-77 |

% |

|

111,088 |

|

|

499,153 |

|

|

-78 |

% |

|

|

Gross written premiums1 |

10,559,993 |

|

|

7,262,622 |

|

|

45 |

% |

|

15,777,765 |

|

|

10,981,840 |

|

|

44 |

% |

|

| |

|

1 Supplementary financial measure – total gross

insurance premiums written during the year. |

| |

GlassMasters Autoglass

(“GlassMasters”)GlassMasters continues its growth

trajectory with a 16% increase in sales for the six months ended

June 30th compared to the comparative period in 2023. The company

is seeing growth occurring at current retail and warehouse

locations and the regular addition of new locations. After adding

three locations in 2023, GlassMasters opened its first location in

Winnipeg in the second quarter of 2024, and the company expects to

add a warehouse in Winnipeg in the coming months. GlassMasters

serves as Western’s primary cash flow source, with regular interest

payments occurring on the restructured shareholder notes.

Foothills Creamery

(“Foothills”)Operational and strategic improvements have

given Foothills a significant boost in profitability over the last

couple of years. Gross margins have improved by 2% from 2023. Sales

of ice cream were impacted in the second quarter by an unseasonably

cold and wet spring; however, thanks to this improved margin, gross

profit remains comparable to the prior year. Foothills continues to

innovate with new products and is expanding its customer base. The

company holds high inventory levels, leaving it well-positioned to

meet high summer demand, which should be enhanced in the third

quarter by the good weather experienced in Foothills’ operational

area.

Golden Health Care

(“Golden”)Golden Health Care revenue increased 11%

compared to the comparative period 2023 thanks to improved

occupancy. Inflation has impacted the cost of care, and attracting

staff has been challenging. Management is focused on improving

occupancy and is working to access government funding for senior

care, which would allow more seniors in need to access their

beds.

OutlookThe tremendous growth in

gross written premiums at Fortress enjoyed so far this year is

expected to continue as it navigates its entry into the Ontario

marketplace. Fortress continues to work on adding new product

offerings to its lineup. GlassMasters is expected to continue its

trend of revenue growth, with revenues in July, one of its peak

business months, increasing 30% compared with the same period in

2023. While the cool spring tempered Foothills’ performance, the

return of hot weather though July and August was beneficial,

driving a 10% increase in sales through the month of July compared

to the same period in 2023.

About The Western Investment Company of

Canada Limited Western is a unique publicly traded,

private equity company founded by a group of successful Western

Canadian businesspeople, and dedicated to building and maintaining

ownership in successful Western Canadian companies, and helping

them to grow. Western's shares are traded on the Exchange under the

symbol WI.

For more information on Western, please visit its

website at www.winv.ca.

To add yourself to our email news alert

subscription please visit this link.

CONTACT INFORMATION - The Western Investment

Company of Canada Limited

Scott Tannas President and Chief Executive Officer

(403) 652-0408 stannas@winv.ca

Advisories This news release may

contain certain forward-looking information and statements,

including without limitation, statements pertaining to future

results and plans for Western and its associated companies,

acquisitions, financings and returns. Statements containing the

words: 'believes', 'intends', 'expects', 'plans', 'seeks' and

'anticipates' and any other words of similar meaning are

forward-looking. All statements included herein involve various

risks and uncertainties because they relate to future events and

circumstances beyond Western's control.

The forward-looking statements are based on certain

key expectations and assumptions made by Western, including

expectations and assumptions concerning the ability of Western to

successfully implement its strategic plans and initiatives.

Although Western believes that the expectations and

assumptions on which the forward-looking statements made by Western

are based are reasonable, undue reliance should not be placed on

the forward-looking statements because no assurance can be provided

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, the ability of management to execute its business

strategy, and the impact of general economic conditions in Canada

and the United States. A description of additional assumptions used

to develop such forward-looking information and a description of

risk factors that may cause actual results to differ materially

from forward-looking information can be found in Western's

disclosure documents on the SEDAR+ website at www.sedarplus.ca.

The forward-looking statements contained in this

news release are made as of the date hereof and Western undertakes

no obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws.

This news release also contains financial outlook

information (“FOFI”) about prospective results of

operations and book value, which are subject to the same

assumptions, risk factors, limitations, and qualifications as set

forth in the above paragraphs. FOFI contained in this news release

was made as of the date of this news release to provide information

about management's current expectations and plans relating to the

future. Readers are cautioned that such information may not be

appropriate for any other purpose. Western disclaims any intention

or obligation to update or revise any FOFI contained in this news

release, whether as a result of new information, future events or

otherwise, except as required by applicable law.

“Neither the TSX Venture Exchange nor its

Regulatory Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.”

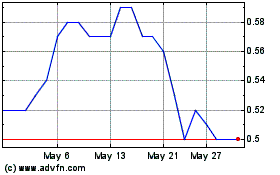

Western Investment Compa... (TSXV:WI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Western Investment Compa... (TSXV:WI)

Historical Stock Chart

From Dec 2023 to Dec 2024