The Western Investment Company of Canada Limited (TSXV: WI)

("

Western" or the "

Corporation"),

today announced a revised financing to replace the multiple voting

structure that was previously announced on March 22, 2024 (the

“

Original Transaction”).

“We have essentially become victims of our own success," said

Scott Tannas, President and CEO of Western. “Securing agreements

for the purchase of 100% of Fortress Insurance, instead of the 51%

outlined as a condition of the Original Transaction, would have

required a complex and costly process in order to close the

Fortress Insurance acquisition. In addition to being costly, this

would have significantly delayed and altered the Original

Transaction. Given the strategic importance to Western of acquiring

100% of Fortress Insurance in the near term, we searched for a

simpler and more efficient financing path. This revised transaction

provides Western with a much clearer and quicker path to achieving

its insurance and investments growth strategy and maintains a

simple capital structure.”

The “Revised Transaction”

- Designed to be simple and fast, with

expedited regulatory approvals.

- Enables Western to increase its

interest in Fortress Insurance Company

("Fortress") from 28.5% to 100%. See "Update on

Increased Interest in Fortress" below.

- Key points:

- $15 million backstop commitment (the

“Backstop”). See “The $15 million Backstop”

below.

- Private placement financing of up to

37,500,000 Units, consisting of one share and one share purchase

warrant (a “Unit”) for gross proceeds of up to $15

million (the “Private Placement”). See “The

Private Placement” below.

- Rights offering of up to $22 million

(the “Rights Offering”) involves the issuance of one right (a

“Right”) for each Western share, that will

commence following the conclusion of the acquisition of Fortress

shares with common shares of Western (the “Common

Shares”). Rights are proposed to be publicly listed and

traded for a period of up to 45 days. In the event that Rights are

fully exercised, an aggregate of $22 million is expected to be

raised for Western. See “The Rights Offering” below.

- The Backstop may be fulfilled by

purchasing shares through either the Private Placement or the

Rights Offering. Tevir Capital Corp. (“Tevir”)

proposes to lead the Backstop with a $5 million commitment.

- Removes Multiple Voting Share

structure which had become a point of concern with regulators.

- Keeps Tevir’s ownership under 20% to

avoid Control Person designation and the incumbent ongoing

requirements.

- Allows Western to engage one or more

brokers to assist with the Rights Offering and the Private

Placement.

- Provides $15 million initial

investment in Western required to fund working capital and provide

acquisition funds. A portion of the proceeds may be used to pay the

cash portion for the purchase of additional shares in Fortress (see

update below).

- Supports Tevir proposal to nominate

at least three of seven members to Western’s board of

directors.

- Maintains all other elements of the

Revised Transaction essentially the same as the Original

Transaction, including Executive Structure with Paul Rivett to

assume CEO role, Scott Tannas to assume the role of Chair of the

Board of Directors, and Management Services / Investment Services

plan.

- Does not require shareholder

approval and therefore eliminates the need for the General and

Special Meeting of Shareholders (the “Meeting”).

Therefore, Western will delay the Meeting until after the Revised

Transaction closes whereupon a new Board of Directors will be

elected.

"Aside from the exclusion of the multiple voting shares our

strategic plan remains the same and we have all the elements we

require for Western’s future success," continued Mr. Tannas. "The

significant interest our shareholders have expressed in the rights

offering as previously conceived is such that we are confident we

can secure the capital we require for our near-term growth

objectives while maintaining a modest level of dilution. "

Transaction Comparison

|

|

OriginalTransaction |

Revised Transaction |

|

Multiple Voting Share structure |

Yes |

No |

|

Able to acquire 100% of Fortress in the near-term |

No |

Yes |

|

Tevir designated Control Person |

Yes |

No |

|

Minimum capital requirements ($ millions) |

20 |

15 |

|

Rights issued per Common Share |

2.5 |

1 |

|

Paul Rivett appointed to CEO |

Yes |

Yes |

|

Scott Tannas appointed to Chair of the Board of Directors |

Yes |

Yes |

|

Management Services / Investment Services Plan |

Yes |

Yes |

|

Tevir nominees to Board |

4 |

3 |

|

Board Seats |

7 |

7 |

|

|

|

|

Transaction is Revised to Remove Multiple Voting

Shares Western has revised its proposed transaction with

Tevir that was previously announced on March 22, 2024 (the

“Revised Transaction”). The Revised Transaction

does not incorporate multiple voting shares. The removal of

multiple voting shares should help expedite the completion of the

Revised Transaction.

“The intention of the multiple voting shares was to protect

Western from inopportune takeover bids,” said Paul Rivett. “There

is a benefit to all shareholders working from an even playing field

which ensures all shareholders’ interests are completely aligned.

We are excited to complete this transaction and to begin executing

on our strategic plan to deliver value to Western’s shareholders

with all the essential elements of our success in place.”

The $15 Million BackstopTevir is expected to

provide $5 million to support the Backstop, subject to several

conditions, including assembling a minimum $10 million of

additional funds from other accredited investors that are expected

to participate in the Backstop. Backstop participants would either

fulfill their Backstop commitment through the Private Placement or

the exercise of unused rights in the Rights Offering. Participants

that provide a backstop guarantee for the Rights Offering, may be

provided with bonus warrants for up to 25% of the Common Shares

that are guaranteed in the backstop for the Rights Offering,

subject to TSX Venture Exchange (the “TSXV”)

policies.

The Private PlacementWestern plans to raise up

to $15 million through a private placement financing to accredited

investors of up to 37,500,000 units at a price of $0.40 per Unit.

Each Unit will consist of one Common Share of the Corporation and

one warrant to purchase a Common Share (the

“Warrant”), with each Warrant exercisable to

purchase one additional Common Share for a period of 5 years from

the date of closing at an exercise price of $0.47. Western may

engage one or more brokers to act as agent for the Private

Placement. The Private Placement is subject to approval of the

TSXV.

The Rights Offering The previous transaction

structure contemplated a rights offering (the “Rights

Offering”) of 2.5 rights to each existing eligible Western

shareholder by way of a rights offering circular. Western is

updating its plans to pursue a more modest Rights Offering whereby

each eligible shareholder as of the record date for such offering

(the “Rights Record Date”) will be issued one

right (the "Right") for each Common Share held on

the Rights Record Date, entitling that holder to purchase one

Common Share for each whole one Right held at a price of $0.40 per

Common Share for a period of 45 days. The Rights Offering will also

include Fortress shareholders who convert into Western shares. The

Rights will be freely tradeable on the TSXV for a period of 45

days. Western may engage one or more brokers to act as solicitation

agent in the Rights Offering.

The Rights Offering is intended to provide existing Western

shareholders with a mechanism to ensure their economic interest in

the Corporation is not diluted. The Revised Transaction results in

lower dilution to Western’s existing shareholders while delivering

all the capital required for Western’s near-term growth

objectives.

The definitive terms of the Rights Offering, including

the proposed Rights Record Date, will be set forth in a subsequent

news release. The Rights Offering (including the subscription price

and any listing of the Rights on the TSXV) is subject to applicable

regulatory approval, including approval of the TSXV.

Use of ProceedsIf both the Rights Offering and

Private Placement are fully subscribed Western could raise proceeds

of up to $37 million. The Company plans to use the proceeds from

the Private Placement and the Rights Offering to fund working

capital and provide funds for acquisitions. A portion of the

proceeds may be used to pay the cash portion for the purchase of

additional shares in Fortress (see below).

Update on Increased Interest in FortressAs

previously announced, Western has secured agreements in aggregate

to increase its share ownership in Fortress from its current 28.5%

position to 100% (the “Share Purchases”). These

share purchase agreements with other holders of Fortress shares,

which are conditional on approval by the TSXV, will be settled

primarily through the issuance of approximately 27 million Common

Shares of Western at a price of $0.40 per share, with the remainder

settled in cash. All of the Share Purchases are arm’s length

transactions, except as described below. The Share Purchases are

expected to close before the end of the year subject to customary

approvals and conditions.

One of the Share Purchases could be deemed a “related party

transaction” because one of the vendors selling Fortress shares to

Western is a private company owned by an independent director of

Western. The private company would be entitled to receive 944,762

Common Shares in exchange for selling its interest (less than 5%)

in Fortress shares to Western. The proposed Share Purchase is

exempt from the formal valuation and minority shareholder approval

requirements of Multilateral Instrument 61-101 (pursuant to

subsections 5.5(a) and 5.7(1)(a)) as neither the fair market value

of the Common Shares of Western to be distributed to, nor the

consideration received from, interested parties exceeds 25% of

Western's market capitalization.

Postponed MeetingThe Revised Transaction does

not require shareholder approval and therefore eliminates the need

for the General and Special Meeting of Shareholders scheduled for

August 30, 2024. Therefore Western proposes to delay the Meeting

until after the Revised Transaction closes whereupon a new Board of

Directors will be elected. Western will provide the details of its

revised meeting and record date in a subsequent release and post a

revised Notice of Meeting and Record Date to Sedar+

(www.sedarplus.ca) at that time.

Investor Rights AgreementThe terms of the

Revised Transaction will also provide Tevir with certain investor

rights from time to time to nominate up to three individuals to the

Board of Directors of Western and customary participation and

registration rights in future Western financings, subject to

certain terms and conditions, including that Tevir holds at least

2.5% of the outstanding Common Shares (including any securities

convertible into Common Shares held by Tevir or its

affiliates).

Tevir Management ContractAs previously

contemplated, as part of the Revised Transaction, Western will

enter into a contract with Tevir where Tevir will provide Western

with access to legal, financial, business development, Toronto

office space, and other expert and clerical assistance for a fixed

fee of $500,000 per year.

Tevir Investment Management ContractAs

previously contemplated, as part of the Revised Transaction,

Western and its subsidiaries will enter into contracts with Tevir

where Tevir will provide certain investment management

services.

Stock ConsolidationAt the Shareholders Meeting,

Western will also put forward a proposal for shareholders to

approve a consolidation of Common Shares on a basis of up to 1 for

10. Any decision to implement a stock consolidation would remain at

the discretion of Western's board of directors.

Webcast - Join Scott Tannas and Paul Rivett as they

discuss the Revised TransactionSeptember 3, 2024

at 8:00 AM Mountain Time, 10:00 AM Eastern TimeOn Tuesday,

September 3, 2024, please join Scott Tannas, President and CEO of

Western, and Paul Rivett, Founder and President of Tevir, on a

webcast where they will discuss the Revised Transaction and related

items. Participants of the live event will also have the

opportunity to ask questions.

The webcast will take place at 10:00 AM Eastern Time, 9:00 AM

Central Time, 8:00 AM Mountain Time, and 7:00 AM Pacific Time.

Participants can access the webcast using the link below:

Webcast Link

https://events.teams.microsoft.com/event/5b3728e2-0ccb-4256-9892-620f8f3a84b3@3149c8f2-095e-4d5e-b9cc-dd2063820f76

Following the webcast a recording of the event will be available

at the link above.

About The Western Investment Company of

Canada Limited Western is a unique publicly traded,

private equity company founded by a group of successful Western

Canadian businesspeople, and dedicated to building and maintaining

ownership in successful Western Canadian companies, and helping

them to grow. Western's shares are traded on the Exchange under the

symbol WI.

For more information on Western, please visit its website at

www.winv.ca.

To add yourself to our email news alert subscription please

visit this link.

CONTACT INFORMATION - The Western Investment Company of Canada

Limited

Scott Tannas President and Chief Executive Officer (403)

652-0408 or stannas@winv.ca

Advisories

Completion of the Revised Transaction is subject to a number of

conditions. There can be no assurance that the Revised Transaction

will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the

management information circular to be prepared in connection with

the Revised Transaction, any information released or received with

respect to the Revised Transaction may not be accurate or complete

and should not be relied upon. Trading in the securities Western

should be considered highly speculative.

The TSXV has in no way passed upon the merits of the proposed

transactions and has neither approved nor disapproved the contents

of this news release.

This document contains forward-looking statements. More

particularly, this document contains statements concerning: the

completion of the Revised Transaction and the other proposed

transactions described in this news release, including the Share

Purchases, and the appointment of the new CEO and additional

directors; and the use of proceeds from the Rights Offering.

Readers are cautioned that the foregoing list of factors should not

be construed as exhaustive.

The forward-looking statements are based on certain key

expectations and assumptions made by Western, including

expectations and assumptions concerning the ability of Western to

successfully implement its strategic plans and initiatives, the

timing of receipt of required shareholder and regulatory approvals

(including TSXV approval) and third party consents and the

satisfaction of other conditions to the completion of the Revised

Transaction and Share Purchases.

Although Western believes that the expectations and assumptions

on which the forward-looking statements made by Western are

reasonable, undue reliance should not be placed on the

forward-looking statements because no assurance can be provided

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks that required shareholder, TSXV, regulatory and

third party approvals and consents are not obtained on terms

satisfactory to the parties within the timelines provided for, or

at all, and risks that other conditions to the completion of the

Revised Transaction are not satisfied on the required timelines or

at all, the ability of management to execute its business strategy,

and the impact of general economic conditions in Canada and the

United States. A description of additional assumptions used to

develop such forward-looking information and a description of risk

factors that may cause actual results to differ materially from

forward-looking information can be found in Western's disclosure

documents on the SEDAR+ website at www.sedarplus.ca.

The forward-looking statements contained in this news release

are made as of the date hereof and Western undertakes no obligation

to update publicly or revise any forward-looking statements or

information, whether as a result of new information, future events

or otherwise, unless so required by applicable securities laws.

This news release also contains financial outlook information

("FOFI") about prospective results of operations

and book value, which are subject to the same assumptions, risk

factors, limitations, and qualifications as set forth in the above

paragraphs. FOFI contained in this news release was made as of the

date of this news release to provide information about management's

current expectations and plans relating to the future. Readers are

cautioned that such information may not be appropriate for any

other purpose. Western disclaims any intention or obligation to

update or revise any FOFI contained in this news release, whether

as a result of new information, future events or otherwise, except

as required by applicable law.

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy securities in the United States,

nor shall there be any sale of the securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful. The

Rights and underlying Common Shares and the Common Shares being

offered have not been, nor will they be, registered under the 1933

Act or under any U.S. state securities laws, and may not be offered

or sold in the United States absent registration or an applicable

exemption from the registration requirements of the 1933 Act, as

amended, and applicable state securities laws.

"Neither the TSX Venture Exchange nor its Regulatory

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release."

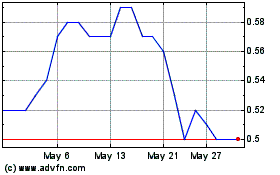

Western Investment Compa... (TSXV:WI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Western Investment Compa... (TSXV:WI)

Historical Stock Chart

From Dec 2023 to Dec 2024