Zenyatta Acquires 100% Ownership of 'Vein Type' Graphite Deposit from Cliffs Natural Resources

22 November 2012 - 12:57AM

Marketwired Canada

Zenyatta Ventures Ltd. ("Zenyatta" or "Company") (TSX VENTURE:ZEN) is pleased to

announce that the Company has reached an agreement with Cliffs Natural Resources

Exploration Canada Inc., an affiliate of Cliffs Natural Resources Inc.

(NYSE:CLF)(Paris:CLF) ("Cliffs"), for the acquisition of 100% of the Albany

graphite deposit.

Zenyatta has recently exercised its right and acquired an 80% interest in a

claim block (4F) by having spent $10 million on exploration over the last 2

years at the Albany project. The Company has now acquired Cliffs' remaining 20%

interest (total of 100%) in the claim block referred to as 4F, which holds the

Albany graphite deposit ("Block 4F Claims"). Pursuant to the terms of the

transaction, Zenyatta and Cliffs agree to the following with respect to the

Block 4F Claims:

a. Zenyatta will issue to Cliffs (or its designated affiliate) a total of

1,250,000 shares as follows: (i) 500,000 shares upon signing the

agreement; (ii) 250,000 shares to be issued upon completion of a pre-

feasibility study; and (iii) 500,000 shares to be issued upon completion

of a feasibility study; and

b. Zenyatta will grant Cliffs a net smelter return royalty of 0.75% on the

Block 4F Claims, of which 0.5% can be purchased at any time for

$500,000.

Aubrey Eveleigh, President and CEO of Zenyatta, stated "This transaction is of

strategic importance to our Company. We now own 100% of the Albany graphite

deposit and, more importantly, have eliminated the back-in right that Cliffs

held under the original agreement. This allows Zenyatta the liberty of

negotiating with another party, especially an end user of graphite, at any time

along the development path of our graphite deposit."

Zenyatta is developing a rare 'vein-type' graphite deposit it discovered in 2011

in northeastern Ontario, Canada. It is the only and largest 'vein type' graphite

deposit under development in the world. Recently, a first pass beneficiation

test at SGS Canada Inc. ("Lakefield") demonstrated a simple concentration and

leaching process capable of producing a 97.2% C (total) graphite product from a

rough concentrate. Mineralogical work shows the graphite material to be very

simple and contains insignificant amounts of undesirable material. Work is

on-going to target ultra-high purity levels of greater than 99.0% C with results

from a second series of tests expected soon. The Albany deposit is located 30km

north of the Trans Canada Highway, power line and natural gas pipeline near the

communities of Constance Lake First Nation and Hearst. A rail line is located

70km away and an all-weather road approximately 4-5km from the graphite deposit.

The deposit is near surface, underneath glacial till overburden.

Prior to the sale of the Block 4F Claims, the Albany Project was subject to an

option and joint venture agreement between the parties dated November 2, 2010

(the "First Amended Albany Agreement"). This agreement is fully described in the

prospectus of Zenyatta dated December 15, 2010 and filed on www.sedar.com.

Concurrent with the sale of the Block 4F Claims, the parties entered into an

amended option agreement dated November 21, 2012 (the "Second Amended Albany

Agreement") with respect to the other claims in the Albany Project (the "Other

Claims"). The primary amendment to the First Amended Albany Agreement is a

variation of the earn-in expenditure obligations. The following is a summary of

the provisions of the Second Amended Albany Agreement which is filed on

www.sedar.com:

-- Zenyatta Second Option to Increase Ownership from 25% to 80%. Pursuant

to the Second Amended Albany Agreement the Company currently has a 25%

interest in the Other Claims and an option (the "Second Option") to

acquire a further 55% interest in the Other Claims. In order to exercise

the Second Option, the Company must carry out and complete not less than

3,000 meters of diamond drilling on targets located on the Other Claims

and sample and analyse the drill core prior to December 31, 2014,

provided that if prior to December 31, 2014, Zenyatta has not completed

at least 3,000 meters of such drilling and Cliffs determines that

targets should be drilled on the Other Claims located outside of the

agreed targets, then Zenyatta will complete such drilling as requested

by Cliffs on other targets on the Other Claims and sample and analyze

the drill core, all prior to December 31, 2014. In addition, Zenyatta

shall pay to Cliffs $55,000 on or before July 1, 2013. Although the

Company is committed to this drilling program and intends to exercise

the Second Option at this time, if the Company does not exercise the

Second Option, the Parties shall associate as a joint venture pursuant

to the terms of the Second Amended Albany Agreement in which the Company

shall have a 25% participating interest and Cliffs shall have a 75%

participating interest.

-- Remaining Terms. The First Amended Albany Agreement provided for the

following all of which have been adopted by the Second Amended Albany

Agreement on the Other Claims: 1) Claw Back Right by exercisable by

Cliffs upon exercise of Second Option. 2) Sole Funding by the Company

after exercise of the Second Option by the Company in the event that

Cliffs does not exercise the Claw-Back Right. 3) Claw Back Right

exercisable by Cliffs upon satisfaction of Sole Funding Obligation. 4)

Cliffs retains its right of first refusal and the right to nominate a

director. 5) Eveleigh Geological Consulting Inc. ("EGC") retains certain

benefits regarding cash payments upon reaching milestones and 2.0% NSR

royalty, 1% of which can be purchased at anytime for $1,000,000 (EGC is

a geological consulting company owned by Aubrey J. Eveleigh, the

President, Chief Executive Officer and a director of the Company). These

benefits were negotiated in 2010 by the parties in recognition of the

initiative taken by EGC in recognizing the geological concept and the

compilation of data which was the basis for staking claims over two

years ago when the Albany project was first established.

As noted above and for the purposes of National Instrument 62-103 early warning

reporting, Cliffs Natural Resources Exploration Inc., an affiliate of Cliffs,

was issued 500,000 shares of Zenyatta pursuant to the terms of a purchase

agreement between the parties that governed the sale of the interest in the

Block 4F Claims. In addition, Cliffs (or its designated affiliate) has the right

to receive up to an additional 750,000 Zenyatta shares (on pre-feasibility and

feasibility studies) pursuant to the sale of the interest in the Block 4F

Claims. Before the sale of the interest in the Block 4F Claims, Cliffs (and its

affiliates) owned a total of 4,675,000 shares of Zenyatta and 3,200,000 common

share purchase warrants (the "Warrants"); 2,200,000 of which entitle the holder

to acquire one common share of Zenyatta for $1.00 until December 23, 2012, and

1,000,000 of which entitle the holder to acquire one common share of Zenyatta

for $1.50 until December 23, 2015. Cliffs (and its affiliates) now hold

5,175,000 common shares of Zenyatta, representing 12.7% of Zenyatta's

outstanding shares. In the event that the Warrants are fully exercised and all

shares are issued pursuant to the Block 4F Claims purchase agreement, Cliffs

(and its affiliates) would hold 9,125,000 Zenyatta shares, representing

approximately 20.5% of the total issued and outstanding shares of Zenyatta

calculated on a partially diluted basis and 15.4% on a fully diluted basis.

Cliffs (and its affiliates) hold the shares and Warrants of Zenyatta for

investment purposes and may, from time to time, acquire additional securities of

Zenyatta or dispose of such securities as it may deem appropriate. Cliffs

Natural Resources Exploration Inc.'s address is c/o Cliffs Natural Resources

Inc., 200 Public Square, Suite 3300, Cleveland, OH 44114, and a copy of the

applicable early warning report can be obtained from counsel to Cliffs Natural

Resources Exploration Inc., Lawson Lundell LLP, Attention Khaled Abdel-Barr at

(604) 631-9233 or under Zenyatta's profile on SEDAR at www.sedar.com.

Cliffs (inclusive of its affiliates) is a "related party" of Zenyatta as it is a

holder of 10% or more of the issued and outstanding shares of Zenyatta and,

thereby, the sale of the interest in the Block 4F Claims is a "related party

transaction", as such terms are defined by Multilateral Instrument 61-101-

Protection of Minority Security Holders in Special Transactions ("MI 61-101").

In addition, Aubrey J. Eveleigh, President, Chief Executive Officer and a

Director of the Company is a "related party" by virtue of his interest in the

Second Amended Albany Agreement. MI 61-101 requires Zenyatta, in the absence of

exemptions, to obtain a formal valuation for, and minority shareholder approval

of, the "related party transaction". Zenyatta is relying on the exemptions from

the formal valuation and minority approval requirements of MI 61-101 pursuant to

which a formal valuation and minority approval are not required in the event

that at the time the transaction is agreed to, neither the fair market value of

the subject matter of, nor the fair market value of the consideration for, the

transaction, insofar as it involves interested parties, exceeds 25 per cent of

Zenyatta's market capitalization. The purchase of the interest in the Block 4F

Claims was approved by the directors of Zenyatta, all of whom are independent of

Cliffs.

Zenyatta now has 40,597,313 common shares issued and outstanding with a total of

59,354,862 shares on a fully diluted basis. Mr. Aubrey Eveleigh, P.Geo.,

President and CEO, is the "Qualified Person" under NI 43-101 and has reviewed

the technical information contained in this news release. To find out more on

Zenyatta Ventures Ltd., please visit website www.zenyatta.ca.

This News Release includes certain "forward-looking statements". These

statements are based on information currently available to the Company and the

Company provides no assurance that actual results will meet management's

expectations. Forward-looking statements include estimates and statements that

describe the Company's future plans, objectives or goals, including words to the

effect that the Company or management expects a stated condition or result to

occur. Forward-looking statements may be identified by such terms as "believes",

"anticipates", "expects", "estimates", "may", "could", "would", "will", "should"

or "plan". Since forward-looking statements are based on assumptions and address

future events and conditions, by their very nature they involve inherent risks

and uncertainties. Actual results relating to, among other things, results of

exploration, project development, reclamation and capital costs of the Company's

mineral properties, and the Company's financial condition and prospects, could

differ materially from those currently anticipated in such statements for many

reasons such as: changes in general economic conditions and conditions in the

financial markets; changes in demand and prices for minerals; litigation,

legislative, environmental and other judicial, regulatory, political and

competitive developments; technological and operational difficulties encountered

in connection with the activities of the Company; and other matters discussed in

this news release. This list is not exhaustive of the factors that may affect

any of the Company's forward-looking statements. These and other factors should

be considered carefully and readers should not place undue reliance on the

Company's forward-looking statements. The Company does not undertake to update

any forward-looking statement that may be made from time to time by the Company

or on its behalf, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Zenyatta Ventures Ltd.

807-346-1660

info@zenyatta.ca

www.zenyatta.ca

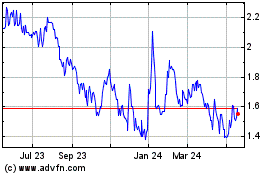

Zentek (TSXV:ZEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

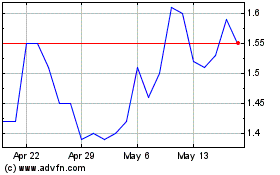

Zentek (TSXV:ZEN)

Historical Stock Chart

From Jan 2024 to Jan 2025