Tech Stocks Drag Asian Markets Down

06 December 2017 - 4:52PM

Dow Jones News

By Kenan Machado

The selloff in Asia-Pacific equities deepened in midday trading,

as the weakness in commodity prices added to the slide in tech

stocks.

Analysts have attributed the declines of the past week to

profit-taking in parts of the stock market that scored big gains

this year.

"The mind-set now is so used to low volatility that a healthy

correction of 2%-3% is making people talk," said Paul Kitney, chief

equity strategist for Asia Pacific at Daiwa Capital Markets.

Hong Kong's Hang Seng Index has fallen more than 5% from its

recent 10-year high, cooling a market that has been among the

world's best performers in 2017. The index was down 1.3%

midday.

Some of that market's biggest gainers were among its biggest

losers Wednesday.

Sunny Optical, a maker of lenses and optical-related products,

was recently 7.6% lower, while Geely Automobile was down 7.3%. Both

stocks have more than tripled this year. Apple supplier AAC

Technologies, which has doubled this year, was off 6.6%.

Japanese stocks extended losses after the midday break, with the

Nikkei falling as much as 2.2% amid the yen's strength. The U.S.

dollar fell to Yen112.15 from Yen112.60 earlier.

The weakness in tech stocks and the up-to-3% overnight slide in

metals prices added to pressure Wednesday.

But Australia's S&P/ASX 200 held up relatively well despite

declines of about 2% for mining companies Rio Tinto and BHP

Billiton. The index closed down 0.4%, as country's big banks

rebounded around 0.5%.

Broadly speaking, "we are starting to see a little bit of

diversification outside of the highly concentrated names" as the

year draws to an end, Mr. Kitney said, adding that the recent

pullback in some hot areas, notably tech, was healthy.

The tech-heavy Taiex index in Taiwan was recently down 1.6% and

South Korea's Kospi declined 1.1%.

Following tech-driven stock gains this year, investors have

become skittish about tax implications from U.S. legislation, said

Douglas Morton, head of research for Asia at Northern Trust Capital

Markets. But "little has changed fundamentally in our opinion."

Still, investors have been cautious this week as Republicans

continue work on the tax policy.

S&P 500 futures were recently down 0.1%.

Elsewhere, oil futures were down about 0.4% in Asia and the U.S.

gasoline benchmark fell 1% after an industry group said inventories

jumped in America last week.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

December 06, 2017 00:37 ET (05:37 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

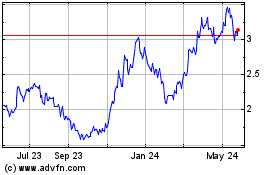

AAC Technologies (PK) (USOTC:AACAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

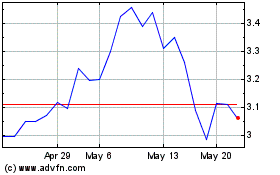

AAC Technologies (PK) (USOTC:AACAY)

Historical Stock Chart

From Feb 2024 to Feb 2025