Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

24 February 2024 - 11:22AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

(Amendment

No. 5)

Under

the Securities Exchange Act of 1934

Ambase

Corp.

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

023164106

(CUSIP

Number)

Eric

Shahinian

Camac

Partners, LLC

350

Park Avenue, 13th Floor

New

York, NY 10022

914-629-8496

(Name,

Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

2/21/2024

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule

13d-7 for other parties to whom copies are to be sent.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Camac

Partners, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

3,528,430 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

3,528,430 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

3,528,430 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

8.7% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

OO |

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Camac

Capital, LLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

3,528,430 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

3,528,430 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

3,528,430 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

8.7% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

OO |

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Camac

Fund, LP |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

WC |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

3,528,430 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

3,528,430 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

3,528,430 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

8.7% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

PN |

| 1 |

|

NAMES

OF REPORTING PERSONS |

| |

|

Eric

Shahinian |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

| |

|

(a)

☐ |

| |

|

(b)

☐ |

| 3 |

|

SEC

USE ONLY |

| |

|

|

| 4 |

|

SOURCE

OF FUNDS (SEE INSTRUCTIONS) |

| |

|

AF |

| 5 |

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION |

| |

|

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

|

SOLE

VOTING POWER |

| |

|

0 |

| 8 |

|

SHARED

VOTING POWER |

| |

|

3,528,430 |

| 9 |

|

SOLE

DISPOSITIVE POWER |

| |

|

0 |

| 10 |

|

SHARED

DISPOSITIVE POWER |

| |

|

3,528,430 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

3,528,430 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS) |

| |

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

8.7% |

| 14 |

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS) |

| |

|

IN |

Item 1. Security and Issuer

This

Amendment No. 5 (this “Amendment”) amends and supplements the Schedule 13D filed with the Securities and Exchange

Commission on January 7, 2020 (the “Schedule 13D”) and as amended on February 3, 2021, May 31, 2023, August 29, 2023,

and February 20, 2024 by the Reporting Person with respect to the Common Stock of Ambase Corp. (the “Issuer” or the

“Company”). Information reported in the Schedule 13D remains in effect except to the extent that it is amended,

restated, or superseded by information contained in this Amendment. Capitalized terms used but not defined in this Amendment have

the respective meanings set forth in the Schedule 13D. All references in the Schedule 13D and this Amendment to the

“Statement” will be deemed to refer to the Schedule 13D as amended and supplemented by this Amendment.

Item 3. Source and Amount of Funds or Other Consideration

Item

3 is hereby amended by deleting Item 3 of Schedule 13D in its entirety and replacing it with the following:

The

Shares purchased by Camac Fund were purchased with working capital (which may, at any given time, include margin loans made by brokerage

firms in the ordinary course of business). The aggregate purchase price of the 3,528,430 Shares beneficially owned by Camac Fund

is approximately $564,549, including brokerage commissions.

Item 5. Interest in Securities of the Issuer

Item

5 is hereby amended by deleting Item 5 of Schedule 13D in its entirety and replacing it with the following:

| |

(a) |

The aggregate percentage

of shares of Common Stock reported owned by each person named herein is based upon 40,737,751 shares of Common Stock outstanding, which

is the total number of shares of Common Stock reported outstanding as of the Issuer’s Quarterly Report on Form 10-Q, filed with

the Securities and Exchange Commission on November 9, 2023. |

As

of the close of business on the date hereof, Camac Fund beneficially owned 3,528,430 shares of Common Stock.

Percentage:

Approximately 8.7%

| |

(b) |

By

virtue of their respective positions with Camac Fund, each of Camac Partners, Camac Capital, and Eric Shahinian may be deemed to

have shared power to vote and dispose of the Shares reported owned by Camac Fund. |

| |

|

|

| |

(c) |

Schedule

A annexed hereto lists all transactions in securities of the Issuer by the Reporting Persons during the past 60 days. |

| |

|

|

| |

(d) |

No

person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from,

or proceeds from the sale of, the shares of Common Stock. |

| |

|

|

| |

(e) |

Not

applicable. |

Item 7. Material to be Filed as Exhibits

SIGNATURES

After

reasonable inquiry and to the best of our knowledge and belief, the undersigned certify that the information set forth in this statement

is true, complete and correct.

Dated:

February 23, 2024

| Camac

Partners, LLC |

|

| |

|

| By: |

Camac

Capital, LLC, |

|

| its

general partner |

|

| By: |

/s/

Eric Shahinian |

|

| |

Eric

Shahinian |

|

| |

Managing

Member of the GP |

|

| Camac

Capital, LLC |

|

| |

|

| By: |

/s/

Eric Shahinian |

|

| |

Eric

Shahinian |

|

| |

Managing

Member |

|

| By: |

/s/

Eric Shahinian |

|

| |

Eric

Shahinian |

|

| Camac

Fund, LP |

|

| |

|

| By: |

Camac

Capital, LLC, |

|

| its

general partner |

|

| By: |

/s/

Eric Shahinian |

|

| Name: |

Eric

Shahinian |

|

| Title:

|

Managing

Member of the GP |

|

SCHEDULE

A

Open

Market Transactions in the Shares by the Reporting Persons During the Past 60 Days

| Date of Sale | |

Shares of

Common Stock Sold | | |

Price Per

Share ($) | |

| | |

| | |

| |

| CAMAC FUND, LP | |

| | | |

| | |

| | |

| | | |

| | |

| 02/21/2024 | |

| 523,635 | | |

$ | 0.2196 | |

| 02/22/2024 | |

| 175,400 | | |

$ | 0.2190 | |

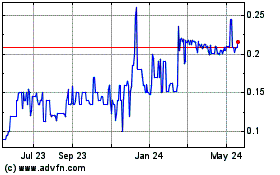

Ambase (PK) (USOTC:ABCP)

Historical Stock Chart

From Nov 2024 to Dec 2024

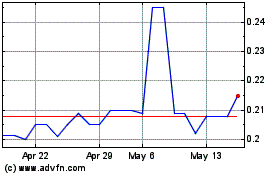

Ambase (PK) (USOTC:ABCP)

Historical Stock Chart

From Dec 2023 to Dec 2024