0001762359FALSE00017623592024-12-022024-12-020001762359acrg:ClassESubordinateVotingSharesMember2024-12-022024-12-020001762359acrg:ClassDSubordinateVotingSharesMember2024-12-022024-12-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 2, 2024

Commission file number 000-56021 | | |

|

| ACREAGE HOLDINGS, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | |

| British Columbia, Canada | | 98-1463868 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 366 Madison Ave, 14th floor | New York | New York | 10017 |

(Address of Principal Executive Offices) | | (Zip Code) |

(646) 600-9181

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class E subordinate voting shares | | ACRHF | | OTC Markets Group Inc. |

| Class D subordinate voting shares | | ACRDF | | OTC Markets Group Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 2, 2024, Acreage Holdings, Inc. (the “Company” or “Acreage”) issued a press release announcing an update with regard to its corporate transaction and its expectation that Canopy USA, LLC will complete its acquisition of Acreage on December 9, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | |

|

| |

| Date: December 5, 2024 | /s/ Corey Sheahan |

| Corey Sheahan |

| Executive Vice President, General Counsel and Secretary |

Canopy Growth and Acreage Provide Update on Closing Timeline

Smiths Falls, ON, and New York, NY December 2, 2024 – Canopy Growth Corporation (“Canopy Growth”) (TSX:WEED, NASDAQ:CGC), a world-leading cannabis company dedicated to unleashing the power of cannabis to improve lives, and Acreage Holdings, Inc. (“Acreage”) (CSE: ACRG.A.U, ACRG.B.U)(OTCQX: ACRHF, ACRDF), a vertically integrated, multi-state operator of cannabis cultivation and retailing facilities in the U.S., are pleased to announce that it is anticipated that Canopy USA, LLC (“Canopy USA”) will complete its acquisition of Acreage on or around December 9, 2024, subject to the satisfaction or waiver of closing conditions set out in the Arrangement Agreements (as defined below).

Canopy Growth and Acreage are party to an arrangement agreement dated April 18, 2019, as amended (the “Fixed Share Arrangement Agreement”), relating to the proposed acquisition (the “Fixed Share Acquisition”) of all issued and outstanding Class E subordinate voting shares of Acreage (the “Fixed Shares”) pursuant to a plan of arrangement under the Business Corporations Act (British Columbia). The Fixed Share Acquisition is anticipated to occur immediately after the acquisition of the Class D subordinate voting shares of Acreage (the “Floating Shares”) pursuant to a plan of arrangement under the Business Corporations Act (British Columbia) in accordance with the arrangement agreement (the “Floating Share Arrangement Agreement” together with the Fixed Share Arrangement Agreement, the “Arrangement Agreements”) dated October 24, 2022, as amended, among Canopy Growth, Acreage and Canopy USA (together with the Fixed Share Acquisition, the “Acquisitions”). Upon the closing of the Acquisitions, Canopy USA will own 100% of the issued and outstanding shares of Acreage.

As previously announced by Acreage, if the price of the common shares of Canopy Growth (the “Canopy Shares”) on the Nasdaq does not go above US$5.00 prior to closing of the Acquisitions (calculated in the manner prescribed in the Fixed Share Arrangement Agreement), holders of Fixed Shares will not receive any consideration in exchange for their Fixed Shares.

A letter of transmittal with respect to the Fixed Share Acquisition and the Floating Share Acquisition will be mailed to registered Acreage shareholders. The letters of transmittal have been filed by Acreage under Acreage’s profile on SEDAR+ at www.sedarplus.ca and with the U.S. Securities and Exchange Commission through EDGAR at www.sec.gov/edgar.

All registered Acreage shareholders with physical certificate(s) or DRS statement(s) will be required to send their certificate(s) or DRS statement(s) representing their Fixed Shares and/or Floating Shares with a completed letter of transmittal to the Company’s transfer agent, Odyssey Trust Company (“Odyssey”), in accordance with the instructions provided in the applicable letter of transmittal. Shareholders who hold their Fixed Shares and/or Floating Shares through a broker or other intermediary and do not have Acreage shares registered in their name will not need to complete the applicable letter(s) of transmittal. Such shareholders should contact their broker or other intermediary to arrange for the deposit of their DRS statement(s) or certificate(s) representing their Acreage shares.

As a result of the labour dispute at Canada Post, registered Acreage shareholders are encouraged to contact Odyssey with any questions by email at shareholders@odysseytrust.com in the event that registered Acreage shareholders have not received copies of their DRS statement(s) or certificate(s) representing their Canopy Shares following the closing of the Acquisitions and completion and delivery of their letter of transmittal to Odyssey.

Copies of the Floating Share Arrangement Agreement and the Fixed Share Arrangement Agreement may be accessed under Acreage’s profile on SEDAR+ at www.sedarplus.ca and with the U.S. Securities and Exchange Commission through EDGAR at www.sec.gov/edgar.

Canopy Growth Contact Details:

Nik Schwenker

Vice President, Communications

Nik.Schwenker@canopygrowth.com

Tyler Burns

Director, Investor Relations

Tyler.Burns@canopygrowth.com

Acreage Contact Details:

Philip Himmelstein

Chief Financial Officer

Investors@acreageholdings.com

About Canopy Growth

Canopy Growth is a world leading cannabis company dedicated to unleashing the power of cannabis to improve lives.

Through an unwavering commitment to consumers, Canopy Growth delivers innovative products with a focus on premium and mainstream cannabis brands including Doja, 7ACRES, Tweed, and Deep Space, in addition to category defining vaporizer technology made in Germany by Storz & Bickel.

Canopy Growth has also established a comprehensive ecosystem to realize the opportunities presented by the U.S. THC market through an unconsolidated, non-controlling interest in Canopy USA. Canopy USA has closed the acquisitions of approximately 77% of the shares of Lemurian, Inc. (“Jetty”) and 100% of the Wana entities that make up Wana Brands, being Wana Wellness, LLC, The CIMA Group, LLC and Mountain High Products, LLC. Jetty owns and operates Jetty Extracts, a California-based producer of high- quality cannabis extracts and pioneer of clean vape technology, and Wana Brands is a leading North American edibles brand. The option to acquire Acreage, a vertically integrated multi-state cannabis operator with principal operations in densely populated states across the Northeast and Midwest, has also been exercised.

Beyond its world-class products, Canopy Growth is leading the industry forward through a commitment to social equity, responsible use, and community reinvestment – pioneering a future where cannabis is understood and welcomed for its potential to help achieve greater well-being and life enhancement.

For more information visit www.canopygrowth.com.

About Acreage

Acreage is a multi-state operator of cannabis cultivation and retailing facilities in the U.S., including its national retail store brand, The Botanist. With its principal address in New York City, Acreage’s wide range of national and regionally available cannabis products include the award-winning brands The Botanist and Superflux, the Prime medical brand in Pennsylvania, and others. Acreage has focused on building and scaling operations to create a seamless, consumer-focused, branded experience. Learn more at www.acreageholdings.com.

References to information included on, or accessible through, the Canopy Growth or Acreage website do not constitute incorporation by reference of the information contained at or available through such websites, and you should not consider such information to be part of this press release.

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Often, but not always, forward-looking statements and information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Canopy Growth, Acreage or their respective subsidiaries to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements or information contained in this news release. Examples of such statements and uncertainties include statements with respect to the anticipated closing date of the Acquisitions, the price of the Canopy Shares, the consideration to be issued to the holders of Fixed Shares pursuant to the Fixed Share Acquisition, the satisfaction of the conditions set forth in the Fixed Share Arrangement Agreement and Floating Share Arrangement Agreement, and the closing of the Acquisitions.

Risks, uncertainties and other factors involved with forward-looking information or statements could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information, including the ability of the parties to satisfy or waive, in a timely manner, the conditions to the completion of the Fixed Share Arrangement Agreement and the Floating Share Arrangement Agreement; the ability of Canopy Growth, Acreage and Canopy USA to satisfy or waive, in a timely manner, the closing conditions set forth in the Fixed Share Arrangement Agreement and Floating Share Arrangement Agreement; risks relating to the value and liquidity of the Canopy Shares, the Fixed Shares and Floating Shares; the rights of the holders of Floating Shares and Fixed Shares may differ materially from those of shareholders on Canopy Growth; negative operating cash flow; uncertainty of additional financing; use of proceeds; volatility in the price of the Canopy Shares, the Fixed Shares and the Floating Shares; expectations regarding future investment, growth and expansion of operations; regulatory and licensing risks; changes in general economic, business and political conditions, including changes in the financial and stock markets and the impacts of increased rates of inflation; legal and regulatory risks inherent in the cannabis industry, including the global regulatory landscape and enforcement related to cannabis; additional dilution; political risks and risks relating to regulatory change; risks relating to anti-money laundering laws; compliance with extensive government regulation and the interpretation of various laws regulations and policies; public opinion and perception of the cannabis industry; and such other risks contained in the public filings of Canopy Growth and Acreage filed with Canadian securities regulators and available under each of the Canopy Growth and Acreage profile on SEDAR+ at www.sedarplus.com and with the Securities and Exchange Commission through EDGAR at www.sec.gov/edgar, including under the heading “Risk Factors” in Canopy Growth’s and Acreage’s respective annual report on Form 10-K for the year ended March 31, 2024 and December 31, 2023, respectively, and their subsequently filed quarterly reports on Form 10-Q.

In respect of the forward-looking statements and information, Canopy Growth and Acreage have provided such statements and information in reliance on certain assumptions that they believe are reasonable at this time. Although Canopy Growth and Acreage believe that the assumptions and factors used in preparing the forward-looking information or forward-looking statements in this news release are reasonable, undue reliance should not be placed on such information or statements and no assurance can be given that such events will occur in the disclosed time frames or at all. Should one or more of the foregoing risks or uncertainties materialize, or should assumptions underlying the forward-looking information or statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Canopy Growth and Acreage have attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The

forward-looking information and forward-looking statements included in this news release are made as of the date of this news release and neither Canopy Growth nor Acreage undertakes any obligation to publicly update such forward-looking information or forward-looking statements to reflect new information, subsequent events or otherwise unless required by applicable securities laws.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=acrg_ClassESubordinateVotingSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=acrg_ClassDSubordinateVotingSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

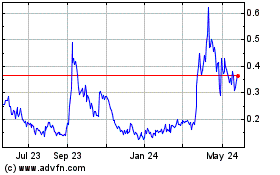

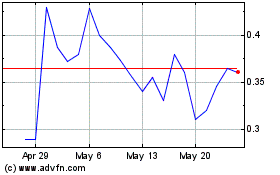

Acreage (QX) (USOTC:ACRHF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Acreage (QX) (USOTC:ACRHF)

Historical Stock Chart

From Feb 2024 to Feb 2025