Greek Banks Turn Corner With Bad-Loan Sales

08 December 2020 - 10:00PM

Dow Jones News

By Margot Patrick

Greek banks, among Europe's weakest, are getting rid of their

bad loans at a healthy clip.

In spring, the pandemic interrupted plans among the country's

banks to shed loans still festering from the eurozone crisis a

decade ago. But stimulus from central banks and governments

globally has sent fresh cash into funds that buy non-performing

loans, reinvigorating the efforts.

"Many of the investors are in the process of fund raising or

have raised additional funds for what they see as a wave of

opportunity," said Alok Gahrotra, a partner in the portfolio lead

advisory team at Deloitte that advises NPL buyers and sellers.

"There's a lot of dry powder to deploy."

In late November, Alpha Bank, one of Greece's four dominant

lenders, said it was in the final stages of selling a EUR10.8

billion gross loan portfolio -- the equivalent of $12 billion --

along with its loan-servicing unit. The exclusive bidder is U.S.

investment firm Davidson Kempner Capital Management LP, which beat

out Pacific Investment Management Co. and others for what would be

the largest-ever NPL sale in the country. Two more big banks,

National Bank of Greece and Piraeus Bank, each aim to sell around

EUR7 billion in loans next year.

The three transactions will tap a new state-supported

securitization program called Hercules, which was first used by

Eurobank SA in June to dispose of EUR7.5 billion gross loans,

"paving the way for its peers," said Eurobank CEO Fokion

Karavias.

The eurozone crisis a decade ago attracted U.S. investing giants

such as Pimco, Cerberus Capital Management and Apollo Global

Management to buy bad loans from banks for as little as a few cents

on the euro. Some investors also scoop up banks' servicing units to

build larger businesses managing bad loans from multiple lenders, a

fast-growing sector in Europe. Returns depend on recoveries from

selling collateral such as homes and office buildings backing the

debt, and fees collected by the servicing units.

The investments flow into NPL funds and other credit-focused

funds that are mainly marketed to institutional investors and the

rich.

Ireland, Spain and Italy all whittled down their NPLs this way.

Greece's banks made only limited progress because the country's

recovery took longer and the government and banks were working on

measures to attract investors. The key plank, finalized only last

year, is the Hercules program. Modeled after a similar program in

Italy, the banks sell NPLs to securitization vehicles that issue

notes to investors. The banks then buy the safest tranche of notes

with a government guarantee for repayment, allowing for larger

transactions.

"Because banks are allowed to provide senior funding that is

guaranteed by the state for a reasonable fee, considerations are

much better than outright sales without generating capital

burdens," said Christos Megalou, the chief executive of Piraeus

Bank.

The uptick in deals is crucial for Greece to bring down the

highest NPL level in the European Union. At almost half of loans in

2016, the ratio was around 35% at the start of 2020 and could fall

closer to 20% if transactions go ahead as planned. The EU-wide

ratio is under 3%. The pandemic caused a few months delay, but bank

executives, advisers and ratings firms said most deals should be

completed in the first quarter of next year.

"Market conditions are normalizing now and there is clearly

investor appetite from international investors," said Lito

Chousiada, an analyst in DBRS Morningstar's global financial

institutions group.

The disposals mark a turning point for an economy that was still

emerging from one of the longest and deepest depressions of modern

times when coronavirus hit. Greece's tourism-heavy economy slumped

along with EU peers, though the country has managed better than

many in containing coronavirus infections and deaths. The big Greek

banks forecast around EUR5 billion in total new NPLs from the

pandemic -- not much against the EUR61.3 billion in NPLs in the

country as off June 30, according to ECB data. The banks say years

of experience managing delinquent customers should help.

Nikos Koutsogiannis, chief financial officer at small lender

Attica Bank SA, said its NPL ratio fell to around 45% from a 62%

peak through two securitizations predating the Hercules program.

Attica aims to get the ratio to single digits by securitizing more

loans next year. Mr. Koutsogiannis said Attica wants to free up

capital for lending to companies in sectors such as the

environment, energy and infrastructure that Greece is targeting for

foreign and government investment.

"We have been working as firemen putting out fires, but at the

end of the day banks need to get back to banking," Mr.

Koutsogiannis said.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

December 08, 2020 05:45 ET (10:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

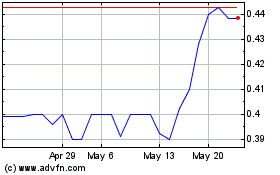

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Feb 2025 to Mar 2025

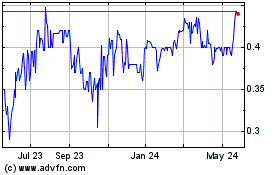

Alpha Services (PK) (USOTC:ALBKY)

Historical Stock Chart

From Mar 2024 to Mar 2025