January 19, 2022 -- InvestorsHub NewsWire -- via Hawk Point

Media -- Alternet Systems, Inc. (OTC

Pink: ALYI) is on many investment radars. And it should be. The

company has done more to set itself up for success in the past two

years than almost any other nano-cap stock in its sector. In fact,

despite its pennyland price, ALYI's work not only has itself

rubbing elbows with industry players multiples its size but is also

positioned to launch an assault on 2022 that could leave investment

procrastinators wishing they paid attention to the opportunity.

And there's plenty on the wires suggesting that ALYI is getting

ready to surge. In fact, ALYI has been transparent about its

mission to transform from a visionary-stage company into a products

and services business targeting some of the biggest opportunities

in the EV sector. Granted, sometimes transparency isn't enough.

Investors would rather have results, and that's understandable.

But, there's a solution to appease the disconnect, an "in-between"

space that addresses both. That's where current and considering

investors should focus.

What's that "in-between" space look like? Well, simply put, it's

a past, present, and future model. The past shows the tangible and

significant strides ALYI made in 2021 to make 2022 a breakout year.

The present indicates how ALYI is emerging from a pandemic-related

global business shutdown that stymied almost every industry in the

world. And the future, using just what ALYI has told the markets,

presents the story of how ALYI can maximize its pieces of a

systematically built infrastructure to seize upon diversified

revenue-generating opportunities in an EV industry expected to

become a trillion-dollar market in the next ten years.

History Repeats, Consider Buying The Dip

And knowing the ALYI story from start to now could explain how

history may repeat. In ALYI's case, that's a good thing. Keep in

mind, when markets were clicking without facing pandemic-related

headwinds, ALYI stock surged to $0.20 a share, roughly

20X higher than current prices. The stock wasn't unique. Many EV

stocks followed in lockstep with its large-cap industry brethren,

and ALYI was embraced as part of the group intending to make a

difference. So, what's happened to allow some EV stocks to keep

value and others to not? Actually, A lot. And none of it should

have led to declines in ALYI stock.

In fact, shares should have pierced that $0.20 level

months ago, especially with a sum of its parts calculation equating

to ALYI being in its best operating position in history. Pointing

toward dilution can be an argument for the downtrend, but it's a

common and often welcomed exchange when that dilution invites

accretive growth. Nearly every public company uses treasury shares

to expand business interests. And while painful at first, when the

assets received are put to work correctly, the results can deliver

upwards of 100X the diluted effect. No, that's not an

exaggeration.

While an exchange yielding that difference is likely to happen

in emerging industries, like EV, it's more common than many think.

Tesla (NASDAQ:

TLSA) and Nio (NYSE:

NIO) are perfect examples. Going back to their IPO's, investors

can see a pattern of dilution that triggered immediate disgruntled

stock sales but left long-term holders the better after the capital

raised was put to good work. It can almost be guaranteed that an

asset bought for $1 million by Tesla has yielded 100X

that value over time. That's why shares sold by quick-to-click

sellers almost immediately get swallowed by more measured buy-side

action. Many like to call it buying the dip, and the strategy can

pay off well.

That could be the case for ALYI stock. Its dip is not only too

deep and long; frankly, it's too big to ignore. The best plan of

action, therefore, may be to pay attention. Then consider seizing

on a valuation disconnect.

From Concept To Reality

First things first, pay attention to what ALYI is telling you.

Read how they expect to deliver a potentially exponential year of

gains for their shareholders. It's always best firsthand. But after

that, it's worth taking a step back to get an outsider's

perspective on how ALYI can turn a bullish forecast into a

near-term reality. Some agree some don't. But that's what makes a

market.

In many ways, the ALYI story is similar to others breaking into

new markets. They combined vision with ambition to bring products

and services to a market still in its relative infancy. Doing it

the right way, ALYI approached its opportunities with purpose and a

willingness to learn. Moreover, instead of throwing products at the

market, they instead relied on an interactive process that

empowered feedback, resulting in a final product that meets the

needs of end-users.

The model proved to be a winner. ALYI began its mission to

penetrate an emerging EV market in 2017 with an initial focus on

better battery technology. They partnered with more experienced

companies in that endeavor, like iQSTEL (NASDAQ:

IQST), to leverage the strength of others and enhance the

technological reach into the industry. To date, that relationship

is bearing the fruits of its labor, with the team nearing

completion of prototype EV batteries and communications systems

using cutting-edge technology and innovative solutions to power

vehicles more effectively and efficiently.

So far, so good. And there's more. At the same time as that was

happening, ALYI recognized additional opportunities capable of

delivering multiple times the revenues from only EV battery and

communications products. Thus, from a single or two product

company, ALYI evolved into a company taking advantage of massive

revenue-generating opportunities with several products and services

needed to complete what was becoming a more cohesive EV

ecosystem.

That meant designing and implementing a plan to creatively tap

into off-balance sheet resources to provide ALYI's EV ecosystem

business plan the capital needed to accelerate into an industry

that was/is exploding in size. Over the past five years, that

perseverance has allowed ALYI to reach several critical

milestones.

Milestones Reached, Now Have Catalyst Potential

The better news is that those milestones are expected to turn

into catalysts. In 2021, several components in ALYI's EV ecosystem

plan transitioned from concept into tangible assets. It was an

important transformation in that it immediately positions ALYI's EV

ecosystem as an influential contributor to a much larger EV sector

reality. Already, ALYI announced that key contracts have been

executed, innovative products are being produced, and revenue is

being generated. Revenues, by the way, are expected to eclipse

the $2 million level in 2021, with a report to confirm

that guidance imminent. From 0 to $2 million is a more

than impressive accomplishment, and expect investors to respond

with bullish fervor when it posts.

And they should get even better news on the revenues front as

the year progresses. ALYI is expected to release its

innovative ReVolt Electric motorcycle, which intends to

maximize opportunities in the flourishing African boda-boda

(motorcycle taxi) market. Updates show its design and function can

be a game-changer in the densely populated markets they serve. But,

more than agile and affordable, they are perfectly aligned with a

plan to eliminate combustible engines within the next few

decades.

In boda-boda markets, like ReVolt will be working in, the shift

to electric can happen much faster. That could be a big part of the

reason for ALYI forecasting a stretch revenue goal of a

whopping $50 million in 2022. With feet on the ground in

that market, they may know more than they are telling. So, pay

attention to market updates. There must be some substance inspiring

their bullish sentiment.

But, remember, ALYI isn't only a products company. While the EV

battery and ReVolt motorcycle may be considerable value drivers,

ALYI is committed to monetizing a plan that takes into account a

perpetual circle of opportunities fueled by an ecosystem of

providers and consumers. That means that instead of identifying

itself as a single products based company, ALYI's mission includes

building a network of EV providers and consumers under a single

brand name recognized for innovation, cooperative excellence, and a

commitment to socially responsible goals. It's a grand plan, but

it's one in motion.

A significant milestone reached in that mission came in 2021

when ALYI made significant strides in establishing EV provider and

consumer partnerships. Notably, the most critical part is that ALYI

now has its first EV provider and consumer satellites set into its

ecosystem orbit, giving the ALYI brand traction needed to build

business faster and efficiently.

First Mover In African Boda-Boda Market

That's happening today. While discussed at length in 2021, ALYI

has committed to leveraging the strength of its EV ecosystem

in Africa to take advantage of one of the lowest per

capita transportation ratios in the world. The strategy allows ALYI

to introduce eco-friendly transportation solutions for the first

time as a transition from combustion-engine transportation

solutions. It puts them in a first-mover position.

But, more than a first-mover, ALYI is hitting the ground with

the right products in a market in need. Consider Africa a

proving ground of sorts. However, don't think of it as a beginner's

market. Africa is an enormous yet underappreciated

economic opportunity in and of itself, with expectations for its

economy to become a $5.6 trillion market by

2025. Africa also accounts for around 17% of the world's

population, but only about 3% of global GDP. That gap represents

the opportunities ahead.

And they are opportunities ALYI wants to address, believing its

EV ecosystem advances environmental sustainability and economic

growth in Africa, both vital components of political and

economic global stability. ALYI stands to benefit from the largely

untapped economic opportunity in Africa and the

opportunity that comes with building a global brand name. That plan

includes delivering two different electric motorcycle models to the

Kenyan market.

The motorcycles are designed to service the robust motorcycle

taxi market in Kenya. In addition to its flagship ReVolt

motorcycle, ALYI delivers components to locally assemble

three-wheeled electric Bajas in Ethiopia, which are also going

into service in the local taxi and delivery markets. Sales of those

units contribute to the expected surge in revenues toward $2

million in 2021. However, as noted, ALYI expects its EV sales

to grow rapidly in 2022 and be further supported by the launch of

adding additional sources of EV ecosystem revenue in 2022.

Potential stretch revenue goal- $50 million.

If they post the revenues as intended, expect credibility to be

restored overnight into a company that may have lost some during

the pandemic. And with spiking revenue comes less dilution. Thus,

ALYI is set up for success on many levels. Not only that, they are

already in the process of getting it done.

Breakout For Potentially Exponential Run In 2022

And here's the better news; expect more value to be created this

year. ALYI made it clear they intend to appeal to potential

partners by creating an annual EV ecosystem symposium staged around

a globally recognized EV race event. It's a time when participants

can demonstrate their areas of excellence to a watching world. To

make it happen, ALYI is working closely with a Kenyan race event

coordinator, East African Grand Prix (EAGP), a company in which

ALYI has been an investor.

By the way, before the onset of Covid, EAGP entered into a

provisional licensing agreement with Formula E to bring

an annual race to Nairobi. While the process slowed, it hasn't

stopped. The feasibility study to verify a race could be conducted

within Formula E's strict standards has been completed

to Formula E's satisfaction. ALYI, EAGP, and Formula

E met at Formula E's headquarters

in London just before the holidays to plan for the

prospective Nairobi Formula E event. That event adds more

credibility on a global scale.

Still, there's more to like. ALYI is leveraging additional

partnerships to make its EV ecosystem stand the pressure test.

Deals with Waterpure International, Inc. (OTC Pink:

WPUR), adding sustainable EV charging solutions, Priority

Aviation, Inc. (OTC Pink: PJET), adding EV market expansion

opportunity, and iQSTEL, Inc. (OTCQX: IQST), contributing

vital EV technologies, all contribute to validating ALYI's plan to

become a more prominent company faster than many expect.

Oh, leaving out a potentially massive windfall from its

investment in car-sharing technology company Zoomcar

Inc can't go unmentioned. That IPO, expected later this year,

has the potential to add an additional component to the ALYI EV

ecosystem that can significantly expand ALYI's ecosystem reach, as

well as provide a substantial boost to the ALYI balance sheet if

the Zoomcar IPO is embraced by the marketplace. Indicators are for

it to be a highly watched event.

And finally, don't forget another ace to play, ReVOLT Token.

That security coin will dedicate financing to ALYI to fund

expansion, provide working capital, and allow ALYI to take a more

ambitious approach in its acquisition strategy. While that project,

independent of ALYI, has taken longer than expected to market,

listing Revolt Token on an exchange is said to be imminent.

Thus, at about $0.012 a share, off its 52-week high

of $0.20, there's a lot to like about Alternet Systems.

In fact, single parts of its portfolio have enough intrinsic value

to make that penny price appear more than appreciably undervalued;

it makes it look ridiculously under-priced. But new year, new eyes,

new investors, and new opportunities.

This time, the difference for ALYI is that its assets,

infrastructure, and ecosystem are at a place that is incredibly

better positioned to drive valuations higher than any other time.

Best of all, that place is in a spot to start producing revenues

for the company sooner than later.

And when that happens, look out above. Validation of a long and

complicated process could lead to a sharp and exponential rise in

valuations. Wear your investment hardhat; the potential surge

higher may be a violent ride.

Disclaimers: Hawk Point Media is responsible for the production

and distribution of this content. Hawk Point Media is not operated

by a licensed broker, a dealer, or a registered investment adviser.

It should be expressly understood that under no circumstances does

any information published herein represent a recommendation to buy

or sell a security. Our reports/releases are a commercial

advertisement and are for general information purposes ONLY. We are

engaged in the business of marketing and advertising companies for

monetary compensation. Never invest in any stock featured on our

site or emails unless you can afford to lose your entire

investment. The information made available by Hawk Point Media is

not intended to be, nor does it constitute, investment advice or

recommendations. The contributors may buy and sell securities

before and after any particular article, report and publication. In

no event shall Hawk Point Media be liable to any member, guest or

third party for any damages of any kind arising out of the use of

any content or other material published or made available by Hawk

Point Media, including, without limitation, any investment losses,

lost profits, lost opportunity, special, incidental, indirect,

consequential or punitive damages. Past performance is a poor

indicator of future performance. The information in this video,

article, and in its related newsletters, is not intended to be, nor

does it constitute, investment advice or recommendations. Hawk

Point Media strongly urges you conduct a complete and independent

investigation of the respective companies and consideration of all

pertinent risks. For some content, Hawk Point Media, its authors,

contributors, or its agents, may be compensated for preparing

research, video graphics, and editorial content. Hawk Point Media

was compensated up to three-thousand-five hundred dollars by a

third-party to research, prepare, and syndicate written and visual

content about Alternet Systems, Inc. for a one-month

period. Readers are advised to review SEC periodic

reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5

Schedule 13D.

The Private Securities Litigation Reform Act of 1995 provides

investors a safe harbor in regard to forward-looking statements.

Any statements that express or involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives,

goals, assumptions or future events or performance are not

statements of historical fact may be forward looking statements.

Forward looking statements are based on expectations, estimates,

and projections at the time the statements are made that involve a

number of risks and uncertainties which could cause actual results

or events to differ materially from those presently anticipated.

Forward looking statements in this action may be identified through

use of words such as projects, foresee, expects, will, anticipates,

estimates, believes, understands, or that by statements indicating

certain actions & quote; may, could, or might occur. Understand

there is no guarantee past performance will be indicative of future

results. Investing in micro-cap and growth securities is highly

speculative and carries an extremely high degree of risk. It is

possible that an investors investment may be lost or impaired due

to the speculative nature of the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Ken Kellis

Email: info@hawkpointmedia.com

Phone: 3057806988

City: Miami Beach

State: Florida

Country: United States

Source - https://www.marketscreener.com/quote/stock/ALTERNET-SYSTEMS-INC-120787852/news/Underestimating-The-Potential-Of-Alternet-Systems-Could-Be-The-Investment-Blunder-Of-2022-Here-s-W-37573279/

SOURCE: Hawk Point Media

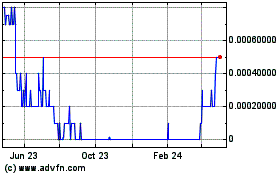

Alternet Systems (PK) (USOTC:ALYI)

Historical Stock Chart

From Dec 2024 to Jan 2025

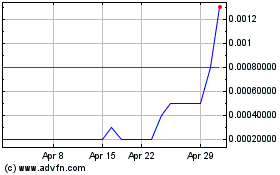

Alternet Systems (PK) (USOTC:ALYI)

Historical Stock Chart

From Jan 2024 to Jan 2025