Today's Logistics Report: Planning Vaccine Delivery; Germany's Export Cloud; Assembling Ford Trucks

19 September 2020 - 12:11AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Plans for distributing a Covid-19 vaccine remain a work in

progress as the shots move closer to approval. State officials and

medical-supply experts say critical issues weren't resolved in the

federal government's release of two vaccine-distribution plans this

week. The WSJ's Peter Loftus and Jared S. Hopkins report the slow

ramp-up for a distribution strategy could hamper efforts to get

doses quickly to health-care workers and others at high risk of

infection. Some states might not initially get all of the supplies

they were expecting, or have the freezer capacity needed to safely

store their drug allocation.

Transportation and logistics companies have been preparing for

the potential sudden rush to distribute doses through

temperature-controlled networks with little margin for error. The

federal program through Operation Warp Speed sketches out

distribution of any vaccine that regulators authorize for use,

including starting shipments within 24 hours of the green light.

But medical experts say it doesn't detail how cold-storage for some

vaccines should be handled, for instance, and that states may be

left to create their own separate plans for warehousing and

distributing doses.

ECONOMY & TRADE

A decoupling from China trade is coming from a surprising

direction. Germany's exporters aren't getting much of a lift from

demand in China, the WSJ's Tom Fairless reports, highlighting

significant and potentially long-lasting changes in trade patterns

since the pandemic began. Germany's exporters are benefiting from a

recovery in international trade, but the country's outbound flows

to China remain far below year-ago levels. That suggests a possible

a tipping point in Germany's relationship with China, its largest

trading partner and a big buyer of German industrial robots,

factory equipment and vehicles. The trade flows were so strong that

German companies took double-digit sales growth to China for

granted. Beijing is now encouraging manufacturers to produce more

sophisticated machinery that can rival high-end German capital

goods. German exporters now are looking at the loss of a lucrative

sales channel along with more competition in other markets.

MANUFACTURING

Ford Motor Co. is giving U.S. automotive supply chains a badly

needed boost. The car marker is expanding its largest and oldest

factory to make electric pickup trucks, the WSJ's Mike Colias

reports, a high-profile manufacturing investment that will ramp up

assembly lines at a plant a few miles from the company's Dearborn,

Mich., headquarters. Ford's top executives underscored the

company's commitment to American manufacturing in announcing the

$700 million investment, which will also take the company deeper

into the electric-vehicle market. Ford plans to make

battery-powered versions of its flagship F-150 pickup at the plant

starting in 2022. Overall automobile sales have been off sharply

during the pandemic and companies have been paring production,

keeping inventories low and helping prop up pricing. Automotive

shipments on U.S. railroads are down nearly 27% this year,

according to the Association of American Railroads, but were nearly

flat in August.

QUOTABLE

IN OTHER NEWS

United Parcel Service Inc. plans to offer buyouts to some

management employees in a move to cut payroll costs. (WSJ)

The number of Americans filing new unemployment claims has

remained largely steady since early August. (WSJ)

A House panel's investigation into Boeing's 737 MAX provides

support for far-reaching changes to air-safety laws. (WSJ)

Top executives at major airlines pleaded at the White House for

more job-saving government aid. (WSJ)

Latam Airlines Group Inc. is bringing in hedge fund Knighthead

Capital Management to supply loans in a $2.45 billion bankruptcy

financing package. (WSJ)

Southwest Airlines Inc. temporarily grounded 115 planes over

discrepancies in weight data. (WSJ)

Auto-parts supplier Garrett Motion Inc. is preparing for a

possible bankruptcy filing amid slowing sales and rising tensions

over asbestos injury payments. (WSJ)

A U.S. judge blocked controversial U.S. Postal Service changes

that have slowed mail nationwide, calling them "politically

motivated." (Associated Press)

A.P. Moller-Maersk A/S will cut jobs in a major shakeup that

could affect up to a third of the shipping giant's staff.

(Reuters)

Amazon.com Inc. plans to open 1,000 small delivery hubs in

cities and suburbs around the U.S. (Bloomberg)

Fast-fashion rivals Zara and Hennes & Mauritz are taking

different approaches toward inventory management during the

pandemic. (Sourcing Journal)

Online pet-products retailer Chewy Inc. added a fulfillment

center with only high-demand products to cope with potential

inventory shortages. (Supply Chain Dive)

Global exports of refined oil products reached multiyear lows in

July. (Lloyd's List)

Job actions by Australian dock workers are causing cargo backups

at Sydney's Port Botany. (The Loadstar)

Container terminal operator Hutchison Ports named former U.K.

transport minister Chris Grayling as an advisor. (BBC)

Temperature-controlled logistics specialist Lineage Logistics

LLC raised $1.6 billion in an equity offering aimed at backing

expansion plans. (Crain's Detroit Business)

FreightCar America Inc. is closing a rail equipment factory in

northwest Alabama. (WHNT)

Delta Air Lines Inc. removed seats from a 777 passenger jet in

the first move by a U.S. carrier to undertake the temporary

freighter modification. (Air Cargo World)

Expedited trucker Forward Air acquired the assets of

Tennessee-based last-mile company CLW Delivery. (Logistics

Management)

French freight forwarder Geodis named Mike Honious chief

executive for the Americas, replacing Randy Tucker. (Air Cargo

News)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage , @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

September 18, 2020 09:56 ET (13:56 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

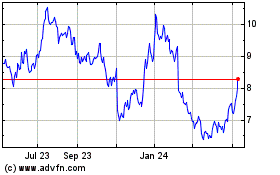

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

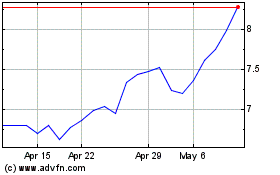

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2023 to Dec 2024