false

0001537561

0001537561

2024-11-04

2024-11-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 4, 2024

ARCH

THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-54986 |

|

46-0524102 |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 235

Walnut Street, Suite 6 |

|

|

| Framingham,

Massachusetts |

|

01702 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (617) 431-2313

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N|A |

|

N|A |

|

N|A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

As

previously disclosed in the Current Report on Form 8-K filed by Arch Therapeutics, Inc. (the “Company”) with the Securities

and Exchange Commission (“SEC”) on May 21, 2024, the Company entered into a Securities Purchase Agreement, dated May

15, 2024 (the “SPA”), with certain institutional and accredited individual investors who have previously purchased

secured promissory notes from the Company, providing for the issuance and sale by the Company to the investors certain Secured Promissory

Notes (each a “2024 First Note” and collectively, the “2024 First Notes”) convertible into shares

of common stock, par value $0.001 per share (the “Common Stock”) (the “Convertible Notes Offering”).

The initial closing (the “Initial Closing”) of the Convertible Notes Offering occurred on May 15, 2024 (the “Initial

Closing Date”).

As

previously disclosed in the Current Report on Form 8-K filed by the Company with the SEC on June 18, 2024, the Company consummated a

second closing on June 12, 2024 (the “Second Closing”) of the Convertible Notes Offering pursuant to the terms and

conditions of the SPA with a certain institutional investor providing for the issuance and sale by the Company to the investor a 2024

First Note convertible into shares of Common Stock. The 2024 First Note was issued as part of the Convertible Notes Offering previously

authorized by the Company’s board of directors. In connection with the Second Closing of the Convertible Notes Offering, the Company

issued and sold to the investor a 2024 First Note in the principal amount of $180,000, which includes a $30,000 original issue discount

in respect of the 2024 First Note. The net proceeds for the sale of the 2024 First Note was approximately $150,000, after deducting issuance

discounts. The Second Closing of the sale of the 2024 First Note under the SPA occurred on June 12, 2024.

As

previously disclosed in the Current Report on Form 8-K filed by the Company with the SEC on June 28, 2024, the Company consummated a

third closing on June 26, 2024 (the “Third Closing”) of the Convertible Notes Offering pursuant to the terms and conditions

of the SPA with a certain institutional investor providing for the issuance and sale by the Company to the investor a 2024 First Note

convertible into shares of Common Stock. The 2024 First Note was issued as part of the Convertible Notes Offering previously authorized

by the Company’s board of directors. In connection with the Third Closing of the Convertible Notes Offering, the Company issued

and sold to the investor a 2024 First Note in the principal amount of $90,000, which includes a $15,000 original issue discount in respect

of the 2024 First Note. The net proceeds for the sale of the 2024 First Note was approximately $75,000, after deducting issuance discounts.

The Third Closing of the sale of the 2024 First Note under the SPA occurred on June 26, 2024.

As

previously disclosed in the Current Report on Form 8-K filed by the Company with the SEC on July 22, 2024, the Company consummated a

fourth closing on July 16, 2024 (the “Fourth Closing”) of the Convertible Notes Offering pursuant to the terms and

conditions of the SPA with certain institutional and accredited individual investors who have previously purchased secured promissory

notes from the Company, providing for the issuance and sale by the Company to the Investors 2024 First Notes convertible into shares

of Common Stock. The 2024 First Notes were issued as part of the Convertible Notes Offering previously authorized by the Company’s

board of directors. In connection with the Fourth Closing of the Convertible Notes Offering, the Company issued and sold to the Investors

2024 First Notes in the aggregate principal amount of $168,000, which includes an aggregate $28,000 original issue discount in respect

of the 2024 First Notes. The net proceeds for the sale of the 2024 First Notes was approximately $140,000, after deducting issuance discounts.

The Fourth Closing of the sale of the 2024 First Notes under the SPA occurred on July 16, 2024.

As

previously disclosed in the Current Report on Form 8-K filed by the Company with the SEC on August 2, 2024, the Company consummated a

fifth closing on July 29, 2024 (the “Fifth Closing”) of the Convertible Notes Offering pursuant to the terms and conditions

of the SPA with certain institutional and accredited individual investors who have previously purchased secured promissory notes from

the Company (the “Investors”), providing for the issuance and sale by the Company to the Investors 2024 First Notes

convertible into shares of Common Stock. The 2024 First Notes were issued as part of the Convertible Notes Offering previously authorized

by the Company’s board of directors. In connection with the Fifth Closing of the Convertible Notes Offering, the Company issued

and sold to the Investors 2024 First Notes in the aggregate principal amount of $96,000, which includes an aggregate $16,000 original

issue discount in respect of the 2024 First Notes. The net proceeds for the sale of the 2024 First Notes was approximately $80,000, after

deducting issuance discounts. The Fifth Closing of the sale of the 2024 First Notes under the SPA occurred on July 29, 2024 (the “Fifth

Closing Date”).

As

previously disclosed in the Current Report on Form 8-K filed by the Company on August 20, 2024, the Company consummated a sixth closing

on August 19, 2024 (the “Sixth Closing”) of the Convertible Notes Offering pursuant to the terms and conditions of

the SPA with certain institutional and accredited individual investors who have previously purchased secured promissory notes from the

Company (the “Investors”), providing for the issuance and sale by the Company to the Investors 2024 First Notes convertible

into shares of Common Stock. The 2024 First Notes were issued as part of the Convertible Notes Offering previously authorized by the

Company’s board of directors. In connection with the Sixth Closing of the Convertible Notes Offering, the Company issued and sold

to the Investors 2024 First Notes in the aggregate principal amount of $120,000, which includes an aggregate $20,000 original issue discount

in respect of the 2024 First Notes. The net proceeds for the sale of the 2024 First Notes was approximately $100,000, after deducting

issuance discounts. The Sixth Closing of the sale of the 2024 First Notes under the SPA occurred on August 19, 2024 (the “Sixth

Closing Date”).

As

previously disclosed in the Current Report on Form 8-K filed by the Company on September 13, 2024, the Company consummated a seventh

closing on September 10, 2024 (the “Seventh Closing”) of the Convertible Notes Offering pursuant to the terms and

conditions of the SPA with certain institutional and accredited individual investors who have previously purchased secured promissory

notes from the Company (the “Investors”), providing for the issuance and sale by the Company to the Investors 2024

First Notes convertible into shares of Common Stock. The 2024 First Notes were issued as part of the Convertible Notes Offering previously

authorized by the Company’s board of directors. In connection with the Seventh Closing of the Convertible Notes Offering, the Company

issued and sold to the Investors 2024 First Notes in the aggregate principal amount of $129,600, which includes an aggregate $21,600

original issue discount in respect of the 2024 First Notes. The net proceeds for the sale of the 2024 First Notes was approximately $108,000,

after deducting issuance discounts. The Seventh Closing of the sale of the 2024 First Notes under the SPA occurred on September 10, 2024

(the “Seventh Closing Date”).

As

previously disclosed in the Current Report on Form 8-K filed by the Company on September 26, 2024, the Company consummated an eighth

closing on September 20, 2024 (the “Eighth Closing”) of the Convertible Notes Offering pursuant to the terms and conditions

of the SPA with certain institutional and accredited individual investors who have previously purchased secured promissory notes from

the Company (the “Investors”), providing for the issuance and sale by the Company to the Investors 2024 First Notes

convertible into shares of Common Stock. The 2024 First Notes were issued as part of the Convertible Notes Offering previously authorized

by the Company’s board of directors. In connection with the Eighth Closing of the Convertible Notes Offering, the Company issued

and sold to the Investors 2024 First Notes in the aggregate principal amount of $129,600, which includes an aggregate $21,600 original

issue discount in respect of the 2024 First Notes. The net proceeds for the sale of the 2024 First Notes was approximately $108,000,

after deducting issuance discounts. The Eighth Closing of the sale of the 2024 First Notes under the SPA occurred on September 20, 2024

(the “Eighth Closing Date”).

On

November 4, 2024, the Company consummated a ninth closing (the “Ninth Closing”) of the Convertible Notes Offering

pursuant to the terms and conditions of the SPA with certain institutional and accredited individual investors who have previously purchased

secured promissory notes from the Company (the “Investors”), providing for the issuance and sale by the Company to

the Investors 2024 First Notes convertible into shares of Common Stock. The 2024 First Notes were issued as part of the Convertible Notes

Offering previously authorized by the Company’s board of directors. In connection with the Ninth Closing of the Convertible Notes

Offering, the Company issued and sold to the Investors 2024 First Notes in the aggregate principal amount of $120,000, which includes

an aggregate $20,000 original issue discount in respect of the 2024 First Notes. The net proceeds for the sale of the 2024 First Notes

was approximately $100,000, after deducting issuance discounts. The Ninth Closing of the sale of the 2024 First Notes under the SPA occurred

on November 4, 2024 (the “Ninth Closing Date”).

Use

of Proceeds

The

Company intends to use the net proceeds from the Convertible Notes Offering primarily for working capital and general corporate purposes,

and has not allocated specific amounts for any specific purposes.

2024

First Notes

The

2024 First Notes become due and payable on November 30, 2024 (the “Maturity Date”) and may be prepaid provided that

an Event of Default (as defined therein) has not occurred. The 2024 First Notes bear interest on the unpaid principal balance at a rate

equal to 10% (computed on the basis of the actual number of days elapsed in a 360-day year) per annum accruing from the Ninth Closing

Date until the 2024 First Notes become due and payable at maturity or upon their conversion, acceleration or by prepayment, and may become

due and payable upon the occurrence of an Event of Default under the 2024 First Notes. Any amount of principal or interest on the 2024

First Notes which is not paid when due shall bear interest at the rate of the lesser of (i) 18% per annum or (ii) the maximum amount

allowed by law from the due date thereof until payment in full (the “Default Interest”).

The

2024 First Notes issued in connection with the Ninth Closing are convertible into an aggregate of 240,000 shares of Common Stock (such

shares of Common Stock, the “Conversion Shares”) at the option of the holder of the 2024 First Notes (the “Holders”)

from the Ninth Closing Date at the Conversion Price (as defined below) through the later of (i) the Maturity Date and (ii) the date of

payment of the Default Amount (as defined in the 2024 First Notes); provided, however, the 2024 First Notes include a provision

preventing such conversion if, as a result, the Holder, together with its affiliates and any other persons whose beneficial ownership

of Company Common Stock would be aggregated with the Holder’s, would be deemed to beneficially own more than 4.99% of the outstanding

shares of the Company’s Common Stock (the “Note Ownership Limitation”) immediately after giving effect to the

Conversion; and provided further, the Holder, upon notice to the Company, may increase or decrease the Note Ownership Limitation;

provided that (i) the Note Ownership Limitation may only be increased to a maximum of 9.99% of the outstanding shares of the Company’s

Common Stock; and (ii) any increase in the Note Ownership Limitation will not become effective until the 61st day after delivery

of such waiver notice. As previously disclosed in the Current Report on Form 8-K filed by the Company on September 19, 2024, effective

September 15, 2024, among other things, the principal amount the Notes issued in connection with the Fourth Closing, Fifth Closing, Sixth

Closing, Seventh Closing and Eighth Closing are increased by a factor of 1.03 in connection with each extension of the Maturity Date.

Giving effect to the foregoing, the 2024 First Notes issued in connection with the First Closing, Second Closing, Third Closing, Fourth

Closing, Fifth Closing, Sixth Closing, Seventh Closing, Eighth Closing and Ninth Closing have a total outstanding principal amount of

$3,288,366, and are convertible into an aggregate of 6,576,741 shares of Common Stock.

The

initial conversion price of the 2024 First Notes (the “Conversion Price”) shall be equal to $0.50 per share and may

be reduced or increased proportionately as a result of any stock dividends, recapitalizations, reorganizations, and similar transactions.

If the Company fails to deliver the shares of Common Stock issuable upon a conversion by the Deadline (as defined in the 2024 First Notes),

then the Company is obligated to pay such 2024 First Note Holders $5,000 per day in cash for each day beyond the Deadline.

The

2024 First Notes contains customary events of default, which includes, among other things, (i) the Company’s failure to pay when

due any principal or interest payment under the 2024 First Notes; (ii) the insolvency of the Company; (iii) delisting of the Company’s

Common Stock; (iv) the Company’s breach of any material covenant or other material term or condition under the 2024 First Notes;

and (v) the Company’s breach of any representations or warranties under the 2024 First Notes which cannot be cured within five

days. Further, Events of Default under the 2024 First Notes also include (i) the unavailability of Rule 144 on or after six months from

the Issue Date (as defined therein); (ii) the Company’s failure to deliver the shares of Common Stock to the 2024 First Note Holders

upon exercise by such Holder of its conversion rights under the 2024 First Notes; (iii) the Company’s loss of the “bid”

price for its Common Stock and/or a market and such loss is not cured during the specified cure periods; and (iv) the Company’s

failure to complete an uplist to a National Exchange (as defined therein) by November 30, 2024.

Upon

an Event of Default, the 2024 First Notes shall become immediately due and payable and the Company shall pay the 2024 First Note Holders

an amount equal to 125% (the “Default Premium”) multiplied by the sum of the outstanding principal amount of the 2024

First Notes plus any accrued and unpaid interest on the unpaid principal amount of the 2024 First Notes to the date of payment, plus

any Default Interest and any other amounts owed to the Holder under the SPA (the “Default Amount”); provided

that, upon any subsequent Event of Default not in connection with the first Event of Default, the Holder shall be entitled to an additional

5% to the Default Premium for each subsequent Event of Default. At the election of each 2024 First Note Holder, the Default Amount may

be paid in cash or shares of Common Stock equal to the Default Amount divided by the Conversion Price at the time of payment.

Upon

the closing of the transaction that results in the uplist of the Common Stock to a National Exchange, 100% of the then outstanding principal

amount of the 2024 First Notes shall automatically convert (the “Automatic Conversion”) into shares of Common Stock

(the “Automatic Conversion Shares”), with the conversion price for purposes of such Automatic Conversion being $0.515625

per share. Upon the Automatic Conversion and to the extent that the beneficial ownership of the Holders of 2024 First Notes would increase

over the applicable Note Ownership Limitation, the Holder will receive pre-funded warrants (the “2024 Note Conversion Pre-Funded

Warrants”, and the shares issuable upon exercise thereof, the “2024 Note Conversion Pre-Funded Warrant Shares”)

in lieu of shares of Common Stock otherwise issuable to the Holder in connection with the Automatic Conversion, which 2024 Note Conversion

Pre-Funded Warrants shall have an exercise price of $0.000125 per share, may be exercised on a cashless basis, shall be exercisable immediately

upon issuance and shall contain a customary beneficial ownership limitation provision. In addition, upon the Automatic Conversion, the

Holder shall receive a warrant (the “Uplist Conversion Warrant”, and the shares issuable upon exercise thereof, the

“Uplist Conversion Warrant Shares”) to purchase a number of shares of Common Stock equal to the number of shares of

Common Stock (or shares of Common Stock underlying 2024 Note Conversion Pre-Funded Warrants, if any) issued upon the Automatic Conversion.

The Uplist Conversion Warrant shall have an exercise price per share of $0.50 and shall otherwise be identical to the warrants (other

than pre-funded warrants) sold pursuant to the securities purchase agreement dated November 8, 2023, as amended. The Company also agreed

in the 2024 First Notes to file no later than 60 days after the closing of an uplist to a National Exchange a registration statement

on Form S-4, or other appropriate form, registering the offer by the Company to exchange, on a one-for-one basis, all outstanding Uplist

Conversion Warrants and certain other warrants for newly issued warrants identical to the warrants being sold in the offering that results

in the uplist to a National Exchange, which warrants are expected to be listed under the symbol “ARTHW.”

The

2024 First Notes issued in connection with the Fourth Closing, Fifth Closing, Sixth Closing, Seventh Closing, Eighth Closing and Ninth

Closing will be senior in priority to the 2024 First Notes previously issued in connection with the First Closing, Second Closing, and

Third Closing, and the notes previously issued pursuant to the Securities Purchase Agreement, dated as of July 6, 2022, by and among

the Company and each of the parties listed on the signature pages thereto.

Registration

Rights Agreement

On

the Initial Closing Date, the Company entered into a Registration Rights Agreement with the Investors (the “Registration Rights

Agreement”), pursuant to which the Company is obligated, subject to certain conditions, to file with the Securities and Exchange

Commission within 60 days after the Initial Closing Date one or more registration statements (any such registration statement, a “Resale

Registration Statement”) to register the Conversion Shares for resale under the Securities Act of 1933, as amended (the “Securities

Act”). The Company’s failure to satisfy certain filing and effectiveness deadlines with respect to a Resale Registration

Statement and certain other requirements set forth in the Registration Rights Agreement may subject the Company to payment of monetary

penalties.

Security

Agreement

In

connection with the issuance of the 2024 First Notes, the Company entered into a Security Agreement with the Collateral Agent (as defined

therein) on behalf of the Investors on the Initial Closing Date (the “Security Agreement”), pursuant to which the

Company and each of its subsidiaries (together with any persons who execute a joinder to the Security Agreement, the “Debtors”)

provided as collateral to the Investors a security interest in, and a lien on, substantially all of the Debtors. Upon an Event of Default

under the 2024 First Note, each Investor may exercise its rights to the collateral pursuant to the terms of the Security Agreement.

IP

Security Agreement

In

connection with the issuance of the 2024 First Notes, the Company also entered into an Intellectual Property Security Agreement with

the Collateral Agent (as defined therein) on behalf of the Investors on the Initial Closing Date (the “IP Security Agreement”),

pursuant to which the Company and each of its subsidiaries (together with any persons who execute a joinder to the Security Agreement,

the “IP Debtors”) provided as collateral to the investors a security interest in, and a lien on, substantially all

of the IP Debtors. Upon an Event of Default under the 2024 First Notes, each Investor may exercise its rights to the collateral pursuant

to the terms of the Security Agreement.

Certain

Restrictions on Activities

The

SPA contains certain restrictions on the Company’s ability to conduct subsequent sales of its equity securities and certain business

activities. In particular, subject to certain customary exemptions, from the Initial Closing Date, until 30 days after the Resale Registration

Statement goes effective, the Company shall not file any registration statement with respect to the Company’s Common Stock.

The

issuance and sale of the 2024 First Notes have not been, and will not upon issuance be, registered under the Securities Act, and the

2024 First Notes may not be offered or sold in the United States absent registration under or exemption from the Securities Act and any

applicable state securities laws. The Securities will be issued and sold in reliance upon an exemption from registration afforded by

Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated under Securities Act based on the following facts: each of the Investors

has represented that it is an accredited investor as defined in Rule 501 promulgated under the Securities Act; that it is acquiring the

Securities for its own account and not with a view towards, or for resale in connection with, the public sale or distribution thereof

in violation of applicable securities; the Company used no advertising or general solicitation in connection with the issuance and sale

of the 2024 First Notes to the Investors; and the Securities will be issued as restricted securities. This Current Report on Form 8-K

is not and shall not be deemed to be an offer to sell or the solicitation of an offer to buy the 2024 First Notes.

The

preceding descriptions of the SPA, 2024 First Notes, Registration Rights Agreement, Security Agreement and IP Security Agreement are

qualified in their entirety by reference to the copies of the Forms of Securities Purchase Agreement, 2024 First Note, Registration Rights

Agreement, Security Agreement and IP Security Agreement attached herewith as Exhibit 10.1, Exhibit 10.2, Exhibit 10.3, Exhibit 10.4,

and Exhibit 10.5 to this Current Report on Form 8-K, respectively, which are incorporated herein by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Reference

is made to the disclosure set forth in Item 1.01 of this Current Report on Form 8-K, which disclosure is incorporated by reference

into this Item 2.03.

Item

3.02 Unregistered Sales of Equity Securities.

Reference

is made to the disclosure set forth in Item 1.01 of this Current Report on Form 8-K, which disclosure is incorporated by reference

into this Item 3.02.

Item

9.01 Financial Statements and Exhibits.

(d)

The following exhibits are being attached herewith:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ARCH

THERAPEUTICS, INC. |

| |

|

| Dated:

November 7, 2024 |

By: |

/s/

Terrence W. Norchi, M.D. |

| |

Name: |

Terrence

W. Norchi, M.D. |

| |

Title: |

President,

Chief Executive Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

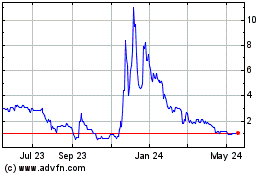

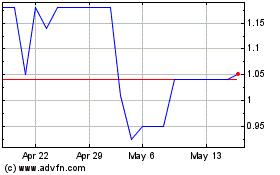

Arch Therapeutics (QB) (USOTC:ARTH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Arch Therapeutics (QB) (USOTC:ARTH)

Historical Stock Chart

From Dec 2023 to Dec 2024