FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2015

Commission File Number 1-15236

Advantest Corporation

(Translation of Registrant’s Name Into English)

Shin Marunouchi Center Building

1-6-2, Marunouchi

Chiyoda-ku

Tokyo 100-0005

Japan

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Material Contained in this Report:

|

|

1.

|

English translation of the Convocation Notice of the 73rd Ordinary General Meeting of Shareholders, including the Business Report for the 73rd Fiscal Year, of the registrant issued on June 1, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Advantest Corporation |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Hiroshi Nakamura |

|

| |

|

Name: |

Hiroshi Nakamura |

|

| |

|

Title: |

Director, Managing Executive Officer |

|

| |

|

|

|

|

Date: June 1, 2015

(The following is an unofficial English translation of the Convocation Notice of the 73rd Ordinary General Meeting of Shareholders of Advantest Corporation (the “Company”). The Company provides this translation for your reference and convenience only and without any warranty as to its accuracy or otherwise.)

(Stock Code Number: 6857, TSE first section)

CONVOCATION NOTICE OF

THE 73rd ORDINARY GENERAL MEETING OF SHAREHOLDERS

|

Date and time:

|

June 24, 2015 (Wednesday) at 10:00 a.m. |

(The reception desk will open at 9:00 a.m.)

|

Place:

|

Main Conference Room of Advantest Corporation

|

32-1, Asahi-cho 1-chome, Nerima-ku, Tokyo

Message to Shareholders

To Our Shareholders

We are pleased to send you our Report for the 73rd Fiscal Year (from April 1, 2014 to March 31, 2015).

In this fiscal year, the semiconductor industry saw active capital investment by manufacturers for expansion of their production capacities and for miniaturization of semiconductors, spurred by ongoing global adoption of smartphones and improvements in handset performance as well as growing demand for semiconductors by data centers.

Amid these conditions, Advantest strove to maximize profitability by engaging in sales promotions for semiconductor test systems as well as by expanding its customer base across all business segments. As a result, both orders and sales increased in comparison to the previous fiscal year: orders received expanded to ¥176.3 billion and net sales expanded to ¥163.3 billion. From a profit and loss perspective, Advantest returned to profitability, with operating income of ¥14.6 billion, income before income taxes and equity in earnings of affiliated company of ¥18.9 billion and net income of ¥12.9 billion.

With respect to the year-end dividend distribution to the shareholders, we resolved at the meeting of the Board of Directors held on May 27, 2015 to distribute a year-end dividend of ¥10 per share, with a payment date of June 2, 2015. Since Advantest has paid an interim dividend of ¥5, the total dividend per share for the fiscal year will be ¥15 per share (the same amount as FY2013).

We hope that we may rely on you for your continued support and guidance in the future.

June 2015

Shinichiro Kuroe

Representative Director,

President and CEO

Contents

|

Message to Shareholders

|

page 2

|

|

Convocation Notice of the 73rd Ordinary General Meeting of Shareholders

|

page 3

|

|

Reference Documents for the General Meeting of Shareholders

|

page 6

|

| |

|

|

(Attachments)

|

|

|

Business Report

|

page 21

|

|

Consolidated Financial Statements

|

page 33

|

|

Non-Consolidated Financial Statements

|

page 40

|

|

Audit Reports

|

page 47

|

| |

|

|

(Reference) Memorandum to Shareholders

|

page 53

|

(Stock Code Number: 6857, TSE first section)

June 1, 2015

To Our Shareholders

| |

Shinichiro Kuroe

|

| |

Representative Director

|

| |

President and CEO

|

| |

ADVANTEST CORPORATION

|

| |

32-1, Asahi-cho 1-chome,

|

| |

Nerima-ku, Tokyo

|

CONVOCATION NOTICE OF

THE 73rd ORDINARY GENERAL MEETING OF SHAREHOLDERS

Dear Shareholders:

Notice is hereby given that the 73rd ordinary general meeting of shareholders of ADVANTEST CORPORATION (the “Company”) will be held as set forth below. Your attendance thereat is respectfully requested.

If you are not able to attend the meeting, we request that you exercise your voting rights in writing or by way of electro-magnetic method (via the Internet, etc.) by 5:00 p.m. of June 23, 2015 (Tuesday) after carefully reading the reference documents as set forth below.

|

1.

|

Date and time:

|

June 24, 2015 (Wednesday) at 10:00 a.m.

(The reception desk will open at 9:00 a.m.)

|

|

2.

|

Place:

|

Main Conference Room of Advantest Corporation

32-1, Asahi-cho 1-chome, Nerima-ku, Tokyo

|

|

3.

|

Subject matters of the general meeting of shareholders:

|

| |

|

Matters to be reported: |

|

| |

|

|

Item No.1:

|

Matters concerning the business report, consolidated financial statements and financial statements reporting for the 73rd Fiscal Year (from April 1, 2014 to March 31, 2015)

|

| |

|

|

Item No.2:

|

Matters concerning the results of audit of the Company’s consolidated financial statements by the Independent Auditors and the Audit & Supervisory Board

|

| |

|

Matters to be resolved: |

| |

|

|

Agenda Item: |

|

| |

|

|

Agenda Item No.1: |

Partial amendments to the Articles of Incorporation

|

| |

|

|

Agenda Item No.2: |

Election of 6 directors (excluding directors who are audit and supervisory committee members) |

| |

|

|

Agenda Item No.3: |

Election of 3 directors who are audit and supervisory committee members

|

| |

|

|

Agenda Item No.4: |

Election of 1 substitute director who is an audit and supervisory committee member |

| |

|

|

Agenda Item No.5: |

Determination of the amount of remuneration for directors (excluding directors who are audit and supervisory committee members) |

| |

|

|

Agenda Item No.6: |

Determination of the amount of remuneration for directors who are audit and supervisory committee members |

| |

|

|

Agenda Item No.7: |

Determination of the amount of remuneration as stock options to directors (excluding directors who are audit and supervisory committee members) |

|

4.

|

Instructions for the Exercise of Voting Rights:

|

[Exercise of voting rights in writing by submitting the enclosed voting right exercise form]

Please indicate your intention to vote “for” or “against” each agenda item on the enclosed voting right exercise form, then return the form to us to be delivered by 5:00 p.m. of June 23, 2015 (Tuesday).

[Exercise of voting rights by way of electro-magnetic method (via the Internet, etc.)]

Please access the website for casting votes (http://www.evote.jp/) and indicate your intention to vote “for” or “against” each agenda item by following the on-screen instructions by the time limit set forth above. For details, please refer to “Instructions for the Exercise of Voting Rights via the Internet, etc.” as set forth on page 5.

[Handling of the duplicated votes]

If the voting rights are exercised by way of both voting right exercise form and electro-magnetic method, the exercise of voting rights by way of electro-magnetic method shall be deemed valid.

If the voting rights are exercised by way of electro-magnetic method multiple times, the last exercise of voting rights shall be deemed valid.

When you arrive at the meeting, please submit the enclosed voting right exercise form to the reception desk at the site of the meeting.

As the following information is available on the Company’s website in accordance with laws and regulations and Article 13 of the Articles of Incorporation, it is not included in this convocation notice.

1. Notes to Consolidated Financial Statements

2. Notes to Non-Consolidated Financial Statements

Amendments to the reference documents for the general meeting of shareholders and/or attached materials, if any, will be posted on the Company’s website.

We cordially invite you to attend a reception to be held after the meeting for shareholders.

For shareholders who will be unable to attend the meeting, presentation materials concerning matters to be reported will be posted on the Company’s website on the day of the meeting.

The resolutions adopted at the meeting will be posted on the Company’s website instead of issuing a written notice of resolution.

The Company’s website: http://www.advantest.com/US/investors/index.htm

<<Instructions for the Exercise of Voting Rights via the Internet, etc.>>

If you choose to exercise your voting rights via the Internet, please read the instructions below before doing so. If you attend the meeting, you do not need to mail the voting right exercise form or vote via the Internet.

1. About the website for casting votes

(1) Voting rights may be exercised online only by accessing the website designated by the Company (http://www.evote.jp/) on a personal computer, smart phone or mobile phone. (This website is out of service from 2:00 a.m. to 5:00 a.m. every day.)

(2) In some cases, you may not be able to use the website for casting votes due to your Internet environment, network service, or communication device model.

(3) Although exercise of Voting Rights via the Internet is available until 5:00 p.m. on June 23, 2015 (Tuesday), please exercise your voting rights early. Please contact the help-desk below if you have any questions.

2. About the exercise of voting rights via the Internet

(1) Please use your “login ID” and “temporary password” indicated on the enclosed voting rights exercise form to access the voting website (http://www.evote.jp/), then vote “for” or “against” by following the on-screen instructions.

(2) Please note that you will be asked to change your “temporary password” on the website for casting votes in order to avoid unauthorized access by any third person other (spoofing) or altering the details of your vote.

3. Handling of votes cast more than one time

(1) If voting rights are exercised both by mail and via the Internet, the exercise of voting rights via the Internet shall be deemed valid.

(2) If voting rights are exercised via the Internet multiple times, the last exercise of voting rights shall be deemed valid. Also, if the voting rights are exercised through the use of more than one electronic devices including a personal computer, a smart phone or a mobile phone, the voting right exercised last in time shall be deemed valid.

4. Charges and fees incurred by accessing the website for casting votes

Any connection charges due to Internet service providers and communication charges due to communication carriers incurred as a result of using the voting website shall be the responsibility of each shareholder.

|

[Contact for inquiry regarding IT system, etc.]

Corporate Agency Division (Help desk) , Mitsubishi UFJ Trust and Banking Corporation

Phone number: 0120-173-027 (toll-free number within Japan)

Business hours: 9 a.m. to 9 p.m. (Japan time)

|

[About the electronic voting platform]

Nominee shareholders (including standing proxies) such as trust banks can use the electronic voting platform operated by ICJ, Inc. by submitting an application in advance.

Reference Documents for the General Meeting of Shareholders

Agenda Items and Reference Matters:

|

Agenda Item No. 1:

|

Partial amendments to the Articles of Incorporation

|

| |

1)

|

According to the Law for Partial Amendment to the Companies Act (Law No. 90, 2014, “Amended Companies Act”) effective as of May 1, 2015, a stock company may transition to a company with an audit and supervisory committee. In order to further strengthen the supervisory function of the board of directors and its corporate governance system and thereby enhance the company’s enterprise value, the Company is transitioning its governance structure to a company with an audit and supervisory committee. In connection with this transition, the Company is making amendments to its Articles of Incorporation which are necessary for the transition to a company with an audit and supervisory committee, such as introducing new provisions for the audit and supervisory committee and its members and deleting provisions related to the audit and supervisory board and its members.

|

| |

2)

|

Further, while the Amended Companies Act has made the requisite conditions for outside directors of a company stricter, it also amended the scope of directors of a company who may enter into a limited liability agreement with the company to directors who are not executive directors, etc. Given such amendment to the Companies Act, the Company is accordingly amending the relevant articles of its Articles of Incorporation which set forth the scope of directors who may enter into a limited liability agreement with the Company. The Company has obtained the consent of all audit and supervisory board members with respect to this amendment to the Articles of Incorporation.

|

| |

3)

|

In addition, the Company is making other necessary amendments to the Articles of Incorporation of the Company, such as changes of wording and expressions and of the numbering of articles resulting from additions and/or deletions of articles, etc.

|

|

2.

|

Details of Proposed Amendments

|

The details of the proposed amendments are as follows:

(Changes (including deletions) are underlined.)

| Present Article |

Proposed Amendment |

| Article 2. |

(Objective)

|

Article 2. |

(Objective)

|

| 1. |

(omitted) |

1. |

(present provisions maintained) |

|

2.

|

(omitted) |

2. |

(present provisions maintained) |

| 3. |

(omitted) |

3. |

(present provisions maintained) |

| 4. |

Lease and rental of equipment and appliances, etc., incidental to each of the foregoing items; |

4. |

Lease and rental of equipment, appliances, etc., incidental to each of the foregoing items; |

| 5. |

(omitted) |

5. |

(present provisions maintained) |

| 6. |

(omitted) |

6. |

(present provisions maintained) |

| |

|

|

|

|

|

| Present Article |

Proposed Amendment |

|

|

(Share Registration Agent)

|

Article 10.

|

(Share Registration Agent)

|

|

1.

|

(omitted) |

1.

|

(present provisions maintained) |

|

2.

|

(omitted) |

2. |

(present provisions maintained) |

|

3.

|

Preparation of, and maintenance and other business concerning, the shareholders’ register and the register for stock acquisition rights shall be commissioned to the share registration agent and shall not be handled by the Company. |

3. |

Preparation, maintenance and other business concerning the shareholders’ register and the register for stock acquisition rights shall be commissioned to the share registration agent and shall not be handled by the Company. |

|

Article 19.

|

(Number of Directors)

|

Article 19. |

(Number of Directors)

|

| |

The number of Directors of the Company shall be no more than ten (10). |

1. |

The number of Directors of the Company shall be no more than fifteen (15). |

| (Newly introduced) |

2. |

Among the Directors set forth in the preceding paragraph, the number of Directors who are Audit and Supervisory Committee members shall be no more than five (5). |

|

Article 20.

|

(Election of Directors)

|

Article 20. |

(Election of Directors)

|

|

1.

|

Directors shall be elected at the General Meeting of Shareholders. |

1. |

Directors shall be elected, distinguishing Directors who shall become Audit and Supervisory Committee members from those who shall not, at the General Meeting of Shareholders. |

|

2.

|

(omitted) |

2.

|

(present provisions maintained) |

| 3. |

Cumulative voting shall not be used for election of Directors. |

3.

|

Cumulative voting shall not be used for resolution to elect Directors. |

|

|

(Term of Office of Directors)

|

Article 21.

|

(Election of Directors)

|

|

|

The term of office of a Director shall expire at the close of the ordinary general meeting of shareholders pertaining to the last fiscal year ending within one (1) year after appointment.

|

1. |

The term of office of a Director (excluding a Director who is an Audit and Supervisory Committee member) shall expire at the close of the ordinary general meeting of shareholders pertaining to the last fiscal year ending within one (1) year after his/her appointment. |

| (Newly introduced) |

2. |

The term of office of a Director who is an Audit and Supervisory Committee member shall expire at the close of the ordinary general meeting of shareholders pertaining to the last fiscal year ending within two (2) years after his/her appointment. |

| (Newly introduced) |

3. |

The term of office of a Director who is an Audit and Supervisory Committee member elected to fill the vacancy of another Director who was an Audit and Supervisory Committee member who retired before the expiration of his/her term of office shall be until the expiration of the term of office of such Director who was an Audit and Supervisory Committee member who retired. |

| |

|

|

|

|

|

| Present Article |

Proposed Amendment |

| (Newly introduced) |

4. |

The term of effectiveness of resolutions to elect a substitute Director who is an Audit and Supervisory Committee member in accordance with Article 329, Paragraph 3 of the Companies Act shall expire at the opening of the Ordinary General Meeting of Shareholders pertaining to the last fiscal year ending within two (2) years after such resolutions. |

| Article 23. |

(Convocation Notice and Resolutions of the Board of Directors)

|

Article 23. |

(Convocation Notice and Resolutions of the Board of Directors) |

|

1.

|

A convocation notice of the Board of Directors shall be dispatched to each Director and Audit & Supervisory Board member at least three (3) days prior to the date set for the meeting; provided, however, that such period may be shortened in the case of urgency. |

1. |

A convocation notice of the Board of Directors shall be dispatched to each Director at least three (3) days prior to the date set for a meeting; provided, however, that such period may be shortened in the case of urgency. |

|

2.

|

A convocation notice as provided for in the preceding paragraph may be omitted when the unanimous consent of all the Directors and the Audit & Supervisory Board members is obtained. |

2. |

A convocation notice as provided for in the preceding paragraph may be omitted when the unanimous consent of all of the Directors is obtained. |

|

3.

|

A resolution of the Board of Directors shall be adopted by a majority vote of the Directors present at the meeting at which a majority of Directors are present. |

3. |

A resolution of the Board of Directors shall be adopted by a majority vote of the Directors present at a meeting at which a majority of Directors who are entitled to participate in the resolution are present. |

|

4.

|

If a Director submits a proposal to resolve a matter that is subject to resolution by the Board of Directors and if all the directors (limited to those Directors who are entitled to participate in the resolution of such matter) consent to such proposal in writing or digitally (except when any Audit & Supervisory Board member objects to such proposal), the Company shall deem that there was a resolution by the Board of Directors adopting such proposal. |

4. |

If a Director submits a proposal to resolve a matter that is subject to resolution by the Board of Directors and if all the Directors (limited to those Directors who are entitled to participate in the resolution of such matter) consent to such proposal in writing or digitally, the Company shall deem that there was a resolution by the Board of Directors adopting such proposal. |

| (Newly introduced) |

Article 24. |

(Delegation of Decisions on Execution of Important Operational Matters) |

| |

|

|

|

The Company may, pursuant to the provisions of Article 399-13, Paragraph 6 of the Companies Act, delegate all or part of decisions on the execution of important operational matters (excluding the matters listed in Article 399-13, Paragraph 5 of the Companies Act) to Directors upon and in accordance with a resolution of the Board of Directors. |

|

Article 24.

|

(Regulations of the Board of Directors)

|

Article 25. |

(Regulations of the Board of Directors) |

| (omitted) |

(present provisions maintained) |

| |

|

|

|

|

|

| Present Article |

Proposed Amendment |

|

Article 25.

|

(Minutes of Meeting of the Board of Directors)

|

Article 26. |

(Minutes of Meeting of the Board of Directors) |

| |

A summary of the proceedings, results and other matters required by laws and regulations regarding a meeting of the Board of Directors shall be recorded in the minutes in writing or digitally, and the Directors and Audit & Supervisory Board members present at the meeting shall affix their names and seals thereto or electronically sign thereon. |

|

A summary of the proceedings, results and other matters required by laws and regulations regarding a meeting of the Board of Directors shall be recorded in the minutes in writing or digitally and the Directors present at the meeting shall affix their names and seals thereto or electronically sign thereon. |

|

Article 26.

|

(Remuneration, etc. of Directors)

|

Article 27. |

(Remuneration, etc. of Directors) |

| |

Remuneration, bonuses and other financial interests received by Directors from the Company as compensation for undertaking their functions (“Remuneration, etc.”) shall be determined at a general meeting of shareholders. |

|

Remuneration, bonuses and other financial interests received by Directors from the Company as compensation for undertaking their functions shall be determined, distinguishing Directors who are Audit and Supervisory Committee members from those who are not, at a general meeting of shareholders. |

|

Article 27.

|

(Exemption of Directors’ Liabilities)

|

Article 28.

|

(Exemption of Directors’ Liabilities) |

|

1.

|

(omitted) |

1. |

(present provisions maintained) |

|

2.

|

Pursuant to the provisions of Article 427, Paragraph 1 of the Companies Act, the Company may enter into contracts with its outside Directors to limit their liabilities for a failure to perform their duties, provided that the maximum amount of liabilities under such contracts shall be the total of the amounts provided in each item of Article 425, Paragraph 1 of the Companies Act. |

2.

|

Pursuant to the provisions of Article 427, Paragraph 1 of the Companies Act, the Company may enter into contracts with its Directors (excluding its Executive Directors, etc.) to limit their liabilities for a failure to perform their duties, provided that the maximum amount of liabilities under such contracts shall be the total of the amounts provided in each item of Article 425, Paragraph 1 of the Companies Act. |

|

|

(Counselors and Advisors)

|

Article 29.

|

(Counselors and Advisors) |

| |

(omitted) |

|

(present provisions maintained) |

|

|

CHAPTER V. AUDIT & SUPERVISORY

|

|

CHAPTER V. AUDIT AND |

| |

BOARD AND ITS MEMBERS |

|

SUPERVISORY COMMITTEE |

| (Newly introduced) |

Article 30.

|

(Establishment of Audit and Supervisory Committee) |

| |

|

|

|

The Company shall establish an Audit and Supervisory Committee. |

| (Newly introduced) |

Article 31. |

(Convocation Notice and Resolutions of the Audit and Supervisory Committee) |

| |

|

|

1. |

A convocation notice of the Audit and Supervisory Committee shall be dispatched to each Audit and Supervisory Committee member at least three (3) days prior to the date set for a meeting; provided, however, that such period may be shortened in the case of urgency. |

| (Newly introduced) |

2. |

A convocation notice as provided for in the preceding paragraph may be omitted when the unanimous consent of all of the Audit and Supervisory Committee members is obtained.

|

| |

|

|

|

|

|

| Present Article |

Proposed Amendment |

| (Newly introduced) |

3. |

A resolution of the Audit and Supervisory Committee shall be adopted by a majority vote of the committee members present at a meeting at which a majority of the Audit and Supervisory Committee members who are entitled to participate in the resolution are present.

|

| (Newly introduced) |

Article 32. |

(Regulations of the Audit and Supervisory Committee) |

| |

|

|

|

Any matters concerning the Audit and Supervisory Committee shall be governed by the Regulations of the Audit and Supervisory Committee to be prescribed by the Audit and Supervisory Committee, in addition to laws and ordinances or these Articles of Incorporation. |

| (Newly introduced) |

Article 33. |

(Minutes of Meeting of the Audit and Supervisory Committee) |

| |

|

|

|

A summary of the proceedings, results and other matters required by laws and regulations regarding a meeting of the Audit and Supervisory Committee shall be recorded in the minutes in writing or digitally, and the Audit and Supervisory Committee members present at the meeting shall affix their names and seals thereto or put their electronic signatures thereon. |

| Article 29. |

(Audit & Supervisory Board and its members)

|

(Deleted) |

| |

The Company shall have Audit & Supervisory Board and its members.

|

|

|

|

|

Article 30.

|

(Number of Audit & Supervisory Board members)

|

(Deleted) |

| |

The number of Audit & Supervisory Board members of the Company shall be no more than five (5).

|

|

|

|

Article 31.

|

(Election of Audit & Supervisory Board members)

|

(Deleted) |

| 1. |

Audit & Supervisory Board members shall be elected at the General Meeting of Shareholders. |

|

|

|

| 2. |

A resolution to elect an Audit & Supervisory Board member shall be made at a meeting at which the shareholders holding one-third (1/3) or more of the voting rights of the total shareholders who are entitled to exercise their voting rights, and shall be adopted by a majority of votes thereof. |

(Deleted) |

| |

|

|

|

|

| Present Article |

Proposed Amendment |

| Article 32. |

(Term of Office of Audit & Supervisory Board members)

|

(Deleted) |

| 1. |

The term of office of an Audit & Supervisory Board member shall expire at the close of the ordinary general meeting of shareholders pertaining to the last fiscal year ending within four (4) years after his/her appointment. |

|

|

|

| 2. |

The term of office of an Audit & Supervisory Board member elected to fill a vacancy of another Audit & Supervisory Board member, who has retired before such another Audit & Supervisory Board member term of office expires, shall be until the term of office of such predecessor would expire. |

(Deleted) |

|

Article 33.

|

(Standing Audit & Supervisory Board member(s))

|

(Deleted) |

| |

The Audit & Supervisory Board shall by its resolution elect standing Audit & Supervisory Board member(s).

|

|

|

|

|

Article 34.

|

(Convocation Notice of the Audit & Supervisory Board and Resolution Thereof)

|

(Deleted) |

| 1. |

The convocation notice of the Audit & Supervisory Board shall be dispatched to each Audit & Supervisory Board member at least three (3) days prior to the date set for the meeting; provided, however, that such period may be shortened in the case of urgency. |

|

|

|

| 2. |

The convocation notice as provided for in the preceding paragraph may be omitted when the unanimous consent of all the Audit & Supervisory Board members is obtained. |

(Deleted) |

| 3. |

The resolution of the Audit & Supervisory Board shall be adopted by a majority of Audit & Supervisory Board members, unless otherwise provided for by laws and ordinances. |

(Deleted) |

|

Article 35.

|

(Regulations of the Audit & Supervisory Board)

|

(Deleted) |

| |

Any matters concerning the Audit & Supervisory Board shall be governed by the Regulations of the Audit & Supervisory Board to be prescribed by the Audit & Supervisory Board in addition to the laws and ordinances or these Articles of Incorporation.

|

|

|

|

| |

|

|

|

|

|

| Present Article |

Proposed Amendment |

|

Article 36.

|

(Minutes of Meeting of the Audit & Supervisory Board)

|

(Deleted) |

|

|

A summary of proceedings, results and other matters required by applicable laws and regulations regarding a meeting of the Audit & Supervisory Board shall be recorded in the minutes in writing or digitally, and the Audit & Supervisory Board members present at the meeting shall affix their names and seals thereto or put their electronic signatures thereon.

|

|

|

|

|

Article 37.

|

(Remuneration, etc. of Audit & Supervisory Board members)

|

(Deleted) |

|

|

Remuneration, etc. of Audit & Supervisory Board members shall be determined at a general meeting of shareholders.

|

|

|

|

|

Article 38.

|

(Exemption of Audit & Supervisory Board members’ Liabilities)

|

(Deleted) |

|

1.

|

Pursuant to the provisions of Article 426, Paragraph 1 of the Companies Act and to the extent permitted by laws and regulations, the Company may, by resolution of the Board of Directors, exempt the liabilities of its Audit & Supervisory Board members (including persons who have previously served as the Company’s Audit & Supervisory Board members) for failing to perform their duties. |

|

|

|

|

2.

|

Pursuant to the provisions of Article 427, Paragraph 1 of the Companies Act, the Company may enter into contracts with its outside Audit & Supervisory Board members to limit their liabilities for a failure to perform their duties, provided that the maximum amount of liabilities under such contracts shall be the total of the amounts provided in each item of Article 425, Paragraph 1 of the Companies Act. |

(Deleted) |

|

Article 39.

|

(Accounting Auditor(s))

|

Article 34. |

(Accounting Auditor(s))

|

| ~ |

~ |

| (omitted) |

(present provisions maintained) |

|

Article 43.

|

(Expiration for Dividend Payment)

|

Article 38.

|

(Expiration for Dividend Payment)

|

|

(omitted)

|

(present provisions maintained) |

| (Newly introduced) |

SUPPLEMENTARY PROVISIONS |

| |

|

|

Article 1. (Transition Measures) |

| |

|

|

|

With regard to (i) partial exemption in accordance with a resolution of the Board of Directors from liabilities for conduct of Audit & Supervisory Board members prior to the amendments to the Company’s Articles of Incorporation resolved at the Company’s 73rd ordinary general meeting of shareholders and (ii) contracts with Audit & Supervisory Board members to limit such liabilities, the provisions of Article 38 of the Company’s Articles of Incorporation prior to such amendments shall remain in effect. |

| |

|

|

|

|

|

|

Agenda Item No.2:

|

Election of 6 directors (excluding directors who are audit and supervisory committee members)

|

If Agenda Item No.1 “Partial amendments to the Articles of Incorporation” is approved as proposed, the Company transitions its governance structure to a company with audit and supervisory committee, and the term of office of all eight current directors will expire upon the closing of this ordinary general meeting of shareholders. The Company therefore requests that you elect six directors (excluding directors who are audit and supervisory committee members).

The profiles of the director candidates (excluding directors who are audit and supervisory committee members) are set forth below.

| |

Name

(Date of Birth) |

Brief personal history; position and assignment; and other significant concurrently held positions, if any |

Number of the Company’s shares owned |

|

1

|

Shinichiro Kuroe

(March 30, 1959) |

April 1981 |

Joined Advantest Corporation |

3,905 |

|

June 2005

|

Executive Officer |

| June 2009 |

Director, Managing Executive Officer |

| June 2013 |

Director, Corporate Vice President |

| August 2014 |

Representative Director, President and CEO (present position) |

|

|

Osamu Karatsu

(April 25, 1947) |

April 1975

|

Joined Nippon Telegraph and Telephone Public Corporation

|

1,245 |

|

June 1991

|

Executive Manager, LSI Laboratories, Nippon Telegraph and Telephone Corporation

|

|

June 1997

|

Vice President and Director, Advanced Telecommunications Research Institute International

(Resigned June 1999)

|

|

April 1999

|

Principal Consultant, SRI Consulting K.K.

|

|

April 2000

|

Chief Executive Director, SRI International Japan

(Resigned January 2012)

|

|

June 2012

|

Outside Director of Advantest Corporation (present position)

|

| The reasons for nomination as a candidate for outside director and the number of years in office |

| ■Mr. Osamu Karatsu is a candidate for outside director. |

| ■The Company selected Mr. Osamu Karatsu as a candidate because of his considerable experience and knowledge as a semiconductor specialist, and the Company believes that he will contribute greatly to its management as an outside director. |

|

■Mr. Osamu Karatsu has served as an outside director of the Company for three years.

|

| |

Name

(Date of Birth)

|

Brief personal history; position and assignment; and other significant concurrently held positions, if any |

Number of the Company’s shares owned |

|

3

|

Seiichi Yoshikawa

(March 22, 1946)

|

July 1969

|

Joined Fujitsu Limited

|

1,835 |

|

June 2000

|

Director, Fujitsu Laboratories Ltd.

|

|

June 2004

|

Managing Director, Fujitsu Laboratories Ltd.

(Resigned June 2009)

|

|

March 2011

|

Chairman, QD Laser, Inc.

(Resigned December 2012)

|

|

September 2012

|

Principal Fellow, Center for Research and Development Strategy, Japan Science and Technology Agency (Resigned March 2015)

|

|

June 2013

|

Outside Director of Advantest Corporation (present position)

|

| The reasons for nomination as a candidate for outside director and the number of years in office |

|

■Mr. Seiichi Yoshikawa is a candidate for outside director.

|

|

■The Company selected Mr. Seiichi Yoshikawa as a candidate because of his considerable experience and knowledge as a research and development strategy specialist, and the Company believes that he will contribute greatly to its management as an outside director.

|

|

■Mr. Seiichi Yoshikawa has served as an outside director of the Company for two years.

|

|

4

|

Sae Bum Myung

(September 16, 1954) |

April 1989

|

Joined Advantest Corporation

|

2,493 |

|

June 2008

|

Executive Officer

|

|

June 2011

|

Director, Managing Executive Officer (present position)

Sales and Marketing (present position)

Executive Vice President, Sales Group (present position)

|

|

|

|

|

5

|

Hiroshi Nakamura

(December 4, 1957)

|

April 1981

|

Joined Advantest Corporation

|

6,425 |

|

June 2006

|

Executive Officer

|

|

June 2009

|

Managing Executive Officer

|

|

June 2010

|

Executive Vice President, Corporate Administration Group (present position)

|

|

June 2012

|

Director, Managing Executive Officer (present position)

|

|

|

Corporate Administration (present position) |

| 6 |

Yoshiaki Yoshida

(February 8, 1958)

|

April 1999 |

Joined Advantest Corporation

|

1,521 |

|

June 2006

|

Executive Officer |

|

June 2009

|

Managing Executive Officer

|

|

June 2013

|

Director, Managing Executive Officer (present position)

Corporate Planning and Corporate Communications (present position)

Executive Vice President, Corporate Relations Group (present position) |

|

1.

|

These candidates do not have any special interest in the Company.

|

|

2.

|

The Company has registered Messrs. Osamu Karatsu and Seiichi Yoshikawa as independent directors with the Tokyo Stock Exchange.

|

|

3.

|

The Company has entered into a limited liability agreement pursuant to Article 427, Paragraph 1 of the Companies Act with each of Messrs. Osamu Karatsu and Seiichi Yoshikawa. The upper limit of liability based on this agreement is the minimum liability as provided in the applicable laws and ordinances.

|

|

Agenda Item No.3:

|

Election of 3 directors who are audit and supervisory committee members

|

If Agenda Item No.1 “Partial amendments to the Articles of Incorporation” is approved as proposed, the Company transitions its governance structure to a “company with audit and supervisory committee”. The Company therefore requests that you elect three directors who are audit and supervisory committee members. The Company has obtained the consent of the Audit & Supervisory Board with respect to this agenda item.

The profiles of the director candidates who are audit and supervisory committee members are set forth below.

| |

|

Brief personal history; position and assignment; and other significant concurrently held positions, if any

|

Number of the Company’s shares owned |

| 1 |

Yuichi Kurita

(July 28, 1949)

|

April 1973

|

Joined Fujitsu Limited

|

5,800 |

|

April 2001

|

Joined Advantest Corporation

|

|

June 2003

|

Executive Officer

|

|

June 2007

|

Director, Managing Executive Officer

|

|

June 2010

|

Director, Senior Executive Officer

|

|

June 2012

|

Standing Audit & Supervisory Board Member (present position)

|

|

2

|

Megumi Yamamuro

(March 8, 1948)

|

April 1974

|

Assistant Judge, Tokyo District Court

|

1,317 |

|

April 1984

|

Judge, Tokyo District Court

|

|

April 1988

|

Instructor, Legal Training and Research Institute

|

|

April 1997

|

Judge, Tokyo High Court

|

|

July 2004

|

Registered as Attorney-at-Law

Joined CAST Law P.C. (currently URYU & ITOGA) (present position)

|

|

October 2004

|

Professor, The University of Tokyo Graduate School of Law and Politics

|

|

June 2005

|

Outside Audit & Supervisory Board Member, Fujitsu Limited (present position)

|

|

June 2006

|

Outside Audit & Supervisory Board Member, Advantest Corporation (present position)

|

|

June 2009

|

Outside Audit & Supervisory Board Member, NIFTY Corporation (present position)

|

|

October 2010

|

Professor, Nihon University Law School

|

|

June 2013

|

Outside Audit & Supervisory Board Member, Yachiyo Industry Co., Ltd. (present position)

|

| |

|

Brief personal history; position and assignment; and other significant concurrently held positions, if any |

Number of the Company’s shares owned |

| |

The reasons for nomination as a candidate for outside director: |

| |

■Mr. Megumi Yamamuro is a candidate for outside director who is an audit and supervisory committee member.

|

| |

■The Company selected Mr. Megumi Yamamuro as a candidate because of his considerable experience and knowledge as a legal specialist, and the Company believes that he will contribute greatly to its management as an outside director who is an audit and supervisory committee member.

|

| |

■Although Mr. Megumi Yamamuro has not been directly involved in the management of a company in the past, because he has been engaged in legal practice as a judge and an attorney-at-law for an extensive period, the Company believes that he will be able to adequately perform his duties as an outside director who is an audit and supervisory committee member.

|

| |

■Mr. Megumi Yamamuro has served as an outside Audit & Supervisory Board Member of the Company for nine years.

|

| 3 |

Yasushige Hagio

(November 24, 1947)

|

April 1972

|

Assistant Judge, Tokyo District Court

|

3,286 |

|

April 1982

|

Judge, Tokyo District Court

|

|

April 1998

|

Instructor, Legal Training and Research Institute

|

|

December 2003

|

Chief of Shizuoka District Court

|

|

June 2004

|

Registered as Attorney-at-Law

|

| |

Joined Seiwa Patent & Law (present position) |

|

June 2006

|

Outside Director of Advantest Corporation (present position)

|

| The reasons for nomination as a candidate for outside director and the number of years in office: |

|

■Mr. Yasushige Hagio is a candidate for outside director who is an audit and supervisory committee member.

|

|

■The Company selected Mr. Yasushige Hagio as a candidate because of his considerable experience and knowledge as a legal specialist, and the Company believes that he will contribute greatly to its management as an outside director who is an audit and supervisory committee member.

|

|

■Although Mr. Yasushige Hagio has not been directly involved in the management of a company in the past, because he has been engaged in legal practice as a judge and an attorney-at-law for an extensive period, the Company believes that he will be able to adequately perform his duties as an outside director who is an audit and supervisory committee member.

|

|

■Mr. Yasushige Hagio has served as an outside director of the Company for nine years.

|

|

1.

|

Messrs. Yuichi Kurita and Megumi Yamamuro are candidates for new directors.

|

|

2.

|

These candidates do not have any special interest in the Company.

|

|

3.

|

The Company has registered Mr. Megumi Yamamuro as an independent Audit & Supervisory Board Member and Mr. Yasushige Hagio as an independent director with the Tokyo Stock Exchange.

|

|

4.

|

The Company has entered into a limited liability agreement pursuant to Article 427, Paragraph 1 of the Companies Act with Messrs. Megumi Yamamuro and Yasushige Hagio. The upper limit of liability based on this agreement is the minimum liability as provided in the applicable laws and ordinances. If Mr. Megumi Yamamuro’s election is approved and he assumes the position of a director who is an audit and supervisory committee member, the Company intends to enter into a new limited liability agreement with the same terms and conditions.

|

|

Agenda Item No. 4:

|

Election of 1 substitute director who is an audit and supervisory committee member

|

If Agenda Item No.1 “Partial amendments to the Articles of Incorporation” is approved as proposed, the Company transitions its governance structure to a company with audit and supervisory committee. The Company therefore requests that you elect one substitute director who is an audit and supervisory committee member to fill the vacancy of another director who was an audit and supervisory committee member who retired before the expiration of his/her term of office. The Company has obtained the consent of the Audit & Supervisory Board with respect to this agenda item.

The candidate for substitute director who is an audit and supervisory committee member is as below.

For the date of birth, brief personal history and other items to be described in the reference documents for the General Meeting of Shareholders for the above candidate, please see Agenda Item No. 2 “Election of 6 directors (excluding directors who are audit and supervisory committee members)”.

|

Agenda Item No.5:

|

Determination of the amount of remuneration for directors (excluding directors who are audit and supervisory committee members)

|

With respect to the amount of remuneration to be paid to directors of the Company, the resolution adopted at the 65th ordinary general meetings of shareholders held on June 27, 2007 to the effect that no more than 615 million yen to directors shall be paid annually remains in effect. However, if Agenda Item No.1 “Partial amendments to the Articles of Incorporation” is approved as proposed, the Company transitions its governance structure to a company with audit and supervisory committee. Accordingly, in accordance with paragraphs 1 and 2 of Article 361 of the Amended Companies Act, the Company would like to revoke the current limit on remuneration to directors and to have resolved that the amount of remuneration for directors (excluding directors who are audit and supervisory committee members) shall be no more than 600 million yen per year, taking into consideration all circumstances, including economic conditions. The specific amount of remuneration for each director and timing of payment of remuneration, etc. shall be determined by the resolution at the meeting of the Board of Directors.

Currently, there are eight directors (including three outside directors). If Agenda Items No. 1 and 2 are approved as proposed, the number of directors (excluding directors who are audit and supervisory committee members) will be six (including two outside directors).

|

Agenda Item No.6:

|

Determination of the amount of remuneration for directors who are audit and supervisory committee members

|

If Agenda Item No.1 “Partial amendments to the Articles of Incorporation” is approved as proposed, the Company transitions its governance structure to a company with audit and supervisory committee. Accordingly, in accordance with the paragraphs 1 and 2 of Article 361 of the Amended Companies Act, the Company would like to have resolved that the amount of remuneration for directors who are audit and supervisory committee members shall be no more than 100 million yen per year, taking into consideration all circumstances, including economic conditions. The specific amount of remuneration for each director who is audit and supervisory committee member and timing of payment of remuneration, etc. shall be determined through discussion among directors who are audit and supervisory committee members.

If Agenda Items No. 1 and 3 are approved as proposed, the number of directors who are audit and supervisory committee members will be three (including two outside directors).

|

Agenda Item No.7:

|

Determination of the amount of remuneration as stock options to directors (excluding directors who are audit and supervisory committee members)

|

The Company requests that you approve the amount of remuneration as stock options in the form of stock acquisition rights to directors (excluding directors who are audit and supervisory committee members) of the Company as described below.

|

1.

|

Reason for requesting shareholder approval

|

The Company has issued stock acquisition rights as stock options to directors of the Company since 2002 to promote management with a view to increasing shareholder value by improving directors’ performance and morale and to attract and retain competent personnel. With respect to the amount of remuneration as stock options in the form of stock acquisition rights to directors, the resolution adopted at the 64th ordinary general meetings of shareholders held on June 27, 2006 to the effect that no more than 700 million yen to directors shall be paid annually remains in effect.

If Agenda Item No. 1 “Partial amendments to the Articles of Incorporation” is approved as proposed, the Company transitions its governance structure to a company with audit and supervisory committee. Accordingly, in accordance with the paragraph 1 and 2 of Article 361 of the Amended Companies Act, the Company would like to have resolved the amount of remuneration as stock options in the form of stock acquisition rights to directors (excluding directors who are audit and supervisory committee members), in addition to the amount of remuneration for directors (excluding directors who are audit and supervisory committee members) to be approved by Agenda Item No. 5, taking into consideration all circumstances, including economic conditions.

If Agenda Items No. 1 and 2 are approved as proposed, the number of directors (excluding directors who are audit and supervisory committee members) will be six (including two outside directors).

|

(1)

|

The amount of remuneration for directors (excluding directors who are audit and supervisory committee members)

|

The amount of remuneration as stock options in the form of stock acquisition rights to directors (excluding directors who are audit and supervisory committee members) shall be no more than 700 million yen per year in addition to the amount of remuneration for directors (excluding directors who are audit and supervisory committee members) to be approved by Agenda Item No.5. Stock options will be granted by (i) issuing stock acquisition rights, (ii) providing cash remuneration that is equal to the total amount of subscription price, and (iii) setting off such remuneration against the subscription price of the stock acquisition rights.

|

(2)

|

Details of stock acquisition rights

|

| |

①

|

Class and total number of shares to be issued or delivered upon exercise of stock acquisition rights

|

The class of shares to be issued or delivered upon exercise of the stock acquisition rights shall be common stock of the Company.

The number of shares to be issued or delivered upon exercise of each stock acquisition right shall be 100 shares, provided that if the subscription price per share has been adjusted in accordance with sub-paragraph ③ below, the number of such shares shall be adjusted according to the following formula. This adjustment shall be made only with respect to stock acquisition rights that have not yet been exercised as of the time of adjustment.

Any fractional share that arises as a result of an adjustment will be rounded down to the nearest whole number of shares.

|

Number of shares to be issued or delivered upon exercise of each stock acquisition right

|

=

|

Total subscription price

|

|

Subscription price per share

|

| |

②

|

Total number of stock acquisition rights to be issued

|

The total amount of the fair value of the stock acquisition rights to be issued for each fiscal year to directors (excluding directors who are audit and supervisory committee members) within one (1) year from the ordinary general meeting of shareholders shall not exceed the amount of remuneration as stock acquisition rights to directors (excluding directors who are audit and supervisory committee members) in (1) above. The total amount of fair value of stock acquisition rights shall be obtained by multiplying each stock acquisition right by its fair value computed based on the Black Sholes model as of the date of issuance.

| |

③

|

Subscription price to be paid upon exercise of each stock acquisition right

|

The subscription price to be paid upon exercise of each stock acquisition right shall be determined by multiplying (i) the subscription price per share as determined in the following paragraph, by (ii) the number of shares to be issued or delivered upon exercise of each stock acquisition right as specified in sub-paragraph ① above (initially, 100 shares).

The subscription price per share shall be 1.05 times the average closing price, rounded up to the nearest yen, of the common stock of the Company in regular trading on the Tokyo Stock Exchange on each day of the month preceding the month in which any stock acquisition rights are issued (excluding any such day on which there was no trade); provided that if such amount is less than the closing price of the common stock of the Company on such day of issuance (or, if there was no trade on such day of issuance, the closing price on the day immediately preceding the day on which there was any trade), the subscription price per share shall be equal to the closing price on such day of issuance. The Company may determine the subscription price per share for the stock acquisition rights to be issued within one (1) year from the ordinary general meeting of shareholders for a fiscal year to be the same as that for the first stock acquisition rights issued after the ordinary general meeting of shareholders for that fiscal year (if the subscription price per share for the first stock acquisition right is adjusted by the method described below, such adjusted subscription price per share) for any subsequent stock acquisition right issued.

If, subsequent to the issuance of the stock acquisition rights, the Company splits or consolidates its common stock, or issues new shares or disposes of its treasury shares below market price (subject to certain exceptions, including the issuance or delivery of shares upon exercise of the stock acquisition rights), the subscription price per share shall be adjusted according to the formula set forth below, rounded up to the nearest yen. Furthermore, the subscription price per share may, to the extent necessary and reasonable, be adjusted in a way deemed appropriate by the Company, in the case of merger or split of the Company, stock-for-stock exchange or certain other events. The Company may determine the subscription price per share for each stock acquisition right issued after such adjustment but within one (1) year from the previous ordinary general meeting of shareholders to be the same as such adjusted subscription price per share.

|

|

(a)

|

Formula for adjustment in the case of share split or consolidation

|

|

Subscription price per

share after adjustment

|

=

|

Subscription price per

share before adjustment

|

x

|

1

|

|

Ratio of split / consolidation

|

|

|

(b)

|

Formula for adjustment in the case of issuance of new shares or disposition of treasury shares below market price

|

|

Subscription price per share after adjustment

|

=

|

Subscription price per share before adjustment

|

x

|

Outstanding number of shares

|

+

|

Number of new shares to be issued

|

x

|

Subscription price per share to be issued

|

| Market price per share |

| |

|

|

|

Outstanding number of shares

|

+

|

Number of new shares to be issued |

| |

|

|

|

|

|

|

|

|

|

|

In the above formula, “outstanding number of shares” shall mean the total number of outstanding shares of the Company after deducting shares held by the Company as treasury shares. In the case of a disposition of treasury shares, “number of new shares to be issued” in the above formula shall be read as “number of treasury shares to be disposed of”.

| |

④

|

Exercise period of stock acquisition rights

|

The exercise period for each stock acquisition right shall be determined by resolution at the meeting of the Board of Directors to approve the issuance of that stock acquisition right, but shall be not more than five (5) years from the day following the date of issuance.

| |

⑤

|

Conditions for exercise of stock acquisition rights

|

|

|

(a)

|

The director (excluding a director who is an audit and supervisory committee member) to whom the stock acquisition rights has been issued must be a director, audit & supervisory board member, executive officer, employee or non-regular employee of the Company or its domestic or overseas subsidiary at the time of exercise, except where there are any reasons the Company deems justifiable.

|

|

|

(b)

|

Stock acquisition rights may not be inherited.

|

|

|

(c)

|

No stock acquisition right may be exercised in part.

|

| |

⑥

|

Restriction on the transfer of stock acquisition rights

|

Acquisition of stock acquisition rights by transfer shall require approval by the Board of Directors, provided, however, that if it is the Company acquiring the stock acquisition rights by transfer, such transfer shall be deemed to be approved by the Board of Directors.

| |

⑦

|

Other details of stock acquisition rights

|

Details of items described in sub-paragraphs ① through ⑥ above and other matters will be determined by resolution at the meeting of the Board of Directors to approve the issuance of the stock acquisition rights.

(Attachments)

Business Report

(April 1, 2014 through March 31, 2015)

1. Current Conditions of the Advantest Group

| |

(1)

|

Business conditions during the fiscal year

|

| |

(i)

|

Operations and Results of Business

|

Overall

During Advantest’s FY2014, the world economy decelerated more than initially expected, but sustained a gradual recovery overall, supported by the ongoing steady growth of the American economy.

The semiconductor industry saw active capital investment by manufacturers into expansions of their production capacities and for miniaturization of semiconductors, spurred by ongoing global adoption of smartphones and improvements in handset performance and growing demand for semiconductors from data centers.

Amid these conditions, Advantest strove to maximize profitability by engaging in sales promotions for non-memory test systems for which demand growth has been particularly strong, as well as by expanding its customer base across all business segments. As a result, both orders and sales increased in comparison to the previous fiscal year: orders received expanded to ¥176.3 billion (a 38.4% increase in comparison to the previous fiscal year) and net sales expanded to ¥163.3 billion (a 46.0% increase in comparison to the previous fiscal year). Advantest returned to profitability, with operating income of ¥14.6 billion, income before income taxes and equity in earnings of affiliated company of ¥18.9 billion and a net income of ¥12.9 billion, mainly due to higher year-over-year net sales, an improved mix of high-profitability products and successful cost-cutting measures undertaken across the entire Advantest Group. The percentage of net sales from overseas customers was 92.0% compared to 89.1% in the previous fiscal year.

Business conditions by Business Segment

Semiconductor and Component Test System Segment

In the Semiconductor and Component Test System segment, demand for non-memory test system was strong throughout the period, driven by robust sales of new high-end smartphones and by expansion of LTE base station infrastructure in China and the growth of the Chinese LTE smartphone market. Demand for memory test systems accelerated in the second half of FY2014 due to increasing functional speeds of DRAM and NAND flash memories.

As a result of the above, orders received were ¥116.1 billion (a 41.3% increase in comparison to the previous fiscal year), net sales were ¥108.3 billion (a 48.3% increase in comparison to the previous fiscal year), and operating income was ¥14.6 billion.

Mechatronics System Segment

In the Mechatronics System segment, nanotechnology business generated higher profits and net sales by capturing increasing demand associated with miniaturization of semiconductors and 3D chip architectures. Demand for device interfaces and test handlers that are closely correlated with the tester market also grew in connection with increased demand for semiconductor test systems.

As a result of the above, orders received were ¥31.2 billion (a 62.8% increase in comparison to the previous fiscal year), net sales were ¥28.3 billion (a 89.2% increase in comparison to the previous fiscal year), and operating income was ¥3.8 billion.

Services, Support and Others Segment

In the Services, Support and Others segment, efforts to improve the profitability of the field services business generated positive results, including an increased number of annual maintenance contracts. Advantest’s newly developed and launched SSD (solid state drive) test system, developed in anticipation of strong growth in the SSD market, also contributed to net sales starting FY2014.

As a result of the above, orders received were ¥29.1 billion (a 10.7% increase in comparison to the previous fiscal year), net sales were ¥26.8 billion (a 10.8% increase in comparison to the previous fiscal year), and operating income was ¥3.3 billion (an 11.2% increase in comparison to the previous fiscal year).

Sales Breakdown by Business Segment (consolidated)

| Fiscal Year |

|

FY2013

(the 72nd)

|

|

|

FY2014

(the 73rd)

|

|

|

Change from the previous period

|

|

|

Segment

|

|

Amount

(in million yen)

|

|

|

Percentage

(%)

|

|

|

Amount

(in million yen)

|

|

|

Percentage

(%)

|

|

|

Amount

(in million yen)

|

|

|

Percentage increase (decrease)

(%)

|

|

|

Semiconductor and Component Test System

|

|

|

73,017 |

|

|

|

65.3 |

|

|

|

108,320 |

|

|

|

66.3 |

|

|

|

35,303 |

|

|

|

48.3 |

|

|

Mechatronics System

|

|

|

14,984 |

|

|

|

13.4 |

|

|

|

28,347 |

|

|

|

17.4 |

|

|

|

13,363 |

|

|

|

89.2 |

|

|

Services, Support and Others

|

|

|

24,151 |

|

|

|

21.6 |

|

|

|

26,752 |

|

|

|

16.4 |

|

|

|

2,601 |

|

|

|

10.8 |

|

|

Intercompany transaction elimination

|

|

|

(274 |

) |

|

|

(0.3 |

) |

|

|

(90 |

) |

|

|

(0.1 |

) |

|

|

184 |

|

|

|

- |

|

|

Total

|

|

|

111,878 |

|

|

|

100.0 |

|

|

|

163,329 |

|

|

|

100.0 |

|

|

|

51,451 |

|

|

|

46.0 |

|

|

Overseas

|

|

|

99,657 |

|

|

|

89.1 |

|

|

|

150,209 |

|

|

|

92.0 |

|

|

|

50,552 |

|

|

|

50.7 |

|

| |

(ii)

|

Capital Expenditures

|

The Advantest Group invested a total of ¥4.2 billion in capital expenditures in FY2014. Most of the investments were used for new product development and production facilities.

No significant financing activities took place in FY2014.

| |

(2)

|

Conditions of Assets, Profit and Loss

|

Conditions of Assets, Profit and Loss of the Advantest Group (consolidated)

| |

|

FY2011

(the 70th)

|

|

|

FY2012

(the 71st)

|

|

|

FY2013

(the 72nd)

|

|

|

FY2014

(the 73rd)

|

|

|

Net sales (in: million yen)

|

|

|

141,048 |

|

|

|

132,903 |

|

|

|

111,878 |

|

|

|

163,329 |

|

|

Net income (in: million yen)

|

|

|

(2,195 |

) |

|

|

(3,821 |

) |

|

|

(35,540 |

) |

|

|

12,948 |

|

|

Basic net income per share (in: yen)

|

|

|

(12.67 |

) |

|

|

(22.03 |

) |

|

|

(204.10 |

) |

|

|

74.31 |

|

|

Net assets (in: million yen)

|

|

|

131,552 |

|

|

|

141,241 |

|

|

|

116,252 |

|

|

|

140,938 |

|

|

Total assets (in: million yen)

|

|

|

219,226 |

|

|

|

225,515 |

|

|

|

229,856 |

|

|

|

273,041 |

|

| (Notes) |

1.

|

The Company prepared its consolidated financial statements in accordance with generally accepted accounting principles (GAAP) in the United States.

|

| |

2.

|

The calculation of “Basic net income per share” was based on the average number of shares issued during the relevant fiscal year reduced by the average number of treasury shares held during the fiscal year.

|

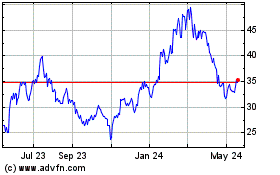

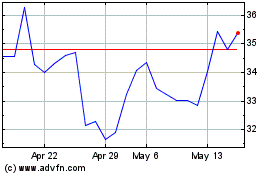

[Charts illustrating the information presented in the above table.]

| |

(3)

|

Significant Subsidiaries

|

|

Name of Subsidiary

|

Common Stock

|

Percentage of Voting Rights

(Note)

|

Principal Activities

|

|

Advantest Laboratories Ltd.

|

¥50 million

|

100%

|

Research and development of measuring and testing technologies

|

|

Advantest Finance Inc.

|

¥1,000 million

|

100%

|

Leasing of the Company’s products and sales of used products

|

|

Advantest America, Inc.

|

4,059 thousand USD

|

100%

|

Development and sales of the Company’s products

|

|

Advantest Europe GmbH

|

10,793 thousand Euros

|

100%

|

Development and sales of the Company’s products

|

|

Advantest Taiwan Inc.

|

760,000 thousand New Taiwan Dollars

|

100%

|

Sales of the Company’s products

|

|

Advantest (Singapore) Pte. Ltd.

|

15,300 thousand Singapore Dollars

|

100%

|

Sales of the Company’s products

|

|

Advantest Korea Co., Ltd.

|

9,516 million Won

|

100%

|

Support for sales of the Company’s products

|

|

Advantest (China) Co., Ltd.

|

8,000 thousand USD

|

100%

|

Support for sales of the Company’s products

|

Japan Engineering Co., Ltd., a former wholly-owned subsidiary of the Company, was merged into the Company as of April 1, 2014.

(Note) Percentage of voting rights includes indirectly held shares.

| |

(4)

|

Issues to be Addressed

|

While maintaining the core competence in measurement technologies cultivated through decades of research and development, Advantest will strive to enhance its corporate value through two structural reforms that take into account its levels of profitability and losses over the last few years.

The first reform aims to sustain a cost structure that can stably generate profits even during periods of market decline. Specifically, Advantest will make an effort to contain the rise in break-even point, which has been lowering since the second half of FY2013, by optimizing payroll costs through flexible workforce deployment that is appropriate under business conditions, improving operation efficiencies and lowering material costs.

The second reform aims to develop a business structure that can achieve sustainable growth. Specifically, while maintaining and improving its competitiveness in the semiconductor test equipment market to secure stable profits, Advantest aims to expand profit from businesses in semiconductor test peripherals market and from markets outside the semiconductor test market. In order to accelerate these structural reforms, Advantest expects to further the flexible reallocation of management resources to growing markets and key sectors while taking into consideration its financial condition and efficiency.

| |

(5)

|

Primary Areas of Business

|

The Advantest Group manufactures and markets semiconductor and component test systems and products related to mechatronics systems (test handlers, device interface, nanotechnology products, etc.). In addition to manufacturing, the Advantest Group also carries out research and development activities and provides maintenance services and related services in the business category of “Services, Support and Others.”

|

|

(6)

|

Significant Sales Offices and Factories

|

|

Category

|

Name of Office

|

Location

|

|

Head Office, Sales Offices and Service Offices

|

Head Office

|

Chiyoda-ku, Tokyo

|

|

Western Tokyo Office

|

Hachioji-shi, Tokyo

|

|

R&D Centers, Laboratories

|

Gunma R&D Center

|

Meiwa-machi, Ora-gun, Gunma

|

|

Saitama R&D Center

|

Kazo-shi, Saitama

|

|

Kitakyushu R&D Center

|

Kitakyushu-shi, Fukuoka

|

|

Advantest Laboratories

|

Sendai-shi, Miyagi

|

|

Factories

|

Gunma Factory

|

Ora-machi, Ora-gun, Gunma

|

|

Sendai Factory

|

Sendai-shi, Miyagi

|

(ii) Overseas

|

Category

|

Name of Office

|

Location

|

|

Sales Offices, R&D Centers, Laboratories and Service Offices

|

Advantest America, Inc.

|

U.S.A.

|

|

Advantest Europe GmbH

|

Germany

|

|

Advantest Taiwan Inc.

|

Taiwan

|

|

Advantest (Singapore) Pte. Ltd.

|

Singapore

|

|

Advantest Korea Co., Ltd.

|

Korea

|

|

Advantest (China) Co., Ltd.

|

China

|

Employees of the Advantest Group (as of March 31, 2015)

|

Number of Employees

|

Decrease from end of FY2013

|

|

4,564 (197)

|

61 (81)

|

| |

(Note)

|

The numbers set forth above indicate the numbers of employees excluding part-time and non-regular employees. The numbers in brackets indicate the annual average number of such part-time and non-regular employees.

|

| |

(9)

|

Other significant matters with respect to the current status of the Advantest Group

|

2. Company Information

| |

(1)

|

Equity Stock (as of March 31, 2015)

|

| |

(i)

|

|

Total number of issuable shares

|

440,000,000 shares

|

| |

|

|

|

|

| |

(ii)

|

|

Total number of issued shares

|

199,566,770 shares

|

(Note) Total number of issued shares includes treasury stock (25,020,294 shares).

| |

(iii)

|

|

Number of shareholders

|

37,291

|

| |

|

|

|

|

| |

(iv)

|

|

Major Shareholders (Top 10 shareholders) |

|

|

Name of Shareholder

|

|

Number of Shares

(in: thousand shares)

|

|

|

Percentage of

Ownership (%)

|

|

|

The Master Trust Bank of Japan, Ltd. (trust account)

|

|

|

28,622 |

|

|

|

16.40 |

|

|

Mizuho Trust & Banking Co., Ltd. (retirement benefit trust (Fujitsu account), re-trust trustees, Trust & Custody Services Bank, Ltd.)

|

|

|

20,143 |

|

|

|

11.54 |

|

|