UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2014

or

[_] TRANSITION REPORT PURSUANT TO SECTION

13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission File No. 000-54009

|

A1 GROUP,

INC. |

| (Exact name of registrant as specified in its charter) |

|

Nevada |

20-5982715 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

7040

Avenida Encinas,

Suite 104-159

Carlsbad, CA 92011

(Address of principal executive offices,

Zip Code)

545

Second Street., #6

Encinitas, CA 92024

(Former address of principal executive offices,

Zip Code)

Registrant’s telephone number,

including area code: (760) 487-7772

Securities registered pursuant to Section

12(b) of the Exchange Act: None.

Securities registered pursuant to Section

12(g) of the Exchange Act:

Common stock, par value $0.001 per share.

(Title

of class)

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [_] No [X]

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [_] No [X]

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes [X] No [_]

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes [X] No [_]

Indicate by check mark if disclosure

of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. [_]

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

| Large accelerated filer |

[_] |

Accelerated filer |

[_] |

Non-accelerated filer

(Do not check if a smaller reporting company) |

[_] |

Smaller reporting company |

[X] |

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [_] No [X]

The aggregate market value of the registrant’s

common stock, par value $0.001 per share, held by non-affiliates of the registrant, based on the closing price of the common stock

as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $3,598,525.

As of March 26, 2015, the registrant

had 34,168,260 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

A1 GROUP, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Page

| PART I |

|

1 |

| ITEM 1. |

BUSINESS |

1 |

| ITEM 1A. |

RISK FACTORS |

6 |

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

6 |

| ITEM 2. |

PROPERTIES |

6 |

| ITEM 3. |

LEGAL PROCEEDINGS |

6 |

| ITEM 4. |

MINE SAFETY DISCLOSURES |

6 |

| PART II |

|

7 |

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

7 |

| ITEM 6. |

SELECTED FINANCIAL DATA |

8 |

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

8 |

| ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

10 |

| ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

10 |

| ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

11 |

| ITEM 9A. |

CONTROLS AND PROCEDURES |

11 |

| ITEM 9B. |

OTHER INFORMATION |

12 |

| PART III |

|

13 |

| ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

13 |

| ITEM 11. |

EXECUTIVE COMPENSATION |

14 |

| ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

15 |

| ITEM 13. |

CERTAIN RELATIONSHIP AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. |

16 |

| ITEM 14. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

16 |

| PART IV |

|

17 |

| ITEM 15. |

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

17 |

Use of Certain Defined Terms

Except as otherwise indicated by the

context, references in this report to “A1 Group”, “we,” “us,” “our,” “our

Company,” or “the Company” are to the combined business of A1 Group, Inc.

Forward-Looking Statements

This Annual Report on Form 10-K contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss

future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,”

“estimate,” “intend,” “could,” “should,” “would,” “may,”

“seek,” “plan,” “might,” “will,” “expect,” “anticipate,”

“predict,” “project,” “forecast,” “potential,” “continue” negatives

thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying

assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially

different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and

uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described

in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or

completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout

this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including

statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives

of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future

financial results, and any other statements that are not historical facts.

These forward-looking statements represent

our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other

factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results

expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described

in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual

Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual

Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the

cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law,

we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events,

a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

PART

I

Business Overview

We are an electronic cigarette company

with Internet sales and kiosk locations in the greater Miami area through our fully owned subsidiary A1 Vapors, Inc., which was

incorporated in April 2012 as a Florida Corporation. A1 Vapors is a product development and marketing company catering to the electronic

vapor cigarette and accessories industry. A1 Vapors offers a variety of options to choose from to appeal to all smokers including

a diverse selection of devices and flavors.

“Electronic cigarettes”

or “e-cigarettes” and “vaporizers” are battery-powered products that enable users to inhale nicotine vapor

without smoke, tar, ash, or carbon monoxide. Electronic cigarettes look like traditional cigarettes and, regardless of their construction

are comprised of three functional components:

| · | A mouthpiece, which is a small plastic

cartridge that contains a liquid nicotine solution; |

| · | The heating element that vaporizes the

liquid nicotine so that it can be inhaled; and |

| · | The electronics, which include: a lithium-ion

battery, an airflow sensor, a microchip controller and an LED which illuminates to indicate use. |

When a user draws air through the electronic

cigarette and or vaporizer, the air flow is detected by a sensor, which activates a heating element that vaporizes the solution

stored in the mouthpiece/cartridge, the solution is then vaporized and it is this vapor that is inhaled by the user. The cartridge

contains either a nicotine solution or a nicotine free solution, either which may be flavored.

The Company was engaged in the business

of operating sweepstakes websites featuring free giveaways of premier consumer products to users who participated in online games.

Prior to this the Company was offering window blind system products and ceased such operation upon the consummation of a change

of control of the Company in August 2012. Since August 2012, and until mid-August 2014, management had been building the Company

to be a platform for marketing and advertising initiatives and a marketplace for consumer products. On August 14, 2014 the Company

entered into a Share Exchange Agreement with A-1 Vapors, Inc. as reported in our Current Report on Form 8-K filed with the Securities

and Exchange Commission (“SEC”) on August 22, 2014 (the “August 2014 Form 8-K”). The Company is now involved

in the electronic cigarette retail market.

The Company has filed an Amendment to

the Articles of Incorporation as reported in the 8-K file on January 16, 2015 requesting the state of Nevada and FINRA change its

name from “FreeButton, Inc.” to the new name “A1 Group, Inc.” All of the Company’s filings will reflect

the new name when the process is completed with the state and federal agencies.

Corporate History

The Company was incorporated on November 27,

2006 under the laws of the State of Nevada and extra-provincially registered under the laws of the Province of Ontario on February

2, 2007. On September 28, 2012, the Company with a majority of the shareholders and directors changed its name from Secured Window

Blinds, Inc. to Freebutton, Inc. On June 23, 2014 a majority of the shareholders and directors and on November 23, 2014 changed

its name from Freebutton, Inc. to A1 Group, Inc.

A1 Group, Inc. is now a product development

and marketing company catering to the electronic vapor cigarette and accessories industry.

Recent Developments

On

May 23, 2014, FreeButton, Inc. (now known as A1 Group, Inc.) entered into an Exchange Agreement with A-1 Vapors, Inc., to acquire

A-1 Vapors. The transaction contemplated by the Exchange Agreement was consummated on August 14, 2014. As reported in our From

8-K filed with the SEC on August 22, 2014, the Company entered into a Share Exchange Agreement (the ‘Share Exchange Agreement”)

which resulted in a Reverse Takeover with selling stockholders named in the prospectus, pursuant to which the Company offered and

sold an aggregate of 21,000,000 shares of common stock to all the stockholders of A-1 Vapors,, Inc., a Florida corporation (“A-1

Vapors”), incorporated in the State of Florida, on April 26, 2012. The acquisition has been treated as a recapitalization

of Freebutton, Inc. (now known as A1 Group, Inc.), with A1 Vapors, Inc. as the accounting acquirer in accordance with the Reverse

Merger rules. As a result of the consummation of the Share Exchange Agreement A-1 Vapors became a wholly-owned subsidiary of the

Company and the electronic cigarette business of A-1 Vapors is now the primary business of the Company.

A1

Group, Inc., (formerly known as Freebutton, Inc.) and through its wholly owned subsidiary A-1 Vapors Inc., is a product development

and marketing company catering to the electronic cigarette and accessory industry, with internet sales and multiple kiosk retail

locations in the Miami area. Bruce Storrs, Chairman, President, Chief Executive Officer, Treasurer, Secretary, Director and Andy

Diaz Chief Operating Officer, Director of the Company, and are the sole shareholders’ of A1 Vapors, Inc.

As

a result of the Share Exchange Agreement, Bruce Storrs and Andy Diaz became the majority shareholders and became the principal

officers and directors of the Company.

As reported in our Form 8-K file with the SEC

on May 14, 2014, on April 11, 2014 the Company entered into a Binding Letter of Intent (“LOI”) to acquire A1 Vapors,

Inc. a product development and marketing firm catering to the electronic vapor cigarette industry. Under the terms of the LOI the

Company will purchase all of the issued and outstanding capital stock of A1 pursuant to a definitive agreement to be entered into

between the parties. Consideration for the purchase will be approximately 21 million restricted shares of the Company’s common

stock. As reported in our Current Report on Form 8-k filed on May 27, 2014, on May 23, 2014 FreeButton (now known as A1 Group,

Inc.) entered into an exchange agreement (the “Exchange Agreement”) with A1 Vapors. Under the terms of the Exchange

Agreement, the shareholders of A1 Vapors received 21,000,000 newly-issued shares of Free Button’s (now known as A1 Group,

Inc.) Common Stock (now known as A1 Group, Inc.) in exchange for all of A1 Vapor’s outstanding Common Stock. On August 22,

2014, the 21,000,000 shares were issued and A1Vapors, Inc. became a wholly-owned subsidiary of A1 Group Inc. (formerly FreeButton

Inc.). The foregoing description of the LOI does not purport to be complete and is qualified in its entirety by reference to the

full text of the LOI, a copy of which is filed as Exhibit 10.3 to this Annual Report on Form 10-K and incorporated herein by reference.

The foregoing description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the LOI, a copy of which is filed as Exhibit 10.4 to this Annual Report on Form 10-K and incorporated herein

by reference.

FSC Agreement

On November 29, 2014 the Company entered into

an Agreement with FSC Company (“FSC”) to assist with the development of a corporate vision and to build a comprehensive

Operating Plan to guide the Company, and to assist in the designing of a strategic sales and marketing plan, with an associated

branding strategy. This agreement includes the following;

| Term: | Six (6) months. Either party may terminate the Agreement after four (4) months with a thirty (30)

day advance written notice. |

| Fees: | Initial fee of ten thousand dollars ($10,000) at time this agreement is executed and six thousand

($6,000) per month during the final five (5) months of the engagement period. |

| Incentives: | the Company and FSC agree to establish an incentive plan. The Company has to provide FSC up to

five hundred thousand (500,000) shares of common stock in A1Group, Inc. following the initial one hundred and twenty (120) days

of the term of this Agreement , so long as items listed in the Agreement have been satisfactory delivered and all terms and conditions

of the Agreement have been met. |

Convertible Promissory Notes

Subsequent to the period on January 16, 2015

an agreement was reached whereby the Convertible Promissory Note of $307,266.26 dated March 11, 2014 and $16,828.56 dated June

20, 2014 would be converted to 1,473,161 common shares of A1 Group, Inc. without restrictive legend. Upon deliverance of the share

certificate they will be no further obligations under the convertible promissory notes. As of the filing date of the Company’s10-K

the certificate had not yet be delivered. As reported in the Company’s 8-K dated March 3, 2015.

Our Website

We currently have one operating website,

www.a1vapors.com. We sell our electronic cigarettes and accessories through the web-site.

Products

The Company offer

disposable electronic cigarettes in multiple sizes, puff counts, styles, flavors and nicotine strengths; rechargeable electronic

cigarettes that use replaceable cartridges (also known as “atomizers or cartomizers”); and rechargeable vaporizers

for use with either electronic cigarette solution (“e-liquid”) or dry herbs or leaf.

We have established

arrangements with certain third party manufacturers, Kanger and Aspire, to re-brand or “white label” most of the products

that we sell, which are manufactured by Kanger and Aspire, with the A1 Vapors logo. In addition, we sell major known brands such

as Cloupor.

Product Descriptions

| · | The disposable electronic cigarettes feature

a one-piece construction that houses ass the components and is utilized until the nicotine or nicotine free solution is depleted. |

| · | Rechargeable electronic cigarettes feature

a rechargeable battery and replaceable cartridge (also known as an “atomizer or cartomizer”). The atomizers or cartomizers

are changed when the solution is depleted from use. |

| · | Vaporizers feature a tank or chamber,

a heating element and a battery. The vaporizer user fills the tank with the e-liquid or the Chamber with dry herb or leaf. The

vaporizer battery can be recharged and the tank and chamber can be refilled. |

| · | The electronic cigarette solution or e-liquid,

is the chemical means through which electronic cigarettes and vaporizers, respectively, deliver nicotine, simulate the taste of

tobacco and or other flavors in addition to emulating the act of smoking by means of the electronic cigarettes “smoke like”

discharge or vapor. We offer the electronic cigarette solutions in different flavors and various strengths, in replaceable cartridges

for our rechargeable e-cigarettes and in bottles for use in our vaporizers. |

Competition

Competition in the electronic cigarette

industry is intense. We compete with other sellers of electronic cigarettes and hookahs, big tobacco companies such as; Altria

Group, Inc., Lorillard, Inc., Reynolds America Inc.; through their electronic cigarettes business segments; the nature of our competitors

is varied as the market is highly fragmented and the barriers to entry into the business are low. Our direct competitors sell products

that are substantially similar to ours and through the same channels through which we sell our electronic cigarette products. We

compete with these direct competitors for sales through distributors, wholesalers and retailers, including but not limited to national

chain stores, tobacco shops, gas stations, travel stores, shopping mall kiosks, in addition to direct public sales through internet,

mail order and telesales.

As a general matter, we have access

to, market and sell the similar electronic cigarettes as our competitors and we sell our products generally at similar prices as

our competitors; accordingly the key competitive factors for our success is the quality of service we offer our customers, the

scope and effectiveness of our marketing efforts, including media advertising campaigns and, increasingly, the ability to identify

and develop new sources of customers.

We believe that we will enjoy the following

competitive advantages:

Marketing, Sales

and Distribution

To this point our

marketing and sales efforts have been limited. As our cash-flow permits, we will increase our advertising efforts through direct

television marketing, on the Internet, trade magazine ads and point of sale materials and displays at retail locations. We will

also attempt to build brand awareness through innovative social marketing activities, price promotions, in-store and on-premises

promotions, public relations and trade show participation.

We intend to expand

our physical retail locations on a geographical basis, adding more stores in areas that are proximate to our existing locations.

We believe this strategy will enable us to create a stronger presence in our core market and maximize our brand awareness in the

region. We intend to increase our online marketing budget and more proactively market our website store to drive online sales.

We have not historically

focused on the wholesale market, and the sale which we have made to our retailers has been inconsistent. We intend to start focusing

on the opportunity by developing a retail package specifically for the distributor sales channel. We are in product development

with respect to this effort and in discussions with prospective channel partners with the goal of testing our products in their

stores.

Customers

We cater to two types of consumers,

cigarette smokers and hookah smokers from the ages of 18 and up.

Legal Environment

Governmental Regulations

Based on the December 2010 U.S. Court of Appeals

for the D.C. Circuit’s decision in Sottera, Inc. v. Food & Drug Administration, 627 F.3d 891 (D.C. Cir. 2010),

the United States Food and Drug Administration (the “FDA”) is permitted to regulate electronic cigarettes as “tobacco

products” under the Family Smoking Prevention and Tobacco Control Act of 2009 (the “Tobacco Control Act”).

Under this Court decision, the FDA is not permitted

to regulate electronic cigarettes as “drugs” or “devices” or a “combination product” under

the Federal Food, Drug and Cosmetic Act unless they are marketed for therapeutic purposes.

Because we do not market our electronic cigarettes

for therapeutic purposes, our electronic cigarettes are subject to being classified as “tobacco products” under the

Tobacco Control Act. The Tobacco Control Act grants the FDA broad authority over the manufacture, sale, marketing and packaging

of tobacco products, although the FDA is prohibited from issuing regulations banning all cigarettes or all smokeless tobacco products,

or requiring the reduction of nicotine yields of a tobacco product to zero.

The Tobacco Control Act also requires

establishment, within the FDA’s new Center for Tobacco Products, of a Tobacco Products Scientific Advisory Committee to

provide advice, information and recommendations with respect to the safety, dependence or health issues related to tobacco products.

The

Tobacco Control Act imposes significant new restrictions on the advertising and promotion of tobacco products. For example, the

law requires the FDA to finalize certain portions of regulations previously adopted by the FDA in 1996 (which were struck down

by the Supreme Court in 2000 as beyond the FDA’s authority). As written, these regulations would significantly limit the

ability of manufacturers, distributors and retailers to advertise and promote tobacco products, by, for example, restricting the

use of color, graphics and sound effects in advertising, limiting the use of outdoor advertising, restricting the sale and distribution

of non-tobacco items and services, gifts, and sponsorship of events and imposing restrictions on the use for cigarette or smokeless

tobacco products of trade or brand names that are used for non-tobacco products. The law also requires the FDA to issue future

regulations regarding the promotion and marketing of tobacco products sold or distributed over the internet, by mail order or

through other non-face-to-face transactions in order to prevent the sale of tobacco products to minors.

It is likely that the Tobacco Control Act could

result in a decrease in tobacco product sales in the United States, including sales of our electronic cigarettes.

While the FDA has not yet mandated electronic

cigarettes should be regulated as tobacco products, during 2012, the FDA indicated that it intends to regulate electronic cigarettes

under the Tobacco Control Act through the issuance of deeming regulations that would include electronic cigarettes under the definition

of a “tobacco product” under the Tobacco Control Act subject to the FDA’s jurisdiction. The FDA initially announced

that it would issue proposed deeming regulations by April 2013 and then extended the deadline to October 31, 2013. As of the

date of this report, the FDA had not taken such action.

The application of the Tobacco Control Act

to electronic cigarettes could impose, among other things, restrictions on the content of nicotine in electronic cigarettes, the

advertising, marketing and sale of electronic cigarettes, the use of certain flavorings and the introduction of new products. We

cannot predict the scope of such regulations or the impact they may have on our company specifically or the electronic cigarette

industry generally, though if enacted, they could have a material adverse effect on our business, results of operations and financial

condition.

In this regard, total compliance and related

costs are not possible to predict and depend substantially on the future requirements imposed by the FDA under the Tobacco Control

Act. Costs, however, could be substantial and could have a material adverse effect on our business, results of operations and financial

condition. In addition, failure to comply with the Tobacco Control Act and with FDA regulatory requirements could result in significant

financial penalties and could have a material adverse effect on our business, financial condition and results of operations and

ability to market and sell our products. At present, we are not able to predict whether the Tobacco Control Act will impact us

to a greater degree than competitors in the industry, thus affecting our competitive position.

State and local governments currently legislate

and regulate tobacco products, including what is considered a tobacco product, how tobacco taxes are calculated and collected,

to whom and by whom tobacco products can be sold and where tobacco products may or may not be smoked. Certain states and cities

have enacted laws which preclude the use of electronic cigarettes where traditional tobacco burning cigarettes cannot be used and

others have proposed legislation that would categorize electronic cigarettes as tobacco products, equivalent to their tobacco burning

counterparts. If the use of electronic cigarettes is banned anywhere the use of traditional tobacco burning cigarettes is banned,

electronic cigarettes may lose their appeal as an alternative to cigarettes; which may have the effect of reducing the demand for

our products and as a result have a material adverse effect on our business, results of operations and financial condition.

At present, neither the Prevent All Cigarette

Trafficking Act (which prohibits the use of the U.S. Postal Service to mail most tobacco products and which amends the Jenkins

Act, which would require individuals and businesses that make interstate sales of cigarettes or smokeless tobacco to comply with

state tax laws) nor the Federal Cigarette Labeling and Advertising Act (which governs how cigarettes can be advertised and marketed)

apply to electronic cigarettes. The application of either or both of these federal laws to electronic cigarettes would have a material

adverse effect on our business, results of operations and financial condition.

The Tobacco industry expects significant regulatory

developments to take place over the next few years, driven principally by the World Health Organization’s Framework Convention

on Tobacco Control (“FCTC”). The FCTC is the first international public health treaty on tobacco, and its objective

is to establish a global agenda for tobacco regulation with the purpose of reducing initiation of tobacco use and encouraging cessation.

Regulatory initiatives that have been proposed, introduced or enacted include:

| |

· |

The levying of substantial and increasing tax and duty charges; |

| |

· |

Restrictions or bans on advertising, marketing and sponsorship; |

| |

· |

The display of larger health warnings, graphic health warnings and other labeling requirements; |

| |

· |

Restrictions on a packaging design, including the use of colors and generic packaging; |

| |

· |

Restrictions on bans on the display of tobacco product packaging at the point of sale, and restrictions or bans on cigarette vending machines; |

| |

· |

Restrictions regarding testing, disclosure and performance standards for tar, nicotine, carbon monoxide and other smoke constituent levels; |

| |

· |

Requirements regarding testing, disclosure and use of tobacco product ingredients; |

| |

· |

Increased restrictions on smoking in public and work places and, in some instances in private places and outdoors |

| |

· |

Elimination of duty free allowances for travelers; and |

| |

· |

Encouraging litigation against tobacco companies. |

If electronic cigarettes are subject

to one or more significant regulatory initiates enacted under the FCTC, our business, results of operations and financial condition

could be materially and adversely affected.

Available Information

Reports we file pursuant to the Exchange Act

of 1934, as amended (the "Exchange Act"), including annual, quarterly and current reports and other information with

the Commission and our filings are available to the public over the Internet at the Commission's website at http://www.sec.gov.

The public may read and copy any materials filed by us with the Commission at the Public Reference Room at 100 F Street NE, Washington,

D.C. 20549, on official business days during the hours of 10:00 am to 3:00 pm. The public may obtain information on the operation

by calling the Commission at 800-732-0330.

Patent and Trademarks

We do no currently own any domestic

or foreign patents relating to electronic cigarettes.

Employees

As of December 2014, we had four employees

both of whom are employed on a full-time basis.

Smaller reporting companies are not

required to provide the information required by this item.

| ITEM 1B. | UNRESOLVED

STAFF COMMENTS |

Not applicable to a “smaller reporting

company” as defined in Item 10(f)(1) of Regulation S-K.

Our principal executive office is located

at 7040 Avenida Encinas, Suite 104-159, Carlsbad CA 92011. We also have two retail locations at Miami International Mall, 1455

NW 107th Avenue, Doral, FL. 33172 and Bayside Market Place, 401 Biscayne Blvd., Miami, Florida 33132

None.

| ITEM 4. | MINE

SAFETY DISCLOSURES |

Not applicable.

PART

II

| ITEM 5. | MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

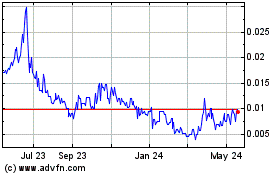

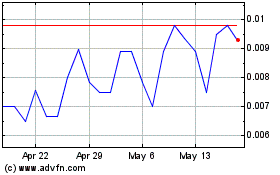

Our common stock has traded on the OTC

Bulletin Board and OTCQB under the symbol “SWCB” since August 13, 2010. Beginning September 2012, our symbol was changed

to “FBTN”. Beginning November 2014, our symbol was changed to “AWON”. The following table sets forth the

range of the quarterly high and low bid price information for fiscal years 2014 and 2013 as reported by the OTCQB and OTC Bulletin

Board.

| | |

High Bid*

($) | | |

Low Bid*

($) | |

| 2014 | |

| | | |

| | |

| First Quarter | |

| 0.88 | | |

| 0.48 | |

| Second Quarter | |

| 0.68 | | |

| 0.25 | |

| Third Quarter | |

| 0.40 | | |

| 0.20 | |

| Fourth Quarter | |

| 0.30 | | |

| 0.05 | |

| 2013 | |

| | | |

| | |

| First Quarter | |

| 0.66 | | |

| 0.40 | |

| Second Quarter | |

| 0.69 | | |

| 0.43 | |

| Third Quarter | |

| 0.89 | | |

| 0.61 | |

| Fourth Quarter | |

| 0.89 | | |

| 0.61 | |

__________

* The quotations of the closing prices

reflect inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The market price of our common stock

is subject to significant fluctuations in response to variations in our quarterly operating results, general trends in the market,

and other factors, over many of which we have little or no control. In addition, broad market fluctuations, as well as general

economic, business and political conditions, may adversely affect the market for our common stock, regardless of our actual or

projected performance.

Holders

As of March 30, 2015, there were 26

holders of record of our common stock. This does not reflect the number of persons or entities who held stock in nominee or street

name through various brokerage firms.

Dividend Policy

We have never declared or paid dividends

on our common stock. We do not anticipate paying any dividends on our common stock in the foreseeable future. We currently intend

to retain all available funds and any future earnings to fund the development and growth of our business. Any future determination

to declare dividends will be subject to the discretion of our board of directors and will depend on various factors, including

applicable laws, our results of operations, financial condition, future prospects and any other factors deemed relevant by our

board of directors.

Equity Compensation Plan Information

See the “Equity Compensation Plan

Information” table in Item 12 of this Annual Report on Form 10-K.

Changes In Control

Of Registrants

The information regarding the Company’s change on control

in connection with the Acquisition set forth in Recent Developments (Item 1) in the Securities Exchange and acquisition of Agreement

between FreeButton Inc. (now known as A1 Group, Inc.) and A-1 Vapors, Inc. is incorporated herein by reference.

At Closing the Company issued 21,000,000 shares of Common Stock

to the former A-1 Vapors Shareholders in exchange for 100% of their ownership in A-1 Vapors. Prior the subject acquisition, the

A-1 Vapors shareholders owned no shares of the company.

After giving the effect to the issuance of the Company Shares the

number of Company Common Stock issued and outstanding is 34,168,260 of which the A-1 Vapors shareholders own approximately 61%.

Recent Sales

of Unregistered Securities

On October 6, 2014, the Company received $$27,200 in Subscription

receivables to issue 181,333 common shares through a private placement at $0.15 per share.

On December 23, 2014 the issued 324,000 common shares in the conversion

of $32,400 of Convertible Promissory Note and accrued interest at $0.10 per share.

All

sales of unregistered securities of the Company during fiscal year 2014 have previously been reported by the Company on our Quarterly

Reports on Form 10-Q or Current Reports on Form 8-K filed with the Commission.

There

were no repurchase of equity securities made by the Company during the fourth quarter of fiscal year 2014.

| ITEM 6. | SELECTED

FINANCIAL DATA |

Not applicable to a “smaller reporting

company” as defined in Item 10(f)(1) of Regulation S-K.

| ITEM 7. | MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This Management’s Discussion

and Analysis of Financial Condition and Results of Operations is intended to provide a reader of our financial statements with

a narrative from the perspective of our management on our financial condition, results of operations, liquidity, and certain other

factors that may affect our future results. The following discussion and analysis should be read in conjunction with our audited

consolidated financial statements and the accompanying notes thereto included in “Item 8. Financial Statements and Supplementary

Data.” In addition to historical financial information, the following discussion and analysis contains forward-looking statements

that involve risks, uncertainties and assumptions. See “Forward-Looking Statements.” Our results and the timing of

selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors.

Business Overview

We are an electronic cigarette company

with Internet sales and kiosk locations in the greater Miami area through our fully owned subsidiary A1 Vapors, Inc. A1 Vapors

is a product development and marketing company catering to the electronic vapor cigarette and accessories industry. A1 Vapors offers

a variety of options to choose from to appeal to all smokers including a diverse selection of devices and flavors.

“Electronic cigarettes” or

“e-cigarettes” and “vaporizers” are battery-powered products that enable users to inhale nicotine vapor

without smoke, tar, ash, or carbon monoxide. Electronic cigarettes look like traditional cigarettes and, regardless of their construction

are comprised of three functional components:

| · | A mouthpiece, which is a small plastic

cartridge that contains a liquid nicotine solution; |

| · | The heating element that vaporizes the

liquid nicotine so that it can be inhaled; and |

| · | The electronics, which include: a lithium-ion

battery, an airflow sensor, a microchip controller and an LED which illuminates to indicate use. |

When a user draws air through the electronic

cigarette and or vaporizer, the air flow is detected by a sensor, which activates a heating element that vaporizes the solution

stored in the mouthpiece/cartridge, the solution is then vaporized and it is this vapor that is inhaled by the user. The cartridge

contains either a nicotine solution or a nicotine free solution, either which may be flavored.

Plan of Operations

Our Plan is to become a leading retailer of electronic cigarette

and vapor related products in the North American market. We intend to accomplish that objective through competing on price and

quality, expanding our presence at physical locations, expanding distribution points and expanding our online presence.

The brands that we select to sell in addition to the A-1 Vapors,

white-label brand, are selected on their general popularity with our target consumer base. We believe that this strategy will enable

us to continue to offer “best-in-class” products which have the potential to increase our sales the most, while avoiding

risk of product development and manufacturing. Our ability to negotiate reasonable pricing with these manufactures is also a contributing

factor to selection.

We will continue to seek out and identify new products to introduce

to our consumer base which we believe will increase our revenue per person and generate greater repeat business such as starter

kits, a variety of batteries and new flavors to our line of e-liquid.

Going Concern

Our auditor has indicated in their reports

on our financial statements for the fiscal years ended December 31, 2014, that conditions exist that raise substantial doubt about

our ability to continue as a going concern due to our recurring losses from operations, deficit in equity, and the need to raise

additional capital to fund operations. A “going concern” opinion could impair our ability to finance our operations

through the sale of debt or equity securities.

Results of Operations

Fiscal Year Ended December 31, 2014 compared to Fiscal Year Ended

December 31, 2013

Revenue. We generated

$273,878 of revenue and had Cost of Goods of $92,551 with net revenues of $181,327 during the fiscal year ended December 31, 2014

and we generated $207,836 of revenue and had Cost of Goods of $99,953 with net revenues of $107,883 during the fiscal year ended

December 31, 2013.

Operating Expenses. Total

expenses for the fiscal year ended December 31, 2014 were $268,364 resulting in an operating loss for the fiscal year of $87,037

as compared to total expenses of $81,056 resulting in an operating profit of $26,827 for the fiscal year ended December 31, 2013.

The operating loss for the fiscal year ended December 31, 2014 is a result of office and general expenses in the amount of $268,364,

made up of management fee of $34,500, rent expense of $117,656, commissions of $30,643, marketing expenses of $19,031 and professional

fees in the amount of $11,375 as compared to office and general expenses in the amount of $81,056, made up of management fee of

$0, rent expense of $46,527, commissions of $7,598, marketing expenses of $393 and professional fees in the amount of $225 for

the fiscal year ended December 31, 2013. The increase in office and general expenses from fiscal

year 2013 to fiscal year 2014 was due to expenses related to reverse takeover of A-1 Vapors Inc., of Freebutton, Inc. (now known

as A1Group, Inc.) and cost associated with this merger. The increase in management fees from fiscal year 2013 to fiscal year 2014

described above was due to the increased management time needed to manage the acquisition of the Assets of the new entity. In

addition, costs increased due to the transition from A-1 Group/Vapors from a private corporation into a public entity.

Interest

expense for the year ended December 31, 2014, was $20,684 compared to interest expense for the year ended December 31, 2013, in

the amount of $0. Interest expense principally consists of interest on the convertible promissory notes issued by the Company

as previously discussed in our Quarterly Reports on Forms 10-Q for the quarter ended September 30, 2014. Gain on debt settlement

of $10,251 for the year ended December 31, 2014 was the result of the merger of the A-1 Vapors Inc. and Freebutton, Inc. (now

known as A1 Group, Inc.), there was $0 Gain/loss on debt settlement for the year ending December 31, 2013.

Capital Resources

and Liquidity

As of December 31, 2014, we had $24,031

of cash compared to $3,856 of cash for the year ended December 31, 2013. We anticipate that our current cash and cash equivalents

and cash generated from financing activities will be insufficient to satisfy our liquidity requirements for the next 12 months.

To date the Company has incurred operating losses since inception of $528,868. As at December 31, 2014, the Company has a working

capital deficit of $351,774.

The Company requires additional funding

to meet its ongoing obligations and to fund anticipated operating losses. Our auditor has expressed substantial doubt about our

ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on raising capital

to fund its initial business plan and ultimately to attain profitable operations. These financial statements do not include any

adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities

that might result from this uncertainty.

We expect to incur marketing and professional

and administrative expenses as well expenses associated with maintaining our filings with the Commission. We will require additional

funds during this time and will seek to raise the necessary additional capital. If we are unable to obtain additional financing,

we may be required to reduce the scope of our business development activities, which could harm our business plans, financial condition

and operating results. Additional funding may not be available on favorable terms, if at all. The Company intends to continue to

fund its business by way of equity or debt financing and advances from related parties.

In the event we seek to raise additional

capital through the issuance of debt or its equivalents, this will result in increased interest expense. If we raise additional

capital through the issuance of equity or convertible debt securities, the percentage ownership of our company held by existing

shareholders will be reduced and those shareholders may experience significant dilution. In addition, new securities may contain

certain rights, preferences or privileges that are senior to those of our common stock. We cannot assure you that we will be able

to raise the working capital as needed in the future on terms acceptable to us, if at all. Any inability to raise capital as needed

would have a material adverse effect on our business, financial condition and results of operations.

If we cannot raise additional funds,

we will have to cease business operations. As a result, investors in the Company’s common stock would lose all of their investment.

Off Balance Sheet

Arrangements

There are no off-balance sheet arrangements

currently contemplated by management or in place that are reasonably likely to have a current or future effect on the business,

financial condition, changes in financial condition, revenue or expenses, result of operations, liquidity, capital expenditures

and/or capital resources.

Recent Accounting

Pronouncements

The Company has implemented all new

accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any

other new accounting pronouncements that have been issued that might have a material impact on its financial position or results

of operations.

| ITEM 7A. | QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Not applicable to a “smaller reporting

company” as defined in Item 10(f)(1) of Regulation S-K.

| ITEM 8. | FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA |

The full text of the Company's audited consolidated

financial statements for the fiscal years ended December 31, 2014 and 2013, begins on page F-1 of this Annual Report on Form 10-K.

CHANGES IN AND DISAGREEMENTS

WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

| ITEM 8A. | CONTROLS

AND PROCEDURES |

Evaluation of

Disclosure Controls and Procedures

Our management, including our chief

executive officer and chief financial officer, evaluated the effectiveness of our disclosure controls and procedures (as defined

in Rules 13a-15(e) or 15d-15(e) under the Exchange Act as of December 31, 2014. Our management does not expect that our disclosure

controls and procedures will prevent all error and all fraud. In designing and evaluating the disclosure controls and procedures,

management recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance

of achieving the desired control objectives.

Based on the evaluation as of December

31, 2014, for the reasons set forth below, our chief executive officer and chief financial officer concluded that our disclosure

controls and procedures were not effective to provide reasonable assurance that information we are required to disclose in reports

that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified

in the Commission’s rules and forms, and that such information is accumulated and communicated to our management, including

our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure.

Management's

Annual Report on Internal Control Over Financial Reporting.

Our management is responsible for establishing

and maintaining adequate internal control over financial reporting for the Company. Our internal control system was designed to,

in general, provide reasonable assurance to our management and the Board regarding the reliability of financial reporting and the

preparation of financial statements for external purposes in accordance with generally accepted accounting principles, but because

of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements.

Our chief executive officer and chief

financial officer evaluated the effectiveness of our internal control over financial reporting as of December 31, 2014, and based

on that evaluation they concluded that our internal control over financial reporting was not effective.

The framework used by management in

making that assessment was the criteria set forth in the document entitled “Internal Control – Integrated Framework”

issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on that re-evaluation due to material weakness

identified below, our management, including our chief executive officer and chief financial officer, concluded that our disclosure

controls and procedures were not effective as of December 31, 2014 to ensure that information required to be disclosed in our Exchange

Act reports was (1) recorded, processed, summarized and reported in a timely manner, and (2) accumulated and communicated to our

management, including our chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding

required disclosure, because of material weaknesses in our internal controls over financial reporting.

A material weakness is a deficiency,

or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that

a material misstatement of the Company's annual or interim financial statements will not be prevented or detected on a timely basis.

In its assessment of the effectiveness of internal control our financial reporting as of December 31, 2014, the Company determined

that the following items constituted a material weakness:

| · | The Company does not have an independent audit committee in place, which would provide oversight

of the Company’s officers, operations and financial reporting function; |

| · | The Company’s disclosure controls and procedures do not provide adequate segregation of duties;

and |

| · | The Company does not have effective controls over period-end financial disclosure and reporting

processes. |

The management believes that the material

weaknesses set forth in the last two items listed above did not have an effect on our financial results. However, management believes

that the lack of a functioning audit committee and lack of a majority of outside directors on our board of directors, results in

ineffective oversight in the establishment and monitoring of required internal controls and procedures which could result in a

material misstatement in our financial statements in future periods.

Management believes that the appointment

of one or more outside directors, who shall be appointed to a fully-functioning audit committee, will remedy the lack of a functioning

audit committee and a lack of a majority of outside directors on our Board.

We will continue to monitor and evaluate

the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing basis

and are committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds

allow.

Changes in

Internal Control over Financial Reporting

There were no changes that have affected,

or are reasonably likely to materially affect, our internal control over financial reporting (as defined in Rules 13a-15(f) or

15d-15(f) under the Exchange Act) during the fiscal quarter ended December 31, 2014.

| ITEM 8B. | OTHER

INFORMATION |

None.

PART

III

| ITEM 9. | DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Our executive officers and director

are as follows:

|

Name |

Age |

Position |

| Bruce Storrs (1) |

56 |

President, Chief Executive Officer, Treasurer, Secretary, and Director |

| Andy Diaz (2) |

45 |

Chief Operating Officer, and Director |

| Michele Evangelista (3) |

51 |

Director |

| Moses Lopez (4) |

24 |

Director |

__________

(1) Bruce Storrs. Mr.

Storrs was appointed Chief Executive Officer of the Company effective as of the Closing. Mr. Storrs founded Advanced Scientific

in 1985, which focused on selling medical hospital and pharmaceutical supplies to medical centers and military hospitals and was

sold in 1994. Between 1994 and 2002, he started two additional companies, Cyprus Resources and Capital Health, which were subsequently

sold. In 2002 he worked as a consultant and investors to companies in the Health and Wellness industry as well as founding Better

Bodies by Chemistry, which manufactures and distributes vitamins and supplements. He is also co-founder of Pacific Rim Distributors,

retail and wholesale company selling and distributing medical, health and beauty products. In December 2012, Mr. Storrs invested

in A-1 Vapors, Inc. and joined as an advisor to the company, and subsequently appointed as CEO in June 2014. Mr. Storrs holds a

BSBM with Wilmington National University and has attended San Diego State University.

(2) Andy Diaz. Mr. Diaz

was appointed as Chief Operating Officer of the Company as of the Closing. In 2005 Mr. Diaz founded A1A Sod, Sand & Soil Inc.,

growing the business from 1 to 25 employees and winning contract with the City of Miami and the State of Florida, generating in

excess of $2 million for 2013. In 2012 Mr. Diaz co-founded A-1 Vapors, opening its first retail location in Doral, Florida, and

expanding to two retail locations, as well as an on-line operation.

(3) Michele Evangelista.

Ms. Evangelista will serve as Director of the Company. Since 2012 Ms. Evangelista has served as a Medical Sales rep for Advanced

Scientific Supply. Ms. Evangelista holds a B.S. from Iona College.

(4) Moses Lopez. Mr. Lopez

will serve as a Director of the Company. Since 2012, Mr. Lopez has served in a senior sales capacity at V2 Cigs. In 2012, Mr. Lopez

co-founded A-1 Vapors, and was instrumental in the initial quality control and research activities as well as establishing the

Company’s online operations. Mr. Lopez graduated from Ferguson High School.

Term of Office

Our directors are appointed for a one-year

term to hold office until the next annual general meeting of our stockholders or until removed from office in accordance with our

bylaws. The Company’s directors hold office after the expiration of his or her term until his or her successor is elected

and qualified, or until he or she resigns or are removed in accordance with the Company’s bylaws and provisions of the Nevada

Revised Statutes.

There are no arrangements or understandings

between any of the Directors and any other person pursuant to which Mr. Storrs, Mr. Diaz, Ms. Evangelista and Mr. Lopez were selected

as a director.

Family Relationships

There are no family relationships between

any of our directors or executive officers.

Our Chief Executive Officer and Chairman,

Bruce Storrs, was married to Michele Evangelista, a director.

Other Directorships

Other than as disclosed above, during

the last 5 years, none of our directors held any other directorships in any company with a class of securities registered pursuant

to section 12 of the Exchange Act or subject to the requirements of section 15(d) of such Act or any company registered as an investment

company under the Investment Company Act of 1940.

Involvement in

Legal Proceedings

To our knowledge, there have been no

material legal proceedings during the last ten years that would require disclosure under the federal securities laws that are material

to an evaluation of the ability or integrity of any of our directors or executive officers.

Potential Conflicts

of Interest

We are not aware of any current or potential

conflicts of interest with our director or executive officers.

Code of Ethics

The Company currently does not have

a code of ethics. However, we are in the process of formulating a code of ethics and intend to adopt one in the near future.

| ITEM 10. | EXECUTIVE

COMPENSATION |

Summary Compensation

Table

The following summary compensation table

sets forth all compensation awarded to, earned by, or paid to, the named persons, during the years ended December 31, 2014 and

2013 as our only named executive officer:

Summary Compensation of Named Executive

Officers

| Name and Principal Position | |

Fiscal Year | | |

Salary

($) | | |

Bonus

($) | | |

Stock

Awards

($) | | |

Option Awards

($) | | |

All Other Compensation ($) | | |

Total

($) | |

| Bruce Storrs | |

| 2014 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 24,000 | (1) | |

| 24,000 | |

| President, Chief Executive Officer, Secretary, Treasurer | |

| 2013 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 0 | (2) | |

| 0 | |

| Andy Diaz | |

| 2014 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 10,500 | (3) | |

| 10,500 | |

| Chief Operating Officer | |

| 2013 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 0 | (4) | |

| 0 | |

__________

(1) Represents Mr. Storrs compensation from A1 Group, Inc. was from August 14, 2014 through December 31, 2014.

(2) Mr. Storrs was not employed by A-1 Vapors in 2013 and received no salary, bonus or award compensation.

(3) Represents Mr. Diaz’s compensation for A1 Group, Inc. was from August 14, 2014 through December 31, 2014.

(4) Mr. Diaz served as the sole officer of A-1 Vapors in 2013 and received no salary, bonus or award compensation.

Outstanding Equity

Awards at Fiscal Year End

None of our executive officers received

any equity awards, including, options, restricted stock, performance awards or other equity incentives during the fiscal year ended

December 31, 2014 and 2013 for either A1 Group, Inc., or A-1 Vapors, Inc.

Employment Agreements

On August 15, 2014 A1 Group, Inc., (the “Company”)

signed an initial two (2) year Employment Agreement with it Chief Executive Officer, Mr. Bruce Storrs. The Company has agreed to

a salary of $3,500 per month starting September 1, 2014 and a lump sum signing bonus of $10,000 due on August 29, 2014. The Storrs

Agreement also calls for participation in an additional bonus plan to be determined by the Company’s board of directors.

On August 15, 2014 A1 Group, Inc., (the “Company”)

signed an initial two (2) year Employment Agreement with it Chief Operating Officer, Mr. Andy Diaz. The Company has agreed to a

salary of $3,500 per month starting September 1, 2014.

During the period ending December 31, 2014,

the Company paid a total of $34,500 in management fees.

The foregoing descriptions of the terms of

Storrs Agreement and Diaz Agreement do not purport to be complete are qualified in their entirety by reference to the provisions

of such agreements as reported in our From 8-K filed with the SEC on August 22, 2014.

Compensation

of Directors

During the fiscal years ended December

31, 2014 and 2013, the Company directors did not receive any compensation solely for services as a director.

Our directors Bruce Storrs, Andy Diaz,

Michele Evangelista and Moses Lopez will not receive any compensation solely for services as a director. It is our current policy

that our directors are reimbursed for reasonable out-of-pocket expenses incurred in attending each board of directors meeting or

meeting of a committee of the board of directors.

Board Committees

We have not formed an Audit Committee,

Compensation Committee or Nominating and Corporate Governance Committee as of the filing of this Annual Report. Our Board of Directors

performs the principal functions of an Audit Committee. We currently do not have an audit committee financial expert on our Board

of Directors. We believe that an audit committee financial expert is not required because the cost of hiring an audit committee

financial expert to act as one of our directors and to be a member of an Audit Committee outweighs the benefits of having an audit

committee financial expert at this time.

Section 16(a)

Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires

our directors, officers and persons who beneficially own more than 10% of a registered class of our equity securities, to file

reports of ownership and changes in ownership with the SEC and are required to furnish us with copies of these reports. Based solely

on our review of the reports filed with the SEC, we believe that all persons subject to Section 16(a) of the Exchange Act timely

filed all required reports in 2014.

Compensation

Committee Interlocks and Insider Participation

During fiscal years 2014 and 2013, we

did not have a standing compensation committee. Our Board was responsible for the functions that would otherwise be handled by

the compensation committee. Our four directors conducted deliberations concerning executive officer compensation, including directors

who were also executive officers.

| ITEM 11. | SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

The following table sets forth certain

information with respect to the beneficial ownership of our voting securities by (i) each director and named executive officer,

(ii) all executive officers and directors as a group; and (iii) each shareholder known to be the beneficial owner of 5% or more

of the outstanding common stock of the Company as of March 30, 2015.

Beneficial ownership is determined in

accordance with the rules of the SEC. Generally, a person is considered to beneficially own securities: (i) over which such person,

directly or indirectly, exercises sole or shared voting or investment power, and (ii) of which such person has the right to acquire

beneficial ownership at any time within 60 days (such as through exercise of stock options or warrants). For purposes of computing

the percentage of outstanding shares held by each person or group of persons, any shares that such person or persons has the right

to acquire within 60 days of March 30, 2015 are deemed to be outstanding, but are not deemed to be outstanding for the purpose

of computing the percentage ownership of any other person. The inclusion herein of any shares listed as beneficially owned does

not constitute an admission of beneficial ownership. Unless otherwise indicated below, the address of each person listed in the

table below is c/o 7040 Avenida Encinas, Suite 104-159, Carlsbad, CA 92011.

| Name and Address of Beneficial Owner | |

Amount and Nature of Beneficial Ownership Common Stock (1) | |

Directors and Officers | |

No. of Shares | | |

% of Class | |

| Bruce Storrs | |

| 10,500,000 | | |

| 30.7% | |

| President, Chief Executive Officer, Treasure, Secretary and Director | |

| | | |

| | |

| Andy Diaz | |

| 10,500,000 | | |

| 30.7% | |

| Chief Operating Officer and Director | |

| | | |

| | |

| All officers and directors as a group (2 persons) | |

| 21,000,000 | | |

| 61.4% | |

__________

(1) Based on 34,168,260 shares of common stock issued and outstanding as of March 30, 2015. Each of Mr. Storrs and Mr. Diaz has sole beneficial ownership of the shares held by such individual.

| ITEM 12. | CERTAIN

RELATIONSHIP AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. |

Transactions with Related Persons

Except as noted below, there has not been, nor is there currently

proposed, any transaction of series of similar transactions to which the Company was or will be a party in which the amount involved

exceeds the lesser of $120,000 or one percent of the average of the Company’s total assets at year end for the last two completed

fiscal years; and in which any director officer, other stockholders of more than 5% of the Company’s Common Stock or any

member of their immediate family had or will have a direct or indirect material interest.

Bruce Storrs, the Company’s Chief Executive Officer, advanced

funds and had outstanding balances to A-1Vapors $33,631 and $14,081 for the years ended December 31, 2014 and December 31, 2013

respectively.

Andy Diaz, the Company’s Chief Operating Officer, advanced

funds and had outstanding balances to A-1Vapors $1,950 and $17,105 for the years ended December 31, 2014 and December 31, 2013

respectively.

Director Independence

Bruce Storrs, Andy Diaz, and Moses Lopez

members of our board are not independent using the definition of independence under the applicable NASDAQ listing standards and

the standards established by the Commission.

| ITEM 13. | PRINCIPAL

ACCOUNTANT FEES AND SERVICES. |

Fees paid to

Auditors

The following table shows the aggregate

fees we paid for professional services provided to us by Bedinger & Company for 2014 and 2013:

| | |

2014 | | |

2013 | |

| Audit Fees | |

$ | 7,793 | | |

$ | 0 | |

| Audit-Related Fees | |

| 0 | | |

| 0 | |

| Tax Fees | |

| 0 | | |

| 0 | |

| All Other Fees | |

| 0 | | |

| 0 | |

| | |

| 0 | | |

| | |

| Total | |

$ | 7,793 | | |

$ | 0 | |

Audit Fees

For the fiscal years ended December

31, 2014 and 2013, we paid approximately $7,793 and $0, respectively, for professional services rendered for the audit and review

of our financial statements.

Audit Related

Fees

For the fiscal years ended December

31, 2014 and 2013, we paid approximately $0 and $0 respectively, for audit related services.

Tax Fees

For our fiscal years ended December

31, 2014 and 2013, we paid $0 and $0 respectively, for professional services rendered for tax compliance, tax advice, and tax planning.

All Other Fees

We did not incur any other fees related

to services rendered by our independent registered public accounting firm for the fiscal years ended December 31, 2014 and 2013.

The SEC requires that before our independent

registered public accounting firm is engaged by us to render any auditing or permitted non-audit related service, the engagement

be either: (i) approved by our Audit Committee or (ii) entered into pursuant to pre-approval policies and procedures established

by the Audit Committee, provided that the policies and procedures are detailed as to the particular service, the Audit Committee

is informed of each service, and such policies and procedures do not include delegation of the Audit Committee’s responsibilities

to management.

We do not have an Audit Committee. Our

Board pre-approves all services provided by our independent registered public accounting firm. All of the above services and fees

paid during 2014 and 2013 were pre-approved by our Board.

PART

IV

| ITEM 14. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

Please see the “Exhibit Index,”

which is incorporated herein by reference, following the signature page for a list of our exhibits.

SIGNATURES

Pursuant to the requirements of Section

13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| Dated: March 26, 2015 |

A1 GROUP, INC. |

| |

|

| |

By: /s/ Bruce Storrs |

| |

Bruce Storrs

President, Chief Executive Officer, Treasurer and Secretary, Treasurer

(Duly Authorized Officer, Principal Executive Officer and Principal Accounting Officer) |

Pursuant to the requirements of the

Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in

the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

|

/s/ Bruce Storrs |

|

President, Chief Executive Officer, Treasurer and Secretary, and Director |

|

March 26, 2015 |

| Bruce Storrs |

|

(Principal Executive Officer and Principal Accounting Officer) |

|

|

| |

|

|

|

|

|

/s/ Andy Diaz |

|

Chief Operating Officer and Director |

|

March 26, 2015 |

| Andy Diaz |

|

|

|

|

EXHIBIT INDEX

| 3.1 | Agreement and Plan of Merger, Dated May 23, 2014 by and among FreeButton, Inc., and A-1 Vapors

Inc. incorporated herein by reference to Exhibit 2.1 with Form 8-K filed August 22, 2014. |

| 3.2 | Certificate of Merger for State of Florida as incorporated herein by reference to Exhibit 2.2 with

Form 8-K filed August 22, 2014. |

| 3.3 | Certificate of Merger for State of Nevada as incorporated herein by reference to Exhibit 2.3 with

Form 8-K filed August 22, 2014. |

| 10.1 | Storrs Employment Agreement as incorporated herein by reference to Exhibit 10.1 with Form 8-K filed

August 22, 2014. |

| 10.2 | Diaz Employment Agreement as incorporated herein by reference to Exhibit 10.1 with Form 8-K filed

August 22, 2014. |

| 31.1 | Certification of Principal Executive Officer and Principal Accounting Officer pursuant to 18 U.S.C.

1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1+ | Certification of Principal Executive Officer and Principal Accounting Officer pursuant to Section

906 of the Sarbanes-Oxley Act of 2002 |

| 101.INS* | XBRL Instance Document |

| 101.SCH* | XBRL Taxonomy Extension Schema

Document |

| 101.CAL* | XBRL Taxonomy Extension Calculation

Linkbase Document |

| 101.DEF* | XBRL Taxonomy Extension Definition

Linkbase Document |

| 101.LAB* | XBRL Taxonomy Extension Label

Linkbase Document |

| 101.PRE* | XBRL Taxonomy Extension Presentation

Linkbase Document |

| | |

| + In accordance with the SEC Release 33-8238, deemed being furnished and not filed. |

| * Furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise not subject to liability under these sections. |

A1 GROUP, INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Audited)

December 31, 2014

A1 GROUP, INC.

(Formerly Freebutton, Inc.)

(A Development Stage Company)

FINANCIAL STATEMENTS

(Audited)

December 31, 2014

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

F-3 |

| |

|

| CONDENSED CONSOLIDATED BALANCE SHEETS |

F-4 |

| |

|

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

F-5 |

| |

|

| CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(DEFICIT) |

F-6 |

| |

|

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

F-7 |

| |

|

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

F-8 |

B E D I N G E R & C O M P A N Y

C

E R T I F I E D P U B L I C A C C O U N T A N T S

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

of A1 Group, Inc.

We have audited the accompanying

balance sheets of A1 Group, Inc. (the “Company”) as of December 31, 2014 and 2013, and the related statements of operations,

changes in stockholders’ equity, and cash flows for each of the years in the two-year period ended December 31, 2014. Multimedia

Platforms, Inc.’s management is responsible for these financial statements. Our responsibility is to express an opinion on

these financial statements based on our audits.

We conducted our audits in

accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we

plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement.

The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting.

Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test

basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

In our opinion, the financial

statements referred to above present fairly, in all material respects, the financial position of Multimedia Platforms, Inc. as

of December 31, 2014 and 2013, and the results of its operations and its cash flows for each of the years in the two-year period

ended December 31, 2014 in conformity with accounting principles generally accepted in the United States of America.

The accompanying

financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note A to

the financial statements, the Company has suffered recurring losses from operations and has a significant amount of accumulated

deficit that raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters

are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this

uncertainty.

Bedinger

& Company

Concord, California

March 25, 2015

1200 CONCORD AVENUE, SUITE 250, CONCORD, CA

94520 • (925) 603-0800 • (925) 603-0804 FAX

MEMBERS

OF THE AMERICAN INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS,