Fintech Stripe Scores Blockbuster $95 Billion Valuation

15 March 2021 - 10:36AM

Dow Jones News

By Peter Rudegeair

A fresh fundraising round for Stripe Inc. has made the

financial-tech company one of the world's most-valuable

startups.

Stripe said on Sunday that it raised $600 million from a group

of investors that included Ireland's National Treasury Management

Agency, insurers Allianz SE and AXA SA and investment managers

Baillie Gifford & Co. and Fidelity Investments. The round

valued Stripe at $95 billion, more than 2 1/2 times the valuation

it attained in a 2019 fundraising round.

Thanks to the new fundraising, Stripe is now worth more than

other startup darlings like Instacart Inc. Globally, it still

trails the Chinese fintech giant Ant Group Co. in terms of

valuation.

As a payment processor to startups and fast-growing internet

companies, Stripe benefited from the pandemic-induced boom in

online shopping. Stripe customers including DoorDash Inc., Shopify

Inc. and Wayfair Inc. all experienced a surge in demand as

consumers shifted their spending away from bricks-and-mortar

establishments.

"We're bigger now than the entire e-commerce [market] was when

we first started Stripe," Dhivya Suryadevara, Stripe's chief

financial officer, said in an interview. Stripe launched in

2010.

In the pandemic, some small businesses were unhappy with steps

Stripe and other payment processors took to protect themselves from

possible losses. The maneuvers, including sometimes making the

businesses wait extra days or even months to access money deposited

in their accounts, intensified a cash crunch at many firms.

Stripe doesn't disclose its payment volumes or financial

results. The company said in a release that it processes payments

worth hundreds of billions of dollars a year for millions of

businesses world-wide and that it counts as customers more than 50

companies that each use Stripe to process more than $1 billion

annually.

Beyond payments, Stripe has been adding more financial services

to the products it offers customers. In December, Stripe announced

it was teaming up with banks including Goldman Sachs Group Inc. and

Citigroup Inc. to offer checking accounts and other

business-banking services to merchants.

Investors have long viewed Stripe and other payments companies

as a way to get exposure to a range of fast-growing industries.

More recently, though, some have started to wonder if the

Covid-fueled run-up in tech stocks is overdone, and they are

starting to rotate out of popular tech companies and into

established industries like banks and industrials.

With the new funding, Stripe plans to bulk up its European

business. The San Francisco-based company recently named Dublin as

a second headquarters and added former Bank of England governor

Mark Carney to its board of directors.

Closer to its home in California, Stripe has stepped into the

political-speech fray that other tech giants are wading through.

After the pro-Trump riots at the Capitol in January, it stopped

processing payments for President Trump's fundraising

apparatus.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

March 14, 2021 19:21 ET (23:21 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

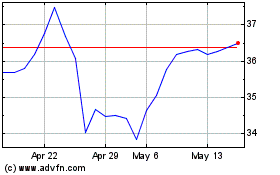

AXA (QX) (USOTC:AXAHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

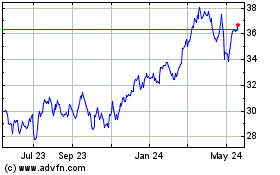

AXA (QX) (USOTC:AXAHY)

Historical Stock Chart

From Nov 2023 to Nov 2024