Airbus Nears Deal With Nigerian Airline for About 50 A220s -- Update

13 February 2020 - 7:09PM

Dow Jones News

By Alison Sider and Benjamin Katz

European plane maker Airbus SE is close to securing a deal for

around 50 aircraft from a Nigerian startup airline that previously

announced plans to buy Boeing Co. 737 MAX jets, according to people

familiar with the plans.

The deal between Airbus and Green Africa Airways could be

announced as soon as Thursday, one of the people said. The carrier

would buy Airbus A220 planes, which seat about 130 passengers.

Boeing in December 2018 announced a commitment from the carrier

for 100 737 MAX jets, about two months after the first MAX crashed

into the Java Sea near Indonesia. That agreement, which Boeing at

the time said was its largest in Africa, came before the 737 MAX

fleet was grounded last March after a second fatal crash. The MAX

fleet has been idled since as Boeing works on fixes to the

plane.

The Chicago-based plane maker has temporarily suspended

production of the MAX as it tries to address the technical issues

with the jet and gain regulatory approval for it to resume flying.

Boeing's new Chief Executive David Calhoun said MAX production

could restart before the plane resumes flying in airline

service.

Boeing has struggled to win deals for its planes amid the MAX

crisis. Order intake last year fell to a 16-year low. The airline

booked no new orders last month.

The Nigerian startup airline turned to Airbus amid uncertainty

about when it would start receiving its MAX jets to be able to

commence service, according to a company executive. Boeing is aware

of the change in strategy and has been understanding of the new

airline's unique situation, the official said--the problems with

the MAX have meant Green Africa has had to postpone its launch.

The Nigerian carrier has support from some heavy hitters from

the airline industry. Tom Horton, former chairman and CEO of

American Airlines Group Inc., and Virasb Vahidi, American's former

chief commercial officer, are backing the carrier. The carrier is

run by Babawande Afolabi, who has been trying to set up a Nigerian

carrier for more than six years.

Airbus officials in recent months have played down the prospect

of taking advantage of Boeing's woes because its A320neo plane,

which competes with the MAX, is sold out for years. The deal with

the Nigerian carrier highlights, though, that the European plane

maker can still benefit from Boeing's troubles. The airline has

opted for a small Airbus aircraft that has been less popular with

airline buyers.

Boeing didn't immediately respond to a request for comment.

Airbus has separately reached an agreement with Bombardier Inc.

to buy out the Canadian manufacturer's remaining stake in the A220

program.

Bombardier will receive $591 million net of adjustments with

Airbus increasing its stake in the A220 to 75%. The government of

Quebec will own 25% of the program after the transaction, Airbus

said in a statement Thursday.

The deal ends Bombardier's involvement in the aircraft it

created, formerly known as the CSeries, after delays and cost

overruns forced it to initially hand over a majority stake to

Airbus in 2018. Airbus has since boosted sales of the jet by 64% to

658 aircraft at the end of January.

It releases Bombardier from its funding commitment that required

the company to cover up to $350 million in annual losses over a set

period as part of the initial stake sale.

Write to Alison Sider at alison.sider@wsj.com and Benjamin Katz

at ben.katz@wsj.com

(END) Dow Jones Newswires

February 13, 2020 02:54 ET (07:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

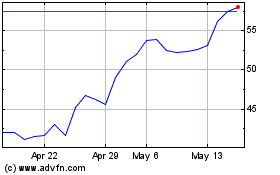

Bombardier (QX) (USOTC:BDRBF)

Historical Stock Chart

From Nov 2024 to Dec 2024

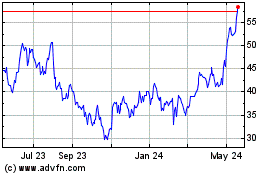

Bombardier (QX) (USOTC:BDRBF)

Historical Stock Chart

From Dec 2023 to Dec 2024