0001715611false00017156112025-01-292025-01-29iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 29, 2025

Date of Report (Date of earliest event reported)

BODY AND MIND INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-55940 | | 98-1319227 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

750 – 1095 West Pender Street Vancouver, British Columbia, Canada | | V6E 2M6 |

(Address of principal executive offices) | | (Zip Code) |

(800) 361-6312

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

__________

SECTION 1 – REGISTRANT’S BUSINESS AND OPERATIONS

Item 1.01 Entry into a Material Definitive Agreement

Membership Interest Purchase Agreements

On January 29, 2025, Body and Mind, Inc.’s (“Company”) wholly owned subsidiary DEP Nevada, Inc. (“DEP”) entered into a Membership Interest Purchase Agreement ( the “NMG 4 MIPA”) with Rubino Ventures IL, LLC (“Rubino”) and NMG IL 4, LLC (“NMG 4”), whereby DEP agreed to sell 100% of the membership interests of NMG 4 to Rubino in exchange for $1,666,667 (the “NMG 4 Purchase Price”), with $833,334 to be payable within 3 business days following the effective date of the NMG 4 MSA (as defined below), and the balance of the NMG 4 Purchase Price to be payable at the closing of the NMG 4 MIPA, less certain transaction expenses. As additional consideration, DEP shall be eligible to receive an Earnout Payment, to be determined as follows (unless defined herein, all definitions as set forth in the NMG 4 MIPA):

(A) Following the end of the Earnout Period Phase One, Rubino shall deliver to DEP an amount equal to (i) 3.2X the Phase One Earnout Period EBITDA, minus (ii) the NMG 4 Purchase Price (the “NMG 4 Phase One Earnout Payment”); and

(B) following the end of the Earnout Period Phase Two, Rubino shall deliver to DEP an amount equal to (i) 3.2X the Phase Two Earnout Period EBITDA plus 3.2X the Phase One Earnout Period EBITDA, minus (ii) the NMG 4 Purchase Price, minus (iii) the NMG 4 Phase One Earnout Payment (the “NMG 4 Phase Two Earnout Payment” together with the NMG 4 Phase One Earnout Payment being the “NMG 4 Earnout Payment”), all in accordance with and subject to the terms and conditions of the NMG 4 MIPA. For the avoidance of doubt, if (1) the amount equal to 3.2X the Phase One Earnout Period EBITDA is less than the NMG 4 Purchase Price, no Phase One Earnout Payment shall be payable to DEP, or (2) the amount equal to 3.2X the Phase Two Earnout Period EBITDA plus 3.2X the Phase One Earnout Period EBITDA is less than the NMG 4 Purchase Price plus the NMG 4 Phase One Earnout Payment (if any), no NMG 4 Phase Two Earnout Payment shall be payable to DEP. The NMG 4 Phase One Earnout Payment is intended to be paid within 90 days of the conclusion of the Earnout Period Phase One, and if applicable, the NMG 4 Phase Two Earnout Payment is intended to be paid within 90 days of the conclusion of the Earnout Period Phase Two.

The closing deliverables of the NMG 4 MIPA include (i) an assignment of the membership interest, (ii) approval from the Illinois Department of Financial and Professional Regulation, Division of Professional Regulation (“IDFPR”) approving the change in ownership of the license, (iii) proper resolutions, (iv) officer’s certificate (v) certificate of good standing, (vi) certain tax documents, (vii) and such other certificates or documents as may be reasonably requested by the Buyer. Following the closing of the NMG 4 MIPA, NMG 4 shall be solely owned by Rubino.

The Company is a signatory to the NMG 4 MIPA solely as a guarantor of the Guaranteed Obligations (as defined in the NMG 4 MIPA) with respect to the performance of the DEP of any obligation to pay any amounts pursuant to the indemnification provisions in the NMG 4 MIPA.

On January 29, 2025, the Company and Big Stone Illinois, LLC (“Big Stone”) entered into a Membership Interest Purchase Agreement (“NMG 1 MIPA” and, together with the NMG 4 MIPA, the “MIPAs”) with Rubino and NMG IL 1, LLC (“NMG 1”) to sell 100% of the membership interests of NMG 1 to Rubino in exchange for $3,333,333 (the “NMG 1 Purchase Price”), with $1,666,666 to be payable within 3 business days following the effective date of the NMG 1 MSA (as defined herein), and the balance of the NMG 1 Purchase Price to be payable at the closing of the NMG 1 MIPA, less certain transaction expenses. As additional consideration, Big Stone shall be eligible to receive an Earnout Payment, to be determined as follows (unless defined herein, all definitions as set forth in the NMG 1 MIPA):

(A) Following the end of the Earnout Period Phase One, Rubino shall deliver to Big Stone an amount equal to (i) 3.2X the Phase One Earnout Period EBITDA, minus (ii) the NMG 1 Purchase Price (the “NMG 1 Phase One Earnout Payment”); and

(B) following the end of the Earnout Period Phase Two, Rubino shall deliver to Big Stone an amount equal to (i) 3.2X the Phase Two Earnout Period EBITDA plus 3.2X the Phase One Earnout Period EBITDA, minus (ii) the NMG 1 Purchase Price, minus (iii) the NMG 1 Phase One Earnout Payment (the “NMG 1 Phase Two Earnout Payment” together with the NMG 1 Phase One Earnout Payment being the “NMG 1 Earnout Payment”), all in accordance with and subject to the terms and conditions of the NMG 1 MIPA. For the avoidance of doubt, if (1) the amount equal to 3.2X the Phase One Earnout Period EBITDA is less than the NMG 1 Purchase Price, no NMG 1 Phase One Earnout Payment shall be payable to Big Stone, or (2) the amount equal to 3.2X the Phase Two Earnout Period EBITDA plus 3.2X the Phase One Earnout Period EBITDA is less than the NMG 1 Purchase Price plus the NMG 1 Phase One Earnout Payment (if any), no NMG 1 Phase Two Earnout Payment shall be payable to Big Stone. The NMG 1 Phase One Earnout Payment is intended to be paid within 90 days of the conclusion of the Earnout Period Phase One, and if applicable, the NMG 1 Phase Two Earnout Payment is intended to be paid within 90 days of the conclusion of the Earnout Period Phase Two.

The closing deliverables of the NMG 1 MIPA include (i) an assignment of the membership interest, (ii) approval from the IDFPR approving the change in ownership of the license, (iii) proper resolutions, (iv) officer’s certificate (v) certificate of good standing, (vi) certain tax documents, (vii) and such other certificates or documents as may be reasonably requested by the Buyer. Following the closing of the NMG 1 MIPA, NMG 1 shall be solely owned by Rubino.

The Company is a signatory to the NMG 1 MIPA solely as a guarantor of the Guaranteed Obligations (as defined in the NMG 1 MIPA) with respect to the performance of Big Stone of any obligation to pay any amounts pursuant to the indemnification provisions in the NMG 1 MIPA.

The foregoing descriptions of the MIPAs do not purport to be complete and are subject to, and qualified in their entirety by the NMG 4 MIPA and NMG 1 MIPA, respectively, which are filed as Exhibits 10.1 and 10.2 hereto, respectively, and are incorporated herein by reference.

Management Services Agreements

Concurrently and in conjunction with entering into the NMG 4 MIPA, Rubino and NMG 4 entered into a Management Services Agreement (the “NMG 4 MSA”) whereby Rubino shall manage certain aspects of NMG 4’s commercial cannabis retail operation. The term of the NMG 4 MSA shall run from the date the IDFPR approves the NMG 4 MSA until the closing date of the NMG 4 MIPA (unless otherwise terminated earlier). Under the NMG 4 MSA, Rubino shall provide the Services (as set forth in the NMG 4 MSA) to NMG 4 in exchange for a service fee of $12,500 payable each month. In addition to the service fee, NMG 4 shall reimburse or pay Rubino for certain expenses including certain technology expenses.

Concurrently and in conjunction with entering into the NMG 1 MIPA, Rubino and NMG 1 entered into a Management Services Agreement (the “NMG 1 MSA” and, together with the NMG 2 MSA, the “MSAs”) whereby Buyer shall manage certain aspects of NMG 1’s commercial cannabis retail operation. The term of the NMG 1 MSA shall run from the date the IDFPR approves the NMG 1 MSA until the closing date of the NMG 1 MIPA (unless otherwise terminated earlier). Under the NMG 1 MSA, Rubino shall provide certain services to NMG 1 in exchange for a service fee of $12,500 payable each month. In addition to the service fee, NMG 1 shall reimburse or pay Rubino for certain expenses, including certain technology expenses.

The foregoing descriptions of the MSAs do not purport to be complete and are subject to, and qualified in their entirety by the NMG 4 MSA and NMG 1 MSA, respectively, which are filed as Exhibits 10.3 and 10.4 hereto, respectively, and are incorporated herein by reference.

Transaction Consent

Concurrently and in connection with the NMG 1 MIPA, Big Stone and DEP entered into a transaction consent (the “Consent”) with Rubino, as a third party beneficiary, pursuant to which DEP granted its consent to Big Stone and NMG 1 to enter into the NMG 1 MIPA in exchange for an assignment (the “Assignment”) from Big Stone of its interest in the NMG 1 MIPA to DEP immediately following the IDFPR approval of each of (i) the sale of membership units of the NMG 1 pursuant to that certain Membership Interest Purchase Agreement (the “Big Stone MIPA”) by and between DEP and Big Stone, dated December 26, 2019 (as amended on December 2, 2022), and (ii) the conversion into membership units of NMG 1 pursuant to that certain Convertible Credit Facility Agreement (the “Note”) by and between DEP and NMG 1, dated December 26, 2019. Upon the Assignment becoming effective, Big Stone shall be fully released from its obligations under the NMG 1 MIPA and all references to the “seller” thereunder shall instead refer to DEP.

The foregoing description of the Consent, which includes the Assignment, does not purport to be complete and is subject to, and qualified in its entirety by the Consent, which is filed as Exhibit 10.5 hereto and is incorporated herein by reference.

Indemnity Agreement

Concurrently and in connection with the NMG 1 MIPA, DEP, Big Stone and Stephen ‘Trip’ Hoffman (and his spouse, heirs, kin and assigns) (collectively, “Mr. Hoffman” together with Big Stone being, the “Big Stone Group”) entered into an indemnity agreement (the “Indemnity Agreement”) whereby DEP warrants and covenants that it shall indemnify, hold harmless and defend the Big Stone Group against any threatened, pending or completed losses, damages, liabilities, deficiencies, interest, awards, penalties, fines, costs, claims, action, suit, arbitration, mediation, alternate dispute resolution mechanism, investigation, inquiry, administrative hearing or proceeding, and whether of a civil, criminal, administrative, or investigative nature, including any appeal therefrom, including attorneys’ fees (collectively “Claims”), including any Claims asserted by Rubino, in which the Big Stone Group was, is, or will be involved as a party, a potential party, a non-party witness or otherwise arising out of, in connection with, or otherwise related to (i) the fact that Big Stone is or was a member of NMG; (ii) the fact that Mr. Hoffman executed on behalf of Big Stone and/or NMG 1 the Big Stone MIPA, the Note, the NMG 1 MIPA, the NMG 1 MSA, the Consent, and/or the Assignment; (iii) the fact that Big Stone is or was a party to the NMG 1 MIPA; (iv) the fact that Big Stone is or was a member of NMG 1 at the execution of the MSA; (v) the fact that Big Stone is a party to the Consent and/or Assignment; (vi) that fact that Big Stone is or was a party to the NMG Sale (as defined in the Indemnity Agreement); (vii) the fact that Big Stone is or was a party to the DEP Transaction (as defined in the Indemnity Agreement); and (viii) DEP as the assignee of the Assignment and/or status of DEP as the seller under the NMG 1 MIPA.

The foregoing description of the Indemnity Agreement does not purport to be complete and is subject to, and qualified in its entirety by the Indemnity Agreement, which is filed as Exhibit 10.6 hereto and is incorporated herein by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit | | Description |

10.1 | | Member Interest Purchase Agreement among NMG IL 4, LLC, DEP Nevada Inc., Body and Mind Inc. and Rubino Ventures IL, LLC, dated January 29, 2025 |

10.2 | | Member Interest Purchase Agreement among NMG IL 1, LLC, Big Stone Illinois, LLC, Body and Mind Inc. and Rubino Ventures IL, LLC, dated January 29, 2025 |

10.3 | | Consultant Management Services Agreement between Rubino Ventures IL, LLC and NMG IL 4, LLC, dated January 29, 2025 |

10.4 | | Consultant Management Services Agreement between Rubino Ventures IL, LLC and NMG IL 1, LLC, dated January 29, 2025 |

10.5 | | Transaction Consent among DEP Nevada, Inc., Big Stone Illinois, LLC and Rubino Ventures IL, LLC, dated January 29, 2025 |

10.6 | | Indemnity Agreement among DEP Nevada, Inc., Big Stone Illinois, LLC and Stephen ‘Trip’ Hoffman, dated January 29, 2025 |

104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

__________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BODY AND MIND INC. | |

| | |

DATE: February 3, 2025 | By: | /s/ Michael Mills | |

| | Michael Mills | |

| | President, CEO and Director | |

__________

nullnullnullnullnullnull

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

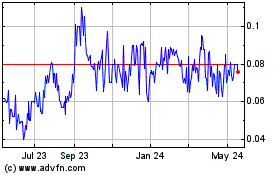

Body and Mind (PK) (USOTC:BMMJ)

Historical Stock Chart

From Jan 2025 to Feb 2025

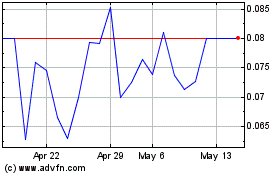

Body and Mind (PK) (USOTC:BMMJ)

Historical Stock Chart

From Feb 2024 to Feb 2025