UPDATE: Michelin Reaffirms Fiscal Year Guidance As 3Q Revenue Rises 11%

27 October 2011 - 5:37AM

Dow Jones News

French tire maker Michelin (ML.FR) reported Wednesday an 11%

increase in third-quarter revenue thanks to a 9.3% rise in sales

volume in expanding markets, and to its aggressive policy of

passing on to customers its increased raw materials costs.

Revenue for the three months ended Sept. 30 came in at EUR5.14

billion, up from EUR4.65 billion a year earlier, and was below an

average estimate of EUR5.21 billion compiled from a company survey

of 12 analysts. Sales for the first nine months were 17% higher at

EUR15.25 billion.

Michelin reaffirmed that it expects sales volume to rise by 8%

this year, and said it expects "substantially higher" operating

profit in 2011 compared with 2010. That was a more robust

projection than Michelin's outlook in July, when it omitted the

adverb and reaffirmed its objective of reporting "higher" operating

income for 2011 than the EUR1.7 billion reported for 2010.

Michelin managing partner Jean-Dominique Senard told analysts in

a conference call that they shouldn't read anything into changes in

language in the company's fiscal year guidance. "There's absolutely

nothing to be changed compared to what we've been saying since

July," he said.

The company had said in July it expected rising raw material

prices to exert a drag of EUR1.8 billion in 2011, but said most of

that pain would be passed on to customers through price increases.

It said then that free cash flow for the full year would be

"temporarily negative" in 2011 due to a EUR400 million-EUR500

million impact on working capital requirements from the raw

materials effect, as well as an accelerated capital spending

program as the company races to expand capacity in fast-growing

emerging markets.

On Wednesday, Michelin reaffirmed this full-year cash flow

guidance, and repeated the EUR1.8 billion raw material impact

estimate in the conference call. The company has a medium-term

objective of generating positive cash flow between 2011 and

2015.

Senard said Michelin expects the growth rate of global tire

market volumes to moderate to a long-term annual pace of between 4%

and 5% in 2012.

Michelin commented that markets expanded at a slower pace in the

third quarter than earlier this year. It noted that, in line with

slowing economic activity, tire markets--especially the truck tire

segment--had turned downwards over the summer. Fourth-quarter

replacement tire sales in Europe will depend on winter tire sales

to end-customers it said, while the outlook for truck tire sales is

uncertain, especially in Europe. However, demand for specialty

tires is expected to remain very buoyant, it said.

Michelin, which vies with Japan's Bridgestone Corp (5108.TO) for

the top spot among the world's tire makers, said exchange rate

fluctuations had exerted a EUR228 million drag on revenue in the

third quarter, chiefly due to the dollar's depreciation against the

euro. For the first nine months currency movements shaved EUR378

million off revenue.

Valerie Magloire, head of investor relations, said on the

conference call that Michelin expects its sales of original

equipment and replacement tires in Thailand to be affected by the

severe flooding there. "We of course will suffer," she said, and

the company is expecting a negative impact on its sales to car

manufacturers until the end of the year that could be "in the high

double digits." Sales of replacement car and truck tires in

Thailand could also be hit as well, she said. Michelin has five

production facilities in Thailand, and two of them are in flood

risk areas, she went on, adding that the company is shutting down

some production at these plants.

Michelin's shares closed up 0.5% on Wednesday at EUR52.28,

giving the company a market value of EUR9.36 billion, down 2.6%

since Jan. 1.

-By David Pearson, Dow Jones Newswires; +331 4017 1740;

david.pearson@dowjones.com

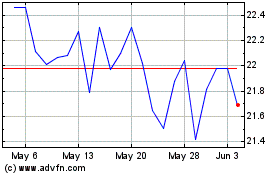

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Dec 2024 to Jan 2025

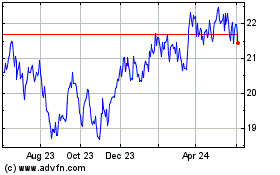

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Jan 2024 to Jan 2025