Commission File Number 001-31914

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16 of the

Securities Exchange Act of 1934

October 30, 2023

China Life

Insurance Company Limited

(Translation of registrant’s name into English)

16 Financial Street

Xicheng District

Beijing

100033, China

Tel: (86-10) 6363-3333

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Commission File Number 001-31914

On October 30, 2023, China Life Insurance Company Limited issued an announcement in relation to the disclosure of relevant representation on the 2023

Corporate Day together with materials for the 2023 Corporate Day, copies of which are attached as exhibits hereto.

EXHIBIT LIST

Commission File Number 001-31914

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

China Life Insurance Company Limited |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

|

/s/ Li Mingguang |

|

|

|

|

|

|

(Signature) |

|

|

|

|

October 30, 2023 |

|

|

|

Name: Title: |

|

Li Mingguang Principal Executive Officer and

Executive Director |

Commission File Number 001-31914

EXHIBIT 99.1

中 國 人 壽 保 險

股 份 有 限 公 司

CHINA LIFE INSURANCE COMPANY LIMITED

(A joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 2628)

ANNOUNCEMENT IN RELATION TO THE DISCLOSURE OF RELEVANT

REPRESENTATION ON THE 2023 CORPORATE DAY

China Life Insurance Company Limited (the “Company”) will host the 2023 Corporate Day on 31 October 2023 and make presentations on the

Company’s achievements in 20 years of public listing and future prospects, senior-care ecosystem planning and its sales system reforms.

For details

of the above-mentioned presentations, please refer to the attachments to this announcement as disclosed by the Company on the HKExnews website of Hong Kong Exchanges and Clearing Limited (www.hkexnews.hk) on the same day.

|

| By Order of the Board |

| China Life Insurance Company Limited |

| Heng Victor Ja Wei |

| Company Secretary |

Hong Kong, 30 October 2023

As at the date of this announcement, the Board of the Company comprises:

|

|

|

| Executive Directors: |

|

Bai Tao, Li Mingguang |

| Non-executive Directors: |

|

Wang Junhui, Zhuo Meijuan |

| Independent Non-executive Directors: |

|

Lam Chi Kuen, Zhai Haitao, Huang Yiping, Chen Jie |

Exhibit 99.2 C H I N A L I F E 2 0 2 3 C O P O R AT E D AY Past

Experiences Herald a Promising Future

FORWARD-LOOKING STATEMENT Certain statements contained in this

presentation may be viewed as “forward-looking statements” as defined by Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors, which may mean that the actual performance, financial condition or results of operations of the Company could be materially different from any future performance, financial condition or

results of operations implied by such forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company’s Annual Report on Form 20-F for the fiscal year ended 31 December 2022

filed with the U.S. Securities and Exchange Commission, or SEC, on 21 April 2023; and in the Company’s other filings with the SEC. You should not place undue reliance on these forward- looking statements. Unless otherwise stated, all

information provided in this presentation is as of the date of this presentation, and the Company undertakes no duty to update such information, except as required under applicable law. Unless otherwise indicated, the Chinese insurance market

information set forth in this presentation is based on public information released by the National Administration of Financial Regulation (NAFR). -2-

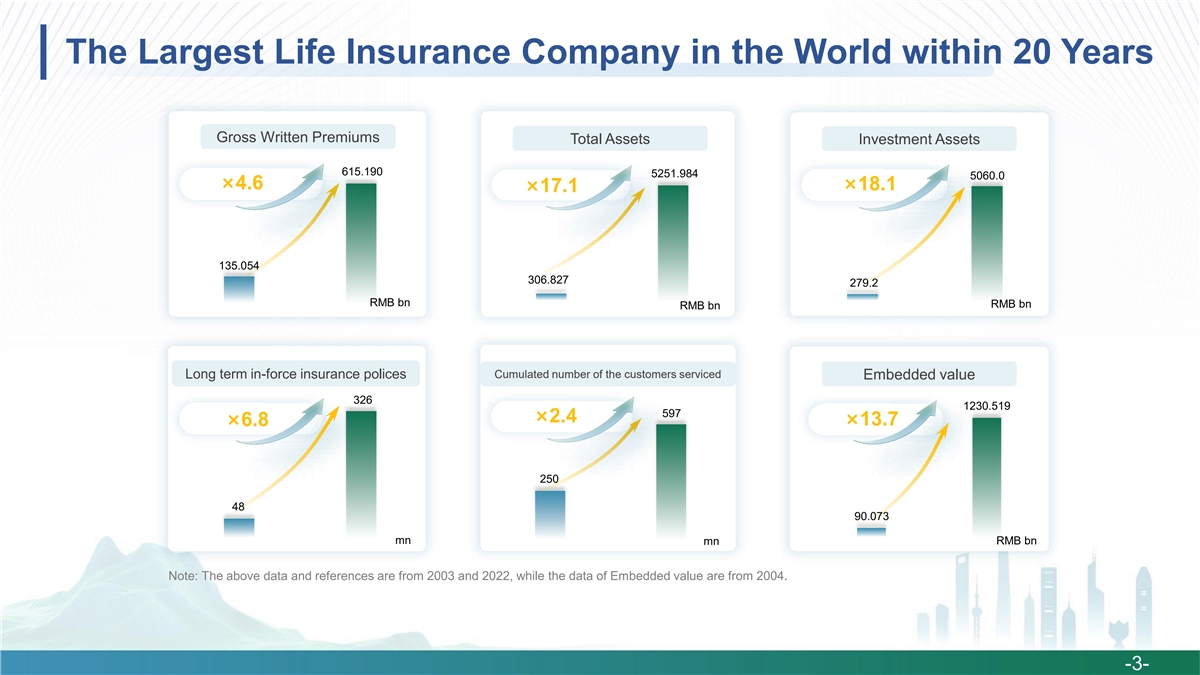

The Largest Life Insurance Company in the World within 20 Years Gross

Written Premiums Total Assets Investment Assets 615.190 5251.984 5060.0 ×4.6 ×18.1 ×17.1 135.054 306.827 279.2 RMB bn RMB bn RMB bn Long term in-force insurance polices Cumulated number of the customers serviced Embedded value 326

1230.519 597 ×2.4 ×6.8 ×13.7 250 48 90.073 mn mn RMB bn Note: The above data and references are from 2003 and 2022, while the data of Embedded value are from 2004. -3-

ORIGINAL Keep Growing with Original Aspiration Unchanged C H I N A L I F

E I N S U R A N C E ASPIRATION

Keep Growing with Original Aspiration Unchanged Social Stabilizer

Economic Shock Absorber -5-

Keep Growing with Original Aspiration Unchanged Promote the

transformation of China Life’s experiences and wisdom into industry actions -6-

Keep Growing with Original Aspiration Unchanged Success for You, Success

by You -7-

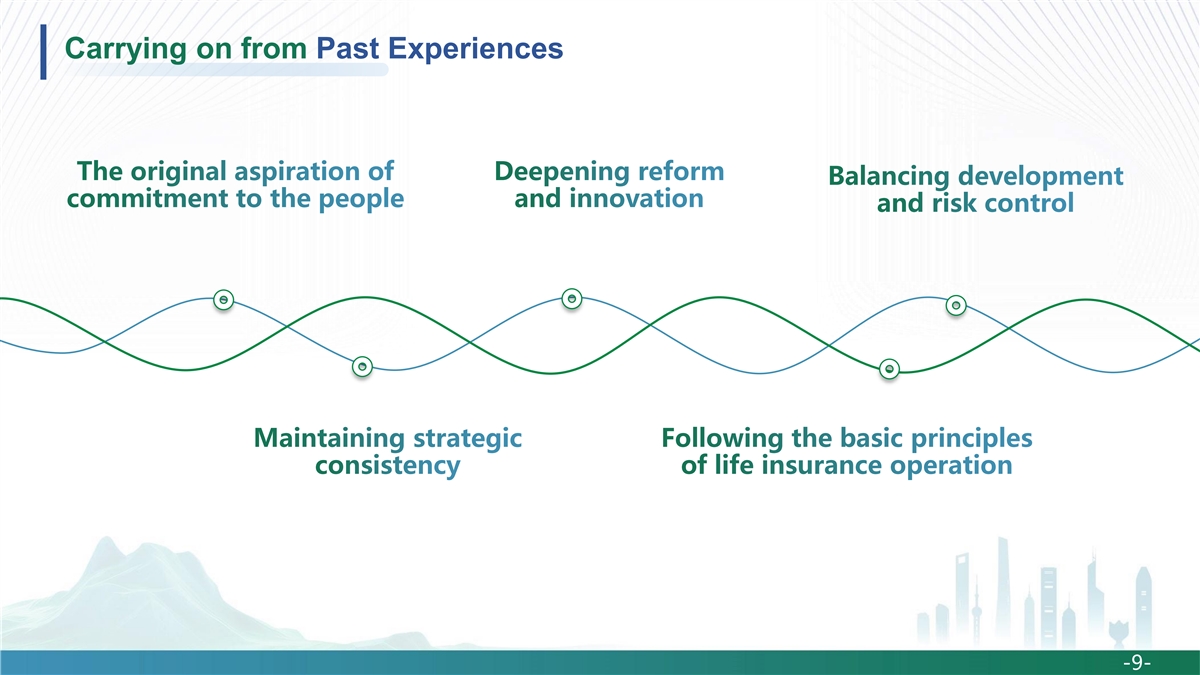

PAST Carrying on from Past Experiences C H I N A L I F E I N S U R A N C

E EXPERIENCES

Carrying on from Past Experiences -9-

FORGING Forging ahead with Confidence C H I N A L I F E I N S U R A N C

E AHEAD

Forging ahead with Confidence New challenges, new opportunities

-11-

Forging ahead with Confidence

夯实销售队伍基础夯实数字化经营基础 夯实精细化管理基础

夯实资负联动基础 -12-

Forging ahead with Confidence Quality services Improve Strengthen sales

service eco-services Optimize First contact point Ecosystems operational service Convenient, Quality and Caring -13-

Thank you!

Exhibit 99.3 INSURANCE + SENIOR CARE MAKE LIFE BETTER China Life's

Distinctive Senior Care Ecosystem 31 October 2023|Tianjin

FORWARD- LOOKING STATEMENT Certain statements contained in this

presentation may be viewed as“forward-lookingstatements” as defined by Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements involve known

and unknown risks, uncertainties and other factors, which may mean that the actual performance, financial condition or results of operations of the Company could be materially different from any future performance, financial condition or results of

operations implied by such forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in theCompany’s Annual Report on Form 20-F for the fiscal year ended 31 December 2022 filed with the

U.S. Securities and Exchange Commission, or SEC, on 21 April 2023; and in theCompany’s other filings with the SEC. You should not place undue reliance on these forward-looking statements. Unless otherwise stated, all information provided in

this presentation is as of the date of this presentation, and the Company undertakes no duty to update such information, except as required under applicable law. Unless otherwise indicated, the Chinese insurance market information set forth in this

presentation is based on public information released by the National Administration of Financial Regulation (NAFR). Note: The financial data contained in this presentation have been prepared in accordance with the China Accounting Standards for

Business Enterprises and are unaudited.

Intention Dedication Confidence

Intention

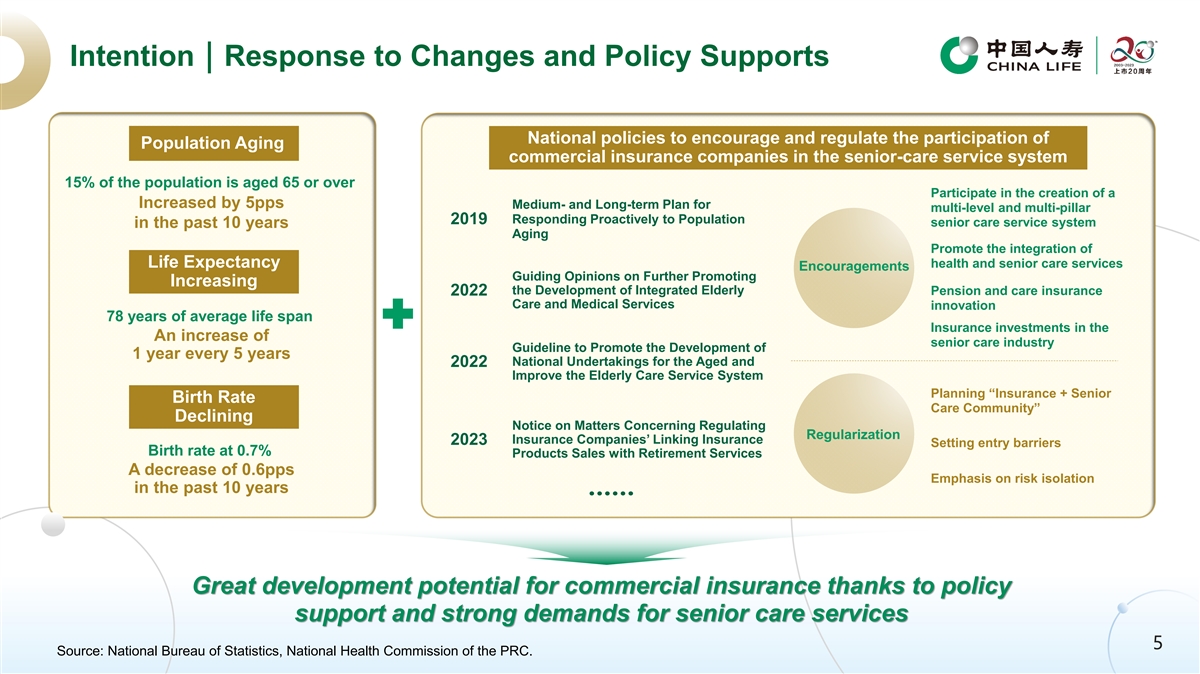

Intention|Response to Changes and Policy Supports National

policies to encourage and regulate the participation of Population Aging commercial insurance companies in the senior-care service system 15% of the population is aged 65 or over Participate in the creation of a Increased by 5pps Medium- and

Long-term Plan for multi-level and multi-pillar Responding Proactively to Population 2019 senior care service system in the past 10 years Aging Promote the integration of Life Expectancy health and senior care services Encouragements Guiding

Opinions on Further Promoting Increasing the Development of Integrated Elderly Pension and care insurance 2022 Care and Medical Services innovation 78 years of average life span Insurance investments in the An increase of senior care industry

Guideline to Promote the Development of 1 year every 5 years National Undertakings for the Aged and 2022 Improve the Elderly Care Service System Planning “Insurance + Senior Birth Rate Care Community” Declining Notice on Matters

Concerning Regulating Regularization Insurance Companies’ Linking Insurance 2023 Setting entry barriers Birth rate at 0.7% Products Sales with Retirement Services A decrease of 0.6pps Emphasis on risk isolation in the past 10 years

…… Great development potential for commercial insurance thanks to policy support and strong demands for senior care services 55 Source: National Bureau of Statistics, National Health Commission of the PRC.

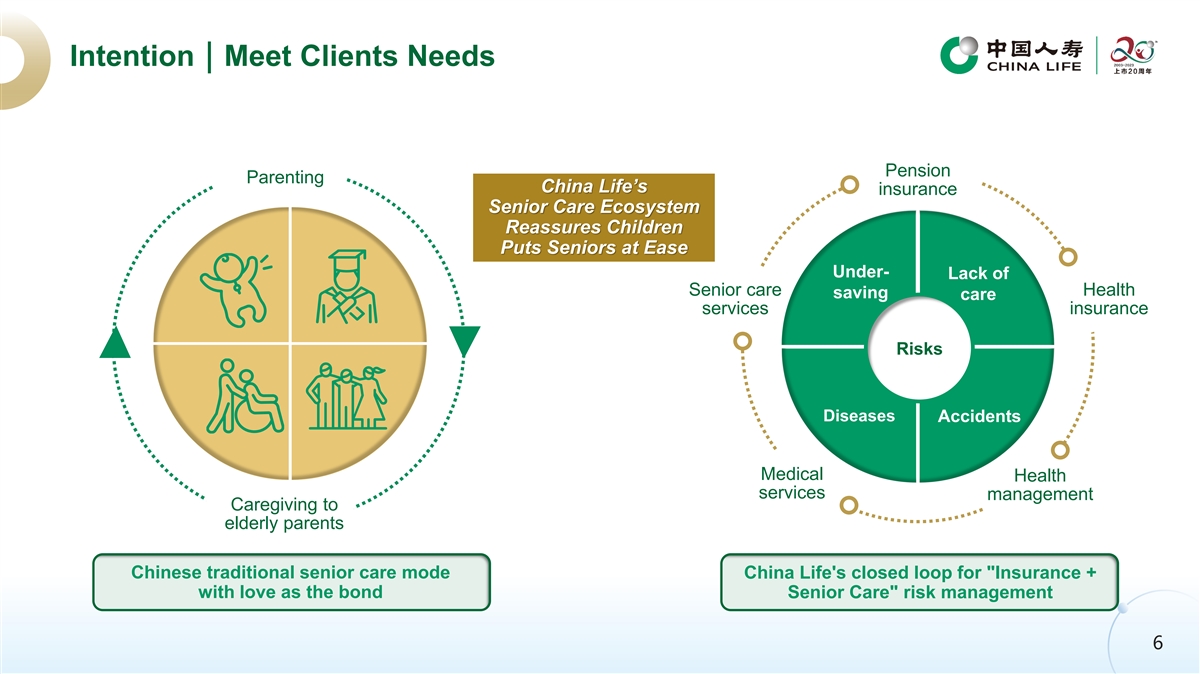

Intention|Meet Clients Needs Pension Parenting China Life’s

insurance Senior Care Ecosystem Reassures Children Puts Seniors at Ease Under- Lack of Senior care Health saving care services insurance Risks Diseases Accidents Medical Health services management Caregiving to elderly parents Chinese traditional

senior care mode China Life's closed loop for Insurance + with love as the bond Senior Care risk management 66

Intention|Contribute to Company Development Insurance + Senior

Care Client Sales Team Experience Reform Product Business Innovation Development Empower Meet business client needs development Extend the value and service chain of insurance 77

Intention|Clear Strategic Positioning China Life is committed to

its original aspiration of “Serving the Overall Interests of National Development and Safeguarding People’s Wellbeing”, fully launching the Healthcare and Senior Care Project, and clearly positioning the construction of the

healthcare and senior care ecosystem as the Company’s long-term development strategy. 88

Dedication 99

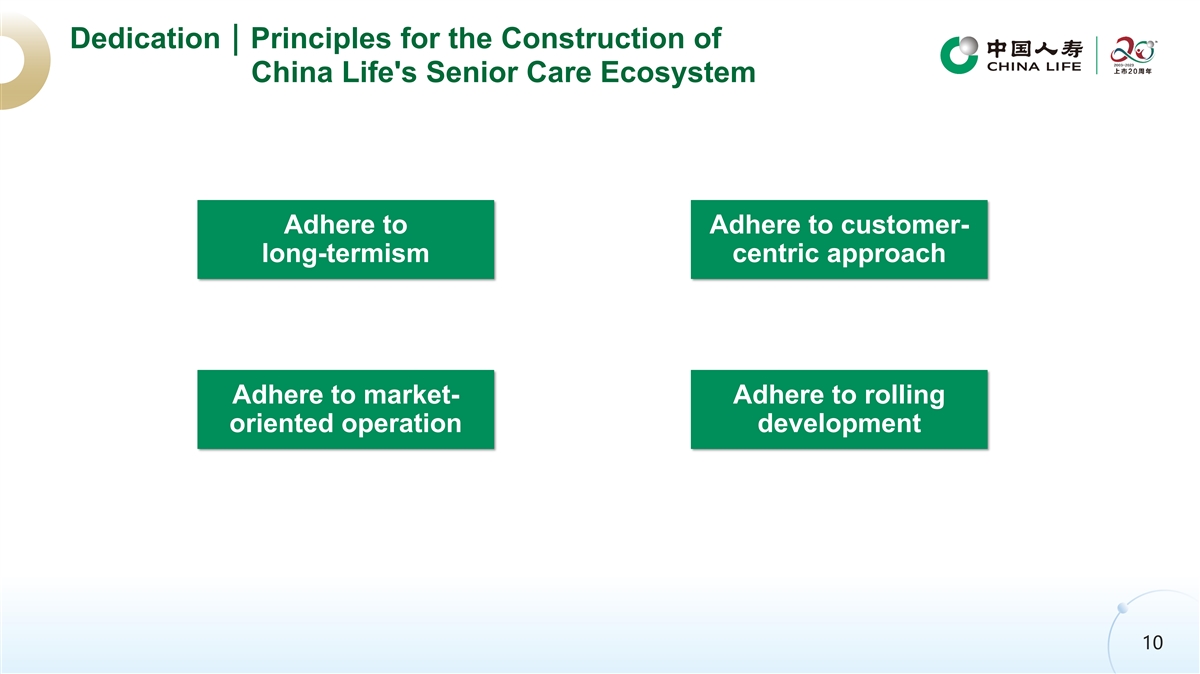

Dedication|Principles for the Construction of China Life's

Senior Care Ecosystem Adhere to Adhere to customer- long-termism centric approach Adhere to market- Adhere to rolling oriented operation development 10 10

Dedication|Development Goal of Senior Care Ecosystem Build a

high-quality and efficient management system for senior care services with enhanced assets/liabilities interaction, to rapidly establish the capability for health and senior care service offerings in selected cities to better satisfy clients’

diversified needs. Create a closed-loop of “products-services-payment” system, facilitate the Company’s transformation from risk compensation to full-chain risk management, make “insurance + senior care services” the

Company’s new growth driver, and become a strong force in strengthening the social security system, and improve people’s wellbeing and quality of life. 11 11

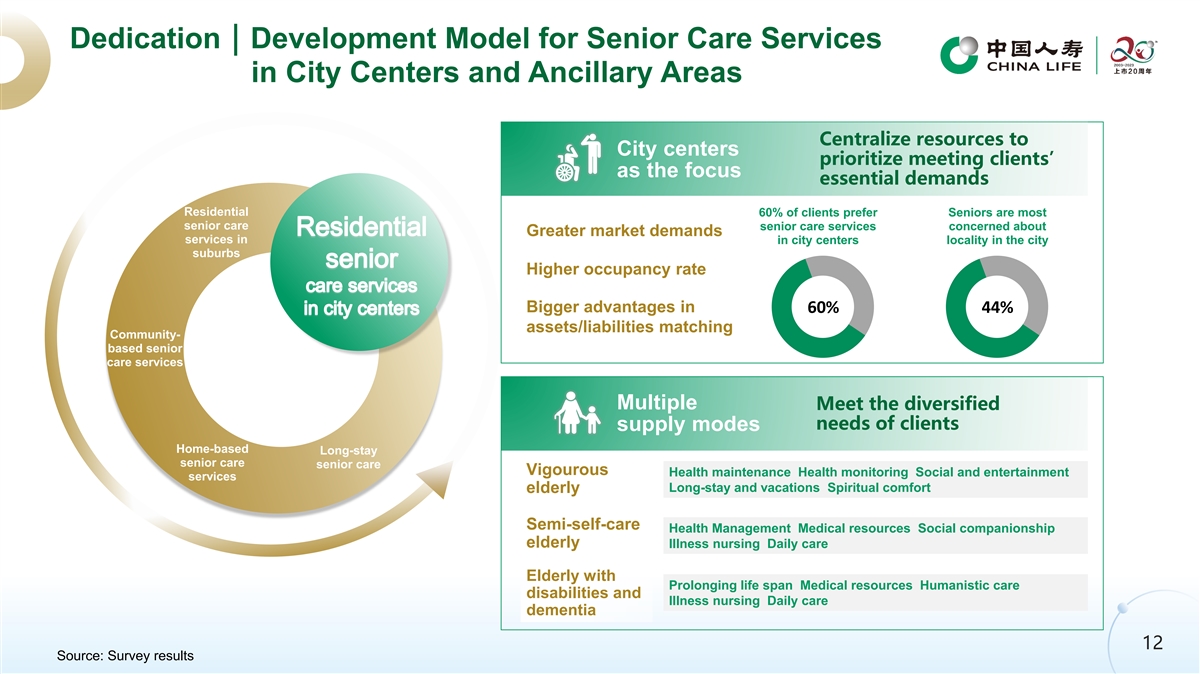

Dedication|Development Model for Senior Care Services in City

Centers and Ancillary Areas Centralize resources to City centers prioritize meeting clients’ as the focus essential demands Residential 60% of clients prefer Seniors are most senior care senior care services concerned about Greater market

demands services in in city centers locality in the city suburbs Higher occupancy rate Bigger advantages in 60% 44% assets/liabilities matching Community- based senior care services Multiple Meet the diversified needs of clients supply modes

Home-based Long-stay senior care senior care Vigourous Health maintenance Health monitoring Social and entertainment services Long-stay and vacations Spiritual comfort elderly Semi-self-care Health Management Medical resources Social companionship

elderly Illness nursing Daily care Elderly with Prolonging life span Medical resources Humanistic care disabilities and Illness nursing Daily care dementia 12 12 Source: Survey results

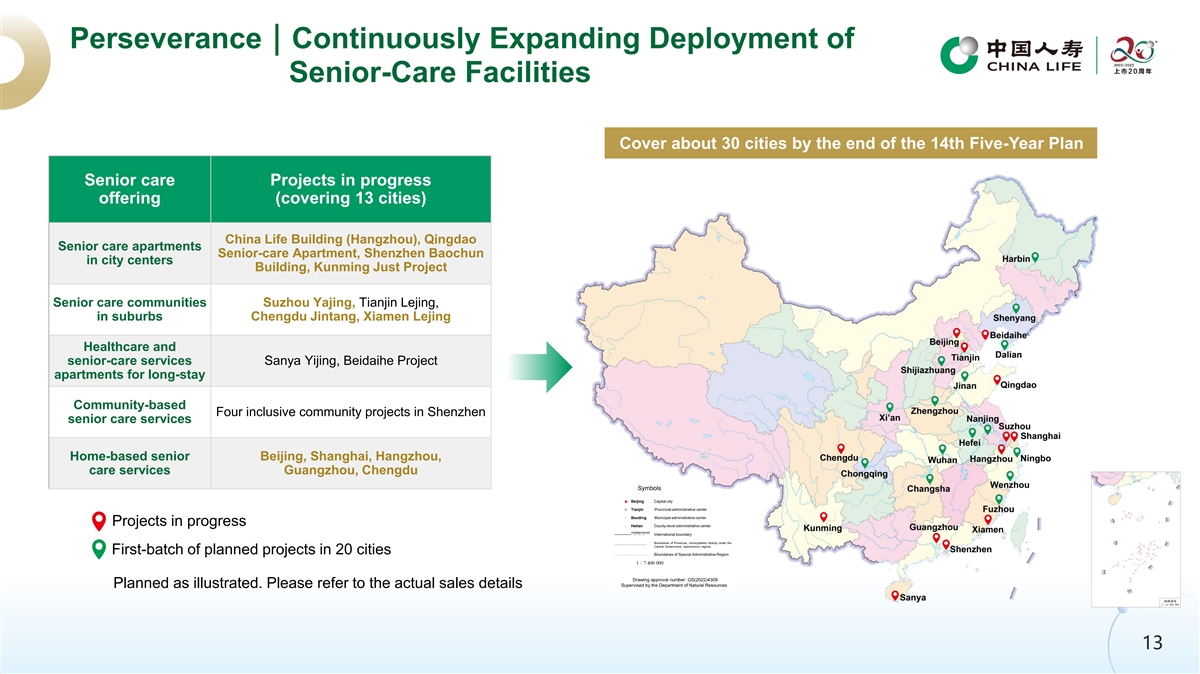

Perseverance|Continuously Expanding Deployment of Senior-Care

Facilities Cover about 30 cities by the end of the 14th Five-Year Plan Senior care Projects in progress offering (covering 13 cities) China Life Building (Hangzhou), Qingdao Senior care apartments Senior-care Apartment, Shenzhen Baochun in city

centers Building, Kunming Just Project Senior care communities Suzhou Yajing, Tianjin Lejing, in suburbs Chengdu Jintang, Xiamen Lejing Healthcare and senior-care services Sanya Yijing, Beidaihe Project apartments for long-stay Community-based Four

inclusive community projects in Shenzhen senior care services Home-based senior Beijing, Shanghai, Hangzhou, care services Guangzhou, Chengdu Symbols Beijing Capital city Tianjin Provincial administrative center Baoding Municipal administrative

center Projects in progress Hetian County-level administrative center Undetermined International boundary Boundaries of Provinces, municipalities directly under the Central Government, autonomous regions First-batch of planned projects in 20 cities

Boundaries of Special Administrative Region Drawing approval number: GS(2022)4309 Supervised by the Department of Natural Resources Planned as illustrated. Please refer to the actual sales details 13 13

Dedication|Provide “Abundant, Professional and Safe”

Senior Care Services Abundance • Catering for the elderly and Eating nutrition management Entertainment • Varieties of activities and entertainments • Beautiful and safe living Housing environment • University for the elderly

Learning and expert forums • Specialized care and Nursing professional team • Multi-location living and Travelling long-stay in senior care • Medical services and Medical centers care health management Safe Professional 55 90%+ 470

667 24 hours Safety management Service standards Operational quality Customer Service indicators and regulations management satisfaction 14 14

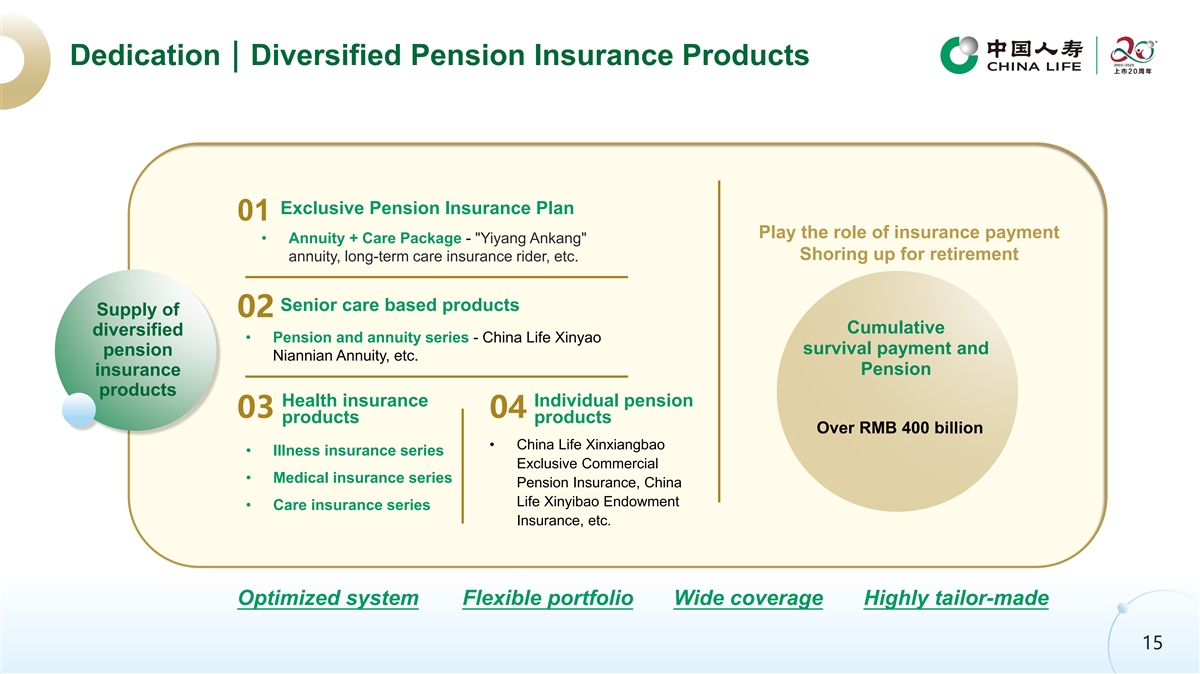

Dedication|Diversified Pension Insurance Products Exclusive

Pension Insurance Plan 01 Play the role of insurance payment • Annuity + Care Package - Yiyang Ankang Shoring up for retirement annuity, long-term care insurance rider, etc. Senior care based products Supply of 02 Cumulative diversified

• Pension and annuity series - China Life Xinyao survival payment and pension Niannian Annuity, etc. Pension insurance products Health insurance Individual pension 03 04 products products Over RMB 400 billion • China Life Xinxiangbao

• Illness insurance series Exclusive Commercial • Medical insurance series Pension Insurance, China Life Xinyibao Endowment • Care insurance series Insurance, etc. Optimized system Flexible portfolio Wide coverage Highly

tailor-made 15 15

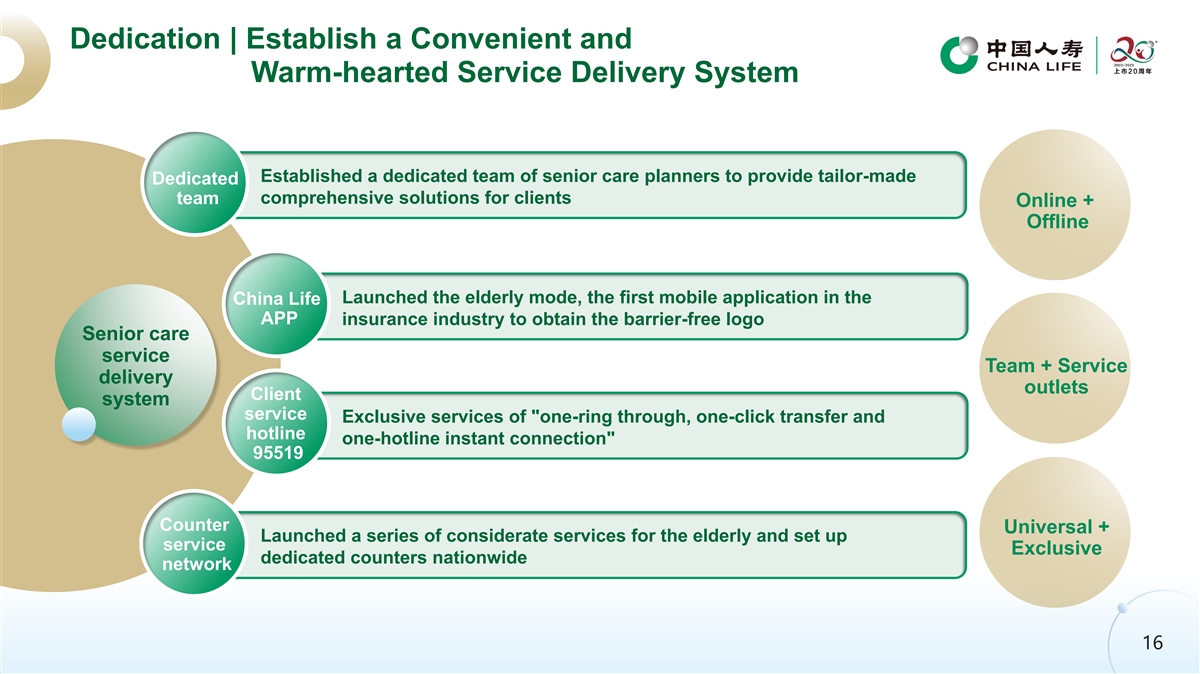

Dedication | Establish a Convenient and Warm-hearted Service Delivery

System Established a dedicated team of senior care planners to provide tailor-made Dedicated team comprehensive solutions for clients Online + Offline Launched the elderly mode, the first mobile application in the China Life APP insurance industry

to obtain the barrier-free logo Senior care service Team + Service delivery outlets Client system service Exclusive services of one-ring through, one-click transfer and hotline one-hotline instant connection 95519 Counter Universal + Launched a

series of considerate services for the elderly and set up service Exclusive dedicated counters nationwide network 16 16

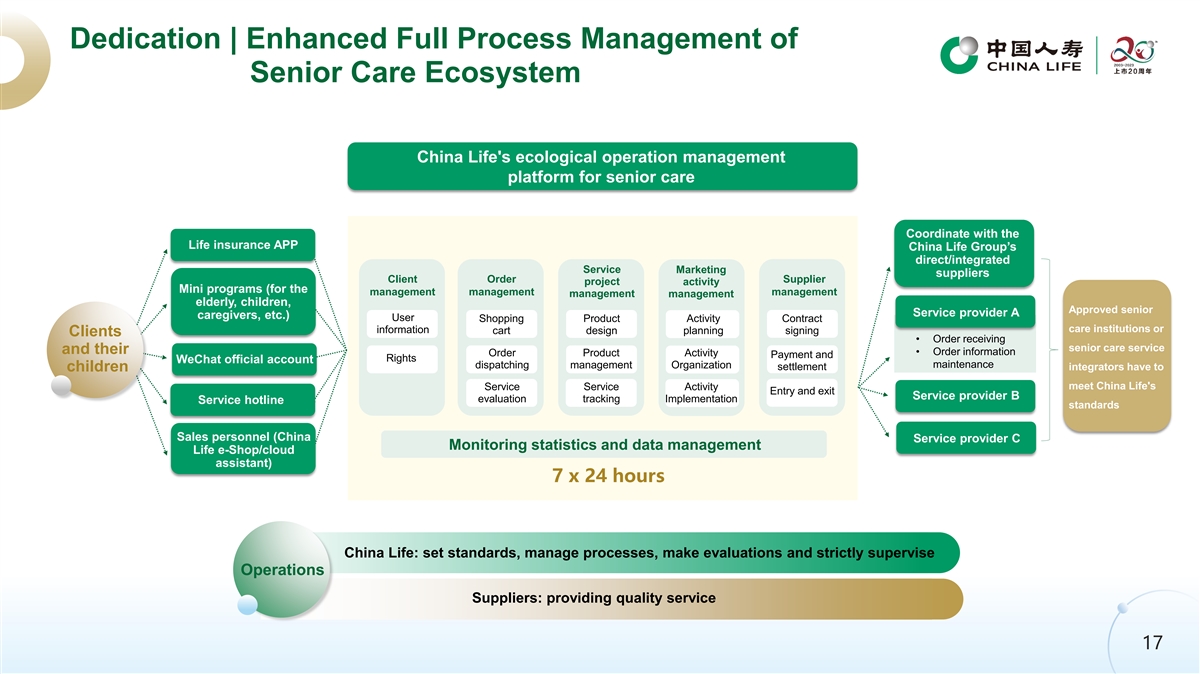

Dedication | Enhanced Full Process Management of Senior Care Ecosystem

China Life's ecological operation management platform for senior care Coordinate with the Life insurance APP China Life Group’s direct/integrated Service Marketing suppliers Client Order Supplier project activity Mini programs (for the

management management management management management elderly, children, Approved senior Service provider A caregivers, etc.) User Shopping Product Activity Contract care institutions or information cart design planning signing Clients •

Order receiving senior care service and their • Order information Order Product Activity Payment and Rights WeChat official account maintenance dispatching management Organization settlement integrators have to children meet China Life's

Service Service Activity Entry and exit Service provider B evaluation tracking Implementation Service hotline standards Sales personnel (China Service provider C Monitoring statistics and data management Life e-Shop/cloud assistant) 7 x 24 hours

China Life: set standards, manage processes, make evaluations and strictly supervise Operations Suppliers: providing quality service 17 17

Confidence

Confidence | Matching Insurance + Senior Care with China Life's

Characteristics Features of the China Life's senior care industry characteristics Long cycle Robustness Large Safety investment Complex Professional operation 19 19

Confidence | Superior Strength and Sound Operations

内含价值 Gross written Embedded value premiums Solvency ratio No. 1 in the No. 1 since the Long-term Remaining strong continuously leaders in business industry since insurance separated Strong and value solvency public

listing operation Net profit Total assets Integrated risk rating for insurance companies Recorded profits Positive growth Risk control and Business performance since public for 15 consecutive management remain Rated A for 21 consecutive quarters

enhanced listing years safe and robust continuously Greater resistance to shocks Stronger stamina for long-distance run 20 20

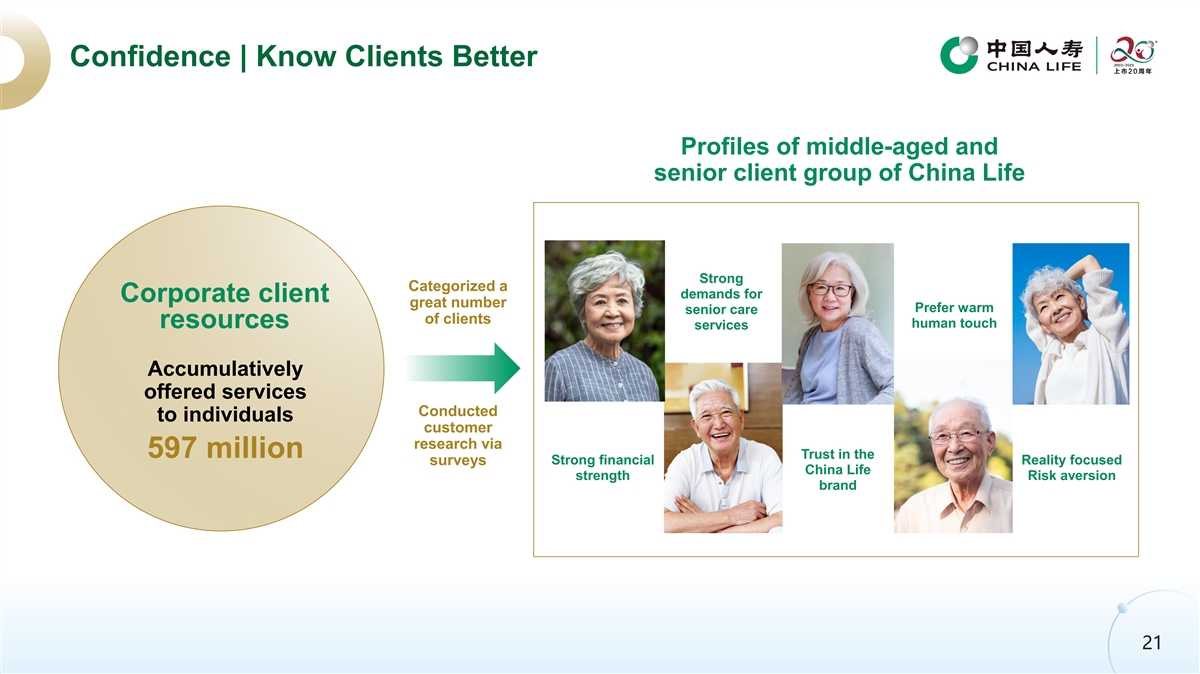

Confidence | Know Clients Better Profiles of middle-aged and senior

client group of China Life Strong Categorized a demands for Corporate client great number Prefer warm senior care of clients human touch resources services Accumulatively offered services Conducted to individuals customer research via 597 million

Trust in the Strong financial Reality focused surveys China Life strength Risk aversion brand 21 21

Confidence | Service Network Covering the Entire Country Geographic

penetration and distribution of customer service Heilongjiang Jilin Sales force Xinjiang Liaoning 720,000 Inner Mongolia Beijing Gansu Dalian Tianjin Symbols Beijing Capital city Hebei Tianjin Provincial administrative center Distribution channels

Shanxi Qingdao Baoding Municipal administrative center Qinghai Ningxia Hetian County-level administrative center Shandong Undetermined Individual agent business, International boundary Boundaries of Provinces, municipalities directly under the

bancassurance, group channel, Central Government, autonomous regions Shaanxi Henan Jiangsu Boundaries of Special Administrative Region health insurance business and Tibet Shanghai online insurance channel Drawing approval number: GS(2022)4309

Supervised by the Department of Natural Resources Hubei Sichuan Anhui Chongqing Zhejiang Branches and sub-branches Significantly above average Ningbo Jiangxi Hunan Guizhou Above average 18,000 Fujian Yunnan Covering urban and Below average Xiamen

Guangxi Guangdong rural areas nationwide Taiwan Significantly below average Shenzhen Hong Kong Macao Penetration rate = Long-term insurance clients or insured clients/permanent resident population. Permanent resident population statistics as at the

end of 2020. Hainan Population in provinces excluded the population in cities with independent planning. 22 22

Confidence | Own a Network of Professional Healthcare and Senior Care

Resources Medical Medical Digital Life science technology services healthcare 华西牙科 More than 50 leading More than 30 local More than 60 large-scale enterprises in the healthcare governments enterprises and senior care

sector 23 23

Looking ahead, China Life will ride on the momentum and quickly respond

to market demands. From a tiny spark to a starry sky, we do our best to ensure that senior people are looked after properly, age with dignity, and find delights in life. Make retirement life simpler, make retirement life better!

THANK YOU

Exhibit 99.4 PROGRESS | INTERGRATION | PROSPECTS Individual Sales System

Reform Tianjin 2023.10.31

FORWARD-LOOKING STATEMENT Certain statements contained in this

presentation may be viewed as “forward-looking statements” as defined by Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors, which may mean that the actual performance, financial condition or results of operations of the Company could be materially different from any future performance, financial condition or

results of operations implied by such forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company’s Annual Report on Form 20-F for the fiscal year ended 31 December 2022

filed with the U.S. Securities and Exchange Commission, or SEC, on 21 April 2023; and in the Company’s other filings with the SEC. You should not place undue reliance on these forward-looking statements. Unless otherwise stated, all

information provided in this presentation is as of the date of this presentation, and the Company undertakes no duty to update such information, except as required under applicable law. Unless otherwise indicated, the Chinese insurance market

information set forth in this presentation is based on public information released by the National Administration of Financial Regulation (NAFR). Note: The financial data contained in this presentation have been prepared in accordance with the China

Accounting Standards for Business Enterprises and are unaudited.

Building a World-Class Life Insurance Company Refining management

Transformation and Start-up system upgrades Strived to develop regular premiums Steadily promoted the Introduced individual business and risk-based business, innovation-driven development agent system with premiums from individual agent

strategy“, with individual agent channel exceeding RMB100 billion force exceeding 1.5 million Optimization of business Rapid development High-quality development structure Accelerated development of Focus on both quantity and

medium-to-long-term regular Accelerated development, with quality of sales force, with gross premiums business, with premiums individual agent force reaching written premiums exceeding from individual agent channel 650,000 RMB 600 billion

approaching RMB 200 billion 1996-1999 1999-2003 2003-2008 2008-2013 2014-2020 2020 to date 3

Origin

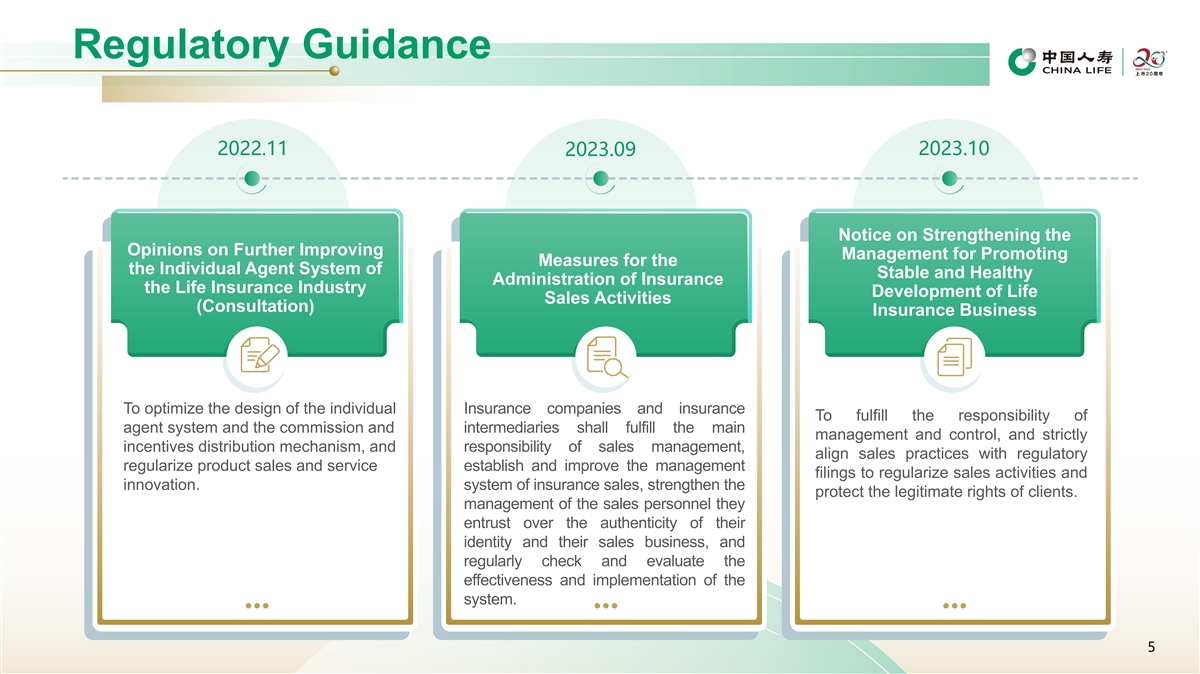

Regulatory Guidance 2022.11 2023.10 2023.09 Notice on Strengthening the

Opinions on Further Improving Management for Promoting Measures for the the Individual Agent System of Stable and Healthy Administration of Insurance the Life Insurance Industry Development of Life Sales Activities (Consultation) Insurance Business

To optimize the design of the individual Insurance companies and insurance To fulfill the responsibility of agent system and the commission and intermediaries shall fulfill the main management and control, and strictly incentives distribution

mechanism, and responsibility of sales management, align sales practices with regulatory regularize product sales and service establish and improve the management filings to regularize sales activities and innovation. system of insurance sales,

strengthen the protect the legitimate rights of clients. management of the sales personnel they entrust over the authenticity of their identity and their sales business, and regularly check and evaluate the effectiveness and implementation of the

system. 5 5

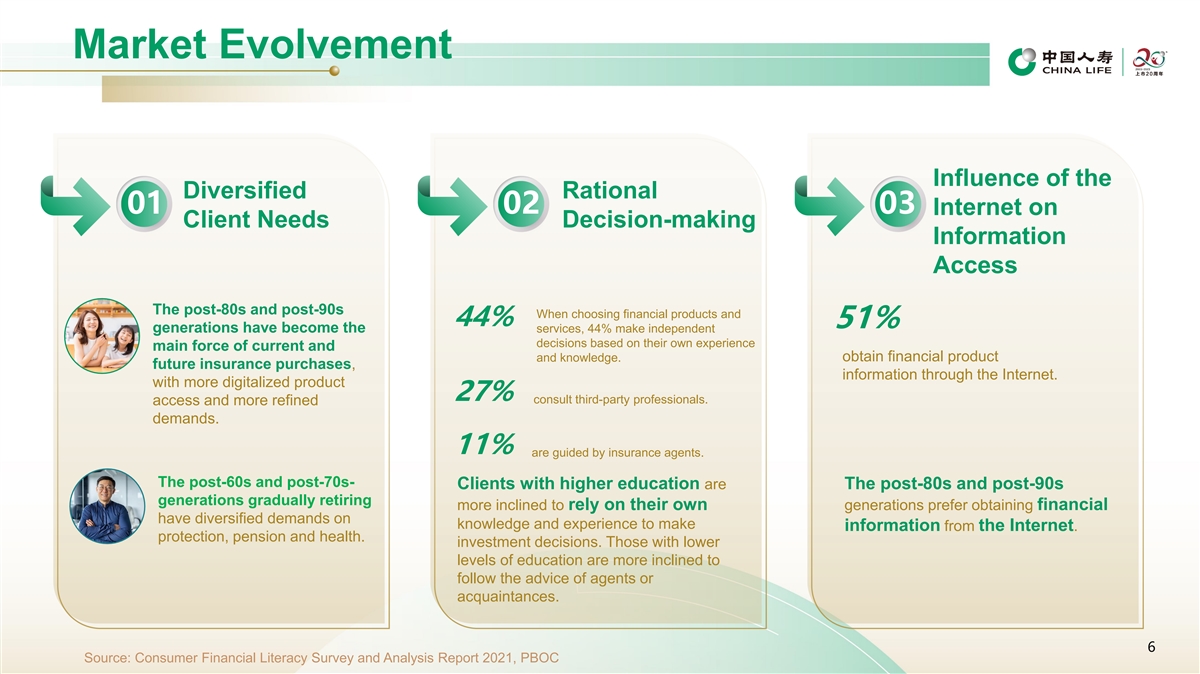

Market Evolvement Influence of the Diversified Rational 01 02 03

Internet on Client Needs Decision-making Information Access The post-80s and post-90s When choosing financial products and 44% 51% generations have become the services, 44% make independent decisions based on their own experience main force of

current and and knowledge. obtain financial product future insurance purchases, information through the Internet. with more digitalized product 27% consult third-party professionals. access and more refined demands. 11% are guided by insurance

agents. The post-60s and post-70s- Clients with higher education are The post-80s and post-90s generations gradually retiring more inclined to rely on their own generations prefer obtaining financial have diversified demands on knowledge and

experience to make information from the Internet. protection, pension and health. investment decisions. Those with lower levels of education are more inclined to follow the advice of agents or acquaintances. 6 Source: Consumer Financial Literacy

Survey and Analysis Report 2021, PBOC

Industry Trends Peer Competition Channel Financial Sector Competition

Competition Emerging channels including Leading insurance companies Banks, brokerages, funds, bancassurance, intermediary have started to innovate their and family offices make brokers, and the Internet are agent channels and drive deployment in

individual growing rapidly. agent transformation. finance and insurance market. 7

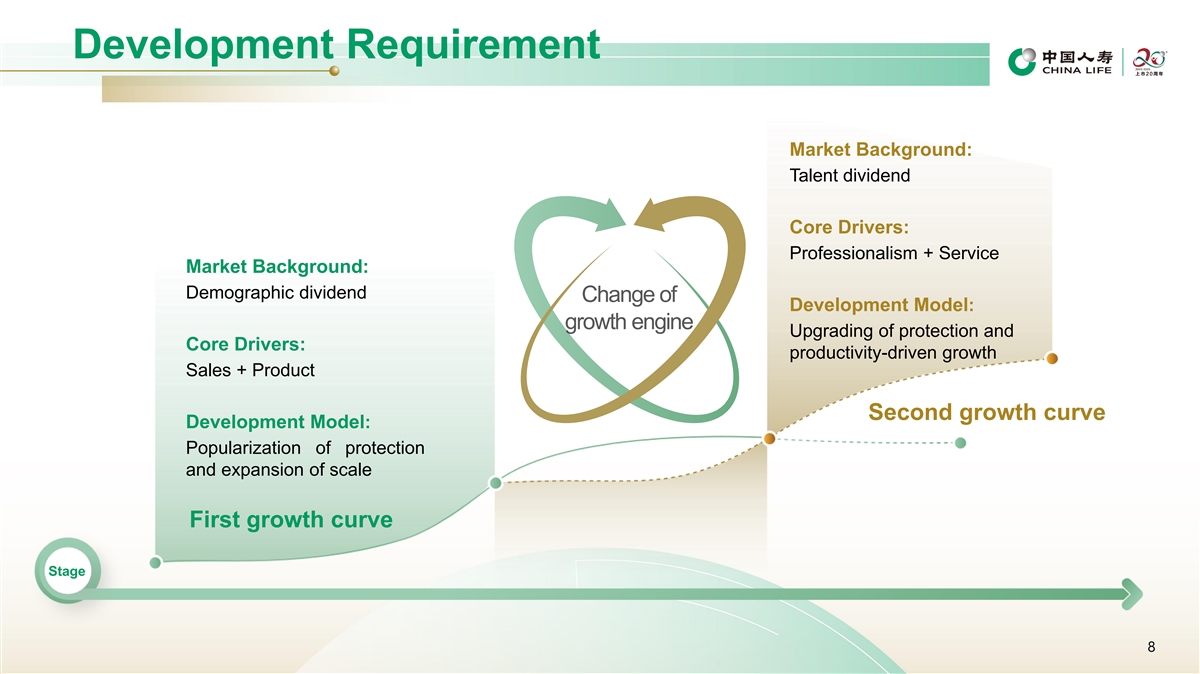

Development Requirement Market Background: Talent dividend Core Drivers:

Professionalism + Service Market Background: Demographic dividend Change of Development Model: growth engine Upgrading of protection and Core Drivers: productivity-driven growth Sales + Product Second growth curve Development Model: Popularization

of protection and expansion of scale First growth curve Stage 8

Progress

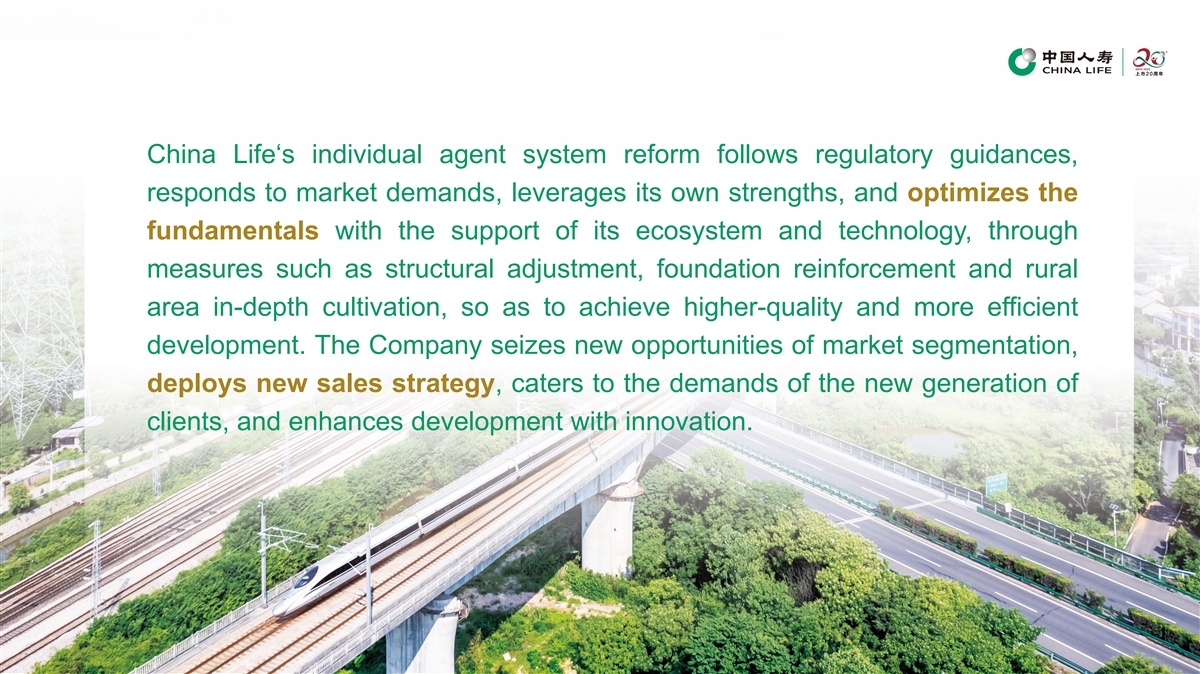

China Life‘s individual agent system reform follows regulatory

guidances, responds to market demands, leverages its own strengths, and optimizes the fundamentals with the support of its ecosystem and technology, through measures such as structural adjustment, foundation reinforcement and rural area in-depth

cultivation, so as to achieve higher-quality and more efficient development. The Company seizes new opportunities of market segmentation, deploys new sales strategy, caters to the demands of the new generation of clients, and enhances development

with innovation.

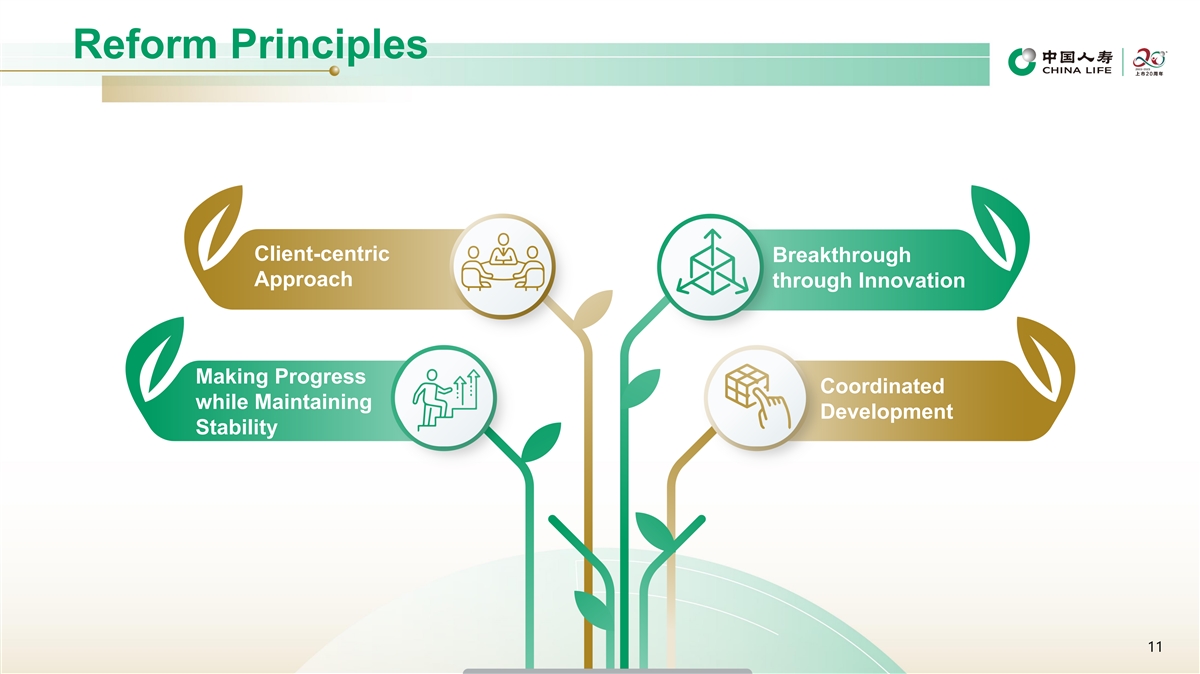

Reform Principles Client-centric Breakthrough Approach through

Innovation Making Progress Coordinated while Maintaining Development Stability 11

Reform Direction Specialization Professionalism Integration

12

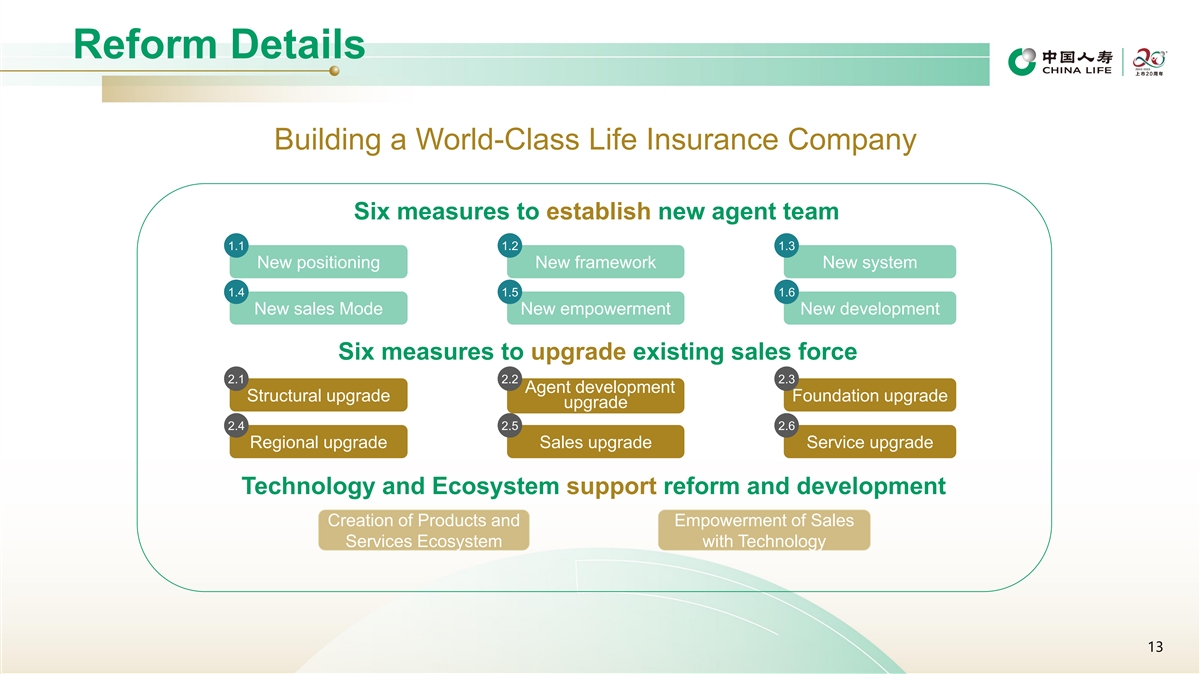

Reform Details Building a World-Class Life Insurance Company Six

measures to establish new agent team 1.1 1.2 1.3 New positioning New framework New system 1.4 1.5 1.6 New sales Mode New empowerment New development Six measures to upgrade existing sales force 2.1 2.2 2.3 Agent development Structural upgrade

Foundation upgrade upgrade 2.4 2.5 2.6 Regional upgrade Sales upgrade Service upgrade Technology and Ecosystem support reform and development Creation of Products and Empowerment of Sales Services Ecosystem with Technology 13

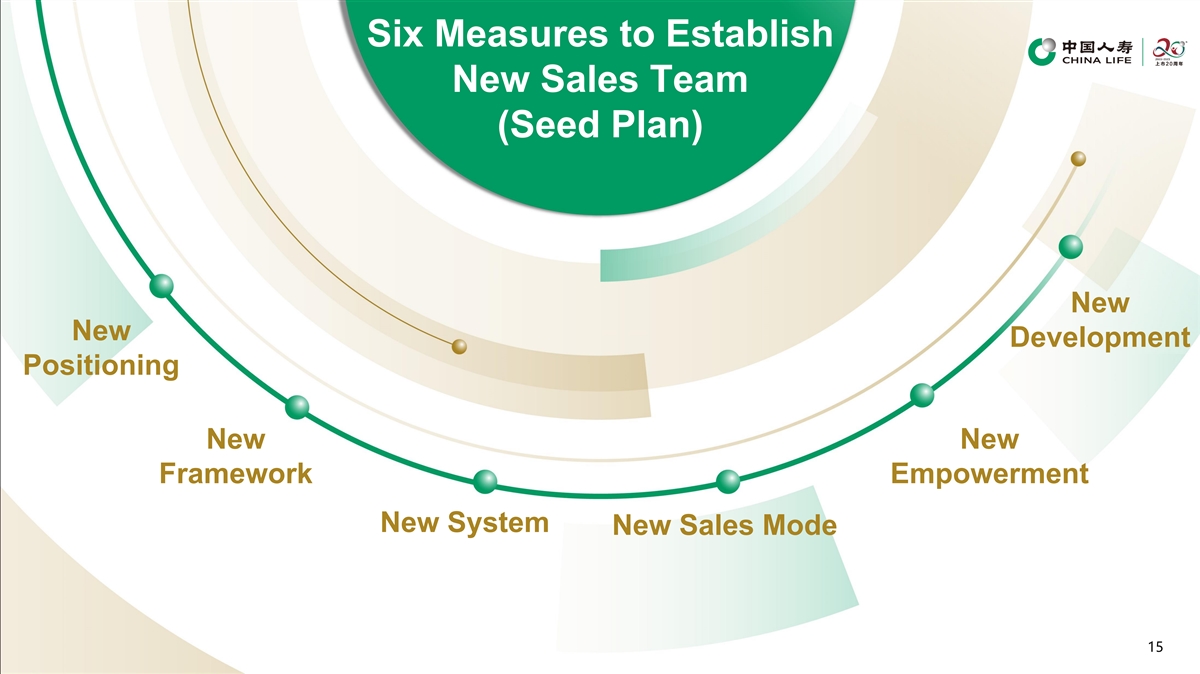

Six Measures to Establish New Sales Team (Seed Plan) New New

Development Positioning New New Framework Empowerment New System New Sales Mode 15

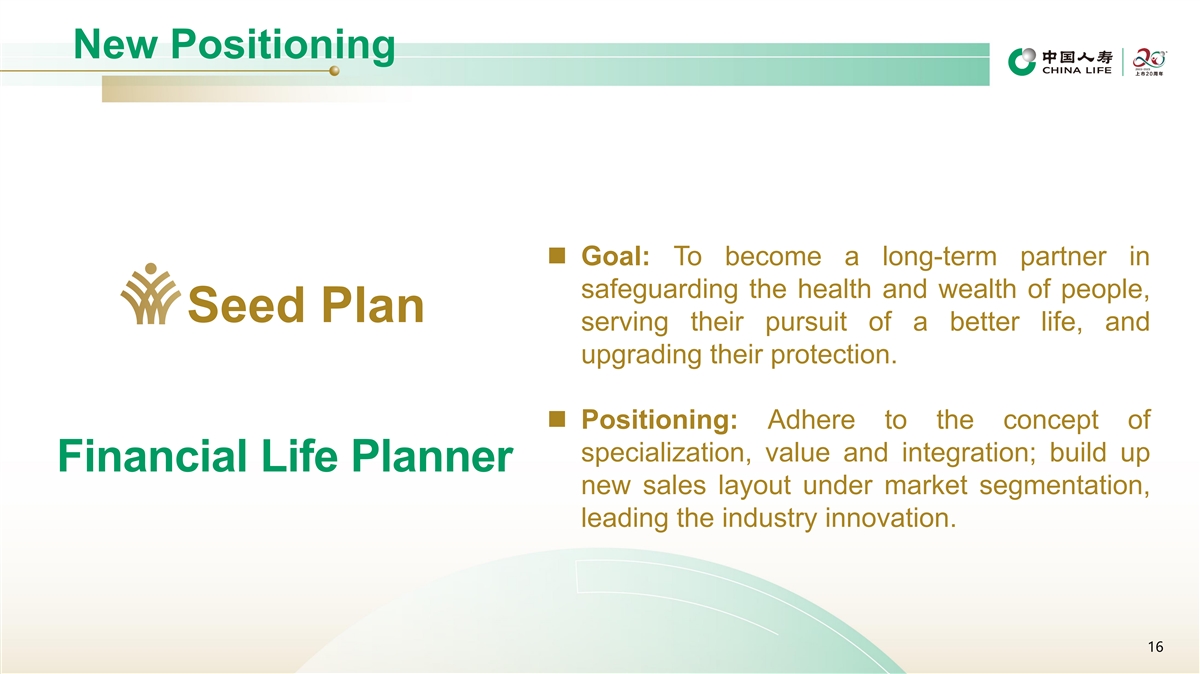

New Positioning ◼ Goal: To become a long-term partner in

safeguarding the health and wealth of people, Seed Plan serving their pursuit of a better life, and upgrading their protection. ◼ Positioning: Adhere to the concept of specialization, value and integration; build up Financial Life Planner new

sales layout under market segmentation, leading the industry innovation. 16

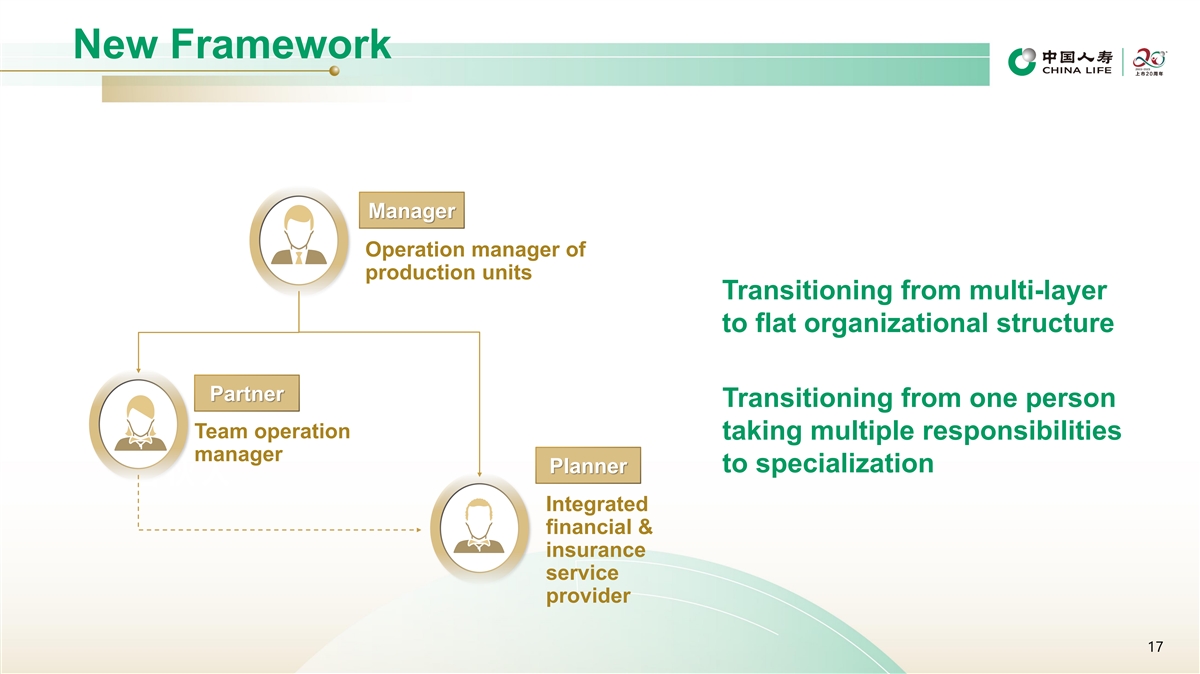

New Framework Manager Operation manager of production units

Transitioning from multi-layer to flat organizational structure Partner Transitioning from one person Team operation taking multiple responsibilities manager to specialization Planner 合伙人 Integrated financial & insurance

service provider 17

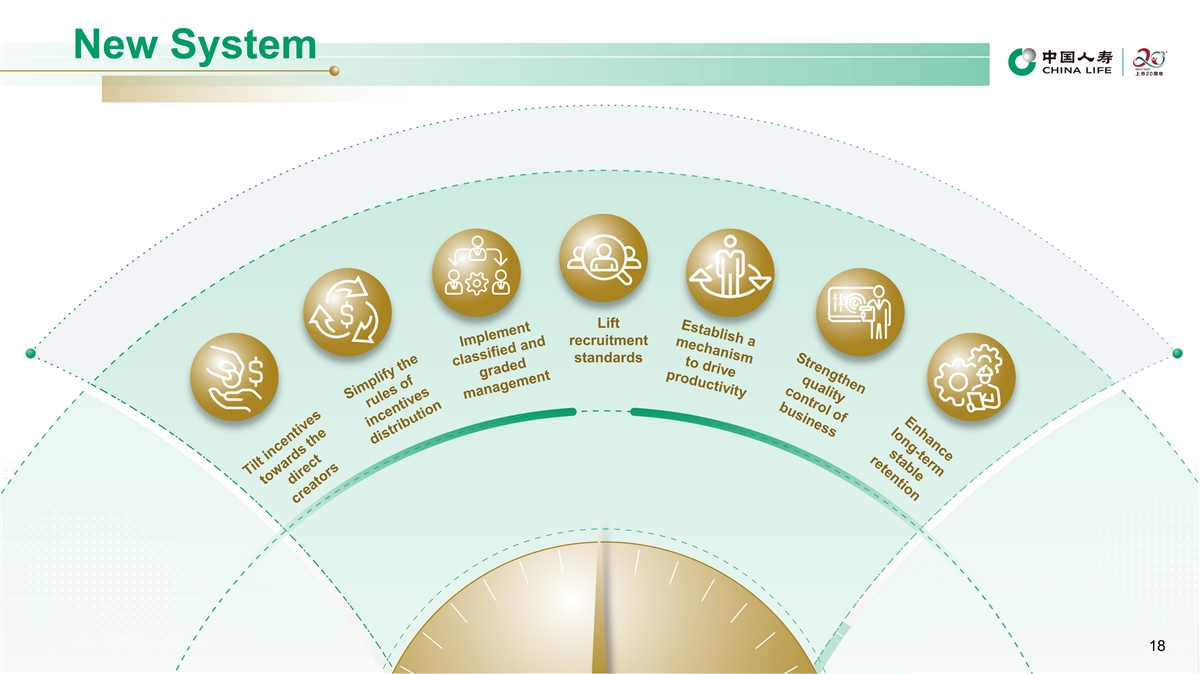

New System Lift recruitment standards 18 18

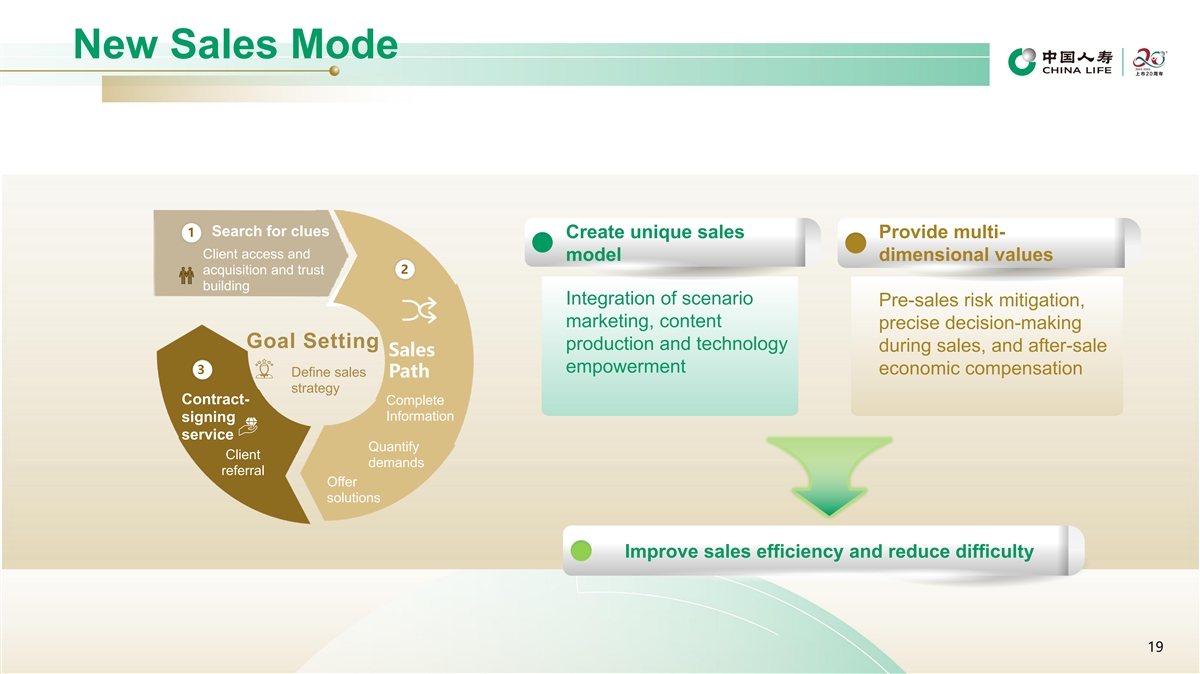

New Sales Mode Search for clues 1 Create unique sales Provide multi-

Client access and model dimensional values 2 acquisition and trust 1 building Integration of scenario Pre-sales risk mitigation, marketing, content precise decision-making Goal Setting production and technology during sales, and after-sale Sales

empowerment 3 economic compensation Define sales Path strategy Contract- Complete Information signing service Quantify Client 1 demands referral Offer solutions Improve sales efficiency and reduce difficulty 19

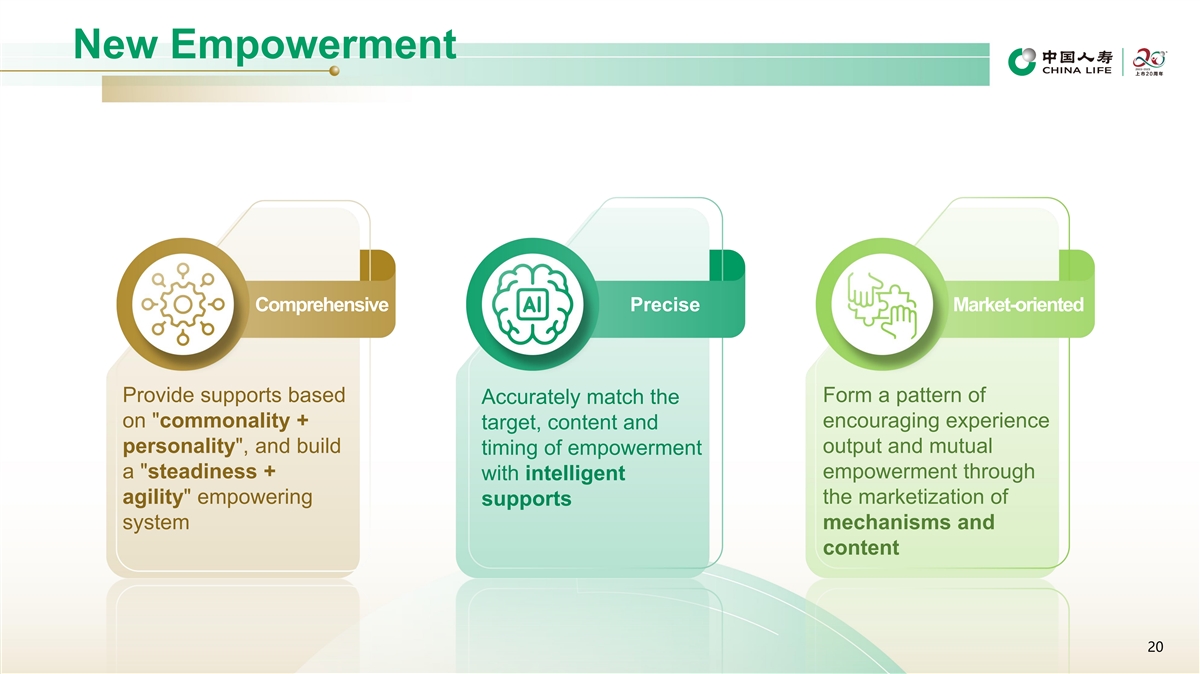

New Empowerment Comprehensive Precise Market-oriented Provide supports

based Form a pattern of Accurately match the on commonality + encouraging experience target, content and personality , and build output and mutual timing of empowerment a steadiness + empowerment through with intelligent agility empowering the

marketization of supports system mechanisms and content 20

New Development Breakthrough of circles Direct recruitment Adhere to

high standards “Company recruitment” + Undergraduates from universities “individual recruitment” in first-and second-tier cities Direct recruitment of agents Management model adaptation Integrated operation Establish a

management On-line and off-line integrated work model model adapted to the new Independent, convenient and open generation agents Balance between delegation and control 21

Six measures to Upgrade Existing Sales Force (Sales Channel

Strengthening Program) Service Structure Upgrade Upgrade Sales Agent Upgrade Development Foundation Regional Upgrade Upgrade Upgrade 22

Structure Upgrade Upgrade team structure and strengthen professional

competence Optimize productivity structure Optimize age structure Zhongxin Project, Team Building 4.0, Evergreen Project and Star Project 2.4 pps 7 Percentage of medium-to-high Pilot branches productivity agents increased Optimize capability

structure Lingyue Project Tengyue Project Chuoyue Project 5,000+ 40,000+ 54% Cultivate elite agents with Training coverage for new agents Cultivate team managers million level FYP with less than 1 year experience 23

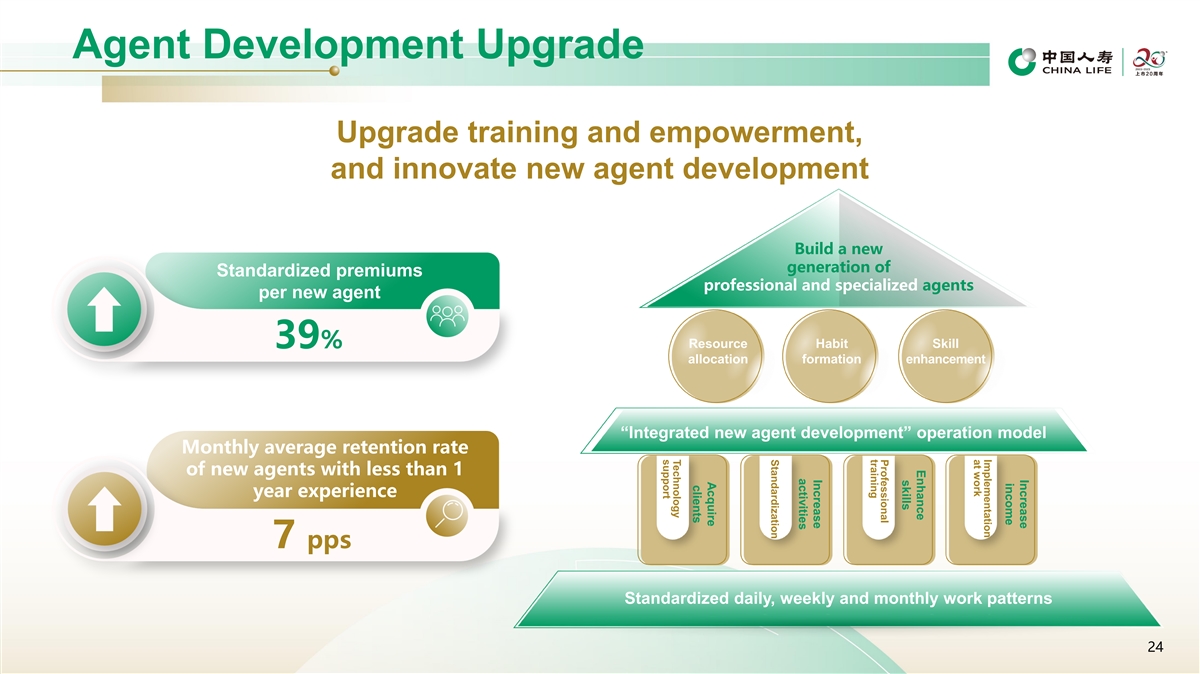

Increase income Implementation at work Enhance skills Professional

training Increase activities Standardization Acquire clients Technology support Agent Development Upgrade Upgrade training and empowerment, and innovate new agent development Build a new generation of Standardized premiums professional and

specialized agents per new agent Resource Habit Skill 39% allocation formation enhancement “Integrated new agent development” operation model Monthly average retention rate of new agents with less than 1 year experience 7 pps

Standardized daily, weekly and monthly work patterns 24

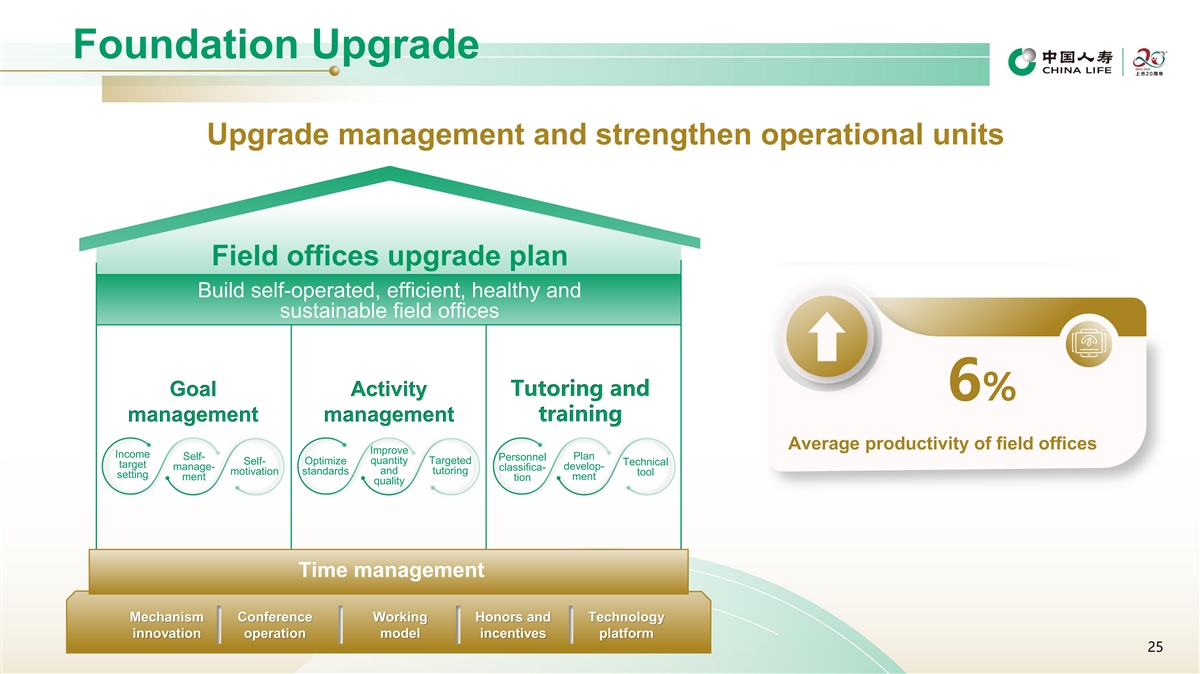

Foundation Upgrade Upgrade management and strengthen operational units

Field offices upgrade plan Build self-operated, efficient, healthy and sustainable field offices Tutoring and Goal Activity 6% management management training Average productivity of field offices Improve Income Self- Plan Personnel quantity Targeted

Self- Optimize Technical target develop- manage- classifica- standards and tutoring motivation tool setting ment ment tion quality Time management Mechanism Conference Working Honors and Technology innovation operation model incentives platform

25

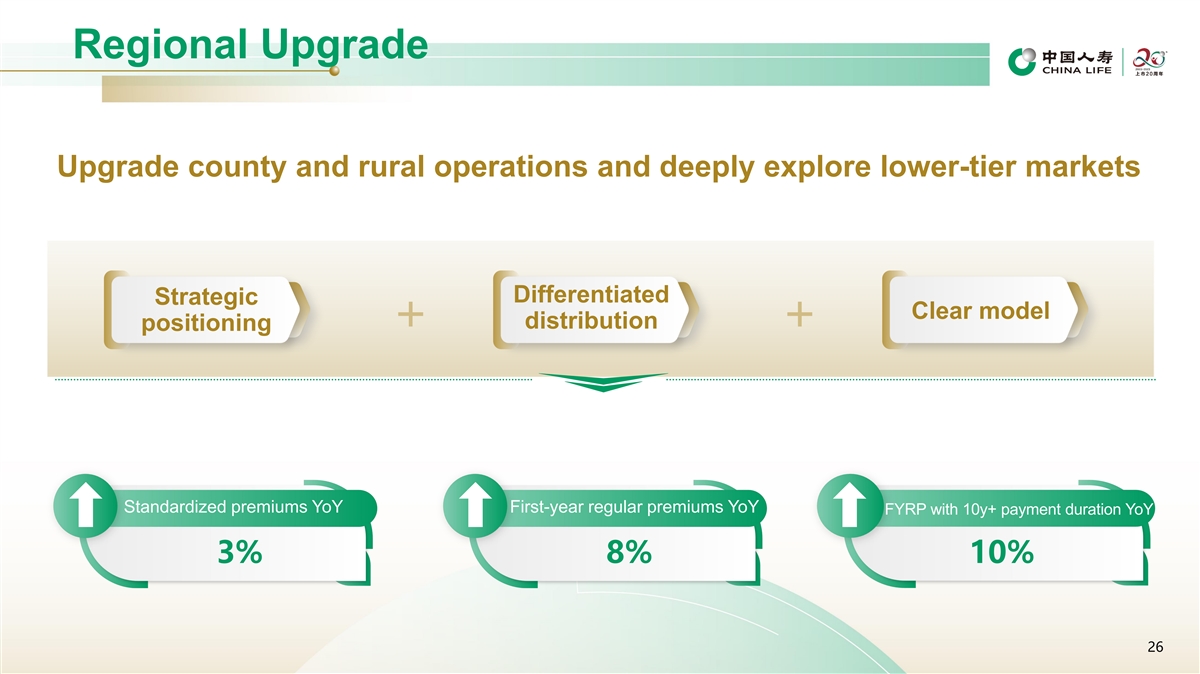

Regional Upgrade Upgrade county and rural operations and deeply explore

lower-tier markets Differentiated Strategic Clear model distribution ++ positioning Standardized premiums YoY First-year regular premiums YoY FYRP with 10y+ payment duration YoY 3% 8% 10% 26

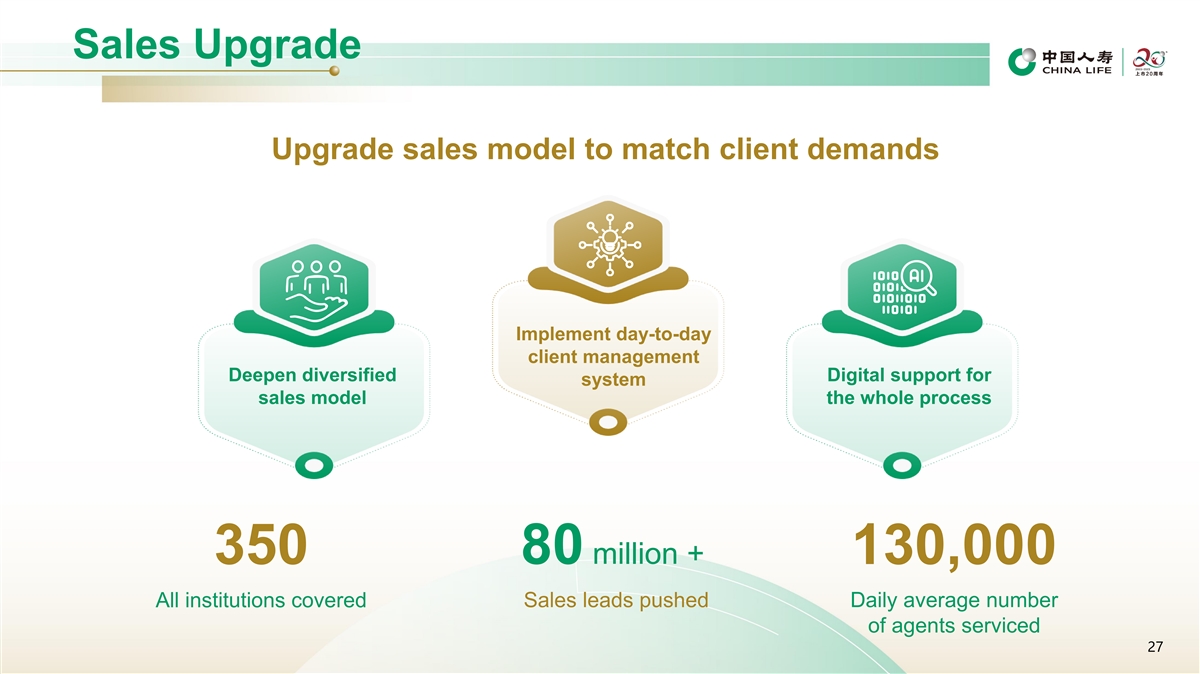

Sales Upgrade Upgrade sales model to match client demands Implement

day-to-day client management Deepen diversified Digital support for system sales model the whole process 80 million + 350 130,000 All institutions covered Sales leads pushed Daily average number of agents serviced 27

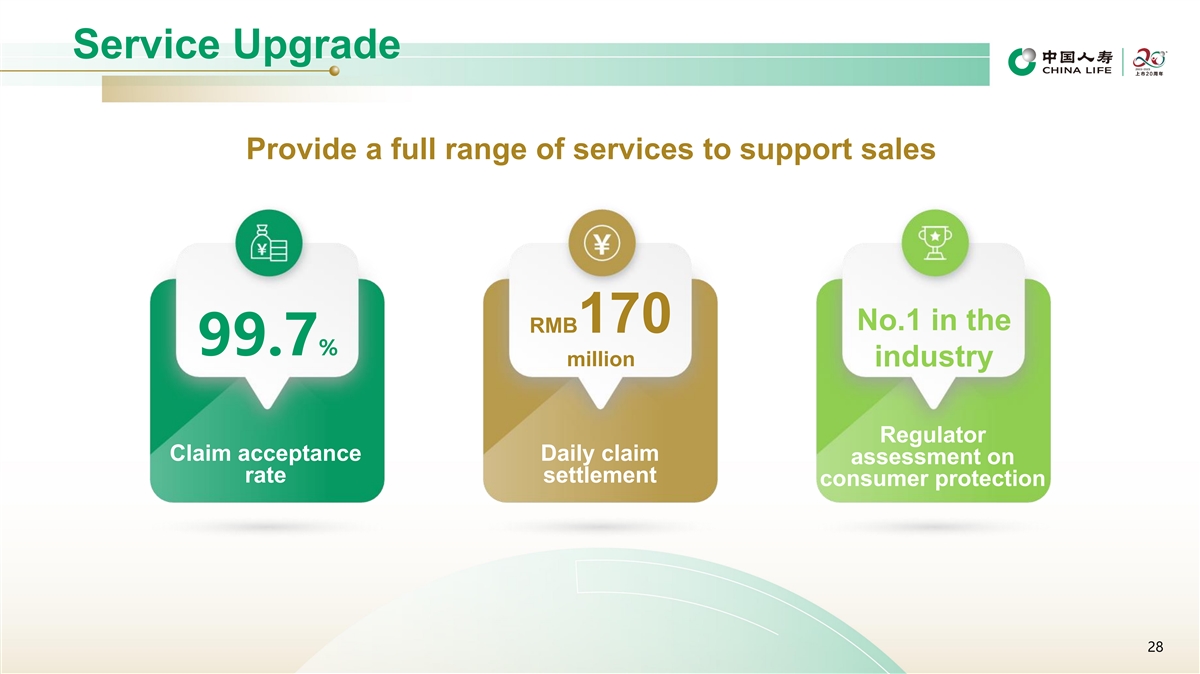

Service Upgrade Provide a full range of services to support sales No.1

in the RMB170 99.7% million industry Regulator Claim acceptance Daily claim assessment on rate settlement consumer protection 28

Blueprint for the New Team, Upgrading of Existing Teams; Complementing

Each Other 29

Ecosystem and Technology Support Reform and Development 30

Products and Services Ecosystem Wealth Accompany clients at life

milestones and serve them throughout the whole life cycle Provide matched financial and insurance products and services to families Property Parenting Marriage Retirement Heritage purchase Offer ecosystem services to enhance the sense of value of

life insurance Enter products workforce Age 31

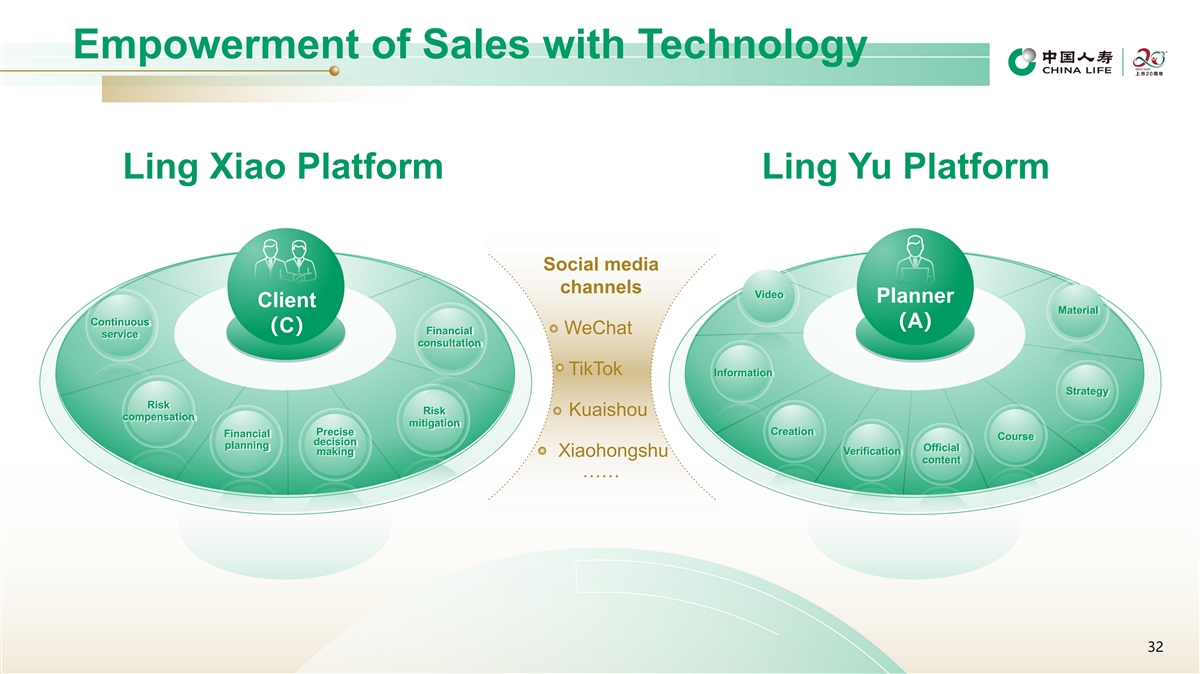

Empowerment of Sales with Technology Ling Xiao Platform Ling Yu

Platform Social media channels Video Planner Client Material Continuous (A) (C) Financial WeChat service consultation TikTok Information Strategy Risk Risk Kuaishou compensation mitigation Creation Precise Financial

Course decision planning Official Verification making Xiaohongshu content …… 32

Eight Reform Programs Accelerate reforms in quality, efficiency and

driving forces PARTY BUILDING TALENTS DEVELOPMENT SALES CHANNEL FOUNDATION PROGRAM PROGRAM STRENGTHENING PROGRAM INTEGRATED SALES CLIENT RESOURCES GOVERNMENT-CORPORATE SYNERGY PROGRAM MANAGEMENT PROGRAM COLLABORATION PROGRAM HEALTHCARE AND SENIOR

CARE FINTECH AND DIGITALIZATION PROGRAM ECOSYSTEM PROGRAM 34

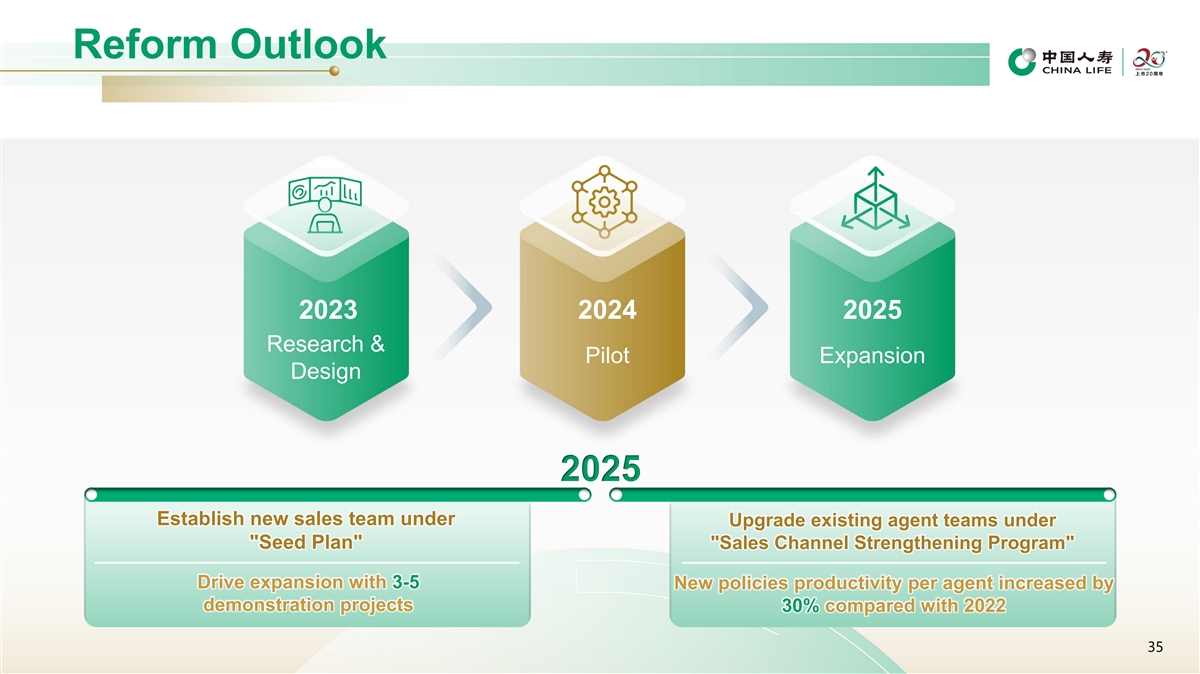

Reform Outlook 2023 2024 2025 Research & Pilot Expansion Design

2025 Establish new sales team under Upgrade existing agent teams under Seed Plan Sales Channel Strengthening Program Drive expansion with 3-5 New policies productivity per agent increased by demonstration projects 30% compared with 2022

35

Those Pro-actively Reform Progress; Those Stand Still Regress. 20 Years

of Concerted Efforts; The Beginning of a New Journey. 36

THANK YOU

China Life Insurance (PK) (USOTC:CILJF)

Historical Stock Chart

From Oct 2024 to Nov 2024

China Life Insurance (PK) (USOTC:CILJF)

Historical Stock Chart

From Nov 2023 to Nov 2024