UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2014

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission

File Number: 000-52500

Confederate

Motors, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

26-4182621 |

(State

or other jurisdiction of

incorporation or organization) |

|

(IRS

employer

identification number) |

| |

|

|

| 3029

2nd Avenue South, Birmingham, AL |

|

35233 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (205) 324-9888

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, Par Value $0.001

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting

company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

|

| Non-accelerated

filer |

☐ |

|

Smaller

reporting company |

☒ |

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The

aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average

bid and asked price of such common equity as of the last business day of the registrant’s most recently completed second

fiscal quarter was $2,357,618.

The

number of shares outstanding of the registrant’s common stock on April 15, 2015, was 29,029,556.

DOCUMENTS

INCORPORATED BY REFERENCE

None

TABLE

OF CONTENTS

| |

Page |

| PART

I |

4 |

| ITEM

1. BUSINESS |

4 |

| ITEM

1A. RISK FACTORS |

7 |

| ITEM

1B. UNRESOLVED STAFF COMMENTS |

17 |

| ITEM

2. PROPERTIES |

17 |

| ITEM

3. LEGAL PROCEEDINGS |

17 |

| ITEM

4. MINE SAFETY DISCLOSURE |

18 |

| |

|

| PART

II |

18 |

| ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

18 |

| ITEM

6. SELECTED FINANCIAL DATA |

19 |

| ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

19 |

| ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

22 |

| ITEM

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

39 |

| ITEM

9A. CONTROLS AND PROCEDURES |

39 |

| ITEM

9B. OTHER INFORMATION |

40 |

| |

|

| PART

III |

41 |

| ITEM

10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE4 |

41 |

| ITEM

11. EXECUTIVE COMPENSATION |

44 |

| ITEM

12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

47 |

| ITEM

13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

48 |

| ITEM

14. PRINCIPAL ACCOUNTING FEES AND SERVICES |

49 |

| |

|

| PART

IV |

49 |

| ITEM

15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

49 |

| |

|

| SIGNATURES |

52 |

Forward-Looking

Statements

This

report contains forward-looking statements. The forward-looking statements are contained principally in, but not limited to, the

section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking

statements provide our current expectations or forecasts of future events. Forward-looking statements include statements about

our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Words

or phrases such as “anticipate,” “believe,” “continue,” “ongoing,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a statement is not forward-looking.

Forward-looking

statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could

cause actual results to differ materially from those expected or implied by the forward-looking statements. Our actual results

could differ materially from those anticipated in forward-looking statements for many reasons. Accordingly, you should not unduly

rely on these forward-looking statements, which speak only as of the date of this report.

Unless

required by law, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events

after the date of this report or to reflect the occurrence of unanticipated events. You should, however, review the

factors and risks we describe in the reports we will file from time to time with the SEC after the date of this report.

Management

cautions that these statements are qualified by their terms and/or important factors, many of which are outside of our control,

and involve a number of risks, uncertainties and other factors that could cause actual results and events to differ materially

from the statements made, including, but not limited to, the following:

| ● | actual

or anticipated fluctuations in our quarterly and annual operating results; |

| ● | decreased

demand for our products resulting from changes in consumer preferences; |

| ● | product

and services announcements by us or our competitors; |

| ● | loss

of any of our key executives; |

| ● | regulatory

announcements, proceedings, or changes; |

| ● | competitive

product developments; |

| ● | intellectual

property and legal developments; |

| ● | mergers

or strategic alliances in the motorcycle industry; |

| ● | any

business combination we may propose or complete; |

| ● | any

financing transactions we may propose or complete; or |

| ● | broader

industry and market trends unrelated to our performance. |

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results,

levels of activity, performance, or achievements.

Our

ability to meet the targets and expectations noted depends upon, among other factors, our ability to (i) continue to realize production

efficiencies and manage operating costs including materials, labor and overhead; (ii) manage production capacity and production

changes; (iii) manage supply chain issues; (iv) provide products, services and experiences that are successful in the marketplace;

(v) develop and implement sales and marketing plans that retain existing retail customers and attract new retail customers in

an increasingly competitive marketplace; (vi) continue to develop the capabilities of our distributor network; (vii) manage

changes and prepare for requirements in legislative and regulatory environments for our products, services and operations; (viii)

manage access to reliable sources of capital and adjust to fluctuations in the cost of capital; (ix) anticipate consumer confidence

in the economy; (x) retain and attract talented employees; and (xi) detect any issues with our motorcycles or manufacturing processes

to avoid delays in new model launches, increased warranty costs or litigation.

Our

ability to sell our motorcycles and related products and services and to meet our financial expectations also depends on the ability

of our independent distributors to sell our motorcycles and related products and services to retail customers. We depend on the

capability and financial capacity of our independent distributors to develop and implement effective retail sales plans to create

demand for the motorcycles and related products and services they purchase from us.

In

addition, our independent distributors may experience difficulties in operating their businesses and selling our products.

Throughout

this report, unless otherwise designated, the terms “we,” “us,” “our,” “the Company”,

“CM” and “our company” refer to Confederate Motors, Inc., a Delaware corporation, and its consolidated

subsidiaries.

PART

I

ITEM

1. BUSINESS

Historical

Development

We

are a publicly held company incorporated in the State of Delaware in May of 2005. On February 12, 2009, we entered

into an Agreement and Plan of Merger and Reorganization by which we acquired all of the outstanding stock of Confederate Motor

Company, Inc., a Louisiana corporation (“CMCI”). CMCI was thereafter merged into our company.

Industry

Overview

The

premium heavyweight (651+cc) street motorcycle industry is a niche market targeting high net worth individuals. In

the past, the motorcycle industry has been subject to significant changes in demand due to changing social and economic conditions

affecting discretionary consumer income, such as employment levels, business conditions, taxation rates, fuel costs, interest

rates and other factors. The factors underlying such changes in demand are beyond our control, and demand for our products may

be adversely affected by a sustained economic downturn, which could have a further negative impact on our business, prospects,

results of operations, or financial condition.

Our

Motorcycle Business

We

are engaged in the design and assembly of premium, heavyweight motorcycles geared for high net worth customers. We currently offer

three models, known as the X132 Hellcat Speedster, the Limited Edition P51 Combat Fighter (pre-production), and the Wraith Tandem

Lusso. The X132 Hellcat Speedster began production in September 2014. The P51 Combat Fighter is scheduled to start

production in July 2015 with only 31 units being produced. The Wraith Tandem Lusso is scheduled

to begin production in early 2016.

Our

design and assembly operations are based in Birmingham, Alabama. Rather than making capital investments in manufacturing

equipment, our operations are limited to assembly of the motorcycles from outsourced parts resulting in a relatively low fixed

cost structure. All motorcycles are designed and assembled under the direction of our CEO and founder, H. Matthew Chambers.

It

is the foundational philosophy of the Confederate brand that our motorcycle lines reflect the heritage of the American hot rod

motorcycle tradition. Our original Hellcat line was inspired by the post WWII fighter pilot who, upon return from service

in the military, promptly bought an American V-Twin motorcycle, stripped it to its barest essentials and tuned the motor to the

farthest extent possible without compromising reliability. This formula, along with Bauhaus (design based on principles

of functionalism and truth to materials) influenced minimalist avant-garde approach has consistently been applied to our motorcycle

lines.

Our

X132 Hellcat Motorcycle Line

We

offer a third generation of our Hellcat line known as the X132 Hellcat Speedster. This design incorporates absolute

chassis and power train rigidity along with complete resistance to core fatigue. For the X132 Hellcat line we have

developed a new unitized power train casing, which is precision carved from a 400 pound block of 6061 aircraft grade aluminum

which management believes provides superior structural integrity at low weight. The new casing encapsulates a big-boned,

large diameter chassis/power train mounting system based on experience gained from 20 years of Hellcat design.

A

strategic alliance between S&S Cycle and Confederate has yielded a new motor providing maximum off-idle broadband torque delivery. In

order to increase low RPM torque, we have fused our patented power train system to the new motor. This system is designed

to maintain specific crankshaft to output shaft alignment, irrespective of the suddenness or the volume of torque application.

Motorcycle

Related Products

In addition

to our motorcycles, we offer a select variety of wearing apparel and other related accessories displaying the Confederate name. These

products are marketed through our online website. Management, however, does not believe these sales to be material

to our business at this point in time.

Our

Business Strategy

Strengthen

our position in our core market

We

intend to strengthen and grow our niche position in our target market of high net worth customers. To this end we have

introduced the X132 Hellcat Speedster, which management believes is tougher, stronger, lighter and more efficient than our previous

designs.

We

intend to develop and introduce new products to appeal to the changing needs of our target clients and to bring new clients to

the Confederate brand. We believe we can expand our traditional market niche by combining hot rod street credibility,

avant-garde American design and quality hand craftsmanship. We believe that the aesthetics of our new third generation

architecture simplified to a slightly more conventional level will both solidify and grow our present target audience and open

our Confederate brand to high net worth individuals.

Strengthen

our Distribution Network

We

believe our U.S. sales deployment strategy will create the most proximate relationship between our target client and our Confederate

team. We plan to eventually open a small servicing center, retail environment, and design boutique in a large metropolitan

market but no definitive plans have been made. This facility will serve as a template for expansion as demand for our

motorcycles increases. Furthermore, in 2015, we will attempt to gain more service centers throughout the United States by offering

cash incentives for sales of the Confederate brand.

Develop

our Internet Business

Currently, our only web presence is

our website, www.confederate.com, which encompasses a wealth of information on our brand and products. Activity on our

website has increased from approximately 14,000 unique visitors per month in 2005 to approximately 22,000 per month in 2013 and

2014. Management believes these statistics point to an improvement in quality and relevance of referrals to our site. Going

forward, our plan is to spread and better organize and classify information about our products and brand by separating information

across a total of three web presences, in order to pull in more web traffic and widen our sales demographic. The goal

of this diversification is not just intended to increase motorcycle sales but specifically to create an entirely new revenue stream

in apparel, parts, and accessory sales.

We

anticipate that www.confederate.com will be a more streamlined and informative site where the motorcycle consumer will be able

to review specs, details, and product photos. This site will be intended to serve as a “nuts and bolts”

information source on Confederate motorcycles.

Marketing

Activities and Brand Development

We

believe the Confederate motorcycle brand is perceived to be one of the most authentic in the motoring industry. This

belief is predicated upon the absolute consistency of the brand message since its launch in the December issue of Motorcyclist

Magazine in 1993. The brand exists to communicate a cerebral and spiritual rebel initiative inspired by fierce

American pure objective individuality through the creation of uncompromised handcrafted motoring works of art.

We

are also utilizing social media sites such as Facebook, Twitter, and Instagram to keep current and potential customers up to date

with company events or promotions as well as share some of the day to day workings and current philosophies.

Media

We

do not invest substantially in paid advertising. We believe that our motorcycles are aspirational products that create

a significant demand “pull.” The primary source of publicity comes from articles written about Confederate

in a broad range of motorcycle publications and the luxury goods press. Articles and broadcast segments featuring Confederate

have appeared in The Wall Street Journal, Forbes, The New York Times, Fast Company, The Robb Report, The Men’s

Journal, DuPont Registry, GQ, Maxim, Popular Science, Ralph Lauren Magazine, I.D.(which deemed the Wraith the “Worlds

Sexiest Motorcycle”) and have recently been featured in the Discovery Network’s series “World’s Most Expensive

Rides.” In addition, management believes that Confederate enthusiasts, including Hollywood celebrities, music

stars and international athletes add to the overall brand exposure.

Manufacturing

and Suppliers

Our

manufacturing operations consist of in-house production of certain components and parts, assembly of motorcycle components and

conducting quality control of finished motorcycles. Certain motorcycle components specific to our bikes are outsourced

for production to our specifications to various vendors, including engines, machined frame components, transmission gears, belt

drives, fenders, fuel tanks and seats. Other key components are purchased off-the-shelf from various independent suppliers

mostly located in the United States, including brake and suspension systems, drive belts, ignition starters, wheels, tires, lights

and batteries. Components manufactured by us in-house include welded motorcycle frames and exhausts.

We

have designed our quality control procedures and standards to include inspection of incoming components and adherence to specific

work-in-process standards during motorcycle assembly. Finished motorcycles are subjected to performance testing under running

conditions and to final quality inspection.

Competition

The

market for premium heavyweight motorcycles is highly competitive. Our principal competitors are custom motorcycle manufacturers,

and, to a more limited extent, Harley-Davidson of the United States and three European manufacturers (Ducati, Triumph and BMW). Most

of our competitors have substantially greater financial resources, are more diversified and have significantly higher sales volumes

(allowing for greater economies of scale) and market share than us.

Insurance

The

nature of our retail business exposes us to a low degree of risk of liability. Of primary concern are product and design

flaws which may expose us to claims by customers or third parties for product liability, personal injury or property damage. We

manage our exposure with general and product liability coverage obtained through independent insurance companies.

Seasonality

The

high performance street motorcycle industry is generally not subject to the normal ebbs and flows associated with general commerce. There

is a slight increase in sales corresponding to the beginning of spring riding season.

Research

and Development

During

the year ended December 31, 2014, we spent $215,541 on research and development related to development of new motorcycle models. During

the year ended December 31, 2013, we spent $189,731 on research and development of new motorcycle models. We anticipate

continuing these research and development activities on an ongoing basis.

Trademarks

and Trade Names

We

hold several federal trade names used in our business, including “Hellcat,” “Confederate,” “Fighter,”

“Bohemian,” “D'Orleans,” “El Bandito,” “Rake,” “Renovatio”, “Curtiss”,

“Copperhead”, “Hellrider”, and “Art of Rebellion.” We also hold a patent (U.S.

Patent No. 5,857,538 issued on January 12, 1999) for the frame rigidity of our motorcycles. We also have website URLs

for “Confederate.com” and “Workandcycle.com.”

Government

Regulation

Vehicles

intended for use on public roadways must satisfy regulations implemented by the United States Department of Transportation (“DOT”)

and by the corresponding agencies in other countries. International, federal, state and local authorities have various

environmental control requirements relating to air, water and noise that affect the business and operations of our company. We

strive to ensure that our facilities and products comply with all applicable environmental regulations and standards.

Our

motorcycles that are sold in the United States are not subject to certification by the U.S. Environmental Protection Agency (“EPA”)

for compliance with applicable emissions and noise standards. As we produce more motorcycles, our current exemption may change.

Additionally, our motorcycle products must comply with the motorcycle emissions, noise and safety standards of certain foreign

markets where they are sold. Because we expect that environmental standards (homologation) will become more stringent

over time, we will continue to incur research, development and production costs in this area for the foreseeable future.

We

plan to submit the X132 Hellcat Speedster, the Limited Edition P51 Combat Fighter, and the Wraith Tandem Lusso to the various

applicable governmental agencies for certification requirements and standards. For this purpose, we have retained a

leading certified motorcycle testing lab. We expect to incur costs of approximately $50,000 per unit introduced to

a previously unregistered country, province, territory, etc. to comply with motorcycle safety and emissions requirements. As

new laws and regulations are adopted, we will assess their effects on current and future Confederate motorcycle products.

Employees

At

April 15, 2015, we had a total of 10 full time employees, consisting of five personnel in production and procurement and five

personnel in management, design, sales and marketing. None of our employees belongs to a labor union, and we consider

our relationship with our employees to be good.

ITEM

1A. RISK FACTORS

Risks

Related to Our Business

We

require additional financing to continue our business and our auditors have expressed uncertainty regarding our ability to continue

as a going concern.

We

have experienced losses since the inception of our business and as of December 31, 2014, we had negative working capital of ($626,583).

We will need the funds from our current equity offering or other sources to finance our ongoing operations and future plans. Such

additional sources of financing could be sought from existing shareholders or others willing to finance our operations. We may

not be able to obtain additional financing from any source on reasonable terms, if at all. If we sell additional securities to

obtain additional financing, we may do so at a price that is less than the price of securities currently offered. Further sales

of equity securities also could result in additional substantial dilution to current shareholders. If we obtain debt financing,

a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness,

thus limiting funds available for our business activities. It would also be likely that any debt financing would require providing

a security interest in all of our assets to the lender. If adequate funds are not available from our current offering or otherwise,

we may be required to curtail significantly or stop our development and commercialization activities.

As

a result of our losses, and the matters described in the preceding paragraph, the independent auditor’s report on our financial

statements for the year ended December 31, 2014 included a paragraph indicating doubt about our ability to continue as a going

concern. The financial statements for the year ended December 31, 2014 and subsequent interim financial statements do not include

any adjustments that might be necessary if we are unable to continue as a going concern.

As of December 31, 2014, we had a shareholders’

deficit of ($711,823) and a working capital deficit of ($749,740). Our ability to generate profits in the future will depend on

a number of factors, including our ability to:

| ● | effectively

manufacture, market, and distribute our motorcycles in commercial quantities; |

| ● | obtain

market acceptance of our motorcycles; |

| ● | expand

our capabilities in terms of personnel, equipment, and internal systems to manage our

growth effectively; |

| ● | compete

within our targeted market; and |

| ● | maintain

control over substantial costs relating to the commercialization, production, and marketing

of our motorcycle products, including ongoing design and development costs relating to

new products and improvements or alterations to existing products. |

Many

of these factors will depend on circumstances beyond our control. We have never been profitable and we may not achieve profitability

in the foreseeable future, if at all. We can give you no assurance that we will ever generate revenues, or that any revenues we

do generate will be sufficient for us to continue operations or achieve profitability.

Since

2009 we have been a growth oriented luxury brand motorcycle company with little operating history compared with larger motorcycle

companies.

Since

the commencement of our growth strategy in the design, manufacture and sale of our motorcycles in 2009, we have been focused primarily

on developing, producing, and marketing our premium big v-twin motorcycle models. Our operating history within this segment is

limited, and combined with global economic conditions, we have not realized significant revenues from our product sales. You should

evaluate the likelihood of our anticipated financial and operational success in light of the uncertainties and complexities inherent

in a short-lived venture, many of which are beyond our control, including:

| ● | our

ability to distribute, sell and market our products; |

| ● | our

ability to develop new products; |

| ● | the

performance of our motorcycle products; |

| ● | the

significant and ongoing funds needed to achieve our production, marketing, and sales

objectives; |

| ● | the

appeal of our products to dealers and consumers; and |

| ● | our

ability to generate adequate revenue to support our operations. |

We

depend upon a limited number of outside suppliers for our key motorcycle components and the loss or interruption of services of

one or more of our suppliers could materially delay or stop our motorcycle production and substantially impair our ability to

generate revenues.

Our

heavy reliance on outside suppliers for our components involves risks including limited control over the price, timely delivery

and quality of parts. For example, during our 2014 first fiscal quarter, our swing arm supplier failed to provide the required

number of swing arms needed to produce the number of bikes anticipated. This backorder cost us four units of production in the

first quarter of 2015 and will cost us 12 units in the second quarter of 2015. While we believe there are other producers that

could satisfy our production needs, there is a production period of 6 to 8 weeks until parts can be delivered. We have entered

into discussions with other manufacturer to be a secondary source and issued purchase orders. Although we have manufactured a

limited number of motorcycles, we have not commenced commercial scale manufacturing and cannot determine at this time if our vendors

and suppliers will be able to timely supply us with our commercial production needs. We cannot assure you that any of our vendors

and suppliers will be able to meet our future commercial production demands as to volume, quality or timeliness.

Our

inability to obtain timely delivery of key components of acceptable quality or any significant increases in the prices of components

could result in material production delays and reductions in motorcycle shipments. Production delays, increased costs of components

or reduction in shipments of our product will seriously impair our ability to generate revenue.

Protecting

our proprietary technology and other intellectual property may be costly and ineffective, and if we are unable to protect our

intellectual property, we may not be able to compete effectively in our market.

We

hold several federal trade names used in our business, including “Hellcat,” “Confederate,” “Fighter,”

“Bohemian,” “D'Orleans,” “El Bandito,” “Rake,” “Renovatio”, “Curtiss”,

“Copperhead”, “Hellrider”, and “Art of Rebellion.” We hold a patent (U.S. Patent

No. 5,857,538 issued on January 12, 1999) for the frame rigidity of our motorcycles. We have no foreign patents which

puts us at risk of competition outside of the U.S. We also have website URLs for “Confederate.com” and “Workandcycle.com.”

Our business success will depend materially on our ability to protect the intellectual property mentioned above, to preserve our

trade secrets, and to avoid infringing the proprietary rights of third parties. In general, our proprietary rights will be protected

only to the extent that protection is available and to the extent we have the financial and other resources to enforce any rights

we hold. Costly litigation might be necessary to protect our intellectual property or to determine the scope and validity of third-party

proprietary rights. If an adverse outcome in litigation finds that we have infringed on proprietary rights of others, we may be

required to pay substantial damages and may have to discontinue use of our products or re-design our products. Any claim of infringement

may involve substantial expenditures and divert the time and effort of management.

The

loss of the services of current management would have a material negative impact on our operations.

We

currently depend and will continue to depend on our current management which includes our President and CEO, H. Matthew Chambers,

for the foreseeable future. The loss of Mr. Chambers’ services could have a material adverse on our operations and prospects.

We have an employment agreement with Mr. Chambers running until February of 2019, which would prevent him from leaving and competing

with the Company. Despite our contractual arrangements with Mr. Chambers, if he were to become ill and unable to work it would

substantially affect the Company. We have not obtained “key man” insurance coverage on Mr. Chambers.

Our

business model of selling our motorcycles at premium prices may not be successful, which could result in the failure of our business.

The

premium heavyweight (651+cc) street motorcycle industry is a niche market targeting high net worth individuals. We intend

to target sales of our motorcycles to a limited number of purchasers who are willing to pay a higher price for our products. The

suggested retail prices of our motorcycles will be considerably higher than retail prices of most custom cruiser models in the

heavyweight cruiser market segment. This significant price difference could deter potential customers from purchasing our products.

If our higher prices deter sales significantly, our basic business model would not succeed and our business would likely fail.

We

target sales of our products to a narrow market segment of our industry and therefore, our business is more vulnerable to changes

in this market.

We

anticipate generating our revenues for the foreseeable future primarily from sales of premium heavyweight motorcycles. The premium

heavyweight market constitutes only one segment of the motorcycle industry. As a result of our focus on only one market segment

of one industry, we are more vulnerable to changes in demand in the premium heavyweight motorcycle market than we would be if

our business was more diversified.

We

have a number of competitors, most of which have greater financial resources than us.

Many

of our competitors are more diversified than we, and they may compete in all segments of the motorcycle market, other power sports

markets and/or the automotive market. Also, our manufacturer’s suggested retail price for our motorcycles is generally higher

than our competitors, and if price becomes a more important competitive factor for consumers in the markets in which we compete,

we may be at a competitive disadvantage. Our responses to these competitive pressures, or our failure to adequately address and

respond to these competitive pressures, may have a material adverse effect on our business and results of operations.

We

will face intense competition from existing motorcycle manufacturers that are already well established, have greater customer

loyalty, manufacturing, and marketing resources than us.

In

the premium heavyweight motorcycle market, we primarily compete with Harley-Davidson, Inc., which dominates the industry. Other

large competitors include The BMW Group, Polaris Industries Inc., Honda Motor Co., Inc. – Motorcycle Division, Moto Guzzi

North America, Inc., Triumph Motorcycles, Kawasaki Motors Corp., U.S.A., Yamaha Corporation of America, American Suzuki Motor

Corporation and Ducati Motor Holding S.p.a. Further competition exists from the many small companies throughout the country that

build motorcycles from non-branded parts and components. In addition, new companies may enter this market at any time. We cannot

assure you that we will be able to compete successfully against current and future competitors. If we cannot compete effectively

in our market, our ability to generate revenues and achieve profitability would be seriously impaired.

Our

operations are dependent upon attracting and retaining skilled employees, including skilled labor, executive officers and other

senior leaders.

Our

future success depends on our continuing ability to identify, hire, develop, motivate, retain, and promote skilled personnel for

all areas of our organization. Our current and future total compensation arrangements, which include benefits and incentive awards,

may not be successful in attracting new employees and retaining and motivating our existing employees. In addition, we must cultivate

and sustain a work environment where employees are engaged and energized in their jobs to maximize their performance. If we do

not succeed in attracting new personnel, retaining existing personnel, implementing effective succession plans and motivating

and engaging personnel, including executive officers, we may be unable to develop and distribute products and services and effectively

execute our plans and strategies.

We

manufacture products that create exposure to product liability claims and litigation.

To

the extent plaintiffs are successful in showing that personal injury or property damage result from defects in the design or manufacture

of our products, we may be subject to claims for damages that are not covered by insurance. The costs associated with defending

product liability claims, including frivolous lawsuits, and payment of damages could be substantial. Our reputation may also be

adversely affected by such claims, whether or not successful.

We

do not insure against all potential operating risks. We may incur losses and be subject to liability claims as a result of our

operations.

We

currently do not maintain insurance to insure against all potential risks and liabilities associated with our business. For some

risks, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented.

As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially, and in some

instances, certain insurance may become unavailable or available only for reduced amounts of coverage. As a result, even if we

obtain insurance we may not be able to renew those insurance policies or procure other desirable insurance on commercially reasonable

terms, if at all. In addition, pollution and environmental risks generally are not fully insurable. Losses and liabilities from

uninsured and underinsured events and delay in the payment of insurance proceeds could have a material adverse effect on our financial

condition, results of operations and cash flows.

We

must detect issues with our motorcycles or manufacturing processes to avoid recall campaigns, increased warranty costs or litigation,

and delays in new model launches.

We

must also complete any recall campaigns within cost expectations. We must continually improve and adhere to product development

and manufacturing processes to ensure high quality products are shipped to dealers. If product designs or manufacturing processes

are defective, we could experience delays in new model launches, product recalls, conventional warranty claims, and product liability

or unconventional warranty claims, which may involve purported class actions. While we use reasonable methods to estimate the

cost of warranty, recall and product liability costs and appropriately reflect those in the financial statements, there is a risk

the actual costs could exceed estimates. Further, shipping products with poor quality may also adversely affect our reputation.

We

are and may in the future become subject to legal proceedings and commercial or contractual disputes.

We

are currently involved in two legal actions. One with a former investor representing a liability of approximately $160,000 at

December 31, 2014, which we are in the process of settling and a second issue involving a real property lease representing a liability

of approximately $35,000 at December 31, 2014. In addition, in March 2010, we identified

additional payroll tax liabilities related to individuals, including our CEO and CFO, paid incorrectly as independent contractors

in prior periods. We have accrued these payroll tax liabilities which at December 31, 2014, were approximately $80,000, and are

making scheduled payments to the IRS to resolve the liability. Further, we have a penalty of approximately $175,000 payable

to certain selling stockholders as a penalty for a delayed effectiveness of a reoffering prospectus. In addition, we may be involved

in business litigation in the future. The uncertainty associated with substantial unresolved claims and lawsuits may harm our

business, financial condition, reputation and brand. The defense of the lawsuits may result in the expenditures of significant

financial resources and the diversion of management’s time and attention away from business operations. In addition, although

we are unable to determine the amount, if any, that it may be required to pay in connection with the resolution of the lawsuits

by settlement or otherwise, any such payment may have a material adverse effect on our business and results of operations.

We

may participate in joint ventures and/or strategic alliances to develop and operate our planned business. These partnerships or

the failure to establish them could have a material adverse effect on our ability to develop and manage our business. In addition,

such undertakings may not be successful.

Due

to our need for financing, our strategy may include plans to participate in joint ventures and other strategic alliances to develop

and operate our motorcycle business. We may develop operations in part through joint ventures and strategic alliances with other

parties as well as with additional outside funding. Joint ventures and strategic alliances may expose us to new operational, regulatory

and market risks, as well as risks associated with additional capital requirements. Additionally, we may not be able to identify

and secure suitable alliance partners. Even if we identify suitable partners, we may be unable to consummate alliances on terms

commercially acceptable to us. If we fail to identify appropriate partners, we may not be able to implement our strategies effectively

or efficiently.

The

global financial crisis may have an impact on our business and financial condition in ways that we currently cannot predict.

Because

we are a motorcycle company that is still in the startup stage, we have never been profitable, and cannot predict when we will

become profitable. The continued credit crisis and related turmoil in the global financial system may have a continued impact

on our business and financial position. The recent high costs of foreign imports and consumables may negatively impact

costs of our operations. In addition, the global financial crisis which has strengthened the US dollar may limit our ability to

raise capital through credit and equity markets. The prices of the metals and resources that we seek to discover and exploit are

affected by a number of factors, and it is unknown how these factors will be impacted by a continuation of the financial crisis.

We

may experience significant returns or warranty claims, which would damage our brand, increase our costs, and impair our ability

to achieve profitability.

Currently,

our motorcycles have not been widely available for purchase by the general public. As a result, we have no meaningful data regarding

the performance or maintenance requirements of our products or any basis on which we can estimate warranty costs. If we are subject

to significant warranty service requirements or product recalls, potential customers may determine that our motorcycles are unreliable

and may choose not to purchase them. Further, significant warranty service requirements will result in increased costs to us as

a result of the costs of repair or replacement of our product and the costs associated with researching and developing solutions

to issues raised by warranty claims. Any significant warranty service requirements or product recalls would increase our costs

materially and reduce the value of our brand significantly.

Risks

Relating to the Industry

The

introduction of new models of motorcycles by our competitors could materially reduce the demand for our products, which would

impair our ability to generate revenues or achieve profitability.

Products

offered by the motorcycle industry often change significantly and rapidly. Changes may arise because of product design and performance

advancements, safety and environmental concerns, or attempts to satisfy the changing tastes of consumers. Our future success will

depend on our ability to anticipate and respond to such changes. In our industry, we will be expected to introduce new products

or product improvements every year. If we cannot introduce acceptable new models and products annually or if our new models and

products do not compete effectively with the new models and products of our competitors, our competitive position in our industry

would be harmed. Even if some of our new products or new models are successful, we cannot assure you that we will be able to repeat

this success with each new product or new model. If we cannot consistently generate acceptable new products or models, our competitive

position will be harmed.

The

purchase of recreational motorcycles is discretionary for consumers, and market demand is influenced by many factors beyond our

control.

Our

motorcycles are luxury consumer products that are discretionary purchases for consumers. Accordingly, market demand in our industry

depends on a number of economic factors affecting discretionary consumer income, such as employment levels, interest rates, taxation

rates, consumer confidence levels and general business conditions. Adverse changes relating to one or more of these factors may

restrict consumer spending and harm our growth and profitability. In addition, our motorcycles will compete with many other power

sports and other recreational products for the discretionary spending of consumers. We cannot assure you that we will be able

to compete successfully against other recreational products to capture consumer discretionary expenditures.

Our

business is subject to seasonality that may cause our quarterly operating results to fluctuate materially and cause the market

price of our common stock to decline.

Motorcycle

sales in general are seasonal in nature since consumer demand is substantially lower during the colder season in North America.

We may endure periods of reduced revenues and cash flows during off-season months and be required to lay off or terminate some

of our employees from time to time. Building inventory during the off-season period could harm our financial results if anticipated

sales are not realized. Further, if a significant number of our dealers are concentrated in locations with longer or more intense

cold seasons, lack of consumer demand due to seasonal factors may impact us more adversely, further reducing revenues or resulting

in reduced revenues over a longer period of time.

Compliance

with environmental and safety regulations could increase our production costs, delay introduction of our products and substantially

impair our ability to generate revenues and achieve profitability.

We

must comply with numerous federal and state regulations governing environmental and safety factors with respect to motorcycles

and their use. These various governmental regulations generally relate to air, water and noise pollution, as well as motorcycle

safety matters. If we were unable to obtain the necessary certifications or authorizations required by government standards, or

fail to maintain them, our business and future operations would be harmed seriously. Use of motorcycles in the United States is

subject to rigorous regulation by the Environmental Protection Agency (“EPA”), and by state pollution control

agencies. Any failure by us to comply with applicable environmental requirements of the EPA or state agencies could subject us

to administratively or judicially imposed sanctions such as civil penalties, criminal prosecution, injunctions, product recalls

or suspension of production.

Motorcycles

are subject to considerable safety standards and requirements under the provisions of the National Traffic and Motor Vehicle Safety

Act and the rules promulgated under this Act by the National Highway Traffic Safety Administration (“NHTSA”).

We could suffer recalls of our motorcycles if they fail to satisfy applicable safety standards administered by the NHTSA. Our

business and facilities also are subject to regulation under various federal, state and local regulations relating to manufacturing

operations, occupational safety, environmental protection, hazardous substance control and product advertising and promotion.

Our failure to comply with any of these regulations in the operation of our business could subject us to administrative or legal

action resulting in fines or other monetary penalties or require us to change or cease our business.

Our

ability to remain competitive is dependent upon our capability to develop and successfully introduce new, innovative, and compliant

products.

The

motorcycle market continues to change in terms of styling preferences and advances in new technology and, at the same time, be

subject to increasing regulations related to safety and emissions. We must continue to distinguish our products from our competitors’

products with unique styling and new technologies. As we incorporate new and different features and technology into our products,

we must protect its intellectual property from imitators and ensure our products do not infringe the intellectual property of

other companies. In addition, these new products must comply with applicable regulations worldwide and satisfy the potential demand

for products that produce lower emissions and achieve better fuel economy. We must make product advancements while maintaining

the look, sound, and feel associated with our products. We must also be able to design and manufacture these products and deliver

them to the marketplace in an efficient and timely manner. There can be no assurances that we will be successful in these endeavors

or that existing and prospective customers will like or want our new products.

Changes

in general economic conditions, tightening of credit, political events or other factors may adversely impact dealers’ and

distributors’ retail sales.

The

motorcycle industry is impacted by general economic conditions over which motorcycle manufacturers have little control. These

factors can weaken the retail environment and lead to weaker demand for discretionary purchases such as motorcycles. Tightening

of credit can limit the availability of funds from financial institutions and other lenders and sources of capital which could

adversely affect the ability of retail consumers to obtain loans for the purchase of motorcycles from lenders. Should general

economic conditions or motorcycle industry demand decline, the Company’s results of operations and financial condition may

be substantially adversely affected. The motorcycle industry can also be affected by political conditions and other factors over

which motorcycle manufacturers have little control.

Our

operations may be affected by greenhouse emissions and climate change and related regulations.

Climate

change is receiving increasing attention worldwide. Many scientists, legislators and others attribute climate change to increased

levels of greenhouse gases, including carbon dioxide, which has led to significant legislative and regulatory efforts to limit

greenhouse gas emissions. Congress has previously considered and may in the future implement restrictions on greenhouse gas emissions.

In addition, several states, including states where we may have manufacturing plants, have previously considered and may in the

future implement greenhouse gas registration and reduction programs. Energy security and availability and its related costs affect

all aspects of our manufacturing operations in the United States, including our supply chain. Our manufacturing plants and/or

those of our distributors use energy, including electricity and natural gas, and certain of our distributors’ plants emit

amounts of greenhouse gas that may be affected by these legislative and regulatory efforts. Greenhouse gas regulation could increase

the price of the electricity we purchase, increase costs for use of natural gas, potentially restrict access to or the use of

natural gas, require us to purchase allowances to offset our own emissions or result in an overall increase in costs of raw materials,

any one of which could increase our costs, reduce competitiveness in a global economy or otherwise negatively affect our business,

operations or financial results. Many of our suppliers face similar circumstances. Physical risks to our business operations as

identified by the Intergovernmental Panel on Climate Change and other expert bodies include scenarios such as sea level rise,

extreme weather conditions and resource shortages. Extreme weather may disrupt the production and supply of component parts or

other items such as natural gas, a fuel necessary for the manufacture of motorcycles and their components. Supply disruptions

would raise market rates and jeopardize the continuity of motorcycle production.

If

we market and sell our products in international markets, we will be subject to additional regulations relating to export requirements,

environmental and safety matters, and marketing of our products and distributorships, and we will be subject to the effect of

currency fluctuations, all of which could increase the cost of selling our products and substantially impair our ability to achieve

profitability in foreign markets.

As

a part of our marketing strategy, we intend, in the future, to market and sell our products internationally. In addition to regulation

by the U.S. government, our products will be subject to environmental and safety regulations in each country in which we market

and sell our motorcycles. Regulations will vary from country to country and will vary from those of the U.S. The difference in

regulations under U.S. law and the laws of foreign countries may be significant and, in order to comply with the laws of these

foreign countries, we may have to alter our manufacturing practices, product design or marketing efforts. Any changes in our business

or products required in response to the laws of foreign countries will result in additional expense to us. Additionally, we may

be required to obtain certifications or approvals by foreign governments to market and sell our products in foreign countries.

We would also be required to obtain approval from the U.S. government to export our products. If we are delayed in receiving,

or are unable to obtain, import or export clearances, or if we are unable to comply with foreign regulatory requirements, we will

be unable to execute our international marketing strategy for our products.

Further,

many countries have laws governing marketing of motorcycles and related products and laws relating to relationships with, and

termination of, distributors in those countries. These laws may make it more difficult for us to promote our product effectively

and in a cost efficient manner. We cannot assure you that we will be able to successfully market and sell our products in foreign

countries or that these efforts will result in additional revenue or that any revenue we do obtain from the sales of our products

in foreign countries will not be offset by increased regulatory and compliance costs. Any foreign operations or sales we generate

will be subject to the effects of currency fluctuations to the extent payments to us or by us are not made in U.S. dollars. The

translation from foreign currency to U.S. dollars could negatively impact our results of operations. We will also be affected

by local economic conditions in the countries in which we sell our products and the difficulties associated with managing operations

from long distances.

Risks

Relating to Our Common Stock

The

public trading market for our common stock is volatile and will likely result in higher spreads in stock prices.

Our

common stock is authorized for trading in the over-the-counter market and is quoted on the OTCQB®. Nevertheless, only a limited

trading marked for our stock with small daily volumes has developed. The over-the-counter market for securities has historically

experienced extreme price and volume fluctuations during certain periods. These broad market fluctuations and other factors, such

as our ability to implement our business plan, as well as economic conditions and quarterly variations in our results of operations,

may adversely affect the market price of our common stock. In addition, the spreads on stock traded through the over-the-counter

market are generally unregulated and higher than on stock exchanges, which means that the difference between the price at which

shares could be purchased by investors on the over-the-counter market compared to the price at which they could be subsequently

sold would be greater than on these exchanges. Significant spreads between the bid and asked prices of the stock could continue

during any period in which a sufficient volume of trading is unavailable or if the stock is quoted by an insignificant number

of market makers. We cannot insure that our trading volume will be sufficient to significantly reduce this spread, or that we

will have sufficient market makers to affect this spread. These higher spreads could adversely affect investors who purchase the

shares at the higher price at which the shares are sold, but subsequently sell the shares at the lower bid prices quoted by the

brokers. Unless the bid price for the stock increases and exceeds the price paid for the shares by the investor, plus brokerage

commissions or charges, the investor could lose money on the sale. For higher spreads such as those on over-the-counter stocks,

this is likely a much greater percentage of the price of the stock than for exchange listed stocks. There is no assurance that

at the time the investor wishes to sell the shares, the bid price will have sufficiently increased to create a profit on the sale.

Our

stock ownership is concentrated among a relatively small group of principal shareholders who have substantial control over us,

including our directors and executive officers, and could delay or prevent a change in corporate control.

H.

Matthew Chambers (our Chairman, President, CEO, and director) and Optimum Solution Pte. Ltd., together with their affiliates,

along with our directors and executive officers, beneficially control, in the aggregate, approximately 65% of our common stock.

As a result, these shareholders, acting together, would have the ability to significantly influence or control the outcome of

matters submitted to our shareholders for approval, including the election of directors and any merger, consolidation or sale

of all or substantially all of our assets. In addition, these shareholders, acting together, would have the ability to significantly

influence or control the management and affairs of our company. Accordingly, this concentration of ownership might harm the market

price of our common stock by:

| ● | delaying,

deferring or preventing a change in corporate control; |

| ● | impeding

a merger, consolidation, takeover or other business combination involving us; or |

| ● | discouraging

a potential acquirer from making a tender offer or otherwise attempting to obtain control

of us. |

In

addition, during the next meeting of shareholders where directors are elected, Mr. Chambers has furnished an irrevocable proxy

to Optimum to vote his shares for the election of Optimum’s designee and Optimum has furnished to Mr. Chambers an irrevocable

proxy to vote its shares to elect the remaining slate of directors at Mr. Chambers’ discretion.

The

price of our securities may be volatile and could decline in value.

The

price of our common stock may fluctuate significantly, making it difficult for an investor to resell our securities at an attractive

price. The market prices for securities of emerging companies have historically been highly volatile. Future events concerning

us or our competitors could cause such volatility, including:

| ● | changes

in consumer preferences, |

| ● | technological

innovations or new commercial products by us or our competitors, |

| ● | actual

or anticipated variations in our operating results, |

| ● | changes

in government regulation and regulation of the securities markets, |

| ● | government

investigation of us or our products, |

| ● | changes

in government regulation of our products, |

| ● | developments

concerning proprietary rights, |

| ● | increases

in gasoline prices, |

| ● | investor

perception of us and our industry, |

| ● | general

economic and market conditions, |

| ● | national

or global political events, or |

| ● | public

confidence in the securities markets. |

In

addition, the stock market is subject to price and volume fluctuations that affect the market prices of our securities, of companies

in general, and small-capitalization companies, such as ours in particular. These fluctuations are often unrelated to the operating

performance of these companies. Additionally, any failure by us to meet or exceed estimates of financial analysts is likely to

cause a decline in the price of our securities. Securities class action litigation has often been instituted following periods

of volatility in the market price of a company’s securities. Any such class action brought against us would likely be very

costly to us and also divert management’s attention and resources that could otherwise be directed to benefit the future

performance of our business.

We

have not paid cash dividends since inception and do not expect to pay dividends in the foreseeable future. Any return on investment

may be limited to the value of our common stock.

We

have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends

on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such

time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because

a return on your investment will only occur if our stock price appreciates.

Our

common stock is deemed “penny stock,” which could make it more difficult for our investors to sell their shares.

Our

common stock is subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock

rules generally apply to companies whose common stock is not listed on the NASDAQ Stock Market or other national securities exchange

and trades at less than $5.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last

three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or

more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established

customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information

concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many

brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number

of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules

for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities remain

subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

We

are subject to the reporting requirements of federal securities laws, and compliance with such requirements can be expensive and

may divert resources from other projects, thus impairing our ability to grow.

We

are subject to the information and reporting requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange

Act”), and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”) and the Dodd-Frank Act Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”).

The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the Securities and

Exchange Commission and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been

if we were privately held.

It

may be time consuming, difficult, and costly for us to develop, implement, and maintain the internal controls and reporting procedures

required by the Sarbanes-Oxley Act and the Dodd-Frank Act. We may need to hire additional financial reporting, internal controls,

and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures.

If

we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results

accurately or prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation

and adversely impact the trading price of our common stock.

Effective

internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial

reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment

existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control

deficiencies may adversely affect our financial condition, results of operations and access to capital. Because of its inherent

limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation

of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions,

or that the degree of compliance with any policies and procedures may deteriorate.

Exercise

of options or warrants or conversion of convertible notes or preferred stock may have a dilutive effect on our common stock.

If

the price per share of our common stock at the time of exercise of any options or warrants or conversion of any convertible notes,

preferred stock, or any other convertible securities is in excess of the various exercise or conversion prices of such convertible

securities, exercise or conversion of such convertible securities would have a dilutive effect on our common stock. Further, any

additional financing that we secure may require the granting of rights, preferences or privileges senior to those of our common

stock and which result in additional dilution of the existing ownership interests of our common stockholders.

Our

Certificate of Incorporation allows for our board to create series of preferred stock without further approval by our stockholders,

which could adversely affect the rights of the holders of our common stock.

Our

board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of

directors also has the authority to issue preferred stock without further stockholder approval. As a result, our board of directors

could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon

liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right

to the redemption of the shares, together with a premium, prior to the redemption of our common stock. In addition, our board

of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or

that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution

to our existing stockholders.

As

a former shell company, if we fail to make publicly available “current Form 10” information, our shareholders will

be unable to use Rule 144 to remove restrictive legends from share certificates.

We

are a former shell company and, as such, are subject to the requirements of Rule 144(i) of the Securities Act of 1933 which require

the disclosure by us of “current Form 10” information in order for shareholders to take advantage of Rule 144 for

the removal of restrictive legends from share certificates. If we fail to make publicly available “current Form 10”

information, our shareholders will not be able to take advantage of Rule 144 for the removal of restrictive legends from their

share certificates which would make their shares illiquid.

ITEM

1B. UNRESOLVED STAFF COMMENTS

We

are not an accelerated filer, a large accelerated filer or a well-known seasoned issuer and therefore have elected not to provide

the information required by this item.

ITEM

2. PROPERTIES

Our

principal offices are located at 3029 2nd Avenue South, Birmingham, Alabama. We lease our headquarters and manufacturing

facility at this address in Birmingham, Alabama under a lease ending October 31, 2018. Our Birmingham facility consists of about

24,179 square feet. Monthly lease payments are $7,201 and increase 2% each year. We do not own any real

estate.

ITEM

3. LEGAL PROCEEDINGS

Confederate

Motors, Inc. v. Francois-Xavier Terny, et al. In 2012 we entered into a Mutual Settlement Agreement & General Release (the

“Settlement Agreement”) with Francois Xavier Terny to settle an outstanding dispute. Under the Settlement

Agreement, we agreed to make scheduled payments to Mr. Terny totaling $350,000 in exchange for the return of 805,000 shares held

by Mr. Terny. We paid Mr. Terny $50,000 upon the execution of the Settlement Agreement and an additional $25,000 prior

to December 31, 2012. The final payment of $275,000 was required to be paid on or before March 31, 2013 but was not made.

We

paid $50,000 in July 2013, $25,000 in November 2013, and $40,000 in December 2014 reducing the settlement payable balance to $160,000.

No penalties have been issued as of the date of this report.

Delta

Staff Leasing, LLC v. South Coast Solar, LLC et al. In 2005 (post Hurricane Katrina), we were granted a business loan from the

City of New Orleans. The city then failed to issue the proceeds of the loan. Based on the approval we signed a lease for real

property. On or about August 29, 2014, a Consent Judgement was issued by the court in the amount of $61,000. We agreed to make

an initial payment of $6,000 upon signing the judgement, $5,000 on the 15th day of each month commencing September

2014, and $35,000 dollars in January 2015. We were unable to facilitate the January 2015 payment.

As

of the date of this report the Company still owes $10,000 to close the matter.

ITEM

4. MINE SAFETY DISCLOSURE

Because

we are not engaged in mining operations, no disclosure is required pursuant to this item.

PART

II

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market

Information

Our

common stock is quoted on the OTCQB, and our trading symbol is “CFED.” We do not believe that a material

number of our shares of common stock trade on a regular basis. The table below sets forth for the periods indicated the quarterly

high and low bid prices as reported by the OTC Markets. These quotations reflect inter-dealer prices, without retail mark-up,

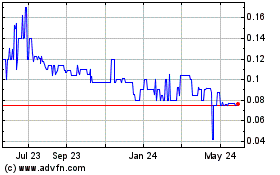

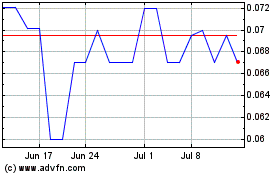

mark-down, or commission and may not necessarily represent actual transactions.

| | |

Quarter | |

High | | |

Low | |

| For the Fiscal Year Ended December 31, 2013 | |

First | |

$ | 0.40 | | |

$ | 0.30 | |

| | |

Second | |

$ | 0.30 | | |

$ | 0.30 | |

| | |

Third | |

$ | 0.93 | | |

$ | 0.20 | |

| | |

Fourth | |

$ | 0.28 | | |

$ | 0.25 | |

| | |

| |

| | | |

| | |

| For the Fiscal Year Ended December 31, 2014 | |

First | |

$ | 0.33 | | |

$ | 0.27 | |

| | |

Second | |

$ | 0.63 | | |

$ | 0.30 | |

| | |

Third | |

$ | 0.65 | | |

$ | 0.52 | |

| | |

Fourth | |

$ | 0.52 | | |

$ | 0.12 | |

Our

common stock is considered to be penny stock under rules promulgated by the Securities and Exchange Commission. Under these rules,

broker-dealers participating in transactions in our common stock must first deliver a risk disclosure document which describes

risks associated with penny stocks, broker-dealers’ duties, customers’ rights and remedies, market and other information,

and make a suitability determination approving the customer for the purchase of such stock, based on their financial situation,

investment experience and objectives. Broker-dealers must also disclose these restrictions to the customer in writing,

as well as provide monthly account statements and obtain specific written consent of each customer. With these restrictions

and the associated paper work involved, it is likely that there will be a decrease in the willingness of broker-dealers to make

a market for our common stock. This could also lead to a decrease in the ability of someone to purchase or sell our common stock

and increase the cost of such transactions.

Holders

As

of April 15, 2015, we had approximately 66 holders of our common stock. The number of record holders was determined

from the records of our transfer agent and does not include beneficial owners of common stock whose shares are held in the names

of various security brokers, dealers, and registered clearing agencies. We have appointed American Registrar and Transfer

Company, Salt Lake City, Utah, to act as the transfer agent of our common stock.

Dividends

Since

inception we have not paid any cash dividends on our common stock. We currently do not anticipate paying any cash dividends

in the foreseeable future on our common stock. Although we intend to retain our earnings, if any, to finance the growth

of our business, our Board of Directors will have the discretion to declare and pay dividends in the future. Payment

of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors

may deem relevant.

Unregistered

Sales of Securities

On

November 21, 2014, the Board of Directors approved a non-public unit offering. As part of the offering, we are authorized to issue

up to 8,000,000 units in four unit classes. Each A unit (the “A Unit”) costs $25,000 per A Unit. Each B unit (the

“B Unit”) costs $50,000 per B Unit. Each C unit (the “C Unit”) costs $75,000 per C Unit. Each D unit (the

“D Unit”) costs $100,000 per D Unit. Each unit consists of 100,000 shares of our common stock. A Unit shares are priced

at $0.25 per share. B Unit shares are priced at $0.50 per share. C Unit shares are priced at $0.75 per share. D Unit shares are

priced at $1.00 per share.

During

the fourth quarter of 2014, we sold three A Units to a total of two investors.

In connection with the nonpublic offering

which commenced in February 2013, we received the final payment of $738.50 after December 31, 2014 and issued 3,100,000 restricted