Current Report Filing (8-k)

18 August 2015 - 2:55AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: July 30, 2015

(Date of Earliest Event Reported)

DATA CALL

TECHNOLOGIES, INC.

(Exact Name Of Registrant

As Specified In Its Charter)

| Nevada |

0-54691 |

30-0062823 |

| (State of

Incorporation) |

(Commission

File Number) |

(I.R.S.

Employer Identification No.) |

| |

|

|

| 700 S. Friendswood Dr.

Suite E,

Friendswood, Texas |

|

77546 |

| (Address of

Principal Executive Offices) |

|

(ZIP Code) |

Registrant's Telephone Number, Including Area Code:

(866) 219-2025

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On July 30, 2015, Data Call Technologies, Inc. (the

"Registrant"), executed a Convertible Note Modification Agreement (the "2015

Modification Agreement") with Ammon Wengerd (the "Note Holder") with respect

to a note in the original principal amount of $50,000 issued on July 21,

2009 (the "Note"). At June 30, 2015, the principal and accrued interest on

the Note is approximately $36,600.

The Note was modified on July 21, 2013 pursuant to an

Addendum (the "2013 Addendum") to provide for conversion rights whereby

holder of the Note was granted the right to convert the principal and

accrued interest into shares of the Registrant's common stock (the "Shares")

at a conversion price of $0.0001 per Share (the "Conversion Rights").

Pursuant to the terms of the 2015 Modification Agreement,

a copy of which is attached as Exhibit 10.18 to this Form 8-K Report, the

Registrant and the Note Holder agreed to modify the Note, as follows: (i)

the Conversion Rights provided in the 2013 Addendum have been rescinded in

their entirety and have no further force or effect; (ii) the maturity date

of the Note has been extended to June 30, 2016; and (iii) the Registrant has

the right to prepay the principal and accrued interest, in whole or in part.

Item 9.01 Financial Statements and

Exhibits

(b) The following documents are filed as exhibits to

this current report on Form 8-K or incorporated by reference herein. Any document

incorporated by reference is identified by a parenthetical reference to the SEC filing

that included such document.

Exhibit

No. |

Description |

| 10.18 |

Convertible Note Modification

Agreement dated July 30, 2015, filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Data Call Technologies, Inc. |

| By: /s/ Timothy E. Vance |

| |

| Date: August 17, 2015 |

Exhibit 10.18

CONVERTIBLE NOTE MODIFICATION AGREEMENT

This Convertible Note Modification Agreement, dated this 30th day of July

2015 (the "Modification Agreement"), is by and between Data Call Technologies,

Inc., a Nevada corporation with offices located at 700 South Friendswood Drive,

Suite E, Friendwood, TX 77546 (the "Company") and Ammon Wengerd (the "Note

Holder") and is related to a promissory note between the Company and the Note

Holder dated July 21, 2009 in the principal amount of $50,000 (the "Promissory

Note"). The Company and the Note Holder are sometimes referred to individually,

as a "Party" and collectively, as the "Parties."

WHEREAS, the Company and the Note Holder entered into the Promissory Note on

July 21, 2009 in the principal amount of $50,000 (the "Principal") together with

accrued interest at the rate of ten (10%) percent per annum (the "Interest");

and

WHEREAS, the Company and the Note Holder entered into an addendum to the

Promissory Note on July 13, 2013 (the "2013 Addendum"), which effectively

modified the Promissory Note, effective June 1, 2013, to include conversion

rights whereby the Principal together with accrued Interest was convertible into

shares of the Company's common stock (the "Shares") at a price of $0.0001 per

Share (the "Conversion Rights"); and

WHEREAS, the Company and the Note Holder, having determined that it is in the

best interests of the Company, the Note Holder and the stockholders of the

Company, of which the Note Holder is one, to eliminate the Conversion Rights

from the Promissory Note as provided in the 2013 Addendum in their entirety.

NOW, THEREFORE, for good and valuable consideration, the receipt of which is

hereby acknowledged, and in consideration of the promises and the mutual

covenants hereinafter set forth, the Parties hereto hereby agree as follows:

Section 1. Modification of the Promissory Note: The Parties agree that the

Promissory Note, subject to the 2013 Addendum, is hereby modified so that the

Note Conversion Rights, including the Voluntary Conversion and Shares Issuable

provisions included in the 2013 Addendum are rescinded and have no further

force or effect.

Section 2. Maturity Date: The Maturity Date on the Promissory Note is hereby

adjusted to June 30, 2016.

Section 3. Prepayment: The Company has the right to prepay the Principal and

accrued Interest, in whole or in part, without penalty.

Section 4. In all other respects, the Promissory Note shall remain unchanged in

any other respect.

DATA CALL TECHNOLOGIES, INC. AMMON WENGERD (NOTE HOLDER)

/s/: Timothy E. Vance /s/: Ammon Wengerg

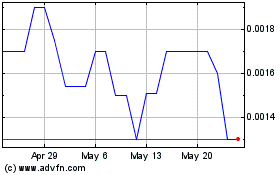

Data Call Technologies (PK) (USOTC:DCLT)

Historical Stock Chart

From Jan 2025 to Feb 2025

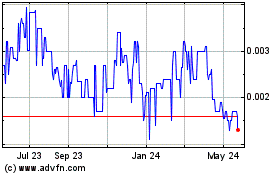

Data Call Technologies (PK) (USOTC:DCLT)

Historical Stock Chart

From Feb 2024 to Feb 2025