false

--03-31

2025

Q2

0000930775

0000930775

2024-04-01

2024-09-30

0000930775

2024-10-31

0000930775

2024-09-30

0000930775

2024-03-31

0000930775

2024-07-01

2024-09-30

0000930775

2023-07-01

2023-09-30

0000930775

2023-04-01

2023-09-30

0000930775

us-gaap:ProductMember

2024-07-01

2024-09-30

0000930775

us-gaap:ProductMember

2023-07-01

2023-09-30

0000930775

us-gaap:ProductMember

2024-04-01

2024-09-30

0000930775

us-gaap:ProductMember

2023-04-01

2023-09-30

0000930775

us-gaap:ServiceMember

2024-07-01

2024-09-30

0000930775

us-gaap:ServiceMember

2023-07-01

2023-09-30

0000930775

us-gaap:ServiceMember

2024-04-01

2024-09-30

0000930775

us-gaap:ServiceMember

2023-04-01

2023-09-30

0000930775

2023-03-31

0000930775

2023-09-30

0000930775

2024-03-30

2024-03-31

0000930775

ecia:ProductsMember

2024-07-01

2024-09-30

0000930775

ecia:ServicesMember

2024-07-01

2024-09-30

0000930775

ecia:ProductsMember

2024-04-01

2024-09-30

0000930775

ecia:ServicesMember

2024-04-01

2024-09-30

0000930775

ecia:ProductsMember

2023-07-01

2023-09-30

0000930775

ecia:ServicesMember

2023-07-01

2023-09-30

0000930775

ecia:ProductsMember

2023-04-01

2023-09-30

0000930775

ecia:ServicesMember

2023-04-01

2023-09-30

0000930775

2023-04-01

2024-03-31

0000930775

2022-04-01

2023-03-31

0000930775

ecia:SBAMember

2020-08-03

2020-08-04

0000930775

ecia:SBAMember

2021-08-01

0000930775

ecia:SBAMember

2021-07-30

2021-08-01

0000930775

ecia:CrestmarkBankMember

2024-04-01

2024-09-30

0000930775

ecia:USBankMember

ecia:NoteAgreementMember

2020-06-30

0000930775

ecia:NoteAgreementMember

ecia:USBankMember

2020-06-01

2020-06-30

0000930775

ecia:USBankMember

ecia:NoteAgreementMember

2022-09-30

0000930775

ecia:NoteAgreementMember

ecia:USBankMember

2022-09-01

2022-09-30

0000930775

ecia:LeasePaymentMember

2024-04-01

2024-09-30

0000930775

ecia:EIDLPaymentMember

2024-04-01

2024-09-30

0000930775

ecia:USBankPaymentMember

2024-04-01

2024-09-30

0000930775

ecia:USBankPayment1Member

2024-04-01

2024-09-30

0000930775

ecia:LeasePaymentMember

2024-09-30

0000930775

ecia:EIDLPaymentMember

2024-09-30

0000930775

ecia:USBankPaymentMember

2024-09-30

0000930775

ecia:USBankPayment1Member

2024-09-30

0000930775

us-gaap:CostOfSalesMember

2024-07-01

2024-09-30

0000930775

us-gaap:CostOfSalesMember

2023-07-01

2023-09-30

0000930775

us-gaap:CostOfSalesMember

2024-04-01

2024-09-30

0000930775

us-gaap:CostOfSalesMember

2023-04-01

2023-09-30

0000930775

us-gaap:SellingAndMarketingExpenseMember

2024-07-01

2024-09-30

0000930775

us-gaap:SellingAndMarketingExpenseMember

2023-07-01

2023-09-30

0000930775

us-gaap:SellingAndMarketingExpenseMember

2024-04-01

2024-09-30

0000930775

us-gaap:SellingAndMarketingExpenseMember

2023-04-01

2023-09-30

0000930775

us-gaap:GeneralAndAdministrativeExpenseMember

2024-07-01

2024-09-30

0000930775

us-gaap:GeneralAndAdministrativeExpenseMember

2023-07-01

2023-09-30

0000930775

us-gaap:GeneralAndAdministrativeExpenseMember

2024-04-01

2024-09-30

0000930775

us-gaap:GeneralAndAdministrativeExpenseMember

2023-04-01

2023-09-30

0000930775

us-gaap:ResearchAndDevelopmentExpenseMember

2024-07-01

2024-09-30

0000930775

us-gaap:ResearchAndDevelopmentExpenseMember

2023-07-01

2023-09-30

0000930775

us-gaap:ResearchAndDevelopmentExpenseMember

2024-04-01

2024-09-30

0000930775

us-gaap:ResearchAndDevelopmentExpenseMember

2023-04-01

2023-09-30

0000930775

srt:DirectorMember

2024-07-01

2024-09-30

0000930775

srt:DirectorMember

2024-04-01

2024-09-30

0000930775

srt:DirectorMember

2023-07-01

2023-09-30

0000930775

srt:DirectorMember

2023-04-01

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 21549

Form 10-Q

| ☒ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September

30, 2024

OR

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________

to________

Commission file number:

001-11789

ENCISION INC.

(Exact name of registrant as specified

in its charter)

| Colorado |

84-1162056 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer Identification No.) |

6797 Winchester Circle

Boulder, Colorado 80301

(Address of principal executive offices)

(303) 444-2600

(Registrant’s telephone number)

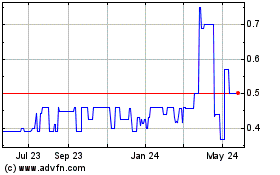

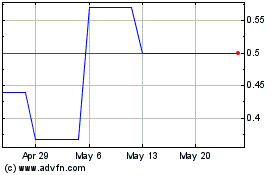

Securities registered pursuant to Section 12(b) of the Securities Exchange

Act of 1934:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

ECIA |

OTC Bulletin Board |

Securities registered under Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated Filer ☒ |

|

Smaller reporting company ☒ |

| |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s

classes of common equity, as of the latest practicable date:

|

Common Stock no par value

(Class) |

11,875,145 Shares

(outstanding at October 31, 2024) |

ENCISION INC.

FORM 10-Q

For the Three and Six Months ended September 30, 2024

INDEX

PART I FINANCIAL INFORMATION

ITEM 1 - Condensed

Interim Financial Statements

Encision Inc.

Condensed Balance Sheets

| | |

| | | |

| | |

| | |

September 30, 2024

Unaudited | | |

March 31, 2024

Audited | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 230,014 | | |

$ | 42,509 | |

| Accounts receivable | |

| 817,002 | | |

| 891,129 | |

| Inventories | |

| 1,164,666 | | |

| 1,402,338 | |

| Prepaid expenses | |

| 70,628 | | |

| 90,298 | |

| Total current assets | |

| 2,282,310 | | |

| 2,426,274 | |

| Equipment: | |

| | | |

| | |

| Furniture, fixtures and equipment, at cost | |

| 2,668,544 | | |

| 2,627,726 | |

| Accumulated depreciation | |

| (2,402,419 | ) | |

| (2,373,722 | ) |

| Equipment, net | |

| 266,125 | | |

| 254,004 | |

| Right of use asset | |

| 736,850 | | |

| 900,787 | |

| Patents, net | |

| 169,283 | | |

| 164,010 | |

| Other assets | |

| 69,376 | | |

| 65,641 | |

| TOTAL ASSETS | |

$ | 3,523,944 | | |

$ | 3,810,716 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 319,371 | | |

$ | 346,049 | |

| Line of credit | |

| 78,851 | | |

| 156,685 | |

| Secured notes | |

| 43,041 | | |

| 42,194 | |

| Accrued compensation | |

| 192,810 | | |

| 184,913 | |

| Other accrued liabilities | |

| 91,145 | | |

| 119,804 | |

| Accrued lease liability | |

| 414,730 | | |

| 370,377 | |

| Total current liabilities | |

| 1,139,948 | | |

| 1,220,022 | |

| Long-term liabilities: | |

| | | |

| | |

| Secured notes | |

| 200,496 | | |

| 67,336 | |

| Accrued lease liability | |

| 481,411 | | |

| 696,610 | |

| Total liabilities | |

| 1,821,855 | | |

| 1,983,968 | |

| Commitments and contingencies (Note 4) | |

| — | | |

| — | |

| Shareholders’ equity: | |

| | | |

| | |

| Preferred stock, no par value: 10,000,000 shares authorized; none issued and outstanding | |

| — | | |

| — | |

| Common stock and additional paid-in capital, no par value: 100,000,000 shares authorized; 11,875,145 and 11,858,627 issued and outstanding at September 30, 2024 and March 31, 2024, respectively | |

| 24,395,358 | | |

| 24,371,795 | |

| Accumulated (deficit) | |

| (22,693,269 | ) | |

| (22,545,047 | ) |

| Total shareholders’ equity | |

| 1,702,089 | | |

| 1,826,748 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 3,523,944 | | |

$ | 3,810,716 | |

The accompanying notes to financial statements are an integral part of

these unaudited condensed financial statements.

Encision Inc.

Condensed Statements of Operations

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | |

| | |

Three

Months Ended | | |

Six Months

Ended | |

| | |

September

30, 2024 | | |

September

30, 2023 | | |

September

30, 2024 | | |

September

30, 2023 | |

| NET REVENUE: | |

| | | |

| | | |

| | | |

| | |

| Product | |

$ | 1,653,820 | | |

$ | 1,752,413 | | |

$ | 3,245,779 | | |

$ | 3,365,965 | |

| Service | |

| 101,568 | | |

| 73,978 | | |

| 140,539 | | |

| 113,809 | |

| Total revenue | |

| 1,755,388 | | |

| 1,826,391 | | |

| 3,386,318 | | |

| 3,479,774 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF REVENUE: | |

| | | |

| | | |

| | | |

| | |

| Product | |

| 882,886 | | |

| 926,455 | | |

| 1,550,520 | | |

| 1,696,493 | |

| Service | |

| 44,020 | | |

| 37,327 | | |

| 64,653 | | |

| 57,947 | |

| Total cost of revenue | |

| 926,906 | | |

| 963,782 | | |

| 1,615,173 | | |

| 1,754,440 | |

| GROSS PROFIT | |

| 828,482 | | |

| 862,609 | | |

| 1,771,145 | | |

| 1,725,334 | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 458,480 | | |

| 389,342 | | |

| 881,716 | | |

| 822,778 | |

| General and administrative | |

| 373,405 | | |

| 366,377 | | |

| 725,310 | | |

| 755,133 | |

| Research and development | |

| 155,515 | | |

| 100,854 | | |

| 294,695 | | |

| 269,274 | |

| Total operating expenses | |

| 987,400 | | |

| 856,573 | | |

| 1,901,721 | | |

| 1,847,185 | |

| OPERATING INCOME (LOSS) | |

| (158,918 | ) | |

| 6,036 | | |

| (130,576 | ) | |

| (121,851 | ) |

| Interest expense, net | |

| (10,598 | ) | |

| (16,851 | ) | |

| (16,967 | ) | |

| (31,083 | ) |

| Other income (expense), net | |

| (746 | ) | |

| 3,286 | | |

| (679 | ) | |

| 4,951 | |

| Interest expense and other income (expense), net | |

| (11,344 | ) | |

| (13,565 | ) | |

| (17,646 | ) | |

| (26,132 | ) |

| Provision for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| NET (LOSS) | |

$ | (170,262 | ) | |

$ | (7,529 | ) | |

$ | (148,222 | ) | |

$ | (147,983 | ) |

| Net (loss) per share—basic and diluted | |

$ | (0.01 | ) | |

$ | 0.00 | | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| Weighted average shares—basic and diluted | |

| 11,875,145 | | |

| 11,769,543 | | |

| 11,875,145 | | |

| 11,769,543 | |

The accompanying notes to financial statements are an integral part of

these unaudited condensed financial statements.

Encision Inc.

Condensed Statements of Cash Flows

(Unaudited)

| | |

| | | |

| | |

| Six Months Ended | |

September 30, 2024 | | |

September 30,

2023 | |

| Cash flows (used in) operating activities: | |

| | | |

| | |

| Net (loss) | |

$ | (148,222 | ) | |

$ | (147,983 | ) |

| Adjustments to reconcile net (loss) to net cash (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 42,525 | | |

| 43,775 | |

| Stock-based compensation expense related to stock options | |

| 25,011 | | |

| 26,149 | |

| Provision for potential inventory obsolescence | |

| 83,152 | | |

| 64,000 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Right of use asset, net | |

| (6,909 | ) | |

| (97,490 | ) |

| Accounts receivable | |

| 74,127 | | |

| (103,629 | ) |

| Inventories | |

| 154,520 | | |

| 193,079 | |

| Prepaid expenses and other assets | |

| 15,935 | | |

| 54,630 | |

| Accounts payable | |

| (26,678 | ) | |

| 47,198 | |

| Accrued compensation and other accrued liabilities | |

| (20,762 | ) | |

| (82,732 | ) |

| Net cash provided by (used in) operating activities | |

| 192,699 | | |

| (3,003 | ) |

| Cash flows (used in) investing activities: | |

| | | |

| | |

| Acquisition of property and equipment | |

| (42,559 | ) | |

| (122 | ) |

| Patent costs | |

| (17,359 | ) | |

| (16,727 | ) |

| Net cash (used in) investing activities | |

| (59,918 | ) | |

| (16,849 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| (Paydown) of line of credit | |

| (77,834 | ) | |

| — | |

| (Payments) from options exercised | |

| (1,449 | ) | |

| — | |

| Borrowing from secured notes | |

| 134,007 | | |

| 136,887 | |

| Net

cash provided by (used in) financing activities | |

| 54,724 | | |

| 136,887 | |

| | |

| | | |

| | |

| Net increase in cash | |

| 187,505 | | |

| 117,035 | |

| Cash, beginning of fiscal year | |

| 42,509 | | |

| 188,966 | |

| Cash, end of six months | |

$ | 230,014 | | |

$ | 306,001 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid during the year for interest | |

$ | 16,967 | | |

$ | 31,083 | |

The accompanying notes to financial statements are an integral part of

these unaudited condensed financial statements.

ENCISION INC.

NOTES TO UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS

SEPTEMBER 30, 2024

(Unaudited)

Note 1. ORGANIZATION AND NATURE OF BUSINESS

Encision Inc. ( the “Company”) is a medical

device company that designs, develops, manufactures and markets patented surgical instruments that provide greater safety to, and saves

lives of, patients undergoing minimally-invasive surgery. The Company believes that the patented AEM® (Active Electrode

Monitoring) surgical instrument technology is changing the marketplace for electrosurgical devices and instruments by providing a solution

to a patient safety risk in laparoscopic surgery. The Company sales to date have been made principally in the United States.

The Company has an accumulated deficit of $22,693,269

at September 30, 2024. A significant portion of the Company operating funds has been provided by issuances of common stock and warrants,

the exercise of stock options to purchase common stock, loans, and (in some periods) by operating profits. Shareholders’ equity

decreased by $124,659 since March 31, 2024 because of net loss of $148,222 and stock-based compensation of $25,011. Should the Company’s

liquidity be diminished in the future because of operating losses, the Company may be required to seek additional capital.

The strategic marketing and sales plan is designed

to expand the use of the Company products in surgically active hospitals and surgery centers in the United States.

Note 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation. The unaudited condensed

interim financial statements included herein have been prepared by the Company, without audit, pursuant to the rules and regulations of

the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosures normally included in financial

statements prepared in accordance with generally accepted accounting principles accepted in the United States (“GAAP”) have

been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures made are adequate

to make the information presented not misleading. The unaudited condensed interim financial statements and notes thereto should be read

in conjunction with the financial statements and the notes thereto included in the Annual Report on Form 10-K for the fiscal year ended

March 31, 2024 filed on July 15, 2024.

The accompanying unaudited condensed interim financial

statements have been prepared, in all material respects, in conformity with the standards of accounting measurements and reflect, in the

opinion of management, all adjustments necessary to summarize fairly the financial position and results of operations for such periods

in accordance with GAAP. All adjustments are of a normal recurring nature. The results of operations for the most recent interim period

are not necessarily indicative of the results to be expected for the full year.

The

Company had a net loss of $170,262 and $148,222 for the three and six months ended September 30, 2024, respectively. At September 30,

2024, the Company had cash of $230,014 current borrowings of $78,851 and borrowing capacity up to $921,149, as restricted by eligible

accounts receivable, under the line of credit. Working capital was $1,142,362, a decrease of $64,890 from March 31, 2024. The Company

increased $187,505 of cash in the fiscal six months ended September 30, 2024, primarily because of cash generated by operating activities

and borrowings. Management is developing plans to ensure that the Company has the working capital necessary to fund operations. The Company

increased the pricing on products to mitigate higher material costs. Management concludes that it is probable that cash resources and

line of credit will be sufficient to meet cash requirements for twelve months from the issuance of the unaudited condensed financial

statements. Therefore, the accompanying unaudited condensed financial statements have been prepared assuming that the Company will continue

as a going concern.

Use of Estimates in the Preparation of Financial

Statements. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions.

Such estimates and assumptions affect the reported amounts of assets and liabilities as well as disclosure of contingent assets and liabilities

at the date of the financial statements and the reported amounts of sales and expenses during the reporting period. Actual results could

differ from those estimates.

Cash and Cash Equivalents. For purposes of

reporting cash flows, the company considers all cash and highly liquid investments with an original maturity of three months or less to

be cash equivalents.

Fair Value of Financial Instruments. The

financial instruments consist of cash, trade receivables, payables and Economic Injury Disaster Loan (“EIDL”) loan. The

carrying values of cash and trade receivables approximate their fair value due to their short maturities. The fair values of the

EIDL loan approximates the carrying value based on estimated discounted future cash flows using the current rates at which similar

loans would be made.

Concentration of Credit Risk. Financial instruments,

which potentially subject us to concentrations of credit risk, consist of cash and accounts receivable. From time to time, the amount

of cash on deposit with financial institutions may exceed the $250,000 federally insured limit. We believe that

cash on deposit that exceeds $250,000 with financial institutions is financially sound and the risk of loss is minimal.

The Company has no off-balance sheet concentrations

of credit risk such as foreign exchange contracts, options contracts or other foreign hedging arrangements. The Company maintains the

majority of cash balances with one financial institution in the form of demand deposits.

Accounts receivable are typically unsecured and are

derived from transactions with and from entities in the healthcare industry primarily located in the United States. Accordingly, the Company

may be exposed to credit risk generally associated with the healthcare industry. The accounts receivable balance at September 30, 2024

of $817,002 and at March 31, 2024 of $891,129 included no more than 8% from any one customer.

Inventories. Inventories are stated at the

lower of cost (first-in, first-out basis) or net realizable value. The Company reduces inventory for estimated obsolete or unmarketable

inventory equal to the difference between the cost of inventory and the net realizable value based upon assumptions about future demand

and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-downs

may be required. At September 30, 2024 and March 31, 2024 inventory consisted of the following:

| Schedule of inventory | |

| | |

| |

| | |

September

30, 2024 | | |

March

31, 2024 | |

| Raw materials | |

$ | 857,366 | | |

$ | 1,044,161 | |

| Finished goods | |

| 307,300 | | |

| 358,177 | |

| Total inventories | |

$ | 1,164,666 | | |

$ | 1,402,338 | |

Property and Equipment. Property and equipment

are stated at cost, with depreciation computed over the estimated useful lives of the assets, generally five to seven years. Depreciation

expense for the three and six months ended September 30, 2024 and 2023 was $16,295 and $30,438, respectively and $15,464 and $31,240,

respectively. The Company uses the straight-line method of depreciation for property and equipment. Leasehold improvements are depreciated

over the shorter of the remaining lease term or the estimated useful life of the asset. Maintenance and repairs are expensed as incurred

and major additions, replacements and improvements are capitalized.

Long-Lived Assets. Long-lived assets are reviewed

for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. A long-lived

asset is considered impaired when estimated future cash flows related to the asset, undiscounted and without interest, are insufficient

to recover the carrying amount of the asset. If deemed impaired, the long-lived asset is reduced to its estimated fair value. Long-lived

assets to be disposed of are reported at the lower of their carrying amount or estimated fair value less cost to sell.

Patents. The costs of applying for patents

are capitalized and amortized on a straight-line basis over the lesser of the patent’s economic or legal life (20 years from the

date of application in the United States). Capitalized costs are expensed if patents are not issued. The Company reviews the carrying

value of patents periodically to determine whether the patents have continuing value and such reviews could result in the conclusion that

the recorded amounts have been impaired.

Income Taxes. The Company accounts for income

taxes under the provisions of FASB Accounting Standards Codification (“ASC”) Topic 740, “Accounting for Income Taxes”

(“ASC 740”). ASC 740 requires recognition of deferred income tax assets and liabilities for the expected future income tax

consequences, based on enacted tax laws, of temporary differences between the financial reporting and tax bases of assets and liabilities.

ASC 740 also requires recognition of deferred tax assets for the expected future tax effects of all deductible temporary differences,

loss carryforwards and tax credit carryforwards. Deferred tax assets are then reduced, if deemed necessary, by a valuation allowance for

the amount of any tax benefits, which, more likely than not based on current circumstances, are not expected to be realized. As a result,

no provision for income tax is reflected in the accompanying statements of operations. Should the Company achieve sufficient, sustained

income in the future, the Company may conclude that some or all of the valuation allowance should be reversed. The Company is required

to make many subjective assumptions and judgments regarding income tax exposures. At September 30, 2024, the Company had no unrecognized

tax benefits, which would affect the effective tax rate if recognized and had no accrued interest, or penalties related to uncertain tax

positions.

Revenue Recognition. The Company records revenue

at a single point in time, when control is transferred to the customer. The Company will continue to apply the current business processes,

policies, systems and controls to support recognition and disclosure. The shipping policy is Free On Board (FOB) Shipping Point. We recognize

revenue from sales to stocking distributors when there is no right of return, other than for normal warranty claims. The Company has no

ongoing obligations related to product sales, except for normal warranty obligations. As presented on the Statement of Operations revenue

is disaggregated between product revenue and service revenue. As it relates specifically to product revenue, the Company does not believe

further disaggregation is necessary as substantially all of the product revenue comes from multiple products within a line of medical

devices. The engineering service contracts are billed on a time and materials basis and revenue is recognized over time as the services

are performed.

Research and Development Expenses. The Company

expenses research and development costs for products and processes as incurred.

Stock-Based Compensation. Stock-based compensation

is presented in accordance with the guidance of ASC Topic 718, “Compensation – Stock Compensation” (“ASC 718”).

Under the provisions of ASC 718, the Company is required to estimate the fair value of share-based payment awards on the date of grant

using an option-pricing model. The value of the portion of the award that is ultimately expected to vest is recognized as expense over

the requisite service periods in the statements of operations.

Stock-based compensation expense recognized under

ASC 718 for the three and six months ended September 30, 2024 and 2023 was $12,637 and $25,011 and $13,074 and $26,149, respectively,

which consisted of stock-based compensation expense related to grants of employee stock options.

Segment Reporting. In November 2023, the FASB

issued ASU No. 2023-07, Segment Reporting (Topic 280) ("ASU 2023-07"), Improvements to Reportable Segment Disclosures, requiring

companies to disclose segment expense information based on what the chief operating decision maker (CODM) deems to be material. These

disclosures must be made both quarterly and annually. As of September 30, 2024 the company is evaluating the adoption of

Topic 280. The Company has concluded that

we have two operating segments, product and service. Product designs, develops, manufactures and markets patented surgical instruments.

Service performs electrical engineering activities for external entities.

Information, by segment, for the three and six months

ended September 30, 2024 and 2023 follows:

| Schedule of information by segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, 2024 |

|

|

Six Months Ended September 30, 2024 |

|

| |

|

Product |

|

|

Service |

|

|

Total |

|

|

Product |

|

|

Service |

|

|

Total |

|

| Net revenue |

|

$ |

1,653,820 |

|

|

$ |

101,568 |

|

|

$ |

1,755,388 |

|

|

$ |

3,245,779 |

|

|

$ |

140,539 |

|

|

$ |

3,386,318 |

|

| Cost of revenue |

|

|

882,886 |

|

|

|

44,020 |

|

|

|

926,906 |

|

|

|

1,550,520 |

|

|

|

64,653 |

|

|

|

1,615,173 |

|

| Gross profit |

|

|

770,934 |

|

|

|

57,548 |

|

|

|

828,482 |

|

|

|

1,695,259 |

|

|

|

75,886 |

|

|

|

1,771,145 |

|

| Operating income (loss) |

|

|

(216,466 |

) |

|

|

57,548 |

|

|

|

(158,918 |

) |

|

|

(206,462 |

) |

|

|

75,886 |

|

|

|

(130,576 |

) |

| Depreciation and amortization |

|

|

23,203 |

|

|

|

— |

|

|

|

23,203 |

|

|

|

42,525 |

|

|

|

— |

|

|

|

42,525 |

|

| Patent and capital expenditures |

|

|

40,377 |

|

|

|

— |

|

|

|

40,377 |

|

|

|

59,918 |

|

|

|

— |

|

|

|

59,918 |

|

| Equipment and patents, net |

|

$ |

435,408 |

|

|

$ |

— |

|

|

$ |

435,408 |

|

|

$ |

435,408 |

|

|

$ |

— |

|

|

$ |

435,408 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Three

Months Ended September 30, 2023 | | |

Six

Months Ended September 30, 2023 | |

| | |

Product | | |

Service | | |

Total | | |

Product | | |

Service | | |

Total | |

| Net revenue | |

$ | 1,752,413 | | |

$ | 73,978 | | |

$ | 1,826,391 | | |

$ | 3,365,965 | | |

$ | 113,809 | | |

$ | 3,479,774 | |

| Cost of revenue | |

| 926,455 | | |

| 37,327 | | |

| 963,782 | | |

| 1,696,493 | | |

| 57,947 | | |

| 1,754,440 | |

| Gross profit | |

| 825,958 | | |

| 36,651 | | |

| 862,609 | | |

| 1,669,472 | | |

| 55,862 | | |

| 1,725,334 | |

| Operating income (loss) | |

| 6,036 | | |

| — | | |

| 6,036 | | |

| (177,714 | ) | |

| 55,862 | | |

| (121,851 | ) |

| Depreciation and amortization | |

| 21,525 | | |

| — | | |

| 21,525 | | |

| 43,775 | | |

| — | | |

| 43,775 | |

| Patent

and capital expenditures | |

| 16,350 | | |

| — | | |

| 16,350 | | |

| 16,849 | | |

| — | | |

| 16,849 | |

| Equipment and patents, net | |

$ | 439,484 | | |

$ | — | | |

$ | 439,484 | | |

$ | 439,484 | | |

$ | — | | |

$ | 439,484 | |

Note 3. BASIC AND DILUTED INCOME AND LOSS PER COMMON SHARE

The Company reports both basic and diluted net income

(loss) per share. Basic net income or loss per common share is computed by dividing net income or loss for the period by the weighted

average number of common shares outstanding for the period. Diluted net income or loss per common share is computed by dividing the net

income or loss for the period by the weighted average number of common and potential common shares outstanding during the period if the

effect of the potential common shares is dilutive. The shares used in the calculation of dilutive potential common shares exclude options

to purchase shares where the exercise price was greater than the average market price of common shares for the period.

The following table presents the calculation of basic

and diluted net income (loss) per share:

| Schedule of basic and diluted net income (loss) per share | |

| | |

| | |

| | |

| |

| | |

Three

Months Ended | | |

Six

Months Ended | |

| | |

September

30, 2024 | | |

September

30, 2023 | | |

September

30, 2024 | | |

September

30, 2023 | |

| Net income (loss) | |

$ | (170,262 | ) | |

$ | (7,529 | ) | |

$ | (148,222 | ) | |

$ | (147,983 | ) |

| Weighted-average basic shares outstanding | |

| 11,875,145 | | |

| 11,769,543 | | |

| 11,875,145 | | |

| 11,769,543 | |

| Effect of dilutive securities | |

| — | | |

| — | | |

| — | | |

| — | |

| Weighted-average diluted shares | |

| 11,875,145 | | |

| 11,769,543 | | |

| 11,875,145 | | |

| 11,769,543 | |

| Basic net income (loss) per share | |

$ | (0.01 | ) | |

$ | 0.00 | | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| Diluted net income (loss) per share | |

$ | (0.01 | ) | |

$ | 0.00 | | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| Antidilutive

employee stock options | |

| 1,099,000 | | |

| 1,049,000 | | |

| 1,099,000 | | |

| 1,049,000 | |

Note 4. COMMITMENTS AND CONTINGENCIES

The Company has a noncancelable lease agreement for

the facilities at 6797 Winchester Circle, Boulder, Colorado. The lease expires October 31, 2026.

In February 2016, the FASB issued ASU No. 2016-02,

Leases (Topic 842) ("ASU 2016-02"), which modified lease accounting for both lessees and lessors to increase transparency and

comparability by recognizing lease assets and lease liabilities by lessees for those leases classified as either finance or operating

leases under previous accounting standards and disclosing key information about leasing arrangements. The Company adopted Topic 842 on

April 1, 2019, using the alternative modified transition method, which requires a cumulative effect adjustment, if any, to the opening

balance of retained earnings to be recognized on the date of adoption with prior periods not restated. There was no cumulative effect

adjustment recorded on April 1, 2019. The primary impact was the balance sheet recognition of right-of-use (“ROU”) assets

and lease liabilities for operating leases as a lessee.

The Company determines if an arrangement contains

a lease at inception. The Company currently does not have any finance leases. Operating lease ROU assets and operating lease liabilities

are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. ROU assets also

include any initial direct costs incurred and any lease payments made at or before the lease commencement date, less lease incentives

received. The Company uses the incremental borrowing rate based on the information available at the commencement date in determining the

lease liabilities as the leases do not provide an implicit rate. Lease expense is recognized on a straight-line basis over the lease term.

Effective November 9, 2017, the Company extended the

noncancelable lease agreement through July 31, 2024, and further extended it through October 31, 2026, for the facilities at 6797 Winchester

Circle, Boulder, Colorado. Lease expense was $357,503 for the fiscal year ended March 31, 2024 and $329,255 for the fiscal year ended

March 31, 2023. Lease expense for the six months ended September 30, 2024 is $163,937. The

minimum future lease payment, by fiscal year, as of September 30, 2024 is as follows:

| Schedule of minimum future lease payment | | |

| | |

| Fiscal

Year | | |

Amount | |

| 2025 | | |

$ | 199,531 | |

| 2026 | | |

| 430,398 | |

| 2027 | | |

| 266,212 | |

| Total | | |

$ | 896,141 | |

On August 4, 2020, the Company received $150,000 in

loan funding from the U.S. Small Business Administration (“SBA”) under the Economic Injury Disaster Loan (“EIDL”)

program administered by the SBA, which program was expanded pursuant to the CARES Act. The EIDL is evidenced by a promissory note, dated

August 1, 2021 in the original principal amount of $150,000 with the SBA, the lender. Under the terms of the Note, interest accrues on

the outstanding principal at the rate of 3.75% per annum. The term of the Note is thirty years, though it may be payable sooner upon an

event of default under the Note.

On November 15, 2023, he Company entered into a loan

and security agreement with Pathward, N.A. (formerly Crestmark Bank). The loan is due on demand and has no financial covenants. Under

the agreement, the Company was provided with a line of credit that is not to exceed the lesser of $1,000,000 or 85% of eligible accounts

receivable. The interest rate is prime rate plus 0.5%, with a floor of 6.75%, plus a monthly maintenance fee of 0.4%, based on the average

monthly loan balance. Interest is charged on a minimum loan balance of $300,000, a loan fee of 0.5% at closing and annually, and an exit

fee of 3%, 2% and 1% during years one, two and three respectively.

The minimum future EIDL payment, by fiscal year, as

of September 30, 2024 is as follows:

| Schedule of minimum future lease payment | | |

| | |

| Fiscal Year | | |

Amount | |

| 2025 | | |

$ | 1,581 | |

| 2026 | | |

| 3,147 | |

| 2027 | | |

| 3,189 | |

| 2028 | | |

| 3,294 | |

| Thereafter | | |

| 143,892 | |

| Total | | |

$ | 155,103 | |

During June 2020, The Company entered into a note

agreement with U.S. Bank for $92,000. The note is for five5 years at a 5% interest rate and the proceeds were used to purchase equipment.

The note is secured by the equipment.

The minimum future U.S. Bank payment, by fiscal year,

as of September 30, 2024 is as follows:

| Schedule of minimum future lease payment | | |

| | |

| Fiscal

Year | | |

Amount | |

| 2025 | | |

$ | 9,200 | |

| 2026 | | |

| 13,800 | |

| Total | | |

$ | 23,000 | |

During September 2022, the Company entered into a

note agreement with U.S. Bank for $115,004. The note is for five5 years at a 6% interest rate and the proceeds were used to purchase equipment.

The note is secured by the equipment.

The minimum future principal U.S. Bank payment, by

fiscal year, as of September 30, 2024 is as follows:

| Schedule of minimum future lease payment | | |

| | |

| Fiscal

Year | | |

Amount | |

| 2025 | | |

| 11,897 | |

| 2026 | | |

| 23,794 | |

| 2027 | | |

| 23,794 | |

| 2028 | | |

| 5,949 | |

| Total | | |

$ | 65,434 | |

Aside from the line of credit, operating lease, EIDL

loan and U.S. Bank loans, the Company does not have any material contractual commitments requiring settlement in the future.

The Company is subject to regulation by the United

States Food and Drug Administration (“FDA”). The FDA provides regulations governing the manufacture and sale of products and

regularly inspects the Company and other manufacturers to determine compliance with these regulations. the Company believes that it was

in substantial compliance with all known regulations at September 30, 2024. FDA inspections are conducted periodically at the discretion

of the FDA. The latest inspection by the FDA occurred in October 2019.

Note 5. SHARE-BASED COMPENSATION

The provisions of ASC 718-10-55 requires the measurement

and recognition of compensation expense for all share-based payment awards made to employees and directors, including employee stock

options and RSUs, based on estimated fair values. The following table summarizes stock-based compensation expense related to employee

stock options for the three and six months ended September 30, 2024 and 2023, which was allocated as follows:

| Schedule of stock-based compensation expense | |

| | |

| | |

| | |

| |

| | |

Three

Months Ended | | |

Six Months

Ended | |

| | |

September

30, 2024 | | |

September

30, 2023 | | |

September

30, 2024 | | |

September

30, 2023 | |

| Cost of sales | |

$ | 201 | | |

$ | — | | |

$ | 402 | | |

$ | — | |

| Sales and marketing | |

| 1,750 | | |

| 1,779 | | |

| 3,369 | | |

| 3,558 | |

| General and administrative | |

| 10,606 | | |

| 10,254 | | |

| 21,080 | | |

| 20,508 | |

| Research and development | |

| 80 | | |

| 1,041 | | |

| 160 | | |

| 2,083 | |

| Stock-based compensation expense | |

$ | 12,637 | | |

$ | 13,074 | | |

$ | 25,011 | | |

$ | 26,149 | |

Share-based compensation cost for stock options is

measured at the grant date, based on the fair value as calculated by the Black-Scholes-Merton ("BSM") option-pricing model.

The BSM option-pricing model requires the use of actual employee exercise behavior data and the application of a number of assumptions,

including expected volatility, risk-free interest rate and expected dividends. There were 45,000 and 410,000 stock options granted and

22,000 and 62,000 exercised or forfeited during the three and six months ended September 30, 2024, respectively. As of September 30, 2024,

approximately $199,000 of total unrecognized compensation costs related to nonvested stock options is expected to be recognized over a

period of five years.

Note 6. RELATED PARTY TRANSACTION

The Company paid consulting fees of $ and $27,670

and $15,747 and $32,032 to an entity owned by one of the board members during the three and six months ended September 30, 2024 and 2023,

respectively.

Note 7. SUBSEQUENT EVENTS

Management evaluated all of

the activity as of the date the unaudited condensed interim financial statements were issued and concluded that no subsequent events have

occurred that would require recognition in the financial statements or disclosed in the notes to the unaudited condensed interim financial

statements.

ITEM 2 - MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements contained in this section on Management’s

Discussion and Analysis are not historical facts, including statements about strategies and expectations with respect to new and existing

products, market demand, acceptance of new and existing products, marketing efforts, technologies and opportunities, market and industry

segment growth, and return on investments in products and markets. These statements are forward looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995 and involve substantial risks and uncertainties that may cause actual results

to differ materially from those indicated by the forward looking statements. All forward looking statements in this section on Management’s

Discussion and Analysis are based on information available to us on the date of this document, and we assume no obligation to update such

forward looking statements. Readers of this Form 10-Q are strongly encouraged to review the section entitled “Risk Factors”

in the Form 10-K for the fiscal year ended March 31, 2024.

General

Encision Inc., a medical device company based in Boulder,

Colorado, has developed and markets innovative technology that provides unprecedented outcomes and patient safety in minimally-invasive

surgery. Approximately one in every three surgeons may have a patient injury each year from preventable stray energy burns. We

believe that the patented Active Electrode Monitoring (“AEM®”) AEM EndoShield™ Burn Protection System is changing

the marketplace for electrosurgical devices and laparoscopic instruments by providing a solution to a well-documented hazard unique to

laparoscopic surgery. The Center for Medicare and Medicaid Services has published its Hospital-Acquired Condition Reduction Program. The

program has begun to levy as much as a 1% penalty on Medicare reimbursements to hospitals in the lower quadrant of performance for selected

quality indicators, including accidental puncture and laceration (“APL”). Examples of APL include the use of a cautery device

(electrosurgery) or scissors to dissect a tissue plane that errantly causes an injury to underlying bowels.

We address market opportunities created by the increase

in minimally-invasive surgery (“MIS”) and surgeons’ use of electrosurgery devices in these procedures. The product

opportunity exists in that monopolar electrosurgery instruments used in laparoscopic procedures provide excellent clinical results, but

are also susceptible to causing inadvertent collateral tissue damage outside the surgeon’s field of view due to insulation failure

and capacitive coupling. The risk of unintended electrosurgical burn injury to the patient in laparoscopic surgery has been well documented.

This risk poses a threat to patient safety, including the risk of death, and creates liability exposure for surgeons and hospitals, as

well as increased and preventable readmissions.

The patented AEM technology provides surgeons with the desired tissue effects, while capturing

stray electrosurgical energy that can cause unintended and unseen tissue injury that may result in death. AEM Surgical Instruments are

equivalent to conventional instruments in size, shape, ergonomics, functionality and competitive pricing, but they incorporate “Active

Electrode Monitoring” technology to dynamically and continuously monitor the flow of electrosurgical current, thereby preventing

patient injury from stray energy burns. With the “shielded and monitored” instruments, surgeons can perform electrosurgical

procedures more safely, effectively and economically than is possible using conventional instruments or alternative energy sources.

The AEM system consists of shielded 5mm AEM Instruments

and an AEM monitor. The AEM Instruments are designed to function identically to the conventional 5mm instruments that surgeons are familiar

with, but with the added benefit of enhanced patient safety. The entire line of laparoscopic instruments has the integrated AEM design

and includes the full range of instruments that are common in laparoscopic surgery today. The AEM monitor is compatible with most electrosurgical

generators and can also be adapted for use in robotic systems. AEM Surgical Instruments provide enhanced patient safety, require no change

in surgeon technique and are cost competitive. Thus, conversion to AEM Surgical Instruments is easy and economical.

AEM technology has been recommended and endorsed by

many groups involved in MIS. Surgeons, nurses, biomedical engineers, the medicolegal community, malpractice insurance carriers and electrosurgical

device manufacturers advocate the use of AEM technology. We have focused our marketing strategies to date on expanding the market awareness

of the AEM technology and our broad independent endorsements and have continued efforts to improve and expand the AEM technology penetration.

When a hospital or surgery center changes to AEM technology,

we receive recurring revenue from sales of replacement instruments. We believe that there is no directly competing technology to supplant

AEM products. The replacement market of reusable and disposable AEM products in hospitals and surgery centers that use our AEM technology

represented over 90% of our product revenue during the three and six months ended September 30, 2024. This revenue stream is expected

to grow as the base of accounts using AEM technology expands. In addition, we intend to further develop disposable versions of more of

our AEM products in order to meet market demands and expand our sales opportunities.

We have an accumulated deficit of $22,693,269 at September

30, 2024. A significant portion of our operating funds have been provided by issuances of our common stock and warrants and the exercise

of stock options to purchase our common stock, loans, and (in some periods) by operating profits. Should our liquidity be diminished in

the future because of operating losses, we may be required to seek additional capital.

During the six months ended September 30, 2024, we

generated $192,699 of cash in our operating activities and used $42,559 for investments in property and equipment. At September 30, 2024,

we had $230,014 in cash and at March 31, 2024 we had $42,509 in cash available to fund future operations, an increase of $187,505 from

March 31, 2024. The increase to cash was principally the result of cash generated by operating activities and borrowing from our line

of credit. Our working capital was $1,142,362 at September 30, 2024 compared to $1,206,252 at March 31, 2024.

Historical Perspective

We were organized

in 1991 and spent several years developing the AEM monitoring system and protective sheaths to adapt to conventional electrosurgical instruments.

We have invested heavily in an effort to protect our valuable technology, and, as a result of this effort, we have been issued 16 unexpired

relevant patents that together form a significant intellectual property position. Our patents relate to the basic shielding and monitoring

technologies that we incorporate into our AEM products.

Our AEM Surgical

Instruments have been engineered to provide a seamless transition for surgeons switching from conventional laparoscopic instruments. AEM

technology has been integrated into instruments that have the same look, feel and functionality as conventional instruments that surgeons

have been using for years. The AEM product line encompasses the full range of instrument sizes, types and styles favored by surgeons.

Additionally, we continue to improve quality and add to the product line. These additions include more disposable versions, the introduction

of hand-activated instruments, our enhanced scissors, our eEdge™ scissors, our EM3 AEM Monitor, our AEM EndoShield Burn Protection

System and the recent introduction of our AEM 2X enTouch® Scissors. Hospitals can make a complete and smooth conversion to our product

line, thereby advancing patient safety in MIS with optimal convenience.

Outlook

Installed Base of AEM Monitoring Equipment:

We believe that sales of our installed base of AEM products will increase as the inherent risks associated with monopolar laparoscopic

electrosurgery become more widely acknowledged and as we focus on increasing our sales efficiency and continue to enhance our product

line. We expect that the replacement sales of electrosurgical instruments and accessories will also increase as additional facilities

adopt AEM technology. We anticipate that the efforts to improve the productivity of sales representatives carrying the AEM product line,

along with the introduction of next generation products, may provide the basis for increased sales and profitable operations. However,

these measures, or any others that we may adopt, may not result in either increased sales or profitable operations.

We believe that the unique performance of the AEM

technology and our breadth of independent endorsements provide an opportunity for continued market share growth. In our view, market awareness

and awareness of the clinical credibility of the AEM technology, as well as awareness of our endorsements, are improving, and we expect

this awareness to benefit our sales efforts for the remainder of fiscal year 2025. Our objectives for the remainder of fiscal year 2025

are to optimize sales execution, to expand market awareness of the AEM technology and to maximize the number of additional hospital and

surgery center accounts switching to AEM instruments while retaining existing customers. In addition, acceptance of AEM products depends

on surgeons’ preference for our instruments, which depends on factors such as ergonomics, quality and ease of use in addition to

the technological and safety advantages of AEM products. If surgeons prefer other instruments to our instruments, our business results

will suffer.

Possibility of Operating Losses: We have an

accumulated deficit of $22,693,269 at September 30, 2024. A significant portion of our operating funds have been provided by issuances

of our common stock and warrants and the exercise of stock options to purchase our common stock, loans, and (in some periods) by operating

profits. Should our liquidity be diminished in the future because of operating losses, we may be required to seek additional capital.

We have made strides toward improving our operating results but due to the ongoing need to develop, optimize and train our direct sales

managers and the independent sales representative network, the need to support the development of refinements to our product line, and

the need to increase sustained sales to a level adequate to cover fixed and variable operating costs, we may operate at a net loss. Sustained

losses, or our inability to generate sufficient cash flow from operations to fund our obligations, may result in a need to raise additional

capital.

Revenue Growth: We expect to generate increased

product revenue in the U.S. from sales to new customers and from expanded sales to existing customers as the medical device industry stabilizes

and our network of direct and independent sales representatives becomes more efficient. We believe that the visibility and credibility

of the independent clinical endorsements for AEM technology will contribute to new accounts and increased product revenue in fiscal year

2025. We also expect to increase market share through promotional programs of placing our

AEM monitors at no charge into hospitals that commit to standardize with AEM instruments. However, all of these efforts to increase market

share and grow product revenue will depend in part on our ability to expand the efficiency and effective coverage range of our direct

and independent sales representatives, as well as maintain and in some cases, improve the quality of our product offerings. The omission

or delay of elective surgeries would negatively impact the extent and timing of revenue growth. Service revenue represents design, development

and product supply revenue from our agreements with strategic partners.

We also have longer-term initiatives in place to improve

our prospects. We expect that development of next generation versions of our AEM products will better position our products in the marketplace

and improve our retention rate at hospitals and surgery centers that have changed to AEM technology, enabling us to grow our sales. We

are exploring overseas markets to assess opportunities for sales growth internationally. Finally, we intend to explore opportunities

to capitalize on our proven AEM technology via licensing arrangements and strategic alliances. These efforts to generate additional sales

and further the market penetration of our products are longer term in nature and may not materialize. Even if we are able to successfully

develop next generation products or identify potential international markets or strategic partners, we may not be able to capitalize on

these opportunities.

Gross Profit and Gross Margins: Gross profit

and gross margins can be expected to fluctuate from quarter to quarter as a result of product sales mix, sales volume and service revenue.

Gross margins on products manufactured or assembled by us are expected to improve at higher levels of production and sales.

Sales and Marketing Expenses: We continue to

refine our domestic and international distribution capability, and we believe that sales and marketing

expenses will decrease as a percentage of net sales with increasing sales volume.

Research and Development Expenses: Research

and development expenses are expected to increase to support quality improvement efforts and development of refinements to our AEM product

line and new products, which will further expand options for surgeons and hospitals.

Results of Operations

For the quarter ended September 30, 2024 compared

to the quarter ended September 30, 2023.

Net Product

revenue. Net product revenue for the quarter ended September 30, 2024 was $1,653,820 compared to $1,752,413 for the quarter ended

September 30, 2023, a decrease of 6%. The decrease in net product revenue is primarily due to a reduction in the sales of disposable products,

which suggests a decrease in the number of procedures performed during this perod. This reduction in procedural volume has, in turn, lowered

the overall demand for our products.

Net

Service revenue. Net service revenue for the quarter ended September 30, 2024 was $101,568 compared to $73,978 for the quarter ended

September 30, 2023. Increase was because of services performed under a Master Services Agreement with Vicarious Surgical Inc.

Gross

profit. Gross profit for the quarter ended September 30, 2024 of $828,482 represented a decrease of 4% from gross profit of $862,609

for the quarter ended September 30, 2023. Gross profit decreased because of a non-cash cost increase of $81,603 to inventory reserves

for the quarter ended September 30, 2024. Gross profit on product net revenue as a percentage of sales (gross margin) was 47% for the

quarters ended September 30, 2024 and 2023. If the cost increase to inventory reserve were excluded, then gross profit on net revenue

would have been 52%.

Sales and marketing expenses. Sales and marketing

expenses of $458,480 for the quarter ended September 30, 2024 represented an increase of 18% from sales and marketing expenses of $389,342

for the quarter ended September 30, 2023. The increase was because of trade shows and commissions.

General and administrative expenses. General

and administrative expenses of $373,405 for the quarter ended September 30, 2024 represented an increase of 2% from general and administrative

expenses of $366,377 for the quarter ended September 30, 2023.This increase was because of

additional staffing needs.

Research and development expenses. Research

and development expenses of $155,515 for the quarter ended September 30, 2024 represented

an increase of 54% compared to $100,854 for the quarter ended September 30, 2023. The increase was because of an increase of allocated

resources for product development.

Net loss. Net loss was $170,262 for the quarter

ended September 30, 2024 compared to net loss of $7,529 for the quarter ended September 30, 2023. The increase to net loss was primarily

because of the increase to inventory reserves and an increase to operating expenses.

For the six months ended September 30, 2024 compared

to the six months ended September 30, 2023.

Net Product

revenue. Net product revenue for the six months ended September 30, 2024 was $3,245,779 compared to $3,365,965 for the six months

ended September 30, 2023, a decrease of 4%. The decrease of net product revenue is attributable to decreased demand for our products.

Net Service

revenue. Net service revenue for the six months ended September 30, 2024 was $140,539 compared to $113,809 for the six months ended

September 30, 2023. Net service revenue for the six months ended September 30, 2023 was for engineering services performed under a Master

Services Agreement with Vicarious Surgical Inc.

Gross

profit. Gross profit for the six months ended September 30, 2024 of $1,771,145 represented an increase of 3% from gross profit of

$1,725,334 for the six months ended September 30, 2023. Gross profit on product net revenue as a percentage of sales (gross margin) was

52% for the six months ended September 30, 2024 and 50% for the six months ended September 30, 2023. Gross profit on net revenue increased

because of higher operating efficiencies.

Sales and marketing expenses. Sales and marketing

expenses of $881,716 for the six months ended September 30, 2024 represented an increase of 7% from sales and marketing expenses of $822,778

for the six months ended September 30, 2023. The increase was the result of higher commissions.

General and administrative expenses. General

and administrative expenses of $725,310 for the six months ended September 30, 2024 represented a decrease of 4% from general and administrative

expenses of $755,133 for the six months ended September 30, 2023. The decrease was because

of decreased bad debt expense and outside accountants’ cost.

Research and development expenses. Research

and development expenses of $294,695 for the six months ended September 30, 2024 represented

an increase of 9% compared to $269,274 for the six months ended September 30, 2023. The increase was the result of an increase to allocations.

Net loss. Net loss was $148,222 for the six

months ended September 30, 2024 compared to net loss of $147,983 for the six months ended September 30, 2023.

The results of operations for the three and six months

ended September 30, 2024 are not necessarily indicative of the results of operations for all or any part of the balance of the fiscal

year.

Liquidity and Capital Resources

To date, a significant portion of our operating funds

have been provided by issuances of our common stock and warrants, the exercise of stock options to purchase our common stock, loans, and

(in some periods) by operating profits. Common stock and additional paid in capital totaled $24,395,358 from inception through September

30, 2024.

On August 4, 2020, we received $150,000 in loan funding

from the U.S. Small Business Administration (“SBA”) under the Economic Injury Disaster Loan (“EIDL”) program administered

by the SBA, which program was expanded pursuant to the CARES Act. The EIDL is evidenced by a promissory note, dated August 1, 2021 in

the original principal amount of $150,000 with the SBA, the lender. Under the terms of the Note, interest accrues on the outstanding principal

at the rate of 3.75% per annum. The term of the Note is thirty years, though it may be payable sooner upon an event of default under the

Note.

During January

2023, we entered into a note agreement with U.S. Bank for $92,000. The note is for five years at a 5% interest rate and the proceeds were

used to purchase equipment. The note is secured by the equipment.

During September 2023, we entered into a note agreement

with U.S. Bank for $115,004. The note is for five years at a 6% interest rate and the proceeds were used to purchase equipment. The note

is secured by the equipment.

On November 15, 2023, we entered into a loan and security

agreement with Pathward, N.A. (formerly Crestmark Bank). The loan is due on demand and has no financial covenants. Under the agreement,

we were provided with a line of credit that is not to exceed the lesser of $1,000,000 or 85% of eligible accounts receivable. The interest

rate is prime rate plus 0.5%, with a floor of 6.75%, plus a monthly maintenance fee of 0.4%, based on the average monthly loan balance.

Interest is charged on a minimum loan balance of $300,000, a loan fee of 0.5% at closing and annually, and an exit fee of 3%, 2% and 1%

during years one, two and three respectively.

Our operations generated $192,699 of cash during the

six months ended September 30, 2024 on net revenue of $3,386,318. The amounts of cash generated by operations for the six months ended

September 30, 2024 are not necessarily indicative of the expected amounts of cash to be generated from or used in operations in fiscal

year 2025. At September 30, 2024, we had $230,014 in cash available to fund future operations and a line of credit for up to $921,149,

restricted by eligible account receivables. Our working capital was $1,142,362 at September 30, 2024 compared to $1,206,252 at March 31,

2024. Current liabilities were $1,140,082 at September 30, 2024 compared to $1,220,022 at March 31, 2024. We have a noncancelable lease

agreement for our facilities at 6797 Winchester Circle, Boulder, Colorado. The lease expires October 31, 2026.

In February 2016, the FASB issued ASU No. 2016-02,

Leases (Topic 842) (“ASU 2016-02”), which modified lease accounting for both lessees and lessors to increase transparency

and comparability by recognizing lease assets and lease liabilities by lessees for those leases classified as operating leases under previous

accounting standards and disclosing key information about leasing arrangements. The primary impact for us was the balance sheet recognition

of right-of-use (“ROU”) assets and lease liabilities for operating leases as a lessee.

Operating lease ROU assets and operating lease liabilities

are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. ROU assets also

include any initial direct costs incurred and any lease payments made at or before the lease commencement date, less lease incentives

received. We use our incremental borrowing rate based on the information available at the commencement date in determining the lease liabilities

as our leases do not provide an implicit rate. Lease expense is recognized on a straight-line basis over the lease term.

The minimum future EIDL payment, by fiscal year, as

of September 30, 2024 is as follows:

| Fiscal

Year | | |

Amount | |

| | 2025 | | |

$ | 1,581 | |

| | 2026 | | |

| 3,147 | |

| | 2027 | | |

| 3,189 | |

| | 2028 | | |

| 3,294 | |

| | Thereafter | | |

| 143,892 | |

| | Total | | |

$ | 155,103 | |

During June 2020, we entered into a note agreement

with U.S. Bank for $92,000. The note is for five years at a 5% interest rate and the proceeds were used to purchase equipment. The note

is secured by the equipment.

The minimum future U.S. Bank payment, by fiscal year,

as of September 30, 2024 is as follows:

| Fiscal

Year | | |

Amount | |

| | 2025 | | |

$ | 9,200 | |

| | 2026 | | |

| 13,800 | |

| | Total | | |

$ | 23,000 | |

During September 2022, we entered into a note agreement

with U.S. Bank for $115,004. The note is for five years at a 6% interest rate and the proceeds were used to purchase equipment. The note

is secured by the equipment.

The minimum future principal U.S. Bank payment, by

fiscal year, as of September 30, 2024 is as follows:

| Fiscal

Year | | |

Amount | |

| | 2025 | | |

| 11,897 | |

| | 2026 | | |

| 23,794 | |

| | 2027 | | |

| 23,794 | |

| | 2028 | | |

| 5,949 | |

| | Total | | |

$ | 65,434 | |

Aside from the line of credit, operating lease, EIDL

loan and U.S. Bank loans, we do not have any material contractual commitments requiring settlement in the future.

As of September 30, 2024, the following table shows

our contractual obligations for the periods presented:

| | |

Payment

due by period | |

| Contractual obligations | |

Totals | | |

Less

than 1

year | | |

1-3 years | | |

3-5 years | | |

More

than 5

years | |

| Line of credit | |

$ | 78,851 | | |

$ | 78,851 | | |

$ | — | | |

$ | — | | |

$ | — | |

| Operating lease obligations | |

| 896,141 | | |

| 414,730 | | |

| 481,411 | | |

| — | | |

| — | |

| EIDL loan | |

| 155,103 | | |

| 3,147 | | |

| 6,401 | | |

| 6,856 | | |

| 138,699 | |

| U.S. Bank loan | |

| 23,000 | | |

| 16,100 | | |

| 6,900 | | |

| — | | |

| — | |

| U.S. Bank loan | |

| 65,434 | | |

| 23,794 | | |

| 41,640 | | |

| — | | |

| — | |

| Total | |

$ | 1,218,529 | | |

$ | 536,622 | | |

$ | 536,352 | | |

$ | 6,856 | | |

$ | 138,699 | |

Our fiscal year 2025 operating plan is focused on

increasing new accounts, retaining existing customers, growing revenue, increasing gross profits and conserving cash. We are investing

in research and development efforts to develop next generation versions of the AEM product line. We have invested in manufacturing property

and equipment to manufacture disposable scissors inserts internally and to reduce our cost of product revenue. We cannot predict with

certainty the expected revenue, gross profit, net income or loss and usage of cash for fiscal year 2024. If we are unable to manage our

business operations in line with budget expectations, it could have a material adverse effect on our business viability, financial position,

results of operations and cash flows.

Income Taxes

As of March 31, 2024, net operating

loss carryforwards totaling approximately $8.9 million are available to reduce taxable income in the future. The net operating loss carryforwards

expire, if not previously utilized, at various dates beginning in the fiscal year ending March 31, 2025. We have not paid income taxes

since our inception. The Tax Reform Act of 1986 and other income tax regulations contain provisions which may limit the net operating

loss carryforwards available to be used in any given year if certain events occur, including changes in ownership interests. We have established

a valuation allowance for the entire amount of our deferred tax asset since inception due to our history of losses. Should we achieve

sufficient, sustained income in the future, we may conclude that some or all of the valuation allowance should be reversed. If some or

all of the valuation allowance were reversed, then, to the extent of the reversal, a tax benefit would be recognized which would result

in an increase to net income.

Critical Accounting Policies and Estimates

Our discussion

and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in

accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires

us to make estimates and judgments that affect the reported amounts of assets, liabilities, sales and expenses, and related disclosure

of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to bad debts, inventories,

sales returns, contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are

believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values

of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different

assumptions or conditions. We believe the following critical accounting policies affect the more significant judgments and estimates used

in the preparation of our financial statements.

We record revenue at a single point in time, when

control is transferred to the customer, which is consistent with past practice. We will continue to apply our current business processes,

policies, systems and controls to support recognition and disclosure. Our shipping policy is FOB Shipping Point. We recognize revenue

from sales to stocking distributors when there is no right of return, other than for normal warranty claims. We have no ongoing obligations

related to product sales, except for normal warranty obligations. We evaluated the requirement to disaggregate revenue, and concluded

that substantially all of our revenue comes from multiple products within a line of medical devices. Our engineering service contracts

are billed on a time and materials basis and revenue is recognized over time as the services are performed. We record deferred revenue

when funds are received prior to the recognition of the associated revenue. We record a contract liability to deferred revenue which

includes customer prepayments and is included in other accrued liabilities.

We provide for

the estimated cost of product warranties at the time sales are recognized. While we engage in extensive product quality programs and processes,

including actively monitoring and evaluating the quality of our component suppliers, we have experienced some costs related to warranties.

The warranty accrual is based on historical experience and is adjusted based on current experience. Should actual warranty experience

differ from our estimates, revisions to the estimated warranty liability would be required.

We reduce inventory

for estimated obsolete or unmarketable inventory equal to the difference between the cost of inventory and the estimated realizable value

based on assumptions about future demand and market conditions. If actual market conditions are less favorable than those projected by