false

2023

FY

0000752294

0000752294

2023-01-01

2023-12-31

0000752294

2023-06-30

0000752294

2024-02-06

0000752294

2023-12-31

0000752294

2022-12-31

0000752294

2022-01-01

2022-12-31

0000752294

us-gaap:CommonStockMember

2021-12-31

0000752294

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0000752294

us-gaap:RetainedEarningsMember

2021-12-31

0000752294

2021-12-31

0000752294

us-gaap:CommonStockMember

2022-12-31

0000752294

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000752294

us-gaap:RetainedEarningsMember

2022-12-31

0000752294

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0000752294

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0000752294

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0000752294

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0000752294

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0000752294

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0000752294

us-gaap:CommonStockMember

2023-12-31

0000752294

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0000752294

us-gaap:RetainedEarningsMember

2023-12-31

0000752294

us-gaap:EmployeeStockOptionMember

2023-06-08

2023-06-09

0000752294

us-gaap:EmployeeStockOptionMember

2023-06-09

0000752294

us-gaap:StockOptionMember

2021-12-31

0000752294

us-gaap:StockOptionMember

2021-01-01

2021-12-31

0000752294

us-gaap:StockOptionMember

2022-01-01

2022-12-31

0000752294

us-gaap:StockOptionMember

2022-12-31

0000752294

us-gaap:StockOptionMember

2023-01-01

2023-12-31

0000752294

us-gaap:StockOptionMember

2023-12-31

0000752294

ELST:MonthlyRateYearOneMember

2022-09-18

2022-09-19

0000752294

ELST:MonthlyRateYearTwoMember

2022-09-18

2022-09-19

0000752294

2022-09-18

2022-09-19

0000752294

2022-09-19

0000752294

us-gaap:CostOfSalesMember

2023-01-01

2023-12-31

0000752294

us-gaap:OperatingExpenseMember

2023-01-01

2023-12-31

0000752294

us-gaap:CostOfSalesMember

2022-01-01

2022-12-31

0000752294

us-gaap:OperatingExpenseMember

2022-01-01

2022-12-31

0000752294

us-gaap:GeographicDistributionDomesticMember

us-gaap:ProductMember

2023-01-01

2023-12-31

0000752294

us-gaap:GeographicDistributionForeignMember

us-gaap:ProductMember

2023-01-01

2023-12-31

0000752294

us-gaap:ProductMember

2023-01-01

2023-12-31

0000752294

us-gaap:GeographicDistributionDomesticMember

us-gaap:ProductMember

2022-01-01

2022-12-31

0000752294

us-gaap:GeographicDistributionForeignMember

us-gaap:ProductMember

2022-01-01

2022-12-31

0000752294

us-gaap:ProductMember

2022-01-01

2022-12-31

0000752294

us-gaap:GeographicDistributionDomesticMember

ELST:SiteSupportSalesMember

2023-01-01

2023-12-31

0000752294

us-gaap:GeographicDistributionForeignMember

ELST:SiteSupportSalesMember

2023-01-01

2023-12-31

0000752294

ELST:SiteSupportSalesMember

2023-01-01

2023-12-31

0000752294

us-gaap:GeographicDistributionDomesticMember

ELST:SiteSupportSalesMember

2022-01-01

2022-12-31

0000752294

us-gaap:GeographicDistributionForeignMember

ELST:SiteSupportSalesMember

2022-01-01

2022-12-31

0000752294

ELST:SiteSupportSalesMember

2022-01-01

2022-12-31

0000752294

us-gaap:GeographicDistributionDomesticMember

2023-01-01

2023-12-31

0000752294

us-gaap:GeographicDistributionForeignMember

2023-01-01

2023-12-31

0000752294

us-gaap:GeographicDistributionDomesticMember

2022-01-01

2022-12-31

0000752294

us-gaap:GeographicDistributionForeignMember

2022-01-01

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:SalesRevenueNetMember

ELST:CustomerAMember

2023-01-01

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:SalesRevenueNetMember

ELST:CustomerAMember

2022-01-01

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:SalesRevenueNetMember

ELST:CustomerBMember

2023-01-01

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:SalesRevenueNetMember

ELST:CustomerBMember

2022-01-01

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerAMember

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerAMember

2023-01-01

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerAMember

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerAMember

2022-01-01

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerBMember

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerBMember

2023-01-01

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerBMember

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerBMember

2022-01-01

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerCMember

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerCMember

2023-01-01

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerCMember

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerCMember

2022-01-01

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerDMember

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerDMember

2023-01-01

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerDMember

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerDMember

2022-01-01

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerEMember

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerEMember

2023-01-01

2023-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerEMember

2022-12-31

0000752294

us-gaap:CustomerConcentrationRiskMember

us-gaap:GeographicDistributionDomesticMember

us-gaap:AccountsReceivableMember

ELST:CustomerEMember

2022-01-01

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the fiscal year ended: December 31, 2023 |

| |

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the transition period from to |

Commission file number: 000-27793

ELECTRONIC SYSTEMS TECHNOLOGY INC.

(Exact name of registrant as specified in its charter)

| Washington |

|

91-1238077 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

| 415 N. Roosevelt St., STE B1, Kennewick, Washington |

|

99336 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (509) 735-9092

Securities registered under Section 12(b) of the Exchange

Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| |

|

|

| None |

N/A |

N/A |

Securities registered under Section 12(g) of the Exchange Act:

Common |

| (Title of Class) |

Indicate by checkmark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by checkmark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of

Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge,

in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

o

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer |

o |

|

Accelerated filer |

o |

| Non-accelerated Filer |

x |

|

Smaller reporting company |

x |

| Emerging Growth Company |

o |

|

|

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and

attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b)

of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes o

No x

If securities are registered pursuant to Section 12(b) of the Act, indicate

by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously

issued financial statements. Yes o No x

Indicate by check mark whether any of those error corrections are restatements

that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during

the relevant period pursuant to §240.10D-1(b). Yes o No x

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant’s

Common Stock held by non-affiliates was $764,151, based on the reported last sale price of Common Stock on June 30, 2023, which was the

last business day of the registrant’s most recently completed second fiscal quarter. For purposes of this computation, all executive

officers and Directors were deemed affiliates.

The number of shares outstanding of the registrant’s

Common Stock as of February 6, 2024: 4,946,502 shares.

ELECTRONIC SYSTEMS TECHNOLOGY INC.

FORM 10-K

Table of Contents

PART I

FORWARD LOOKING STATEMENTS:

This Annual Report on Form 10-K and the exhibits attached

hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as

amended. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations

in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur

in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts

not yet determinable and assumptions of management.

Any statement that express or involve discussions

with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often,

but not always using words or phrases such as “believes”, “expects” or “does not expect”, “is

expected”, “anticipates” or “does not anticipate”, “plans”, “estimates”, or “intends”,

or stating that certain actions, events or results “may” or “could”, “would”, “might”

or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking

statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results

to differ from those expressed or implied by the forward-looking statements.

The Company cautions readers not to place undue reliance

on any such forward-looking statements, which speak only as of the date made. The Company disclaims any obligation subsequently to revise

any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated

or unanticipated events, except as required by law. The Company advises readers to carefully review the reports and documents filed from

time to time with the Securities and Exchange Commission (the “SEC”), particularly the Company’s Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K.

Management’s Discussion and Analysis is intended

to be read in conjunction with the Company’s financial statements and the integral notes (“Notes”) thereto for the fiscal

year ended December 31, 2023. The following statements may be forward-looking in nature and actual results may differ materially. All

dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

Item 1. Business.

For over 40 years, Electronic Systems Technology,

Inc. (“EST”, “us”, “we”, “our” or the “Company”) has specialized in the development

and manufacturing of digital data (non-voice) radio transceivers for use in industrial wireless networking applications. With reliance

on wireless communication in the modern world, the global modernization of industrial control systems now requires the benefits gained

by use of wireless technology. EST designs, manufactures, develops and produces these specialized, hardened products uniquely designed

to operate and survive in these difficult environments in which these systems must perform.

The Company’s ESTeem® line of products provide

innovative communication solutions for harsh environment applications not served or that are underutilized by conventional, commercial

grade communication systems. Our products are part of the ESTeem® Industrial Wireless Solutions for commercial, industrial, and government

arenas both domestically and internationally. We market through direct sales, sales representatives, resellers, and system integrators.

EST was incorporated in the State of Washington in

February 1984, and was granted a United States Patent for the “Wireless Computer Modem” in May 1987, and Canadian patent in

October 1988. We registered and commenced building brand recognition on the trade name of “ESTeem® Wireless Modems” in

2007. After reviewing for marketability and profitability, our strategy is to provide product improvements and enhancements that incorporate

technological developments in response to customer needs and market opportunities arising from changes in FCC regulations or technological

developments.

Development efforts in 2023 were focused primarily

on software enhancements and hardware maintenance for the ESTeem® Horizon Series. These next generation industrial wireless products

will improve our networking capability with higher data rates, improved security, improved support features and updates to the latest

wireless standards.

In an effort to maintain and expand our customer base

in the industrial control marketplace, we team with major automation hardware vendors such as Rockwell Automation. Our 30-year relationship

with Rockwell Automation’s Technology Partner Program delivers significant benefits via increased exposure to markets that would

not otherwise be available to us. Rockwell Automation has the largest market share in the United States and is a major entity in the world-wide

automation and controls marketplace.

PRODUCTS AND MARKETS

ESTeem® industrial wireless products provide communication

links between computer networks, network enabled devices and mobile devices without cables. The widespread use of networked computer systems

in business, industry and public service and the adoption of mobile devices in all aspects of modern life has created an environment where

the wireless network is no longer a convenience but a necessity. As wireless networking proliferates through the modernization of the

industrial sector the need for our products, which are specifically designed for rigors of operation in harsh environments, is increasing

dramatically. Wireless networks are the backbone connections to the Internet for cloud-based services such as the Internet of Things (“IoT”)

and Industrial Internet of Things (“IIoT”).

All of the ESTeem® models come with industry standard

Ethernet communication ports and legacy serial ports to provide the broadest range of connections for both new and legacy hardware. The

combined features such as AES 128 or AES 256 security encryption, self-healing repeaters, mesh networking, long range operation and outdoor

weatherproof cases make the ESTeem® products unique in our market space.

PRODUCT APPLICATIONS

Major applications and industries in which ESTeem®

products are being utilized are as follows:

| Water/Wastewater |

Mining |

| Oil/Gas |

Industrial Automation |

PRODUCT LINES

We manufacture nine (9) models of the ESTeem®

industrial wireless modems that operate in frequency from 150 MHz to 5.8 GHz. A wireless modem is a hardware device for sending and receiving

data over a radio carrier and is the foundation of our industrial wireless solution. Each model will fit best in a specific application

based upon several factors such as distance, required data rate and Federal Communication Commission (“FCC”) licensing requirements.

Each wireless network is discussed in detail with the end customer to determine the best overall solution for their application. No single

model or frequency band can solve all applications and having a diverse product selection is critical for expanding our customer base.

The following is a summary of our product offering.

ESTeem

Model |

Type |

Frequency

(MHz) |

RF Power

(Watts) |

RF Data Rate |

LOS Range

(Miles) |

Interface |

| 210M |

Narrow Band Licensed |

150 to 174 |

2 |

64.8 Kbps |

15 |

Ethernet/RS-232 |

| 195M |

Narrow Band Licensed |

150 to 174 |

4 |

12.5 Kbps |

15 |

Ethernet/RS-232/422/485 |

| 195C |

Narrow Band Licensed |

450 to 470 |

4 |

12.5 Kbps |

15 |

Ethernet/RS-232/422/485 |

| 195H |

Narrow Band Licensed |

217 to 220 |

2 |

50 Kbps |

15 |

Ethernet/RS-232/422/485 |

| Horizon900 |

Unlicensed |

900 |

1 |

72.2 Mbps |

10 |

Ethernet/ RS-232 |

| Horizon2.4MIMO |

Unlicensed |

2400 |

.5 (Dual Stream) |

300 Mbps |

5-7 |

Ethernet/ RS-232 |

| Horizon4.9 |

Licensed |

4900 |

1 |

72.2 Mbps |

5-7 |

Ethernet/ RS-232 |

| Horizon5.8 |

Unlicensed |

5800 |

.250 (Dual Stream) |

300 Mbps |

5-7 |

Ethernet/ RS-232 |

| Edge900 |

Unlicensed |

900 |

.25 |

1 Mbps |

10 |

Ethernet/ RS-232 |

ADDITIONAL PRODUCTS AND SERVICES

Various accessories to support the above products,

e.g., antennas, power supplies and cable assemblies, are purchased from other manufacturers and resold by us to support the application

of our industrial wireless modems for repairs and upgrades. To assist in the application of ESTeem industrial wireless modems, we also

offer professional services, including site survey testing, system start-up, and custom engineering.

RESEARCH AND DEVELOPMENT AND NEW PRODUCTS

Our products compete in an environment of rapidly

changing technology which results in the necessity for continuous updates and enhancements. Research and development expenditures for

new product development and improvements of existing products for 2023 and 2022 were $121,896 and $163,189 respectively. None of our research

and development expenses were paid directly by any of our customers. We contract with third parties for software development and hardware

design as needed. Development efforts during 2023 were focused primarily on software enhancements for the ESTeem® Horizon Series and

the redesign of the Horizon900. Research and development expenditures will continue, in order to meet our customers’ evolving needs.

MARKETING, CUSTOMERS AND SUPPORT

The majority of our products sold during 2023 were

through the reselling efforts of non-exclusive, non-stocking distributors and resellers, and the remainder our sales were direct to end-users.

Orders are generally placed on an “as needed basis”. Shipping of products is usually completed 1 to 15 working days after

receipt of a customer order, with the exception of ongoing scheduled projects and custom designed equipment for specific applications.

Our sales order backlog at year end was $55,636.

We advertise in trade publications and attend trade

shows specifically targeting industrial automation systems. We provide support personnel and maintain an internet web site to provide

access to product and technical information for customers. We provide technical support and service for our products and installations

through phone support, field technicians and internet sources. High quality customer support is vital to differentiate ourselves in our

marketplace. We intend to maintain this high level of customer support by investing in our customer service programs.

COMPETITION

All of our markets are highly competitive as there

are approximately twenty major automation hardware manufacturers worldwide. Listed below are major competitors in the markets in which

we compete:

| Major Market |

Major

Competitors |

| Industrial Automation |

FreeWave Technologies, GE/Microwave Data Systems, Data-Linc and Cal Amp |

| |

| Computer networking, inter and intra building, and remote internet access |

Cisco, Digital Wireless, D-link, Linksys, P-Com and Proxim |

We believe our products compete favorably based on

performance, price, and adaptability of the products to a wide range of applications, as well as world class service and support.

PATENTS, TRADEMARKS, AND PROPRIETARY INFORMATION

To protect the Company against unauthorized disclosure

of proprietary information belonging to the Company, all employees, dealers, distributors, original equipment manufacturers, sales representatives

and other persons having access to confidential information regarding Company products or technology are bound by nondisclosure agreements.

Rights to the ESTeem® Wireless Modems, trademark were renewed in 2014. The initial patents granted in 1987 and 1988 have expired and

we currently have no patents on any of our products.

GOVERNMENT REGULATION

For operation in the United States, the ESTeem®

industrial wireless products require FCC type acceptance which is granted for devices demonstrating operation within mandated and tested

performance criteria. All of our products requiring FCC type acceptance have been granted such acceptance, and all except the Horizon4.9

have been granted such acceptance in Canada.

The ESTeem® industrial wireless products that

operate in the FCC licensed frequency band require licensing under Part 90 of the FCC Rules and Regulations which must be applied for

by the end user. We provide information to customers to assist in the application for FCC consumer licenses, although we cannot guarantee

FCC licenses in a given frequency spectrum for a particular application will be received.

While there can be no assurance that future FCC regulations

will not have material adverse effects on our operations, we are unaware of any such existing or proposed FCC regulations at this time.

SOURCE OF SUPPLY AND MANUFACTURING

Components are purchased through a number of distributors

and key component suppliers, such as Hitachi, Motorola, and others, some of which have long lead times. Although these components could

be replaced or substituted by other products, if necessary, a significant interruption or delay in their availability could have a material

adverse effect on our business.

Approximately 45% of the Company’s inventory

at December 31, 2023, consisted of parts having lead times ranging from 12 to 30 weeks. Some parts are maintained at high levels to assure

availability to meet production requirements, thus, accounting for a significant portion of the Company’s inventory value. Based

on past experience with component availability, distributor relationships, and inventory levels, we do not foresee shortages of materials.

However, developments in the electronic component marketplace, which are also used in cellular phones, personal technology devices and

other technology devices, have the potential of creating negative availability and delivery issues for components used by us. Although

we have been able to procure parts on a timely basis as of the date of this report, however procurement cannot be guaranteed in the future.

If shortages were to occur, material interruption of production and product delivery to customers would result.

The Company contracts with multiple companies for

manufacturing of sub-assemblies and some engineering assistance services as needed. By contracting with these companies, the Company is

able to avoid staff fluctuations associated with operating its own manufacturing and reduced capital investments in specialized manufacturing

equipment. We review the costs for the services provided by these companies and regularly submit Requests for Quotes (RFQ) to multiple

suppliers of these operations. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations”,

and “Financial Statements”.

ACCESS TO COMPANY INFORMATION

The Registrant does not issue annual or quarterly

reports to security holders other than the annual Form 10-K and quarterly Forms 10-Q as electronically filed with the Securities and Exchange

Commission (“SEC”) and available for viewing at www.sec.gov. Electronically filed reports may be accessed at www.sec.gov or

via the Company’s website at www.esteem.com. We make available on our website such reports as soon as reasonably practicable after

they are filed with the SEC.

EMPLOYEES

As of December 31, 2023, we employ 8 persons on a

full-time basis (5 in sales/marketing, 2 in engineering/manufacturing, and 1 in finance and administration). The Company’s operations

are dependent upon key members of its engineering and management personnel, which, if lost to the Company, could have a material adverse

effect on our business.

Item 1A. Risk Factors.

Our Common Stock value and our business, results

of operations, cash flows and financial condition are subject to various risks, including, but not limited to those set forth below. If

any of the following risks actually occurs, our Common Stock, business, results of operations, cash flows and financial condition could

be materially adversely affected. These risk factors should be carefully considered together with the other information in this Annual

Report on Form 10-K, including the risks and uncertainties described under the heading “Forward-Looking Statements.” This

list is not exhaustive of the factors that may affect the Company’s forward-looking statements. Some of the important risks and

uncertainties that could affect forward-looking statements are described further under the sections titled “Risk Factors and Uncertainties”,

“Description of Business” and “Management’s Discussion and Analysis” of this Annual Report. If any of the

events described in the risk factors below actually occur, our business, financial condition or results of operations could suffer significantly.

In such case, the value of your investment could decline, and you may lose all or part of the money you paid to buy our Common Stock.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual

events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

We cannot predict whether we will be able to sustain

revenue growth, profitability or positive cash flow. Our products are sold in highly competitive markets. Our revenues and operating

results may be negatively affected by technology changes in our markets, economic conditions in our markets, and the level of competition

in our markets.

Our marketing efforts may be unsuccessful due to

limited marketing and sales capabilities. Our limited national advertising and sales coverage may result in our markets not being

fully penetrated. The lack of market penetration may result in an adverse effect on our revenues. We must continue to develop and maintain

appropriate marketing, sales, technical, customer service and distribution capabilities, or enter into agreements with third parties to

provide these services, to successfully market our products. A failure to develop these capabilities or obtain third-party agreements

could adversely affect us.

We may be unable to produce products for sale if

we are unable to obtain component materials. Our products require highly specialized components, which are subject to rapid obsolescence,

limited availability and design change. Many of the components in our products are also used in cellular phone, pagers and other technology

devices. If we cannot obtain material to produce products, our sales revenues will be negatively impacted.

Our success depends on our ability to retain key

management personnel. The success of our Company depends in large part on our ability to attract and retain highly qualified management,

administrative, manufacturing, sales, and research and development personnel. Due to the specialized nature of our business, it may be

difficult to locate and hire qualified personnel. Our success is significantly dependent on the performance and continued service of key

members of Management, such as Chief Executive Officer, Dan Tolley and Chief Financial Officer Michael Eller, and certain other key employees.

If the services of any members of Management become unavailable for any reason, our business and prospects could be adversely affected.

Although we have been successful in retaining highly capable and qualified management in the past, there can be no assurance that we will

be able to do so in the future.

We may be adversely affected by government regulation.

The Federal Communication Commission (FCC) governs use of the products we sell. If the FCC were to implement rules detrimental to our

products and the markets in which they are offered, our operations would be negatively impacted.

Rapid technological changes in our industry may

adversely affect us if we do not keep pace with advancing technology. The wireless communication market is characterized by rapidly

advancing technology. Our success depends on our ability to keep pace with advancing technology, processes and standards, such as cellular

telephone based technology. We intend to continue to develop and enhance our products to meet perceived market opportunities. However,

our development efforts may be rendered obsolete by research efforts and technological advances made by others, and devices other than

those we currently produce may prove more advantageous.

The market for our Common Stock is limited and

our shareholders may have difficulty reselling their shares when desired or at attractive market prices. Our stock price and our listing

may make it more difficult for our shareholders to resell shares when desired or at attractive prices. Our Company stock trades on the

“over-the-counter” market and is listed on OTCQB tier of the OTC Markets. Our Common Stock has continued to trade in low volumes

and at low prices. Some investors view low-priced stocks as unduly speculative and therefore not appropriate candidates for investment.

Many institutional investors have internal policies prohibiting the purchase or maintenance of positions in low-priced stocks.

Item 1B. Unresolved Staff Comments.

None.

Item 1C. Cybersecurity.

The Company

employs several strategies for assessing, identifying, and managing material risks from cybersecurity threats. Components of this strategy

include the use of industry standard traffic monitoring tools, training users to detect, report, and prevent unusual behavior.

We employ

continuous monitoring mechanisms to detect and respond to cybersecurity threats promptly. Regular reports are generated as needed for

management and the board, providing insights into our cybersecurity posture, incidents, and remediation efforts. We conduct regular

assessments and testing to ensure the effectiveness of these controls, especially those related to the protection of financial information.

The implementation and management of these processes are integrated with the Company’s overall operational risk management processes

that seeks to limit our exposure to unnecessary risks across our operations.

Our

cybersecurity program is overseen by the Chief Financial Officer (CFO), who reports directly to the Chief Executive Officer (CEO) and

updates the Board of Directors (BOD) on cyber security matters.

Our employees

receive regular training on cybersecurity best practices, emphasizing the protection of financial information. We foster a culture of

cybersecurity awareness and responsibility throughout the organization.

We maintain a comprehensive incident response

plan that outlines the steps to be taken in the event of a cybersecurity incident. This plan includes procedures for promptly reporting

material incidents to the SEC, as required, and for communicating with affected stakeholders. Upon discovery of a cybersecurity incident,

the identifying party immediately notifies the Company's CFO. The CFO activates the incident response plan to include the following:

| • | Gather preliminary information about the cybersecurity incident. |

| • | CFO notifies the CEO and the Board of Directors of the cybersecurity threat. |

| • | The CFO allocates resources for disclosure if determined to be a material cybersecurity event. |

| • | The CFO consults with cybersecurity consultants and other involved parties to identify the undesirable

effects of the cybersecurity incident. |

| • | The CFO develops a recommendation for determination of materiality. |

| • | If disclosure is required, the material incident disclosure plan is executed by the CFO. |

Item 2. Properties.

We do not own any real property, plants, mines, or

any other materially important physical properties. The Company’s administrative offices, inventory and laboratories are located

in leased facilities at 415 N. Roosevelt Street, STE B1, Kennewick, Washington. The Company leases approximately 5,270 square feet of

office and laboratory space by a lease agreement with the Port of Kennewick in Kennewick, Washington. As of December 31, 2023, the total

monthly lease cost, including tax, is $3,925. The lease initially covered a period of two years, expiring September 2024.

We also own miscellaneous assets, such as computer

equipment, laboratory equipment, and furnishings. We maintain insurance in such amounts and covering such losses, contingencies and occurrences

deemed adequate to protect our property. Insurance coverage includes a comprehensive liability policy covering legal liability for bodily

injury or death of persons, and for property owned by, or under our control, as well as damage to the property of others. We also maintain

fidelity insurance which provides coverage to the Company in the event of employee dishonesty.

Item 3. Legal Proceedings.

EST is not a party to any material legal proceedings,

and, to management’s knowledge, no such proceedings are threatened or contemplated.

Item 4. Mine Safety Disclosure.

Not Applicable

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities.

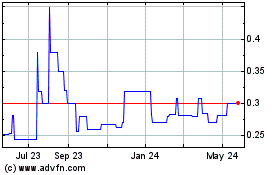

The closing price for our Common Stock (ELST) on the

OTCQB was $0.28 on February 27 2024.

There were 329 holders of record of our Common Stock

as of February 6, 2024.

Our stock transfer agent is EQ Shareowner Services,

320 Cherry Creek Drive South, Suite 435, Denver CO 80209.

The Company does not maintain any form of Equity Compensation

Plan.

Item 6. [Reserved]

Item 7. Management’s Discussion and Analysis of Financial Condition

and Results of Operations.

Management’s discussion and analysis is provided

as supplement to, and is intended to be read in conjunction with, the Company’s audited financial statements and the accompanying

integral notes (“Notes”) thereto. The following statements may be forward-looking in nature and actual results may differ

materially.

RESULTS OF OPERATIONS

GENERAL: We specialize in the manufacturing and development

of data radio products. The Company offers product lines which provide innovative communication solutions for applications not served

by existing conventional communication systems. We offer product lines in markets for process automation in commercial, industrial and

government arenas domestically as well as internationally. We market our products through direct sales, sales representatives, and domestic,

as well as foreign, resellers. Operations are sustained solely from revenues received through sales of its products and services.

FISCAL YEAR 2023 vs. FISCAL YEAR 2022

GROSS REVENUES: Total revenues for the fiscal year

2023 were $1,544 821 reflecting a decrease of 19.1% from $1,910,061 in gross revenues for fiscal year 2022. During the year ended December

31, 2023, one customer’s sales accounted for more than 10% of the total sales revenues. The decrease in total revenues is the result

of decreased product sales during 2023. Domestic Sales for the fiscal year were $1,488,685 compared to $1,697,261 in 2022. Sales to Foreign

Customers for the fiscal year were $56,137 compared to $212,800 in 2022. Product sales decreased to $1,517,921 in 2023, as compared to

2022 sales of $1,881,661, reflecting a decrease of 19.3%.

Interest revenues during 2023 increased to $23,151

from 2022 level of $5,217 due to the increased interest rates for the certificates of deposit held by the Company held during 2023. Other

income was $0 for the current year compared to $63,000 in 2022 for the employee retention tax credit.

As of December 31, 2023, the Company had sales backlog

of $55,636. The Company’s customers generally place orders on an “as needed basis”. Shipment of the Company’s

products is generally completed within 1 to 15 working days after receipt of customer orders, with the exception of ongoing, scheduled

projects, and custom designed equipment for specific customer applications.

COST OF SALES: Cost of Sales, as a percentage of net

sales, was 48.5% and 46.1% respectively, for 2023 and 2022. Cost of Sales variances are the result of differences in the product mix sold

and occurrences of obsolete inventory expense, as well as differences in the price discounting structure for the mix of products sold

during the period.

INVENTORY: The Company’s year-end inventory

values for 2023 and 2022 were as follows:

| | |

2023 | |

2022 |

| Parts | |

$ | 118,472 | | |

$ | 172,190 | |

| Work in progress | |

| 313,597 | | |

| 336,298 | |

| Finished goods | |

| 290,388 | | |

| 216,990 | |

| TOTAL | |

$ | 722,457 | | |

$ | 725,478 | |

The Company’s objective is to maintain inventory

levels as low as possible to provide maximum cash liquidity, while at the same time meet production and delivery requirements. Inventory

levels were increased during the year due to concerns with regards to supply chain issues with long-lead time items.

OPERATING EXPENSES: Operating expenses increased to

$979,648 in 2023 from 2022 levels of $950,338. Significant changes in expenses are comprised of the following components: increases in

salaries and benefits $30,236, travel $13,116, and professional services $10,827, offset by decrease in services purchased ($45,875).

LIQUIDITY AND CAPITAL RESOURCES

The Company’s revenues and expenses resulted

in a net loss of $160,783 for 2023, a decrease from net income of $146,531 for 2022. At December 31, 2023, the Company’s working

capital was $1,578,705 compared with $1,747,472 at December 31, 2022. The Company’s operations rely solely on the income generated

from sales. The Company’s major capital resource requirements are payment of employee salaries and benefits and maintaining inventory

levels adequate for production. Extended availability for components critical for production of the Company’s products, ranging

from 12 to 52 weeks, require the Company to maintain high inventory levels. It is management’s opinion that the Company’s

working capital as of December 31, 2023, is adequate for expected resource requirements for the next twelve months. During the twelve-month

period ending December 31, 2023, the Company had negative cash flow of ($264,866).

The Company’s current asset to current liability

ratio at December 31, 2023, was 16.2:1 compared to 8.6:1 at December 31, 2022. The increase in current asset ratio is the result of the

Company having decreased accounts payable for year-end 2023 when compared with year-end 2022. The Company’s liquid resources at

December 31, 2023, including cash and cash equivalent and certificates of deposits, were $886,252, compared to $1,002,817 at December

31, 2022. The net loss in 2023 resulted in a decrease of liquid resources. . The Company’s accounts receivable at December 31, 2023,

was $52,592, compared to $141,394 at December 31, 2022. Management believes that all Company accounts receivable as of December 31, 2023,

are collectible and does not have a reserve for uncollectable accounts.

The Company believes the level of risk associated

with customer receipts on export sales is minimal. Foreign shipments are made only after payment has been received or on Net 30 day credit

terms to established foreign companies with which the Company has distributor relationships. Foreign orders are generally filled as soon

as they are received therefore; foreign exchange rate fluctuations do not impact the Company.

Inventories at December 31, 2023, were $722,457, reflecting

a slight decrease from December 31, 2022, balance of $725,478.

We had capital expenditures of $19,768 during 2023,

$18,245 of this amount was used to develop an eCommerce website. The Company intends on investing in additional capital equipment as deemed

necessary to support development and manufacture of current and future products.

As of December 31, 2023, our current liabilities decreased

to $103,780 from $228,652 at December 31, 2022. The decrease in current liabilities was impacted by an decrease in accounts payable to

$37,355 from $138,996.

We had no off-balance sheet arrangements for the year

ended December 31, 2023.

Inflation had minimal adverse effect on the Company’s

operations during 2023. Minimal adverse effect is anticipated during 2024.

FORWARD LOOKING STATEMENTS: The above discussion may

contain forward-looking statements that involve a number of risks and uncertainties. These factors are more fully described in the “Risk

Factors” section of Item 1A of this Annual Report on Form 10-K. In addition to the factors discussed above, among other factors

that could cause actual results to differ materially are the following: competitive factors such as rival wireless architectures and price

pressures; availability of third party component products at reasonable prices; inventory risks due to shifts in market demand and/or

price erosion of purchased components; change in product mix, rapid advances in competing technologies and risk factors that are listed

in the Company’s reports filed with the Securities and Exchange Commission.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Smaller reporting companies are not required to provide the information

required by this Item.

Item 8. Financial Statements and Supplementary Data.

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

DBA ESTEEM WIRELESS MODEMS

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

AND

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022

TABLE OF CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

To the Board of Directors and Stockholders

Electronic Systems Technology, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of

Electronic Systems Technology, Inc. (“the Company”) as of December 31, 2023 and 2022, and the related statements of operations,

changes in stockholders’ equity and cash flows for the years then ended, and the related notes (collectively referred to as the

financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the

Company as of December 31, 2023 and 2022, and the results of its operations and its cash flows for the years then ended, in conformity

with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility

of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our

audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are

required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and

regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards

of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements

are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform,

an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal

control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal

control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess

the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond

to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating

the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the

current-period audit of the financial statements that were communicated or required to be communicated to the audit committee and that

(1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective,

or complex judgments. We determined that there are no critical audit matters.

Supplemental Information

The supplemental schedule of operating expenses for

the years ended December 31, 2023 and 2022 (“the supplemental information”) has been subjected to audit procedures performed

in conjunction with the audit of the Company’s financial statements. The supplemental information is the responsibility of the Company’s

management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the

underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information

presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental

information, including its form and content, is presented in conformity with accounting principles generally accepted in the United States

of America. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements

as a whole.

/s/ Assure CPA, LLC.

We have served as the Company’s auditor since

2012.

Spokane, Washington

Firm ID is 444

March 8, 2024

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

DBA ESTEEM WIRELESS MODEMS

BALANCE SHEETS

DECEMBER 31, 2023 AND 2022 |

| | |

| | | |

| | |

| | |

2023 | |

2022 |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 486,252 | | |

$ | 751,118 | |

| Certificates of deposit | |

| 400,000 | | |

| 251,699 | |

| Accounts receivable - net | |

| 52,592 | | |

| 141,394 | |

| Inventories - net | |

| 722,457 | | |

| 725,478 | |

| Prepaid expenses | |

| 19,278 | | |

| 42,627 | |

| Employee retention tax credit receivable (Note 10) | |

| — | | |

| 63,000 | |

| Accrued interest receivable | |

| 1,906 | | |

| 808 | |

| | |

| | | |

| | |

| Total Current Assets | |

| 1,682,485 | | |

| 1,976,124 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT – NET | |

| 18,255 | | |

| 914 | |

| | |

| | | |

| | |

| Right of use – asset, net of amortization (NOTE 8) | |

| 30,298 | | |

| 69,419 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 1,731,038 | | |

$ | 2,046,457 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 37,355 | | |

$ | 138,996 | |

| Accrued wages | |

| 4,188 | | |

| 24,777 | |

| Operating lease liability – current (NOTE 8) | |

| 30,773 | | |

| 39,120 | |

| Accrued vacation payable | |

| 21,243 | | |

| 16,846 | |

| Other accrued liabilities | |

| 10,221 | | |

| 8,913 | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 103,780 | | |

| 228,652 | |

| | |

| | | |

| | |

| Operating lease liability (NOTE 8) | |

| — | | |

| 30,457 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 103,780 | | |

| 259,109 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Common stock - $.001 par value 50,000,000 shares authorized, 4,946,502 and 4,946,502 shares issued and outstanding, respectively | |

| 4,947 | | |

| 4,947 | |

| Additional paid-in capital | |

| 933,105 | | |

| 932,412 | |

| Retained earnings | |

| 689,206 | | |

| 849,989 | |

| TOTAL STOCKHOLDERS’ EQUITY | |

| 1,627,258 | | |

| 1,787,348 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 1,731,038 | | |

$ | 2,046,457 | |

See accompanying notes to the financial statements.

|

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

DBA ESTEEM WIRELESS MODEMS

STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

| | |

| |

|

| | |

2023 | |

2022 |

| | |

| |

|

| SALES – NET | |

$ | 1,544,821 | | |

$ | 1,910,061 | |

| | |

| | | |

| | |

| COST OF SALES | |

| 749,107 | | |

| 881,409 | |

| | |

| | | |

| | |

| GROSS PROFIT | |

| 795,714 | | |

| 1,028,652 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| 979,648 | | |

| 950,338 | |

| | |

| | | |

| | |

| OPERATING INCOME/(LOSS) | |

| (183,934 | ) | |

| 78,314 | |

| | |

| | | |

| | |

| OTHER INCOME: | |

| | | |

| | |

| Interest income | |

| 23,151 | | |

| 5,217 | |

| Gain on Employee Retention Credit (Note 10) | |

| — | | |

| 63,000 | |

| TOTAL OTHER INCOME | |

| 23,151 | | |

| 68,217 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| INCOME TAX PROVISION (BENEFIT) | |

| — | | |

| — | |

| | |

| | | |

| | |

| NET INCOME/(LOSS) AFTER INCOME TAXES | |

$ | (160,783 | ) | |

$ | 146,531 | |

| | |

| | | |

| | |

| NET INCOME/(LOSS) PER SHARE, BASIC AND DILUTED | |

$ | (0.03 | ) | |

$ | 0.03 | |

| | |

| | | |

| | |

| WEIGHTED AVERAGE SHARES OUTSTANDING, BASIC AND DILUTED | |

| 4,946,502 | | |

| 4,946,502 | |

See accompanying notes to the financial statements.

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

DBA ESTEEM WIRELESS MODEMS

STATEMENTS OF CHANGES IN STOCKHOLDERS’

EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

| | |

| |

| |

| |

| |

|

| | |

| |

| |

Additional | |

| |

|

| | |

Common Stock | |

Paid-In | |

Retained | |

|

| | |

Shares | |

Amount | |

Capital | |

Earnings | |

Total |

| | |

| |

| |

| |

| |

|

| BALANCE AT DECEMBER 31, 2021 | |

| 4,946,502 | | |

$ | 4,947 | | |

$ | 931,412 | | |

$ | 703,458 | | |

$ | 1,640,817 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| — | | |

| — | | |

| — | | |

| 146,531 | | |

| 146,531 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE AT DECEMBER 31, 2022 | |

| 4,946,502 | | |

$ | 4,947 | | |

$ | 932,412 | | |

$ | 849,989 | | |

$ | 1,787,348 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (160,783 | ) | |

| (160,783 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share based compensation | |

| — | | |

| — | | |

| 693 | | |

| — | | |

| 693 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE AT DECEMBER 31, 2023 | |

| 4,946,502 | | |

$ | 4,947 | | |

$ | 933,105 | | |

$ | 689,206 | | |

$ | 1,627,258 | |

See accompanying notes to the financial statements.

``

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

DBA ESTEEM WIRELESS MODEMS

STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

| | |

| |

|

| | |

2023 | |

2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net income/(loss) | |

$ | (160,783 | ) | |

$ | 146,531 | |

| Noncash expenses included in net income: | |

| | | |

| | |

| Depreciation and amortization | |

| 2,427 | | |

| 444 | |

| Share based compensation | |

| 693 | | |

| — | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 88,802 | | |

| 24,909 | |

| Inventories - net | |

| 3,021 | | |

| (223,645 | ) |

| Prepaid expenses | |

| 23,349 | | |

| (18,241 | ) |

| Employee retention tax credit receivable | |

| 63,000 | | |

| — | |

| Accrued interest receivable | |

| (1,098 | ) | |

| (773 | ) |

| Accounts payable | |

| (101,641 | ) | |

| 67,351 | |

| Other accrued liabilities and wages | |

| (14,567 | ) | |

| 21,581 | |

| Net Cash used by Operating Activities | |

| (96,797 | ) | |

| (44,843 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Certificates of deposits purchased | |

| (1,550,000 | ) | |

| (1,002,283 | ) |

| Certificates of deposits redeemed | |

| 1,401,699 | | |

| 1,150,584 | |

| Purchase of equipment | |

| (19,768 | ) | |

| — | |

| Net Cash provided (used) by Investing Activities | |

| (168,069 | ) | |

| 148,301 | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Principal payments on CARES Act loan payable (round 1) | |

| — | | |

| (7,956 | ) |

| Net Cash used by Financing Activities | |

| — | | |

| (7,956 | ) |

| | |

| | | |

| | |

| NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS | |

| (264,866 | ) | |

| 95,502 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR | |

| 751,118 | | |

| 655,616 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS AT END OF YEAR | |

$ | 486,252 | | |

$ | 751,118 | |

| | |

| | | |

| | |

| Noncash investing and financing activities: | |

| | | |

| | |

| Recognition of operating lease liability and right of use asset | |

$ | — | | |

$ | 78,757 | |

See accompanying notes to the financial statements.

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

NOTES TO FINANCIAL STATEMENTS

| |

1. |

Organization and Summary of Significant Accounting Policies |

Business Organization

The Company was incorporated under the laws

of the State of Washington on February 10, 1984, primarily to develop, produce, sell and distribute wireless modems that will allow communication

between peripherals via radio frequency waves.

Effective September 13, 2007, the Company

announced their establishment of a “doing business as” or dba structure, based on the Company’s registered trade name

of ESTeem® Wireless Modems.

Basis of Presentation and Accounting

Estimates

The preparation of financial statements

are prepared in conformity with generally accepted accounting principles in the United States which requires management to make estimates

and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Estimates used in the accompanying financial

statements include the allowance for doubtful accounts receivable, inventory obsolescence, useful lives of depreciable assets, share-based

compensation, and deferred income taxes. Actual results could differ from those estimates.

Concentrations and Credit Risks

The Company places its cash with three major

financial institutions. During the period, the Company had cash balances that were in excess of federally insured limits.

The Company purchases certain key components

necessary for the production of its products from a limited number of suppliers. The components provided by the suppliers could be replaced

or substituted by other products. It is possible that if this action became necessary, an interruption of production and/or material cost

expenditures could take place.

Revenue Recognition

The Company recognizes revenue when it has

satisfied the performance obligation required under a contract with the customer. A performance obligation is a promise in a contract

with a customer to transfer a distinct good or service to the customer. Our contracts with customers contain a single performance obligation.

A contract’s transaction price is recognized as revenue when, or as, the performance obligation is satisfied.

Performance obligations for product sales

are satisfied as of a point in time. Revenue is recognized when control of the product transfers to the customer, generally upon product

shipment. Performance obligations for site support and engineering services are satisfied over-time if the customer receives the

benefits as we perform work and we have a contractual right to payment. Revenue recognized on an over-time basis is based on costs incurred

to date relative to milestones and total estimated costs at completion to measure progress.

The Company considers the contractual consideration

payable by the customer when determining the transaction price of each contract. Revenue is recorded net of charges for certain sales

incentives and discounts, and applicable state and local sales taxes, which represent components of the transaction price. Charges are

estimated by us upon shipment of the product based on contractual terms, and actual charges typically do not vary materially from our

estimates. Shipping estimates are determined by utilizing shipping costs provided by the various service providers websites based on number

of packages, weight and destination. Shipping costs are included in the cost of goods sold as the revenue is captured in total sales.

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

NOTES TO FINANCIAL STATEMENTS

The Company receives payments from customers

based on the terms established in our contracts. When amounts are billed and collected before the services are performed, they are included

in deferred revenues. The Company does not generally sell its products with the right of return. Therefore, returns are accounted for

when they occur and are accepted. Products sold to foreign customers are shipped after payment is received in U.S. funds, unless an established

distributor relationship exists, or the customer is a foreign branch of a U.S. company.

The Company warrants its products as free

of manufacturing defects and provides a refund of the purchase price, repair or replacement of the product for a period of one year from

the date of installation by the first user/customer. No allowance for estimated warranty repairs or product returns has been recorded

due to the Company’s historical experience of repairs and product returns.

Financial Instruments

The Company’s financial instruments

are cash, cash equivalents, and certificates of deposit. The recorded values of cash, and certificates of deposit approximate their fair

values based on their short-term nature.

Cash and Cash Equivalents

Cash and cash equivalents are cash purchased

with original maturities of three months or less.

Allowance for Uncollectible Accounts

The Company uses the allowance method to

account for estimated uncollectible accounts receivable. Accounts receivable are presented net of an allowance for doubtful accounts.

As of December 31, 2023 and 2022, the Company’s estimate of doubtful accounts was zero 0.

The Company’s policy for writing off past due accounts receivable is based on the time past due and responses received from the

subject customer.

Inventories

Inventories are stated at lower of direct

cost or market. Cost is determined on an average cost basis that approximates the first-in, first-out (FIFO) method. Market is determined

based on net realizable value and consideration is given to obsolescence.

Property and Equipment

Property and equipment are carried at cost.

Major betterments are capitalized and de minimis purchases are expensed. Depreciation is computed using the straight-line method over

the estimated useful lives of the assets. The useful life of property and equipment for purposes of computing depreciation is three to

seven years. When the Company sells or otherwise disposes of property and equipment, a gain or loss is recorded in the statement of operations.

The cost of improvements that extend the life of property and equipment is capitalized. The Company periodically reviews its long-lived

assets for impairment and, upon indication that the carrying value of such assets may not be recoverable, recognizes an impairment loss

by a charge against current operations.

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

NOTES TO FINANCIAL STATEMENTS

Certificates of Deposit

Certificates of deposit with original maturities

ranging from one month to twelve months were $400,000 and $251,699 at December 31, 2023 and 2022, respectively.

Leases

Contracts that meet the definition of a

lease are classified as operating or financing leases and are recorded on the balance sheet as both a right-of-use asset and lease liability,

calculated by discounting fixed lease payments over the lease term at the rate implicit in the lease or the Company’s incremental

borrowing rate. Lease liabilities are increased by interest and reduced by payments each period, and the right-of-use asset is amortized

over the lease term. For operating leases, interest on the lease liability and the amortization of the right-of-use asset result in straight-line

rent expense over the lease term. Variable lease expenses are recorded when incurred.

Income Taxes

The provision (benefit) for income taxes

is computed on the pretax income (loss) based on the current tax law. Deferred income taxes are recognized for the tax consequences in

future years of differences between the tax basis of assets and liabilities and their financial reporting amounts at each year-end based

on enacted tax laws and statutory tax rates. The Company evaluates positive and negative information when estimating the valuation allowance

for deferred tax assets. For tax positions that meet the more likely than not recognition threshold a deferred tax asset is recognized.

Research and Development

Research and development costs are recognized

as operating expenses when incurred. Research and development expenditures for new product development and improvements of existing products

by the Company for 2023 and 2022 were $121,896 and $163,189, respectively.

Advertising Costs

Costs incurred for producing and communicating

advertising are recognized as operating expenses when incurred. Advertising costs for the years ended December 31, 2023 and 2022 were

$10,038 and $8,895, respectively.

Earnings Per Share

The Company is required to have dual presentation

of basic earnings per share (“EPS”) and diluted EPS. Basic EPS is computed as net income (loss) divided by the weighted

average number of common shares outstanding for the period. Diluted EPS is calculated based on the weighted average number of common shares

outstanding during the period plus the effect of potentially dilutive common stock equivalents.

Potentially dilutive common stock equivalents

consist of 225,000 and 180,000 stock options outstanding as of December 31, 2023 and 2022, respectively. As of December 31, 2023 and 2022,

the potentially dilutive stock options were not included in the calculation of the diluted weighted average number of shares outstanding

or diluted EPS as their effect would have been anti-dilutive.

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

NOTES TO FINANCIAL STATEMENTS

Share-Based Compensation

Share-based payments to employees, including

grants of employee stock options, are measured at fair value and expensed in the statement of operations over the vesting period. In addition

to the recognition of expense in the financial statements, any excess tax benefits received upon exercise of options will be presented

as a financing activity inflow rather than an adjustment of operating activity in the statement of cash flows. The fair value of stock

options is determined using a Black-Scholes valuation model. Option pricing models require the input of subjective assumptions including

the length of time employees will retain their vested stock options before exercising them, expected share price volatility, and interest

rate. Changes in the input assumptions can materially affect the fair value estimate and the Company's net loss.

Fair Value Measurements

When required to measure assets or liabilities

at fair value, the Company uses a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used.

The Company determines the level within the fair value hierarchy in which the fair value measurements in their entirety fall. The categorization

within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Level 1 uses

quoted prices in active markets for identical assets or liabilities, Level 2 uses significant other observable inputs, and Level 3 uses

significant unobservable inputs. The amount of the total gains or losses for the period are included in earnings that are attributable

to the change in unrealized gains or losses relating to those assets and liabilities still held at the reporting date. At December 31,

2023 and 2022, the Company has no assets or liabilities subject to fair value measurements on a recurring basis.

New Accounting Pronouncements

In November 2023, the Financial Accounting

Standards Board (“FASB”) issued Accounting Standards Update 2023-07 (“ASU 2023-07”), Segment Reporting (Topic

280): Improvements to Reportable Segment Disclosures, amending reportable segment disclosure requirements to include disclosure of incremental

segment information on an annual and interim basis. Among the disclosure enhancements are new disclosures regarding significant segment

expenses that are regularly provided to the chief operating decision-maker and included within each reported measure of segment profit

or loss, as well as other segment items bridging segment revenue to each reported measure of segment profit or loss. The amendments in

ASU 2023-07 are effective for fiscal years beginning after December 15, 2023, and for interim periods within fiscal years beginning after

December 15, 2024, and are applied retrospectively. Early adoption is permitted. We are currently evaluating the impact of this update

on our financial statements and disclosures.

In December 2023, the FASB issued Accounting

Standards Update 2023-09 (“ASU 2023-09”), Income Taxes (Topic 740): Improvement to Income Tax Disclosures, amending income

tax disclosure requirements for the effective tax rate reconciliation and income taxes paid. The amendments in ASU 2023-09 are effective

for fiscal years beginning after December 15, 2024 and are applied prospectively. Early adoption and retrospective application of the

amendments are permitted. We are currently evaluating the impact of this update on our financial statements and disclosures.

Other accounting standards issued by the

Financial Accounting Standards Board that do not require adoption until a future date are not expected to have a material impact on the

financial statements upon adoption.

ELECTRONIC SYSTEMS TECHNOLOGY, INC.

NOTES TO FINANCIAL STATEMENTS

Inventories consist of the following:

| Schedule of inventories | |

| |

|

| | |

2023 | |

2022 |

| Parts | |

$ | 118,472 | | |

$ | 172,190 | |

| Work in progress | |

| 313,597 | | |

| 336,298 | |

| Finished goods | |

| 290,388 | | |

| 216,990 | |

| Total inventories | |

$ | 722,457 | | |

$ | 725,478 | |

Included in the above amounts are reserves

for obsolete inventories of $8,935 and $8,716 at December 31, 2023 and 2022, respectively.

| |

3. |

Property and Equipment |

Property and equipment consist of the following

at December 31, 2023 and 2022:

| Schedule of property and equipment | |

| |

|

| | |

2023 | |

2022 |

| Laboratory equipment | |

$ | 554,740 | | |

$ | 522,575 | |

| Software | |

| 18,245 | | |

| 35,028 | |