Excelsior Releases Positive Prefeasibility Study Demonstrating

$1.24 Billion Pre-Tax NPV and 59.7% Pre-Tax IRR for the Gunnison

Copper Project

PHOENIX, ARIZONA--(Marketwired - Jan 17, 2014) - Excelsior

Mining Corp. (TSX-VENTURE:MIN)(FRANKFURT:3XS)(OTCQX: EXMGF)

("Excelsior" or the"Company") is pleased to announce the results of

a comprehensive Prefeasibility Study ("PFS") on the North Star

Deposit of the Gunnison Copper Project, located in southern

Arizona. The PFS was completed by M3 Engineering & Technology

Corporation ("M3") of Tucson, AZ and is effective as of January 13,

2014. The National Instrument ("NI") 43-101 compliant Report (the

"Report") summarizing the results of the PFS will be filed on SEDAR

and Excelsior's website within 45 days of this news release.

Results of the PFS disclosed in this press release are in USD and

pre-tax (except where otherwise indicated).

Highlights of the

North Star Gunnison Copper Project PFS "Acid Plant" option

include:

- Pre-tax Net Present Value ("NPV") of $1.24 billion (after-tax

$0.826 billion) at a 7.5% discount rate (using a copper price of

$2.75/lb)

- Pre-tax Internal Rate of Return ("IRR") of 59.7% (after-tax

44.7%)

- Pre-tax payback period of 1.8 years (after-tax 2.4 years)

- Initial estimated capital cost (excluding sustaining capital)

of $284.74 million

- Average life-of-mine operating costs of US$0.68 per pound

- Other costs of $0.12 per pound, including Royalties of $0.029

per pound

- Annual production rate of 110 million pounds of copper for the

first 14 years, then declining for a 20 year mine life, with a

total of 1.682 billion pounds of copper produced over the life of

the mine.

"The completion of a

positive Prefeasibility Study is a significant de-risking event in

Excelsior's development and we are very pleased with the results.

The results surpass the robust economic potential indicated by the

2011 Preliminary Economic Assessment and support copper extraction

of the North Star Deposit through in-situ recovery with the

potential to generate exceptional financial returns," says Mark J.

Morabito, Chairman of Excelsior. "With initial production expected

to commence in Q4 2016 we are looking forward to beginning the next

phase of development."

Commenting on the

results, President and CEO, Stephen Twyerould said, "With the

completion of this major milestone, the commercial case for the

Gunnison Copper Project has grown even stronger. The Prefeasibility

Study has confirmed the robust economics and technical viability

for what has the potential to be one of the lowest cost copper

producers in North America."

Financial

Analysis

As highlighted in

the tables below, the PFS demonstrates robust project economics in

both the "Acid Plant" and "Non-Acid Plant" scenarios, with the Acid

Plant option adding an additional $174.2 million to the project

pre-tax NPV. Based on an initial annual production rate of 110

million pounds, the PFS indicates that including an Acid Plant as a

component of the project, generates a pre-tax NPV of $1.24 billion,

at a cash flow discount rate of 7.5%. The pre-tax IRR for this

option is 59.7% with a payback period of 1.8 years. On an after-tax

basis, the PFS shows an NPV7.5 of $825.83 million, IRR of 44.7% and

a payback period of 2.4 years.

Without an Acid

Plant, the project still has a significant pre-tax NPV7.5 of $1.06

billion and an IRR of 61.4%, (after-tax NPV7.5 of $721.41 million

and an IRR of 46.1%). The after-tax analysis is based on a number

of assumptions which will be fully set out in the Report. The level

of accuracy of the PFS is considered to be +/-20%.

Both scenarios used

the following parameters over the 20 year life of the project:

- copper selling price of $2.75 per pound,

- total copper recovery of approximately 47% (based on a

combination of metallurgical recovery and sweep efficiency),

- average of 8.14 pounds of acid consumed for every pound of

copper produced,

- acid price of $45.70/ton for the Acid Plant option and $125/ton

for the Non-Acid Plant option,

- state tax rate of 6.97%, and

- a federal tax rate of 35%.

|

PRE-TAX |

Acid Plant |

|

Non-Acid Plant |

|

|

IRR |

59.7 |

% |

61.4 |

% |

|

Payback (years) |

1.8 |

|

1.5 |

|

|

NPV (million $) |

|

|

|

|

|

Discount Rate |

|

|

|

|

|

0% |

2,377.9 |

|

1,961.7 |

|

|

5% |

1,525.7 |

|

1,295.1 |

|

|

7.5% |

1,238.6 |

|

1,064.3 |

|

|

10% |

1,013.4 |

|

880.8 |

|

|

AFTER-TAX |

Acid Plant |

|

Non-Acid Plant |

|

|

IRR |

44.7 |

% |

46.1 |

% |

|

Payback (years) |

2.4 |

|

2.0 |

|

|

NPV (million $) |

|

|

|

|

|

Discount Rate |

|

|

|

|

|

0% |

1,625.4 |

|

1,360.0 |

|

|

5% |

1,028.8 |

|

887.2 |

|

|

7.5% |

825.8 |

|

721.4 |

|

|

10% |

666.0 |

|

588.8 |

|

Total initial

capital expenditures for the "Acid Plant" option (including

contingency) are estimated at $284.74 million. Sustaining capital,

which includes the acid plant built in year three, water treatment

facilities and production wellfield are estimated at $602.4

million. Net closure costs are estimated at $44.5 million. For the

"Non-Acid Plant" option, total initial capital expenditures

(including contingency) are estimated at $284.74 million.

Sustaining capital, which includes the water treatment facilities

and production wellfield are estimated at $528.8 million. Net

closure costs are estimated at $42.3 million.

The PFS assumes a

copper selling price of $2.75/lb. Average life-of-mine operating

direct cash costs are estimated at $0.68/lb for the "Acid Plant"

option and $0.98/lb for the "Non-Acid Plant" option.

|

|

Acid Plant |

Non-Acid Plant |

|

Copper Cathode sold (MMlb) |

1,682 |

1,682 |

|

Copper Price ($/lb) |

2.75 |

2.75 |

|

Gross Revenue (million $) |

4,625.9 |

4,625.9 |

|

Operating Costs |

(million $) |

Cost/lb |

(million $) |

Cost/lb |

|

Production (Wellfield) |

449.3 |

0.27 |

935.5 |

0.56 |

|

SXEW |

355.7 |

0.21 |

367.6 |

0.22 |

|

Water Treatment Plant |

198.5 |

0.12 |

198.5 |

0.12 |

|

G&A |

147.3 |

0.09 |

147.3 |

0.09 |

|

Direct Operating Cash Costs |

1,150.7 |

0.68 |

1,648.8 |

0.98 |

|

Royalties |

48.3 |

0.03 |

48.3 |

0.03 |

|

Other Production Expenses |

161.8 |

0.09 |

153.5 |

0.09 |

|

Initial Capital Costs |

(million $) |

Cost/lb |

(million $) |

Cost/lb |

|

Production (Wellfield) |

75.3 |

0.04 |

75.3 |

0.04 |

|

SXEW + Infrastructure |

186.3 |

0.11 |

186.3 |

0.11 |

|

Owners Costs |

23.2 |

0.01 |

23.2 |

0.01 |

|

Sub-total Initial Capital Costs |

284.7 |

0.17 |

284.7 |

0.17 |

|

Sustaining Capital Costs |

(million $) |

Cost/lb |

(million $) |

Cost/lb |

|

Production (Wellfield) |

440.2 |

0.26 |

440.2 |

0.26 |

|

Plant + Infrastructure |

162.2 |

0.10 |

88.6 |

0.05 |

|

Sub-total Sustaining Capital Costs |

602.4 |

0.36 |

528.8 |

0.31 |

|

Taxes |

752.5 |

0.45 |

601.7 |

0.36 |

Mineral Resources

and Mineral Reserves

Mineral Resource

Estimate

The mineral resource

estimate for the North Star Deposit is based on results from 88

drill holes totalling 129,272 feet (ft). The estimate is consistent

with the CIM definitions referred to in NI 43-101. Mr. Herb

Welhener, RM-SME, of Independent Mining Consultants, Inc. ("IMC")

of Tucson, Arizona is a Qualified Person as defined by NI 43-101

and is responsible for reviewing and approving the mineral resource

and mineral reserve estimates and the QA/QC associated with the

estimates. Mr. Welhener is independent of the Company. He has

verified, reviewed and approved the technical disclosure contained

in the 'Mineral Resources and Mineral Reserves' section of this

news release and the underlying sampling, analytical and test data.

The mineral resource estimate has been prepared using a 0.05% Total

Cu cut-off grade and is effective as of January 13, 2014.

| North Star Resources (Oxide and Transition at 0.05%

cut-off) |

|

Category |

Short Tons (million) |

Total Copper % |

Pounds of Cu (million) |

|

Measured |

158 |

0.38 |

1,205 |

|

Indicated |

525 |

0.26 |

2,704 |

|

Total M&I |

683 |

0.29 |

3,909 |

|

|

|

|

|

|

Inferred |

338 |

0.21 |

1,397 |

The mineral resource

estimate is contained within a block model of the North Star

deposit covering a surface area of 3.30 square miles and to a

maximum depth of 2,575 feet below the topographic surface.

The major geologic

formations and oxidization types are incorporated into the block

model based on the drill hole intercept data. The total copper

grades are estimated using an ordinary kriging estimation technique

from 25 ft drill hole composite data. The grade estimate for the

sedimentary units uses a 700 ft circular by 50 ft search distance

dipping 30 degrees east to parallel the general dip of the

sedimentary units. The grade estimation respected the contacts of

the various sedimentary units. The 700 ft distance is 70% of the

variogram range. The total copper grades in the non-sedimentary

units were estimated using a 500 ft spherical search. No copper

grades are estimated in the overburden or un-mineralized rock

units. Copper grade estimates based on eight or more holes are

classified as Measured, grades based on three to seven holes are

Indicated and grades based on less than three holes are

Inferred.

All samples are

prepared from manually split half-core sections on site in Arizona.

Split drill core samples are then sent to Skyline Assayers &

Laboratories in Tucson, Arizona for Total Copper and Sequential

Copper analyses. Standards, blanks, and duplicate assays are

included at regular intervals in each sample batch submitted from

the field as part of an ongoing Quality Assurance/Quality Control

Program.

Mineral Reserve

Estimate

The PFS mineral

reserve is based on an economic analysis of the mineral resource

using the costs developed during the 2011 PEA, test work to

estimate the recovery factors and a $2.75/lb copper price. The

economic optimization was performed on Measured and Indicated

Resources. EBIT (earnings before interest and tax) was calculated

on a block by block basis based on economic parameters. Consistent

blocks (in vertical and horizontal directions) at a cut-off grade

of 0.05% total Cu with a positive EBIT values that were greater

than the capital cost of drilling and establishing the wells

required for each column of blocks were included in the reserve.

Total Cu% was selected for the mineral reserve estimate. The

mineral reserve was estimated after applying engineering and

operational design parameters which removed the thinner and deeper

portions of the mineral resource. Internal dilution has been

included in the final mineral reserve estimate. IMC is of the

opinion that the mineral reserve estimate derived in this PFS

reasonably quantifies the economical ore mineralization of the

North Star Deposit. The reserve estimate is as of January 13, 2014

and the mineral reserves presented in the table below are included

in the mineral resource estimate set out above.

| North Star Mineral Reserves (Oxide and Transition at

0.05% cut-off) |

|

Category |

Short Tons (million) |

Total Copper % |

Pounds of Cu (million) |

|

Probable |

632 |

0.29 |

3,614 |

Excelsior is not

aware of any environmental, permitting, legal, title, taxation,

socio-political, marketing or other issues which may materially

affect the mineral resource and mineral reserve estimates. The

production schedule of the PFS recovers approximately 47% of the

mineral reserve.

Project Summary

The Gunnison Copper

Project is located in a remote section of Cochise County about 65

miles east of Tucson, Arizona in the Johnson Camp Mining District.

The property is within the copper porphyry belt of Arizona. The

focus of the project is the North Star deposit, which currently

hosts a total Measured and Indicated mineral resource of 3.91

billion pounds of copper (683 M tons at 0.29%) and an Inferred

mineral resource of 1.40 billion pounds of copper (338 M tons at

0.21%). The Probable mineral reserves for the North Star Deposit

are 3.61 billion pounds of copper (632 M tons at 0.29%). This oxide

and transition portion of the mineral reserve has the potential to

be mined using in-situ recovery methods.

The proposed

project, as stated in the PFS, includes the following

components:

- The North Star copper deposit.

- The Wellfield including injection, recovery, observation and

perimeter wells and related infrastructure.

- The acid plant, including sulfur and sulfuric acid handling and

cogeneration plant.

- Processing infrastructure including a Solvent

Extraction/Electrowinning ("SXEW") Plant and pipe corridors.

- Water treatment facility and facility ponds.

- Ancillary infrastructure to support the mine and process plant

(electrical substation, administration/office buildings and

transmission lines).

- The rail infrastructure and rail car storage.

The proposed project

will produce 110 million pounds of copper per year for the first 14

years, then declining to year 20. Processing will take place at the

Gunnison site and will involve solvent extraction and

electrowinning to produce pure copper cathode sheets.

Technical Report and

Qualified Person

An NI 43-101

Technical Report will be filed on SEDAR and on Excelsior's website

within 45 days of the date of this news release. The Report will

consist of a summary of the Prefeasibility Study. The Report is

being prepared under the supervision of Conrad Huss, P.E. of M3

Engineering & Technology Corporation, Tucson, Arizona, who is a

qualified person that is independent of the Company. The Report

will also receive contributions from the following additional

qualified persons, who are also independent of the Company:

- Dr. Ronald J. Roman of Leach, Inc., Tucson, Arizona (metallurgy

and leaching recovery).

- Peter Lenton, P.E. of Haley & Aldrich, Phoenix, Arizona

(hydrology, extraction methods, production schedule).

- Peter Lemke, P.E. of Golder Associates Inc., Lakewood, Colorado

(water treatment and related facilities).

- Mr. Herb Welhener, RM-SME, of IMC of Tucson, Arizona (geology,

mineral resource and reserve).

Each of the

qualified persons has reviewed and approved the technical

information contained in this news release that is relevant to his

area of responsibility and verified the data underlying such

technical information.

About Excelsior

Excelsior is a

mineral exploration and development company that is advancing the

Gunnison Copper Project. The Excelsior management team consists of

experienced professionals with proven track records of advancing

mining projects into production.

Prior to the release

of the Report on the PFS results, additional information about the

Gunnison Copper Project can be found in the technical report filed

on SEDAR at www.sedar.com entitled: "Gunnison Copper Project

Preliminary Economic Assessment, NI 43-101 Technical Report" dated

November 18, 2011.

For more information

on Excelsior, please visit our website at

www.excelsiormining.com.

ON BEHALF OF THE

EXCELSIOR BOARD

Stephen Twyerould,

President & CEO

Cautionary Note

Regarding Forward-Looking Information

This news

release contains "forward-looking information" concerning

anticipated developments and events that may occur in the future.

Forward looking information contained in this news release

includes, but is not limited to, statements with respect to: (i)

the estimation of mineral resources and mineral reserves; (ii) the

robust economics, potential returns associated with the Gunnison

Project, (iii) the technical viability of the Gunnison Project;

(iv) the market and future price of copper; (v) expected

infrastructure requirements; (vi) the results of the PFS including

statements about future production, future operating and capital

costs, the projected IRR, NPV, payback period, construction

timelines, permit timelines and production timelines for the Kami

Property, (vii) expected acid consumption rates; and (viii) the

ability to mine the Gunnison Project using in-situ recovery mining

techniques.

In certain

cases, forward-looking information can be identified by the use of

words such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or

"will be taken", "occur" or "be achieved" suggesting future

outcomes, or other expectations, beliefs, plans, objectives,

assumptions, intentions or statements about future events or

performance. Forward-looking information contained in this news

release is based on certain factors and assumptions regarding,

among other things, the estimation of mineral resources and mineral

reserves, the realization of resource and reserve estimates, copper

and other metal prices, the timing and amount of future exploration

and development expenditures, the estimation of initial and

sustaining capital requirements, the estimation of labour and

operating costs, the availability of necessary financing and

materials to continue to explore and develop the Gunnison Project

in the short and long-term, the progress of exploration and

development activities, the receipt of necessary regulatory

approvals, the completion of the permitting process, the estimation

of insurance coverage, and assumptions with respect to currency

fluctuations, environmental risks, title disputes or claims, and

other similar matters. While the Company considers these

assumptions to be reasonable based on information currently

available to it, they may prove to be incorrect.

Forward looking

information involves known and unknown risks, uncertainties and

other factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking information. Such factors include risks

inherent in the exploration and development of mineral deposits,

including risks relating to changes in project parameters as plans

continue to be redefined including the possibility that mining

operations may not commence at the Gunnison Project, risks relating

to variations in mineral resources and reserves, grade or recovery

rates resulting from current exploration and development

activities, risks relating to the ability to access infrastructure,

risks relating to changes in copper and other commodity prices and

the worldwide demand for and supply of copper and related products,

risks related to increased competition in the market for copper and

related products and in the mining industry generally, risks

related to current global financial conditions, uncertainties

inherent in the estimation of mineral resources, access and supply

risks, reliance on key personnel, operational risks inherent in the

conduct of mining activities, including the risk of accidents,

labour disputes, increases in capital and operating costs and the

risk of delays or increased costs that might be encountered during

the development process, regulatory risks, including risks relating

to the acquisition of the necessary licenses and permits,

financing, capitalization and liquidity risks, including the risk

that the financing necessary to fund the exploration and

development activities at the Gunnison Project may not be available

on satisfactory terms, or at all, risks related to disputes

concerning property titles and interest, environmental risks and

the additional risks identified in the "Risk Factors" section of

the Company's reports and filings with applicable Canadian

securities regulators.

Although the

Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from

those described in forward-looking information, there may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking information. The

forward-looking information is made as of the date of this news

release. Except as required by applicable securities laws, the

Company does not undertake any obligation to publicly update or

revise any forward-looking information.

Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release, and no

securities regulatory authority has either approved or disapproved

of the contents of this release.

Excelsior Mining Corp.JJ JennexVice President, Corporate

Affairs604-681-8030

x240info@excelsiormining.comwww.excelsiormining.com

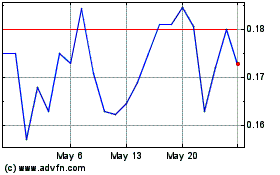

Gunnison Copper (QB) (USOTC:EXMGF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gunnison Copper (QB) (USOTC:EXMGF)

Historical Stock Chart

From Jan 2024 to Jan 2025