First Colombia Gold Provides Update on Letter of Intent to Acquire Oil and Gas Assets

30 June 2014 - 11:45PM

Business Wire

First Colombia Gold (OTCQB: FCGD) (“First Colombia” or “The

Company”) is pleased to provide an update on its due diligence in

relation to the signed a Letter of Intent (“LOI”) to acquire a

nineteen and a half percent (19.5%) interest in three private oil

companies located in south central Kentucky.

As previously announced, the signed LOI outlines the structure

of the transaction, which will give First Colombia a working

interest in over 50 active producing wells, ownership in 39 active

oil and gas leases covering 5,322 acres, as well as full title and

ownership to six acres of real estate, which includes a 6800 sq.

ft. office complex and maintenance facility. The LOI also includes

drilling and operating equipment, including two drilling rigs and

six completion rigs.

Over the past month, the company has been conducting a thorough

evaluation of all of the properties which have included site

visits, personnel interviews, document review and a physical

inspection of titles, deeds and assets. Based upon our thorough

analysis, we can now confirm that there are an additional 105 acres

of land that will be included in the acquisition in which The

Company will own outright in addition to also owning the mineral

rights. Additionally, there are 5 of the 39 leases that already

have reserve studies completed on the properties that show over 3

million barrels of proven oil reserves on the properties. Perhaps

the most exciting confirmation, however, is that these leases being

acquired produced over 12,000 barrels of crude in 2013 and are on

track to match that production output in 2014. That means that

these leases generated over one million dollars of revenue in

2013.

“Based upon these findings and developments, we are now engaged

in finalizing the final contract and both parties desire to close

quickly. We have set a preliminary goal to close before the end of

July,” First Colombia Gold CEO, E. Robert Gates, stated. “We are

very pleased with our due diligence findings and are eager to

complete this acquisition. We have very strict criteria when

considering possible acquisitions, which includes a stringent

requirement for short term asset appreciation and a positive cash

flow growth. We are assembling a dynamic management team that can

make significant contributions to the overall productivity of these

companies. We fully expect First Colombia should be booking revenue

and income from this potential acquisition in our third

quarter.”

This acquisition along with the installation of the new energy

division of FCGD, has not overshadowed the progress occurring

within the mining division of the company. We are currently

proceeding with exploration at the Nile Mine project and on its

forty acre Skip unpatented mining claims. The company is also

considering various financial alternatives both to fund the planned

acquisition, and improve its working capital position. Gates was

very clear about his intention to continue to develop the mining

projects, “Our energy division is certainly coming out of the gates

with a great deal of activity and momentum, but we will not and

never intended to neglect the development of our mining projects.

Our newly appointed management team is very hard at work in

developing those projects and putting the capital in place to

advance our mining division.”

About First Colombia Gold

First Colombia Gold Corp. is a capital company focused on

acquiring, developing and advancing natural resource, energy, and

real estate projects in Europe, North America, and South America.

Our business model is to acquire undervalued assets combining

potential for building assets values and cash flow through leverage

to improved operational efficiencies and development.

Our current activity focus is on precious metal exploration in

Montana, and preparing for increased activity in our energy

division.

Investor Inquiries:David Kugelman, Investor

RelationsPhone: (404) 856-9157 / (866) 692-6847Website:

www.firstcolombiagold.comEmail: info@firstcolombiagold.com

Disclaimer

This release contains forward-looking statements that are based

on beliefs of First Colombia Gold Corp. management and reflect

First Colombia Gold Corp.'s current expectations as contemplated

under section 27A of the Securities Act of 1933, as amended, and

section 21E of the Securities and Exchange Act of 1934, as amended.

When we use in this release, the words "estimate," "project,"

"believe," "anticipate," "intend," "expect," "plan," "predict,"

"may," "should," "will," "can," the negative of these words, or

such other variations thereon, or comparable terminology, are all

intended to identify forward looking statements. Such statements

reflect the current views of First Colombia Gold Corp. with respect

to future events based on currently available information and are

subject to numerous assumptions, risks and uncertainties, including

but not limited to, risks and uncertainties pertaining to

development of mining properties, changes in economic conditions

and other risks, uncertainties and factors, which may cause the

actual results, performance, or achievement expressed or implied by

such forward looking statements to differ materially from the

forward looking statements. The information contained in this press

release is historical in nature, has not been updated, and is

current only to the date shown in this press release. This

information may no longer be accurate and therefore you should not

rely on the information contained in this press release. To the

extent permitted by law, First Colombia Gold Corp. and its

employees, agents and consultants exclude all liability for any

loss or damage arising from the use of, or reliance on, any such

information, whether or not caused by any negligent act or

omission. This press release incorporates by reference the

Company's filings with the SEC including 10k, 10Q, 8K reports and

other filings. Investors are encouraged to review all filings.

There is no assurance First Colombia Gold Corp. will identify

projects of merit or if it will have sufficient financing to

implement its business plan. There is no assurance that the

Company’s due diligence on the potential acquisition of oil and gas

assets will be favorable nor that definitive terms can be

negotiated. Information in this release includes representations

form the private companies referred to which has not been

independently verified by the company. A downturn in oil prices

would effect the potential profitability of the proposed

acquisition negatively. Third quarter forecast in income from

dividends or operations is dependent on closing our first

acquisition, and additional acquisitions of revenue-producing

operations.

First Colombia GoldDavid KugelmanPhone: (404) 856-9157 / (866)

692-6847Investor

Relationsinfo@firstcolombiagold.comwww.firstcolombiagold.com

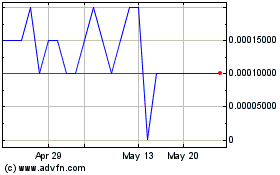

First Colombia Gold (PK) (USOTC:FCGD)

Historical Stock Chart

From Nov 2024 to Dec 2024

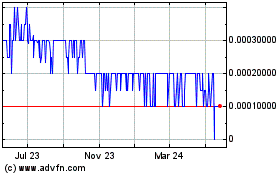

First Colombia Gold (PK) (USOTC:FCGD)

Historical Stock Chart

From Dec 2023 to Dec 2024