0001729997false00017299972024-10-032024-10-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 3, 2024 |

Grayscale Digital Large Cap Fund LLC

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Cayman Islands |

000-56284 |

98-1406784 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

c/o Grayscale Investments, LLC 290 Harbor Drive, 4th Floor |

|

Stamford, Connecticut |

|

06902 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 668-1427 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Grayscale Digital Large Cap Fund LLC Shares |

|

GDLC |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On October 2, 2024, Grayscale Investments, LLC, the manager (the “Manager”) of Grayscale Digital Large Cap Fund LLC (the “Fund”), completed its quarterly review of the Fund’s portfolio and initiated the process of rebalancing the Fund in accordance with the fund construction criteria, as described in the Fund’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on September 6, 2024 (the “Annual Report”). In accordance with the fund construction criteria, the digital assets held by the Fund (the “Fund Components”) consist of the digital assets (the “Index Components”) included in the CoinDesk Large Cap Select Index (the “DLCS”), subject to the Manager’s discretion to exclude an Index Component under certain circumstances. The DLCS is rebalanced quarterly, beginning 14 days before the second business day of each January, April, July and October. On October 2, 2024, CoinDesk Indices, Inc. (in this capacity, the “Index Provider”) completed the quarterly rebalancing of the DLCS and determined that Bitcoin, Ethereum (“Ether”), Solana (“SOL”), Avalanche (“AVAX”), and XRP met the inclusion criteria of the DLCS Index. Accordingly, the Manager adjusted the Fund’s portfolio by purchasing and selling the existing Fund Components in proportion to their respective weightings. As of October 3, 2024, following the rebalancing, the Fund Components consisted of 75.68% Bitcoin, 17.79% Ether, 4.03% SOL, 1.87% XRP, and 0.63% AVAX, and each of the Fund’s Shares represented 0.0004 Bitcoin, 0.0023 Ether, 0.0089 SOL, 1.0702 XRP, and 0.0077 AVAX. Additional information regarding the Fund’s quarterly rebalancing is available in the Fund’s periodic reports filed with the Securities and Exchange Commission on Forms 10-K and 10-Q. A copy of the press release announcing the Fund’s quarterly rebalancing for the quarter ended September 30, 2024 is attached to this Current Report as Exhibit 99.1.

For operational purposes, the Fund values each Fund Component it holds by reference to a “Digital Asset Reference Rate.” The Digital Asset Reference Rate for each Fund Component at any time is the Indicative Price for such Fund Component as of 4:00 p.m., New York time, on the most recent business day. The “Indicative Price” is a volume-weighted average price in U.S. dollars of a digital asset for the immediately preceding 60-minute period derived from data collected from Digital Asset Trading Platforms trading such Fund Component (each, a “Constituent Trading Platform”) selected by CoinDesk Indices, Inc. (in this capacity, the “Reference Rate Provider”).

The Constituent Trading Platforms included in the Indicative Price for each respective Fund Component as of October 3, 2024 were as follows:

•Bitcoin: Coinbase, Kraken, and Crypto.com

•Ether: Coinbase, Crypto.com, and LMAX Digital

•SOL: Coinbase, Kraken, and Crypto.com

•AVAX: Coinbase, Kraken, and Crypto.com

•XRP: Coinbase, Kraken, and Crypto.com

Effective October 2, 2024, the Reference Rate Provider removed LMAX Digital as a Constituent Trading Platform used to calculate the Indicative Price for SOL and added Crypto.com as a Constituent Trading Platform, due to Crypto.com exceeding LMAX Digital in trading volume for SOL, as part of its scheduled quarterly review. Also effective October 2, 2024, the Reference Rate Provider removed Bitstamp as a Constituent Trading Platform used to calculate the Indicative Price for XRP and added Crypto.com as a Constituent Trading Platform, due to Crypto.com exceeding Bitstamp in trading volume for XRP, as part of its scheduled quarterly review.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Grayscale Investments, LLC as Manager of Grayscale Digital Large Cap Fund LLC |

|

|

|

|

Date: |

October 4, 2024 |

By: |

/s/ Edward McGee |

|

|

|

Edward McGee

Chief Financial Officer* |

* The Registrant is a fund and the identified person signing this report is signing in their capacity as an authorized officer of Grayscale Investments, LLC, the Manager of the Registrant.

Exhibit 99.1

Grayscale Investments® Announces Rebalancing of Multi-Asset Funds for Third Quarter 2024

STAMFORD, Conn., Oct. 04, 2024 (GLOBE NEWSWIRE) -- Grayscale Investments®, an asset management firm with expertise in crypto investing, offering more than 20 crypto investment products, and manager of Grayscale® Decentralized AI Fund (AI Fund), Grayscale® Decentralized Finance (DeFi) Fund (OTCQB: DEFG) (DeFi Fund), Grayscale® Digital Large Cap Fund (OTCQX: GDLC) (Digital Large Cap Fund), and Grayscale® Smart Contract Platform Ex-Ethereum Fund (GSCPxE Fund), today announced the updated Fund Component weightings for each product in connection with their respective third quarter 2024 reviews.

In accordance with AI Fund Methodology, Grayscale has adjusted AI Fund’s portfolio by selling RNDR, LPT, and existing Fund Components in proportion to their respective weightings, and using the cash proceeds to purchase RENDER and GRT. As a result of the rebalancing, RNDR and LPT were removed from AI Fund, and RENDER and GRT were added to AI Fund. At the end of the day on October 3, 2024, AI Fund’s Fund Components were a basket of the following assets and weightings*:

•NEAR Protocol (NEAR), 30.03%

No new tokens were added or removed from DEFG. At the end of the day on October 3, 2024, DEFG’s Fund Components were a basket of the following assets and weightings**:

No new tokens were added or removed from GDLC. At the end of the day on October 3, 2024, GDLC’s Fund Components were a basket of the following assets and weightings**:

In accordance with the CoinDesk Smart Contract Platform Select Ex ETH Index, Grayscale has adjusted GSCPxE Fund’s portfolio by selling existing Fund Components in proportion to their respective weightings and using the cash proceeds to purchase NEAR. As a result of the rebalancing, NEAR was added to GSCPxE Fund. At the end of the day on October 3, 2024, GSCPxE Fund’s Fund Components were a basket of the following assets and weightings**:

•Avalanche (AVAX), 10.28%

•NEAR Protocol (NEAR), 5.33%

Neither AI Fund, nor DEFG, nor GDLC, nor GSCPxE Fund, generate any income, and all regularly distribute Fund Components to pay for ongoing expenses. Therefore, the amount of Fund Components represented by shares of each fund gradually decreases over time.

For more information, please visit grayscale.com.

This press release is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal, nor shall there be any sale of any security in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction.

*The composition of the AI Fund is evaluated on a quarterly basis to remove existing Fund Components or to include new Fund Components, in accordance with the fund methodology established by Grayscale as the Manager of the Fund. Holdings and weightings of the AI Fund are subject to change.

**The compositions of DEFG, GDLC, and GSCPxE Fund are evaluated on a quarterly basis to remove existing Fund Components or to include new Fund Components, in accordance with the index methodologies established by the Index Provider. Holdings and weightings of each Fund are subject to change. Investors cannot directly invest in an index.

About Grayscale® Decentralized AI Fund

AI Fund seeks to provide investors with exposure to protocols building Decentralized AI services, protocols building solutions to centralized AI-related problems, and infrastructure and resources critical to AI technology development. Grayscale intends to attempt to have shares of this new product quoted on a secondary market. However, there is no guarantee this will be successful. Although the shares of certain products have been approved for trading on a secondary market, investors in this product should not assume that the shares will ever obtain such an approval due to a variety of factors, including questions regulators such as the SEC, FINRA or other regulatory bodies may have regarding the product. As a result, shareholders of this product should be prepared to bear the risk of investment in the shares indefinitely.

About Grayscale® Decentralized Finance Fund

DeFi Fund seeks to provide investors with exposure to a selection of industry-leading decentralized finance platforms through a market cap-weighted portfolio designed to track the CoinDesk DeFi Select Index. DeFi Fund holds some of the largest and most liquid digital assets that meet certain trading and custody requirements and are classified in the DeFi sector defined by CoinDesk Digital Asset Classification Standard (DACS); the weightings of each Fund Component change daily and are published around 4:00 p.m. NY-time. Additional information on the CoinDesk DeFi Select Index methodology can be found at: https://www.coindesk.com/indices/dfx/.

DeFi Fund’s investment objective is for its Shares to reflect the value of Fund Components held by the DeFi Fund, less its expenses and other liabilities. To date, the DeFi Fund has not met its investment objective and the Shares quoted on OTCQB have not reflected the value of Fund Components held by the DeFi Fund, less the DeFi Fund's expenses and other liabilities, but instead have traded at both premiums and discounts to such value, with variations that have at times been substantial.

About Grayscale® Digital Large Cap Fund

Digital Large Cap Fund seeks to provide investors with exposure to large-cap coverage of the digital asset market through a market cap-weighted portfolio designed to track the CoinDesk Large Cap Select Index. Digital Large Cap Fund holds the largest and most liquid digital assets that meet certain trading and custody requirements and are classified in the CoinDesk Digital Asset Classification Standard (DACS); the weightings of each Fund Component change daily and are published around 4:00 p.m. NY-time. Additional information on the Index methodology can be found at: https://www.coindesk.com/indices/dlcs/.

Digital Large Cap Fund’s investment objective is for its Shares to reflect the value of Fund Components held by the Digital Large Cap Fund, less its expenses and other liabilities. To date, the Digital Large Cap Fund has not met its investment objective and the Shares quoted on OTCQX have not reflected the value of Fund Components held by the Digital Large Cap Fund, less the Digital Large Cap Fund's expenses and other liabilities, but instead have traded at both premiums and discounts to such value, with variations that have at times been substantial.

About Grayscale® Smart Contract Platform Ex-Ethereum Fund

GSCPxE Fund seeks to provide investors with exposure to a selection of industry-leading Smart Contract Platforms through a market cap-weighted portfolio designed to track the CoinDesk Smart Contract Platform Select Ex ETH Index. GSCPxE Fund holds some of the largest and most liquid digital assets, excluding ether, that meet certain trading and custody requirements, and are classified in the Smart Contract Platform sector defined by CoinDesk Digital Asset Classification Standard (DACS); the weightings of each Fund Component change daily and are published around 4:00 p.m. NY-time. Additional information on the CoinDesk Smart Contract Platform Select Ex ETH Index methodology can be found at: https://www.coindesk.com/indices/scpxx/.

Grayscale intends to attempt to have shares of this new product quoted on a secondary market. However, there is no guarantee this will be successful. Although the shares of certain products have been approved for trading on a secondary market, investors in this product should not assume that the shares will ever obtain such an approval due to a variety of factors, including questions regulators such as the SEC, FINRA or other regulatory bodies may have regarding the product. As a result, shareholders of this product should be prepared to bear the risk of investment in the shares indefinitely.

Smart contracts are a new technology and ongoing development may magnify initial problems, cause volatility on the networks that use smart contracts and reduce interest in them, which could have an adverse impact on the value of digital assets that deploy smart contracts.

Extreme volatility of trading prices that many digital assets have experienced in recent periods and may continue to experience, could have a material adverse effect on the value of the products and the shares could lose all or substantially all of their value.

About Grayscale Investments®

Grayscale enables investors to access the digital economy through a family of future-forward investment products. Founded in 2013, Grayscale has a decade-long track record and deep expertise as an asset management firm focused on crypto investing. Investors, advisors, and allocators turn to Grayscale for single asset, diversified, and thematic exposure. Grayscale products are distributed by Grayscale Securities, LLC (Member FINRA/SIPC).

Media Contact

Jennifer Rosenthal

press@grayscale.com

Client Contact

866-775-0313

info@grayscale.com

v3.24.3

Document And Entity Information

|

Oct. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 03, 2024

|

| Entity Registrant Name |

Grayscale Digital Large Cap Fund LLC

|

| Entity Central Index Key |

0001729997

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

000-56284

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Tax Identification Number |

98-1406784

|

| Entity Address, Address Line One |

c/o Grayscale Investments, LLC

|

| Entity Address, Address Line Two |

290 Harbor Drive, 4th Floor

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06902

|

| City Area Code |

212

|

| Local Phone Number |

668-1427

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(g) Security |

Grayscale Digital Large Cap Fund LLC Shares

|

| Trading Symbol |

GDLC

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

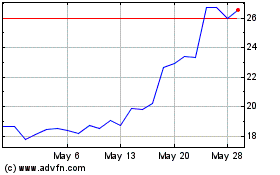

Grayscale Digital Large ... (QX) (USOTC:GDLC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Grayscale Digital Large ... (QX) (USOTC:GDLC)

Historical Stock Chart

From Nov 2023 to Nov 2024