Table

of Contents

As filed with the U.S. Securities and Exchange

Commission on August 27, 2024

Registration No. 333-276881

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM

S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Go

Green Global Technologies Corp.

(Exact name of registrant

as specified in its charter)

| Nevada |

3990 |

46-0853279 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5 Production Drive

Brookfield, CT 06804

(866) 847-3366

(Address, including zip code, and telephone number,

including area code,

of registrant’s principal executive offices)

Direct Transfer LLC

One Glenwood Avenue, Suite 1001

Raleigh, NC 27603

(919) 744-2722

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Ross D. Carmel, Esq.

Shane Wu, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

Telephone:

(212) 930-9700

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities

Act”), check the following box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities

Exchange Act of 1934.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective

on such date as the SEC, acting pursuant to said Section 8(a) may determine.

The information in this

prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an

offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated __________, 2024

PRELIMINARY PROSPECTUS

Go

Green Global Technologies Corp.

Up to 11,171,136 Shares of Common Stock

Up to 21,100,000 Shares of Common Stock Issuable

Upon Exercise of Warrants

This prospectus relates to up to 11,171,136

shares of common stock of Go Green Global Technologies Corp., par value $0.001 per share (“Common Stock”), that the selling

security holders identified in this prospectus (the “Selling Shareholders,” and each, “Selling Shareholder”)

may sell from time to time in one or more transactions in amounts, at prices and on terms that will be determined at the time of the

offering. The shares of Common Stock being offered for resale pursuant to this prospectus include up to (i) 3,076,923 shares of Common

Stock (collectively, the “Outstanding AJB Shares”) issued to one Selling Shareholder, AJB Capital Investments LLC (“AJB

Capital”), in our February 2022 bridge financing round (“2022 Bridge Financing”); (ii) 750,000 shares of Common Stock

issued to AJB Capital pursuant to amended terms of pre-funded warrants issued to AJB Capital in our May 2023 bridge financing round;

(iii) 7,344,213 shares of Common Stock held by certain Selling Shareholders (such shares, collectively and together with the Outstanding

AJB Capital Shares, the “Outstanding Shares”); (iv) 2,500,000 shares of Common Stock issuable upon exercise of our warrants

to purchase Common Stock, such warrants issued to AJB Capital in the 2022 Bridge Financing and which are exercisable for five years from

issuance, at an exercise price of $0.01 per share (the “2022 Warrants”); (v) 9,600,000 shares of Common Stock, in the aggregate,

issuable upon the exercise of warrants issued to certain Selling Shareholders in 2022 and 2023 as compensation for their services and

which are exercisable for five years from issuance, at various exercise prices (collectively, “Additional Warrants”); and

(vi) 9,000,000 shares of Common Stock issuable upon the exercise of our pre-funded warrants to purchase Common Stock, such pre-funded

warrants issued to AJB Capital in our May 2023 bridge financing round and which are exercisable at an exercise price of $0.001 per share

(collectively, the “2023 Warrants,” and, together with the 2022 Warrants and the Additional Warrants, the “Warrants,”

and the Common Stock underlying the Warrants, the “Warrant Shares”). We issued all of the aforesaid Common Stock and Warrants

to the Selling Shareholders in transactions which were not public securities offerings. See the section entitled “Selling

Shareholders” herein.

Our registration of the Outstanding Shares and

Warrant Shares (collectively, the “Shares”) does not mean that any or all of the Selling Shareholders will offer or sell any

of their respective Shares. The Selling Shareholders may sell the Shares registered pursuant to this prospectus on an existing public

trading market at prevailing market prices or privately negotiated prices. We will not receive any of the proceeds from such sales of

the Shares, except with respect to amounts received by us upon exercise of the Warrants. We will bear all costs, expenses and fees in

connection with the registration of the Shares, including with regard to compliance with state securities or “blue sky” laws.

The Selling Shareholders will bear all of the commissions and discounts, if any, attributable to its sale of their respective Shares.

Each Selling Shareholder may be considered an “underwriter” within the meaning of the Securities Act.

This prospectus describes the general manner

in which the Shares may be offered and sold by the Selling Shareholders. If necessary, the specific manner in which the Shares may be

offered and sold will be described in a supplement to this prospectus. Any such prospectus supplement may also add, update or change

information in this prospectus. You should carefully read this prospectus and any applicable prospectus supplement carefully before you

invest. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution”

in this prospectus.

As

of the date of this prospectus, management holds 6.34% of the voting power of the Company. Additionally, our Chief Executive

Officer, President, and Director, Danny G. Bishop, holds all of the shares of our Series B Preferred Stock, which entitle their

holder to 20 votes per share. See “Risk Factors” for a discussion of the risks associated with (i) the significant

voting power of our Series B Preferred Stock; and (ii) future issuances of preferred stock, additional Common Stock or securities

convertible into shares of Common Stock in connection with our incentive plans, acquisitions or otherwise.

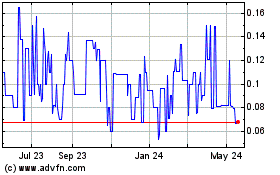

Our

Common Stock is quoted on the OTCQB under the symbol “GOGR.” The closing price of our Common Stock on August 26,

2024, as reported by the OTC Markets Group Inc. (the “OTC Markets Group”), was $0.07 per share.

Investing in our Common Stock involves a

high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a

discussion of information that should be considered in connection with an investment in our Common Stock.

Neither the U.S. Securities and Exchange Commission

(“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company”

as that term is used in the Jumpstart Our Business Startups Act of 2012, and we have elected to comply with certain reduced public company

reporting requirements.

Table of Contents

ABOUT

THIS PROSPECTUS

This prospectus describes the general manner

in which the Selling Shareholders may offer, from time to time, up to 32,271,136 Shares held by the Selling Shareholders as described

in the cover page of this prospectus. You should rely only on the information contained in this prospectus and the related exhibits,

any prospectus supplement or amendment thereto and the documents incorporated by reference, or to which we have referred you, before

making your investment decision. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement

or amendments thereto do not constitute an offer to sell, or a solicitation of an offer to purchase, the Common Stock offered by this

prospectus, any prospectus supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful

to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus,

any prospectus supplement or amendments thereto, as well as information we have previously filed with the SEC, is accurate as of any

date other than the date on the front cover of the applicable document.

If necessary, the specific manner in which the

Shares may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update or change

any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus

and any prospectus supplement, you should rely on the information in such prospectus supplement, provided that if any statement in one

of these documents is inconsistent with a statement in another document having a later date, for example, a document incorporated by

reference in this prospectus or any prospectus supplement, the statement in that document having the later date modifies or supersedes

the earlier statement.

Neither the delivery of this prospectus nor any

distribution of Common Stock pursuant to this prospectus shall, under any circumstances, create any implication that there has been no

change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus.

Our business, financial condition, results of operations and prospects may have changed since such date.

Unless the context indicates otherwise, the terms

“Go Green,” “Company,” “we,” “us” and “our” in this prospectus refer to Go

Green Global Technologies Corp., a Nevada corporation.

PROSPECTUS

SUMMARY

This summary highlights information contained

elsewhere in this prospectus and does not contain all the information you should consider before investing in our Common Shares and it

is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus.

You should carefully consider, among other things, the sections titled “Risk Factors,” “Cautionary Note Regarding

Forward-Looking Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and our financial statements and the related notes included elsewhere in this prospectus.

Introduction

We are a technology and manufacturing company

based in Brookfield, Connecticut. We own the patented Sonical™ technology (U S. Patent Number 11,634,344 B2), which is designed

to render impurities inert in fluids, in a way that is cost-saving and avoids the use of harsh chemicals for fluid treatment. Our Sonical™

technology is intended to be installed into existing water supply and fuel consumption systems. The Sonical™ apparatus is designed

such that, after installation into an existing water or fuel treatment system, fluid can pass through the electromagnetic field created

within the apparatus and undergo molecular-level changes, resulting in cleaner water and fuel.

We envision our Sonical™ technology to

be a revolutionary catalyst in the global transition to a green economy. Our mission is to provide global access to this technology,

allowing for the extension of fuel life, a decrease in carbon emissions, and the elimination of harsh chemicals in water treatment worldwide.

Currently, we are in a pre-revenue stage of

development. As of the date of this prospectus, we have not launched any of the products discussed herein. We are in the process of finalizing

our manufacturing processes and sourcing materials to manufacture and commercialize our products at scale. We expect to begin launching

certain products approximately between the second and third fiscal quarters of 2024, assuming these products are successfully manufactured

and commercialized. We cannot assure that any or all of our products will ever launch, launch successfully, or that we will be able to

generate revenue from these products or adequate revenue to continue as a going concern.

The

report from our independent registered public accounting firm for the year ended December

31, 2023 includes an explanatory paragraph stating that we have suffered recurring losses

from operations and have a net capital deficiency that raises substantial doubt about its

ability to continue as a going concern. We have incurred net losses of $787,452 for the six

months ended June 30, 2024 and $3,454,183 for the year ended December 31, 2023 and our net

capital deficiency was $1,909,231 as of June 30, 2024 and $1,803,754 as of December 31, 2023.

Our Technology and Anticipated Products

The Sonical™ apparatus

is the technology supporting and incorporated into all of our water and fuel treatment products. This is a patented technology utilizing

pulsed power, which features unique coil design configurations that can create and conduct an electromagnetic field within the Sonical™

apparatus. The electromagnetic field triggers a forced sequential re-phasing arrangement within fluid passing through, which renders impurities

in the fluid inert.

We believe that our

Sonical™ technology, when incorporated into fuel and water treatment systems, can effectively address some of the issues with conventional

methods for fuel and water treatment. For one, conventional methods for water treatment typically involve the addition of chemical disinfectants

to remove bacteria within water, which can be harmful to human and environmental health. Disinfectants such as chlorine also have an

unpleasant taste and smell, which are especially significant concerns pertaining to potable water. There is also the persistent problem

of mineral buildup, specifically calcium carbonate, in distribution networks such as pipes and water flow devices. Ion-exchange water

softeners have been commonly used to remove minerals from (descale) pipes and water flow devices, but these softeners require continuous

and consistent maintenance, which can compound the costs associated with water treatment. Pipe repair and cleanup at large facilities

is also costly and poses significant safety concerns. The pulse power technology of the Sonical™ removes the need for chemical

disinfectants to water treatment systems while descaling water and controlling bacterial growth. The Sonical™ products are

customizable and easy to install and following installation require little to no maintenance. We believe that incorporating our Sonical™

products into existing water treatment and distribution systems will be a less costly and more environmentally sound alternative to conventional

methods.

Conventional methods

for extracting fuel from crude oil are also costly and harmful to the environment. Refinement costs for the production of commonly used

fuel from petroleum are substantial. To save on costs, producers may sell fuel products which may not be entirely free from impurities

such as hydrocarbons, even though the products can technically still be used for combustion. As a result, existing hydrocarbons in such

fuels can be emitted into the atmosphere, adding significant pollution to the environment. We believe the technology behind the Sonical™

apparatus, which produces varying electromagnetic wavelengths to alter the molecular structure of fuel, can potentially enable fuel to

burn more efficiently and result in cost savings and fewer carbon emissions.

We intend to have our

Sonical™ fuel products tested extensively in private laboratories to evaluate significant fuel efficiency increases, as well as

decreases in overall carbon emissions. For our Sonical™ water products, we intend to have our technology tested extensively at

private laboratories to evaluate the product's ability to eliminate the minerals causing scale buildup, as well as the elimination of

harmful microorganisms, such as bacteria in water.

Business Plans

We are presently ramping up manufacturing and

solidifying our market strategy to commercialize our products. We are in the process of finalizing our manufacturing processes and

sourcing materials to manufacture and commercialize our products at scale. Below are the business lines we expect to launch between

the second and third fiscal quarters of 2024, if and when our manufacturing and marketing goals are achieved. Currently, we have prototypes

for certain categories of these products and are finalizing their testing and techniques for manufacturing.

| Fuel

Treatment |

|

Water

Treatment & Descaling |

| Commercial

Boilers |

|

HVAC

Cooling Towers |

| Residential

Boilers |

|

Commercial

Descaling |

| Diesel

Generators |

|

Residential

Water |

| Automotive/Trucking |

|

Municipal

Water |

| Locomotive

(Heavy Rail) |

|

|

| Maritime

Vessels |

|

|

Our fuel treatment products are aimed at increasing

the efficiency of fuel, improving overall engine function, and decreasing lifetime carbon emissions. We believe this is achieved by installing

our fuel devices, which contain the Sonical™ technology, on a pre-combustion location within any fossil-fuel-burning system, such

as an oil-burning furnace, a generator, a car, a truck, and more. We believe the products in the planned fuel treatment line will experience

rapid growth due to increased fuel costs on a global level and increased levels of interest to decrease carbon dioxide emissions.

Our water treatment products are aimed at eliminating

the minerals causing scale buildup in water, allowing for better maintenance of water systems without the use of chemicals, and providing

improved life span of pipes. We believe the water treatment products are capable of increasing microbial control and eliminating unwanted

organic compounds, including viruses and bacteria both in potable water and industrial applications, such as HVAC systems. We anticipate

that the water treatment and descaling product lines will experience slower but more long-term growth compared to the fuel treatment

product lines.

We anticipate launching our boiler products and

diesel generator products first, anytime between the second and third fiscal quarters of 2024, using our existing distributor networks

to target (i) consumers in the northeast region of the United States utilizing residential and commercial boilers and (ii) consumers in

the diesel generator market in Canada. As our production capabilities grow and we obtain the necessary and desired certifications for

our products (including but not limited to UL certification and National Science Foundation water safety certification) within the next

year, we plan to expand our business to target the following segments for water treatment: residential potable water treatment, municipal

potable water treatment, municipal wastewater treatment, and industrial and commercial wastewater treatment. As to fuel treatment, after

our production capabilities grow, we plan to target the automotive, small and medium duty trucks, locomotive engines, and maritime vessels

markets.

After a year of commercializing and manufacturing

these products, we anticipate being able to target other markets and industry verticals to achieve larger scale installations of our

fuel and water products amongst our client base. Within a year from the start of production, we anticipate being able to scale up our

product output and generating more demand for our products.

In the long term, we plan to target the maritime

industry and the locomotive industry. There is a great demand for cost savings and reductions in carbon emissions in both of these industries,

which we believe we can directly address with our Sonical™ technology in the future.

Industry Overview

We operate in the “green-tech” or

“clean-tech” manufacturing space, which is a relatively new, emerging sector. The novel technology that this sector centers

around is still limited in use. We believe there are currently few existing competitors in this space, which provides us with a strong

path to market.

We believe there has been trending interest in

green technology and sustainability both in the public and private sectors and an increasingly expanding market for simple, retrofit

devices that can solve certain challenges in the treatment of water and fuel. Particularly in the public sector, there has been significant

legislation regarding emissions standards and mandates to address carbon footprint. Private automobiles, small and medium duty trucks,

locomotives, maritime vessels, and furnaces for heating of residential and commercial spaces are all examples of technologies which we

believe could benefit from the integration of our Sonical™ apparatus.

Additionally, there has been significant legislation

addressing the minimization of chemicals used to treat both potable water and water used in commercial and industrial processes. Residential

drinking water, municipal drinking water supplies, swimming pool maintenance, commercial water treatment of HVAC cooling towers, and

wastewater treatment are examples of functions that could benefit from the integration of our Sonical™ apparatus.

According

to our internal calculations based on addressable market sizes for various fuel and water treatment products, derived from public data

sources and guided pricing from our existing distributor networks, at just 1% of domestic market penetration across the variety of residential,

commercial, and industrial applications for our Sonical™ water and fuel treatment technology, there is potential for over $3 billion

in annual gross revenue at full-scale operation and production of our products. We calculated gross revenue for each product (“Gross

Revenue”) in our water and fuel treatment lines by using the addressable market size of each product (in units of product), approximated

from public data sources, multiplied by (i) 1% market penetration and (ii) wholesale pricing based on guided pricing within our existing

distributor networks. Then, we added the Gross Revenues for each of our products based on the formula in this paragraph and derived a

total gross revenue (“Total Gross Revenue”) of approximately $3 billion. [1] In our calculation for Total Gross

Revenue, material assumptions included: (i) the addressable market size of each product derived from each public data source was accurate;

(ii) the wholesale pricing based on guiding pricing within existing distributor networks are accurate; and (iii) there will indeed be

1% market penetration for our products. We did not commission

any of the industry or market data referenced in this prospectus.

Market and Growth

We believe there is a large, addressable market

for our Sonical™ fuel and water treatment technology. We have staggered plans to target various sectors of this market based on

our stage of development.

According to the U.S. Energy Information Administration’s

Short-Term Energy Outlook report, roughly 4.96 million households used heating oil as their main source of space heating fuel,

with 82% of those households in the northeast region of the country.[2] According to the same report, households spent an average

of $2,094 for the 2022 to 2023 winter season, a 13% increase from the 2021 to 2022 season. With oil prices continuing to rise, we anticipate

high consumer demand for a product with a high return on investment in a relatively short timeframe, which can increase fuel efficiency,

with the added benefit of decreasing consumer household carbon footprint.

As to water treatment, we plan to target

consumers who use descaling HVAC cooling towers and consumers who struggle with scale buildup in their water systems within the

commercial space, including restaurants, fast food chains, and other retailers. According to Forbes, in 2023, a new HVAC

system can cost anywhere from $5,000 to $34,000 depending on size. On average, HVAC installations cost around $8,000.[3] HVAC

systems must also be regularly maintained and are subject to scale buildup. To eliminate scale, HVAC technicians currently use

chemical maintenance programs that are costly and dangerous for human health. If these programs are not executed effectively, scale

buildup of just 0.18 of an inch on the fireside of boiler tubes can reduce heat transfer by 69%,[4] which thereby

increases fuel consumption and costs. We believe the installation of a Sonical™ unit can lead to cost savings for homeowners

and commercial buildings by eliminating the need for chemical descaling programs and decreasing the need for costly repairs and

replacements. We anticipate significant demand for our HVAC products, as well as demand for our general descaling product across a

variety of industries where descaling is a costly problem.

_________________________

[1] For a list of public data sources

which we consulted in arriving at these addressable market sizes, see footnote 1 in “Business – Industry Overview”

below.

[2]

U.S. Energy Information Administration, Short-Term Energy Outlook, Winter Fuels Outlook, Table WFO1, March

2023.

[3] Weimert,

Kelly. “How Much Does a New HVAC System Cost in 2023?” Forbes, Salaky, Kristin (editor). Last updated July 31,

2023.

https://www.forbes.com/home-improvement/hvac/new-hvac-system-cost/#:~:text=The%20price%20of%20a%20new,%248%2C000%2C%20including%20parts%20and%20labor.

[4]

As reported by the government of Canada. “Increasing the Energy Efficiency of Boiler and Heater Installations.”

Last modified February 17, 2016. https://natural-resources.canada.ca/energy/publications/efficiency/industrial/cipec/6699

To our knowledge, there is currently no product

in the residential, commercial, or industrial fuel and water treatment markets utilizing pulse power. Given the lack of competition, we

believe it is possible to achieve a 1% to 2% overall market penetration across the variety of potential vertical business niches in the

fuel and water treatment space.

In the longer term, we plan to target two other

major markets, the maritime industry, and the locomotive industry. These markets are currently in need of solutions for reducing carbon

emissions and decreasing costs. We believe these markets have great revenue potential and our products can effectively address cost saving

and carbon emissions concerns in the future.

The maritime industry currently uses exhaust

gas cleaning systems, or “scrubbers,” to decrease its carbon footprint, but this is not a holistic solution. With scrubbers,

carbon emissions are redirected from the atmosphere into the aquatic environment, which contributes to rising oceanic temperatures and

harms marine ecosystems. Scrubbers are also very expensive, ranging anywhere from $500,000 to $2.5 million to install one per vessel.

Go Green can integrate its Sonical™ technology into products geared towards the maritime industry, servicing large and small fleets,

including passenger vessels. We believe our Sonical™ products can increase fuel efficiency as well as decrease carbon emissions,

a two-fold solution that scrubbers do not provide. The Sonical™ product is also a more affordable solution compared to scrubbers,

as they are much simpler to install. We believe our products have the technology that increases fuel efficiency and decrease carbon emissions

directly, as opposed to scrubbers, which simply redirect air pollutants. Within the maritime industry, we believe we can also offer water

treatment solutions for both potable water usage and wastewater treatment. The installation of the Sonical™ apparatus on fleets

are projects of large scale by virtue of the size of maritime vessels, and costs to install our apparatus range from $250,000 to $1 million

per installation. We believe these projects offer significant revenue potential.

Within the locomotive industry, railway operators

are also under significant global pressure to modernize their systems and decrease their overall emissions output. At present, not many

solutions are available to address these issues. We believe we can offer our fuel products to locomotive companies across the globe,

providing a simple and affordable solution to improve fuel efficiency, increase the lifespan of engine components, and decrease lifetime

emissions. Our water treatment products can provide a chemical-free solution to descaling water systems. The installation of our products

into locomotive systems are conceivably projects of large scale and earnings associated therewith could significantly increase our overall

revenue stream.

Competition

With respect to the water treatment market, there

is one known company, Evapco Inc., which offers a similar product to the Sonical™, a descaling device similar to ours called Pulse-Pure.

Notably, one of Evapco’s main patents references two past patents of the inventor of our Sonical™ technology.[5] We

believe that the Pulse-Pure product has a lower efficiency rate than our products. We believe that the newest generation of the patented

Sonical™ technology, with its increased power, can offer customers even more efficient descaling.

With respect to the fuel treatment market, to

our knowledge and as of the date of this prospectus, there are no existing competitors that offer fuel efficiency devices utilizing pulsed

power technology. In the automobile market, there are other retrofit devices such as the EcoMax Fuel Saver that claim to offer fuel savings,

most of these being chip devices that connect to a vehicle’s electronic control unit (“ECU”). The companies launching

these products claim that after a consumer has driven for a certain number of miles, the chip will be able to read data from the ECU and

tune the vehicle’s computer for lower fuel consumption specific to the particular driver’s statistics, such as speed and driving

habits, among other things. In our view, there is limited data as to the efficacy of these products. We believe that our Sonical™

technology, when installed directly into a fuel line on a pre-burn location of nearly any fossil-fuel-burning engine, decreases fuel consumption

and thereby lifetime emissions. To our knowledge, no market participant has such capabilities.

[5] Patent No. 7,704,364, one of the

patents supporting Pulse-Pure, cites two past patents of Mr. Pandolfo, the inventor of our Sonical™ technology. The two patents

referenced were for decalcifier descaling devices for water treatment, utilizing variable resonance technology.

Intellectual Property

As of the date of this prospectus, we own the

following patents:

|

Patent

Number |

Place of

registration |

Title |

Owner |

Filing date |

Publication date |

| US 11,634,344 B2 |

United States |

Apparatus and method for treating substances using asymmetric-vector electrical fields |

Go Green Global Technologies Corp.[6] |

September 10, 2021 |

April 25, 2023 |

| |

|

|

|

|

|

| PCT/US2022/043068 |

International[7];

the Company submitted applications during the national entry phase

to Mexico on March 8, 2024 (Application no. MX/a/2024/003051) and Canada on March 11, 2024 (Application no. 3231504). |

Apparatus and method for treating substances using asymmetric-vector electrical fields |

Go Green Global Technologies Corp.[8] |

September 9, 2022 |

March 16, 2023 |

As of the date of this prospectus, we have the

following trademark applications pending:

| Trademark |

Place

of

registration |

Application

Number |

Owner |

Class |

Filing

date |

| SONICAL[9] |

Canada |

209183 |

Go Green Global Technologies Corp. |

009 |

March 26, 2021 |

| |

|

|

|

|

|

|

SONICAL[10]

|

United States |

90631615 |

Go Green Global Technologies Corp.[11] |

009 |

April 8, 2021 |

Recent Developments

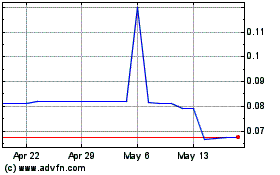

On July 22, 2024, the Company’s Common Stock

started trading on the OTCQB.

On

July 3, 2024, the Company entered into a Distribution Agreement (“Distribution Agreement”)

with CALCLEAR Investments PTY Limited, (“CALCLEAR”) an Australian corporation

selling water conditioning products. The term of the Distribution Agreement will last until

July 3, 2027, after which the Distribution Agreement will be automatically renewed for an

additional three (3)-year term if the Company sells the minimum amount of CALCLEAR’s

water treatment products specified in the Distribution Agreement. Pursuant to the Distribution

Agreement, the Company will serve as the exclusive North American distributor of certain

CALCLEAR water treatment products developed using CALCLEAR’s patented technology and

related products manufactured or marketed by CALCLEAR during the term of the Distribution

Agreement. Certain individuals identified in “Item 15 – Recent Sales of Unregistered

Securities” will receive Common Stock as consideration for CALCLEAR ’s entry

into the Distribution Agreement. CALCLEAR will also receive value in the form of royalty

payments as consideration pursuant to the Distribution Agreement. The Distribution Agreement

is filed as Exhibit 10.7.

On June 3, 2024, we filed the Certificate of Amendment

to Designation, Preferences, and Rights of the Series A Preferred Stock, which, among other things, clarified that (i) the Series A Preferred

Stock will convert upon a securities offering of the Company or any of its subsidiaries which raises proceeds of $2,000,000 or more; and

(ii) the holders of Series A Preferred Stock have liquidation rights senior to holders of Common Stock.

On May 29, 2024, we filed the Certificate of Amendment

to Designation of the Series B Preferred Stock, which clarified that holders of the Series B Preferred Stock have liquidation rights senior

to holders of Series A Preferred Stock and holders of Common Stock, in such order.

On May 6, 2024, we filed the Certificate of Amendment

to the Articles of Incorporation, which increased our authorized capital stock to 525,000,000 and our authorized Common Stock to 500,000,000.

The Certificate of Amendment to the Articles of Incorporation is filed as Exhibit 3.11.

[6] The

inventor is Salvatore Mario Pandolfo, who previously assigned the patent to us pursuant to the APA (as defined below). We

were the applicant for this patent.

[7]

This patent was filed on the International Patent System, which allows patent holders to seek protection for their intellectual

property in its 57 participating countries, which list of countries can be accessed here: https://www.wipo.int/pct/en/pct_contracting_states.html.

[8] The

inventor is Salvatore Mario Pandolfo, who previously assigned the patent to us. We were the applicant for this patent.

[9] Goods associated with trademark as claimed in this

application: Fluid treatment apparatus for effecting physical or chemical changes to fluids or particles carried by fluids using variable

magnetic fields.

[10]

Goods and services associated with trademark as claimed in application: Scientific fluid treatment apparatus for domestic

and industrial use, namely, fluid handling device for effecting physical or chemical changes to fluids or particles carried by fluids

using variable magnetic fields used for disposable bioprocessing applications and parts and fittings therefor.

[11]

This trademark application (the “Pending U.S. Trademark”) has been suspended by the USPTO. The Canadian trademark

for application number 2095183 (the “Pending Canadian Trademark”) was filed prior to the Pending U.S. Trademark. Pursuant

to the Paris Convention for the Protection of Industrial Property, subsequent applications can be filed within six months of the Pending

Canadian Trademark application and claim the benefit of the Canadian filing date. In order for the priority date of the Pending Canadian

Trademark to apply for the Pending U.S. Trademark, the Pending Canadian Trademark must first be registered. Since the Pending Canadian

Trademark is still under review, the suspension on the Pending U.S. Trademark will continue until the Pending Canadian Trademark is registered.

On February 16, 2023, we entered into that certain

First Amended and Restated Asset Purchase Agreement with Salvatore Mario Pandolfo (“Pandolfo,” and the aforesaid agreement,

the “2023 APA Amendment”), which amended and restated that certain Asset Purchase Agreement between the Company and Pandolfo

dated May 2017 (the “APA”) to reflect (i) Pandolfo’s finalization of sale to us of all of the assets of the water and

fuel treatment business of his entity, Sonical s.r.l., an Italian company (the “Purchased Assets”), which Purchased Assets

includes, among other things, the intellectual property rights supporting the Sonical™ technology, (ii) Pandolfo’s transfer

of all of the intellectual property associated with the Purchased Assets, and (iii) Pandolfo’s delivery of certain Sonical™

testing units to us. A copy of the 2023 APA Amendment is filed as Exhibit 10.3 to this registration statement. The APA is filed as Exhibit

10.1 to this registration statement. The Amendment to the Asset Purchase Agreement dated June 2019 (the “2019 APA Amendment”)

is filed as Exhibit 10.2 to this registration statement, which, among other things, amended certain terms in the APA regarding our consideration

for the Purchased Assets. The 2023 APA Amendment superseded the terms of the 2019 APA Amendment and the Asset Purchase Agreement in their

entirety.

On April 25, 2023, the USPTO issued Patent

Number 11,634,344 to us for our proprietary Sonical™ technology.

On September 9, 2022, we submitted a Patent Cooperation

Treaty application for international patent registration for our Sonical™ technology. The application was published on March

16, 2023.

Corporate History

We were originally incorporated in Nevada on

February 22, 2006, under the name “Photomatica, Inc.” On August 12, 2008, we changed our name to “Secure Runway Systems

Corp.” On June 22, 2010, we changed our name to “Diversified Secure Ventures Corp.” We changed our name to Go Green

Global Technologies Corp., our current name, on March 5, 2012. We are currently in good standing with the State of Nevada.

We were previously a reporting company when we

registered our Common Stock under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) on

May 10, 2007. On June 21, 2011, we ceased to be a reporting company when we terminated our duty to file periodic reports with the filing

of a Form 15, pursuant to Rule 12g-4(a)(1).

Summary of Risk Factors

Below is a summary of

material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the

risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as

well as other risks and uncertainties that we face, can be found under the section titled “Risk Factors” in this prospectus.

The below summary is qualified in its entirety by that more complete discussion of such risks and uncertainties. You should consider

carefully the risks and uncertainties described under the section titled “Risk Factors” as part of your evaluation of an

investment in our securities:

| · | Our

business is currently in a pre-revenue stage of development and there is no assurance that

we will ever operate profitably. |

| · | We

cannot assure that we will launch any or all of our products. |

| · | Certain

models of our products will be launched prior to the completion of laboratory testing regarding

their efficacy, efficiency, and safety and before we obtain product certifications for them,

which means there are risks that our products could be subject to product liability

claims. We have not independently consulted any legal counsel regarding our regulatory requirements

concerning the launch and offering of our products in the United States and abroad. |

| · | We

operate in an industry that is still relatively new and subject to many uncertainties. |

| · | Our

products incorporate pulsed power technology, which applications have yet to be widely accepted. |

| · | We

cannot assure that there will be positive consumer reception or adequate consumer demand

for our products. |

| · | We

may fail to maintain a competitive position within our market sector. |

| · | Increases in manufacturing

and/or distribution costs and disruptions in our distribution networks or supplies could

materially and adversely impact our business. |

| · | Our costs of operations

may exceed estimates due to various factors, including but not limited to those outside of

our control, such as labor shortages or external price increases, and we may be unable to

pass these increased costs to our customers, which would negatively impact our financial

results. |

| · | We

are heavily dependent on our executive management, and a loss of a member of our executive

management team or our failure to attract and retain other highly qualified personnel in

the future, could materially harm our business. |

| · | Damage to our reputation

could negatively impact our business, financial condition, and results of operations. |

| | · | Our performance may be negatively impacted by general and

regional economic volatility or an economic downturn. |

| · | Unforeseen or unavoidable

events or market conditions may negatively impact our financial performance. Our business

may be affected by new or changing government regulations particularly by the Environmental

Protection Agency (EPA) and other state and federal bodies. |

| · | Our ability to protect

our intellectual property and proprietary technology is uncertain. |

| · | Patent

terms are limited, and we may not be able to effectively protect our devices and business. |

| · | Changes

in U.S. patent law could diminish the value of patents in general, thereby impairing our

ability to protect our devices. |

| · | We

may not be able to protect our intellectual property rights throughout the world. |

| · | Third

parties may assert that our employees or consultants have wrongfully used or disclosed confidential

information or misappropriated trade secrets. |

| · | Patents

covering our products could be found invalid or unenforceable if challenged in court or before

administrative bodies in the United States or abroad. |

| · | Obtaining

and maintaining our patent protection depends on compliance with various procedural, document

submission, fee payment and other requirements imposed by government patent agencies, and

our patent protection could be reduced or eliminated for non-compliance with these

requirements. |

| · | Third

parties may attempt to commercialize competitive products or services in countries where

we do not have any patents or patent applications and/or where legal recourse may be limited.

Some countries also compel patent owners to grant licenses to third parties. These conditions

may have a negative commercial impact on our non-U.S. business operations. |

| · | We

may be subject to claims challenging the ownership or inventorship of our patents and other

intellectual property and, if unsuccessful in any of these proceedings, we may be required

to obtain licenses from third parties, which may not be available on commercially reasonable

terms, or at all, or to cease the development, manufacture and commercialization of one or

more of our products. |

| · | Our

commercial success depends in part on our and any potential future collaborators’ ability

to develop, manufacture, market, and sell any products that we may develop and use our proprietary

technologies without infringing, misappropriating and otherwise violating the patents and

other intellectual property rights of third parties. It is uncertain whether the issuance

of any third-party patent would require us or any potential collaborators to alter our development

or commercial strategies, obtain licenses or cease certain activities. |

| · | If

our trademarks and trade names are inadequately protected, then we may not be able to build

name recognition in our markets of interest and our business may be adversely affected. |

| · | This

is not an initial public offering of stock to investors at large, and there is no guarantee

that any of the Selling Shareholders will sell the Shares. Alternatively, if a large number

of Shares are sold, the public price of our Common Stock on the OTCQB will decrease. |

| · | Our

Common Stock is currently thinly traded on the OTCQB and the public price for our

Common Stock is volatile. We can offer no assurance that an active trading market for our

Common Stock will develop or that the public price of our Common Stock will become less volatile. |

| · | Future

sales of Common Stock by the Selling Shareholders and our other existing shareholders, or

lack thereof, may contribute to price volatility of our Common Stock on the OTCQB. |

| · | You

may be diluted by future issuances of preferred stock, additional Common Stock or securities

convertible into shares of Common Stock in connection with our incentive plans, acquisitions

or otherwise. Future sales of such shares in the public market, or the expectations that

such sales may occur, could lower our stock price. |

| | · | Our Series B Preferred Stock

entitles its holders to 20 votes per share and all currently issued and outstanding shares of such stock are held by our Chief Executive officer, President,

and Director, Danny G. Bishop, or 62% of the Company’s voting power. Minority shareholders will have no say in the Company’s

policies or corporate matters and future issuances of Series B Preferred Stock will dilute their voting power and may lower the perceived

value of our Common Stock. |

| · | We

do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. |

| · | We

may need to raise additional capital in the future, and our failure to do so could restrict

our operations or adversely affect our ability to operate and continue our business. There

is no guarantee that we will successfully raise additional capital on favorable terms or

at all and if and when we need it. |

| · | If

securities or industry analysts do not publish research or reports about our business, or

if they downgrade their recommendations regarding our Common Stock, its trading price and

volume could decline. |

| · | We

are a “smaller reporting company,” and our election to comply with the reduced

disclosure requirements as a public company may make our Common Stock less attractive to

investors. |

| · | We

are an “emerging growth company,” and our election to comply with the

reduced disclosure requirements as a public company may make our Common Stock less attractive

to investors. |

| · | Provisions

in our Articles of Incorporation (“Articles of Incorporation”) and Bylaws (“Bylaws”)

could discourage a change in control, or an acquisition of us by a third party, even if the

acquisition would be favorable to you, thereby adversely affecting existing shareholders. |

RISK

FACTORS

Our business is subject to many risks and

uncertainties, which may affect our future financial performance. If any of the events or circumstances described below occur, our business

and financial performance could be adversely affected, our actual results could differ materially from our expectations, and the price

of our stock could decline. The risks and uncertainties discussed below are not the only ones we face. There may be additional risks

and uncertainties not currently known to us or that we currently do not believe are material that may adversely affect our business and

financial performance. You should carefully consider the risks described below, together with all other information included in this

prospectus including our financial statements and related notes, before making an investment decision. The statements contained in this

prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual

results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually

occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our Common Stock

could decline, and investors in our securities may lose all or part of their investment.

Risks Related to Our Business and Operations

Our business is

currently in a pre-revenue stage of development and there is no assurance that we will ever operate profitably.

To date, we have not generated any revenue from

our products. We are in the process of finalizing our manufacturing processes and sourcing materials to manufacture and commercialize

our products at scale. We plan to launch our products approximately between the second and third fiscal quarters of 2024, but we

cannot assure that our products will indeed launch as planned, within the expected timeframe, or even after they launch will generate

revenue. Many factors could affect our profitability, including but not limited to costs of production, consumer reception to our products,

unpredictable market conditions, amongst others, as well as unforeseen events. There is a possibility that we may never generate revenue

or generate adequate revenue to operate profitably or continue as a going concern.

Additionally, we currently have a contractual

obligation with Dr. Pandolfo, the inventor of the Sonical™ devices, which requires us to remit payment to Dr. Pandolfo if sales

of our products reach a certain threshold. If Dr. Pandolfo does not waive this payment and we do not generate enough revenue to compensate

for payment made to Dr. Pandolfo, there is a risk that this would disrupt our ability to continue as a going concern or negatively impact

our financial performance.

We cannot assure

that we will launch any or all of our products.

Although we plan to launch

many of our products after intensifying their manufacture and successfully marketing them, we cannot provide assurance that we will launch

our products within the estimated time frames, will launch the products set forth in this prospectus, or launch any products at all. Additionally,

certain products, such as our planned residential water treatment devices, are contingent on us scaling up our product output and generating

more demand for them, and there is no assurance that these events may take place. The water and fuel treatment products featuring our

Sonical™ technology are our core revenue source and if we do not launch any or all of them or manufacture and sell them at adequate

levels, we will be at significant risk of failing to operate profitably and continue as a going concern.

Certain

models of our products will be launched prior to the completion of laboratory testing regarding their efficacy, efficiency, and

safety and before we obtain product certifications for them, which means there are risks that our products could be subject to

product liability claims. We have not independently consulted any legal counsel regarding our regulatory requirements concerning the

launch and offering of our products in the United States and abroad.

We do not know of any

legal requirements for the products in our anticipated fuel and water treatment lines to undergo laboratory testing or certification

prior to launch, and we have not consulted regulatory counsel in this regard. Sichenzia Ross Ference Carmel LLP is acting only as our

securities law counsel with respect to the registration of the Shares pursuant to this prospectus and not as our regulatory counsel in

any capacity, especially with respect to our legal compliance obligations as to our products.

For the majority of

our products, we plan to obtain UL Solutions (“UL”) and European Conformity (“CE”) certifications for our products

and complete laboratory testing following their launch. Within our manufacturing facility in Brookfield, Connecticut, we have a full

setup for quality control of our products prior to launch, but this setup addresses product functioning, not their efficacy, efficiency,

and safety, especially compared to other products on the market. Even after obtaining results from laboratory tests and certifications,

including UL and CE certifications, we can offer no assurance that our products will be free from third party product liability claims.

If these third parties bring product liability claims against us, we will have to divert additional resources to address them. This may

result in financial and reputational harm to our business, especially if we do not prevail against such claims.

Our financial projections may differ materially from actual results.

The financial projections included in this prospectus

are based on our estimates and assumptions as of the date of this prospectus concerning various factors which are subject to significant

risks and uncertainties, many of which are beyond our control. Therefore, our actual results may differ materially from financial projections.

Significantly, we state in the “Industry

Overview” subsection that at just 1% of domestic market penetration, there is potential for over $3 billion in annual gross revenue

at full-scale operation and production of our products. This figure is dependent on certain material assumptions being true, including

that: (i) the addressable market size of each product derived from each public data source was accurate; (ii) the wholesale pricing based

on guiding pricing within existing distributor networks are accurate; and (iii) there will indeed be 1% market penetration for our products.

Actual annual gross revenue for our anticipated products could be significantly less than $3 billion and we cannot provide any assurance

that our anticipated products will garner the market acceptance necessary to reach hypothetical domestic market penetration levels.

These estimates and assumptions are subject to various factors beyond our control, including, for example, changes in

customer demand, increased costs and price stability in our supply chain, increased labor costs, changes in the regulatory environment,

the impact of global health crises (including the COVID-19 pandemic and COVID-19 variants) and changes in our executive

team. Accordingly, our future financial condition and results of operations may differ materially from our projections. We do not have

any duty to update the financial projections included in this prospectus. Our failure to achieve our projected results could harm the

trading price of the Common Stock and our financial position.

We operate in

an industry that is still relatively new and subject to many uncertainties.

Our business operates

in the “clean-tech” or “green-tech” manufacturing space, which is a relatively new, emerging sector. As such,

this sector faces many uncertainties, including, amongst others, technological and financial ones. New technologies may emerge in this

field with unexpected costs required to further develop and/or implement them. New market participants may also emerge in this sector

which we cannot anticipate. While this sector is forecasted to grow, there is no guarantee that it will, at a level that will benefit

our business, or even if it grows, we cannot assure that our business will operate profitably in spite of favorable market conditions

in this industry.

Our products incorporate

pulsed power technology, which applications have yet to be widely accepted.

The Sonical™ apparatus

we incorporate into all of our fuel and water treatment products operates on pulsed power technology, in which the energy stored within

a generated electromagnetic field is released over a short period of time to render inert unwanted elements in fluids. We cannot be certain

as to the pace of development of and/or improvements in pulsed power technology applications over time, especially for fuel and water

treatment. Increased scientific development of this technology and applications for fuel and water treatment may contribute to an increased

number of market participants offering efficient products within the clean-tech manufacturing sector. This may limit our competitive

position and adversely affect our financial performance. Unanticipated issues or consequences of applying pulsed power technology could

also arise over time which could have an adverse impact on our product development and financial performance.

We cannot assure

that there will be positive consumer reception or adequate consumer demand for our products.

While we believe in

our fuel and water treatment products’ ability to provide more cost-efficient and environmentally friendly solutions than the ones

currently available on the market, we cannot guarantee that these are the ultimate impacts our products will have. Consumers of our products

may not receive our products favorably or favorably enough for us to generate profit. If our products are not found to generate the results

we believe they can provide, or if they do not our business may suffer reputational and/or monetary harm.

We may fail to

maintain a competitive position within our market sector.

The profitability of our business, like others,

is subject to general economic conditions, competition, the desirability of particular products, the relationship between supply of and

demand for particular technological devices, and other factors. While we operate in a market with few competitors, there are some companies

that offer a similar product to ours in one arena of our addressable market which may be further along in operations and better funded

than we are. Furthermore, there may be additional competitors outside of our knowledge, who may have a stronger competitive position

in the market than we anticipated. Our continued success will depend, in large part, upon our ability to compete in areas such as cost,

quality, and effectiveness of the treatments offered. Our operational and growth prospects also depend on the strength and desirability

of our product and our ability to address the market for our products favorably. Our commercial opportunities may be reduced or eliminated

if a competitor emerges and develops and markets products that are less expensive, more effective than our products, or gains greater

consumer reception than our products do. There is no assurance that we can maintain a robust competitive position in our market sector,

and if we fail to do so, we may fail to operate profitably, and our financial performance may be negatively impacted.

Increases in manufacturing and/or distribution

costs and disruptions in our distribution networks or supplies could materially and adversely impact our business.

We may experience increases in manufacturing

and distribution costs or an interruption in our distribution networks or supplies for the manufacturing of our products. Any such an

increase or interruption could materially and negatively impact our business, prospects, financial condition and operating results by

affecting our product output and subsequently sales. Especially, reliable distributor networks are crucial to our product output and

disruptions therein will negatively impact our business operations and financial performance. Various market conditions such as inflationary

pressures could also increase the costs in manufacturing and/or distribution costs associated with our products and could adversely affect

our business and operating results. Such price increases will also increase our operating costs and could reduce our margins (assuming

we generate any) if we cannot recoup the increased costs through increased prices for our product lines.

Our costs of operations may exceed estimates

due to various factors, including but not limited to those outside of our control, such as labor shortages or external price increases,

and we may be unable to pass these increased costs to our customers, which would negatively impact our financial results.

We depend on our employees and operations teams

to assist in manufacturing and distributing our products. We rely on access to a competitive, local labor supply, including skilled and

unskilled positions, to operate our business consistently and reliably. Any labor shortage and/or any disruption in our ability to hire

workers may negatively impact our operations and financial condition. If we experience a sustained labor shortage, we may need to increase

wages to attract workers, which would increase our costs of production. Furthermore, if our operating costs increased, including due

to inflationary pressures, we may be unable to pass those increased costs on to our customers. If we are unable to do so, any profit

margin we generate in the future (if any) will decline, and our financial results will be negatively impacted.

We are heavily

dependent on our executive management, and a loss of a member of our executive management team or our failure to attract and retain other

highly qualified personnel in the future, could materially harm our business.

If we lose members of our senior management, we

may not be able to find appropriate replacements on a timely basis, and our business could be materially and adversely affected. Our existing

operations and continued future development depend to a significant extent upon the performance and active participation of certain key

individuals, including Danny Bishop, our President and Chief Executive Officer (CEO), Corrine Couch, our current Chief Operating Officer

(COO) and Director, Dennis Beckert, an independent director, and John Eric D’Alessandro, Jr., a Director on the Board and Director

of Manufacturing. If we were to lose any of these senior officers or Directors, we may not be able to find appropriate replacements on

a timely basis and our financial condition and results of operations could be materially and adversely affected. Furthermore, we do not

have key person life insurance policies on such individuals and must bear sole financial risk of the departure of such management team

members.

In addition, to execute our growth plan, we must

attract and retain highly qualified personnel. Competition for these employees is intense, and we may not be successful in attracting

and retaining qualified personnel. We could also experience difficulty in hiring and retaining highly skilled employees with appropriate

qualifications. If we fail to attract new personnel, or fail to retain our current personnel, our business and future growth prospects

could be severely harmed.

Damage to our reputation could negatively

impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are

critical to our business and success in existing markets and will be critical to our success as we continue to develop our business.

Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely

affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms

and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals

with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms

is virtually immediate as is its impact. Information posted may be averse to our interests or may be inaccurate, each of which may harm

our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity

for redress or correction.

Our performance may be negatively impacted by general and

regional economic volatility or an economic downturn.

An overall decline in economic activity could

adversely impact our business and financial results, and the severity and/or duration of such declines are hard or impossible to predict.

Economic uncertainty may reduce end user spending on water and fuel treatment products. Inadequate demand for our products will result

in decreased revenue and worsen our financial performance.

Unforeseen or unavoidable events or market

conditions may negatively impact our financial performance.

Our ability to increase sales, and to profitably

sell our products, is subject to a number of risks, including changes in our business relationships with various service providers, competitive

risks such as the entrance of additional competitors into our markets, pricing and other competitive risks associated with the development

and marketing of new products in order to remain competitive and risks associated with changing economic conditions and government regulation.

Global health crises or catastrophes may occur in the future which drive down the demand for our products and adversely affect our business

operations and financial performance.

We cannot control global events or market factors

which affect the demand for our products and the revenue we generate from sales of our products. Therefore, our financial performance

may be negatively impacted by events which we may not foresee or adequately prepare for.

Our business may

be negatively affected by new or changing government regulations, particularly by the Environmental Protection Agency (EPA) and other

state and federal bodies.

Our products incorporate pulsed power technology,

using electromagnetic wavelengths to break down organic material found in fuel to increase fuel efficiency and to eliminate compounds

in water such as the minerals known to cause scale build-up and the presence of microorganisms such as bacteria. While this technology

has been around for a number of years and the various electromagnetic wavelengths used are not necessarily subject to any regulation,

any changes in regulations that might impact their use in commercial products may negatively impact our ability to sell our equipment

into the market, reduce our earnings, increase our costs and compliance requirements. Our financial performance may be negatively impacted

as a result.

Risks Related to Our Intellectual Property

Our ability to protect our intellectual

property and proprietary technology is uncertain.

While the patent supporting the Sonical™

has been issued in the U.S. and we have filed an international patent application for this technology under the Patent Cooperation Treaty,

the potential for the patent to be rendered unenforceable or to be challenged does exist. Furthermore, the scope of the subject matter

in the patent applications for different patent offices of different countries varies and might be restricted by varying amounts in the

final patents, if any, issued to us by the various patent offices. We cannot guarantee that the scope of coverage of any patent issued

to us will be exactly the same in each of the jurisdictions where we have already filed, or will file, patent applications. Consequently,

the issuance and scope of patents cannot be predicted with certainty. Patents, even if issued, may be challenged, invalidated or circumvented.

U.S. patents and patent applications may also be subject to interference or derivation proceedings, and U.S. patents may be subject to

inter partes review, post grant review and ex parte reexamination proceedings in the U.S. Patent and Trademark Office (and

foreign patents may be subject to opposition or comparable proceedings in the corresponding foreign patent office), which proceedings

could result in either loss of the patent or denial of the patent application or loss or reduction in the scope of one or more of the

claims of the patent or patent application. Similarly, opposition or invalidity proceedings could result in loss of rights or reduction

in the scope of one or more claims of a patent in foreign jurisdictions. Such interference, inter partes review, post grant review

and ex parte reexamination and opposition proceedings may be costly. Accordingly, rights under any issued patents may not provide

us with sufficient protection against competitive products or processes.

Moreover, we have a pending trademark application

at the USPTO but there is no guarantee that our trademark application will be approved. Even if approved, the scope of protection afforded

by the trademark may not be sufficiently broad.

If we are unable

to obtain and maintain patent or other intellectual property protection for our product, or if the scope of the patent and other intellectual

property protection obtained is not sufficiently broad, our competitors could develop and commercialize products and technology similar

or identical to ours, and our ability to successfully commercialize any products we may develop as well as our financial performance

may be adversely affected.

Patent terms are limited, and we may not

be able to effectively protect our devices and business.

Patents have a limited lifespan. In the United

States, the natural expiration of a utility patent is generally 20 years after its effective filing date and the natural expiration of

a design patent is generally 14 years after its issue date, unless the filing date occurred on or after May 13, 2015, in which case

the natural expiration of a design patent is generally 15 years after its issue date. Various extensions may be available; however, the

life of a patent, and the protection it affords, is limited. Without patent protection for our products and services, we may be open

to competition. Further, if we encounter delays in our development efforts, the period of time during which we could market our products

and services under patent protection would be reduced and, given the amount of time required for the development, testing and regulatory

review of planned or future products, patents protecting such products may expire before or shortly after such products are commercialized.

As a result, our intellectual property might not provide us with sufficient rights to exclude others from commercializing products similar

or identical to ours.

Moreover, the coverage claimed in a patent application

can be significantly reduced before the patent is issued, and its scope can be reinterpreted after issuance. Even if patent applications

we license or own, currently or in the future, are issued as patents, they may not be issued in a form that will provide us with any

meaningful protection, prevent competitors or other third parties from competing with us, or otherwise provide us with any competitive

advantage. Any patents that we own may be challenged, narrowed, circumvented or invalidated by third parties. Consequently, we cannot

guarantee that our products or other technologies will be protectable, or will remain protected, by valid and enforceable patents. Our

competitors or other third parties may be able to circumvent our patents by developing similar or alternative technologies or products

in a non-infringing manner which could materially adversely affect our business, financial condition, and results of operations.

Changes in U.S. patent law could diminish

the value of patents in general, thereby impairing our ability to protect our devices.

Our success is heavily dependent on our proprietary

Sonical™ technology, the intellectual property rights protecting it, as well as any future intellectual property we own, particularly

patents. Obtaining and enforcing patents involves both technological and legal complexity. Therefore, obtaining and enforcing patents

is costly, time-consuming and inherently uncertain. In addition, the U.S. has recently enacted and is currently implementing wide-ranging

patent reform legislation. Recent U.S. Supreme Court rulings have narrowed the scope of patent protection available in certain circumstances

and weakened the rights of patent owners in certain situations. In addition to increasing uncertainty with regard to our ability to obtain

patents in the future, this combination of events has created uncertainty with respect to the value of patents, once obtained. Depending

on future actions by the U.S. Congress, the federal courts and the USPTO, the laws and regulations governing patents could change in

unpredictable ways that would weaken our ability to obtain new patents or to enforce our existing patents and patents that we might obtain

in the future.

We may not be able to protect our intellectual

property rights throughout the world.

Filing, prosecuting and defending patents on