true

S-1/A

0001378866

0001378866

2024-01-01

2024-09-30

0001378866

2024-09-30

0001378866

2023-12-31

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2024-09-30

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2023-12-31

0001378866

us-gaap:SeriesBPreferredStockMember

2024-09-30

0001378866

us-gaap:SeriesBPreferredStockMember

2023-12-31

0001378866

2023-01-01

2023-09-30

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2023-12-31

0001378866

GOGR:SeriesBPreferredStocksMember

2023-12-31

0001378866

us-gaap:CommonStockMember

2023-12-31

0001378866

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001378866

us-gaap:RetainedEarningsMember

2023-12-31

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2022-12-31

0001378866

GOGR:SeriesBPreferredStocksMember

2022-12-31

0001378866

us-gaap:CommonStockMember

2022-12-31

0001378866

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001378866

us-gaap:RetainedEarningsMember

2022-12-31

0001378866

2022-12-31

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2024-01-01

2024-09-30

0001378866

GOGR:SeriesBPreferredStocksMember

2024-01-01

2024-09-30

0001378866

us-gaap:CommonStockMember

2024-01-01

2024-09-30

0001378866

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-09-30

0001378866

us-gaap:RetainedEarningsMember

2024-01-01

2024-09-30

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2023-01-01

2023-09-30

0001378866

GOGR:SeriesBPreferredStocksMember

2023-01-01

2023-09-30

0001378866

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001378866

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-09-30

0001378866

us-gaap:RetainedEarningsMember

2023-01-01

2023-09-30

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2024-09-30

0001378866

GOGR:SeriesBPreferredStocksMember

2024-09-30

0001378866

us-gaap:CommonStockMember

2024-09-30

0001378866

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0001378866

us-gaap:RetainedEarningsMember

2024-09-30

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2023-09-30

0001378866

GOGR:SeriesBPreferredStocksMember

2023-09-30

0001378866

us-gaap:CommonStockMember

2023-09-30

0001378866

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001378866

us-gaap:RetainedEarningsMember

2023-09-30

0001378866

2023-09-30

0001378866

2023-01-01

2023-12-31

0001378866

us-gaap:WarrantMember

2024-01-01

2024-09-30

0001378866

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2024-01-01

2024-09-30

0001378866

GOGR:SeriesAConvertiblePreferredStockMember

2023-01-01

2023-12-31

0001378866

us-gaap:GeneralAndAdministrativeExpenseMember

2024-01-01

2024-09-30

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022NoteMember

2022-02-18

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022WarrantsMember

2022-02-18

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022CommitmentSharesMember

2022-02-17

2022-02-18

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

2022-02-17

2022-02-18

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022NoteMember

2023-01-01

2023-12-31

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022NoteMember

GOGR:InterestPaidMember

2023-01-01

2023-12-31

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022NoteMember

GOGR:OriginalIssuedDebtDiscountMember

2023-01-01

2023-12-31

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022NoteMember

GOGR:OriginallyIssuedDiscountMember

2023-01-01

2023-12-31

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022WarrantsMember

2022-02-17

2022-02-18

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022CommitmentSharesMember

2022-02-18

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022NoteMember

2022-02-17

2022-02-18

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022NoteMember

2023-12-31

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023WarrantsMember

2023-03-01

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023WarrantsMember

2023-02-26

2023-03-01

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2022NoteMember

2023-02-26

2023-03-01

0001378866

GOGR:SA2022Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023NoteMember

2023-03-08

2023-03-09

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023NoteMember

2023-05-05

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023WarrantsMember

2023-05-05

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

2023-05-04

2023-05-05

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023WarrantsMember

2023-05-04

2023-05-05

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023NoteMember

2023-05-04

2023-05-05

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023NoteMember

GOGR:FirstAmendmentToPromissoryNoteMember

2024-06-07

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023NoteMember

GOGR:FirstAmendmentToPromissoryNoteMember

2024-06-06

2024-06-07

0001378866

GOGR:SA2023Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2023NoteMember

GOGR:FirstAmendmentToPromissoryNoteMember

2024-09-30

0001378866

GOGR:SA2024Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2024NoteMember

2024-08-06

0001378866

GOGR:SA2024Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2024CommitmentSharesMember

2024-08-06

0001378866

GOGR:SA2024Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2024CommitmentSharesMember

2024-08-05

2024-08-06

0001378866

GOGR:SA2024Member

GOGR:AJBCapitalInvestmentLLCMember

2022-08-05

2022-08-06

0001378866

GOGR:SA2024Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2024NoteMember

2024-08-05

2024-08-06

0001378866

GOGR:SA2024Member

GOGR:AJBCapitalInvestmentLLCMember

GOGR:AJB2024NoteMember

2024-09-30

0001378866

GOGR:LenderMember

GOGR:July2024NotesMember

GOGR:PromissoryNoteMember

2024-07-16

0001378866

GOGR:LenderMember

GOGR:July2024NotesMember

GOGR:PromissoryNoteMember

2024-07-15

2024-07-16

0001378866

GOGR:LenderMember

GOGR:July2024NotesMember

GOGR:DebtReleaseAgreementMember

2024-08-15

0001378866

GOGR:LenderMember

GOGR:July2024NotesMember

GOGR:DebtReleaseAgreementMember

2024-08-14

2024-08-15

0001378866

GOGR:LenderMember

GOGR:July2024NotesMember

GOGR:PromissoryNoteMember

2024-09-30

0001378866

GOGR:LenderMember

GOGR:April222024NoteMember

GOGR:PromissoryNoteMember

2024-04-22

0001378866

GOGR:LenderMember

GOGR:April222024NoteMember

GOGR:PromissoryNoteMember

2024-04-21

2024-04-22

0001378866

GOGR:LenderMember

GOGR:April222024NoteMember

GOGR:PromissoryNoteMember

2024-09-30

0001378866

GOGR:April2024NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2024-04-02

0001378866

GOGR:April2024NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2024-07-16

0001378866

GOGR:April2024NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2024-04-21

2024-04-22

0001378866

GOGR:LenderMember

GOGR:April2024NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2024-08-15

0001378866

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

GOGR:April2024NoteMember

2024-08-06

0001378866

GOGR:April2024NoteMember

GOGR:TwoAmendmentsToApril2024NoteMember

2024-01-01

2024-09-30

0001378866

GOGR:April2024NoteMember

GOGR:TwoAmendmentsToApril2024NoteMember

2024-09-30

0001378866

GOGR:LenderMember

GOGR:April2024NoteMember

GOGR:TwoAmendmentsToApril2024NoteMember

2024-09-30

0001378866

GOGR:LenderMember

GOGR:April2024NoteMember

GOGR:TwoAmendmentsToApril2024NoteMember

2024-01-01

2024-09-30

0001378866

GOGR:April2024NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2024-09-30

0001378866

GOGR:February12024ConsolidatedNoteMember

GOGR:CancellationAndConsolidationAgreementMember

2024-02-01

0001378866

GOGR:February12024ConsolidatedNoteMember

GOGR:CancellationAndConsolidationAgreementMember

2024-01-25

2024-02-01

0001378866

GOGR:February12024ConsolidatedNoteMember

GOGR:ConversionCancellationAndConsolidationAgreementMember

2024-02-01

0001378866

GOGR:February12024ConsolidatedNoteMember

GOGR:ConversionCancellationAndConsolidationAgreementMember

2024-01-25

2024-02-01

0001378866

GOGR:January2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-31

0001378866

GOGR:December2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-31

0001378866

GOGR:January2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-30

2023-01-31

0001378866

GOGR:January2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-01

2023-12-31

0001378866

GOGR:January2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-12-31

0001378866

GOGR:January122023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-12

0001378866

GOGR:March2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-03-06

0001378866

GOGR:December2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-12-20

0001378866

GOGR:January122023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-11

2023-01-12

0001378866

GOGR:March2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-03-05

2023-03-06

0001378866

GOGR:December2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-12-19

2023-12-20

0001378866

GOGR:January122023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-03-06

0001378866

GOGR:December2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-03-05

2023-03-06

0001378866

GOGR:January122023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-01

2023-12-31

0001378866

GOGR:March2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-01

2023-12-31

0001378866

GOGR:January122023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-12-31

0001378866

GOGR:March2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-12-31

0001378866

GOGR:December2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-12-31

0001378866

GOGR:November2022NotesJanuary2023NotesAndNovember2023Member

GOGR:CancellationAndConsolidationAgreementMember

2024-01-25

2024-02-01

0001378866

GOGR:November2022NotesJanuary2023NotesAndNovember2023Member

GOGR:CancellationAndConsolidationAgreementMember

2024-02-01

0001378866

GOGR:March92023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-03-09

0001378866

GOGR:March92023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-03-08

2023-03-09

0001378866

GOGR:March92023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-01

2023-12-31

0001378866

GOGR:March92023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-12-31

0001378866

GOGR:March92023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2024-09-30

0001378866

GOGR:LenderMember

GOGR:August2023NotesMember

GOGR:PromissoryNoteMember

2023-08-11

0001378866

GOGR:LenderMember

GOGR:August2023NotesMember

GOGR:PromissoryNoteMember

2023-08-10

2023-08-11

0001378866

GOGR:LenderMember

GOGR:August2023NotesMember

GOGR:PromissoryNoteMember

2023-12-31

0001378866

GOGR:September2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-09-06

0001378866

GOGR:September2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-09-05

2023-09-06

0001378866

GOGR:September2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-01-01

2023-12-31

0001378866

GOGR:September2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2023-12-31

0001378866

GOGR:September2023NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2024-09-30

0001378866

GOGR:LenderMember

GOGR:October2023NotesMember

GOGR:PromissoryNoteMember

2023-10-04

0001378866

GOGR:LenderMember

GOGR:October2023NotesMember

GOGR:PromissoryNoteMember

2023-10-03

2023-10-04

0001378866

GOGR:LenderMember

GOGR:October2023NotesMember

GOGR:PromissoryNoteMember

2023-12-31

0001378866

GOGR:November2023NoteMember

GOGR:UnsecuredPromissoryNoteMember

GOGR:IndividualLenderMember

2023-11-01

0001378866

GOGR:November2023NoteMember

GOGR:UnsecuredPromissoryNoteMember

GOGR:IndividualLenderMember

2023-10-30

2023-11-01

0001378866

GOGR:UnsecuredPromissoryNoteMember

GOGR:November2023NoteMember

GOGR:IndividualLenderMember

2023-10-30

2023-11-01

0001378866

GOGR:IndividualLenderMember

GOGR:November2023NoteMember

GOGR:UnsecuredPromissoryNoteMember

2023-12-31

0001378866

GOGR:UnsecuredPromissoryNoteMember

GOGR:November2023NoteMember

GOGR:IndividualLenderMember

2023-01-01

2023-12-31

0001378866

GOGR:November2023NoteMember

GOGR:UnsecuredPromissoryNoteMember

GOGR:IndividualLenderMember

2023-11-17

0001378866

GOGR:November2023NoteMember

GOGR:UnsecuredPromissoryNoteMember

GOGR:IndividualLenderMember

2023-11-16

2023-11-17

0001378866

GOGR:UnsecuredPromissoryNoteMember

GOGR:November2023NoteMember

GOGR:IndividualLenderMember

2023-11-16

2023-11-17

0001378866

GOGR:September2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-09-17

0001378866

GOGR:September2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-09-16

2022-09-17

0001378866

GOGR:October2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-10-03

0001378866

GOGR:October2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2022-10-03

0001378866

GOGR:September2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2022-09-17

0001378866

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:October2022NoteMember

GOGR:LenderMember

2022-10-02

2022-10-03

0001378866

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:September2022NoteMember

GOGR:LenderMember

2022-09-16

2022-09-17

0001378866

GOGR:November2022NotesMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-11-18

0001378866

GOGR:November2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-11-15

2022-11-18

0001378866

GOGR:November2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2022-11-18

0001378866

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:November2022NoteMember

GOGR:LenderMember

2022-11-15

2022-11-18

0001378866

GOGR:November2022NotesMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-12-31

0001378866

GOGR:November2022NotesMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2023-12-31

0001378866

GOGR:November2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2023-01-01

2023-12-31

0001378866

GOGR:November2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-11-10

0001378866

GOGR:November2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-11-09

2022-11-10

0001378866

GOGR:November2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:LenderMember

2022-11-10

0001378866

GOGR:PromissoryUnsecuredLoanAgreementMember

GOGR:November2022NoteMember

GOGR:LenderMember

2022-11-09

2022-11-10

0001378866

GOGR:AmendmentToNovember2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-12-09

2022-12-10

0001378866

GOGR:AmendmentToNovember2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-12-10

0001378866

GOGR:November2022NoteMember

GOGR:PromissoryUnsecuredLoanAgreementMember

2022-12-31

0001378866

GOGR:November2022NoteMember

GOGR:MutualReleaseAgreementMember

GOGR:LenderMember

2023-02-28

0001378866

GOGR:LenderMember

GOGR:MutualReleaseAgreementMember

GOGR:November2022NoteMember

2023-01-01

2023-12-31

0001378866

GOGR:March2015NoteMember

GOGR:UnsecuredPromissoryNoteMember

GOGR:IndividualLenderMember

2015-03-01

0001378866

GOGR:IndividualLenderMember

GOGR:March2015NoteMember

GOGR:UnsecuredPromissoryNoteMember

2022-06-30

0001378866

GOGR:March2015NoteMember

GOGR:UnsecuredPromissoryNoteMember

GOGR:IndividualLenderMember

2022-06-29

2022-06-30

0001378866

GOGR:March2015NoteMember

GOGR:UnsecuredPromissoryNoteMember

GOGR:IndividualLenderMember

2022-01-01

2022-12-31

0001378866

GOGR:DebtReleaseAgreementMember

2024-06-14

0001378866

GOGR:DebtReleaseAgreementMember

2024-01-01

2024-09-30

0001378866

GOGR:FirstAmendmentMember

2024-09-30

0001378866

GOGR:April22024NoteMember

2024-09-30

0001378866

GOGR:AnEmployeeForServicesMember

2024-09-30

0001378866

GOGR:November12023NoteMember

2023-12-31

0001378866

GOGR:LegalServicesMember

2023-12-31

0001378866

srt:MinimumMember

2024-04-26

0001378866

srt:MaximumMember

2024-04-26

0001378866

us-gaap:SeriesBPreferredStockMember

2024-01-01

2024-09-30

0001378866

us-gaap:SeriesAPreferredStockMember

2024-06-02

2024-06-03

0001378866

GOGR:SeriesBConvertiblePreferredStockMember

2024-09-30

0001378866

GOGR:SeriesBConvertiblePreferredStockMember

2023-12-31

0001378866

us-gaap:CommonStockMember

2024-02-12

2024-02-13

0001378866

us-gaap:CommonStockMember

2023-01-30

2023-01-31

0001378866

us-gaap:CommonStockMember

GOGR:AssetPurchaseAgreementMember

2023-02-15

2023-02-16

0001378866

us-gaap:CommonStockMember

GOGR:AssetPurchaseAgreementMember

2023-02-16

0001378866

us-gaap:CommonStockMember

GOGR:November102022NoteMember

2023-02-28

0001378866

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001378866

us-gaap:CommonStockMember

2023-03-30

2023-03-31

0001378866

us-gaap:CommonStockMember

GOGR:USPatentAndTrademarkOfficeMember

2023-04-24

2023-04-25

0001378866

us-gaap:CommonStockMember

GOGR:PromissoryNotesIssuedAndAmendedMember

2024-01-01

2024-09-30

0001378866

us-gaap:CommonStockMember

GOGR:PromissoryNotesIssuedAndAmendedMember

2023-01-01

2023-09-30

0001378866

us-gaap:CommonStockMember

2024-01-01

2024-09-30

0001378866

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001378866

us-gaap:CommonStockMember

GOGR:VendorsMember

2024-01-01

2024-09-30

0001378866

us-gaap:CommonStockMember

GOGR:DebtorsMember

2024-01-01

2024-09-30

0001378866

us-gaap:CommonStockMember

GOGR:AJBNote2023Member

2024-01-01

2024-09-30

0001378866

us-gaap:CommonStockMember

GOGR:JanuaryMarchAndDecember2023NoteholderMember

2024-01-01

2024-09-30

0001378866

us-gaap:CommonStockMember

GOGR:AJBMember

2024-01-01

2024-09-30

0001378866

2023-03-01

0001378866

2023-02-27

2023-03-01

0001378866

GOGR:AJBCapitalInvestmentsLLCMember

GOGR:SecuritiesAgreementMember

2023-05-05

0001378866

GOGR:AJBCapitalInvestmentsLLCMember

GOGR:SecuritiesAgreementMember

2023-05-01

2023-05-05

0001378866

2023-05-05

0001378866

GOGR:CommonStockToLendersMember

2024-01-01

2024-09-30

0001378866

GOGR:CommonStockToVendorForProfessionalServicesMember

2024-01-01

2024-09-30

0001378866

GOGR:CommonStockToEmployeesForServicesPerformedMember

2023-01-01

2023-12-31

0001378866

GOGR:CommonStockToEmployeesForServicesPerformedMember

2024-01-01

2024-09-30

0001378866

us-gaap:WarrantMember

2022-12-31

0001378866

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001378866

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001378866

us-gaap:WarrantMember

2023-12-31

0001378866

us-gaap:WarrantMember

2024-01-01

2024-09-30

0001378866

us-gaap:WarrantMember

2024-09-30

0001378866

us-gaap:WarrantMember

srt:MinimumMember

2023-09-30

0001378866

us-gaap:WarrantMember

srt:MaximumMember

2023-09-30

0001378866

us-gaap:WarrantMember

srt:MinimumMember

2024-01-01

2024-09-30

0001378866

us-gaap:WarrantMember

srt:MaximumMember

2024-01-01

2024-09-30

0001378866

us-gaap:WarrantMember

srt:MinimumMember

2023-01-01

2023-09-30

0001378866

us-gaap:WarrantMember

srt:MaximumMember

2023-01-01

2023-09-30

0001378866

us-gaap:WarrantMember

2023-01-01

2023-09-30

0001378866

GOGR:AssetPurchaseAgreementMember

2023-02-15

2023-02-16

0001378866

GOGR:AssetPurchaseAgreementMember

us-gaap:CommonStockMember

2023-02-15

2023-02-16

0001378866

GOGR:AssetPurchaseAgreementMember

us-gaap:CommonStockMember

2023-02-16

0001378866

GOGR:AssetPurchaseAgreementMember

GOGR:USPatentAndTrademarkOfficeMember

2023-04-24

2023-04-25

0001378866

GOGR:AssetPurchaseAgreementMember

GOGR:USPatentAndTrademarkOfficeMember

2023-04-25

0001378866

GOGR:AssetPurchaseAgreementMember

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table

of Contents

As filed with the U.S. Securities and Exchange

Commission on January 14, 2025

Registration No. 333-276881

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM

S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Go Green Global Technologies Corp.

(Exact name of registrant

as specified in its charter)

| Nevada |

3990 |

46-0853279 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

22 Kenosia Avenue, Unit 9

Danbury, CT 06810

(866) 847-3366

(Address, including zip code, and telephone number,

including area code,

of registrant’s principal executive offices)

Direct Transfer LLC

One Glenwood Avenue, Suite 1001

Raleigh, NC 27603

(919) 744-2722

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Ross D. Carmel, Esq.

Shane Wu, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

Telephone:

(212) 930-9700

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities

Act”), check the following box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities

Exchange Act of 1934.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided to Section 7(a)(2)(B) of the Securities Act.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective

on such date as the SEC, acting pursuant to said Section 8(a) may determine.

The information in this prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities

in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated

January 14, 2025

PRELIMINARY PROSPECTUS

Go

Green Global Technologies Corp.

Up to 13,171,136

Shares of Common Stock

Up to 22,600,000

Shares of Common Stock Issuable Upon Exercise of Warrants

This prospectus relates to up to 13,171,136 shares of common stock

of Go Green Global Technologies Corp., par value $0.001 per share (“Common Stock”), that the selling security holders identified

in this prospectus (the “Selling Shareholders,” and each, “Selling Shareholder”) may sell from time to time in

one or more transactions in amounts, at prices and on terms that will be determined at the time of the offering. The shares of Common

Stock being offered for resale pursuant to this prospectus include up to (i) 3,076,923 shares of Common Stock (collectively, the “Outstanding

AJB Shares”) issued to one Selling Shareholder, AJB Capital Investments LLC (“AJB Capital”), in our February 2022 bridge

financing round (“2022 Bridge Financing”); (ii) 750,000 shares of Common Stock issued to AJB Capital pursuant to amended terms

of pre-funded warrants issued to AJB Capital in our May 2023 bridge financing round (the “2023 Bridge Financing”); (iii) 500,000

shares of Common Stock issued to AJB Capital as a commitment fee in our August 2024 bridge financing round (the August 2024 AJB Financing”);

(iv) 1,500,000 shares of Common Stock issued to AJB Capital as a commitment fee as consideration for extending the maturity date of the

note issued in the 2023 Bridge Financing; 7,344,213 shares of Common Stock held by certain Selling Shareholders (such shares, collectively

and together with the Outstanding AJB Capital Shares, the “Outstanding Shares”); (v) 2,500,000 shares of Common Stock issuable

upon exercise of our warrants to purchase Common Stock, such warrants issued to AJB Capital in the 2022 Bridge Financing and which are

exercisable for five years from issuance, at an exercise price of $0.01 per share (the “2022 Warrants”); (vi) 9,600,000 shares

of Common Stock, in the aggregate, issuable upon the exercise of warrants issued to certain Selling Shareholders in 2022 and 2023 as compensation

for their services and which are exercisable for five years from issuance, at various exercise prices (collectively, “Additional

Warrants”); (vii) 9,000,000 shares of Common Stock issuable upon the exercise of our pre-funded warrants to purchase Common Stock,

such pre-funded warrants issued to AJB Capital in the 2023 Bridge Financing, round which are exercisable at an exercise price of $0.001

per share (collectively, the “2023 Warrants”); and (viii) 1,500,000 shares of Common Stock issuable upon exercise of pre-funded

warrants granted to AJB Capital as consideration for extending the maturity date of the note issued in the 2023 Bridge Financing (the

“2024 Warrants,” and, together with the 2023 Warrants, the 2022 Warrants and the Additional Warrants, the “Warrants,”

and all of the Common Stock underlying the Warrants, collectively, the “Warrant Shares”). We issued all of the aforesaid Common

Stock and Warrants to the Selling Shareholders in transactions which were not public securities offerings. See the section entitled “Selling Shareholders” herein.

Our registration of the Outstanding Shares and

Warrant Shares (collectively, the “Shares”) does not mean that any or all of the Selling Shareholders will offer or sell any

of their respective Shares. The Selling Shareholders and any of their pledgees, assignees and successors-in-interest may, from time to

time, sell any or all of their Shares on the OTCQB at prevailing market prices or at privately negotiated prices. See “Plan of Distribution” for more details. We will not receive any of the proceeds from such sales of the Shares, except with respect

to amounts received by us upon exercise of the Warrants. We will bear all costs, expenses and fees in connection with the registration

of the Shares, including with regard to compliance with state securities or “blue sky” laws. The Selling Shareholders will

bear all of the commissions and discounts, if any, attributable to its sale of their respective Shares. Each Selling Shareholder may be

considered an “underwriter” within the meaning of the Securities Act.

This prospectus describes the general manner

in which the Shares may be offered and sold by the Selling Shareholders. If necessary, the specific manner in which the Shares may be

offered and sold will be described in a supplement to this prospectus. Any such prospectus supplement may also add, update or change

information in this prospectus. You should carefully read this prospectus and any applicable prospectus supplement carefully before you

invest. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution”

in this prospectus.

As of the

date of this prospectus, management holds approximately 40.37% of the voting power of the Company on a non-diluted basis. Additionally,

our Chief Executive Officer, President, and Director, Danny G. Bishop, holds all of the shares of our Series B Preferred Stock, which

entitle their holder to 20 votes per share. Mr. Bishop’s ownership of capital stock in the Company results in his ownership of

approximately 38.11% of the voting power of the Company on a non-diluted basis. See “Risk Factors” for

a discussion of the risks associated with (i) the significant voting power of our Series B Preferred Stock; and (ii) future issuances

of preferred stock, additional Common Stock or securities convertible into shares of Common Stock in connection with our incentive plans,

acquisitions or otherwise.

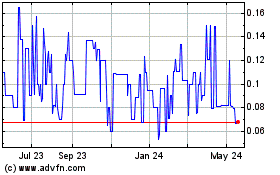

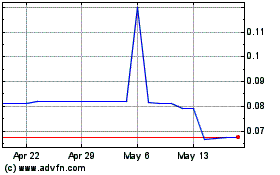

Our Common Stock is quoted on the OTCQB under

the symbol “GOGR.” The closing price of our Common Stock on January 13, 2025, as reported

by the OTC Markets Group Inc. (the “OTC Markets Group”), was $0.07 per share.

Investing in our Common Stock involves a high

degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of

information that should be considered in connection with an investment in our Common Stock.

Neither the U.S. Securities and Exchange Commission

(“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

We are an “emerging growth company”

as that term is used in the Jumpstart Our Business Startups Act of 2012, and we have elected to comply with certain reduced public company

reporting requirements.

Table of Contents

ABOUT

THIS PROSPECTUS

This prospectus describes the general manner

in which the Selling Shareholders may offer, from time to time, up to 35,771,136 Shares held

by the Selling Shareholders as described in the cover page of this prospectus. You should rely only on the information contained in this

prospectus and the related exhibits, any prospectus supplement or amendment thereto and the documents incorporated by reference, or to

which we have referred you, before making your investment decision. Neither we nor the Selling Shareholders have authorized anyone to

provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

This prospectus, any prospectus supplement or amendments thereto do not constitute an offer to sell, or a solicitation of an offer to

purchase, the Common Stock offered by this prospectus, any prospectus supplement or amendments thereto in any jurisdiction to or from

any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume

that the information contained in this prospectus, any prospectus supplement or amendments thereto, as well as information we have previously

filed with the SEC, is accurate as of any date other than the date on the front cover of the applicable document.

If necessary, the specific manner in which the

Shares may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update or change

any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus

and any prospectus supplement, you should rely on the information in such prospectus supplement, provided that if any statement in one

of these documents is inconsistent with a statement in another document having a later date, for example, a document incorporated by

reference in this prospectus or any prospectus supplement, the statement in that document having the later date modifies or supersedes

the earlier statement.

Neither the delivery of this prospectus nor any

distribution of Common Stock pursuant to this prospectus shall, under any circumstances, create any implication that there has been no

change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus.

Our business, financial condition, results of operations and prospects may have changed since such date.

Unless the context indicates otherwise, the terms

“Go Green,” “Company,” “we,” “us” and “our” in this prospectus refer to Go

Green Global Technologies Corp., a Nevada corporation.

PROSPECTUS

SUMMARY

This summary highlights information contained

elsewhere in this prospectus and does not contain all the information you should consider before investing in our Common Shares and it

is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus.

You should carefully consider, among other things, the sections titled “Risk Factors,” “Cautionary Note Regarding

Forward-Looking Statements,” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and our financial statements and the related notes included elsewhere in this prospectus.

Introduction

We

are a technology and manufacturing company based in Danbury, Connecticut. We own the patented Sonical™ technology (U S.

Patent Number 11,634,344 B2), which is designed to render impurities inert in fluids, in a way that is cost-saving and avoids the use

of harsh chemicals for fluid treatment. Our Sonical™ technology is intended to be installed into existing water supply and fuel

consumption systems. The Sonical™ apparatus is designed such that, after installation into an existing water or fuel treatment

system, fluid can pass through the electromagnetic field created within the apparatus and undergo molecular-level changes, resulting

in cleaner water and fuel.

We envision our Sonical™ technology to

be a revolutionary catalyst in the global transition to a green economy. Our mission is to provide global access to this technology,

allowing for the extension of fuel life, a decrease in carbon emissions, and the elimination of harsh chemicals in water treatment worldwide.

Currently, we are in a pre-revenue stage of development.

As of the date of this prospectus, we have not launched any of the products discussed herein. We are in the process of finalizing our

manufacturing processes and sourcing materials to manufacture and commercialize our products at scale. We expect to begin launching

certain products approximately between the first fiscal quarter of 2025 and second fiscal quarter of 2025, assuming these products are

successfully manufactured and commercialized and depending on the progress of our research and development for these products. We

cannot assure that any or all of our products will ever launch, launch successfully, or that we will be able to generate revenue from

these products or adequate revenue to continue as a going concern.

The report

from our independent registered public accounting firm for the year ended December 31, 2023 includes an explanatory paragraph stating

that we have suffered recurring losses from operations and have a net capital deficiency that raises substantial doubt about its ability

to continue as a going concern. We have incurred net losses of $1,421,272 for the nine months ended September 30, 2024 and $3,454,183

for the year ended December 31, 2023 and our net capital deficiency was $2,124,611 as of September 30, 2024 and $1,803,754 as of December

31, 2023.

Our Technology and Anticipated Products

The Sonical™ apparatus

is the technology supporting and incorporated into all of our water and fuel treatment products. This is a patented technology utilizing

pulsed power, which features unique coil design configurations that can create and conduct an electromagnetic field within the Sonical™

apparatus. The electromagnetic field triggers a forced sequential re-phasing arrangement within fluid passing through, which renders

impurities in the fluid inert.

We believe that our

Sonical™ technology, when incorporated into fuel and water treatment systems, can effectively address some of the issues with conventional

methods for fuel and water treatment. For one, conventional methods for water treatment typically involve the addition of chemical disinfectants

to remove bacteria within water, which can be harmful to human and environmental health. Disinfectants such as chlorine also have an

unpleasant taste and smell, which are especially significant concerns pertaining to potable water. There is also the persistent problem

of mineral buildup, specifically calcium carbonate, in distribution networks such as pipes and water flow devices. Ion-exchange water

softeners have been commonly used to remove minerals from (descale) pipes and water flow devices, but these softeners require continuous

and consistent maintenance, which can compound the costs associated with water treatment. Pipe repair and cleanup at large facilities

is also costly and poses significant safety concerns. The pulse power technology of the Sonical™ removes the need for chemical

disinfectants to water treatment systems while descaling water and controlling bacterial growth. The Sonical™ products are customizable

and easy to install and following installation require little to no maintenance. We believe that incorporating our Sonical™ products

into existing water treatment and distribution systems will be a less costly and more environmentally sound alternative to conventional

methods.

Conventional methods

for extracting fuel from crude oil are also costly and harmful to the environment. Refinement costs for the production of commonly used

fuel from petroleum are substantial. To save on costs, producers may sell fuel products which may not be entirely free from impurities

such as hydrocarbons, even though the products can technically still be used for combustion. As a result, existing hydrocarbons in such

fuels can be emitted into the atmosphere, adding significant pollution to the environment. We believe the technology behind the Sonical™

apparatus, which produces varying electromagnetic wavelengths to alter the molecular structure of fuel, can potentially enable fuel to

burn more efficiently and result in cost savings and fewer carbon emissions.

We intend to have our

Sonical™ fuel products tested extensively in private laboratories to evaluate significant fuel efficiency increases, as well as

decreases in overall carbon emissions. For our Sonical™ water products, we intend to have our technology tested extensively at

private laboratories to evaluate the product's ability to eliminate the minerals causing scale buildup, as well as the elimination of

harmful microorganisms, such as bacteria in water.

Business Plans

We are presently ramping up manufacturing and

solidifying our market strategy to commercialize our products. We are in the process of finalizing our manufacturing processes and sourcing

materials to manufacture and commercialize our products at scale. Below are the business lines we expect to launch between the first

fiscal quarter of 2025 and second fiscal quarter of 2025 if and when our manufacturing and marketing goals are achieved, and also depending

on the progress of our research and development for these products. Currently, we have prototypes for certain categories of these

products and are finalizing their testing and techniques for manufacturing.

| Fuel

Treatment |

|

Water

Treatment & Descaling |

| Commercial

Boilers |

|

HVAC

Cooling Towers |

| Residential

Boilers |

|

Commercial

Descaling |

| Diesel

Generators |

|

Residential

Water |

| Automotive/Trucking |

|

Municipal

Water |

| Locomotive

(Heavy Rail) |

|

|

| Maritime

Vessels |

|

|

Our fuel treatment products are aimed at increasing

the efficiency of fuel, improving overall engine function, and decreasing lifetime carbon emissions. We believe this is achieved by installing

our fuel devices, which contain the Sonical™ technology, on a pre-combustion location within any fossil-fuel-burning system, such

as an oil-burning furnace, a generator, a car, a truck, and more. We believe the products in the planned fuel treatment line will experience

rapid growth due to increased fuel costs on a global level and increased levels of interest to decrease carbon dioxide emissions.

Our water treatment products are aimed at eliminating

the minerals causing scale buildup in water, allowing for better maintenance of water systems without the use of chemicals, and providing

improved life span of pipes. We believe the water treatment products are capable of increasing microbial control and eliminating unwanted

organic compounds, including viruses and bacteria both in potable water and industrial applications, such as HVAC systems. We anticipate

that the water treatment and descaling product lines will experience slower but more long-term growth compared to the fuel treatment

product lines.

We anticipate launching our boiler products and

diesel generator products first, anytime between the first fiscal quarter of 2025 and second fiscal quarter of 2025, using our

existing distributor networks to target (i) consumers in the northeast region of the United States utilizing residential and commercial

boilers and (ii) consumers in the diesel generator market in Canada. As our production capabilities grow and we obtain the necessary

and desired certifications for our products (including but not limited to UL certification and National Science Foundation water safety

certification) within the next year, we plan to expand our business to target the following segments for water treatment: residential

potable water treatment, municipal potable water treatment, municipal wastewater treatment, and industrial and commercial wastewater

treatment. As to fuel treatment, after our production capabilities grow, we plan to target the automotive, small and medium duty trucks,

locomotive engines, and maritime vessels markets.

After a year of commercializing and manufacturing

these products, we anticipate being able to target other markets and industry verticals to achieve larger scale installations of our

fuel and water products amongst our client base. Within a year from the start of production, we anticipate being able to scale up our

product output and generating more demand for our products.

In the long term, we plan to target the maritime

industry and the locomotive industry. There is a great demand for cost savings and reductions in carbon emissions in both of these industries,

which we believe we can directly address with our Sonical™ technology in the future.

Industry Overview

We operate in the “green-tech” or

“clean-tech” manufacturing space, which is a relatively new, emerging sector. The novel technology that this sector centers

around is still limited in use. We believe there are currently few existing competitors in this space, which provides us with a strong

path to market.

We believe there has been trending interest in

green technology and sustainability both in the public and private sectors and an increasingly expanding market for simple, retrofit

devices that can solve certain challenges in the treatment of water and fuel. Particularly in the public sector, there has been significant

legislation regarding emissions standards and mandates to address carbon footprint. Private automobiles, small and medium duty trucks,

locomotives, maritime vessels, and furnaces for heating of residential and commercial spaces are all examples of technologies which we

believe could benefit from the integration of our Sonical™ apparatus.

Additionally, there has been significant legislation

addressing the minimization of chemicals used to treat both potable water and water used in commercial and industrial processes. Residential

drinking water, municipal drinking water supplies, swimming pool maintenance, commercial water treatment of HVAC cooling towers, and

wastewater treatment are examples of functions that could benefit from the integration of our Sonical™ apparatus.

Market and Growth

We believe there is a large, addressable market

for our Sonical™ fuel and water treatment technology. We have staggered plans to target various sectors of this market based on

our stage of development.

According to the U.S. Energy Information Administration’s

Short-Term Energy Outlook report, roughly 4.96 million households used heating oil as their main source of space heating fuel,

with 82% of those households in the northeast region of the country.[2] According to the same report, households spent an average

of $2,094 for the 2022 to 2023 winter season, a 13% increase from the 2021 to 2022 season. With oil prices continuing to rise, we anticipate

high consumer demand for a product with a high return on investment in a relatively short timeframe, which can increase fuel efficiency,

with the added benefit of decreasing consumer household carbon footprint.

As to water treatment, we plan to target consumers

who use descaling HVAC cooling towers and consumers who struggle with scale buildup in their water systems within the commercial space,

including restaurants, fast food chains, and other retailers. According to Forbes, in 2023, a new HVAC system can cost anywhere

from $5,000 to $34,000 depending on size. On average, HVAC installations cost around $8,000.[3] HVAC systems must also be regularly

maintained and are subject to scale buildup. To eliminate scale, HVAC technicians currently use chemical maintenance programs that are

costly and dangerous for human health. If these programs are not executed effectively, scale buildup of just 0.18 of an inch on the fireside

of boiler tubes can reduce heat transfer by 69%,[4] which thereby increases fuel consumption and costs. We believe the installation

of a Sonical™ unit can lead to cost savings for homeowners and commercial buildings by eliminating the need for chemical descaling

programs and decreasing the need for costly repairs and replacements. We anticipate significant demand for our HVAC products, as well

as demand for our general descaling product across a variety of industries where descaling is a costly problem.

_________________________

[1] For a list of public data sources

which we consulted in arriving at these addressable market sizes, see footnote 1 in “Business – Industry Overview”

below.

[2] U.S. Energy Information Administration, Short-Term

Energy Outlook, Winter Fuels Outlook, Table WFO1, March 2023.

[3] Weimert, Kelly. “How Much

Does a New HVAC System Cost in 2023?” Forbes, Salaky, Kristin (editor). Last updated July 31, 2023. https://www.forbes.com/home-improvement/hvac/new-hvac-system-cost/#:~:text=The%20price%20of%20a%20new,%248%2C000%2C%20including%20parts%20and%20labor.

[4] As reported by the government of

Canada. “Increasing the Energy Efficiency of Boiler and Heater Installations.” Last modified February 17, 2016. https://natural-resources.canada.ca/energy/publications/efficiency/industrial/cipec/6699

To our knowledge, there is currently no product

in the residential, commercial, or industrial fuel and water treatment markets utilizing pulse power. Given the lack of competition,

we believe it is possible to achieve a 1% to 2% overall market penetration across the variety of potential vertical business niches in

the fuel and water treatment space.

In the longer term, we plan to target two other

major markets, the maritime industry, and the locomotive industry. These markets are currently in need of solutions for reducing carbon

emissions and decreasing costs. We believe these markets have great revenue potential and our products can effectively address cost saving

and carbon emissions concerns in the future.

The maritime industry currently uses exhaust

gas cleaning systems, or “scrubbers,” to decrease its carbon footprint, but this is not a holistic solution. With scrubbers,

carbon emissions are redirected from the atmosphere into the aquatic environment, which contributes to rising oceanic temperatures and

harms marine ecosystems. Scrubbers are also very expensive, ranging anywhere from $500,000 to $2.5 million to install one per vessel.

Go Green can integrate its Sonical™ technology into products geared towards the maritime industry, servicing large and small fleets,

including passenger vessels. We believe our Sonical™ products can increase fuel efficiency as well as decrease carbon emissions,

a two-fold solution that scrubbers do not provide. The Sonical™ product is also a more affordable solution compared to scrubbers,

as they are much simpler to install. We believe our products have the technology that increases fuel efficiency and decrease carbon emissions

directly, as opposed to scrubbers, which simply redirect air pollutants. Within the maritime industry, we believe we can also offer water

treatment solutions for both potable water usage and wastewater treatment. The installation of the Sonical™ apparatus on fleets

are projects of large scale by virtue of the size of maritime vessels, and costs to install our apparatus range from $250,000 to $1 million

per installation. We believe these projects offer significant revenue potential.

Within the locomotive industry, railway operators

are also under significant global pressure to modernize their systems and decrease their overall emissions output. At present, not many

solutions are available to address these issues. We believe we can offer our fuel products to locomotive companies across the globe,

providing a simple and affordable solution to improve fuel efficiency, increase the lifespan of engine components, and decrease lifetime

emissions. Our water treatment products can provide a chemical-free solution to descaling water systems. The installation of our products

into locomotive systems are conceivably projects of large scale and earnings associated therewith could significantly increase our overall

revenue stream.

Competition

With respect to the water treatment market, there

is one known company, Evapco Inc., which offers a similar product to the Sonical™, a descaling device similar to ours called Pulse-Pure.

Notably, one of Evapco’s main patents references two past patents of the inventor of our Sonical™ technology.[5] We

believe that the Pulse-Pure product has a lower efficiency rate than our products. We believe that the newest generation of the patented

Sonical™ technology, with its increased power, can offer customers even more efficient descaling.

With respect to the fuel treatment market, to

our knowledge and as of the date of this prospectus, there are no existing competitors that offer fuel efficiency devices utilizing pulsed

power technology. In the automobile market, there are other retrofit devices such as the EcoMax Fuel Saver that claim to offer fuel savings,

most of these being chip devices that connect to a vehicle’s electronic control unit (“ECU”). The companies launching

these products claim that after a consumer has driven for a certain number of miles, the chip will be able to read data from the ECU

and tune the vehicle’s computer for lower fuel consumption specific to the particular driver’s statistics, such as speed

and driving habits, among other things. In our view, there is limited data as to the efficacy of these products. We believe that our

Sonical™ technology, when installed directly into a fuel line on a pre-burn location of nearly any fossil-fuel-burning engine,

decreases fuel consumption and thereby lifetime emissions. To our knowledge, no market participant has such capabilities.

[5] Patent No. 7,704,364, one of the

patents supporting Pulse-Pure, cites two past patents of Mr. Pandolfo, the inventor of our Sonical™ technology. The two patents

referenced were for decalcifier descaling devices for water treatment, utilizing variable resonance technology.

Intellectual Property

As of the date of this prospectus, we own the

following patents:

Patent

Number |

Place

of

registration |

Title |

Owner |

Filing

date |

Publication

date |

| US 11,634,344 B2 |

United States |

Apparatus and method for treating substances using

asymmetric-vector electrical fields |

Go Green Global Technologies Corp.[6] |

September 10, 2021 |

April 25, 2023 |

| |

|

|

|

|

|

| PCT/US2022/043068 |

International[7];

the Company submitted applications during the national entry phase

to Mexico on March 8, 2024 (Application no. MX/a/2024/003051) and Canada on March 11, 2024 (Application no. 3231504). |

Apparatus and method for treating substances using

asymmetric-vector electrical fields |

Go Green Global Technologies Corp.[8] |

September 9, 2022 |

March 16, 2023 |

As of the date of this prospectus, we have the

following trademark applications pending:

| Trademark |

Place

of

registration |

Application

Number |

Owner |

Class |

Filing

date |

| SONICAL[9] |

Canada |

209183 |

Go Green Global Technologies Corp. |

009 |

March 26, 2021 |

| |

|

|

|

|

|

|

SONICAL[10]

|

United States |

90631615 |

Go Green Global Technologies Corp.[11] |

009 |

April 8, 2021 |

Recent Developments

On November

1, 2024, we hired Michael Tavolacci as our Director of Commercial Strategy pursuant to the Employment Agreement with Mr. Tavolacci (the

“Tavolacci Employment Agreement”), filed herein as Exhibit 10.11. The Director of Commercial Strategy position is not an

executive officer position. This is a full-time position and the term of Mr. Tavolacci’s employment is three years. As Director

of Commercial Strategy, Mr. Tavolacci’s principal duties will include, amongst others, leading the successful launch and commercialization

of new products, managing the Company’s sales force, and developing and implementing the Company’s marketing strategies.

As compensation for his services as Director of Commercial Strategy, we will compensate Mr. Tavolacci on a revenue share basis, specifically

certain percentage amounts of the Company’s wholesale and retail sales. Additionally, upon the Company’s earning of gross

sales, Mr. Tavolacci will receive bonus payments of Common Stock as follows: (i) upon the Company’s earning of $1 million in gross

sales, 250,000 shares of Common Stock; (ii) upon the Company’s earning of $3 million in gross sales, 500,000 shares of Common Stock;

and (iii) upon the Company’s earning of $5 million in gross sales, 1 million shares of Common Stock. Mr. Tavolacci will receive

an initial stock grant of up to 2,375,000 shares of Common Stock vesting over the course of three years, as set forth in more detail

in the Tavolacci Employment Agreement.

On August 1,

2024, the Company entered into a Lease Agreement, (“the Lease Agreement”), filed herein as Exhibit 10.12, for the rental

of approximately 2,000 square feet of office, warehouse, and light-industrial space at 22 Kenosia Avenue, Unit 9, Danbury, CT 06810.

The lease term is for five years, as set forth in more detail in the Lease Agreement.

On July 22, 2024, the Company’s Common

Stock started trading on the OTCQB.

On

July 3, 2024, the Company entered into a Distribution Agreement (“Distribution Agreement”)

with CALCLEAR Investments PTY Limited, (“CALCLEAR”) an Australian corporation

selling water conditioning products. The term of the Distribution Agreement will last until

July 3, 2027, after which the Distribution Agreement will be automatically renewed for an

additional three (3)-year term if the Company sells the minimum amount of three thousand

of CALCLEAR’s water treatment products specified in the Distribution Agreement.

Pursuant to the Distribution Agreement, the Company will serve as the exclusive North American

distributor of certain CALCLEAR water treatment products developed using CALCLEAR’s

patented technology and related products manufactured or marketed by CALCLEAR during the

term of the Distribution Agreement. Certain individuals identified in “Item 15 –

Recent Sales of Unregistered Securities” will receive Common Stock as consideration

for CALCLEAR ’s entry into the Distribution Agreement. CALCLEAR will also receive value

in the form of royalty payments as consideration pursuant to the Distribution Agreement.

The Distribution Agreement is filed as Exhibit 10.7. The Company launched sales of CALCLEAR’s

products as a distributor in the third fiscal quarter of 2024.

On June 3, 2024, we filed the Certificate of

Amendment to Designation, Preferences, and Rights of the Series A Preferred Stock, which, among other things, clarified that (i) the

Series A Preferred Stock will convert upon a securities offering of the Company or any of its subsidiaries which raises proceeds of $2,000,000

or more; and (ii) the holders of Series A Preferred Stock have liquidation rights senior to holders of Common Stock.

On May 29, 2024, we filed the Certificate of

Amendment to Designation of the Series B Preferred Stock, which clarified that holders of the Series B Preferred Stock have liquidation

rights senior to holders of Series A Preferred Stock and holders of Common Stock, in such order.

On May 6, 2024, we filed the Certificate of Amendment

to the Articles of Incorporation, which increased our authorized capital stock to 525,000,000 and our authorized Common Stock to 500,000,000.

The Certificate of Amendment to the Articles of Incorporation is filed as Exhibit 3.11.

[6] The inventor is Salvatore Mario

Pandolfo, who previously assigned the patent to us pursuant to the APA (as defined below). We were the applicant for this patent.

[7] This patent was filed on the International

Patent System, which allows patent holders to seek protection for their intellectual property in its 57 participating countries, which

list of countries can be accessed here: https://www.wipo.int/pct/en/pct_contracting_states.html.

[8] The inventor is Salvatore Mario

Pandolfo, who previously assigned the patent to us. We were the applicant for this patent.

[9] Goods associated with trademark

as claimed in this application: Fluid treatment apparatus for effecting physical or chemical changes to fluids or particles carried by

fluids using variable magnetic fields.

[10] Goods and services associated

with trademark as claimed in application: Scientific fluid treatment apparatus for domestic and industrial use, namely, fluid handling

device for effecting physical or chemical changes to fluids or particles carried by fluids using variable magnetic fields used for disposable

bioprocessing applications and parts and fittings therefor.

[11] This trademark application (the

“Pending U.S. Trademark”) has been suspended by the USPTO. The Canadian trademark for application number 2095183 (the “Pending

Canadian Trademark”) was filed prior to the Pending U.S. Trademark. Pursuant to the Paris Convention for the Protection of Industrial

Property, subsequent applications can be filed within six months of the Pending Canadian Trademark application and claim the benefit of

the Canadian filing date. In order for the priority date of the Pending Canadian Trademark to apply for the Pending U.S. Trademark, the

Pending Canadian Trademark must first be registered. Since the Pending Canadian Trademark is still under review, the suspension on the

Pending U.S. Trademark will continue until the Pending Canadian Trademark is registered.

On February 16, 2023, we entered into that certain

First Amended and Restated Asset Purchase Agreement with Salvatore Mario Pandolfo (“Pandolfo,” and the aforesaid agreement,

the “2023 APA Amendment”), which amended and restated that certain Asset Purchase Agreement between the Company and Pandolfo

dated May 2017 (the “APA”) to reflect (i) Pandolfo’s finalization of sale to us of all of the assets of the water and

fuel treatment business of his entity, Sonical s.r.l., an Italian company (the “Purchased Assets”), which Purchased Assets

includes, among other things, the intellectual property rights supporting the Sonical™ technology, (ii) Pandolfo’s transfer

of all of the intellectual property associated with the Purchased Assets, and (iii) Pandolfo’s delivery of certain Sonical™

testing units to us. A copy of the 2023 APA Amendment is filed as Exhibit 10.3 to this registration statement. The APA is filed as Exhibit

10.1 to this registration statement. The Amendment to the Asset Purchase Agreement dated June 2019 (the “2019 APA Amendment”)

is filed as Exhibit 10.2 to this registration statement, which, among other things, amended certain terms in the APA regarding our consideration

for the Purchased Assets. The 2023 APA Amendment superseded the terms of the 2019 APA Amendment and the Asset Purchase Agreement in their

entirety.

On April 25, 2023, the USPTO issued Patent Number

11,634,344 to us for our proprietary Sonical™ technology.

On September 9, 2022, we submitted a Patent Cooperation

Treaty application for international patent registration for our Sonical™ technology. The application was published on March 16,

2023.

Corporate History

We were originally incorporated in Nevada on

February 22, 2006, under the name “Photomatica, Inc.” On August 12, 2008, we changed our name to “Secure Runway Systems

Corp.” On June 22, 2010, we changed our name to “Diversified Secure Ventures Corp.” We changed our name to Go Green

Global Technologies Corp., our current name, on March 5, 2012. We are currently in good standing with the State of Nevada.

We were previously a reporting company when we

registered our Common Stock under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) on

May 10, 2007. On June 21, 2011, we ceased to be a reporting company when we terminated our duty to file periodic reports with the filing

of a Form 15, pursuant to Rule 12g-4(a)(1).

Summary of Risk Factors

Below is a summary of

material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the

risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as

well as other risks and uncertainties that we face, can be found under the section titled “Risk Factors” in this prospectus.

The below summary is qualified in its entirety by that more complete discussion of such risks and uncertainties. You should consider

carefully the risks and uncertainties described under the section titled “Risk Factors” as part of your evaluation of an

investment in our securities:

| · | Our

business is currently in a pre-revenue stage of development and there is no assurance that

we will ever operate profitably. |

| · | We cannot assure that we will

launch any or all of our products. |

| · | Certain models of our products

will be launched prior to the completion of laboratory testing regarding their efficacy,

efficiency, and safety and before we obtain product certifications for them, which means

there are risks that our products could be subject to product liability claims. We have not

independently consulted any legal counsel regarding our regulatory requirements concerning

the launch and offering of our products in the United States and abroad. |

| · | We operate in an industry that

is still relatively new and subject to many uncertainties. |

| · | Our products incorporate pulsed

power technology, which applications have yet to be widely accepted. |

| · | We cannot assure that there

will be positive consumer reception or adequate consumer demand for our products. |

| · | We may fail to maintain a competitive

position within our market sector. |

| · | Increases in manufacturing

and/or distribution costs and disruptions in our distribution networks or supplies could

materially and adversely impact our business. |

| · | Our costs of operations may

exceed estimates due to various factors, including but not limited to those outside of our

control, such as labor shortages or external price increases, and we may be unable to pass

these increased costs to our customers, which would negatively impact our financial results. |

| · | We are heavily dependent on

our executive management, and a loss of a member of our executive management team or our

failure to attract and retain other highly qualified personnel in the future, could materially

harm our business. |

| · | Damage to our reputation could

negatively impact our business, financial condition, and results of operations. |

| | · | Our performance

may be negatively impacted by general and regional economic volatility or an economic downturn. |

| · | Unforeseen or unavoidable events

or market conditions may negatively impact our financial performance. Our business may be

affected by new or changing government regulations particularly by the Environmental Protection

Agency (EPA) and other state and federal bodies. |

| · | Our ability to protect our

intellectual property and proprietary technology is uncertain. |

| · | Patent terms are limited, and

we may not be able to effectively protect our devices and business. |

| · | Changes in U.S. patent law

could diminish the value of patents in general, thereby impairing our ability to protect

our devices. |

| · | We may not be able to protect

our intellectual property rights throughout the world. |

| · | Third parties may assert that

our employees or consultants have wrongfully used or disclosed confidential information or

misappropriated trade secrets. |

| · | Patents covering our products

could be found invalid or unenforceable if challenged in court or before administrative bodies

in the United States or abroad. |

| · | Obtaining

and maintaining our patent protection depends on compliance with various procedural, document

submission, fee payment and other requirements imposed by government patent agencies, and

our patent protection could be reduced or eliminated for non-compliance with these

requirements. |

| · | Third

parties may attempt to commercialize competitive products or services in countries where

we do not have any patents or patent applications and/or where legal recourse may be limited.

Some countries also compel patent owners to grant licenses to third parties. These conditions

may have a negative commercial impact on our non-U.S. business operations. |

| · | We may be subject to claims

challenging the ownership or inventorship of our patents and other intellectual property

and, if unsuccessful in any of these proceedings, we may be required to obtain licenses from

third parties, which may not be available on commercially reasonable terms, or at all, or

to cease the development, manufacture and commercialization of one or more of our products. |

| · | Our commercial success depends

in part on our and any potential future collaborators’ ability to develop, manufacture,

market, and sell any products that we may develop and use our proprietary technologies without

infringing, misappropriating and otherwise violating the patents and other intellectual property

rights of third parties. It is uncertain whether the issuance of any third-party patent would

require us or any potential collaborators to alter our development or commercial strategies,

obtain licenses or cease certain activities. |

| · | If

our trademarks and trade names are inadequately protected, then we may not be able to build

name recognition in our markets of interest and our business may be adversely affected. |

| · | This is not an initial public

offering of stock to investors at large, and there is no guarantee that any of the Selling

Shareholders will sell the Shares. Alternatively, if a large number of Shares are sold, the

public price of our Common Stock on the OTCQB will decrease. |

| · | Our Common Stock is currently

thinly traded on the OTCQB and the public price for our Common Stock is volatile. We can

offer no assurance that an active trading market for our Common Stock will develop or that

the public price of our Common Stock will become less volatile. |

| · | Future sales of Common Stock

by the Selling Shareholders and our other existing shareholders, or lack thereof, may contribute

to price volatility of our Common Stock on the OTCQB. |

| · | You may be diluted by future

issuances of preferred stock, additional Common Stock or securities convertible into shares

of Common Stock in connection with our incentive plans, acquisitions or otherwise. Future

sales of such shares in the public market, or the expectations that such sales may occur,

could lower our stock price. |

| | · | Our Series B Preferred Stock