false

2023

FY

0001497649

421,892,610

0001497649

2022-10-01

2023-09-30

0001497649

2023-09-30

0001497649

2024-01-15

0001497649

2022-09-30

0001497649

2021-10-01

2022-09-30

0001497649

us-gaap:CommonStockMember

2021-09-30

0001497649

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0001497649

GSTX:StockReceivableMember

2021-09-30

0001497649

us-gaap:RetainedEarningsMember

2021-09-30

0001497649

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-09-30

0001497649

2021-09-30

0001497649

us-gaap:CommonStockMember

2022-09-30

0001497649

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001497649

GSTX:StockReceivableMember

2022-09-30

0001497649

us-gaap:RetainedEarningsMember

2022-09-30

0001497649

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-30

0001497649

us-gaap:CommonStockMember

2021-10-01

2022-09-30

0001497649

us-gaap:AdditionalPaidInCapitalMember

2021-10-01

2022-09-30

0001497649

GSTX:StockReceivableMember

2021-10-01

2022-09-30

0001497649

us-gaap:RetainedEarningsMember

2021-10-01

2022-09-30

0001497649

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-10-01

2022-09-30

0001497649

us-gaap:CommonStockMember

2022-10-01

2023-09-30

0001497649

us-gaap:AdditionalPaidInCapitalMember

2022-10-01

2023-09-30

0001497649

GSTX:StockReceivableMember

2022-10-01

2023-09-30

0001497649

us-gaap:RetainedEarningsMember

2022-10-01

2023-09-30

0001497649

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-10-01

2023-09-30

0001497649

us-gaap:CommonStockMember

2023-09-30

0001497649

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001497649

GSTX:StockReceivableMember

2023-09-30

0001497649

us-gaap:RetainedEarningsMember

2023-09-30

0001497649

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0001497649

us-gaap:FairValueInputsLevel3Member

2021-09-30

0001497649

us-gaap:FairValueInputsLevel3Member

2021-10-01

2022-09-30

0001497649

us-gaap:FairValueInputsLevel3Member

2019-10-01

2020-09-30

0001497649

us-gaap:FairValueInputsLevel3Member

2022-09-30

0001497649

us-gaap:FairValueInputsLevel3Member

2020-10-01

2021-09-30

0001497649

us-gaap:FairValueInputsLevel3Member

2022-10-01

2023-09-30

0001497649

us-gaap:FairValueInputsLevel3Member

2023-09-30

0001497649

us-gaap:ConvertibleNotesPayableMember

2022-10-01

2023-09-30

0001497649

us-gaap:ConvertibleNotesPayableMember

2021-10-01

2022-09-30

0001497649

us-gaap:EquipmentMember

2023-09-30

0001497649

us-gaap:EquipmentMember

2022-09-30

0001497649

us-gaap:ComputerEquipmentMember

2023-09-30

0001497649

us-gaap:ComputerEquipmentMember

2022-09-30

0001497649

us-gaap:FurnitureAndFixturesMember

2023-09-30

0001497649

us-gaap:FurnitureAndFixturesMember

2022-09-30

0001497649

GSTX:FJGarafaloMember

2023-09-30

0001497649

GSTX:BoardOfDirectorsMember

2022-10-01

2023-09-30

0001497649

GSTX:BoardOfDirectorsMember

2021-10-01

2022-09-30

0001497649

country:US

2022-10-01

2023-09-30

0001497649

country:NZ

2022-10-01

2023-09-30

0001497649

GSTX:LocalMember

2022-10-01

2023-09-30

0001497649

GSTX:LocalMember

2021-10-01

2022-09-30

0001497649

GSTX:ForeignMember

2022-10-01

2023-09-30

0001497649

GSTX:ForeignMember

2021-10-01

2022-09-30

0001497649

country:US

2021-10-01

2022-09-30

0001497649

country:US

2023-09-30

0001497649

country:US

2022-09-30

0001497649

country:NZ

2021-09-30

0001497649

country:NZ

2020-10-01

2021-09-30

0001497649

country:NZ

2022-10-01

2023-09-30

0001497649

country:NZ

2021-10-01

2022-09-30

0001497649

country:NZ

2023-09-30

0001497649

country:NZ

2022-09-30

0001497649

country:NZ

2023-09-30

0001497649

country:NZ

2022-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

FORM 10-K

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

(Mark One)

| ☒ |

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal

year ended September 30, 2023

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

file number: 333-174194

GRAPHENE

& SOLAR TECHNOLOGIES LIMITED

(Exact name

of registrant as specified in its charter)

| colorado |

|

27-2888719 |

| (State

or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

11201

North Tatum Boulevard Suite 300

Phoenix,

AZ |

|

85028 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (602)

388-8335

Securities

registered pursuant to Section 12(b) of the Act: None.

Title of Each

Class. N/A

Trading Symbol.

N/A

Name of Each

Exchange as which registered. N/A

Securities

registered pursuant to Section 12(g) of the Act: None.

Indicate by

check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate by

check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No

☒

Indicate by

check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes ☒

No ☐

Indicate by

check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulations S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required

to submit such filing). Yes ☐ No

☒

Indicate by

check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

and/or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

Growth Company |

☒ |

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by

check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ☐ No

☒

The aggregate

market value of the voting stock held by non-affiliates of the registrant on September 30, 2023 was approximately $1,973,080.00

As of January

15, 2024, the registrant had 421,892,610

outstanding shares of common stock.

Documents

Incorporated by Reference: None

Table of Contents

FORWARD-LOOKING

STATEMENTS

This report

contains forward-looking statements. The Securities and Exchange Commission (the “Commission”) encourages companies to disclose

forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions.

This report and other written and oral statements that we make from time to time contain such forward-looking statements that set out

anticipated results based on management’s plans and assumptions regarding future events or performance. We have tried, wherever

possible, to identify such statements by using words such as “anticipate,” “estimate,” “expect,”

“project,” “intend,” “plan,” “believe,” “will” and similar expressions in

connection with any discussion of future operating or financial performance. In particular, these include statements relating to future

actions, future performance or results of current and anticipated sales efforts, expenses, the outcome of contingencies, such as legal

proceedings, and financial results.

We caution

that the factors described herein, and other factors could cause our actual results of operations and financial condition to differ materially

from those expressed in any forward-looking statements we make and that investors should not place undue reliance on any such forward-looking

statements. Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation

to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect

the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible

for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent

to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements.

PART I

ITEM 1.

BUSINESS

Overview.

We are primarily

focused on the energy and water sectors, providing the materials and technologies for a greener future. GSTX has a portfolio of projects

in the cleantech arena with:

| |

• |

Patented

and novel technologies. |

| |

• |

Proven

products with exclusive geographical distribution rights. |

| |

• |

Ground-breaking

new innovations. |

| |

• |

Mineral

resources that critical to the high-tech supply chain. |

These investments

focus on global opportunities, multi-billion-dollar industries, with a significant positive environmental impact. GSTX is focused on

projects with exceptionally strong business opportunities, taking advantage of the environmental and supply chain challenges the world

faces at present. GSTX is currently focused on supplying advanced materials to existing manufacturers and water harvesting products to

market.

Advanced

Materials

A portfolio

of proprietary technologies for upstream manufacturing material supply into high tech markets including solar, semiconductor, defence.

| |

• |

The

Dragonfly range of transparent conductive thin films. |

| |

• |

High

purity quartz sand production. |

Water Technologies

A portfolio

of products and technologies for providing clean drinkable water for consumers and industry.

| |

• |

Ambient

water harvesting equipment. |

| |

• |

The

company is also exploring opportunities in water remediation, oils spill clean-up. |

The Company

is also exploring acquisition opportunities for solar cell manufacturing, Critical Resources Assets (Minerals with identified supply

chain risk), zero emission fossil fuel replacement, green hydrogen, and ammonia production.

Operational Overview.

US Thin

Films

US Thin-Film Corporation,

a 100% owned subsidiary of GSTX holds a Patent Portfolio (IP) relating to the novel leading-edge production of conductive transparent

thin films. The thin films are based on a conductive nanoparticle technology, an innovative conductive coating that self-assembles into

a random mesh-like network pattern when coated, providing excellent electrical conductivity, high transparency, and flexibility. The

Technology was founded and developed in Israel and has built up significant R&D profile for over 15 years with more than USD $90

Million invested. The technology has won several international touchscreen technology awards.

Applications of the

proprietary thin film in existing electronics applications outperforms current materials. Key applications include: Electromagnetic Interference

(EMI) Shielding, Flexible Transparent Antennas (4G/5G communications), Transparent Heaters (windows, goggles, etc), Touch Displays (monitors,

phones, tablets), Photovoltaic, OLED Lighting, Flexible Displays, Sensors, and numerous other electronic applications

The US Thin-Film

technology is superior to traditional/existing technology with multiple times the electrical conductivity of conventional ITO based transparent

conductive films with a simple manufacturing method protected by the company’s patent portfolio.

The company is presently

in discussions with several contract manufacturing groups to produce initial samples of its thin film technology, branded Dragonfly film,

for product qualification and pre-sales activity purposes.

Water Harvesting

Water scarcity

is at the center of the world’s most significant challenges. The United Nations estimates approximately 30% of the world’s

population will face severe water shortages by 2025. Many people do not realise that the atmosphere, the air we breathe, contains a significant

amount of water. Humidity is water in the air. Air can hold 1-2 ounces of water per cubic yard. At any one instant, the Earth’s

atmosphere contains 37.5 trillion gallons of water vapor – enough to cover the entire surface of the planet with 1.5 inches of

rain if condensed.

In parallel,

massive population growth and urbanisation has led to an unprecedented demand for fresh water. Investment in infrastructure has been

woefully inadequate, resulting in severe and critical water stress globally.

There are

an estimated 13 trillion litres (3.4 trillion gal) of water floating in the atmosphere at any one time. There is 6 times as much fresh

water in the air as in all rivers and lakes in the world.

The Company

is continuing commercialization of a unique water harvesting technology utilizing modular, self-contained units that can be solar or

grid powered, and deployed in urban and rural environments. The water harvesters will extract moisture from the ambient air and collect

as 100% pure fresh water. Each domestic water harvester will be capable of generating 30-50 liters (8-13 gal) of pure fresh water per

day for personal use, with commercial models collecting up to 50,000 liters (13,000 gal) per day. The 100% pure H20 extracted from the

atmosphere is also suitable for industrial use in green hydrogen production and pharmaceutical, semiconductor processing plants.

A 100% operational

subsidiary has been established for the water harvesting products. It will trade as Adaquo, which is a Latin verb meaning to supply water.

The company has engaged the services of two industry veterans (20+ years experience) to assist with commercialization of the technology.

Whilst still

undertaking in house development of the company’s proprietary solid-state technology, the company is also exploring opportunities

to license and distribute existing products that have been market proven on an exclusive geographical basis.

Quartz

Material.

The company

has significant technical expertise and experience in the high purity quartz sector. Initially, the company focused upon acquiring resources

and developing high purity silica (99.9% purity) into commercial grade high purity quartz sand (HPQS 99.997% purity). HPQS is essential

for the production of semiconductors and photovoltaic solar panels.

Although

the enterprise was successful in identifying substantial resources and valuable customers in Japan, China, South Korea, Taiwan and South-East

Asia, the company was unable to secure funding to scale to meet demand for HPQS product, largely due to complications with the onset

of Covid-19 in March 2020. The COVID Pandemic saw significant disruption to the global solar and semiconductor manufacturing sector.

This had significant flow on effects to HPQS market. It is anticipated that by mid-2023 the sector will be substantially recovered to

pre-covid levels of production and associated demand for raw materials. At present manufacturing levels of solar cells are showing strong

growth and a swift recovery.

The company

is presently re-engaging with past acquisition opportunities and customers in the HPQ sector. At present there is a significant production

shortfall for the material and prices/volumes are showing strong growth. The company is continuing to pursue the development of an Australian

based production facility.

Graphene

Material.

Graphene,

a new material, was discovered in 2004 by two UK based Russian university professors who were awarded the Nobel Prize in 2010 for their

discovery. Graphene is a 2D material, (one atom thickness) made from graphite/carbon atoms, and whilst still largely unknown to the world

is rapidly becoming a new industrial revolution in its own right with more than 8,800 patent applications for graphene and graphene enabled

product applications having been filed recently. We have taken an early-stage leading-edge position in this evolving new technological

field of graphene enabling and enhancement, specifically to focus upon development of graphene enabled photovoltaic solar panels.

Graphene is

the world’s thinnest and strongest material ever, with remarkable electrical, thermal, and optical properties being the most conductive

material ever scientifically measured. A sheet of graphene material is only one single atom in thickness and is referred to as a 2D nano-material

having almost no measurable depth, only length and width. Graphene is also highly transparent and can be easily flexed and stretched

25% of its size without breaking. However, it is also 200 times stronger than steel and harder than a diamond. Graphene material is completely

impermeable, even a helium atom (the smallest) cannot pass through graphene. The advent of graphene and the introduction of the extraordinary

benefits from combining graphene with existing materials and products.

Our main focus

remains dedicated to our original premise of producing low cost, high grade, high purity graphene for industrial sales to existing materials

groups.

Government

Product Approvals.

There are

no identified government approvals required for our products and no export restrictions for the products.

Effect

of Existing or Probable Governmental Regulations on the Business.

Management

believes that there are no identified existing or probable government regulations that will adversely impact our business.

Research

and Development Activities.

The primary

research and development during the next fiscal year will involve further development and evaluation of new efficient material processing

techniques. The company plans to manufacture samples of its products for customer validation and presales activity purposes.

Additional

research and development resources will be progressively committed to develop new graphene/silica (quartz) and thin film materials and

applications to expand and diversify the company product offerings into complimentary high tech and clean tech storage markets.

Compliance

with Environmental Laws.

Based upon

our long-term experience, management believes that the nature of our proposed processing operations does not involve any onerous environmental

compliance requirements. Compliance costs have been identified and quantified in the company plan of operations, business plan including

financial plan.

Employees.

Certain members

of our management team have been involved in this industry since 2005 and this has resulted in an experienced team of learned employees,

advisors and technical experts in various locations and capacities within both Australia, Central Europe, and in the United States. It

is planned to increase fulltime and part time employees/contractors from the present levels to a minimum of 30 within the next 12 months,

subject to the company securing additional funding.

At the present

time we rely upon experienced consultants with whom management has long-term relationships.

Executive

Management and Technical Team.

Our executive

management and technical team have largely co-worked together since 2005, and especially the last 5 years in Melbourne, Australia, China

and the USA. All the specialized human resources are available to us.

ITEM 1.A. RISK

FACTORS.

Not applicable.

ITEM 1.B. UNRESOLVED

STAFF COMMENTS.

Not Applicable

ITEM 2.

PROPERTIES.

We own general

office, lab and factory equipment with a net book value of $937 and $1,273 as of September 30, 2023 and 2022 respectively, net of depreciation.

We currently

maintain a representative office at 11201 North Tatum Boulevard suite 300 Phoenix, Arizona 85028 (the Company pays monthly rent in the

amount of $275 for this office). We also maintain a substantial office at 88 Lorimer Street, Docklands, Melbourne 3008, in the State

of Victoria, Australia (the company pays monthly expense for use, equivalent to the amount of AUD$2,200 for this office, which it has

occupied for the last eight years). These offices are currently adequate for our needs. These are month to month arrangements and therefore

scoped out of ASC 842.

ITEM 3.

LEGAL PROCEEDINGS.

Not applicable

PART II

ITEM 5.

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

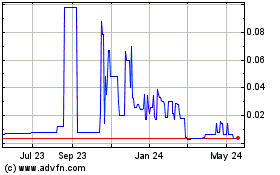

Our common

stock at September 30, 2023 trades in the OTC Markets OTC Pink Market under the symbol “GSTX”. Shown below is the range of

high and low closing prices for our common stock for the periods indicated. The market quotations reflect inter-dealer prices, without

retail mark-up, mark-down or commissions and may not necessarily represent actual transactions.

| Quarter

Ended | |

High | |

Low |

| | September

30, 2021 | | |

$ | 0.68 | | |

$ | 0.55 | |

| | December

31, 2021 | | |

$ | 0.68 | | |

$ | 0.60 | |

| | March

31, 2022 | | |

$ | 0.29 | | |

$ | 0.28 | |

| | June

30, 2022 | | |

$ | 0.20 | | |

$ | 0.20 | |

| | September

30, 2022 | | |

$ | 0.16 | | |

$ | 0.16 | |

| | December

31, 2022 | | |

$ | 0.07 | | |

$ | 0.06 | |

| | March

31, 2023 | | |

$ | 0.00 | | |

$ | 0.00 | |

| | June

30, 2023 | | |

$ | 0.00 | | |

$ | 0.00 | |

| | September

30, 2023 | | |

$ | 0.00 | | |

$ | 0.00 | |

Holders of

our common stock are entitled to receive dividends as may be declared by the Board of Directors. Our Board of Directors is not restricted

from paying any dividends but is not obligated to declare a dividend. No cash dividends have ever been declared and it is not anticipated

that cash dividends will ever be paid.

Our Articles

of Incorporation authorize our Board of Directors to issue up to 500,000,000 shares of common stock and up to 10,000,000 shares of preferred

stock. The provisions in the Articles of Incorporation relating to the preferred stock allow our directors to issue preferred stock with

multiple votes per share and dividend rights which would have priority over any dividends paid with respect to the holders of our common

stock. The issuance of preferred stock with these rights may make the removal of management difficult even if the removal would be considered

beneficial to shareholders, generally, and will have the effect of limiting shareholder participation in certain transactions such as

mergers or tender offers if these transactions are not favored by our management.

As of September

30, 2023, we had approximately 396 shareholders of record.

We have not

declared or paid any dividends on our common stock since our inception, and we do not anticipate declaring or paying any dividends on

our common stock for the foreseeable future. We currently intend to retain any future earnings to finance future growth. Any future determination

to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations,

capital requirements and other factors the board of directors considers relevant.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable.

ITEM 7.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following

discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related

notes, and other financial information included in this Form 10-K. Our Management’s Discussion and Analysis contains not only statements

that are historical facts, but also statements that are forward-looking. Forward-looking statements can be by their very nature, uncertain

and risky. Although the forward-looking statements in this Report reflect the good faith judgment of our management, such statements

can only be based on facts and factors currently known by them. Consequently, and because forward-looking statements are inherently subject

to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking

statements. You are urged to carefully review and consider the various disclosures made by us in this report as we attempt to advise

interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

Overview

In July

2017, the Company acquired Solar Quartz Technologies Limited, a New Zealand corporation with substantial mineral resource and technical

engineering assets.

In September

2021, the Company through its 100% owned subsidiary, US Thin Film Corporation, acquired Specialty Material Group, Cayman Island corporation

who holds a significant group of invention and processing patents in making Nanoparticle conductive thin film material for various industrial

and technology applications.

We continue

to seek new financing in the form of equity, debt, or a combination thereof to meet further development and general operating obligations.

Achieving sufficient funds soon is of vital importance. The Company has managed to raise sufficient capital by sale of shares, but as

of September 30, 2022, the Company has not been successful in raising sufficient funds to maintain primary operations. However, substantial

efforts are underway to secure funding, and we believe that funding for the Company is imminent in the near future, although no assurance

can be made as to the amount of funds, if any, or the terms thereof.

Current

Business and Operation

The company has had

a significant change of Management and the Board of Directors. Following the passing of Roger May (CEO) on 24 August 2022, the company

appointed Dr. Andrew Liang as CEO and Roger’s son, Jason May, as CTO. On 1 April 2023, Jason May was appointed as CEO and Dr. Andrew

Liang resigned as CEO but continues as a Director.

The company has a

renewed focus and strategy to supply materials and technologies for the cleantech sector. This leverages the existing company operations

and includes thin films, graphene, quartz, and water harvesting. The company is exploring acquisitions and partnerships in aligned areas

of materials.

The Company

is actively recruiting new members of the management team to assist with implementing its strategic plan. The company is re-engaging

various opportunities that it was pursuing pre pandemic.

Currently,

GSTX is primarily focused upon completing development and initial sample production of commercially viable products. The goal for the

2024 FY is to establish initial production and begin generating revenue.

Results of Operations.

Years

Ended September 30, 2023 and 2022

| | |

Years Ended | |

|

| | |

September

30, | |

|

| | |

2023 | |

2022 | |

Changes

($) |

| Operating expenses | |

$ | 1,273,106 | | |

| 15,021,841 | | |

$ | (13,748,735 | ) |

| Other Expense | |

$ | 31,956 | | |

| 5,997,535 | | |

$ | (5,965,579 | ) |

| Net Income (loss) | |

$ | (1,305,062 | ) | |

$ | (21,019,376 | ) | |

$ | (19,714,314 | ) |

For the

years ended September 30, 2023 and 2022, we generated no revenues, and thus no cost of sales or gross profits.

For the

years ended September 30, 2023 and 2022, we incurred $1,273,106 and $15,021,841, respectively in operating expenses. The operating expense

decreases are due primarily to reduced costs of contracting professional services in the development of markets, financing, legal fees,

and other general and administrative expenses.

For the

years ended September 30, 2023 and 2022, our other income (expenses) consisted of the following:

| | |

Years Ended | |

|

| | |

September

30, | |

|

| | |

2023 | |

2022 | |

Changes

($) |

| Other (Income) Expense: | |

| | | |

| | | |

| | |

| Interest expense | |

$ | (23,249 | ) | |

$ | (35,262 | ) | |

$ | 12,013 | |

| Rental income | |

| 31,455 | | |

| 24,982 | | |

| 6,473 | |

| Impairment of assets | |

| — | | |

| (5,794,603 | ) | |

| 5,794,603 | |

| Foreign currency transaction gain | |

| — | | |

| — | | |

| — | |

| Change in fair value of derivative liability | |

| — | | |

| — | | |

| — | |

| Loss on settlement of convertible note | |

| (40,162 | ) | |

| (192,652 | ) | |

| 152,490 | |

| | |

$ | (31,956 | ) | |

$ | (5,997,535 | ) | |

$ | 5,965,579 | |

For the

year ended September 30, 2023, we reported a net loss before taxes of $1,305,062 compared to a net loss before taxes of $21,019,376 for

the year ended September 30, 2022. Since there were no tax obligations in either year, net loss in each year was the same as that reported

before taxes.

Cash

Flows

| | |

Years Ended | |

|

| | |

September

30, | |

|

| | |

2023 | |

2022 | |

Changes

($) |

| Cash Flows used in Operating Activities | |

$ | (72,180 | ) | |

| (43,823 | ) | |

$ | (28,357 | ) |

| Cash Flows Provided (Used) by Investing Activities | |

$ | — | | |

| — | | |

$ | — | |

| Cash Flows provided by Financing Activities | |

$ | 71,713 | | |

| 46,921 | | |

$ | 24,792 | |

| Effect of exchange rate in cash | |

| (1,296 | ) | |

| (3,969 | ) | |

| 2,673 | |

| Net Change in Cash During Period | |

$ | (1,763 | ) | |

$ | (871 | ) | |

$ | (892 | ) |

Cash Flow from Operating Activities

Cash flows

used in operating activities was $72,180 in the year ended September 30, 2023, while for the year ended September 30, 2022, the Company

expended $43,823.

The increase

in the year ended September 30, 2023 was primarily due to an increase in accounts payable and accrued expenses, primarily for legal and

consulting expenses and due to related parties.

Cash

Flow from Investing Activities

Shareholder

loans and some minimal funding activities were mainly significant in the year ended September 30, 2023 and 2022.

Cash

Flow from Financing Activities

Cash from

financing activities in the year ended September 30, 2023 contributed $71,713 from the issuance of short term note payables. Cash from

financing activities in the year ended September 30, 2022 contributed $46,921, $138,093 from the sales of shares to unaffiliated investors

and $133,005 from proceeds of a convertible note payable.

Liquidity

and Capital Resources.

Years

Ended September 30, 2023 and 2022.

| | |

September

30,

2023 | |

September

30,

2022 | |

Changes

($) |

| Cash | |

$ | 1,094 | | |

$ | 2,857 | | |

$ | (1,763 | ) |

| Working capital deficit | |

$ | (4,984,957 | ) | |

$ | (4,047,534 | ) | |

$ | (937,423 | ) |

| Total assets | |

$ | 18,130 | | |

$ | 18,382 | | |

$ | (252 | ) |

| Total liabilities | |

$ | (4,997,159 | ) | |

$ | (4,061,574 | ) | |

$ | (935,585 | ) |

| Total stockholders’ deficit | |

$ | (4,979,029 | ) | |

$ | (4,043,192 | ) | |

$ | (935,837 | ) |

As of

September 30, 2023, we had total current liabilities of $4,997,159, while as of September 30, 2022 we had total current liabilities of

$4,061,574, an increase of $935,585. The increase in current liabilities was primarily due to an increase in accounts payable and due

to related party.

As of

September 30, 2023, we had a working capital deficit of $4,984,957 compared to a working capital deficit of $4,047,534 as of September

30, 2022. As of September 30, 2023, we had cash and cash equivalents of $1,094 and total assets of $18,130 compared to cash and cash

equivalents of $2,857 and total assets of $18,382 as of September 30, 2022.

General Discussion.

Whereas

management has been successful in the past in raising capital, there are no assurances that these sources of financing will continue

to be available to us and/or that demand for our common stock will be sufficient to meet our capital needs, or that financing will be

available on terms favorable to us. If funding is insufficient at any time in the future, we may not be able to take advantage of business

opportunities or respond to competitive pressures or may be required to reduce the scope of our planned product development and marketing

efforts, any of which could have a negative impact on its business and operating results. In addition, insufficient funding may have

a material adverse effect on our financial condition, which could require it to:

| |

● |

seek

joint venture partners; |

| |

● |

monetize

its assets; |

| |

● |

seek

arrangements with strategic partners or other parties that may require the company to relinquish significant rights to products,

technologies or markets; or |

| |

● |

explore

other strategic alternatives, including a merger or sale of our company. |

| |

● |

Cease

current operations |

To the

extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities may

result in dilution to our existing stockholders. If additional funds are raised through the issuance of debt securities, these securities

may have rights, preferences and privileges senior to holders of common stock and the terms of such debt could impose restrictions on

our operations. Regardless of whether our cash assets prove to be inadequate to meet its operational needs, we may seek to compensate

providers of services by issuance of stock in lieu of cash, which may also result in dilution to our existing stockholders.

Inflation.

The impact

of inflation on our costs and the ability to pass on cost increases to its customers over time is dependent upon market conditions. We

are not aware of any inflationary pressures that have had any significant impact on its operations over the past quarter and we do not

anticipate that inflationary factors will have a significant impact on future operations.

Impact

of the Inflation Reduction Act.

The Inflation

Reduction Act of 2022 (the “IRA”) was signed into law on August 16, 2022. Among other things, the IRA contained certain clean

energy incentives and initiatives. The Company operates in sectors that management believe will benefit from these initiatives.

Going

Concern and Management’s Liquidity Plans.

As reflected

in the consolidated financial statements, the Company had an accumulated deficit at September 30 2022, a net loss and net cash used in

operating activities for the year then ended and has generated no revenues since inception. These factors raise substantial doubt about

the Company’s ability to continue as a going concern within one year from the issuance date of the consolidated financial statements.

The ability

of the Company to continue its operations is dependent on management’s plans, which include the raising of capital through debt

and/or equity markets. The Company may need to incur additional liabilities with certain related parties to sustain the Company’s

existence until such time that funds provided by operations are sufficient to fund working capital requirements. There can be no assurance

that the Company will be able to raise any additional capital.

The Company

may also require additional funding to finance the growth of our anticipated future operations as well as to achieve its strategic objectives.

There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all. In that event, the

Company would be required to change its growth strategy and seek funding on that basis, if at all.

The Company’s

plan regarding these matters is to raise additional debt and/or equity financing to allow the Company the ability to cover its current

cash flow requirements and meet its obligations as they become due. There can be no assurances that financing will be available or if

available, that such financing will be available under favorable terms. In the event that the Company is unable to generate adequate

revenues to cover expenses and cannot obtain additional financing in the near future, the Company may seek protection under bankruptcy

laws. The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets

and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating

to the recovery of the recorded assets or the classification of the liabilities that might be necessary.

Off-Balance

Sheet Arrangements.

We do

not maintain off-balance sheet arrangements, nor do we participate in non-exchange traded contracts requiring fair value accounting treatment.

Critical

Accounting Policies and New Accounting Pronouncements.

The Securities

and Exchange Commission SEC has issued Financial Reporting Release No. 60, “Cautionary Advice Regarding Disclosure About Critical

Accounting Policies,” suggesting companies provide additional disclosure and commentary on their most critical accounting policies.

In FRR 60, the Securities and Exchange Commission has defined the most critical accounting policies as the ones that are most important

to the portrayal of a company’s financial condition and operating results and require management to make its most difficult and

subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. Based on this definition,

our most critical accounting policies are set forth below. The methods, estimates, and judgments the company uses in applying these most

critical accounting policies have a significant impact on the results the company reports in its financial statements.

A summary

of the significant accounting policies applied in the preparation of the accompanying financial statements follows:

Stock-Based

Compensation – We account for employee and non-employee stock-based compensation using the fair value method. The fair value

attributable to stock options is calculated based on the Black-Scholes option pricing model and is amortized to expense over the service

period which is equivalent to the time required to vest the stock options.

Income

Taxes – Income taxes are provided based on the liability method for financial reporting purposes. Under this method deferred

tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and are measured using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences are expected to reverse. Valuation allowances are established when necessary to reduce deferred

income tax assets to the amount expected to be realized.

Uncertain

tax positions are recognized in the financial statements only if that position is more likely than not of being sustained upon examination

by taxing authorities, based on the technical merits of the position. The Company recognizes interest and penalties related to uncertain

tax positions in income tax expense.

We are

required to file federal income tax returns in the United States and in various state and local jurisdictions. Our tax returns filed

since inception are subject to examination by taxing authorities in the jurisdictions in which it operates in accordance with the normal

statutes of limitations in the applicable jurisdiction.

Earnings

Per Share – Basic earnings per share have been calculated based upon the weighted-average number of common shares outstanding.

Diluted earnings per share have been calculated based upon the weighted-average number of common and potential shares and is not presented

when anti-dilutive.

Financial

Instruments and Fair Value Measurements - As defined in ASC 820 “Fair Value Measurements,” fair value is the

price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at

the measurement date (exit price). The Company utilizes market data or assumptions that market participants would use in pricing the

asset or liability, including assumptions about risk and the risks inherent in the inputs to the valuation technique. These inputs can

be readily observable, market corroborated, or generally unobservable. The Company classifies fair value balances based on the observability

of those inputs. ASC 820 establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy gives

the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the

lowest priority to unobservable inputs (level 3 measurement).

The Company

determines the level in the fair value hierarchy within which each fair value measurement falls in its entirety, based on the lowest

level input that is significant to the fair value measurement in its entirety. In determining the appropriate levels, the Company performs

an analysis of the assets and liabilities at each reporting period end.

The Company’s

financial instruments consist of cash, accounts receivable, accounts payable, accrued interest, and due to related parties. The carrying

amounts of these financial instruments approximate fair value due to either length of maturity or interest rates that approximate prevailing

rates unless otherwise disclosed in these financial statements.

Derivative

Financial Instruments - The Company accounts for freestanding contracts that are settled in a company’s own stock, including

common stock warrants, to be designated as an equity instrument or generally as a liability. A contract so designated is carried at fair

value on a company’s balance sheet, with any changes in fair value recorded as a gain or loss in a company’s results of operations.

The Company

records all derivatives on the balance sheet at fair value, adjusted at the end of each reporting period to reflect any material changes

in fair value, with any such changes classified as changes in derivatives valuation in the statement of operations. The calculation of

the fair value of derivatives utilizes highly subjective and theoretical assumptions that can materially affect fair values from period

to period. The recognition of these derivative amounts does not have any impact on cash flows.

At the

date of the conversion of any convertible debt, the pro rata fair value of the related embedded derivative liability is transferred to

additional paid-in capital.

The Company

determines our derivative liabilities to be a Level 3 fair value measurement and uses the Binomial pricing model to calculate the fair

value. There are no derivative liabilities as of September 30, 2023 and 2022. The Binomial model requires six basic data inputs: the

exercise or strike price, time to expiration, the risk-free interest rate, the current stock price, the estimated volatility of the stock

price in the future, and the dividend rate. Changes to these inputs could produce a significantly higher or lower fair value measurement.

The fair value of each convertible note is estimated using the Binomial valuation model.

Recently

Issued Accounting Pronouncements – For discussion of recently issued accounting pronouncements, please see Note 2 to the consolidated

financial statements included in this report.

ITEM 7A.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable.

ITEM 8.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

| |

|

Page |

|

| |

|

|

|

| Reports

of Independent Registered Public Accounting Firms |

|

F-1 |

|

| |

|

|

|

| Consolidated

Balance Sheets |

|

F-3 |

|

| |

|

|

|

| Consolidated

Statements of Operations and Comprehensive Loss |

|

F-4 |

|

| |

|

|

|

| Consolidated

Statements of Changes in Stockholders’ Deficit |

|

F-5 |

|

| |

|

|

|

| Consolidated

Statements of Cash Flows |

|

F-6 |

|

| |

|

|

|

| Notes

to the Consolidated Financial Statements |

|

F-7 |

|

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Board of Directors and

Stockholders

of Graphene & Solar Technologies Limited

Opinion

on the Financial Statements

We

have audited the accompanying consolidated balance sheets of Graphene & Solar Technologies Limited (the Company) as of September

30, 2023 and 2022, and the related consolidated statements of operations and comprehensive loss, stockholders’ deficit, and cash

flows for each of the years in the two-year period ended September 30, 2023, and the related notes (collectively referred to as the financial

statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of

the Company as of September 30, 2023 and 2022, and the results of its operations and its cash flows for each of the years in the twoyear

period ended September 30, 2023, in conformity with accounting principles generally accepted in the United States of America.

Going

Concern

The

accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed

in Note 1 to the consolidated financial statements, the Company had a net loss from continuing operations, net cash used in operations,

and a lack of revenues to-date, which raises substantial doubt about its ability to continue as a going concern. Management’s plans

regarding those matters are discussed in Note 1. The consolidated financial statements do not include any adjustments that might result

from the outcome of this uncertainty.

Basis

for Opinion

These

consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion

on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public

Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance

with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part

of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing

an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our

audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether

due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence

regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles

used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that our audits provide a reasonable basis for our opinion.

Critical

Audit Matters

The

critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial statements that

was communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material

to the consolidated financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication

of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are

not, by communicating the critical audit matter below, providing separate opinions on the critical audit matter or on the accounts or

disclosures to which they relate.

Going

Concern

As

discussed in Note 1 to the consolidated financial statements, the Company had a net loss from continuing operations, net cash used in

operations, and a lack of revenues to-date.

Auditing

management’s evaluation of a going concern can be a significant judgement given the fact that the Company uses management estimates

on future revenues and expenses which are not able to be substantiated.

To

evaluate the appropriateness of the going concern, we examined and evaluated the financial information that was the initial cause along

with management’s plans to mitigate going concern and management’s disclosure on going concern.

/s/

M&K CPAS, PLLC M&K CPAS, PLLC

We

have served as the Company’s auditor since 2020

Firm

ID 2738

The

Woodlands, TX

January

16, 2024

GRAPHENE

& SOLAR TECHNOLOGIES LIMITED

CONSOLIDATED

BALANCE SHEETS

| | |

| |

|

| | |

September 30, | |

September 30, |

| | |

2023 | |

2022 |

| Assets | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 1,094 | | |

$ | 2,857 | |

| Prepaid expenses | |

| 11,108 | | |

| 11,183 | |

| Total Current Assets | |

| 12,202 | | |

| 14,040 | |

| Other Assets: | |

| | | |

| | |

| Furniture and equipment, net of depreciation $77,056 | |

| 937 | | |

| 1,273 | |

| Intellectual property – at cost, net | |

| 1 | | |

| — | |

| Other intangible assets – at cost | |

| 975 | | |

| 975 | |

| Other receivable | |

| 4,015 | | |

| 2,094 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 18,130 | | |

$ | 18,382 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Deficit | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and other payable | |

$ | 2,594,247 | | |

$ | 2,380,565 | |

| Accrued interest payable | |

| 184,851 | | |

| 161,602 | |

| Due to related party | |

| 1,985,601 | | |

| 1,342,405 | |

| Notes payable – in default | |

| 60,000 | | |

| 76,255 | |

| Convertible notes payable, net of discount $0

and $0,

and $100,747 in default | |

| 100,747 | | |

| 100,747 | |

| Notes payable – Related

Party | |

| 71,713 | | |

| — | |

| Total Current Liabilities | |

| 4,997,159 | | |

| 4,061,574 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 4,997,159 | | |

| 4,061,574 | |

| | |

| | | |

| | |

| Stockholders’ Deficit | |

| | | |

| | |

| Preferred stock: 10,000,000

shares authorized; $0.00001

par value; no

shares issued and outstanding | |

| — | | |

| — | |

| Common stock: 500,000,000

shares authorized; $0.00001

par value; 421,292,610

and 374,305,480

shares issued and outstanding | |

| 4,219 | | |

| 3,748 | |

| Additional paid-in capital | |

| 63,883,853 | | |

| 63,527,513 | |

| Stock Receivable | |

| (795,000 | ) | |

| (795,000 | ) |

| Accumulated deficit | |

| (68,375,078 | ) | |

| (67,070,016 | ) |

| Accumulated other comprehensive income | |

| 302,977 | | |

| 290,563 | |

| Total Stockholders’ Deficit | |

| (4,979,029 | ) | |

| (4,043,192 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’

Deficit | |

$ | 18,130 | | |

$ | 18,382 | |

The accompanying

notes are an integral part of these consolidated financial statements.

GRAPHENE

& SOLAR TECHNOLOGIES LIMITED

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

| | |

| |

|

| | |

Years Ended |

| | |

September

30, |

| | |

2023 | |

2022 |

| | |

| |

|

| Revenue | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| Professional fees | |

| 1,096,237 | | |

| 13,912,620 | |

| General and administration | |

| 176,869 | | |

| 1,109,221 | |

| Total operating

expenses | |

| 1,273,106 | | |

| 15,021,841 | |

| | |

| | | |

| | |

| Loss from operations | |

| (1,273,106 | ) | |

| (15,021,841 | ) |

| | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | |

| Other income | |

| 31,455 | | |

| 24,982 | |

| Interest expense | |

| (23,249 | ) | |

| (35,262 | ) |

| Loss on extinguishment of debt | |

| (40,162 | ) | |

| (192,652 | ) |

| Impairment of assets | |

| — | | |

| (5,794,603 | ) |

| Total Other

Income (Expense) | |

| (31,956 | ) | |

| (5,997,535 | ) |

| | |

| | | |

| | |

| Net Income (Loss) | |

$ | (1,305,062 | ) | |

$ | (21,019,376 | ) |

| | |

| | | |

| | |

| Other Comprehensive Income | |

| 12,414 | | |

| 182,661 | |

| | |

| | | |

| | |

| Net Comprehensive Loss | |

$ | (1,292,648 | ) | |

$ | (20,836,715 | ) |

| | |

| | | |

| | |

| Net Loss available to common

shareholders | |

$ | (1,292,648 | ) | |

$ | (20,836,715 | ) |

| | |

| | | |

| | |

| Basic and diluted loss per common

share | |

$ | (0.00 | ) | |

$ | (0.06 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| | | |

| | |

| Basic and diluted | |

| 387,153,066 | | |

| 363,203,503 | |

The accompanying

notes are an integral part of these consolidated financial statements.

GRAPHENE

& SOLAR TECHNOLOGIES LIMITED

CONSOLIDATED

STATEMENTS OF STOCKHOLDERS’ DEFICIT

| | |

| |

| |

| |

| |

| |

| |

|

| | |

Common

Stock | |

Additional | |

Stock | |

Accumulated | |

Accumulated

Comprehensive | |

Stockholders’ |

| | |

Shares | |

Amount | |

Paid-in | |

Receivable | |

Deficit | |

Income | |

Deficit |

| Balance September 30, 2021 | |

| 343,237,369 | | |

| 3,437 | | |

$ | 49,922,922 | | |

$ | (720,000 | ) | |

$ | (46,050,640 | ) | |

$ | 107,902 | | |

$ | 3,263,621 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for cash | |

| 1,200,000 | | |

| 12 | | |

| 121,909 | | |

| (75,000 | ) | |

| — | | |

| — | | |

| 46,921 | |

| Stock-based compensation | |

| 28,868,111 | | |

| 289 | | |

| 13,207,692 | | |

| — | | |

| — | | |

| — | | |

| 13,207,981 | |

| Settlement of notes | |

| 1,000,000 | | |

| 10 | | |

| 274,990 | | |

| — | | |

| — | | |

| — | | |

| 275,000 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 182,661 | | |

| 182,661 | |

| Other comprehensive income, net of tax | |

| — | | |

| — | | |

| — | | |

| — | | |

| (21,019,376 | ) | |

| — | | |

| (21,019,376 | ) |

| Balance September 30, 2022 | |

| 374,305,480 | | |

| 3,748 | | |

$ | 63,527,513 | | |

$ | (795,000 | ) | |

$ | (67,070,016 | ) | |

$ | 290,563 | | |

$ | (4,043,192 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| 46,750,000 | | |

| 468 | | |

| 291,132 | | |

| — | | |

| — | | |

| — | | |

| 291,600 | |

| Settlement of notes | |

| 237,130 | | |

| 3 | | |

| 65,208 | | |

| — | | |

| — | | |

| — | | |

| 65,211 | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 12,414 | | |

| 12,414 | |

| Other comprehensive income, net of tax | |

| — | | |

| | | |

| — | | |

| — | | |

| (1,305,062 | ) | |

| — | | |

| (1,305,062 | ) |

| Balance September 30, 2023 | |

| 421,292,610 | | |

| 4,219 | | |

$ | 63,883,853 | | |

$ | (795,000 | ) | |

$ | (68,375,078 | ) | |

$ | 302,977 | | |

$ | (4,979,029 | ) |

The accompanying

notes are an integral part of these consolidated financial statements.

GRAPHENE &

SOLAR TECHNOLOGIES LIMITED

CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

| |

|

| | |

Year Ended |

| | |

September

30, |

| | |

2023 | |

2022 |

| Cash flows from operating activities | |

| | | |

| | |

| Net Income (loss) | |

$ | (1,305,062 | ) | |

$ | (21,019,376 | ) |

| Adjustments to reconcile net

income/(loss) to net cash from operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 291,600 | | |

| 13,207,981 | |

| Depreciation expense | |

| 338 | | |

| 829 | |

| Amortization of intangibles | |

| — | | |

| 982,821 | |

| Amortization of discount | |

| — | | |

| 13,943 | |

| Loss on Settlement of Debt | |

| 40,162 | | |

| 192,652 | |

| Accounts payable related party | |

| — | | |

| — | |

| Impairment of assets | |

| — | | |

| 5,794,603 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts payable | |

| 227,007 | | |

| 238,554 | |

| Accrued interest payable | |

| 23,249 | | |

| 21,318 | |

| Other Receivables | |

| (1,921 | ) | |

| (2,094 | ) |

| Pre-Payments | |

| — | | |

| 6,403 | |

| Due to related parties | |

| 652,447 | | |

| 518,543 | |

| Net cash used in

operating activities | |

| (72,180 | ) | |

| (43,823 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Cash paid for purchase of fixed

assets | |

| — | | |

| — | |

| Net cash used in investing activities | |

| — | | |

| — | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from issuance of common stock | |

| — | | |

| 46,921 | |

| Due to Affiliates | |

| — | | |

| — | |

| Issuance of short term

note payable, net of OID | |

| 71,713 | | |

| — | |

| Net cash from financing activities | |

| 71,713 | | |

| 46,921 | |

| | |

| | | |

| | |

| Effect of currency translations to cash

flow | |

| (1,296 | ) | |

| (3,969 | ) |

| Net change in cash and cash equivalents | |

| (1,763 | ) | |

| (871 | ) |

| Beginning of Period | |

| 2,857 | | |

| 3,728 | |

| End of Period | |

$ | 1,094 | | |

$ | 2,857 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Supplemental cash flow information | |

| | | |

| | |

| | |

| 2023 | | |

| 2022 | |

| Interest paid | |

$ | — | | |

$ | — | |

| Taxes | |

$ | — | | |

$ | — | |

| Non-cash investing and financing

activities: | |

| | | |

| | |

| Settlement

of Debt for Common Stock | |

$ | 25,049 | | |

$ | 82,348 | |

The accompanying

notes are an integral part of these consolidated financial statements.

GRAPHENE

& SOLAR TECHNOLOGIES LIMITED

NOTES TO

CONSOLIDATED FINANCIAL STATEMENTS

AS OF SEPTEMBER

30, 2023 AND 2022

NOTE

1 – BASIS OF PRESENTATION

These consolidated

financial statements of Graphene & Solar Technologies Limited (GSTX or the Company) have been prepared in accordance with accounting

principles generally accepted in the United States of America (U.S. GAAP). In the opinion of management, these financial statements include

all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the results for the interim periods.

Certain information, accounting policies and footnote disclosures normally included in financial statements prepared in accordance with

U.S. GAAP have been omitted pursuant to Securities and Exchange Commission (SEC) rules and regulations.

Going Concern

– The Company has incurred cumulative net losses since inception of $68,375,078 at September 30, 2023. Accordingly, it requires

capital to fund working capital deficits and for future operating activities to take place. The Company’s ability to raise new

funds through the future issuances of debt or common stock is unknown. The obtainment of additional financing, the successful development

of a plan of operations, and its transition, ultimately, to the attainment of profitable operations are necessary for the Company to

continue operations. The ability of the Company to continue its operations is dependent on management’s plans, which include the

raising of capital through debt and/or equity markets, with some additional funding from other traditional financing sources, including

term notes, until such time that funds provided by operations are sufficient to fund working capital requirements. The Company may need

to incur additional liabilities with certain related parties to sustain the Company’s existence. There can be no assurance that

the Company will be able to raise any additional capital and therefore raise doubt about the Company’s ability to continue as a

going concern.

Future issuances

of the Company’s equity or debt securities will be required for the Company to finance operations and continue as a going concern.

The financial statements do not include any adjustments that may result from the outcome of these uncertainties.

Going

Concern

The Company’s

consolidated financial statements have been presented on the basis that it is a going concern, which contemplates the realization of

assets and satisfaction of liabilities in the normal course of business. The Company has not generated any revenues from operations to

date and does not expect to do so in the foreseeable future. The Company has a stockholders’ deficit as of September 30, 2023.

Furthermore, the Company has experienced recurring operating losses and negative operating cash flows since inception and has financed

its working capital requirements during this period primarily through the recurring sale of its equity securities.

As a result,

management has concluded that there is substantial doubt about the Company’s ability to continue as a going concern within one

year of the date that the consolidated financial statements are being issued. In addition, the Company’s independent registered

public accounting firm, in their report on the Company’s consolidated financial statements for the year ended September 30, 2022,

has also expressed substantial doubt about the Company’s ability to continue as a going concern.

The Company’s

plan regarding these matters is to raise additional debt and/or equity financing to allow the Company the ability to cover its current

cash flow requirements and meet its obligations as they become due. There can be no assurances that financing will be available or if

available, that such financing will be available under favorable terms. In the event that the Company is unable to generate adequate

revenues to cover expenses and cannot obtain additional financing in the near future, the Company may seek protection under bankruptcy

laws. The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets

and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating

to the recovery of the recorded assets or the classification of the liabilities that might be necessary.

The spread of a novel

strain of coronavirus (COVID-19) around the world from the first half of 2020 has caused significant volatility in U.S. and international

markets. There is significant uncertainty around the breadth and duration of business disruptions relate to COVlD-19, as well as its

impact on the U.S. and international economies. The outbreak and any preventative or protective actions that governments or we may take

in respect of this COVID-19 may result in a period of business disruption. Any financial impact cannot be reasonably estimated at this

time but may materially affect our future business and financial condition. The extent to which COVID-19 impacts our results will depend

on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the

severity of the COVID-19 and the actions required to contain the COVID-19 or treat its impact, among others.

The Company’s

ability to continue as a going concern is dependent upon its ability to raise additional equity capital to fund its activities and to

ultimately achieve sustainable operating revenues and profits. The Company’s consolidated financial statements do not include any

adjustments that might result from the outcome of these uncertainties.

Because the

Company is currently engaged in an early stage of development, it may take a considerable amount of time to develop any product or intellectual

property capable of generating sustainable revenues. Accordingly, the Company’s business is unlikely to generate any sustainable

operating revenues in the next several years. In addition, to the extent that the Company is able to generate revenues through product

sales, there can be no assurance that the Company will be able to achieve positive earnings and operating cash flows.

At September

30, 2023, the Company had cash of $1,094 available

to fund its operations. The Company needs to raise additional capital during the year ending September 30, 2024 to fund its ongoing business

activities.

The amount

and timing of future cash requirements during the year ended September 30, 2024 will depend on the extent of financing the Company is

able to arrange. As market conditions present uncertainty as to the Company’s ability to secure additional funds, there can be

no assurances that the Company will be able to secure additional financing on acceptable terms, or at all, as and when necessary to continue

to conduct operations. If cash resources are insufficient to satisfy the Company’s ongoing cash requirements, the Company would

be required to scale back or discontinue its technology and product development programs, or obtain funds, if available (although there

can be no certainty), through strategic alliances that may require the Company to relinquish rights to certain of its assets, or to discontinue

its operations entirely.

Intangible

Assets

We amortize

capitalized patent costs for internally generated patents on a straight-line basis for 7 years, which represents the estimated useful

lives of the patents. The seven-year estimated useful life for internally generated patents is based on our assessment of such factors

as: the integrated nature of the portfolios being licensed, the overall makeup of the portfolio over time, and the length of license

agreements for such patents. The estimated useful lives of acquired patents and patent rights, however, have been and will continue to

be based on a separate analysis related to each acquisition and may differ from the estimated useful lives of internally generated patents.

The average estimated useful life of acquired patents is 6.7 years. We assess the potential impairment to all capitalized net

patent costs when events or changes in circumstances indicate that the carrying amount of our patent portfolio may not be recoverable.

Assumed

Liabilities

As a result

of the acquisition of Cima Specialty Materials Ltd (CSML) from CIMA Nanotech Holdings Limited, “CNHL”, (a Cayman Island Registered

company) the Company’s wholly owned subsidiary US Thin Film Corporation (USTFC) under the terms of the of the Share Sale and Purchase

agreement the Company issued 3,000,000 shares of common stock for future liability settlement for assumed liabilities. The fair value

of these future assumed liabilities of $720,000

was recorded as a stock receivable.

Revenue recognition

Policies (ASC 606)

The Company recognizes

revenue on arrangements in accordance with ASC 606, Revenue from Contracts with Customers (“ASC 606”). The core principle

of ASC 606 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration

to which an entity expects to be entitled for those goods or services ASC 606 requires companies to assess their contracts to determine

the timing and amount of revenue to recognize under the new revenue standard. The model has a five-step approach:

1. Identify

the contract with the customer.

2. Identify

the performance obligations in the contract.

3. Determine

the total transaction price.

4. Allocate

the total transaction price to each performance obligation in the contract.

5. Recognize

as revenue when (or as) each performance obligation is satisfied.

Disclosure

of Rental Income

Rental income

is not recognized as ‘operating revenue” but as ‘other income’ during the period of $31,455.

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles

of Consolidation

The consolidated

financial statements include the financial statements of Graphene and its wholly owned subsidiaries, Graphene and Solar Technologies

Limited (“GSTXNZ) and US Thin-Film Corporation (“USTFC”). All significant inter-company balances and transactions within

the Company have been eliminated upon consolidation.

Basis

of Presentation

These accompanying

consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States

of America (“GAAP”).

Use

of Estimates

The preparation

of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Management

bases its estimates on historical experience and on various assumptions that are believed to be reasonable in relation to the financial

statements taken as a whole under the circumstances, the results of which form the basis for making judgments about the carrying values

of assets and liabilities that are not readily apparent from other sources. Management regularly evaluates the key factors and assumptions

used to develop the estimates utilizing currently available information, changes in facts and circumstances, historical experience, and

reasonable assumptions. After such evaluations, if deemed appropriate, those estimates are adjusted accordingly. Actual results could

differ from those estimates. Significant estimates include those related to assumptions used in accruals for potential liabilities, valuing

equity instruments issued for services, and the realization of deferred tax assets.

Cash

and Cash Equivalents

Cash and cash

equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all