Gowest Acquires White Star Leases to Support Bradshaw Mining Infrastructure

03 March 2014 - 11:00PM

Marketwired

Gowest Acquires White Star Leases to Support Bradshaw Mining

Infrastructure

- Promising ground for Bradshaw Gold Deposit strike

extension

- Visit Gowest at Booth 2331 during PDAC

TORONTO, ONTARIO--(Marketwired - Mar 3, 2014) - Gowest Gold Ltd.

("Gowest" or the "Company") (TSX-VENTURE:GWA)(OTCBB:GWSAF) is

pleased to report that it has finalized an agreement to acquire two

mining leases (12 claim units) covering 193 hectares (1.93 sq km)

adjacent to the eastern portion of the Company's wholly-owned

Bradshaw Gold Deposit (Bradshaw) on the Frankfield Property, part

of the Company's North Timmins Gold Project (NTGP). Formerly known

as the White Star property, the surface rights (81 hectares)

accompanying these newly acquired leases provide additional land

needed for the infrastructure to be built around Gowest's planned

mine at Bradshaw, including room for the planned waste rock dump

and settling ponds.

Importantly, Gowest also believes that this new property has

strong geological potential and could enable the Company to extend

Bradshaw's current 1.3 kilometre gold mineralization strike length

still further to the east. White Star contains a 1.2-km strike

length of the same volcanic stratigraphy that hosts this

mineralization. Gowest's easternmost drill intersection on Bradshaw

returned of 2.98 grams per tonne (g/t) gold over 0.8 metres just 75

m west of the White Star boundary.

In 2006, Gowest conducted shallow diamond drilling (three holes

totaling 1,180 m) on the White Star leases under a previous option

and prior to the current resource expansion of the Bradshaw deposit

to NI 43-101 standards. Gowest has since developed a clearer

understanding of the gold mineralization at Bradshaw, which will

better allow the Company to focus on the recognized potential to

extend eastward across the White Star leases.

The leases are to be acquired pursuant to the terms and

conditions of a purchase agreement entered into between J. Patrick

Sheridan (the "Vendor"), New Texmont Explorations Ltd. ("New

Texmont") and the Company. The purchase price payable by the

Company for the leases will be the grant to the Vendor of a sliding

scale net smelter return royalty in respect of gold production from

the relevant properties equal to 1.0% at gold prices less than

US$950 per ounce and 1.5% at gold prices equal to or greater than

US$950 per ounce (the "NSRR"). Pursuant to the purchase agreement,

the Vendor will immediately following closing assign and transfer

all of his right, title and interest in and to the NSRR to New

Texmont. The NSRR will be subject to the same terms and conditions

(and form part of the same royalty interest) as previously granted

by the Company to New Texmont as set out in an Acquisition

Agreement dated December 19, 2008 between the Purchaser and New

Texmont.

The Company also announces that a total of 3,275,000 options to

purchase common shares of the Company were granted on February 28,

2014 to directors, officers and consultants at an exercise price of

$0.08 per share, expiring on February 28, 2019. The grant is

subject is subject to regulatory approval.

The Company also announces that it intends to issue, subject to

TSX Venture Exchange approval, an aggregate of 250,000 common

shares to non-management directors of the Corporation (50,000

common shares per director), as partial payment of fees owed to

such directors in respect of the quarter ended October 31, 2013.

The aggregate deemed value of the common shares to be issued is

$12,500.00. The shares are being issued in lieu of cash in order to

conserve the cash resources of the Corporation.

Qualified Person: This press release has been reviewed by Mr.

Kevin Montgomery, P.Geo., Gowest's Manager of Exploration and a

Qualified Person under National Instrument 43-101.

About Gowest

Gowest is a Canadian gold exploration and development company

focused on the delineation and development of its 100% owned

Bradshaw Gold Deposit (Bradshaw), on the Frankfield Property, part

of the Company's North Timmins Gold Project (NTGP). Gowest is

exploring additional gold targets on its 109-square-kilometre NTGP

land package and continues to evaluate the area, which is part of

the prolific Timmins, Ontario gold camp. The latest updated

resource estimate for Bradshaw included approximately 945,600

ounces of gold ("Au") in the Indicated category (6.0 million tonnes

at a grade of 4.9 grams per tonne ["g/t"] Au) and 536,800 ounces of

gold in the Inferred category (3.7 million tonnes at a grade of 4.2

g/t Au). As was used in the Company's Preliminary Economic

Assessment, the current estimate is based on a 3.0 g/t Au cut-off

and a conservative gold price of US$1,200/oz. This resource

estimate has been completed by Neil N. Gow, P. Geo., an independent

Qualified Person, and reported in accordance with Canadian

Securities Administration National Instrument 43-101 ("NI 43-101")

requirements and CIM Standards on Mineral Resources and

Reserves.

Forward-looking statements

This news release contains certain "forward looking statements".

Such forward-looking statements involve risks and uncertainties.

The results or events depicted in these forward-looking statements

may differ materially from actual results or events. Any

forward-looking statement speaks only as of the date of this news

release and, except as may be required by applicable securities

laws, the Company disclaims any intent or obligation to update any

forward-looking statement, whether as a result of new information,

future events or results or otherwise.

NEITHER THE TSX-VENTURE EXCHANGE NOR ITS REGULATION PROVIDER (AS

THAT TERM IS DEFINED IN THE POLICIES OF THE TSX-VENTURE EXCHANGE)

ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OF THIS RELEASE.

Greg RomainPresident & CEO(416)

363-1210info@gowestgold.comGreg TaylorInvestor Relations905

337-7673 / Mob: 416 605-5120gregt@gowestgold.com

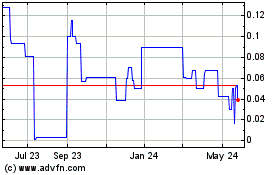

Gowest Gold (PK) (USOTC:GWSAF)

Historical Stock Chart

From Jan 2025 to Feb 2025

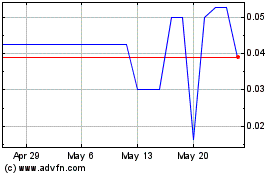

Gowest Gold (PK) (USOTC:GWSAF)

Historical Stock Chart

From Feb 2024 to Feb 2025