UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

PROXY

STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Filed

by the Registrant

|

[X]

|

|

|

|

|

Filed

by a Party other than the Registrant

|

[ ]

|

Check

the appropriate box:

|

|

[ ]

|

Preliminary

Proxy Statement

|

|

|

|

|

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

|

|

[X]

|

Definitive

Proxy Statement

|

|

|

|

|

|

|

[ ]

|

Definitive

Additional Materials

|

|

|

|

|

|

|

[ ]

|

Soliciting

Material Pursuant to §240.14a-12

|

GREENWAY

TECHNOLOGIES, INC.

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

|

|

[X]

|

No

fee required.

|

|

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials:

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Filing

Party:

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Date

Filed:

|

|

|

|

|

1521

North Cooper Street, Suite 205

Arlington,

Texas 76011

November

8, 2019

Dear

Stockholders:

You

are cordially invited to attend a special meeting (our “Special Meeting”) of the stockholders of Greenway Technologies,

Inc., a Texas corporation (our “Company”) to be held on Wednesday, December 11, 2019, at the Hilton Arlington,

2401 East Lamar Blvd., Arlington, Texas 76006. Our Special Meeting will start promptly at 10:30 a.m. Central Standard Time.

Whether

or not you plan to attend our Special Meeting in person, your vote is important. Pursuant to the rules promulgated by the Securities

and Exchange Commission (the “SEC”), on or about November 20, 2019, we will begin mailing to our stockholders

our proxy statement, a proxy card, and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, filed

with the SEC on April 19, 2019, as amended by Amendment No. 1 on form 10-K/A, filed with the SEC on May 15, 2019 (collectively,

our “Proxy Materials”). You may vote (i) in person at our Special Meeting, (ii) via a toll-free telephone number,

(iii) over the Internet, or (iv) by completing, signing, dating, and promptly returning the proxy card you receive with our Proxy

Materials. Please review the instructions on our Proxy Materials regarding your voting options.

Details

regarding the business to be conducted at the Special Meeting are more fully described in the accompanying Notice of Special Meeting

of the Stockholders and Proxy Materials.

Thank

you for being a stockholder of our Company. We look forward to seeing you at the Special Meeting.

|

|

Very

truly yours,

|

|

|

|

|

|

/s/

Raymond Wright

|

|

|

Raymond

Wright

|

|

|

Chairman

of the Board of Directors

|

1521

North Cooper Street, Suite 205

Arlington,

Texas 76011

NOTICE

OF A SPECIAL MEETING OF THE STOCKHOLDERS

TO BE HELD ON

DECEMBER 11, 2019

DEAR

STOCKHOLDER:

Please

take notice that a special meeting (our “Special Meeting”) of the stockholders (our “Stockholders”)

of Greenway Technologies, Inc., a Texas corporation (our “Company”), will be held on Wednesday, December 11,

2019, at 10:30 a.m. Central Standard Time, at the Hilton Arlington, 2401 East Lamar Boulevard, Arlington, Texas 76006 for the

following purposes:

|

|

1.

|

To

amend our certificate of formation of our Company (our “Certificate”) to increase the number of authorized

shares of Class A Shares of our Company, par value $0.0001 per share (the “Class A Shares”) from 300,000,000

to 500,000,000;

|

|

|

|

|

|

|

2.

|

To

amend our Certificate to change the name of our Class A Shares to “common stock” (our “Common Stock”),

with the same $0.0001 par value per share, designations, powers, privileges, rights, qualifications, limitations, and restrictions

as the current Class A Shares;

|

|

|

|

|

|

|

3.

|

To

amend our Certificate to eliminate the Class B Shares of our Company, par value $0.0001 per share (the “Class B Shares”),

as a class of stock of our Company;

|

|

|

|

|

|

|

4.

|

To

amend our Certificate to specify the vote required to approve certain actions before our Stockholders, including “fundamental

actions,” as defined by Texas Business Organizations Code (the “TBOC”) Section 21.364, and “fundamental

business transactions,” as defined by TBOC Section 1.002(32);

|

|

|

|

|

|

|

5.

|

To

transact such other business as may properly come before our Special Meeting and any adjournment or postponement thereof.

|

The

above-listed items of business are more fully described in the proxy statement (our “Proxy Statement”) accompanying

this notice of our Special Meeting (this “Meeting Notice”).

Our

board of directors (our “Board of Directors”) has fixed 5:00 p.m. Central Daylight Time on Tuesday, October

29, 2019, as the record date for determining our Stockholders entitled to receive our Meeting Notice and to vote at our Special

Meeting and for any adjournment or postponement thereof. Pursuant to the rules promulgated by the Securities and Exchange Commission,

on or about November 20, 2019, we will begin mailing to our Stockholders our Proxy Statement, a proxy card (our “Proxy

Card”), and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, filed with the SEC

on April 19, 2019, as amended by Amendment No. 1 on form 10-K/A, filed with the SEC on May 15, 2019 (collectively, our “Proxy

Materials”).

Whether

or not you expect to attend our Special Meeting in person, you are urged to vote (i) via a toll-free telephone number, (ii) over

the Internet, or (iii) by completing, signing, dating, and promptly returning the Proxy Card. Instructions regarding all three

methods of voting are included in our Proxy Materials. If you vote and then decide to attend our Special Meeting to vote your

shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in our Proxy Statement.

|

|

By

Order of our Board of Directors,

|

|

|

|

|

|

/s/

Kent Harer

|

|

|

Kent

Harer

|

|

|

Acting

President

|

|

|

Arlington,

Texas

|

|

|

November

8, 2019

|

GREENWAY

TECHNOLOGIES, INC.

1521

North Cooper Street, Suite 205

Arlington,

Texas 76011

PROXY

STATEMENT

FOR

A SPECIAL MEETING OF THE STOCKHOLDERS

TO

BE HELD ON DECEMBER 10, 2019

Table

of Contents

1521

North Cooper Street, Suite 205

Arlington,

Texas 76011

PROXY

STATEMENT

I.

GENERAL INFORMATION

Greenway

Technologies, Inc., a Texas corporation, is soliciting your proxy to vote your shares at our Special Meeting of the Stockholders

to be held on Wednesday, December 11, 2019, at 10:30 a.m. Central Standard Time (“CST”) at the Hilton Arlington,

2401 East Lamar Boulevard, Arlington, Texas 76006.

Our

proxy statement (our “Proxy Statement”) contains important information regarding our Special Meeting. Specifically,

it identifies the proposals on which you are being asked to vote, provides information that you may find useful in determining

how to vote, and describes voting procedures.

We

use several abbreviations in our Proxy Statement. We refer to Greenway Technologies, Inc. as our “Company.”

We call our board of directors of our Company our “Board of Directors” and each of the directors serving on

our Board of Directors, a “Director,” and collectively, our “Directors.” References to “2018”

mean our fiscal period 2018, which began on January 1, 2018, and ended on December 31, 2018. We refer to our special meeting of

the Stockholders to be held on December 11, 2019, as our “Special Meeting” and the notice of our Special Meeting

as our “Meeting Notice.” References to our “Annual Report” mean our Annual Report on Form

10-K for the fiscal year ended December 31, 2018, filed with the U.S. Securities and Exchange Commission (the “SEC”)

on April 19, 2019, and amended by Amendment No. 1 on Form 10-K/A, filed with the SEC on May 13, 2019. “Class A Shares”

means our Company’s Class A Shares, par value $0.0001 per share, and holders of our Class A Shares are collectively referred

to as “Stockholders.”

On

or about November 20, 2019, we plan to mail to all of our Stockholders of record (our “Stockholders of Record”)

as of 5:00 p.m. Central Daylight Time on Tuesday, October 29, 2019 (the “Record Date”) our Meeting Notice,

our Proxy Statement, a proxy card (our “Proxy Card”) and a copy of our Annual Report (together with our Meeting

Notice, Proxy Statement, and Proxy Card, our “Proxy Materials”). Our Proxy Materials provide instructions for

how to vote your Class A Shares.

You

are accordingly urged to vote (i) via a toll-free telephone number, (ii) over the Internet, or (iii) by completing, signing, dating,

and promptly returning our Proxy Card. Instructions regarding all three methods of voting are included in our Proxy Materials.

If you vote and then decide to attend our Special Meeting to vote your shares in person, you may still do so. Your proxy is revocable

in accordance with the procedures set forth in our Proxy Statement. Our Company will bear all attendant costs of the solicitation

of proxies for our Special Meeting.

Our

Company will reimburse brokerage firms and other persons representing beneficial owners (“Beneficial Owners”)

of shares for their expenses in forwarding solicitation materials to such Beneficial Owners. Proxies may be solicited by certain

of our Company’s Directors, officers, and regular employees, without additional compensation, personally or by telephone,

facsimile, or email, or by a third party.

A.

About this Proxy Statement

A

copy of our Annual Report is included with our Proxy Materials, but is available on our website (gwtechinc.com/investors)

or upon request by contacting us via mail at Greenway Technologies, Inc. 1521 N. Cooper Street, Suite 205, Arlington, TX 76011,

Attn: Investor Relations, or via email at ir@gwtechinc.com. The following questions provide information about our Proxy

Materials and our Special Meeting.

Who

may attend our Special Meeting and vote at our Special Meeting?

Our

Board of Directors has fixed 5:00 p.m. CDT on Tuesday, October 29, 2019, as the Record Date for determining Stockholders entitled

to receive our Meeting Notice and to vote their Class A Shares at our Special Meeting and at any adjournment or postponement thereof.

Each Stockholder as of the Record Date is entitled to one (1) vote for each Class A Share owned as of the Record Date. On the

Record Date there were 290,148,677 Class A Shares issued and outstanding.

At

least 10 days before our Special Meeting, we will make a complete list of Stockholders entitled to vote at our Special Meeting

open to the examination of any Stockholder, for any purpose germane to our Special Meeting, at our offices located at 1521 N.

Cooper Street, Suite 205, Arlington, TX 76011. The list will also be made available to Stockholders present at our Special Meeting.

What

is the difference between holding shares as a Stockholder of Record and as a Beneficial Owner?

Most

Stockholders hold their shares through a broker, bank, or other nominee rather than directly in such Stockholder’s own name

as the Stockholder of Record. As summarize below, there are some distinctions between Class A Shares held of record and those

owned beneficially.

|

|

●

|

Stockholder

of Record - If your Class A Shares are registered directly in your name with our transfer agent, Transfer Online, Inc.,

you are considered, with respect to those Class A Shares, as the Stockholder of Record. As the Stockholder of Record, you

have the right to grant your voting proxy directly to our Company or to vote in person at our Special Meeting.

|

|

|

|

|

|

|

|

|

●

|

Beneficial

Owner - If your Class A Shares are held in a stock brokerage account or by a bank or other nominee, you are considered

the Beneficial Owner of Class A Shares held in street name and your broker or nominee is considered, with respect to those

Class A Shares, the Stockholder of Record. As the Beneficial Owner, you have the right to direct your broker or nominee on

how to vote those Class A Shares and are also invited to attend our Special Meeting. However, since you are not the Stockholder

of Record, you may not vote these Class A Shares in person at our Special Meeting unless you receive a proxy from your broker

or nominee. Your broker or nominee should provide voting instructions for you to use to vote the Class A Shares for which

you are the Beneficial Owner. If you wish to attend our Special Meeting and vote in person, please contact your broker or

nominee so that you can receive a legal proxy to present at our Special Meeting.

|

|

How

do I vote?

As

a Stockholder, you have the right to vote on specified business matters affecting our Company. The proposals that will be presented

at our Special Meeting, and upon which you are being asked to vote, are discussed in the sections of our Proxy Statement beginning

with “Proposal No. 1” as outlined in our Meeting Notice. Each Class A Share you own entitles you to one vote.

If

you are a Stockholder of Record, you may vote in person at our Special Meeting or by proxy. There are three ways to vote by

proxy:

|

|

●

|

By

Telephone - Stockholders of Record located in the United States can vote by telephone by calling 1 (866) 390-5236 and

following recorded instructions;

|

|

|

|

|

|

|

|

|

●

|

By

Internet - You may vote over the Internet at http://www.proxypush.com/GWTI by following the instructions on the Proxy

Card; or

|

|

|

|

|

|

|

|

|

●

|

By

Mail - You may vote by completing, signing, dating, and mailing our Proxy Card to: Proxy Tabulator for Greenway Technologies,

Inc., P.O. Box 8016, Cary, NC 27512-9903.

|

|

Telephone

and Internet voting facilities for Stockholders of Record will be available 24-hours-a-day and will close at 11:59 p.m., CST on

Tuesday, December 10, 2019. All Proxy Cards submitted by mail must be received by Tuesday, December 10, 2019.

If

you vote by proxy, you enable the individuals named in your proxy to vote your Class A Shares at our Special Meeting in the manner

you indicate. We encourage you to vote by proxy even if you plan to attend our Special Meeting. In this way, your Class A Shares

will be voted even if you are unable to attend our Special Meeting.

Your

Class A Shares will be voted as you direct on your proxy, whichever way you choose to submit it. If you attend our Special Meeting,

you may deliver your completed Proxy Card in person or fill out and return a ballot that will be supplied to you.

If

you are a Beneficial Owner, you should follow the voting instructions provided by your broker or nominee.

What

constitutes a quorum?

The

holders of record of a majority of the voting power of the issued and outstanding shares of capital stock entitled to vote at

the Special Meeting must be present in person or represented by proxy to constitute a quorum for our Special Meeting. Abstentions

and “broker non-votes” are counted as present for purposes of determining a quorum.

What

items will be voted on at our Special Meeting?

Our

Company is aware of eight items that Stockholders may vote on at our Special Meeting. Those eight items are each listed below

and on our Proxy Card:

|

|

●

|

Proposal

1: The approval of an amendment to our certificate of formation (our “Certificate”) to increase

the number of authorized shares of Class A Shares of our Company, par value $0.001 per share (our “Class A Shares”),

from 300,000,000 to 500,000,000, (such amendment, “Amendment No. 1”);

|

|

|

|

|

|

|

|

|

●

|

Proposal

2: The approval of an amendment to the Certificate to change the name of our Class A Shares from “Class A”

to “common stock” (our “Common Stock”). The Common Stock would have the same par value $0.0001

per share, designations, powers, privileges, rights, qualifications, limitations, and restrictions as the current Class A

Shares (such amendment, “Amendment No. 2”);

|

|

|

|

|

|

|

|

|

●

|

Proposal

3: The approval of an amendment to our Certificate to eliminate Class B Shares of our Company, par value $0.0001 per

share (the “Class B Shares”), as a class of capital stock of our Company (such amendment, “Amendment

No. 3”); and

|

|

|

|

|

|

|

|

|

●

|

Proposal

4: The approval of an amendment to our Certificate to specify the vote required to approve certain actions before

our Stockholders, including “fundamental actions,” as defined by Texas Business Organizations Code (the “TBOC”)

Section 21.364, and “fundamental business transactions,” as defined by TBOC Section 1.002(32) (such amendment,

“Amendment No. 4”).

|

|

What

does our Board of Directors recommend?

Our

Board of Directors recommends that you vote:

|

|

●

|

“FOR”

Proposal 1: The approval of Amendment No. 1 to increase the number of authorized shares of Common Stock from 300,000,000

to 500,000,000;

|

|

|

|

|

|

|

|

|

●

|

“FOR”

Proposal 2: The approval of Amendment No. 2 to change the name of our Class A Shares to Common Stock, with the same

$0.0001 par value per share, designations, powers, privileges, rights, qualifications, limitations, and restrictions as the

current Class A Shares;

|

|

|

|

|

|

|

|

|

●

|

“FOR”

Proposal 3: The approval of Amendment No. 3 to eliminate Class B Shares as a class of stock of our Company; and

|

|

|

|

|

|

|

|

|

●

|

“FOR”

Proposal 4: the approval of Amendment No. 4 to specify the vote required to approve certain action before our Stockholders,

including “fundamental actions,” as defined by the TBOC Section 21.364, and “fundamental business transactions,”

as defined by TBOC Section 1.002(32).

|

|

What

vote is required for approval of each proposal?

Our

outstanding Class A Shares represent the only voting capital stock of our Company, and each Class A Share is entitled to cast

one vote. The following votes are required for approval of the proposals:

|

|

●

|

Proposal

Nos. 1, 2, and 3 - The affirmative vote of the holders of at least 66 2/3% in voting power of the then-outstanding

Class A Shares entitled to vote on the matter, voting together as a single class, is needed to approve Proposal Nos. 1, 2,

and 3. Abstentions will have the same effect as a vote against the approval of Proposal Nos. 1, 2, and 3. As the vote for

each of Proposal Nos. 1, 2, and 3 is considered a “routine” matter under applicable rules, your bank, broker,

or other nominee may vote on Proposal Nos. 1, 2, and 3 without instructions from you. Therefore, your bank, broker,

or other nominee will be permitted to exercise its discretion to vote uninstructed Class A Shares on Proposal Nos. 1, 2 and

3. Also, unless instructions to the contrary are specified in a Proxy Card properly voted and returned through available channels,

the proxies will be voted “FOR” Proposal Nos. 1, 2, and 3.

|

|

|

|

|

|

|

|

|

●

|

Proposal

No. 4 - The affirmative vote of the holders of at least 66 2/3% in voting power of the then-outstanding

Class A Shares entitled to vote on the matter, voting together as a single class, is needed to approve Proposal No. 4. Abstentions

will have the same effect as a vote against the approval of Proposal No. 4. As the vote on Proposal No. 4 is considered a

“non-routine” matter under applicable rules, your bank, broker, or other nominee may not

vote on Proposal No. 4 without instructions from you. Therefore, broker “non-votes” will have the same effect

as a vote against Proposal No. 4. Unless instructions to the contrary are specified in a Proxy Card properly voted and returned

through available channels, the proxies will be voted “FOR” Proposal No. 4.

|

|

An

automated system administered by Mediant Communications Inc., our master tabulator and inspector of elections (“Mediant”),

will tabulate votes by proxy at our Special Meeting, and a representative of Mediant will tabulate votes cast in person at our

Special Meeting.

What

if I sign and return my Proxy Card without making any selection?

If

you sign and return your Proxy Card without making any selections, your Class A Shares will be voted as recommended by our Board

of Directors. If other matters properly come before our Special Meeting, the proxy holders will have the authority to vote on

those matters for you at their discretion. As of the date of our Proxy Statement, we are not aware of any matters that will come

before our Special Meeting, other than those disclosed in our Proxy Statement.

What

if I am a Beneficial Owner and I do not give the nominee voting instructions?

Brokerage

firms have the authority to vote shares for which their customers do not provide voting instructions on certain “routine”

matters. However, for “non-routine” matters, brokerage firms may not vote shares for which their customers

have not provided voting instructions. A broker “non-vote” occurs when a nominee who holds shares of stock for another

does not vote on a particular item, because the nominee does not have discretionary voting authority for that item and has not

received instructions from the owner of the shares of stock. Broker “non-votes” are included in the calculation of

the number of votes considered to be present at our Special Meeting for purposes of determining the presence of a quorum, but

broker non-votes are not counted as shares present and entitled to be voted with respect to a matter on which the nominee has

expressly not voted. Without your voting instructions, a broker may vote your Class A Shares with respect to Proposal

Nos. 1-3, but may not vote your Class A Shares with respect Proposal No. 4.

What

if I abstain or withhold authority to vote on a proposal?

For

all proposals, if you sign and return your proxy marked “ABSTAIN,” or withhold authority to vote, it will have the

same effect as a vote “AGAINST” such proposal, because an abstention represents a share entitled to vote and thus

is included in the denominator in determining the percentage approved.

Also,

as the vote on Proposal No. 4 is considered “non-routine” matters under applicable rules, your bank, broker,

or other nominee may not vote on this matter without instructions from you. Therefore, broker “non-votes” will have

the same effect as a vote “AGAINST” these proposals.

What

does it mean if I receive more than one full set of Proxy Materials?

If

you receive more than one full set of Proxy Materials by mail, you will need to vote once for each set of Proxy Materials you

receive, either (i) via a toll-free telephone number, (ii) over the Internet, or (iii) by completing, signing, dating, and promptly

returning our Proxy Card, which you received with our Proxy Materials.

May

I change my proxy?

Yes,

a proxy may be revoked by the Stockholder giving the proxy, at any time before it is voted, by delivering a written notice of

revocation to our Company at its principal executive offices located at 1521 North Cooper Street, Suite 205, Arlington, Texas

76011 prior to our Special Meeting. A prior proxy is automatically revoked by a Stockholder giving a subsequent proxy or attending

and voting at our Special Meeting. To revoke a proxy previously submitted by telephone or through the Internet, you may simply

vote again at a later date, using the same procedures, in which case your later-submitted vote will be recorded, and your earlier

vote revoked. Attendance at our Special Meeting in and of itself does not revoke a prior proxy.

B.

Interest of Certain Persons in or Opposition to Matters to be Acted Upon

None

of our officers, Directors, or any “associate” (as defined under Regulation 14A of the Securities Exchange Act of

1934, as amended (the “Exchange Act”)) of such persons has any substantial interest in the matters to be voted

upon by our Stockholders, other than in such person’s role as an officer, Director, or Stockholder.

C.

Security Ownership of Certain Beneficial Owners and Management

The

following table sets forth, as of the Record Date, the number of Class A Shares beneficially owned and the percentage ownership

for: (i) each person or entity known by our Company to beneficially own more than 5% of any class of our voting securities, based

on our review of any statements filed with the SEC under Section 13(d) or Section 13(g) of the Exchange Act; (ii) each Director;

(iii) each of our chief executive officer and our two other most highly compensated executive officers whose annual compensation

exceeded $100,000 for 2018 (collectively, our “Named Executive Officers”); and (iv) all of our current Directors

and Named Executive Officers as a group. Unless otherwise indicated the address for each person named below is: c/o Greenway Technologies,

Inc., 1521 North Cooper Street, Suite 205, Arlington, Texas, 76011.

As

of the Record Date, there were 290,148,677 outstanding Class A Shares, which are the only outstanding voting securities of our

Company.

|

Title

and Class of Securities Beneficially Owned

|

|

Name

of Beneficial Owner

|

|

Amount

and Nature of

Beneficial Ownership (1)

|

|

|

5%

Stockholders:

|

|

Number

|

|

|

Percent

of Class

|

|

|

Class

A Shares

|

|

Paul

Alfano (2)

|

|

|

21,500,000

|

|

|

|

7.4

|

%

|

|

Class

A Shares

|

|

Richard

Halden (3)

|

|

|

19,205,911

|

|

|

|

6.6

|

%

|

|

Class

A Shares

|

|

Kevin

Jones (4)

|

|

|

22,492,843

|

|

|

|

7.8

|

%

|

|

Class

A Shares

|

|

Randy

Moseley (5)

|

|

|

22,178,302

|

|

|

|

7.6

|

%

|

|

Class

A Shares

|

|

D.

Patrick Six (6)

|

|

|

15,333,272

|

|

|

|

5.3

|

%

|

|

Class

A Shares

|

|

Raymond

Wright (7)

|

|

|

17,500,000

|

|

|

|

6.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors

and Named Executive Officers:

|

|

|

Number

|

|

|

|

Percent

of Class

|

|

|

Class

A Shares

|

|

Paul

Alfano(2)

|

|

|

21,500,000

|

|

|

|

7.4

|

%

|

|

Class

A Shares

|

|

Kent

Harer (8)

|

|

|

4,000,000

|

|

|

|

1.4

|

%

|

|

Class

A Shares

|

|

Kevin

Jones (4)

|

|

|

22,492,843

|

|

|

|

7.8

|

%

|

|

Class

A Shares

|

|

Ransom

Jones (9)

|

|

|

4,125,000

|

|

|

|

1.4

|

%

|

|

Class

A Shares

|

|

Raymond

Wright (7)

|

|

|

17,500,000

|

|

|

|

6.0

|

%

|

|

Class

A Shares

|

|

Michael

Wykrent (10)

|

|

|

8,799,999

|

|

|

|

3.0

|

%

|

|

Class

A Shares

|

|

Thomas

Phillips (11)

|

|

|

2,500,000

|

|

|

|

0.9

|

%

|

|

Class

A Shares

|

|

All

current Directors and Named Executive Officers as a group (7 persons) (12)

|

|

|

80,917,842

|

|

|

|

27.9

|

%

|

|

Class

A Shares

|

|

John

Olynick (13)

|

|

|

500,000

|

|

|

|

0.2

|

%

|

|

|

(1)

|

Applicable

percentages are based on 290,148,677 Class A Shares outstanding as of the Record Date.

Beneficial ownership is determined by rules promulgated by the SEC and generally includes

voting or investment power with respect to securities. Class A Shares underlying options,

warrants, and convertible notes currently exercisable or convertible, or exercisable

or convertible within 60 days of the Record Date are deemed outstanding for computing

the percentage of the person holding such securities but are not deemed outstanding for

computing the percentage of any other person. Unless otherwise indicated in the footnotes

to this table, we believe that each of the individuals named in the table has sole voting

and investment power with respect to the Class A Shares indicated as beneficially owned

by such individual. The table includes Class A Shares and options, warrants, and convertible

notes exercisable or convertible into Class A Shares that are either vested or may vest

within 60 days of the Record Date. Other than as stated in this table or the footnotes

to this table, there are no arrangements or understandings known to our Company, including

any pledge by any person of our securities, the operation of which may, result in a change

in control of our Company.

|

|

|

(2)

|

Paul

Alfano. Mr. Alfano is a 5% Stockholder and a Director.

|

|

|

(3)

|

Richard

Halden. Mr. Halden is a 5% Stockholder. The total number of Class A Shares listed

includes Class A Shares beneficially owned through various entities and through a spousal

interest, as reported by Mr. Halden on his most recent Form 4 filed on July 27, 2015.

Additionally, Mr. Halden is the beneficial owner of securities convertible into Class

A Shares, including: (a) 2,000,000 pursuant to that Severance and Release Agreement by

and between the Company and Mr. Halden, dated February 1, 2017, and filed as Exhibit

10.30 to the Company’s Form 10-Q/A, filed with the SEC on September 21, 2017;

and (b) 2,083,333 pursuant to that Subordinated Convertible Promissory Note, dated December

20, 2017, by and between the Company and Tunstall Canyon Group, LLC, an entity controlled

by Mr. Halden, filed as Exhibit 10.34 to the Company’s Form 10-K filed with

the SEC on April 5, 2018.

|

|

|

(4)

|

Kevin

Jones. Mr. Kevin Jones is a 5% Stockholder and a Director. Kevin Jones and Ransom

Jones are brothers. Mr. K. Jones has sole voting and dispositive power with respect to

5,250,000 Class A Shares. In addition, the number of Class A Shares beneficially owned

by Mr. K. Jones includes: (a) 4,875,000 Class A Shares held by Mabert, LLC, a Texas limited

liability company (“Mabert”), in which Mr. K. Jones has an ownership

interest and for which he serves as a manager; (b) 8,500,000 Class A Shares owned by

Mr. K. Jones’s spouse, Ms. Christine Mary Earley, in which Mr. K. Jones has a spousal

interest; and (c) 1,867,843 Class A Shares issuable to Mr. K. Jones pursuant to that

certain Loan Agreement by and between Mabert and the Company, dated September 14, 2018,

filed as Exhibit 10.49 to the Company’s Form 10-K/A, filed with the SEC

on May 13, 2019.

|

|

|

(5)

|

Randy

Mosley. Mr. Mosely is a 5% Stockholder.

|

|

|

(6)

|

D.

Patrick Six. Mr. Six is a 5% Stockholder. Mr. Six also served as our president and

a Director, but resigned from those positions effective as of May 10, 2018, and February

19, 2019, respectively.

|

|

|

(7)

|

Raymond

Wright. Mr. Wright is a 5% Stockholder, our chairman of our Board of Directors, and

president of Greenway Innovative Energy, Inc., our wholly-owned subsidiary.

|

|

|

(8)

|

Kent

Harer. Mr. Harer is a Director and our acting president, making him a Named Executive

Officer. The Class A Shares beneficially owned by Mr. Harer are those immediately issuable

upon Mr. Harer’s exercise of that certain Stock Purchase Warrant, dated January

8, 2018, by and between the Company and Mr. Harer, filed as Exhibit 10.37 to our

Annual Report on Form 10-Q/A, filed with the SEC on May 22, 2018.

|

|

|

(9)

|

Ransom

Jones. Mr. Ransom Jones is a Director and our secretary, treasurer, and chief financial

officer, making him a Named Executive Officer. Ransom Jones and Kevin Jones are brothers.

Mr. R. Jones has sole voting and dispositive power with respect to 250,000 Class A Shares.

In addition, the number of Class A Shares beneficially owned by Mr. R. Jones includes

3,875,000 Class A Shares owned by Mr. R. Jones’s spouse, Ms. Jan Jones, in which

Mr. R. Jones has a spousal interest.

|

|

|

(10)

|

Michael

Wykrent. Mr. Wykrent is a Director.

|

|

|

(11)

|

Thomas

Phillips. Mr. Phillips is Vice President of Operations, and receives more than $100,000

in annual compensation, making him a Named Executive Officer.

|

|

|

(12)

|

All

current Directors and Named Executive Officers as a group. This ownership includes

only the ownership of current Named Executive Officers and Directors.

|

|

|

(13)

|

John

Olynick. Mr. Olynick served as our president from May 10, 2018, to July 19, 2019.

|

II.

PROPOSALS TO BE VOTED ON AT OUR SPECIAL MEETING

|

|

A.

|

Proposal

No. 1: Approval of Amendment No. 1 to Increase the Number of Authorized Class A Shares

from 300,000,000 to 500,000,000

|

Background

and Purpose of Proposal No. 1

On

November 7, 2019, our Board of Directors approved Amendment No. 1 to increase the number of authorized Class A Shares from 300,000,000

to 500,000,000. The purpose of Amendment No. 1 is to provide our Company with the ability to raise capital through stock issuances

so that our Company can achieve its objectives for product development, staffing, reduction of debt, general operating expenses,

and other general corporate purposes.

Text

of Amendment No. 1

The

proposed text of Amendment No. 1 described above is provided in Appendix A to our Proxy Statement, which provides the text

of each of the proposed amendments to our Certificate (the “Certificate Amendments”). If Proposal No. 1 is

approved by our Stockholders, we will file an amendment to our Certificate with the Secretary of State of the State of Texas,

which includes Amendment No. 1, and such amendment will become effective upon its filing with the Secretary of State of the State

of Texas, which is anticipated to occur promptly after our Special Meeting.

Required

Vote for Approval of Proposal No. 1

The

affirmative “FOR” vote of the holders of at least 66 2/3% in voting power of the then-outstanding Class

A Shares entitled to vote on the matter, voting together as a single class, is needed to approve Amendment No. 1. As this is a

“routine” matter, without voting instructions from you, your broker may vote your Class A Shares with

respect to Proposal No. 1. However, abstentions will have the same effect as a vote against the approval of Proposal No. 1.

OUR

BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR”

THE APPROVAL OF AMENDMENT NO. 1

|

|

B.

|

Proposal

No. 2: Approval of Amendment No 2. to Change the Name of our Class A Shares to Common

Stock

|

Background

and Purpose of Proposal No. 2

On

November 7, 2019, our Board of Directors approved Amendment No. 2 to change the name of our Class A Shares to Common Stock. Amendment

No. 2 would not change the $0.0001 par value per share, designations, powers, privileges, rights, qualifications, limitations,

or restrictions of the Class A Shares. However, Amendment No. 2 would change the name of the Class A Shares to Common Stock to

make it consistent with the name of the capital stock registered with the SEC under the Securities Act of 1933.

Text

of Amendment No. 2

The

proposed text of Amendment No. 2 described above is provided in Appendix A to our Proxy Statement, which provides the text

of each of the Certificate Amendments. If Proposal No. 1 is approved by our Stockholders, we will file an amendment to our Certificate

with the Secretary of State of the State of Texas, which includes Amendment No. 2, and such amendment will become effective upon

its filing with the Secretary of State of the State of Texas, which is anticipated to occur promptly after our Special Meeting.

Required

Vote for Approval of Proposal No. 2

The

affirmative “FOR” vote of the holders of at least 66 2/3% in voting power of the then-outstanding Class

A Shares entitled to vote on the matter, voting together as a single class, is needed to approve Amendment No. 2. As this is a

“routine” matter, without voting instructions from you, your broker may vote your Class A Shares with

respect to Proposal No. 2. However, abstentions will have the same effect as a vote against the approval of Proposal No. 2.

OUR

BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR”

THE APPROVAL OF AMENDMENT NO. 2

|

|

C.

|

Proposal

No. 3: Approval of Amendment No. 3 to Eliminate the Class B Shares

|

Background

and Purpose of Proposal No. 3

On

November 7, 2019, our Board of Directors approved Amendment No. 3 to eliminate the Class B Shares as a class of capital stock

of our Company. Currently, there are no issued and outstanding Class B Shares. Our Board of Directors has determined there is

a de minimis benefit to the existence of the Class B Shares. Moreover, assuming Proposal No. 2 is approved by our Stockholders,

eliminating the Class B Shares would eliminate confusion as to whether there was another outstanding class of capital stock of

our Company.

Text

of Amendment No. 3

The

proposed text of Amendment No. 3 described above is provided in Appendix A to our Proxy Statement, which provides the text

of each of the Certificate Amendments. If Proposal No. 3 is approved by our Stockholders, we will file an amendment to our Certificate

with the Secretary of State of the State of Texas, which includes Amendment No. 3, and such amendment will become effective upon

its filing with the Secretary of State of the State of Texas, which is anticipated to occur promptly after our Special Meeting.

Required

Vote for Approval of Proposal No. 3

The

affirmative “FOR” vote of the holders of at least 66 2/3% in voting power of the then-outstanding Class

A Shares entitled to vote on the matter, voting together as a single class, is needed to approve Amendment No. 3. As this is a

“routine” matter, without voting instructions from you, your broker may vote your Class A Shares with respect

to Proposal No. 3. However, abstentions will have the same effect as a vote against the approval of Proposal No. 3.

OUR

BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR”

THE APPROVAL OF AMENDMENT NO. 3

|

|

D.

|

Proposal

No. 4: Approval of Amendment No. 4 to Specify the Vote Required to Approve Certain

Actions before our Stockholders

|

Background

and Purpose of Proposal No. 4

On

November 7, 2019, our Board of Directors approved Amendment No. 4 to specify the vote required to approve certain actions before

our Stockholders. If a Texas corporation does not specify what action constitutes the action of its stockholders, the default

requirement for many actions is that a majority of the shares entitled to vote on, and who voted for, against, or expressly abstained

with respect to the matter at a meeting of the shareholders at which a quorum is present.1 Additionally, Texas law

states that both “fundamental actions” and “fundamental business transactions” require the affirmative

vote of two-thirds of the outstanding shares of capital stock entitled to vote on such action to approve such actions, unless

a different voting requirement is specified in an entity’s certificate of formation.2 Under the TBOC, (i) a “fundamental

action” of an entity includes an amendment to the entity’s certificate of formation, a voluntary winding up of the

entity, a revocation of a voluntary decision to wind up the entity, a cancellation of an event requiring winding up, or a reinstatement

of the entity, and (ii) a “fundamental business transaction” of an entity is a merger, interest exchange, conversion,

or sale of all or substantially all of an entity’s assets.3

To

modify the TBOC’s default voting requirement, a corporation must amend its certificate of formation to specify another voting

requirement for actions of stockholders. Amendment No. 4 would specify that the vote required to approve certain actions before

our Stockholders, including fundamental actions and fundamental business transactions, would be as follows:

|

|

1.

|

Fundamental

Actions: The affirmative vote of the holders of the majority of the shares entitled

to vote on a “fundamental action,” as defined by Section 21.364 of the TBOC,

is required to approve such “fundamental action.”

|

|

|

|

|

|

|

2.

|

Fundamental

Business Transactions: The affirmative vote of the holders of the majority of the

shares entitled to vote on a “fundamental business transaction,” as defined

by Section 1.002(32) of the TBOC, is required to approve such “fundamental business

transaction.”

|

|

|

|

|

|

|

3.

|

All

Other Matters: For matters other than the election of directors, “fundamental

actions,”4 and “fundamental business transactions,”5

the affirmative vote of the holders of a majority of the shares entitled to vote

on that matter and represented in person or by proxy at a meeting of the stockholders

at which a quorum is present.

|

Our

Board of Directors believes Amendment No. 4 will facilitate investment in our Company, eliminate confusion as to which actions

by our Stockholders require a certain number of votes, and align our Company’s governing documents with those of other public

companies.

1

Texas Bus. Orgs. Code Ann. §

21.363 (West 2019).

2

Id. § 1.002(32); id. § 21.364.

3

Id. § 21.364.

4

Id § 1.002(32).

5

Id. § 21.364.

Text

of Amendment No. 4

The

proposed text of Amendment No. 4 described above is provided in Appendix A to our Proxy Statement, which provides the text

of each of the Certificate Amendments. If Proposal No. 4 is approved by our Stockholders, we will file an amendment to our Certificate

with the Secretary of State of the State of Texas, which includes Amendment No. 4, and such amendment will become effective upon

its filing with the Secretary of State of the State of Texas, which is anticipated to occur promptly after our Special Meeting.

Required

Vote for Approval of Proposal No. 4

The

affirmative “FOR” vote of the holders of at least 66 2/3% in voting power of the then-outstanding Class

A Shares entitled to vote on the matter, voting together as a single class, is needed to approve Amendment No. 4. As this is a

“non-routine” matter, without voting instructions from you, your broker may not vote your Class A Shares

with respect to Proposal No. 4. Thus, broker non-vote and abstentions are will have the same effect as a vote against the approval

of Proposal No. 4.

OUR

BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR”

THE APPROVAL OF AMENDMENT NO. 4

III.

ADDITIONAL INFORMATION

A.

Stockholder Proposals

In

accordance with Rule 14a-8 promulgated by the SEC under the Exchange Act (“Rule 14a-8”), our Stockholders may

submit a written proposal for business to be brought before our Special Meeting by November 13, 2019, which is five days before

we anticipate that we will mail our Proxy Materials to our Stockholders.

Among

other requirements, a Stockholder’s intent to bring any proposal of business, including but not limited to Director nominations,

before our 2020 annual Stockholder meeting (our “2020 Annual Meeting”) must be made in accordance with Rule

14a-8 and received at our principal executive offices, located at 1521 North Cooper Street, Arlington, Texas, 76011, no later

than the close of business on the 120th day (January 24, 2020) in advance of the anniversary of the filing of our 2019 Schedule

14A filed on Form DEF14A, which we filed with the SEC on May 23, 2019. If our 2020 Annual Meeting is not held within 30 days before

or after June 26, 2020, then such business must be delivered to or mailed and received by our Company at our principal executive

offices a reasonable time before our Company begins to print and send our 2020 Annual Meeting proxy solicitation materials. Any

proxy that management solicits for our 2020 Annual Meeting will confer on the holder of the proxy discretionary authority to vote

on the proposal so long as such proposal is properly presented at the 2020 Annual Meeting.

Our

Company may require any proposed Director nominee or nominating Stockholder to furnish such other information as may reasonably

be required to determine the eligibility of such proposed Director nominee to serve as a Director of our Company. If such procedures

are not complied with, the chairman of our 2020 Annual Meeting may determine and declare to the meeting that the nomination was

defective, and such nomination will be disregarded.

B.

Other Matters to be Presented at our Special Meeting

We

know of no other matters that will be presented for consideration at our Special Meeting. If any other matters properly come before

our Special Meeting, it is intended that proxies in the enclosed form will be voted in respect thereof in accordance with the

judgments of the persons voting the proxies.

It

is important that the proxies be returned promptly and that your Class A Shares are represented. Stockholders are urged to vote

via toll-free telephone number, via the Internet, or by mail, by completing, signing, dating, and promptly returning the Proxy

Card you received with our Proxy Materials.

C.

Delivery of Documents to Stockholders Sharing an Address

Only

one set of our Proxy Materials is being delivered to multiple security holders sharing an address, unless we received contrary

instructions from one or more of the security holders at such address. We will promptly deliver, upon written or oral request,

a separate copy of our Proxy Materials to a security holder at a shared address to which a single set of our Proxy Materials was

delivered. A security holder may notify us that the security holder wishes to receive a separate set of our Proxy Materials by

requesting via the Internet at www.investorelections.com/GWTI, via telephone at 1 (866) 648-8133, via mail at Greenway Technologies,

Inc., 1565 North Central Expressway, Suite 220 Richardson, TX 75080, Attn: Investor Relations, or via email at paper@investorelections.com.

If you request a separate copy of our Proxy Materials via e-mail, please send a blank e-mail with the provided 12-digit control

number in the subject line. A security holder may use the same website, telephone number, mailing address or e-mail address to

request either separate copies or a single copy for a single address for all future information statements and proxy statements,

if any, and annual reports of our Company.

D.

Financial Statements and Form 10-K Annual Report

Our

audited financial statements for the year ended December 31, 2018, and other related financial and business information of our

Company are contained in our Annual Report (including exhibits), are herein incorporated by reference. Copies of our Annual

Report, including our audited financial statements, are included with your Proxy Materials, but may also be obtained without

charge by contacting us via mail at Greenway Technologies, Inc., 1521 North Cooper Street, Arlington, TX. 76011, Attn: Investor

Relations or by email at IR@gwtechinc.com.

E.

Voting Results of our Special Meeting

Preliminary

voting results will be announced at our Special Meeting. Final voting results will be tallied by Mediant, as inspector of elections,

after the taking of the vote at our Special Meeting. Our Company will publish the final voting results in a Current Report on

Form 8-K, which our Company is required to file with the SEC within four business days following our Special Meeting.

APPENDIX

A

Text

of Proposed Certificate Amendments

|

Current

Language in the Certificate

|

|

Proposed

Text of Certificate Giving Effect to Proposed Amendments Nos. 1-4

|

|

Included

Amendments

|

|

ARTICLE

FOUR

The

Corporation may issue two classes of shares, designed “Class A” and “Class B”. The Corporation

may issue a total of 320,000,000 shares. The authorized number of Class A shares is 300,000,000 with a par value of $.0001

per share. The authorized number of Class B shares is 20,000,000 with a par value of $.0001 per share. The Class B shares

must be issued as fully paid non-assessable shares.

|

|

ARTICLE

FOUR

A.

The Corporation is authorized to issue a total of 500,000,000 shares of common stock, par value $0.0001 per share

(“Common Stock”).

B.

As of the date of filing of this Certificate, all authorized or issued shares of the Corporation designated

“Class A” shall hereby be designated as Common Stock.

C.

As of the date of filing of this Certificate, all authorized or issued shares of the Corporation designated

“Class B” shall hereby be eliminated.

|

|

Amendment

No. 1

(Article VI.A)

Amendment

No. 2

(Article VI.B)

Amendment

No. 3

(Article VI.C)

|

|

ARTICLE

FIVE

5.01 A

merger of the corporation of the lease or conveyance of all or substantially all of its assets is not considered a liquidation,

dissolution, or winding up of the corporation’s affairs within the meaning of this article.

5.02 On

any voluntary dissolution, liquidation, or winding up of the corporation’s affairs, the Class B shareholders are

entitled to be paid in full the respective amounts fixed in accordance with Paragraph 4.02, together with accrued dividends

(whether or not earned or declared) to the last distribution-payment date, before any distribution or payment may be made

to the Class A shareholders.

5.03 On

any voluntary liquidation, dissolution, or winding up of the corporation’s affairs, the Class B shareholders are

entitled to be paid in full the respective amounts fixed in accordance with Paragraph 4.02, together with accrued dividends

(whether or not earned or declared) to the last distribution-payment date, before any distribution or payment may be made

to the Class shareholders.

5.04 If,

on any voluntary or involuntary liquidation, dissolution, or winding up on the corporation’s affairs, the corporation’s

assets are insufficient to permit full payment to the Class B shareholders as provided in these articles, then the Class

B shareholders of any series must share ratably in any distribution of assets incorporation to the full amounts to which

they would otherwise be entitled.

|

|

ARTICLE

FIVE

(Delete

Article V in its entirety as it only relates to rights of Class B Shares)

|

|

Amendment

No. 3

|

Appendix

A

|

Current

Language in the Certificate

|

|

Proposed

Text of Certificate Giving Effect to Proposed Amendments Nos. 1-4

|

|

Included

Amendments

|

|

ARTICLE

TEN

(Not

in current Certificate)

|

|

ARTICLE

TEN

A. The

affirmative vote of the holders of the majority of the shares entitled to vote on a “fundamental action,”

as defined by Section 21.364 of the TBOC (a “Fundamental Action”), is required to approve such Fundamental

Action.

B. The

affirmative vote of the holders of the majority of the shares entitled to vote on a “fundamental business transaction,”

as defined by Section 1.002(32) of the TBOC (a “Fundamental Business Transaction”), is required to

approve such Fundamental Business Transaction.

C. For

matters other than the election of directors, Fundamental Actions, and Fundamental Business Transactions, the affirmative

vote of the holders of a majority of the shares entitled to vote on that matter and represented in person or by proxy

at a meeting of the stockholders at which a quorum is present.

|

|

Amendment

No. 4

|

Appendix

A

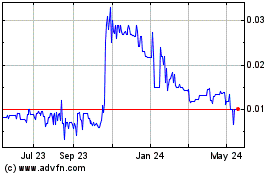

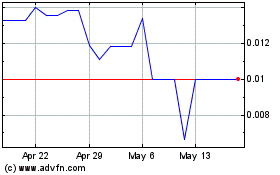

Greenway Technologies (PK) (USOTC:GWTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Greenway Technologies (PK) (USOTC:GWTI)

Historical Stock Chart

From Dec 2023 to Dec 2024