Thales to Sell Signaling Business to Hitachi, Valuing It at $2 Billion -- Update

04 August 2021 - 8:09PM

Dow Jones News

By Olivia Bugault

Thales SA said Wednesday that it has entered into exclusive

negotiations with Japanese conglomerate Hitachi Ltd.'s subsidiary

Hitachi Rail for the sale of its rail-signaling business for an

enterprise value of 1.66 billion euros ($1.97 billion).

The final purchase price of the sale of the ground

transportation systems business, which should be completed by the

end of 2022 or the beginning of 2023, will be set "after customary

adjustments for net working capital and net debt based on actual

amounts at the closing date," the French aerospace-and-defense

company said.

The completion of the deal will take time as it requires a

carve-out --the partial divestiture of a business unit--in around

40 countries, Thales said.

For 2020, Thales's transport unit booked order intake that was

down 4% organically at EUR1.65 billion, while organic sales fell

14% to EUR1.62 billion on the back of the coronavirus pandemic and

delay in signing contracts. The segment had a negative earnings

before interest and taxes margin of 2.4% in 2015 but returned to

positive territory since, reaching 5.3% in 2020, and should come

above 7% this year, Thales said.

After the acquisition, Hitachi Rail will be positioned to become

a global leader in the rail signaling market, it said.

Meanwhile, the additional liquidity from the planned sale will

help Thales further invest in research and development and

potential future acquisitions, Chief Executive Patrice Caine said

Wednesday during a call with journalists.

Mr. Caine said the cash will allow the group to continue to

invest in bolt-on acquisitions--which refers to smaller

companies--but also in the potential takeover of larger companies,

which it did when it bought software company Gemalto for EUR4.8

billion in 2019. Future acquisitions won't necessarily be based on

the operational performance of the targeted company at the time of

the acquisition but on the potential synergies and estimated

profitability trajectory, he said.

Through the sale of its rail-signalling business, Thales will

strengthen its balance sheet but also its focus on three main

markets--defense and security, aerospace, and digital identity and

security, the company said.

Post-disposal, its defense and security segment should represent

roughly 53% of its sales, while aerospace will be at about 28% and

the share of digital identity and security will be at roughly 19%,

Thales said. It also now targets an EBIT margin of 12% in the

medium-term, compared with 10.6% in 2019.

Thales said its transport business will be treated as

discontinued business as of 2021, and so updated its outlook for

the year. The company now expects 2021 sales to come between

EUR15.8 billion and EUR16.3 billion compared with a previous range

of EUR17.5 billion-EUR18 billion, while it targets a higher EBIT

margin of 9.8% to 10.3%. That compares with a previous forecast of

9.5% to 10%.

At 0937GMT Thales shares were trading 1.6% higher at EUR89.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

August 04, 2021 06:09 ET (10:09 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

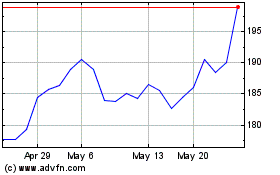

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

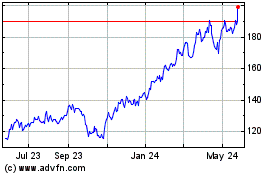

Hitachi (PK) (USOTC:HTHIY)

Historical Stock Chart

From Jan 2024 to Jan 2025