false

0001481028

0001481028

2024-06-03

2024-06-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 3, 2024

SUNHYDROGEN, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-54437 |

|

26-4298300 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

BioVentures Center, 2500 Crosspark Road

Coralville, IA 52241

(Address of principal executive offices and Zip

Code)

Registrant’s telephone number, including

area code: (805) 966-6566

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Not applicable |

|

Not applicable |

|

Not applicable |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b2 of the Securities

Exchange Act of 1934 (§240.12b2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entr y into a Material Definitive Agreement.

On June 3, 2024, SunHydrogen, Inc. (the “Company”) entered

into a purchase agreement (the “Purchase Agreement”) with GHS Investments, LLC (“GHS”). Under the Purchase Agreement,

the Company may sell, in its discretion (subject to the terms and conditions of the Purchase Agreement) up to an aggregate of $50,000,000

of common stock to GHS.

The Company has the right, in its sole discretion, subject to the conditions

and limitations in the Purchase Agreement, to direct GHS, by delivery of a purchase notice from time to time (a “Purchase Notice”)

to purchase (each, a “Purchase”) over the two-year term of the Purchase Agreement, a minimum of $100,000 and up to a maximum

of $2,000,000 (the “Purchase Amount”) of shares of common stock (the “Purchase Shares”) for each Purchase Notice,

provided that the parties may agree to waive such $2,000,000 limitation. The number of Purchase Shares the Company will issue under each

Purchase will be equal to 112.5% of the Purchase Amount sold under such Purchase, divided by the Purchase Price per share (as defined

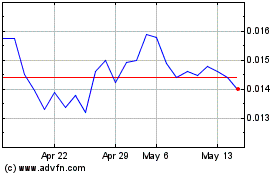

under the Purchase Agreement). The “Purchase Price” is defined as 90% of the lowest end-of-day volume weighted average price

of the common stock for the five consecutive business days immediately preceding the purchase date, including the purchase date.

The Purchase Agreement prohibits the Company from directing GHS to

purchase any shares of common stock if those shares, when aggregated with all other shares of the Company’s common stock then beneficially

owned by GHS and its affiliates, would result in GHS and its affiliates having beneficial ownership, at any single point in time, of more

than 4.99% of the then total outstanding shares of the Company’s common stock.

There are no trading volume requirements or restrictions under the

Purchase Agreement. The Company will control the timing and amount of any sales of its common stock to GHS. The Company may not deliver

more than one Purchase Notice to GHS every five business days, except as the parties may otherwise agree. The Company may at any time

in its sole discretion terminate the Purchase Agreement.

If an event of default (as defined under the Purchase Agreement) (all

of which are outside the control of GHS) occurs and is continuing, the Company may not deliver to GHS any Purchase Notice.

The Company will pay a fee of 2% of the gross proceeds the Company

receives from sales of common stock under the Purchase Agreement, to Icon Capital Group, LLC (“Icon”) pursuant to a placement

agent agreement between the Company and Icon (the “Placement Agent Agreement”).

The shares were offered, and will be issued, pursuant to the Prospectus

Supplement, dated June 3, 2024 to the Prospectus included in the Company’s Registration Statement on Form S-3 (Registration No.

333-276678) filed with the Securities and Exchange Commission on January 24, 2024.

GHS was also the purchaser under securities purchase agreements with

the Company dated September 21, 2020, February 24, 2021 and November 17, 2022.

Sichenzia Ross Ference Carmel LLP, counsel to the Company, has issued

an opinion to the Company regarding the validity of the securities to be issued in the offering. A copy of the opinion is filed as Exhibit

5.1 to this Current Report on Form 8-K.

The foregoing descriptions of the Purchase Agreement and Placement

Agent Agreement are qualified in their entirety by reference to Exhibit 10.1 and Exhibit 10.2, respectively, attached hereto and incorporated

herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SUNHYDROGEN, INC. |

| |

|

| Date: June 3, 2024 |

/s/ Timothy Young |

| |

Timothy Young |

| |

Chief Executive Officer |

2

Exhibit 5.1

June 3, 2024

SunHydrogen, Inc.

BioVentures Center

2500 Crosspark Road,

Coralville, IA 52241

Re: Common Stock registered under Registration

Statement on Form S-3

Ladies and Gentlemen:

We have acted as counsel to SunHydrogen, Inc.,

a Nevada corporation (the “Company”), in connection with the purchase agreement dated June 3, 2024 (the “Purchase Agreement”)

by and between the Company and GHS Investments, LLC (the “Investor”), relating to the sale by the Company to the Investor

of up to $50,000,000 of shares (the “Shares”) of the Company’s common stock, par value $0.001 per share.

This opinion is being delivered in accordance

with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act of 1933, as amended (the “Securities

Act”).

In connection with this opinion, we have examined

originals or copies, certified or otherwise identified to our satisfaction, of the following:

1. Articles of Incorporation of the Company, as

amended;

2. Bylaws of the Company, as amended;

3. The Purchase Agreement;

4. Registration Statement on Form S-3 (Registration

No. 333-276678) as filed by the Company with the Securities and Exchange Commission (the “Commission”) on January 28,

2024 (as such registration statement became effective on February 1, 2024 the “Registration Statement”) pursuant to the Securities

Act;

5. The prospectus supplement filed with the Commission

on June 3, 2024, pursuant to Rule 424(b)(5) promulgated under the Securities Act, together with the base prospectus dated February

3, 2021; and

6. Written consent of the Board of Directors of

the Company approving the Purchase Agreement.

We have also examined originals or copies, certified

or otherwise identified to our satisfaction, of such records of the Company and such agreements, certificates and receipts of public officials,

certificates of officers or other representatives of the Company and others, and such other documents as we have deemed necessary or appropriate

as a basis for the opinions stated below.

In our examination, we have assumed the genuineness

of all signatures, including endorsements, the legal capacity and competency of all natural persons, the authenticity of all documents

submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified

or photostatic copies, and the authenticity of the originals of such copies. In making our examination of executed documents, we have

assumed (i) that the parties thereto, other than the Company, had the power, corporate or other, to enter into and perform all obligations

thereunder and (ii) the due authorization by all requisite action, corporate or other, and the execution and delivery by such parties

of such documents, and the validity and binding effect thereof on such parties.

1185 Avenue of the Americas

| 31st Floor | New York, NY | 10036

T (212) 930 9700 | F (212) 930 9725 | WWW.SRFC.LAW

The opinion expressed below is limited to the

federal securities laws of the United States of America and the corporate laws of the State of Nevada and we express no opinion as to

the effect on the matters covered by the laws of any other jurisdiction.

Based upon and subject to the foregoing, we are

of the opinion that when the Shares have been delivered to and paid for by the Investor as contemplated by the Purchase Agreement, the

Shares will be duly authorized, validly issued, fully paid and non-assessable.

We hereby consent to the filing of this opinion

with the Commission as an exhibit to the Company’s Current Report on Form 8-K being filed on the date hereof and incorporated by

reference into the Registration Statement. We also hereby consent to the reference to our firm under the caption “Legal Matters”

in the Prospectus Supplement. In giving this consent, we do not thereby admit that we are within the category of persons whose consent

is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder. This opinion

is expressed as of the date hereof unless otherwise expressly stated, and we disclaim any undertaking to advise you of any subsequent

changes in the facts stated or assumed herein or of any subsequent changes in applicable laws.

| Very truly yours, |

|

| |

|

| /s/ Sichenzia Ross Ference Carmel LLP |

|

1185 Avenue of the Americas

| 31st Floor | New York, NY | 10036

T (212) 930 9700 | F (212) 930 9725 | WWW.SRFC.LAW

Exhibit

10.1

PURCHASE

AGREEMENT

PURCHASE

AGREEMENT (the “Agreement”), dated as of June 3, 2024, by and between SUNHYDROGEN, INC., a Nevada corporation

(the “Company”), and GHS Investments, LLC, a Nevada limited liability company (the “Investor”).

WHEREAS:

Subject

to the terms and conditions set forth in this Agreement, the Company wishes to sell to the Investor, and the Investor wishes to buy from

the Company, up to Fifty Million Dollars ($50,000,000) of the Company’s registered common stock, $0.001 par value per share (the

“Common Stock”). The shares of Common Stock to be purchased hereunder are referred to herein as the “Purchase

Shares.”

NOW

THEREFORE, in consideration of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the receipt

and adequacy of which are hereby acknowledged, the Company and the Investor hereby agree as follows:

1.

CERTAIN DEFINITIONS.

For

purposes of this Agreement, the following terms shall have the following meanings:

(a)

“Available Amount” means, initially, Fifty Million Dollars ($50,000,000) in the aggregate, which amount shall be reduced

by the Purchase Amount each time the Investor purchases shares of Common Stock pursuant to Section 2 hereof.

(b)

“Bankruptcy Law” means Title 11, U.S. Code, or any similar federal or state law for the relief of debtors.

(c)

“Base Prospectus” means the Company’s final base prospectus, dated February 1, 2024, a preliminary form of which

is included in the Registration Statement, including the documents incorporated by reference therein.

(d)

“Business Day” means any day on which the Principal Market is open for trading, including any day on which the Principal

Market is open for trading for a period of time less than the customary time.

(e)

“Custodian” means any receiver, trustee, assignee, liquidator or similar official under any Bankruptcy Law.

(f)

“DTC” means The Depository Trust Company, or any successor performing substantially the same function for the Company.

(g)

“DWAC Shares” means shares of Common Stock that are (i) issued in electronic form, (ii) freely tradable and transferable

and without restriction on resale and (iii) timely credited by the Company to the Investor’s or its designee’s specified

Deposit/Withdrawal at Custodian (DWAC) account with DTC under its Fast Automated Securities Transfer (FAST) Program, or any similar program

hereafter adopted by DTC performing substantially the same function.

(h)

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

(i)

“Initial Prospectus Supplement” means the prospectus supplement of the Company relating to the Purchase Shares, including

the accompanying Base Prospectus, to be prepared and filed by the Company with the SEC pursuant to Rule 424(b)(5) under the Securities

Act and in accordance with Section 5(a) hereof, together with all documents and information incorporated therein by reference.

(j)

“Material Adverse Effect” means any material adverse effect on (i) the enforceability of any Transaction Document,

(ii) the results of operations, assets, business or financial condition of the Company, other than any material adverse effect that resulted

exclusively from (A) any change in the United States or foreign economies or securities or financial markets in general that does not

have a disproportionate effect on the Company taken as a whole, (B) any change that generally affects the industry in which the Company

operates that does not have a disproportionate effect on the Company, (C) any change arising in connection with earthquakes, hostilities,

acts of war, sabotage or terrorism or military actions or any escalation or material worsening of any such hostilities, acts of war,

sabotage or terrorism or military actions existing as of the date hereof, (D) any action taken by the Investor, its affiliates or its

or their successors and assigns with respect to the transactions contemplated by this Agreement, (E) the effect of any change in applicable

laws or accounting rules that does not have a disproportionate effect on the Company, or (F) any change resulting from compliance with

terms of this Agreement or the consummation of the transactions contemplated by this Agreement, or (iii) the Company’s ability

to perform in any material respect on a timely basis its obligations under any Transaction Document to be performed as of the date of

determination.

(k)

“Maturity Date” means the twenty-four month anniversary of the date of this Agreement or March___, 2026.

(l)

“Person” means an individual or entity including but not limited to any limited liability company, a partnership,

a joint venture, a corporation, a trust, an unincorporated organization and a government or any department or agency thereof.

(m)

“Principal Market” means the OTCQB (or any nationally recognized successor thereto); provided, however, that in the

event the Company’s Common Stock is ever listed or traded on The Nasdaq Capital Market, The Nasdaq Global Market, The Nasdaq Global

Select Market, the New York Stock Exchange, the NYSE American, CBOE or the OTCQX or OTC Pink operated by the OTC Markets Group, Inc.

(or any nationally recognized successor to any of the foregoing), then the “Principal Market” shall mean such other market

or exchange on which the Company’s Common Stock is then listed or traded

(n)

“Prospectus” means the Base Prospectus, as supplemented from time to time by any Prospectus Supplement (including

the Initial Prospectus Supplement), including the documents and information incorporated by reference therein.

(o)

“Prospectus Supplement” means any prospectus supplement to the Base Prospectus (including the Initial Prospectus Supplement)

filed with the SEC pursuant to Rule 424(b) under the Securities Act in connection with the transactions contemplated by this Agreement,

including the documents and information incorporated by reference therein.

(p)

“Purchase Amount” means, with respect to any Purchase, the portion of the Available Amount to be purchased by the

Investor pursuant to Section 2 hereof.

(q)

“Purchase Date” means, with respect to a Purchase made pursuant to Section 2(a) hereof, the Business Day on

which the Investor receives a valid Purchase Notice in accordance with this Agreement.

(r)

“Purchase Notice” means, with respect to a Purchase pursuant to Section 2(a) hereof, an irrevocable written notice

from the Company to the Investor, substantially in the form of Exhibit A hereto, directing the Investor to buy a specified amount of

Purchase Shares (subject to the Purchase Share limitations contained in Section 2(a) hereof) at the applicable Purchase Price for such

Purchase in accordance with this Agreement. Purchase Notices shall be delivered between 4PM through 11:59PM (Eastern Time). If the Investor

determines that the Purchase Notice is not compliant according to the terms of this Agreement, then the Investor shall notify the Company

with the basis for such determination of the non-compliance before 9:30AM (Eastern Time) on the next Business Day, and, provided the

Investor provides a valid basis for such non-compliance, the Purchase Notice shall be null and void. In the absence of any such determination

and valid basis for non-compliance, the Purchase Notice shall be deemed valid by 9:31AM (Eastern Time).

(s)

“Purchase Price” means, with respect to a Purchase made pursuant to Section 2(a) hereof, 90% of the lowest

end-of-day VWAP during the Valuation Period.

(t)

“Registration Statement” means the Company’s registration statement on Form S-3 (File No. 333-276678), including

the documents incorporated by reference therein.

(u)

“SEC” means the U.S. Securities and Exchange Commission.

(v)

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

(w)

“Settlement Date” means the date on which the Company delivers the Purchase Shares to the Investor’s Broker,

against the payment of the Purchase Price by the Investor, which date will be one Business Day following the Valuation Period. If the

Company fails to deliver the Purchase Shares on the Settlement Date, then the Purchase Notice is automatically null and void.

(x)

“Transaction Documents” means, collectively, this Agreement and the schedules and exhibits hereto, and each of the

other agreements, documents, certificates and instruments entered into or furnished by the parties hereto in connection with the transactions

contemplated hereby and thereby.

(y)

“Transfer Agent” means Worldwide Stock Transfer, LLC, or such other Person who is then serving as the transfer agent

for the Company in respect of the Common Stock.

(z)

“Valuation Period” means the five (5) consecutive Business Days immediately preceding the Purchase Date, including

the Purchase Date.

(aa)

“VWAP” means the volume weighted average price of the Common Stock on the Principal Market, as reported on the Principal

Market.

2.

PURCHASE OF COMMON STOCK.

Subject

to the terms and conditions set forth in this Agreement, the Company has the right to sell to the Investor, and the Investor has the

obligation to purchase from the Company, Purchase Shares as follows:

(a)

Sales of Common Stock. Subject to the satisfaction of all of the conditions set forth in Sections 6 and 7 hereof (the “Commencement”

and the date of satisfaction of such conditions the “Commencement Date”), at any time commencing on the Commencement

Date and thereafter, the Company shall have the right, but not the obligation, to direct the Investor, by its delivery to the Investor

of a Purchase Notice from time to time, to purchase a minimum of one hundred thousand dollars ($100,000) and up to a maximum of two million

dollars ($2,000,000) of Purchase Shares (the number of Purchase Shares being determined in accordance with Section 2(b) hereunder) for

each Purchase Notice (subject to the Available Amount), at the Purchase Price on the Purchase Date (each, a “Purchase”).

Each Purchase Notice will set forth the Purchase Price and number of Purchase Shares, in accordance with the terms of this Agreement.

If the Company delivers any Purchase Notice for a Purchase Amount in excess of the limitations contained herein, such Purchase Notice

shall be void ab initio to the extent of the amount by which the amount of Purchase Shares set forth in such Purchase Notice exceeds

the amount of Purchase Shares which the Company is permitted to include in such Purchase Notice in accordance herewith, and the Investor

shall have no obligation to purchase such excess Purchase Shares in respect of such Purchase Notice; provided, however,

that the Investor shall remain obligated to purchase the amount of Purchase Shares which the Company is permitted to include in such

Purchase Notice. Notwithstanding the foregoing dollar limitations, the Company and the Investor may, from time to time, mutually agree

(in writing) to waive the aforementioned limitations for a relevant Purchase Notice, which waiver, for the avoidance of doubt, shall

not exceed the Beneficial Ownership Limitation contained herein. The Company may not deliver more than one Purchase Notice to the Investor

every five (5) Business Days unless, from time to time, the Company and the Investor mutually agree to different timing of the delivery

Purchase Notices.

(b)

Settlement for Purchase Shares. On each Settlement Date, for each Purchase hereunder, the Company shall deliver a number of Purchase

Shares equal to 112.5% of the aggregate Purchase Amount for such Purchase divided by the Purchase Price per share for such Purchase,

against payment by the Investor to the Company of the Purchase Amount with respect to such Purchase (less documented deposit and clearing

fees, if any), as full payment for such Purchase Shares via wire transfer of immediately available funds. The Company shall not issue

any fraction of a share of Common Stock upon the any Purchase. If any issuance hereunder would result in the issuance of a fraction of

a share of Common Stock, the Company shall round such fraction of a share of Common Stock up or down to the nearest whole share. All

Purchase Shares issued hereunder will be DWAC Shares. All payments made under this Agreement shall be made in lawful money of the United

States of America by wire transfer of immediately available funds to such account as the Company may from time to time designate by written

notice in accordance with the provisions of this Agreement. Whenever any amount expressed to be due by the terms of this Agreement is

due on any day that is not a Business Day, the same shall instead be due on the next succeeding day that is a Business Day.

(c)

Beneficial Ownership Limitation. Notwithstanding anything to the contrary contained in this Agreement, the Company shall not issue

or sell, and the Investor shall not purchase or acquire, any shares of Common Stock under this Agreement which, when aggregated with

all other shares of Common Stock then beneficially owned by the Investor and its affiliates (as calculated pursuant to Section 13(d)

of the Exchange Act and Rule 13d-3 promulgated thereunder), would result in the beneficial ownership by the Investor and its affiliates

of more than 4.99% of the then issued and outstanding shares of Common Stock (the “Beneficial Ownership Limitation”).

Upon the written or oral request of the Investor, the Company shall promptly (but not later than one Business Day) confirm orally or

in writing to the Investor the number of shares of Common Stock then outstanding. The Investor and the Company shall each cooperate in

good faith in the determinations required hereby and the application hereof. The Investor’s written certification to the Company

of the applicability of the Beneficial Ownership Limitation, and the resulting effect thereof hereunder at any time, shall be conclusive

with respect to the applicability thereof and such result absent manifest error.

3.

INVESTOR’S REPRESENTATIONS AND WARRANTIES.

The

Investor represents and warrants to the Company as of the date hereof and as of the Commencement Date that:

(a)

Organization, Authority. Investor is an entity duly organized, validly existing and in good standing under the laws of the jurisdiction

of its organization, with the requisite power and authority to enter into and to consummate the transactions contemplated by this Agreement

and otherwise to carry out its obligations hereunder and thereunder.

(b)

Investment Purpose. The Investor is acquiring the Purchase Shares as principal for its own account for investment only and not

with a view to or for distributing or reselling such Purchase Shares or any part thereof in violation of the Securities Act or any applicable

state securities law, has no present intention of distributing any of such Purchase Shares in violation of the Securities Act or any

applicable state securities law and has no direct or indirect arrangement or understandings with any other Persons to distribute or regarding

the distribution of such Purchase Shares in violation of the Securities Act or any applicable state securities law (this representation

and warranty not limiting the Investor’s right to sell the Purchase Shares at any time pursuant to the Registration Statement described

herein or otherwise in compliance with applicable federal and state securities laws). The Investor is acquiring the Purchase Shares hereunder

in the ordinary course of its business.

(c)

Accredited Investor Status. The Investor is an “accredited investor” as that term is defined in Rule 501(a)(3) of

Regulation D promulgated under the Securities Act.

(d)

Information. The Investor understands that its investment in the Company and the Purchase Shares involves a high degree of risk

including without limitation the risks set forth in the Registration Statement. The Investor (i) is able to bear the economic risk of

an investment in the Purchase Shares including a total loss thereof, (ii) has such knowledge and experience in financial and business

matters that it is capable of evaluating the merits and risks of the proposed investment in the Purchase Shares, (iii) has had an opportunity

to ask questions of and receive answers from the officers of the Company concerning the financial condition and business of the Company

and others matters related to an investment in the Purchase Shares, and (iv) has had the opportunity to review the Registration Statement.

Neither such inquiries nor any other due diligence investigations conducted by the Investor or its representatives shall modify, amend

or affect the Investor’s right to rely on the Company’s representations and warranties contained in Section 4 below.

The Investor has sought such accounting, legal and tax advice as it has considered necessary to make an informed investment decision

with respect to its acquisition of the Purchase Shares. The Investor acknowledges and agrees that the Company neither makes nor has made

any representations or warranties with respect to the transactions contemplated hereby other than those specifically set forth in Section

4 hereof.

(e)

Validity; Enforcement. This Agreement has been duly and validly authorized, executed and delivered on behalf of the Investor and

is a valid and binding agreement of the Investor enforceable against the Investor in accordance with its terms, subject as to enforceability

to general principles of equity and to applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws

relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies.

(f)

No Short Selling. The Investor represents and warrants to the Company that at no time prior to the date of this Agreement has

any of the Investor, its agents, representatives or affiliates engaged in or effected, in any manner whatsoever, directly or indirectly,

any (i) “short sale” (as such term is defined in Rule 200 of Regulation SHO of the Exchange Act) of the Common Stock or (ii)

hedging transaction, which establishes a net short position with respect to the Common Stock.

4.

REPRESENTATIONS AND WARRANTIES OF THE COMPANY.

The

Company represents and warrants to the Investor as of the date hereof and as of the Commencement Date, that:

(a) Organization,

Good Standing. The Company is a corporation, validly existing and in good standing under the laws of Nevada.

(b) Authority.

The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by the

Transaction Documents and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement by the Company

and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary action on the

part of the Company.

(c) No

Conflicts. The execution, delivery and performance by the Company of this Agreement, the issuance and sale of the Purchase Shares

and the consummation by it of the transactions contemplated hereby party do not and will not conflict with or violate any provision of

the Company’s articles of incorporation or other organizational or charter documents. The Purchase Shares, upon issuance in accordance

with this Agreement, will be duly issued, fully paid, and nonassessable.

(d) Validity,

Enforcement. This Agreement has been duly and validly authorized, executed and delivered on behalf of the Company and is a valid

and binding agreement of the Company enforceable against the Investor in accordance with its terms, subject as to enforceability to general

principles of equity and to applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating

to, or affecting generally, the enforcement of applicable creditors’ rights and remedies.

(e)

Registration Statement. The Company has prepared and filed the Registration Statement

with the SEC in accordance with the Securities Act. The Registration Statement was declared effective by order of the SEC on February

1, 2024. The Registration Statement is effective pursuant to the Securities Act and available for the issuance of the Purchase Shares

thereunder. No stop order suspending the effectiveness of the Registration Statement has been issued by the SEC, and no proceeding for

that purpose or pursuant to Section 8A of the Securities Act against the Company or related to the offering of the Purchase Shares has

been initiated or, to the knowledge of the Company, threatened by the SEC. The “Plan of Distribution” section of the Prospectus

permits the issuance of the Purchase Shares under the terms of this Agreement. At the time the Registration Statement and any amendments

thereto became effective, at the date of this Agreement and at each deemed effective date thereof pursuant to Rule 430B(f)(2) of the

Securities Act, the Registration Statement and any amendments thereto complied and will comply in all material respects with the requirements

of the Securities Act and did not and will not contain any untrue statement of a material fact or omit to state any material fact required

to be stated therein or necessary to make the statements therein not misleading; and the Base Prospectus and any Prospectus Supplement

thereto, at the time such Base Prospectus or such Prospectus Supplement thereto was filed and on the Commencement Date, complied and

will comply in all material respects with the requirements of the Securities Act and did not and will not contain an untrue statement

of a material fact or omit to state a material fact necessary in order to make the statements therein, in light of the circumstances

under which they were made, not misleading; provided that this representation and warranty does not apply to statements in or omissions

from any Prospectus Supplement made in reliance upon and in conformity with information relating to the Investor furnished to the Company

in writing by or on behalf of the Investor expressly for use therein. The Company meets all of the requirements for the use of a registration

statement on Form S-3 pursuant to the Securities Act for the offering and sale of the Purchase Shares contemplated by this Agreement

in reliance on General Instruction I.B.1., and the SEC has not notified the Company of any objection to the use of the form of the Registration

Statement pursuant to Rule 401(g)(1) of the Securities Act. The Company hereby confirms that the issuance of the Purchase Shares to the

Investor pursuant to this Agreement would not result in non-compliance with the Securities Act or any of the General Instructions to

Form S-3. The Registration Statement, as of its effective date, meets the requirements set forth in Rule 415(a)(1)(x) pursuant to the

Securities Act.

5.

COVENANTS.

(a)

Filing of Current Report and Initial Prospectus Supplement. The Company agrees that it shall, within the time required under the

Exchange Act, file with the SEC a Current Report on Form 8-K relating to the transactions contemplated by, and describing the material

terms and conditions of, the Transaction Documents (the “Current Report”). The Company further agrees that it shall,

within the time required under Rule 424(b) under the Securities Act, file with the SEC the Initial Prospectus Supplement pursuant to

Rule 424(b) under the Securities Act specifically relating to the transactions contemplated by, and describing the material terms and

conditions of, the Transaction Documents, containing information previously omitted at the time of effectiveness of the Registration

Statement in reliance on Rule 430B under the Securities Act, and disclosing all information relating to the transactions contemplated

hereby required to be disclosed in the Registration Statement and the Prospectus as of the date of the Initial Prospectus Supplement,

including, without limitation, information required to be disclosed in the section captioned “Plan of Distribution” in the

Prospectus. The Investor acknowledges that it will be identified in the Initial Prospectus Supplement as an underwriter within the meaning

of Section 2(a)(11) of the Securities Act. The Investor shall furnish to the Company such information regarding itself, the Purchase

Shares held by it and the intended method of distribution thereof, including any arrangement between the Investor and any other Person

relating to the sale or distribution of the Purchase Shares, as shall be reasonably requested by the Company in connection with the preparation

and filing of the Current Report and the Initial Prospectus Supplement, and shall otherwise cooperate with the Company as reasonably

requested by the Company in connection with the preparation and filing of the Current Report and the Initial Prospectus Supplement with

the SEC.

(b)

Listing/DTC. The Company shall use commercially reasonable efforts to maintain the listing of the Common Stock on the Principal

Market and to comply in all respects with the Company’s reporting, filing and other obligations under the bylaws or rules and regulations

of the Principal Market. The Company shall not take any action that would reasonably be expected to result in the delisting or suspension

of the Common Stock on the Principal Market. The Company shall promptly, and in no event later than the following Business Day, provide

to the Investor copies of any notices it receives from any Person regarding the continued eligibility of the Common Stock for listing

on the Principal Market; provided, however, that the Company shall not be required to provide the Investor copies of any such notice

that the Company reasonably believes constitutes material non-public information and the Company would not be required to publicly disclose

such notice in any report or statement filed with the SEC and under the Exchange Act or the Securities Act. The Company shall pay all

fees and expenses in connection with satisfying its obligations under this Section 5(c). The Company shall take all action necessary

to ensure that its Common Stock can be transferred electronically as DWAC Shares.

(c)

Prohibition of Short Sales and Hedging Transactions. The Investor agrees that beginning on the date of this Agreement and ending

on the date of termination of this Agreement as provided in Section 9, the Investor and its agents, representatives and affiliates shall

not in any manner whatsoever enter into or effect, directly or indirectly, any (i) “short sale” (as such term is defined

in Rule 200 of Regulation SHO of the Exchange Act) of the Common Stock or (ii) hedging transaction, which establishes a net short position

with respect to the Common Stock.

(d)

Purchase Records. The Investor and the Company shall each maintain records showing the remaining Available Amount at any given

time and the dates and Purchase Amounts for each Purchase or shall use such other method, reasonably satisfactory to the Investor and

the Company.

(e)

Use of Proceeds. The Company will use the net proceeds from the offering for any corporate purpose at the sole discretion of the

Company.

6.

CONDITIONS TO THE COMPANY’S RIGHT TO COMMENCE SALES OF SHARES OF COMMON STOCK.

The

right of the Company hereunder to commence sales of Purchase Shares is subject to the satisfaction of each of the following conditions:

(a)

The Investor shall have executed each of the Transaction Documents the Investor is a party to and delivered the same to the Company;

and

(b)

No stop order with respect to the Registration Statement shall be pending or threatened by the SEC

7.

CONDITIONS TO THE INVESTOR’S OBLIGATION TO PURCHASE SHARES OF COMMON STOCK.

The

obligation of the Investor to buy Purchase Shares under this Agreement is subject to the satisfaction of each of the following conditions

on or prior to the Commencement Date and, once such conditions have been initially satisfied, there shall not be any ongoing obligation

to satisfy such conditions after the Commencement has occurred:

(a)

The Company shall have executed each of the Transaction Documents the Company is a party to and delivered the same to the Investor;

(b)

The Common Stock shall be listed on the Principal Market, trading in the Common Stock shall not have been within the last 365 days suspended

by the SEC or the Principal Market and such suspension has not subsequently been cured;

(c)

The representations and warranties of the Company shall be true and correct in all material respects (except to the extent that any of

such representations and warranties is already qualified as to materiality in Section 4 above, in which case, such representations

and warranties shall be true and correct without further qualification) as of the date hereof and as of the Commencement Date as though

made at that time (except for representations and warranties that speak as of a specific date, which shall be true and correct as of

such date) and the Company shall have performed, satisfied and complied with the covenants, agreements and conditions required by the

Transaction Documents to be performed, satisfied or complied with by the Company at or prior to the Commencement Date.;

(d)

The Registration Statement shall continue to be effective and no stop order with respect to the Registration Statement shall be pending

or threatened by the SEC. The Company shall have a maximum dollar amount certain of Common Stock registered under the Registration Statement

which is sufficient to issue to the Investor not less than the full Available Amount worth of Purchase Shares. The Current Report and

the Initial Prospectus Supplement each shall have been filed with the SEC, as required pursuant to Section 5(a). The Prospectus

shall be current and available for issuances and sales of all of the Purchase Shares by the Company to the Investor. Any other Prospectus

Supplements required to have been filed by the Company with the SEC under the Securities Act at or prior to the Commencement Date shall

have been filed with the SEC within the applicable time periods prescribed for such filings under the Securities Act;

(e)

The Company will have delivered to the Transfer Agent irrevocable instructions, in a form reasonably acceptable to the Investor, to issue

Purchase Shares in accordance with this Agreement; and

(f)

No Event of Default has occurred and is continuing.

8.

EVENTS OF DEFAULT.

An

“Event of Default” shall be deemed to have occurred at any time as any of the following events occurs:

(a)

the effectiveness of the Registration Statement lapses for any reason (including, without limitation, the issuance of a stop order or

similar order) or such Registration Statement (or the prospectus forming a part thereof) is unavailable to the Investor for issuance

of or resale of any or all of the Purchase Shares to be issued to the Investor under the Transaction Documents;

(b)

the suspension of the Common Stock from trading on the Principal Market for a period of two (2) Business Days, provided that the Company

may not direct the Investor to purchase any shares of Common Stock during any such suspension;

(c)

the delisting of the Common Stock from the OTCQB provided, however, that the Common Stock is not immediately thereafter trading on The

NASDAQ Capital Market, The NASDAQ Global Market, The NASDAQ Global Select Market, the New York Stock Exchange, the NYSE American, CBOE

or the OTC Pink or the OTCQX operated by the OTC Markets Group, Inc. (or any nationally recognized successor to any of the foregoing);

(d)

the failure for any reason by the Transfer Agent to issue Purchase Shares to the Investor within three (3) Business Days after the applicable

date on which the Investor is entitled to receive such Purchase Shares;

(e)

the Company breaches any representation, warranty, covenant or other term or condition under any Transaction Document if such breach

could have a Material Adverse Effect and except, in the case of a breach of a covenant which is reasonably curable, only if such breach

continues for a period of at least five (5) Business Days;

(f)

if any Person or entity commences a proceeding against the Company pursuant to or within the meaning of any Bankruptcy Law;

(g)

if the Company, pursuant to or within the meaning of any Bankruptcy Law, (i) commences a voluntary case, (ii) consents to the entry of

an order for relief against it in an involuntary case, (iii) consents to the appointment of a Custodian of it or for all or substantially

all of its property, or (iv) makes a general assignment for the benefit of its creditors or is generally unable to pay its debts as the

same become due;

(h)

a court of competent jurisdiction enters an order or decree under any Bankruptcy Law that (i) is for relief against the Company in an

involuntary case, (ii) appoints a Custodian of the Company or for all or substantially all of its property, or (iii) orders the liquidation

of the Company; or

(i)

if at any time the Company is not eligible to transfer its Common Stock electronically as DWAC Shares.

So

long as an Event of Default has occurred and is continuing, the Company shall not deliver to the Investor any Purchase Notice.

9.

TERMINATION

This

Agreement may be terminated only as follows:

(a)

If pursuant to or within the meaning of any Bankruptcy Law, the Company commences a voluntary case or any Person commences a proceeding

against the Company, a Custodian is appointed for the Company or for all or substantially all of its property, or the Company makes a

general assignment for the benefit of its creditors (any of which would be an Event of Default as described in Sections 8(f),

9(g) and 9(h) hereof), this Agreement shall automatically terminate without any liability or payment to the Company (except

as set forth below) without further action or notice by any Person.

(b)

At any time after the Commencement Date, the Company shall have the option to terminate this Agreement for any reason or for no reason

by delivering notice (a “Company Termination Notice”) to the Investor electing to terminate this Agreement without

any liability whatsoever of any party to any other party under this Agreement (except as set forth below). The Company Termination Notice

will be effective upon delivery by the Company.

(c)

This Agreement shall automatically terminate on the date that the Company sells and the Investor purchases the full Available Amount

as provided herein, without any action or notice on the part of any party and without any liability whatsoever of any party to any other

party under this Agreement (except as set forth below).

(d)This

Agreement shall automatically terminate if there is a change in control of the Company (50% or greater) or if there is a material change

in the operations of the Company which material change may include (but not be exclusive to) a change in the Company’s Board of

Directors or any Officers.

(e)

If, for any reason or for no reason, the full Available Amount has not been purchased in accordance with Section 2 of this Agreement

by the Maturity Date, this Agreement shall automatically terminate on the Maturity Date, without any action or notice on the part of

any party and without any liability whatsoever of any party to any other party under this Agreement (except as set forth below).

Except

as set forth in Sections 9(a) (in respect of an Event of Default under Sections 8(f), 8(g) and 8(h)), 9(c)

and 9(d), any termination of this Agreement pursuant to this Section 9 shall be effected by written notice from the Company

to the Investor, or the Investor to the Company, as the case may be, setting forth the basis for the termination hereof. The representations

and warranties and covenants of the Company and the Investor contained in Sections 3, 4, and 5 (excluding Section 5(b)

and 5(c), hereof, and the agreements and covenants set forth in Sections 8, 9 and 10 shall survive the execution

and delivery of this Agreement and any termination of this Agreement. No termination of this Agreement shall (i) affect the Company’s

or the Investor’s rights or obligations under (A) this Agreement with respect to any pending Purchases, and the Company and the

Investor shall complete their respective obligations with respect to any pending Purchases under this Agreement or (ii) be deemed to

release the Company or the Investor from any liability for intentional misrepresentation or willful breach of any of the Transaction

Documents.

10.

MISCELLANEOUS.

(a)

Governing Law; Jurisdiction; Jury Trial. The corporate laws of the State of Nevada shall govern all issues concerning the relative

rights of the Company and its stockholders. All other questions concerning the construction, validity, enforcement and interpretation

of this Agreement and the other Transaction Documents shall be governed by the internal laws of the State of New York, without giving

effect to any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdictions) that would

cause the application of the laws of any jurisdictions other than the State of New York. Each party hereby irrevocably submits to the

exclusive jurisdiction of the state and federal courts sitting in the State of New York, County of New York, for the adjudication of

any dispute hereunder or under the other Transaction Documents or in connection herewith or therewith, or with any transaction contemplated

hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that

it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is brought in an inconvenient

forum or that the venue of such suit, action or proceeding is improper. Each party hereby irrevocably waives personal service of process

and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to such party at the address for

such notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice

thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law.

(b)

Counterparts. This Agreement may be executed in two or more identical counterparts, all of which shall be considered one and the

same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party; provided

that a facsimile signature or signature delivered by e-mail in a “.pdf” format data file shall be considered due execution

and shall be binding upon the signatory thereto with the same force and effect as if the signature were an original signature.

(c)

Headings. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation

of, this Agreement.

(d)

Severability. If any provision of this Agreement shall be invalid or unenforceable in any jurisdiction, such invalidity or unenforceability

shall not affect the validity or enforceability of the remainder of this Agreement in that jurisdiction or the validity or enforceability

of any provision of this Agreement in any other jurisdiction.

(e)

Entire Agreement. The Transaction Documents supersede all other prior oral or written agreements between the Investor, the Company,

their affiliates and Persons acting on their behalf with respect to the subject matter thereof, and this Agreement, the other Transaction

Documents and the instruments referenced herein contain the entire understanding of the parties with respect to the matters covered herein

and therein and, except as specifically set forth herein or therein, neither the Company nor the Investor makes any representation, warranty,

covenant or undertaking with respect to such matters.

(f)

Notices. Any notices, consents or other communications required or permitted to be given under the terms of this Agreement must

be in writing and will be deemed to have been delivered: (i) upon receipt when delivered personally; (ii) upon receipt when sent by facsimile

or email (provided confirmation of transmission is mechanically or electronically generated and kept on file by the sending party); or

(iii) one Business Day after deposit with a nationally recognized overnight delivery service, in each case properly addressed to the

party to receive the same. The addresses for such communications shall be:

If

to the Company:

| |

SunHydrogen,

Inc. |

| |

10 E. Yanonali, Suite 36 |

| |

Santa Barbara, CA 93101 |

| |

Telephone: |

805-966-6566 |

| |

E-mail: |

tyoung@sunhydrogen.com |

| |

Attention: |

Timothy

Young |

With

a copy to (which shall not constitute notice or service of process):

| |

Sichenzia

Ross Ference Carmel LLP |

| |

1185

Avenue of the Americas, 37th Floor |

| |

New York, New York 10036 |

| |

Telephone: |

(212)

930-9700 |

| |

E-mail: |

gsichenzia@srfc.law |

| |

Attention: |

Gregory

Sichenzia |

If

to the Investor:

GHS

Investments, LLC

420

Jericho Turnpike, Suite 102,

Jericho,

NY 11753

| |

Telephone: |

(718) 530- 0182 |

| |

E-mail: |

Sarfraz@ghscap.com |

| |

Attention: |

Sarfraz Hajee |

or

at such other address, email address and/or facsimile number and/or to the attention of such other Person as the recipient party has

specified by written notice given to each other party one (1) Business Day prior to the effectiveness of such change. Written confirmation

of receipt (A) given by the recipient of such notice, consent or other communication, (B) mechanically or electronically generated by

the sender’s facsimile machine or email account containing the time, date, and recipient facsimile number or email address, as

applicable, or (C) provided by a nationally recognized overnight delivery service, shall be rebuttable evidence of personal service,

receipt by facsimile or email or receipt from a nationally recognized overnight delivery service in accordance with clause (i), (ii)

or (iii) above, respectively.

(g)

Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors

and assigns. The Company shall not assign this Agreement or any rights or obligations hereunder without the prior written consent of

the Investor, including by merger or consolidation. The Investor may not assign its rights or obligations under this Agreement.

(h)

No Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted

successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

(j)

Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things, and

shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request

in order to consummate and make effective, as soon as reasonably possible, the Commencement, and to carry out the intent and accomplish

the purposes of this Agreement and the consummation of the transactions contemplated hereby.

(k)

No Strict Construction. The language used in this Agreement will be deemed to be the language chosen by the parties to express

their mutual intent, and no rules of strict construction will be applied against any party.

(l)

Enforcement Costs. In the event of a dispute arising out of or relating to this Agreement, if a court of competent jurisdiction

determines in a final, non-appealable order that a party has breached this Agreement, then, in addition to any other available remedies,

the non-breaching party shall be entitled to, and the breaching party shall be liable for, the reasonable legal fees and expenses incurred

by the non-breaching party in connection with the dispute, including any appeals in connection therewith.

(m)

Amendment and Waiver; Failure or Indulgence Not Waiver. No provision of this Agreement (i) may be amended other than by a written

instrument signed by both parties hereto and (ii) may be waived other than in a written instrument signed by the party against whom enforcement

of such waiver is sought. No failure or delay in the exercise of any power, right or privilege hereunder shall operate as a waiver thereof,

nor shall any single or partial exercise of any such power, right or privilege preclude other or further exercise thereof or of any other

right, power or privilege.

IN

WITNESS WHEREOF, the Investor and the Company have caused this Purchase Agreement to be duly executed as of the date first written

above.

| |

THE

COMPANY: |

| |

|

|

| |

SUNHYDROGEN,

INC. |

| |

|

|

| |

By: |

/s/

Timothy Young |

| |

Name: |

Timothy

Young |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

INVESTOR: |

| |

|

| |

GHS

INVESTMENTS, LLC |

| |

|

|

| |

By: |

/s/ Mark Grober |

| |

Name: |

Mark

Grober |

| |

Title: |

|

EXHIBIT

A

FORM

OF PURCHASE NOTICE

________,

24_

To:

GHS Investments, LLC

In

accordance with Section 2 of the purchase agreement, dated April __, 2024 (the “Purchase Agreement”), between SunHydrogen,

Inc. (the “Company”) and GHS Investments, LLC (the “Investor”), the Company hereby provides notice to the Investor

of a sale by the Company to the Investor of Purchase Shares in the amount set forth in this Purchase Notice. Capitalized terms used herein

have the meanings set forth in the Purchase Agreement.

Purchase

Amount: $___________

Purchase

Price per share: $____________

Number

of Purchase Shares: __________

Very

truly yours,

SunHydrogen,

Inc.

13

Exhibit 10.2

MEMBER FINRA/SIPC

895 Dove Street

Suite 300

Newport Beach, CA 92660

949-851-4700

www.iconcapg.com

June 3, 2024

SunHydrogen, Inc.

BioVentures Center

2500 Crosspark Road

Coralville IA, 52241

Attention: Timothy Young

Dear Mr. Young:

This letter (the

“Agreement”) constitutes the agreement between Icon Capital Group, LLC a Texas limited liability company

(“ICG” or the “Placement Agent”) and SunHydrogen, Inc., a Nevada corporation (the

“Company”), who hereby agrees to sell up to an aggregate of fifty million dollars ($50,000,000.00) of securities

of the Company, including, (the “Shares”) of the Company’s common stock, $0.001 par value per share (the

“Common Stock” or the “Securities”) directly to an investor (the “Investor”)

through the Placement Agent, on a “reasonable best efforts” basis, in connection with the proposed placement (the

“Placement”) of the Securities. The terms of the Placement and the Securities shall be mutually agreed upon by

the Company and the purchaser (the “Purchaser”) and nothing herein constitutes that the Placement Agent would

have the power or authority to bind the Company or any Purchaser or an obligation for the Company to issue any Securities or

complete the Placement. This Agreement and the documents executed and delivered by the Company and the Purchaser in connection with

the Placement, including but not limited to the Purchase Agreement (as defined below), shall be collectively referred to herein as

the “Transaction Documents.” The date of the closing of the Placement shall be referred to herein as the

“Closing Date.” The Company expressly acknowledges and agrees that the Placement Agent’s obligations

hereunder are on a reasonable best-efforts basis only and that the execution of this Agreement does not constitute a commitment by

the Placement Agent to purchase the Securities and does not ensure the successful placement of the Securities or any portion thereof

or the success of the Placement Agent with respect to securing any other financing on behalf of the Company. Following the prior

written consent of the Company, the Placement Agent may retain other brokers or dealers to act as sub-agents or selected-dealers on

its behalf in connection with the Placement. The sale of the Securities to any Purchaser will be evidenced by a purchase agreement

(the “Purchase Agreement”) between the Company and such Purchaser in a form mutually agreed upon by the Company

and the Purchaser. Capitalized terms that are not otherwise defined herein have the meanings given to such terms in the Purchase

Agreement.

SECTION 1. REPRESENTATIONS AND WARRANTIES

OF THE COMPANY; COVENANTS OF THE COMPANY.

A. Representations

of the Company. Each of the representations and warranties (together with any related disclosure schedules thereto) and covenants

made by the Company to the Purchaser in the Purchase Agreement in connection with the Placement is hereby incorporated herein by reference

into this Agreement (as though fully restated herein) and is, as of the date of this Agreement and as of the Closing Date, hereby made

to, and in favor of, the Placement Agent. In addition to the foregoing, the Company represents and warrants that:

1. The

Company has prepared and filed with the Commission a registration statement on Form S-3 (Registration No. 333-276678), and amendments

thereto, and related preliminary prospectuses, for the registration under the Securities Act of 1933, as amended (the “Securities

Act”), of the applicable Securities, which registration statement, as so amended (including post-effective amendments, if any)

became effective on February 1, 2024. At the time of such filing, the Company met the requirements of Form S-3 under the Securities Act.

Such registration statement meets the requirements set forth in Rule 415(a)(1)(x) under the Securities Act and complies with said Rule.

The Company will file with the Commission pursuant to Rule 424(b) under the Securities Act, and the rules and regulations (the “Rules

and Regulations”) of the Commission promulgated thereunder, a supplement to the form of prospectus included in such registration

statement relating to the placement of the Shares and the plan of distribution thereof and has advised the Placement Agent of all further

information (financial and other) with respect to the Company required to be set forth therein. Such registration statement, including

the exhibits thereto, as amended at the date of this Agreement, is hereinafter called the “Registration Statement”;

such prospectus in the form in which it appears in the Registration Statement is hereinafter called the “Base Prospectus”;

and the supplemented form of prospectus, in the form in which it will be filed with the Commission pursuant to Rule 424(b) (including

the Base Prospectus as so supplemented) is hereinafter called the “Prospectus Supplement.” Any reference in this Agreement

to the Registration Statement, the Base Prospectus or the Prospectus Supplement shall be deemed to refer to and include the documents

incorporated by reference therein (the “Incorporated Documents”) pursuant to Item 12 of Form S-3 which were filed under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on or before the date of this Agreement, or the

issue date of the Base Prospectus or the Prospectus Supplement, as the case may be; and any reference in this Agreement to the terms “amend,”

“amendment” or “supplement” with respect to the Registration Statement, the Base Prospectus or the Prospectus

Supplement shall be deemed to refer to and include the filing of any document under the Exchange Act after the date of this Agreement,

or the issue date of the Base Prospectus or the Prospectus Supplement, as the case may be, deemed to be incorporated therein by reference.

All references in this Agreement to financial statements and schedules and other information which is “contained,” “included,”

“described,” “referenced,” “set forth” or “stated” in the Registration Statement, the

Base Prospectus or the Prospectus Supplement (and all other references of like import) shall be deemed to mean and include all such financial

statements and schedules and other information which is or is deemed to be incorporated by reference in the Registration Statement, the

Base Prospectus or the Prospectus Supplement, as the case may be. No stop order suspending the effectiveness of the Registration Statement

or the use of the Base Prospectus or the Prospectus Supplement has been issued, and no proceeding for any such purpose is pending or has

been initiated or, to the Company’s knowledge, is threatened by the Commission.

2. The

Registration Statement (and any further documents to be filed with the Commission) contains all exhibits and schedules as required

by the Securities Act. Each of the Registration Statement and any post-effective amendment thereto, at the time it became effective,

complied in all material respects with the Securities Act and the Exchange Act and the applicable Rules and Regulations and did not

and, as amended or supplemented, if applicable, will not, contain any untrue statement of a material fact or omit to state a

material fact required to be stated therein or necessary to make the statements therein not misleading. The Base Prospectus and the

Prospectus Supplement, each as of its respective date, comply in all material respects with the Securities Act and the Exchange Act

and the applicable Rules and Regulations. Each of the Base Prospectus and the Prospectus Supplement, as amended or supplemented, did

not and will not contain as of the date thereof any untrue statement of a material fact or omit to state a material fact necessary

in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. The

Incorporated Documents, when they were filed with the Commission, conformed in all material respects to the requirements of the

Exchange Act and the applicable Rules and Regulations, and none of such documents, when they were filed with the Commission,

contained any untrue statement of a material fact or omitted to state a material fact necessary to make the statements therein (with

respect to Incorporated Documents incorporated by reference in the Base Prospectus or Prospectus Supplement), in the light of the

circumstances under which they were made not misleading; and any further documents so filed and incorporated by reference in the

Base Prospectus or Prospectus Supplement, when such documents are filed with the Commission, will conform in all material respects

to the requirements of the Exchange Act and the applicable Rules and Regulations, as applicable, and will not contain any untrue

statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the

circumstances under which they were made, not misleading. No post- effective amendment to the Registration Statement reflecting any

facts or events arising after the date thereof which represent, individually or in the aggregate, a fundamental change in the

information set forth therein is required to be filed with the Commission. Except for this Agreement, there are no documents

required to be filed with the Commission in connection with the transaction contemplated hereby that (x) have not been filed as

required pursuant to the Securities Act or (y) will not be filed within the requisite time period. Except for this Agreement, there

are no contracts or other documents required to be described in the Base Prospectus or Prospectus Supplement, or to be filed as

exhibits or schedules to the Registration Statement, which (x) have not been described or filed as required or (y) will not be filed

within the requisite time period.

3. Reserved.

4. There

are no affiliations with any FINRA member firm among the Company’s officers, directors or, to the knowledge of the Company, any ten percent

(10.0%) or greater stockholder of the Company, except as set forth in the Registration Statement and SEC Reports.

5. The Company has

the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and

otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of each of this Agreement by the Company

and the consummation by it of the transactions contemplated hereby and thereby and under the Base Prospectus have been duly

authorized by all necessary action on the part of the Company and no further action is required by the Company, the Company’s

Board of Directors (the “Board of Directors”) or the Company’s stockholders in connection therewith. This

Agreement has been duly executed by the Company and, when delivered in accordance with the terms hereof, will constitute the valid

and binding obligation of the Company enforceable against the Company in accordance with its terms, except (i) as limited by general

equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application

affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific

performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be

limited by applicable law.

6. The

execution, delivery and performance by the Company of this Agreement and the transactions contemplated pursuant to the Time of Sale Disclosure

Prospectus, the issuance and sale of the Shares and the consummation by it of the transactions contemplated hereby and thereby to which

it is a party do not and will not (i) conflict with or violate any provision of the Company’s or any subsidiary’s certificate

or articles of incorporation, bylaws or other organizational or charter documents, or (ii) conflict with, or constitute a default (or

an event that with notice or lapse of time or both would become a default) under, result in the creation of any lien upon any of the properties

or assets of the Company or any subsidiary, or give to others any rights of termination, amendment, acceleration or cancellation (with

or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument (evidencing a Company or subsidiary

debt or otherwise) or other understanding to which the Company or any subsidiary is a party or by which any property or asset of the Company

or any subsidiary is bound or affected, or (iii) conflict with or result in a violation of any law, rule, regulation, order, judgment,

injunction, decree or other restriction of any court or governmental authority to which the Company or a subsidiary is subject (including

federal and state securities laws and regulations), or by which any property or asset of the Company or a subsidiary is bound or affected;

except in the case of each of clauses (ii) and (iii), such as could not have or reasonably be expected to result in a material adverse

effect.

7. Any

certificate signed by an officer of the Company and delivered to the Placement Agent or to counsel for the Placement Agent shall be deemed

to be a representation and warranty by the Company to the Placement Agent as to the matters set forth therein.

8. The

Company acknowledges that the Placement Agent will rely upon the accuracy and truthfulness of the foregoing representations and warranties

and hereby consents to such reliance.

9. No

forward-looking statements (within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act) contained in

the Base Prospectus and the Prospectus Supplement has been made or reaffirmed without a reasonable basis or has been disclosed other than

in good faith.

10. Each

of the representations and warranties (together with any related disclosure schedules thereto) made to the Investors in the Purchase Agreements

is hereby incorporated herein by reference (as though fully restated herein) and is hereby made to, and in favor of, the Placement Agent.

B. Covenants

and Agreements of the Company. The Company further covenants and agrees with the Placement Agent as follows:

1. Registration

Statement Matters. The Company will advise the Placement Agent promptly after it receives notice thereof of the time when any

amendment to the Registration Statement has been filed or becomes effective or any supplement to the Base Prospectus or the Final

Prospectus has been filed and will furnish the Placement Agent with copies thereof. The Company will file promptly all reports and

any definitive proxy or information statements required to be filed by the Company with the Commission pursuant to Section 13(a), 14

or 15(d) of the Exchange Act subsequent to the date of any Prospectus and for so long as the delivery of a prospectus is required in

connection with the Offering. The Company will advise the Placement Agent, promptly after it receives notice thereof (i) of any

request by the Commission to amend the Registration Statement or to amend or supplement any Prospectus or for additional

information, and (ii) of the issuance by the Commission of any stop order suspending the effectiveness of the Registration Statement

or any post-effective amendment thereto or any order directed at any Incorporated Document, if any, or any amendment or supplement

thereto or any order preventing or suspending the use of the Base Prospectus or the Final Prospectus or any prospectus supplement or

any amendment or supplement thereto or any post-effective amendment to the Registration Statement, of the suspension of the

qualification of the Shares for offering or sale in any jurisdiction, of the institution or threatened institution of any proceeding

for any such purpose, or of any request by the Commission for the amending or supplementing of the Registration Statement or a

Prospectus or for additional information. The Company shall use its reasonable best efforts to prevent the issuance of any such stop

order or prevention or suspension of such use. If the Commission shall enter any such stop order or order or notice of prevention or

suspension at any time, the Company will use its reasonable best efforts to obtain the lifting of such order at the earliest

possible moment, or will file a new registration statement and use its reasonable best efforts to have such new registration

statement declared effective as soon as practicable. Additionally, the Company agrees that it shall comply with the provisions of

Rules 424(b), 430A, 430B and 430C, as applicable, under the Securities Act, including with respect to the timely filing of documents

thereunder, and will use its reasonable efforts to confirm that any filings made by the Company under such Rule 424(b) are received

in a timely manner by the Commission.

2. Blue

Sky Compliance. The Company will cooperate with the Placement Agent and the Investors in endeavoring to qualify the Shares for sale

under the securities laws of such jurisdictions (United States and foreign) as the Placement Agent and the Investor may reasonably request

and will make such applications, file such documents, and furnish such information as may be reasonably required for that purpose, provided

the Company shall not be required to qualify as a foreign corporation or to file a general consent to service of process in any jurisdiction

where it is not now so qualified or required to file such a consent, and provided further that the Company shall not be required to produce

any new disclosure document. The Company will, from time to time, prepare and file such statements, reports and other documents as are

or may be required to continue such qualifications in effect for so long a period as the Placement Agent may reasonably request for distribution

of the Shares. The Company will advise the Placement Agent promptly of the suspension of the qualification or registration of (or any

such exemption relating to) the Shares for offering, sale or trading in any jurisdiction or any initiation or threat of any proceeding

for any such purpose, and in the event of the issuance of any order suspending such qualification, registration or exemption, the Company