Stock Picking Fund Managers see Bargains as Markets Digest 'Living With Covid' -- Financial News

20 July 2021 - 9:13PM

Dow Jones News

By David Ricketts

Of Financial News

The spread of the Delta variant of Covid-19 sparked stock market

tumbles on Monday, while the pound posted a five-month low against

the dollar. But fund managers are convinced that the U.K.'s FTSE

100 index, as well as several smaller companies, pose longer-term

investment opportunities.

"If the market decides to put a negative spin onto the rising

case numbers, that could create buying opportunities," said Steve

Clayton, head of equity funds at Hargreaves Lansdown.

"I suspect what hasn't happened yet is the emergence of a

general understanding that any reopening will have significant

human costs as rapidly transmissible variants find their way to the

vulnerable. That is ultimately what 'living with Covid' means."

Mr. Clayton said that if there were a significant pull-back by

the market in response to rising infections, smaller hospitality

names like Fuller Smith & Turner PLC and Young & Co's

Brewery PLC could be in play, due to their high quality freehold

estates in prime London and Southern locations.

"In the long run, we see those prime pub assets as only going up

in value, even if the short term is highly unpredictable," he

said.

The FTSE 100 slumped 2.3% Monday, leasing a broader market

selloff in the U.S., where benchmarks had their worst day since

May. Companies that contributed to the U.K. stock market downtrend

were those in the travel and leisure industries, including British

Airways owner International Consolidated Airlines Group S.A., which

plummeted 5%.

Cineworld Group PLC and cruise operator Carnival PLC also posted

falls, dropping 10% and 8% respectively.

U.S. stocks also suffered a drop, with the S&P 500 falling

by more than 2% on Monday.

"Investors often flock to companies with positive free cash

flows and net cash on the balance sheet," when markets wobble, said

Stephen Yiu, lead manager of the 850 million pound ($1.16 billion)

Blue Whale Growth Fund which has a large allocation to U.S.

stocks.

He said his firm's portfolio, which has allocations to Alphabet

Inc, Mastercard Inc and Visa Inc, is "positioned on the right side

of structural drivers like digital transformation and digital

payments."

Mr. Yiu added: "These companies have both greater resilience and

growth prospects than the rest of the market so if they experience

a similar sell-off then that presents an opportunity."

Russ Mould, investment director at online investment platform AJ

Bell, said U.K. share price falls were a sign that investors think

the "reopening trade is now a dud."

"Many of the stocks leading the U.K. stock market downwards are

related to travel and leisure, suggesting that investors are

extremely worried that we've lifted restrictions too soon and that

another lockdown could be a month or two round the corner," said

Mr. Mould.

Neil Ferguson, a government adviser and professor at Imperial

College London, told the BBC on Sunday that lifting Covid

restrictions in England would "almost certainly" lead to the U.K.

recording in the region of 100,000 new Covid cases a day, with the

potential for that figure to double.

However, Nick Burchett, director of investments at Stonehage

Fleming and co-manager of the TM Stonehage Fleming Opportunities

Fund, said: "Markets and companies might get a few problems or

setbacks along the way, but these could throw up opportunities for

stock pickers like us."

Alex Wright, manager of the GBP3 billion Fidelity Special

Situations fund, said the outlook for U.K. equities "looks

bright."

U.K. companies are trading above pre-pandemic levels, but they

remain cheaper compared to other regions, he said.

Mr. Wright is particularly bullish on value stocks--those

companies investors believe are undervalued relative to their

earnings and growth potential--and has added bank stocks to his

portfolio in recent months.

"The continued very strong credit performance also makes the

banks' balance sheets look extremely overcapitalized, with NatWest

Group PLC being the first to be able to start returning this

capital," he said.

"The bank has already recently used some of the excess capital

to buy back shares from the U.K. government. An improving

competitive landscape in Ireland has also led us to add to our

banking exposure there."

Elsewhere, Mr. Wright said his funds had added to travel and

leisure-related names, but he remains "relatively cautious" on the

sectors.

Website: www.fnlondon.com

(END) Dow Jones Newswires

July 20, 2021 06:58 ET (10:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

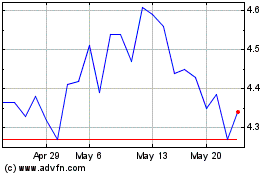

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

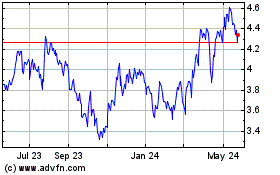

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Dec 2023 to Dec 2024