Mainland Chinese Investors Pivot to Safer Hong Kong Stocks

31 August 2016 - 5:07PM

Dow Jones News

By Anjie Zheng

HONG KONG--Chinese investors are plowing money into well-known

Hong Kong-listed stocks as they join the global hunt for yield and

safe assets, a trend that points to a change in investing tastes on

the mainland.

The surge of mainland money has helped boost the share prices of

the major Chinese banks listed in Hong Kong, such as Industrial and

Commercial Bank of China Ltd., the world's biggest bank by assets

and China Construction Bank Corp., both of which are among the top

gainers in the benchmark Hang Seng Index this year. Chinese

investors have also piled into blue-chip companies such as global

bank HSBC Holdings PLC and tech giant Tencent Holdings Ltd. this

year, the two biggest components of the index.

Mainland Chinese investors, who can access the Hong Kong market

via a trading link with the Shanghai exchange, have in the past

preferred investing in smaller companies that had high growth

potential but carried plenty of risk. A favorite name before its

trading halt last year was highflying Hanergy Thin Film Group Ltd.,

whose share price surged urged 6.6 times in one year before

plunging 47% in May 2015.

This year, amid relatively subdued markets--the Hang Seng is up

5% in 2016--Chinese investors have swung toward companies that may

have less exciting prospects but at least pay a decent dividend.

ICBC, for example, yields around 5.6%, while HSBC yields 7.7%. That

compares with an average dividend yield for Hang Seng Index stocks

of 3.5% and 2.1% for Shanghai Composite shares.

"Chinese investors last year bought small-caps because they were

chasing capital gains since the market was rallying strongly," said

Edmond Law, an analyst at UOB Kay Hian Research. "This year,

because the market isn't performing as strongly, they are chasing

yield."

Bi-weekly data on the most popular stocks for Chinese funds

buying Hong Kong shares via Shanghai bear out the trend. ICBC's

Hong Kong shares, for example, have been among the 10 most-traded

stocks during 12 two-week periods out of 15 this year, helping push

its share price up 10.6% this year. Over the same period last year,

it was a top-traded stock just once.

One attraction for mainland investors is that shares of

dual-listed Chinese companies, particularly banks, are often

cheaper in Hong Kong, where they are known as H-shares, than in

Shanghai, where they are called A-shares. ICBC trades at a 5.1%

discount in Hong Kong, for example, while other banks such as China

Construction Bank Corp. and Agricultural Bank of China Ltd. trade

at 4.9% and 16.8% discounts, respectively.

The difference makes it cheaper for investors to receive the

same dividend payout in Hong Kong--an increasingly important

consideration for mainland investors, according to Qi Wang , chief

executive at MegaTrust Investments, a mainland-based fund

manager.

The shift into high-dividend stocks is "not a temporary market

change like picking different sectors every month," Mr. Qi said.

"It's a long-term secular change."

"Very few A-shares pay dividends. So investors are desperately

seeking higher yield. This is something we're seeing in both A- and

H-share markets," he said.

There is little clear data on what type of mainland investors

are leading the charge into major Hong Kong-listed stocks. However,

the trend appears to be driven in part by large institutional

investors such as insurance and pension funds since Chinese retail

investors are still less focused on high-yield stocks, according to

Jian Shi Cortesi, China fund manager at GAM Holding AG, which

manages $115.49 billion globally.

Chinese investors' hunt for yield has helped so-called

southbound investment flows from Shanghai to Hong Kong via the

Stock Connect system to outweigh those going in the other direction

this year. Analysts expect that more money could start to flow from

the mainland into Hong Kong later this year, when a new trading

link with the Shenzhen Stock Exchange is opened.

For sure, Chinese investors have other reasons to invest in Hong

Kong. Often it is the only place they can buy shares in major

Chinese brands that don't have a listing at home, such as Tencent,

electric-vehicle maker Geely Automobile Holdings Ltd., telecom

giant China Mobile Ltd. and casino operator Sands China Ltd.

Some Chinese investors have also looked to invest in Hong Kong

to act as a defense against currency depreciation. The Chinese yuan

has dropped 7% in the past year against the U.S. dollar. The Hong

Kong dollar is pegged to the greenback, so putting money into

relatively safer Hong Kong-listed stocks has become a way for

Chinese investors to benefit.

"High-yielding bank stocks are being used as a proxy against the

weakening yuan," said Wendy Liu, equity strategist at Nomura

Holdings Inc.

(END) Dow Jones Newswires

August 31, 2016 02:52 ET (06:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

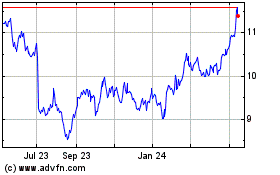

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Nov 2024 to Dec 2024

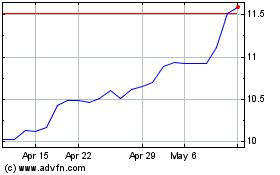

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Dec 2023 to Dec 2024