By Costas Paris and Joanne Chiu

China poured $20 billion into ship financing this year,

reflecting the country's ambition to become the world's dominant

maritime player as European banks have scaled back their

investments.

That is 33% more than Chinese banks invested in 2016, according

to the leasing arm of Industrial & Commercial Bank of China

Ltd. It dwarfs China's financing as recently as 2008, when its

lessors lent just a few million to shipowners that built their

vessels in the country's shipyards.

ICBC's numbers only include leasing deals, China's preferred

financing method. Bilateral loans, ship mortgages and private

placements aren't reported, but research firm Marine Money

estimates that Chinese financiers such as ICBC, China Minsheng

Banking Corp., Bank of Communications Co. and China Merchants Bank

Co. account for as much as one-quarter of a ship-financing sector

it values at $200 billion a year.

European banks like Norway's DNB ASA, Sweden's Nordea and

France's BNP Paribas still hold some of the world's biggest

shipping portfolios, but China's growth has drawn notice.

"It's an unprecedented shift in ship financing," said Basil

Karatzas, a New York-based maritime adviser who has arranged many

such deals. "We've come from export credits, to a few Western

owners, to China becoming a mainstream financier in both new and

used vessels."

Three of China's biggest leasing firms, ICBC Financial Leasing

Co., Minsheng Financial Leasing Co. and Bank of Communications

Financial Leasing Co., own more than 800 vessels, valued at $23.6

billion. ICBC's shipping portfolio has grown to $10 billion this

year from around $600 million in 2009, while Minsheng Financial

Leasing has doubled its shipping assets in the past three years to

$6 billion, or more than 300 ships, Chief Executive Jerry Yang

said.

In contrast, European financiers that were once heavyweights in

the industry, including Royal Bank of Scotland Group PLC and Lloyds

Banking Group PLC, have withdrawn from shipping. Others, like

Germany's HSH Nordbank AG and Nord/LB Group, are looking to divest

themselves of part or all of their shipping portfolios. HSH has cut

its portfolio to EUR12 billion in September from around EUR17

billion at the end of last year, while Nord/LB has shrunk its

holdings to EUR13.3 billion from EUR16.8 billion over the same

period.

"The traditional financiers have either eliminated or

drastically reduced their exposure," said Soren Skou, chief

executive of A.P. Moeller-Maersk A/S. "It's more or less impossible

to raise significant amounts of finance from European banks, so

others like the Chinese have stepped in a big way."

European firms are pulling back because of shipping's long down

cycle, in which overcapacity kept freight rates low and made

investments risky. Chinese banks are rushing in, but they too may

reconsider if the economics don't improve, said Marine Money

President Matthew McCleery.

"As the portfolios of Chinese leasing companies grow, so too

will the likelihood that they will have some defaults, which are

inevitable in a cyclical industry like shipping," he said. "How

Chinese leasing companies will manage these defaults, especially

when bankruptcy is involved, has yet to be seen."

ICBC Financial Leasing's executive director, Bill Guo, said the

bank is working with established operators such as Denmark's Maersk

Line, Swiss-based Mediterranean Shipping Co. and France's CMA-CGM

SA, which "makes default risk lower."

People in the industry expect China to play an increasing role

in ship financing in the coming years. Its banks are flush with

cash, they expect a strong industry recovery and if things go

wrong, they can deploy their ships to state-owned operators or

scrap them in exchange for government subsidies.

"China controls up to 40% of the global shipbuilding capacity,

and that's a natural metric of where they want to be in the

financing business," said Arlie Sterling, president of Boston-based

shipping consultancy Marsoft Inc., which works with Chinese

financiers.

China's ship leasing typically entails lending enough to pay for

up to 85% of a vessel, then charging a 5.5% average annual interest

rate. Traditional bank loans usually consist of lower upfront loans

and interest rates. The country's banks are quicker than their

European counterparts to recover ships if payments are missed.

"The Chinese own the vessel, so the cargo is unloaded at the

first port of call and the ship is seized," said George Lazaridis,

of Athens-based Allied Shipbroking. "It keeps operators on their

toes, because if they can't deliver the cargo, their reputation

gets a big blow."

Scorpio Tankers Inc., one of the world's biggest operators of

petroleum tankers, leased five vessels from Bank of Communications

in September. Company President Robert Bugbee said the Chinese

banks are lending "at great rates."

In shipping, where personal relationships between bankers and

owners remain an important part of doing business, industry

watchers say some shipping companies could relocate to Asia to

build those ties with Chinese lenders.

"You no longer have your banker a short distance away so that

you can meet up for coffee and talk business," Martin Kroger,

managing director of the German Shipowners' Association said at a

shipping conference in Hamburg in November. "That's a total

mind-set change."

Write to Costas Paris at costas.paris@wsj.com and Joanne Chiu at

joanne.chiu@wsj.com

(END) Dow Jones Newswires

December 23, 2017 08:14 ET (13:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

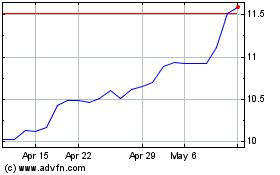

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Feb 2025 to Mar 2025

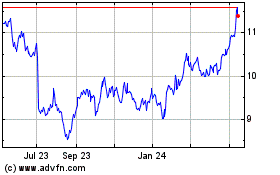

Industrial and Commercia... (PK) (USOTC:IDCBY)

Historical Stock Chart

From Mar 2024 to Mar 2025