Infineon 1Q Revenue Increased Amid Strong Automotive, Industrial Demand -- Update

02 February 2023 - 6:49PM

Dow Jones News

By Mauro Orru

Infineon Technologies AG on Thursday posted higher revenue and

profit for its fiscal first quarter as strong chips sales in the

automotive and industrial segments offset weaker demand for

smartphones, computers and data centers.

The German chip maker said revenue for the three months ended

Dec. 31 climbed to 3.95 billion euros ($4.34 billion) from EUR3.16

billion the prior-year quarter. Infineon's automotive segment

contributed EUR1.87 billion to the total.

"The energy transition and expansion of electromobility are

causing a continuously high need for our solutions in industrial

and automotive applications. In contrast, we are seeing

significantly weaker demand in areas such as smartphones, PCs and

data centers," Chief Executive Jochen Hanebeck said.

Last week, Intel Corp. reported a fourth-quarter loss and a

decrease in sales, reflecting, in part, the sharp downturn the

personal-computer market has been experiencing over recent months.

Infineon also saw lower demand for chips in laptops, TVs and games

consoles.

Net profit jumped to EUR728 million from EUR457 million.

Infineon's segment result, a key profitability metric, surged to

EUR1.11 billion from EUR717 million, generating a margin of

28%.

Analysts polled by FactSet had forecast revenue of EUR4 billion,

a net profit of EUR675 million and a segment result of EUR1

billion.

Infineon had guided for revenue of around EUR4 billion and a

segment result margin of about 25%.

For the fiscal second quarter, Infineon is targeting revenue of

around EUR3.9 billion and a segment result margin of around

25%.

"We are continuing to navigate carefully in these challenging

times and remain flexible in our approach to market dynamics. All

in all, we are increasing our guidance slightly for the fiscal

year, adjusting for currency effects," Mr. Hanebeck said.

For the fiscal year, Infineon continues to expect revenue of

around EUR15.5 billion, plus or minus EUR500 million, but raised

its segment result margin forecast to around 25% from about 24%

previously. The company based its guidance on an exchange rate of

$1.05 to the euro, up from $1 previously.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

February 02, 2023 02:34 ET (07:34 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

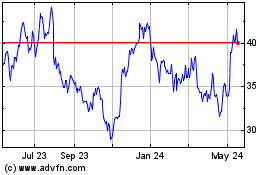

Infineon Technologies (QX) (USOTC:IFNNY)

Historical Stock Chart

From Dec 2024 to Jan 2025

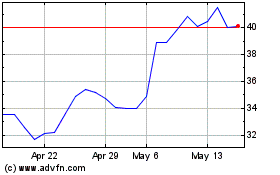

Infineon Technologies (QX) (USOTC:IFNNY)

Historical Stock Chart

From Jan 2024 to Jan 2025