Infineon Warns of Slower Sales Growth on Low Personal Electronics Demand

15 November 2023 - 10:22PM

Dow Jones News

By David Sachs and Mauro Orru

Infineon Technologies said sales would continue to grow in its

new fiscal year, albeit at a slower pace than in fiscal 2023, as

the company grapples with weakening demand for chips in personal

electronics such as computers and smartphones.

The German chip maker is aiming for around 17 billion euros

($18.50 billion) in revenue for the year ending September 2024, up

from EUR16.31 billion that Infineon reported for fiscal 2023. Its

segment result margin--a key profitability metric--is expected at

roughly 24%, below 27% reported for fiscal 2023.

Citi and UBS analysts wrote in research notes that Infineon's

guidance is in line with expectations, as the company continues to

see good demand for semiconductors from the automotive industry and

its push for electric vehicles.

"Structural semiconductor growth in the areas of renewable

energy, electromobility - especially in China - and

microcontrollers for the automotive industry remains unabated,"

said Chief Executive Jochen Hanebeck. "In contrast, consumer,

communication, computing and IoT applications are experiencing a

temporary period of low demand."

Infineon on Wednesday posted revenue of EUR4.15 billion for the

three months to the end of September, compared with EUR4.14 billion

in last year's fiscal fourth quarter. Its Automotive division

contributed EUR2.16 billion to sales, up 12% on year. However,

revenue at its Power & Sensor Systems contracted 22% to EUR912

million.

"Automotive remains the standout division and, so far,

continuing to demonstrate that automotive power semis remain

resilient," Citi analysts said. Last month, peer chip maker

STMicroelectronics also posted higher revenue led by growth at its

automotive division despite weaker sales at its personal

electronics business.

Infineon's net profit climbed to EUR753 million from EUR735

million, while its segment result slipped to EUR1.04 billion from

EUR1.06 billion, generating a 25.2% margin.

Analysts had forecast revenue of EUR4.04 billion on a net profit

of EUR674.8 million and a segment result of EUR1.01 billion,

according to FactSet. Infineon had expected quarterly revenue of

around EUR4 billion and a segment result margin of around 25%.

The group hit its annual targets for revenue and segment result

margin in fiscal 2023 and proposed a dividend of EUR0.35 per share,

up from EUR0.32 in fiscal 2022. Infineon shares climbed more than

6.5% in mid-morning trading.

Write to David Sachs at david.sachs@wsj.com and Mauro Orru at

mauro.orru@wsj.com

(END) Dow Jones Newswires

November 15, 2023 06:07 ET (11:07 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

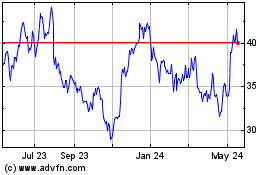

Infineon Technologies (QX) (USOTC:IFNNY)

Historical Stock Chart

From Oct 2024 to Nov 2024

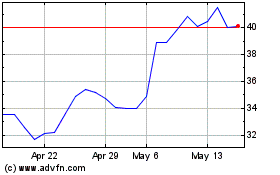

Infineon Technologies (QX) (USOTC:IFNNY)

Historical Stock Chart

From Nov 2023 to Nov 2024