false

0001527702

0001527702

2024-05-10

2024-05-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): May 10,

2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 1 - REGISTRANT'S BUSINESS AND OPERATIONS

ITEM 1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On May 10, 2024, we entered into a Purchase Company Agreement (“Purchase

Agreement”) with Omar Luna and Lynk Holding LLC (together, the “Seller”) concerning the sale by Seller and the purchase

by us of 51% of the membership interests the Seller holds in Lynk Telecom, LLC, a Virginia limited liability company (the “Company”).

The closing of the Purchase Agreement is expected to occur no later than July 1, 2024, once due diligence has been completed.

The Company provides certified business telephony,

SMS, connectivity, and networking services across various sectors in the United States. Lynk Holding LLC recently acquired selected assets

from a company known as Voyce Telecom, and Lynk Holding LLC has the obligation to pay the shareholders of Voyce Telecom the purchase price

in that acquisition, which is outstanding.

The Purchase Price for 51% of the membership interests

of the Company is US $1,500,000, and this amount will be paid by the Seller to the Buyer in 12 consecutive monthly cash payments of US$

125,000 each. The Seller agrees to use these funds for the amortization of the payments that it owes to Voyce in relation to the goodwill

acquisition contract between Lynk Holding and Voyce Telecom.

Once we have paid the $1,500,000 for the acquisition

of the Company, and the Company has achieved the business goals outlined in the Purchase Agreement, under what we refer to as “Phase

I,” we have agreed to lend up to US$1,500,000 to the Company, in installments of up to US$100,000 per month, to be used solely for

marketing campaigns, promotion and development of the retail services of the Company, according to a business plan that has to be approved

by the Company’s board of directors.

The disbursements of this loan will be subject

to the achievements of the quarterly goals set in the business plan of the Company. This retail business plan will have the aim of achieving

the objective of generating a minimum of US$200,000 in operating income per month, with intermediate staggered quarterly goals.

Upon the completion of Phase I, and the business

goals in the Purchase Agreement have been achieved, we have agreed to lend the Company up to US$1,500,000 in at least three stages, each

of up to US$500,000 per year to help accelerate the amortization of the debt Lynk Holding LLC has with the Voyce Telecom shareholders.

These loans would be linked to compliance with the financial statements for fiscal years 2026, 2027, 2028, 2029 and 2030. The goals for

these years will be defined posteriori by the parties and approved by the Company’s Board of Directors. The payment of this loan

will be guaranteed with the portion of dividends that correspond to Lynk Holding LLC when the Company makes a dividend distribution.

If, as a result of operations, the Company does

not reach the projections in the Purchase Agreement, and the business plan for the years 2026, 2027, 2028, 2029 and 2030 approved by the

Company´s Board of Directors, we may retain the stipulated loan. If the Company surpassed the projections in the Purchase Agreement,

we have agreed to true up the purchase price, with details of the true up contained in the Purchase Agreement.

Once this Purchase Agreement is signed, the manager

of the Company, Omar Luna, is expected to enter into a 3-year employment agreement with the Company, that will be executed before the

closing date, renewable for a 2-year period to guarantee the operational continuity of the Company and the implementation of a business

plan that will lead the Company into a productive company with positive net income as established in the Purchase Agreement.

The Company shall have a Board of Directors composed of 3 members: 2 of

the members shall be appointed by us and the remaining member shall be appointed by the Seller. The position of President and Secretary

will be reserved for us.

The closing of the Purchase Agreement is subject to, among other things,

the Company having prepared all accounting information in accordance with SEC standards in such a manner that any audit of the Company,

if required, may be performed.

The Purchase Agreement contains customary representations and warranties

of the parties, including, among others, with respect to corporate organization, capitalization, corporate authority, financial statements

and compliance with applicable laws. The representations and warranties of each party set forth in the Purchase Agreement were made solely

for the benefit of the other parties to the Purchase Agreement, and investors are not third-party beneficiaries of the Purchase Agreement.

In addition, such representations and warranties (a) are subject to materiality and other qualifications contained in the Purchase Agreement,

which may differ from what may be viewed as material by investors, (b) were made only as of the date of the Purchase Agreement or such

other date as is specified in the Purchase Agreement and (c) may have been included in the Purchase Agreement for the purpose of allocating

risk between the parties rather than establishing matters as facts. Accordingly, the Purchase Agreement is included with this filing only

to provide investors with information regarding the terms of the Purchase Agreement, and not to provide investors with any other factual

information regarding any of the parties or their respective businesses.

The foregoing description of the Purchase Agreement is not complete and

is qualified in its entirety by reference to the text of such document, which is filed as Exhibit 2.1 hereto and which is incorporated

herein by reference.

SECTION 8 – OTHER EVENTS

Item 8.01

Other Events

On May 10, 2024, we issued a press release concerning the Purchase Agreement

with the Company. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 8.01 of this Current Report on Form 8-K (including

Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SECTION 9 – Financial

Statements and Exhibits

Item 9.01 Financial Statements

and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date May 10, 2024

PURCHASE COMPANY

AGREEMENT

This PURCHASE COMPANY AGREEMENT

("Agreement") is made as of the May 10th, 2024, (the "Signing Date") between iQSTEL Inc. a SEC reporting issuer

that is quoted on the OTC Markets (OTCQX: IQST), incorporated under the laws of the State of Nevada, USA, with its principal office at

300 Aragon Avenue, Suite 375, Coral Gables, Florida 33134 ("Buyer"), and Omar Luna, Drivers License Number L500-641-84-201-0,

current CEO of LYNK HOLDING LLC and LYNK TELECOM LLC incorporated under the laws of the State of Virginia, with registered office at 8200

Greensboro Dr, Suite 820, Mclean, VA ("Seller") regarding the sale by Seller and the acquisition by Buyer of 51% of the Membership

Interest (Capital Stock) of LYNK TELECOM LLC ("The Company”).

RECITALS:

Seller LYNK HOLDING LLC is the

registered and beneficial owner of 100% of the Membership Interest (Capital Stock) of LYNK TELECOM LLC (The Company), a Corporation organized

and existing under the laws of Virginia.

LYNK HOLDING acquired from VOYCE

TELECOM (VOYCE) the whole Business of VOYCE including all the clients, vendors, platforms, Accounts Receivables, Accounts Payable, bank

balance, intellectual property (IP), commercial processes among others, software, hardware, platforms, from now on the “Business”.

This purchase agreement is in the Exhibit C.

LYNK HOLDING, the parent company

of LYNK TELECOM acquired the obligation to pay to the VOYCE TELECOM Shareholders for the acquisition of the “Business”, a

debt which details are in Clause 4 below.

LYNK TELECOM (The Company) provides

certified business telephony, SMS, connectivity and networking services across various sectors in the US, with 499 Registration number

836818-

Buyer desires to purchase,

and Seller desires to sell the 51% of the Membership Interest (Capital Stock) of LYNK TELECOM LLC, pursuant to the terms and provisions

of this Agreement.

IN CONSIDERATION of the mutual

covenants, agreements, representations, and warranties contained in this Agreement the parties agree as follows:

Signing Purchase Agreement

(Signing Date): Corresponds to the moment in which the Purchase Agreement is signed, which will implicitly mean all acquisition

terms are already accepted by Seller and Buyer. Even though the ownership of the 51% of the Membership Interest (Capital Stock) of

the Company has not been transferred to Buyer, there is a firm commitment to do so within the terms of this contract. In the same way,

from the Signing Date, it will not be possible to sell, alienate, indebt, distribute dividends of the Company, assets or bank accounts,

without the express authorization of Buyer. Seller is committed to maintaining the Company in full and complete operability for the normal

operations of the business as usual. The parties agree that the Execution Date (Closing Date) will not be later than July 1st, 2024.

Transfer of the 51% of

the Membership Interest to Buyer (Closing Date): Corresponds to the moment in which the 51% of the Membership Interest (Capital Stock)

of the Company is transferred to the Buyer. This closing date must comply with the conditions at the closing date. The Parties agree

that the Closing Date will not be later than July 1st, 2024.

Subject to terms and conditions

of this Agreement and upon the basis of the covenants, representations and warranties of Seller as set forth below, Seller agrees to sell

to Buyer and Buyer agrees to purchase from Seller the 51% of the Membership Interest (Capital Stock) of the Company. The Seller and the

Buyer have agreed that:

The Purchase Price of the

51% of the Membership Interest (Capital Stock) of the Company is ONE MILLION FIVE HUNDRED THOUSAND DOLLARS (US $1,500,000.00) for the

51% of the

Company, and this amount will

be paid by the Seller to the Buyer in 12 consecutive monthly cash payments of One Hundred Twenty Five Thousand Dollars (US$ 125,000.00)

each. The Seller agrees to use these funds for the amortization of the payments that it owes to Voyce in relation to the goodwill acquisition

contract between Lynk Holding and Voyce.

| b) | Investment commitments: |

PHASE 1: Once iIQSTEL had paid

the $1,500,000 for the acquisition of LYNK TELECOM, and The Company had achieved the business goals defined in the Exhibit D, IQSTELiQSTEL

would be willing to lend up (cash in) up to ONE MILLION FIVE HUNDRED THOUSAND DOLLARS (US$

1,500,000.00) to The Company,

in installments of up to One Hundred Thousand Dollars (US$ 100,000.00) per month to be used solely for marketing campaigns, promotion

and development of the retail services of The Company, according to a business plan that has to be approved by the LYNK TELECOM’s

board of directors. The disbursements of this loan will be subjected to the achievements of the quarterly goals set in the business plan

referred above. This retail business plan will have the aim of achieving the objective of generating a minimum of Two Hundred Thousand

Dollars (US$ 200,000.00) in Operating Income per month, with intermediate staggered quarterly goals.

PHASE II: Once Phase I

is completed, and the business goals in the Exhibit D and in the Phase I have been achieved, Buyer is willing to lend up to LYNK

HOLDING up to ONE MILLION FIVE HUNDRED THOUSAND DOLLARS (US$ 1,500,000.00) in at least three stages each of up to Five Hundred Thousand

Dollars (US$ 500,000.00) as maximum per year to help accelerate the amortization of the debt LYNK HOLDING has with VOYCE shareholders.

These loans would be linked to compliance with the financial statements for fiscal years 2026, 2027, 2028, 2029, 2030. The goals for these

years will be defined posteriori by the parties, and approved by the LYNK TELECOM Board of Directors. The payment of this loan will be

guaranteed with the portion of dividends that correspond to LYNK HOLDING when LYNK TELECOM makes a dividend distribution.

If as a result of the operation,

LYNK TELECOM does not reach the projections in the Exhibit D, and the Business plan for the years 2026, 2027, 2028, 2029, 2030

approved by the Company´s Board of Directors, Buyer may retain the stipulated loan in this Agreement.

If under the leadership of the CEO

Omar Luna, LYNK TELECOM surpassed the projections in the

Exhibit D, IQSTEL shall true up the purchase price,

and the details will be in the Exhibit F.

The term "Dollars", as used in

this Agreement, is defined to be lawful United States currency.

| 3. | OBLIGATIONS OF LYNK HOLDING WITH VOYCE SHAREHOLDERS |

LYNK HOLDING acquired from

VOYCE shareholders the revenue generating assets from VOYCE TELECOM, the “Business”, including all revenue generating

clients, vendors, platforms, Accounts Receivables, , bank balance, intellectual property, commercial processes among others,

software, hardware, platforms, For this transaction LYNK HOLDING will pay NINE MILLION DOLLARS (US$ 9,000,000.00) in 72 recurring

monthly installments of One Hundred Twenty Five Thousand Dollars (US$ 125,000.00). During the first 6 months, will have a Ramp Up

where the first 3 months the recurring monthly installments will be of Fifty Thousand Dollars (US$ 50,000.00) and the last 3 months,

the recurring monthly installments will be of Seventy Five Thousand Dollars (US$

75,000.00). The first monthly installment payment to the VOYCE shareholders´ debt starts in May 2024.

This purchase agreement is in the Exhibit C.

Once IQSTEL has completed the

payment of the acquisition price, and all this these funds have been paid to VOYCE Shareholders, LYNK HOLDING will invoice LYNK TELECOM

a monthly fee, for to get the funds to pay to VOYCE Shareholders´ purchase debt, for the same amount of the monthly installment

of the debt in reference. LYNK HOLDING must show to LYNK TELECOM the support of the payment of the monthly installments to the VOYCE shareholders´

on a monthly basis.

| 4. | ASSIGNMENT OF MEMBERSHIP INTEREST. |

Subject to the terms of this

Agreement, Seller will deliver to Buyer at Closing Date an assignment declaration evidencing the transfer of the 51% of the Membership

Interest of the Company, against the first payment of the Purchase Price as detailed in Clause 2 above.

| 5. | REPRESENTATIONS AND WARRANTIES OF SELLER. |

Seller represents and warrant

to Buyer as follows, and acknowledge and confirm that Buyer is relying upon such representations and warranties in connection with the

purchase of the 51% of the Membership Interest of the Company:

(a)

Incorporation and Share Capital. LYNK TELECOM LLC (The Company) is duly incorporated under the laws

of Virginia, is not a public company, is a valid subsisting company in good standing under the laws of Virginia, and has at all times

been domiciled in Virginia, for the purpose of all applicable income tax legislation. All LYNK HOLDING and LYNK TELECOM information such

as registration certificate, By Laws, financial statements and bank account information is described in Exhibit A.

There are no other members

holding any Membership interests in the Company other than the Seller. No person, firm, or corporation other than Buyer has any agreement

or option or a right capable of becoming an agreement or option for the purchase, subscription or issuance of any of the issued or unissued

Membership Interest of the Company or to direct the voting or disposition of the Membership Interests. There are no members or other agreements

affecting the Membership Interest or Seller's ability to transfer such Membership Interest to Buyer.

Seller is the owner,

beneficially and of record, of the 100% of the Membership Interest of the Company, free of any liens, encumbrances, security

agreements, equities, options, claims, charges and restrictions. Seller has the right and authority to enter into this Agreement on

the terms and conditions set forth in

it and has full power to transfer the legal and beneficial ownership of the 51% of the Membership Interest of the Company to Buyer without

giving notice to, making any filing with, or obtaining the consent or approval of any other person or governmental authority.

(b)

Legal Requirements. The Company and Seller have each the power to carry on the Business, are duly

qualified to carry on business in USA pursuant to 499 Registration 836818 , and hold or will acquire at the sole expenses of the

Seller all required licenses, permits, approvals and authorizations for carrying on the Business. The Company has complied with all applicable

federal, state or local statutes, laws and regulations affecting the operation of the Business. Seller has the right, power, legal capacity,

and authority to enter into, and perform Seller’s obligations under, this Agreement.

The Company is not in default

or breach of, and there exists no state of facts which after notice or lapse of time, or both, would constitute a default or breach of,

any of the material contracts. All of the material contracts are in good standing.

The consummation of the

transactions contemplated by this Agreement will not result in or constitute any of the following: (i) a breach of any term or provision

of this Agreement, or of any law, regulation or ordinance; (ii) a default or an event that, with notice or lapse of time or both, would

be a default, breach or violation of the articles of Organization or Operating Agreement of the Company or of any lease, license, promissory

note, conditional sales contract, commitment, indenture, mortgage, deed of trust or other agreement, instrument or arrangement to which

any of Seller or The Company is a party, or by which any of them, or the property of any of them, is bound; (iii) an event that would

permit any party to terminate any agreement, or to accelerate the maturity of any indebtedness or other obligation of The Company; or

(iv) the creation or imposition of any lien, encumbrance or restriction of any nature in favor of a third party upon or against The Company.

All material transactions

of The Company have been promptly and properly recorded or filed in the appropriate books and records.

(c)

Ordinary Course of Business. The Business has been carried on in the ordinary course and the Company

has not entered into any material agreements or commitments other than in the ordinary course of the routine affairs of the Business.

Without limiting the generality of the foregoing, except in the ordinary course of the routine affairs of the Business or as disclosed

in this Agreement, the Company has not: (i) made or authorized any payment to any officers, directors, employees or other persons, including

the payment of any personal expenses of Seller, except at the regular rates of salary, bonus or other remuneration payable to them by

the Signing Date; (ii) paid or authorized any dividends or other distributions on, or payments in respect of, any of their shares or securities;

(iii)

made any loan or advance

to any person; (iv) subjected any of the Assets to any mortgage, deed of trust, lien, pledge, conditional sales contract, security interest,

lease, encumbrance or charge; (v) sold, leased or otherwise transferred or disposed of any of the Assets; (vi) modified, amended or terminated

any agreement, or waived or released any rights under any agreement; (vii) incurred any debt, obligation or liability of any nature, whether

accrued, absolute, contingent or otherwise; (viii) issued or sold, other than to Buyer, any equity or debt security; (ix) made any changes

or amendments to the Articles of Organization or Operating Agreement of The Company; or (x) authorized or agreed to do any of the matters

described in the preceding clauses (i) through (x).

The Company has not experienced,

nor is Seller aware of, any occurrence or event which has had, or might reasonably be expected to have, a materially adverse effect on

the financial condition, business, assets or prospects of The Company.

(d)

After the closing the financial control and the Banks, Treasury and the finance of the Company will

be managed by the Buyer.

(e)

Claims and Litigation. There is no claim, suit, action, arbitration, governmental inquiry, Tax injunction,

consent decree or legal, administrative or other proceeding existing, pending, or threatened against or relating to the Company or to

the Company’s financial condition, or to the Business, or any of the Total Assets, nor does Seller knows of, or have reasonable

grounds for, believing that there is any basis for any such action, arbitration, proceeding or inquiry,

(f)

Financial Statements. As LYNK HOLDING has acquired the assets of VOYCE TELECOM the “Business”,

it is understood that all financial statements of the commercial relations with revenue generating customers and vendors of VOYCE TELECOM

are now part of LYNK TELECOM. The Buyer has until the Closing Date to conduct a detail due diligence.

The financial statements

of the Company, attached as part of Exhibit A and made a part hereof, are true and correct in every material respect, have been

prepared in accordance with generally accepted accounting principles consistently followed by the Company throughout the periods indicated

therein, represent fairly the financial position of the Company as of the respective dates of the balance sheets included in the financial

statements and the results of its operations for the respective periods indicated, and do not include or omit to state any fact which

renders such financial statements misleading. Except as and to the extent shown or provided for in such financial statements, the Company

has no liabilities or obligations (whether accrued, absolute, contingent or otherwise) which might be or become a charge against the Assets.

All financial and other

information provided by Seller to Buyer and their representative to date is true and correct in every material respect, and no extraordinary

events of any nature have in any way affected such information or the Business. There are no additional sets of books, duplicate sets,

"second sets" or other documents or records of the Business kept by Seller or the Company which purport to show the financial

status of the Business and that have not been delivered to or inspected by Buyer.

(g)

Taxes and Unemployment Compensation. There are no special charges or levies, taxes, unemployment

compensation contributions, penalties or interest that form or might form a charge or encumbrance that may become payable by the Company

or Buyer as a result of, or in connection with, any event that has occurred to the Signing Date.

(h)

All Accounts Paid. All account billings which have been received by the Company or Seller for work,

labor or materials in connection with the Business have been paid in the ordinary course of the routine affairs of the Business.

(i)

Liabilities. All of the Company ́s liabilities are listed in Exhibit C, along with a

list of the payable accounts and their expiration date. It is expressed in Exhibit C the conditions of payment of such liabilities

or if so, if there are payment agreements for those liabilities. If there is any liability that is not listed in Exhibit C or that

it has not been disclosed or declared by the Seller, such liability shall not be accepted by Buyer as a company liability, provided, that

if Seller is not aware of such liability or it is a liability based on the normal operation of the business, this provision would not

apply. In the event there is an undisclosed liability, the purchase price shall be proportionally reduced.

(j)

Contractual Arrangements. The Company does not have any contracts, agreements, undertakings or arrangements,

whether oral, written or implied, with lessees, licensees, managers, accountants, suppliers, agents, officers, distributors, directors,

lawyers, or other third parties, which cannot be terminated on a reasonable period's notice.

(k)

Employment Matters. (i) The Company is in compliance with all federal, state and local laws, ordinances

and regulations respecting employment practices, terms and conditions of employment and wages and hours, and is not engaged in any unfair

labor practice. The Company is not, and has never been, a party to any profit sharing, retirement, pension or similar plans, or other

deferred compensation plans affecting the Business, except as disclosed on Exhibit A, attached hereto and made a part hereof. The

Company is not now, nor has it ever been, a party to any union contract or collective bargaining agreement with any labor union or other

association of employees and, to the best of the knowledge of Seller, no attempt has been made to organize or certify the employees of

the

Company as a bargaining

unit. The Company is not a party to, nor bound by, any written or oral employment, advisory or consulting agreement other than those terminable

at will by The Company. All employment benefits of the Company in place, including without limitation, any insurance plans are disclosed

on; (ii) to the knowledge of Seller, the Company has never been fined or otherwise penalized by reason of any failure to comply with the

American immigration laws, nor is any such proceeding pending or threatened; (iii) Exhibit A, attached hereto and made a part hereof,

contains a list of all employees of the Company, their wages and other remuneration of every kind, including current year vacation pay

earned to date, accrued sick leave, and the date and amount of the latest wage increase of each such employee. There has been no hiring

of new employees or termination of existing employees, voluntary or otherwise, by the Company since the Inspection Date.

(iv)

The Company has not agreed to nor is required to make any adjustment for any period after the Closing

Date. There is no application pending with any governmental body requesting permission for any such change in any accounting method of

the Company and the corresponding tax authority in the jurisdiction where the Company operates has not issued in writing any pending proposal

regarding any such adjustment or change in accounting method.

(v)

The Company is not a party to any agreement with any third party relating to allocating or sharing

the payment of, or liability for, taxes.

(vi)

The sale of the 51% of the Membership Interest and the consumption of the transactions contemplated

by this Agreement does not create any tax liabilities for the Company. Seller will perform the rigor consultations with the Tax Agency

in order to measure the impact of the sale of the 51% of the Membership Interest of the Company and shall formally notify Buyer by correspondence

about the impact. This communication must be part of the Agreement for the Closing Date and shall be signed by both parties.

(l)

Accounts Receivable. The Receivables shown in the books of the Company are good and collectible,

except for normal trade accounts which may become uncollectible in the ordinary course of business.

(m)

Banks and Financial Institutions. The names and locations of all banks and other financial institutions

at which the Company has any accounts or safety deposit boxes, the numbers of such accounts, and the names of all persons authorized to

draw thereon or have access thereto are set forth on Exhibit A, attached hereto and made a part hereof.

(n) Full

Disclosure. None of the representations and warranties made by Seller, or made in any document, Exhibit, certificate, memorandum or

in any information of any kind furnished, or to be furnished by Seller, or on

Seller's behalf, contains or will contain any false statement of a material fact.

(o)

Brokers. There are no brokers, salesmen or finders involved in this transaction. If a claim for brokerage

commission in connection with this transaction is made by any broker, salesmen or finder claiming to have dealt by, through or on behalf

of one of the parties hereto ("Indemnitor"), Indemnitor shall indemnify, defend and hold harmless the other party hereunder

("Indemnitee") and Indemnitee's officers, directors, agents and representatives, from and against any and all liabilities, damages,

claims, costs, fees and expenses whatsoever, including reasonable attorneys' and paralegals' fees and costs up through and including all

trial and appellate levels with respect to said claim for brokerage. The provisions of this Paragraph shall survive Closing or any cancellation

or earlier termination of this Agreement.

(p)

Anti-Corruption. Neither the Company nor any of its officers Members, directors, agents or employees,

acting on its behalf has: (i) made or offered to make any illegal payment to any officer or employee of any governmental agency or body,

or any employee, customer or supplier of the Company or (ii) accepted or received any unlawful contributions, payments, expenditures or

gifts and not proceedings have been filed or commenced alleging any such payments. None of the officers, Members, directors, agents or

employees of The Company are a governmental official.

(q)

Intellectual Property. Exhibit C sets forth a complete list of all Intellectual Property (IP)

Rights used, held for use or owned by The Company (the "Intellectual Property") and a true correct and complete list of all

designs, manufacturing, pictures, licenses, software, platforms, data, back up or similar agreements or arrangements to which the Company

is a party, either as licensee or licensor with respect to the Intellectual Property. The Company is the sole and exclusive owner of all

of the Intellectual Property of each one. Neither The Company nor Seller has knowledge of not received notice of any claim or basis for

a claim against it that any of its operations, activities, products or publications infringes on any Intellectual Property right or other

property right of a third party, or that it is illegally otherwise using the trade secrets or any property rights of other. The Company

owns all right, title and interest to any custom or proprietary software and telecommunications programs used in the conduct of its property

rights of any third party. The Company uses all of its software for its intended use and complies with applicable law. The Company has

no obligation to refund any fees for any products or services sold to any third party.

(r)

Business Continuity. None of the software, computer hardware (whether general or special purpose)

and other similar or related items of automated, computerized and/or software systems and any other similar or related items of automated,

computerized and/or software systems and any other

networks or systems and

related services that are used by or relied on by The Company in the conduct of its businesses (collectively, the "Systems")

have experienced bugs, failures, breakdowns or continued substandard performance in the past twelve (12) months that has caused or reasonably

could be expected to cause a materially adverse effect to the Business and all of them are third party owned and operated.

(a)

Financial and Other Information. Seller covenant that Seller will do or will cause to be done the

following: (i) make available to Buyer as soon as practicable, all books, accounts, records and other financial and accounting data of

the Company; (ii) make available to counsel for Buyer as soon as practicable, all charter documents, minute books and other corporate

records and all documents of title and related records of the Company and (iii) Buyer will open a new bank account for the Company.

(b)

Operating Agreement Seller covenant that they will procure the amendment, modification or change,

at the expense of the Company, the Operating Agreement of the Company in case it is necessary or required to adopt and incorporate the

terms of this Agreement. A copy of the current Operating Agreement of the Company is enclosed in Exhibit A

(c) Ordinary

Course of Business. Seller will ensure that to the Closing Date, the Company will: (i) conduct the Business only in the ordinary

course; (ii) make no increase in the compensation payable to, or agreements with, any employee or agent by which Buyer or the

Company is bound; (iii) not make any commitment on behalf of Buyer or the Company by which Buyer or the Company is bound to any

third party, including, without limitation, a commitment to hire any person as an employee; (iv)

use Seller's best efforts to keep the business organization of the Company intact, and to keep available to the Company the services

of the present employees, and to preserve for the Company the goodwill of the Business, suppliers, customers and dealers, and others

with which Seller and the Company have business relations; (v) Omar Luna will continue as CEO of The Company; (vi) make no

announcement or disclosure of the prospective purchase and sale contemplated by this Agreement without consultation and coordination

of such announcement with Buyer; (vii) Seller, while remaining as CEO of the Company, shall continue to have complete and

unrestricted power and authority to hire, fire, retained or suspend any person as employee or independent contractor, and to assign,

increase, decrease the salary, wages, or any other compensation or bonuses to such employees or independent contractors of the

Company, provided that such transaction is in the ordinary course of business and customary for the Company and in the

Company’s best interest, and (viii) the Treasury of the Company will be managed by Buyer. All parties will use their best

efforts to attain a favorable public relations posture and response in the community,

and to retain the goodwill of the Business pending, during and after closing.

(d)

Litigation. Seller will be fully responsible for all losses, damages, expenses, liabilities, attorneys'

fees, claims or demands whatsoever suffered or incurred by Buyer or the Company as a result of any litigation or threatened litigation

arising from matters that occur on or before the Closing Date, provided, however, that Seller shall not be responsible for any losses,

damages, expenses, liabilities, attorneys' fees, claims or demands arising out of the ordinary course of business of the Company or that

have been disclosed to Buyer in this Agreement.

(e)

Any regulatory issue that arises as a consequence of cruised traffic prior to the “Closing

Date”, will be of the sole responsibility of LYNK HOLDING and in any case of the VOYCE Shareholders. Buyer may reserve the right

to withhold part of the contributions to face litigation and regulatory issues.

(f)

The Company Records and Minute Books. On the Closing Date: (i) the minute books of the Company will

contain accurate and complete minutes of all meetings and proceedings of the directors, any committee appointed by the directors, and

of the Members of the Company since the date of its incorporation, and all waivers, notices and other documents required by law to be

contained in such books; (ii) all resolutions contained in the minute books will have been duly passed and all meetings referred to above

duly called and held; (iii) the records of the Company concerning Membership Interest certificates, if any, and membership Interest registers,

if any, will be complete and accurate; and (iv) the Company will be in good standing under the laws of the State of Texas and will have

passed all resolutions necessary to approve and effect the transaction contemplated by this Agreement.

(g)

Goodwill. Seller agrees to do everything within Seller's ability to protect the ongoing goodwill

of the Company and the Business both before and after the Closing Date.

(h)

Consents. Seller will diligently take all reasonable steps required to assure that the Company’s

licenses are not affected by the sale of the 51 % of the Membership Interest to Buyer. In addition, Seller will diligently take all reasonable

steps required to obtain, prior to the Closing Date, all consents to the assignment, transfer, conveyance or other disposition to Buyer

where such a consent is required. Buyer will use its best efforts to assist in the obtaining of all such consents.

(i)

Further Assurances. After the Closing Date, Seller will, at the expense of Buyer, execute and do

all such further deeds, acts, things and assurances that may be requisite in the opinion of counsel for Buyer for more perfectly and absolutely

assigning, transferring, assuring to and vesting in Buyer title

to the Assets, save and

except for liens and encumbrances securing the assumed debt, free and clear of all mortgages, liens, charges, pledges, security interests,

encumbrances, equities or other claims of every nature and kind whatsoever, except as disclosed in this Agreement and its Exhibits, and

for carrying out the intention of, or facilitating the performance of, the terms of this Agreement.

(j)

Distributions. The Seller will not do any cash distributions, nor any other kind, before closing

date for purpose of dividends

(k)

Seller's Release. Seller for Seller, Seller’s heirs, successors and assigns, releases and forever

discharges the Company and all of its affiliates, and its respective successors and assigns, of and from all claims and causes of action

known or unknown, accrued or un-accrued, that Seller has or may have against any of them including, without limitation, all claims for

past wages and all claims for compensatory, exemplary or punitive damages for any cause arising on, or prior to, the Closing Date.

(l)

Non-Solicitation Clause. The Seller agrees that, while working for the Company as CEO, respectively

and for one year following the resignation, termination or departure from such position, for any reason, such Seller will not directly

or indirectly solicit business that directly compete with the voice business of the Company from any person or entity that was the Company’s

clients or customers during the time such Seller was an employee of the Company. Seller further agree that they will not assist others

in such solicitation or client acceptance. The failure to comply with this disposition will give rise to Buyer to demand a compensation

equivalent to the actual damages suffered by the Company, not to exceed twice the lesser of amount paid to Seller for the Purchase Price.

(m)

Certificate of Closing. Seller agrees to provide Buyer, on the Closing Date, with a certificate dated

the Closing Date certifying that all representations and warranties contained in this Agreement are true and correct as of the Closing

Date, and that Seller has performed and complied with all agreements, warrants and conditions required by this Agreement to be performed

or complied with by Seller ("Closing Certificate”).

Once this Purchase

Agreement is signed by the Parties, the actual manager of the Company, Omar Luna as CEO will each enter into a 3-year Employment

Agreement, that will be discussed and executed before the closing date, renewable for a 2-year period to guarantee the operational

continuity of the Company and the implementation of a business plan that will lead the Company into a productive company with

positive net income as established in this document. The Omar Luna employment

agreement will be included in the Exhibit E. The Company Board of Directors could review

this at any time.

The Company shall have a Board

of Directors composed of 3 Members: 2 of the Members shall be appointed by Buyer and 1 of the Members shall be appointed by Seller. The

position of President and Secretary will be reserved for Buyer.

The Board of Directors will be appointed

as follows:

President/Chairman: Mr. Leandro Jose Iglesias Conde

Secretary: Mr. Alvaro Quintana Cardona

Member of the Board: Mr. Omar Luna

All the decisions of the Board

of Directors will be taken by simple majority rule.

The compensation of the management and employees is on the Exhibit B

The Buyer agrees that Seller

shall be allowed to withdraw from the Company’s accounts the accumulated dividends Seller would have paid themselves in their ordinary

course of the manner in which they managed the business prior to the execution of this Agreement without affecting the operation of the

business.

It shall be required the

approval of the Members holding 100% of the membership Interest in the Company to require additional capital contributions from Members

and amend the Operating Agreement, to sell any assets of the Company or to acquire or enter into any loans or financial obligations with

third parties.

Should the majority of the

Members holding more than 50% of the membership Interest in the Company (“Selling Members”) desire to sell or transfer their

Membership Interest, they must first give the option to the remaining Members to purchase or acquire such interest under the same terms

and conditions as contracted with the third party buyer; if the remaining Members do not wish to acquire the interest as provided herein,

the Selling Members must procure that the remaining Members have the right to join in the transaction and sell their minority interest

in The Company under the same terms as the Selling Members are transferring their interest. 10-day terms are deemed reasonable each time

a response by the remaining members is required pursuant to this paragraph.

Should any Member desire

to sell or transfer all or part of her/his/its Membership Interest in the Company (“Transacting Member”), such Transacting

Member must first give the option to the remaining Members of the Company to purchase or acquire such interest under the terms and conditions

provided by such Transacting Member, prorated based on the percentage of membership interest held by the remaining Members desiring to

purchase or acquire such interest; if none of the remaining Members wish to purchase or acquire the interest as provided herein, the Transacting

Member may proceed with the transfer to a third party buyer under the same terms and conditions as offered to the remaining Members; the

terms negotiated with the third party buyer can not differ by 1% or more, the Transacting Member must offer the membership interest again

to the remaining Members under such new terms and conditions, and the procedure provided herein shall be follow each time. 10-day terms

are deemed reasonable each time a response by the remaining members is required pursuant to this paragraph.

In case of IQSTEL Inc.

files for bankruptcy protection, Seller will have the right to repurchase from Buyer the percentage of the Membership Interests (Capital

Stock) of the Company sold under this Agreement at One Dollar (US$ 1.00) per each one percent (1%). This right will expire on December

31, 2026.

| 9. | SURVIVAL OF REPRESENTATIONS. |

The representations, warranties,

covenants and agreements by Seller in this Agreement and its Exhibits, or documents delivered pursuant to the provisions of this Agreement

or in connection with the transactions contemplated by it will be true at and as of the Closing Date as though made at that time. Notwithstanding

any investigations or inquiries made by Buyer prior to the Closing Date or the waiver of any conditions, the representations, warranties,

covenants and agreements of Seller will survive the Closing Date and, notwithstanding the closing of the transaction of purchase and sale

provided for in this Agreement, will continue in full force and effect.

Seller agree to reimburse Buyer

and to indemnify and hold Buyer harmless from and against any and all losses, damages, expenses, liabilities, claims or demands whatsoever

suffered or incurred by Buyer or the Company resulting or arising from: (a) any breach of, or misrepresentation in, the representations,

warranties and covenants of Seller contained in this Agreement and its Exhibits or in the documents delivered pursuant to the provisions

of this Agreement or in connection with the transactions contemplated by this Agreement; and (b) any and all liabilities and obligations

whatsoever whether accrued, absolute, contingent or otherwise, relating to the operation of the

Business prior to the Closing

Date provided, however, that Seller shall not be responsible or liable to Buyer or The Company for any losses, damages, expenses, liabilities,

attorneys' fees, claims or demands arising out of the ordinary course of business of the Company or that have been disclosed to Buyer

in this Agreement.

| 11. | TERMINATION CONDITIONS. |

Once this Acquisition Agreement is

signed, Seller are obliged to sell and Buyer agrees to buy, and

can only terminate this agreement

if:

| (a) | Buyer or the Company is economically unviable, or is declared bankrupt. |

(b)

If during the Due Diligence prior to closing or file 8-K and/or 8-K amendment, or while the twelve

months after the Closing Date, some information is detected that causes a material impact on the Company valuation or that implies a violation

of a US law, or that the Closing Date is delayed without logical reason, in which case Buyer or Seller may terminate the acquisition of

Membership interest and additional assets of the Company, and demand the return of the amounts paid until then, if so those amounts must

be paid within a maximum period of 30 days.

(c)

If the Parties mutually agree at any time to terminate the acquisition process before the Closing

Date. In this event, Seller must return to Buyer the amounts received up to that moment, within a maximum period of 30 days.

(d)

If the parties do not reach an agreement about the employeement agreement of the CEO Omar Luna, before

the Closing.

| (e) | If the Buyer does not get approval for this acquisition of its Board of

Directors. |

| 12. | CONDITIONS PRECEDENT TO CLOSING. |

The completion of the

transaction contemplated by this Agreement is subject to: (a) Buyer obtaining approval to proceed from its Board of Directors,

and any necessary third-party consents, if the Buyer will not obtain its Board of Directors approval, this is a termination cause,

and the seller will not have any right of indemnification; (b) satisfactory completion of a Due Diligence review, by Buyer

(including review of the financial statements and the other reports or audits referred to in this Agreement) within thirty (30) days

from the date of the beginning of the Due Diligence as declared solely by the Buyer (Each Party pays for own expenses). These

provisions or any of them may be removed by Buyer and are solely for its benefit. If

the conditions are not satisfied and Buyer terminates this Agreement, then the Deposit,

plus interest, if any, shall be returned to Buyer.

After execution of this Agreement,

the Seller acknowledge the Company does not owe Seller any debts, account payables or any liability, including any receivable the Company

may have with the Seller.

The Company will be delivered

with normal levels of working capital, defined as current assets (except cash) minus current liabilities forecasted for the following

12 months, based on average levels of working capital for the 3 months preceding the closing. At the closing date, the Company shall have

enough funds in its bank accounts to cover the normal operation of the business as the Seller would have kept them prior to closing after

withdrawing the dividends as provided in Section 9 of this agreement.

The Company has prepared all

accounting information in accordance with SEC standards in such manner that the Audit and/or Due Diligence may be performed within 30

days after, or before of the Closing Date.

(a) Delivery of Closing Documents

by Seller. On the Closing Date, Seller will deliver to Buyer or its counsel the following, in form and substance satisfactory to Buyer

and its counsel: (i) the originals of the assignment declarations to effect the transfer of 51% of the Membership Interests (Capital Stock)

of the Company to the Buyer, duly signed by the Seller; (ii) the combined duly signed Membership Interest register and beneficial owner

register of the Company, if any, evidencing the Buyer’s entry as the holder of 51% of the Membership Interest (Capital Stock) with

full voting rights and the beneficial owners in original form; (iii) a resolution of the Board of the Directors of The Company by which

the sale and transfer of 51% of the Membership Interest is approved and pursuant to which the Buyer is entered into the Membership Interest

register of the Company as the owner of 51% of the Membership Interest, in original form; (iv) the minutes of the meetings of the Board

of Directors and the Annual Members Meeting of The Company of the last three years (if available); (v) the Closing Certificate; (vi) certificate

of good standing of The Company issued by the Commercial Registry Office; (vii) the Employment Agreements; and (viii) all other documents,

acts, things and assurances as may be required in the reasonable opinion of the attorneys for Buyer for insuring that all of the transactions

contemplated by this Agreement are carried out to the fullest extent possible.

(a)

Closing Conditions. In order to complete the Closing, the Due Diligence must have been terminated;

and if necessary, an audit and a detail Due Diligence shall be performed under the applicable rules and regulations of the Securities

and Exchange Commission and the Public Company Accounting Oversight Board (PCAOB) must have been completed and Buyer must have the corresponding

8-K file and the corresponding 8-K amendment if need ready to file. When the transfer of the Membership Interest of The Company is completed,

the Buyer will release the respective payments.

(b)

Date and Time of Closing. Subject to the terms and conditions of this Agreement, the purchase and

sale of the 51% of the Membership Interests (Capital Stock) of The Company will be completed at a closing date (the "Closing")

to be held at 10:00 a.m. local time, time and date as will be agreed upon in writing between the parties or their respective attorneys.

| (c) | Place of Closing Date. The Closing will take place at Miami, Florida. |

(d)

Communications. All communications required to be given will be in writing and will be deemed to

have been properly given if transmitted by E-Mail or delivered to the address of the party directly by U.S. Mail or Federal Express or

other nationally recognized overnight courier service, and will be deemed to have been received, upon the date of delivery or transmission.

Such communications will be sent to the following addresses:

SELLER:

Omar Luna

LYNK HOLDINGS, LLC

8200 Greensboro Dr, Suite 820,

Mclean, VA 22102 Omar.luna@Lynktel.net

BUYER:

IQSTEL Inc.

Represented by:

Leandro Jose Iglesias Conde

300 Aragon Ave, Suite 375

Coral Gables FL. 33134

E-Mail: ceo@iQSTEL.com CC: alvaroquintana@iQSTEL.com

(e)

Applicable Law. This Agreement will be deemed to be a contract made under the laws of the State of

Florida and for all purposes will be governed by and interpreted in accordance with the laws prevailing in the State of Florida, without

regard to principles of conflict of laws. Venue shall be state and federal courts located in Florida. The Company and this agreement has

to fulfilment all the laws and regulations of the publicly listed companies in US.

(f)

Inurement. This Agreement will inure to the benefit of and be binding upon the parties, their heirs,

administrators, successors and assigns.

(g)

Counterparts. This Agreement may be executed in several counterparts, each of which when so executed

will be deemed to be an original and which will together constitute the one and the same agreement; and it will not be necessary in proving

this Agreement to produce or to prove more than one such counterpart.

(h)

Severability. If a court of competent jurisdiction should find any term or provision of this Agreement

to be unenforceable and invalid by reason of being overly broad, the parties agree that the court shall limit the scope or duration of

such provision to the maximum enforceable scope or duration allowed by law. Any term or provision deemed by a court of competent jurisdiction

to be unenforceable and invalid for any other reason shall be severed from this Agreement, and the remainder of this Agreement shall continue

in full force and effect.

(i)

Legal Fees and Costs. In the event of any disputes or controversies arising from the Agreement or

its interpretation, the prevailing party shall be entitled to recover its attorneys' and paralegals' fees and costs from the non-prevailing

party, up through and including all trial, appellate and post- judgment proceedings. Each Party will pay its own fees and expenses (including

legal, accounting, investment banking and financial advisory fees and expenses) incurred in connection with the negotiation and execution

of this Agreement.

(j)

Confidentiality. The parties agree that from and after the date of this Agreement, none of the terms

and conditions of this Agreement or any other agreement entered into by the parties or their affiliates, will be disclosed to any third

party other than attorneys, accountants, Buyer's lender and other professionals advising the parties in connection with the contemplated

transaction, without the prior

written consent of the

other party. The parties further agree that any information exchanged in connection with the transaction contemplated by this Agreement

is proprietary to the disclosing party, and confidential in nature and it will be treated as such by the receiving party unless such information

is or becomes a matter of public record.

(k)

Relation to Previous Agreements. This Agreement (including its appendices) constitutes the entire

understanding and agreement between the Parties and supersedes and merges all prior agreements, promises, understandings, statements,

representations, warranties, indemnities and covenants, whether written or oral with respect to the subject matter hereof.

(l)

Entire Agreement. This Agreement, including the Exhibits and any other documents referred to herein,

constitutes the entire agreement and understanding among the Parties with respect to the subject matter hereof, and shall supersede all

prior oral and written agreements, understandings or undertakings of the Parties.

(m)

No Assignment. Neither Party shall assign this Agreement or any rights, claims, obligations or duties

under this Agreement without the prior written consent of the other Parties.

(n)

Tax Gross-Up. All payments to be made by the Buyer to the Seller shall be made free and clear of

and without deduction, unless the tax deduction is required by law. If a tax deduction is required by law to be made by the Buyer, the

amount of the payment due from that Party shall be increased to an amount which (after making any tax deduction) leaves an amount equal

to the payment which would have been due if no tax deduction had been required.

IN WITNESS WHEREOF the parties have

executed this Agreement as of the day and year first above

written.

SELLER

/s/ Omar Luna

Lynk Holdings LLC

CEO: Omar

Luna

BUYER

/s/ Leandro Jose Iglesias

Conde

iQSTEL Inc.

CEO: Leandro Jose Iglesias

Conde

LIST OF EXHIBITS

EXHIBIT A: COMPANY INFORMATION

| A.1. | By Laws and Registration Certificate of LYNK HOLDING |

| A.2. | By Laws and Registration Certificate of LYNK TELECOM LTD |

| A.3. | By Laws and Registration Certificate of VOYCE TELECOM |

| A.4. | Bank Account Information |

EXHIBIT B: 499 Registration of LYNK

TELECOM

EXHIBIT C: Purchase Agreement of

LYNK HOLDINGS to VOYCE TELECOM Shareholders EXHIBIT D: LYNK TELECOM Projections

EXHIBIT E: Employment agreement

Omar Luna (CEO Lynk Telecom) EXHIBIT F: Over performance of the Business Forecast, True Up EXHIBIT G: IQSTEL Board Consent for this acquisition

IQST – iQSTEL Announces Agreement to Add $20M In Revenue

and $1M in Net Income with Acquisition of Lynk Telecom

NEW YORK,

May 10, 2024 -- iQSTEL Inc. (OTC-QX: IQST) (www.iQSTEL.com)

a US-based, multinational, fully reporting and audited publicly listed telecommunications and technology company preparing for a Nasdaq

up-listing today announced executing an agreement to acquire a 51% membership interest in Lynk Telecom (Lynktel,net).

Lynk Telecom Highlights

| · | $20 million in estimated annual revenue |

| · | $1 million in estimated annual net income |

| · | Full suite of wholesale and retail telecom services for US

market |

| · | Strong US network and commercial presence |

| · | Retail services expansion plan projected to deliver a million

dollars in operating net income or more by next year |

The acquisition agreed

to in the sales and purchase contract executed today is expected to close no later than July 1, 2024 after due diligence is completed.

The terms of the agreement call for iQSTEL to buy 51% equity ownership of Lynk Telecom. Comprehensive details will be filed in a form

8-K.

Omar

Luna, CEO of Lynk Telecom said, “I'm absolutely thrilled to join the iQSTEL family. The support and synergies that iQSTEL offers

are invaluable, and I have no doubt that they will help us double our business in a relatively short period. This partnership is a fantastic

opportunity for growth, and I can't wait to see where it takes us.

Leandro

Iglesias, CEO of iQSTEL said, “Lynktel is a very strategic acquisition for iQSTEL adding substantial operating and net income in

proportion to its revenue base and giving iQSTEL enhanced presence in the US market. Lynktel takes iQSTEL one step closer to realizing

our billion dollar annual revenue goal.”

About IQSTEL:

iQSTEL

Inc. (OTC-QX: IQST) (www.iQSTEL.com)

is a US-based, multinational publicly listed company preparing for a Nasdaq up-listing with an FY2023 $144 million revenue,

and with a Quarter Billion Dollar Revenue forecast and a Positive Operating Income of 7 digits forecast for FY-2024. iQSTEL's mission

is to serve basic human needs in today's modern world by making the necessary tools accessible regardless of race, ethnicity, religion,

socioeconomic status, or identity. iQSTEL recognizes that in today's modern world, the pursuit of the human hierarchy of needs (physiological,

safety, relationship, esteem and self-actualization) is marginalized without access to ubiquitous communications, the freedom of virtual

banking, clean affordable mobility and information and content. iQSTEL has 4 Business Divisions delivering accessibly to the necessary

tools in today's pursuit of basic human needs: Telecommunications, Fintech, Electric Vehicles and Metaverse.

| · | The Enhanced Telecommunications Services Division (Communications)

includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform. |

| · | The Fintech Division (Financial Freedom) includes remittances

services, top up services, Master Card Debit Card, a US Bank Account (No SSN required), and a Mobile App. |

| · | The Electric Vehicles (EV) Division (Mobility) offers Electric

Motorcycles and plans to launch a Mid Speed Cars. |

| · | The Artificial Intelligence (AI)-Enhanced Metaverse Division

(information and content) includes an enriched and immersive white label proprietary AI-Enhanced Metaverse platform to access products,

services, content, entertainment, information, customer support, and more in a virtual 3D interface. |

The company continues

to grow and expand its suite of products and services both organically and through mergers and acquisitions. iQSTEL has completed

10 acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions.

Safe Harbor Statement:

Statements in this news release may be "forward-looking statements". Forward-looking statements include, but are not limited

to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating to our future

activities or other future events or conditions. These statements are based on current expectations, estimates, and projections about

our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve risks,

uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ materially

from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements speak only

as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect events

or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for sale.

Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the United

States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

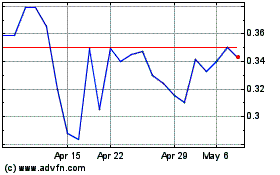

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Oct 2024 to Nov 2024

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Nov 2023 to Nov 2024