Jade Art Group Inc. (OTCBB:JADA; "Jade Art" or the "Company"), a

seller and distributor of raw jade in China, announced today its

financial results for the year ended December 31, 2009.

2009 Key Items

- Revenue of $25.3 million

represents a 17% decrease from $30.5 million in 2008.

- Gross profit was $20.6 million,

compared to $25.3 million in 2008.

- Income from continuing

operations was $18.7 million, compared to $22.5 million in

2008.

- Net income in 2009 was $13.2

million, compared to $15.4 million in 2008, excluding the gain in

2008 from discontinued operations of $55.4 million.

- Fully diluted earnings per share

decreased to $0.16 from $0.19, excluding the gain from discontinued

operations of $0.69 in 2008.

2009 Results

Commentary

Revenue for 2009 was $25.3 million, representing a 17% decrease

from the $30.5 million of revenue recorded in 2008. The decrease

was primarily due to the global economic downturn that has reduced

the demand for luxury goods such as jade. In addition, the

Company’s management believes that the adverse weather condition

also impacted the ability to transport product in 2009.

The resulting gross profit for 2009 was $20.6 million, which

represented approximately 81.4% of revenue, compared to $25.3

million for 2008, which represented approximately 82.9% of revenue.

This decrease in gross profit primarily resulted from the decrease

in the Company’s sales revenue.

Selling, general and administrative expenses were $1.9 million

for 2009, representing a 33.4% decrease from $2.8 million recorded

in 2008. The reduction of sales revenue resulted in a decrease of

sales commissions, which lowered expenses compared to the expenses

for 2008.

The 2009 net income of $13.2 million, resulting in earnings per

diluted share of $0.16, represents a decrease from the 2008 net

income level of $15.4 million, excluding $55.4 million of income

from discontinued operations in 2008 from the Company’s wood

carving business, with related earnings per diluted share in 2008

of $0.19.

Jade Art Group Inc.’s Form 10-K

for the year ended December 31, 2009 was filed on May 17th,

2010.

Commenting on the Company’s financial results for 2009, Hua-Cai

Song, Chief Executive Officer of the Company, said, “The inclement

weather occurred in China during the year caused conditions

unfavorable to mining and transporting Jade Art’s raw materials.

Moreover, we feel that the global economic downturn has temporarily

reduced the demand of luxury goods, which directly impacted the

Company’s commercial and residential construction material markets

and the high-end jade jewelry market. Although we have not yet seen

a rebound in the luxury goods market, we are well positioned to

take advantage of opportunities when economic conditions

improve.”

Selected consolidated figures are presented below. For full

figures, please reference Jade Art Group Inc.’s Form 10-K filing,

located on the SEC's

EDGAR: http://www.sec.gov/Archives/edgar/data/1370823/000114420410028490/v185429_10k.htm.

Financial Condition

As of December 31, 2009, Jade Art Group had cash and cash

equivalents of $147,392. During 2009, operating activities of the

Company provided cash flow of $11.1 million.

About Jade Art Group Inc.

Jade Art Group Inc. is a seller and distributor in China of raw

jade, which has uses ranging from decorative construction material

for both the commercial and residential markets to high-end

jewelry. For more information, please

visit: http://www.jadeartgroupinc.com/.

FORWARD-LOOKING STATEMENTS

This press release contains certain statements that may include

"forward-looking statements." All statements other than statements

of historical fact included herein are "forward-looking

statements." These forward looking statements are often identified

by the use of forward-looking terminology such as 'believes,'

'expects' or similar expressions, involve known and unknown risks

and uncertainties. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. You should not

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. The Company's

actual results could differ materially from those anticipated in

these forward-looking statements as a result of a variety of

factors, including those discussed in the Company's periodic

reports that are filed with the Securities and Exchange Commission

and available on its website http://www.sec.gov. All

forward-looking statements attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by

these factors. Other than as required under the securities laws,

the Company does not assume a duty to update these forward-looking

statements.

Jade Art Group, Inc.

Selected Consolidated

Statements of Operations

(in millions, except per share

amounts)

YEAR ENDED DECEMBER 31, 2009

2008 Sales

$

25.3

$

30.5

Cost of sales (4.7 ) (5.2 )

Gross profit

20.6 25.3 Selling, general and administrative

expenses (1.9 ) (2.8 )

Income from operations

18.7 22.5 Interest income - 0.1 Interest expense -

(0.4 ) Loss on forgiveness of debt - (0.1 )

Income from continuing operations before income taxes

18.7 22.1 Provision for income taxes (5.6 )

(6.7 )

Net income from continuing operations

13.2 15.4 Discontinued operations: Income from

Woodcarving operations, net of tax - 0.1

Income from transfer of

woodcarving operations, net of tax

- 55.3 Net income from discontinued operations -

55.4

Net Income 13.2 70.8 Basic

and Diluted weighted average shares 80.0 80.7 Basic and Diluted

Earnings Per Share: Income from Continuing operations attributable

to JADA shareholders

$

0.16

$

0.19

Income from Discontinued operations attributable to JADA

shareholders - 0.69

Total Basic and

Diluted Earnings Per Share

$

0.16

$

0.88

NOTE: The above numbers may not

equal the total due to rounding.

Jade Art Group Inc.

Selected Consolidated Balance

Sheets

(in millions)

Assets 12/31/2009

12/31/2008 Current Assets Cash and cash equivalents

$

0.1

$

0.1

Accounts receivable, net

7.5

1.5 Total Current Assets

7.6

1.6 Property, plant & equipment, net

-

- Acquisition deposit

8.8

- Distribution rights, net

63.1

66.0

Total Assets

$

79.6

$

67.5

Liabilities and Stockholders’ Equity Current

Liabilities Notes payable – Related parties

$

-

$

2.3

Accounts payable – Trade and accrued liabilities

1.0

0.6 Advances from customers

-

0.1 Taxes payable

2.1

1.3 Total Current Liabilities

3.1

4.3

Total Liabilities

3.1

4.3 Stockholders' Equity Total Stockholders'

Equity

76.5

63.2

Total Liabilities and Stockholders'

Equity

$

79.6

$

67.5

NOTE: The above numbers may not

equal the total due to rounding.

Jade Art Group Inc.

Selected Consolidated Cash Flow

Items

(in millions) Year ended December 31, 2009

2008 Net cash provided by operating activities $ 11.1

$

19.8 Net cash used in investing activities (8.8 ) (8.8 ) Net cash

used in financing activities (2.3 ) (12.1 ) Effect of exchange rate

changes on cash - 0.9 Net change in

cash and cash equivalents $ -

$

(0.2 )

NOTE: The above numbers may not

equal the total due to rounding.

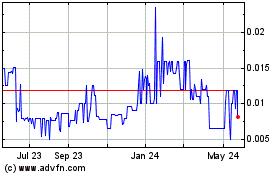

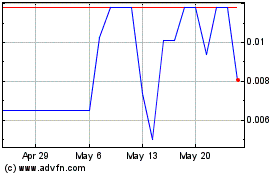

Jade Art (PK) (USOTC:JADA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Jade Art (PK) (USOTC:JADA)

Historical Stock Chart

From Feb 2024 to Feb 2025