UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Check the appropriate box:

☒ Preliminary Information Statement

☐ Confidential, for Use of the Commission Only (as permitted

by Rule 14c-5(d)(2))

☐ Definitive Information Statement

ONESOLUTION

TECHNOLOGY INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate

box)

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14c-5(g)

and 0-11.

| |

1) |

Title of each class of securities to which transaction applies: |

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

5) |

Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date of its filing.

| |

1) |

Amount Previously Paid: |

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

3) |

Filing Party: |

| |

4) |

Date Filed: |

Unit 1813, 18/F, Fo Tan Industrial Centre

26-28 Au Pui Wan Street

Fo Tan, Hong Kong

NOTICE OF CORPORATE ACTIONS TAKEN BY WRITTEN

CONSENT

OF MAJORITY STOCKHOLDERS WITHOUT SPECIAL MEETING

OF THE STOCKHOLDERS

Dear Stockholders:

We are writing to advise you that, on January

22, 2025, the board of directors of OneSolution Technology Inc., a Delaware corporation (“KRFG,” “the Company,”

“we” or “us”), and certain stockholders holding a majority of the voting rights of our common stock approved by

written consent in lieu of a special meeting the taking of all steps necessary to effect the following action (collectively, the “Corporate

Actions”):

| |

1. |

Amend the Company’s Certificate of Incorporation filed with the Delaware Secretary of State (the “Certificate of Incorporation”) to change the Company’s name to King Resources, Inc.; |

|

| |

2. |

Amend the Company’s Amended and Restated Certificate of Incorporation filed with the Delaware Secretary of State (the “Certificate of Incorporation”) to effect a 1-for-10,000 reverse stock split of our issued and outstanding Common Stock (the “Reverse Stock Split”); |

|

| |

3. |

Issue to all shareholders that directly as a result of the Reverse Stock Split would hold less than 100 shares of common stock of the Company (each, an “Affected Shareholder”) such number of additional shares of common stock so that each Affected Shareholder shall hold 100 shares of common stock of the Company after the Reverse Stock Split; and |

|

| |

4. |

Ratify certain prior corporate acts as valid acts of the Company. |

|

The accompanying information statement, which

describes the Corporate Actions in more detail, is being furnished to our stockholders for informational purposes only, pursuant to Section

14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder.

The consent that we have received constitutes the only stockholder approval required for the Corporate Actions under the Delaware General

Corporation Law, our Amended and Restated Certificate of Incorporation and Bylaws. Accordingly, the Corporate Actions will not be submitted

to the other stockholders of the Company for a vote.

The record date for the determination of stockholders

entitled to notice of the action by written consent is January 22, 2025. Pursuant to Rule 14c-2 under the Exchange Act, the Corporate

Actions will not be implemented until at least twenty (20) calendar days after the mailing of this information statement to our stockholders.

This information statement will be mailed on or about February 17, 2025, to stockholders of record on January 22, 2025. As such, we expect

that the Corporate Actions will be effective no earlier than March 10, 2025 (the “Effective Date”).

No action is required by you to effectuate this

action. The accompanying information statement is furnished only to inform our stockholders of the action described above before it takes

effect in accordance with Rule 14c-2 promulgated under the Exchange Act.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY OF

OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO AUTHORIZE THE CORPORATE ACTIONS. THE NUMBER OF VOTES RECEIVED IS SUFFICIENT TO SATISFY

THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THIS MATTER.

By order of the Board of Directors,

/s/ WONG Nga Yin Polin

WONG Nga Yin Polin

February 6, 2025

ONESOLUTION TECHNOLOGY INC.

INFORMATION STATEMENT REGARDING

CORPORATE ACTIONS TAKEN BY WRITTEN CONSENT OF

OUR BOARD OF DIRECTORS AND HOLDERS OF

A MAJORITY OF OUR VOTING CAPITAL STOCK

IN LIEU OF SPECIAL MEETING

OneSolution Technology Inc. is furnishing this

information statement to you to provide a description of actions taken by our Board of Directors and the holders of a majority of our

outstanding voting capital stock on January 22, 2025, in accordance with the relevant sections of Delaware General Corporation Law of

the State of Delaware (the “DGCL”).

This information statement is being mailed on

or about February 17, 2025, to stockholders of record on January 22, 2025 (the “Record Date”). The information statement is

being delivered only to inform you of the Corporate Actions described herein before such actions take effect in accordance with Rule 14c-2

promulgated under the Exchange Act on the Effective Date. No action is requested or required on your part.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS

AND NO STOCKHOLDERS' MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY OF

OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO AUTHORIZE THE CORPORATE ACTIONS. THE NUMBER OF VOTES RECEIVED IS SUFFICIENT TO SATISFY

THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THESE MATTERS.

GENERAL DESCRIPTION OF CORPORATE ACTIONS

On January 22, 2025, the board

of directors OneSolution Technology Inc., a Delaware corporation, and certain stockholders holding a majority of the voting rights of

our common stock approved by written consent in lieu of a special meeting the taking of all steps necessary to effect the Corporate Actions

as described below:

| |

1. |

Amend the Company’s Certificate of Incorporation filed with the Delaware Secretary of State (the “Certificate of Incorporation”) to change the Company’s name to King Resources, Inc.; |

|

| |

2. |

Amend the Company’s Amended and Restated Certificate of Incorporation filed with the Delaware Secretary of State (the “Certificate of Incorporation”) to effect a 1-for-10,000 reverse stock split of our issued and outstanding Common Stock (the “Reverse Stock Split”); |

|

| |

3. |

Issue to all shareholders that directly as a result of the Reverse Stock Split would hold less than 100 shares of common stock of the Company (each, an “Affected Shareholder”) such number of additional shares of common stock so that each Affected Shareholder shall hold 100 shares of common stock of the Company after the Reverse Stock Split; and |

|

| |

4. |

Ratify certain prior corporate acts as valid acts of the Company. |

|

VOTING AND VOTE REQUIRED

Pursuant to KRFG’s

Bylaws and the DGCL, a vote by the holders of at least a majority of KRFG’s outstanding capital stock is required to effect the

actions described herein. Each common stockholder is entitled to one vote for each share of common stock held by such stockholder. Each

share of Series C Convertible Preferred Stock entitles the holder thereof to 500 votes on all matters submitted to a vote of the stockholders

of the Corporation. As of the Record Date, KRFG had 6,650,786,818 shares of common stock and 30,000,000 shares of Series C Preferred

Stock (representing the voting power of 15,000,000,000 shares of Common Stock) issued and outstanding.

The voting power representing

not less than 10,825,393,410 shares of common stock calculated on a fully diluted basis is required to pass any stockholder resolutions.

Pursuant to Section 228 of the DGCL, the following stockholders holding an aggregate of 2,835,820,896 shares of common stock and 30,000,000

shares of Series C Preferred Stock, collectively representing the voting power of 17,835,820,896 shares of common stock calculated on

a fully diluted basis, on the Record Date (the “Majority Stockholders”), delivered an executed written consent dated January

22, 2025, authorizing the Corporate Actions.

| Name |

Common Shares Beneficially Held |

% of Issued and Outstanding Common Stock |

Series C

Preferred Shares |

% of Issued and Outstanding Series C Preferred |

| Silver Bloom Properties Limited |

2,835,820,869 |

42.64% |

– |

– |

| Herbert Ying Chiu Lee |

– |

– |

30,000,000 |

100% |

| TOTAL |

2,835,820,896 |

49.03% |

30,000,000 |

100% |

NO APPRAISAL RIGHTS

Under the DGCL, stockholders

are not entitled to appraisal rights with respect to the Corporate Actions, and we will not provide our stockholders with such rights.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE

ACTED UPON

Except in their capacity as

stockholders, none of our officers, directors or any of their respective affiliates has any interest in the Corporate Actions.

CORPORATE ACTION NO. 1

On January 22, 2025, the Board

and the Majority Stockholders approved by written consent in lieu of a special meeting an amendment to the Company’s Certificate

of Incorporation to change the name of the Company to King Resources, Inc. (the “Name Change”).

Our Board and the Majority

Stockholders believe that it is advisable and in the Company’s best interests to authorize and approve the Name Change amendment

in order to more accurately reflect the changes in the Company’s business and to enhance the ability of the Corporation to finance

the acquisition, expansion, development and or operation of its current and future businesses. After the Effective Date, the Board may

enter into discussions to acquire one or more additional operating companies. We may also conduct private placements of our securities

to secure additional working capital for the Company. Except as set forth above, as of the date of this filing we do not have any definitive

plans, proposals or arrangements to issue any of the newly available authorized shares of common stock for any purpose or which may result

in a change in control of the Company.

Vote Required

Section 242 of the DGCL provides

that proposed amendments to the Certificate of Incorporation must first be adopted by the Board and then approved by the Majority Stockholders.

On January 22, 2025, our Board and the Majority Stockholders authorized, adopted and approved by written consent in lieu of a special

meeting the Name Change amendment. January 22, 2025, or the Record Date, was the date for determining the stockholders entitled to receive

notice of and to vote on the proposed increase to our authorized capital.

The amendment to change our

name will not be effective until the Effective Date. No further action on the part of stockholders is required to authorize or effect

the amendments to the Certificate of Incorporation.

CORPORATE ACTION NO. 2

On January 22, 2025, our Board

and the Majority Stockholders adopted and approved a resolution to effect a one-for-ten thousand (1:10,000) reverse stock split of all

issued and outstanding shares of common stock of KRFG. Upon the effectiveness of the Reverse Stock Split, each holder of common

stock will receive one share of common stock for every one thousand shares of common stock held immediately prior to effecting the Reverse

Stock Split. The Reverse Stock Split will not change the number of authorized shares of common stock or the par value of KRFG’s

common stock. Except for any changes arising from the treatment of fractional shares, each stockholder of KRFG will hold the same

percentage of common stock outstanding immediately following the Reverse Stock Split as such stockholder held immediately prior to the

Reverse Stock Split.

The Reverse Stock Split is

implemented in connection with the Company’s plans to attract additional financing and potential business opportunities.

We are at all times investigating additional sources of financing, business candidates and other opportunities which our Board believes

will be in our best interests and in the best interests of our stockholders. Except as set forth above, there are currently no definitive

plans, proposals or arrangements to issue shares of KRFG or which may result in a change in control of KRFG.

Under Rule 14c-2, promulgated

pursuant to the Securities Exchange Act of 1934, as amended, the Reverse Stock Split shall be effective twenty (20) days after this Information

Statement is mailed to stockholders of KRFG. No further action on the part of stockholders is required to authorize or effect

the Reverse Stock Split.

The Purpose Of The Reverse Stock Split

Our Board authorized and approved

the proposed amendment to our Certificate of Incorporation to reduce the number of issued and outstanding shares of Common Stock so that

the Company will have additional unissued shares to be utilized for general corporate purposes, including financing activities, without

the requirement of further action by our stockholders. Potential uses of the additional available shares may include, but are not limited

to, public or private offerings, conversions of convertible securities, issuance of securities pursuant to incentive plans, acquisition

transactions and other general corporate purposes. Increasing the number of shares of our common stock available for issuance will give

us greater flexibility and will allow us to issue such shares, in most cases, without the expense or delay of seeking stockholder approval.

We are at all times investigating additional sources of financing, business candidates and other opportunities which our Board believes

will be in our best interests and in the best interests of our stockholders. We may also conduct one or more private placements of our

securities to secure additional working capital for the Company. Except as set forth above and in our other disclosures filed with the

Securities and Exchange Commission, as of the date of this filing we do not have any definitive plans, proposals or arrangements to issue

any of the newly available authorized shares of common stock for any purpose or which may result in a change in control of the Company.

Potential Effects of the Reverse Stock Split

Upon the implementation of

the Reverse Stock Split, the number of shares of the outstanding common stock will be reduced while the number of shares of authorized

common stock will remain unchanged. We believe that the decrease in the number of shares of outstanding common stock

as a consequence of the proposed Reverse Stock Split should increase the per share price of the common stock, which may encourage greater

interest in the common stock and possibly promote greater liquidity for the Company's stockholders. However, the increase in

the per share price of the common stock as a consequence of the proposed Reverse Stock Split, if any, may be proportionately less than

the decrease in the number of shares outstanding, and any increased liquidity due to any increased per share price could be partially

or entirely off-set by the reduced number of shares outstanding after the proposed Reverse Stock Split. The effect the Reverse

Stock Split upon the market price of the common stock, however, cannot be predicted, and the history of reverse stock splits for companies

in similar circumstances includes cases where stock performance has and has not improved. There can be no assurance that the

trading price of the common stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of our

common stock outstanding as a result of the Reverse Stock Split or remain at an increased level for any period. The trading

price of the common stock may change due to a variety of other factors, including our operating results, other factors related to our

business and general market conditions.

The Reverse Stock Split will

not have any immediate effect on the rights of existing stockholders. However, our Board will have the authority to issue shares of our

Common Stock and Preferred Stock without requiring future stockholder approval of such issuances, except as may be required by applicable

law or exchange regulations. To the extent that additional shares of Common Stock are issued in the future, such issuance will decrease

the existing stockholders' percentage equity ownership, dilute the earnings per share and book value per share of outstanding shares of

Common Stock and, depending upon the price at which they are issued, could be dilutive to the existing stockholders.

Although the Reverse Stock

Split is prompted by business and financial considerations, stockholders nevertheless should be aware that such Corporate Actions could

facilitate future efforts by our management to deter or prevent a change in control of the Company. By way of example, our management

could issue additional shares to dilute the stock ownership and the voting power of persons seeking to obtain control of the Company or

shares could be issued to purchasers who would support the Board in opposing a takeover proposal. In addition, the increase in available

shares may have the effect of delaying or discouraging a challenge for control or make it less likely that such a challenge, if attempted,

would be successful, including challenges that are favored by a majority of the stockholders or in which the stockholders might otherwise

receive a premium for their shares over then-current market prices or benefit in some other manner. The Board and executive officers of

the Company have no knowledge of any current effort to obtain control of the Company or to accumulate large amounts of Common Stock.

We may also conduct one or

more private placements of our securities to secure additional working capital for the Company. Except as set forth above and in our other

disclosures filed with the Securities and Exchange Commission, the Board has no current plans to use any of the additional shares of Common

Stock that will become available when the increase in authorized capital occurs to deter or prevent a change of control of the Company.

The following table summarizes

the approximate effect of the Reverse Stock Split on our authorized and outstanding shares of common stock and preferred stock.

| |

Prior to Reverse

Stock Split |

After Reverse

Stock Split* |

| Common

Stock, par value $0.0001 |

|

|

| Authorized

Shares |

36,000,000,000 |

36,000,000,000 |

| Outstanding

Shares |

6,650,786,818 |

763,072 |

| Preferred

Stock, par value $0.0001 |

|

|

| Series

C Convertible Preferred Stock Authorized/ Outstanding, par value $0.001) |

50,000,000/30,000,000 |

50,000,000/30,000,000 |

*Approximate

Effects on Ownership by Individual Stockholders

As a result of the Reverse

Stock Split, the number of shares of our common stock held by each stockholder will be reduced by multiplying the number of shares held

immediately before the Reverse Stock Split by the 1-for-10,000 exchange ratio. All stockholders holding a fractional share

will have the fractional share rounded and adjusted to the nearest whole share. The Reverse Stock Split will affect all of

our stockholders uniformly and will not affect any stockholder's percentage ownership interests in the Company or proportionate voting

power, except to the extent that the Reverse Stock Split results in any of our stockholders owning additional shares as a result of adjustments

made to fractional interests.

Holders of shares of Series

C Convertible Preferred Stock will not be affected by the Reverse Stock Split.

Other Effects on outstanding Shares

The rights and preferences

of the outstanding shares of the common stock will remain the same when the Reverse Stock Split occurs. Each share of common

stock issued pursuant to the Reverse Stock Split will be fully paid and non-assessable.

Reduction in Stated Capital

The Reverse Stock Split will

not affect the par value of our common stock. As a result, on the effective date of the Reverse Stock Split, the stated capital on our

balance sheet attributable to our common stock will be reduced in proportion to the size of the Reverse Stock Split, and the additional

paid-in capital account will be credited with the amount by which the stated capital is reduced. The per share net income or loss and

net book value of KRFG’s common stock will be increased because there will be a lesser number shares of KRFG’s common stock

outstanding. Our stockholders’ equity, in the aggregate, will remain unchanged.

Potential Dilution

The Reverse Stock Split will

not change the number of authorized shares of our common stock as designated by our Certificate of Incorporation. As a result,

the number of shares remaining available for issuance under our authorized pool of common stock will increase. Our Board of

Directors may authorize, without further stockholder approval, the issuance of such shares of common stock or preferred stock to such

persons, for such consideration, and upon such terms as the Board of Directors determines. Such issuance could result in a

significant dilution of the voting rights and the stockholders' equity of the then existing stockholders.

Anti-Takeover Provisions

Some of the provisions of

Delaware law, our Amended and Restated Certificate of Incorporation and our Bylaws may have the effect of delaying, deferring or discouraging

another person from acquiring control of our company or removing our incumbent officers and directors. These provisions, summarized below,

are expected to discourage certain types of coercive takeover practices and inadequate takeover bids. These provisions are

also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors. We believe that

the benefits of increased protection against an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages

of discouraging such proposals. Among other things, negotiation of such proposals could result in an improvement of their terms.

Our Amended and Restated Certificate of Incorporation

and Bylaws provide that:

| |

· |

Board of Directors Vacancies. Our Amended and Restated Certificate of Incorporation and Bylaws authorize only our board of directors to fill vacant directorships, including newly created seats. In addition, the number of directors constituting our board of directors is permitted to be set only by a resolution adopted by a majority vote of our entire board of directors. These provisions would prevent a stockholder from increasing the size of our board of directors and then gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change the composition of our board of directors but promotes continuity of management. |

| |

|

|

| |

· |

Stockholder Action; Special Meeting of Stockholders. Our Bylaws provide that special meetings of our stockholders may be called by holders or more than fifty percent (50%) of the shares entitled to vote at a meeting of stockholders, a majority of our board of directors, the chairman of our board of directors, or our chief executive officer. |

| |

|

|

| |

· |

No Cumulative Voting. The Delaware General Corporation Law provides that stockholders are not entitled to the right to cumulate votes in the election of directors unless a corporation’s certificate of incorporation provides otherwise. Our Amended and Restated Certificate of Incorporation and Bylaws do not provide for cumulative voting. |

| |

|

|

| |

· |

Issuance of “Blank Check” Preferred Stock. Our board of directors has the authority, without further action by the stockholders, to issue up to 100,000,000 shares of “blank check” preferred stock with rights and preferences, including voting rights, designated from time to time by our board of directors. The existence of authorized but unissued shares of preferred stock enables our board of directors to render more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest, or otherwise; |

| |

· |

Bylaws Amendments Without Stockholder Approval. Our Bylaws provide that a majority of the authorized number of directors will generally have the power to adopt, amend or repeal our Bylaws without stockholder approval; |

| |

|

|

| |

· |

Broad Indemnity. We are permitted to indemnify directors and officers against losses that they may incur in investigations and legal proceedings resulting from their services to us, which may include services in connection with takeover defense measures. This provision may make it more difficult to remove directors and officers and delay a change in control of our management. |

These provisions of our Amended and Restated Certificate of Incorporation

or Bylaws may have the effect of delaying, deferring or discouraging another person or entity from acquiring control of us.

Delaware Anti-Takeover

Provisions

Section 203 of the DGCL prohibits

public companies from entering into a business combination (including a merger, sale of assets or transfer of stock) with an “interested

stockholder” for a period of three years after the person becomes an interested stockholder, unless certain conditions apply. An

“interested stockholder” is defined as a person or group of persons who beneficially acquire 15% or more of the outstanding

voting stock of the corporation. Section 203 does not apply if the corporation’s board of directors preapproves the transaction

by which a stockholder becomes an interested stockholder, or if the subsequent business combination with an interested stockholder is

authorized at a stockholder meeting by two-thirds of the corporation’s outstanding voting stock (excluding the stock held by the

interested stockholder). Further, a stockholder who acquires 85% or more of the voting stock of a corporation (excluding stock held by

directors who are also officers and certain employee stock plans) in the first transaction in which it becomes an interested stockholder

is not subject to the three-year waiting period for any subsequent business combination.

A Delaware corporation may

amend its certificate of incorporation to “opt out” of Section 203’s anti-takeover protection. The amendment must be

approved by the affirmative vote of a majority of the shares entitled to vote, in addition to any other vote required by law, and it must

be effected before any stockholder becomes an interested stockholder. Subject to certain exceptions, such amendment will not take effect

until twelve months after its adoption.

We have elected not to be

governed by Section 203 of the DGCL to facilitate potential future business combinations regardless of whether such business combinations

are with interested stockholders.

Vote Required

Section 242 of the DGCL provides

that proposed amendments to the Amended and Restated Certificate of Incorporation must first be adopted by the Board and then approved

by the Majority Stockholders. January 22, 2025, our Board and the Majority Stockholders authorized, adopted and approved by written consent

in lieu of a special meeting the Corporate Actions. January 22, 2025, or the Record Date, was the date for determining the stockholders

entitled to receive notice of and to vote on the proposed increase to our authorized capital.

The Corporate Actions will

not be effective until the Effective Date. No further action on the part of stockholders is required to authorize or effect the amendments

to the Amended and Restated Certificate of Incorporation.

CORPORATE ACTION NO. 3

APPROVAL TO ISSUE ADDITIONAL

SHARES OF COMMON STOCK TO PRESERVE ROUND LOTS

On January 22, 2025, our Board

and the Majority Stockholders adopted and approved a resolution to issue to all stockholders that directly as a result of the Reverse

Stock Split would hold less than 100 shares of common stock of the Company (each, an “Affected Stockholder”) such number of

additional shares of common stock so that each Affected Stockholder shall hold 100 shares of common stock of the Company after the Reverse

Stock Split.

Reasons For The Issuance

of Additional Shares To Preserve Round Lots

A “round lot”

is the standard unit of trading for stocks under SEC rules and establishes the minimum number of shares needed to set bid and offer prices

in the market. While discussions regarding reducing the number of shares constituting a round lot is underway, almost all stocks still

currently trade with a 100-share round lot. The Company believes that preserving the 100-share round lot holdings for the Affected Stockholders

will facilitate the trading of its securities by the Affected Stockholders, which in turn may facilitate the liquidity of its securities

in general. The Company further believes the preservation of the 100-share round lot may assist the Company in maintaining the number

and diversity of its pre-Reverse Stock Split shareholder base.

Vote Required

On January 22, 2025, our Board

and the Majority Stockholders authorized, adopted and approved by written consent in lieu of a special meeting this Corporate Action.

January 22, 2025, or the Record Date, was the date for determining the stockholders entitled to receive notice of and to vote on this

Corporate Action.

This Corporate Action will

effective on the Effective Date. No further action on the part of stockholders is required to authorize or effect this Corporate Action.

CORPORATE ACTION NO. 4

RATIFICATION OF CERTAIN

PRIOR CORPORATE ACTS

It has come to the attention

of the Board that the books and records of the Company do not contain copies of certain documents relating to historical actions (the

“Missing Records”) involving the Company and the appointment, election or re-election of certain of its past executive officers

and directors. As a result, the Company cannot establish that the appointment, election or re-election of certain of its prior directors

and officers of the Company occurred in compliance with the terms of the DGCL. The Board believes that it is the best interests of the

Company and its shareholders to cure any deficiencies that may arise from the Missing Records in accordance with the framework provided

by Section 204 of the DGCL which allows the Company to affirm and ratify a “defective corporate act,” as that term is defined

in Section 204(h)(1) of the DGCL.

According to Section 204(h)(1)

of the DGCL, a “[d]efective corporate act” means an overissue, an election or appointment of directors that is void or voidable

due to a failure of authorization, or any act or transaction purportedly taken by or on behalf of the corporation that is, and at the

time such act or transaction was purportedly taken would have been, within the power of a corporation…, but is void or voidable

due to a failure of authorization.” A “Failure of authorization” is defined in Section 204(h)(2) to mean: “(i)

the failure to authorize or effect an act or transaction in compliance with (A) the provisions of this title, (B) the certificate of incorporation

or bylaws of the corporation, or (C) any plan or agreement to which the corporation is a party or the disclosure set forth in any proxy

or consent solicitation statement, if and to the extent such failure would render such act or transaction void or voidable; or (ii) the

failure of the board of directors or any officer of the corporation to authorize or approve any act or transaction taken by or on behalf

of the corporation that would have required for its due authorization the approval of the board of directors or such officer.”

Defective corporate acts may

be ratified upon the approval of the Board and the Majority Shareholder. Section 204(d) further provides that notice of the shareholder

action must be given at least 20 days before the date of the meeting, or the date of the written stockholder consent if in lieu of a meeting,

at the address of such holder as it appears or most recently appeared, as appropriate, on the records of the corporation.

Section 204 provides that

any claim that the defective corporate act ratified hereunder is void or voidable due to the failure of authorization, or that the Court

of Chancery should declare in its discretion that a ratification in accordance with section 204 not be effective or be effective only

on certain conditions must be brought within 120 days from the applicable validation effective time, which is the Effective Date.

Resolutions Adopted and

Effective Date

On January 22, 2025, our Board

and the Majority Stockholders adopted and approved the following resolutions.

NOW, THEREFORE

BE IT RESOLVED, that the Board hereby recognizes each of the following Corporate Acts as a “defective corporate act” solely

for the purposes of Section 204 of the DGCL:

| Description of Corporate Act |

Putative Date of Corporate Act |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Norris R. Harris (Director/Chairman, CEO)

Jack R. Durland (Director, CFO, VP)

Jr. Jonathan G. Harris (Director, VP) |

May 7, 1999-April 4, 2006 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Norris R. Harris (Director)

Joseph Meuse (Director, Sole Officer)

James Fajack (Director) |

April 5, 2006-April 4, 2007 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Norris R. Harris (Director)

James Fajack (Director, Sole Officer) |

April 5, 2007-May 6, 2008 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Norris R. Harris (Director)

Joseph Meuse (Director, Sole Officer) |

May 6, 2008-March 10, 2009 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Keith Roberts (Sole Director and Officer) |

March 11, 2009 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Roxanne Rojas (Sole Director and Officer) |

March 11, 2010 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Roxanne Rojas (Director and Sole Officer)

Louis Purvis (Director) |

February 25, 2011 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Dennis Giancola (Sole Officer and Director) |

June 8, 2012-May 14, 2017 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Skylier Davis (Director, Sole Officer)

Mason Marshall (Director) |

May 15, 2017 |

|

Appointment, election or re-election, as applicable, of the following

individuals to the offices set forth next to their names is hereby ratified pursuant to Section 204 of the DGCL:

Brian Kistler (Sole Officer and Director) |

April 12, 2018 |

RESOLVED FURTHER,

that the Board hereby ratifies and affirms the Corporate Acts described in the foregoing resolutions as valid acts of the Corporation

with full force and effect as of the date on which each such Corporate Act in fact occurred;

RESOLVED FURTHER,

that the officers of the Corporation be and they hereby are authorized and directed to deliver a notice of the ratification (the “Ratification

Notice”) of the Corporate Acts to the holders of the Corporation’s capital stock, in accordance with Section 204 of the DGCL;

RESOLVED FURTHER, notwithstanding the

approval of the ratification of the Corporate Acts by stockholders, the Board may abandon the ratification of any or all of the Corporate

Acts without further action of the stockholders;

RESOLVED FURTHER,

that nothing herein shall be deemed an admission that the Corporate Acts ratified pursuant to Section 204 of the DGCL herein are defective,

void or voidable in any manner.

January 22, 2025, or the Record Date, was the

date for determining the stockholders entitled to receive notice of and to vote on this Corporate Action. This Corporate Action will effective

on the Effective Date. No further action on the part of stockholders is required to authorize or effect this Corporate Action.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth

certain information with respect to the beneficial ownership of our common stock, as of January 22, 2025, for: (i) each of our named executive

officers; (ii) each of our directors; (iii) all of our current executive officers and directors as a group; and (iv) each person, or group

of affiliated persons, known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock.

Except as indicated in footnotes

to this table, we believe that the stockholders named in this table will have sole voting and investment power with respect to all shares

of common stock shown to be beneficially owned by them, based on information provided to us by such stockholders. Unless otherwise indicated,

the address for each director and executive officer listed is: c/o OneSolution Technology Inc., Unit 1813, 18/F, Fo Tan Industrial Centre,

26-28 Au Pui Wan Street, Fo Tan, Hong Kong.

| | |

Common Stock Beneficially Owned | | |

Series C Preferred Stock Owned | |

| Name and Address of Beneficial Owner | |

Number of Shares

and Nature of

Beneficial

Ownership | | |

Percentage of

Total Common

Equity (1) | | |

Number of Shares

and Nature of

Beneficial

Ownership | | |

Percentage of

Total Series C Preferred

Equity (1) | |

| WONG Nga Yin Polin | |

| – | | |

| – | | |

| – | | |

| – | |

| LAU Ping Kee | |

| – | | |

| – | | |

| – | | |

| – | |

| All executive officers and directors as a Group (2 persons) | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| 5% or Greater Stockholders: | |

| | | |

| | | |

| | | |

| | |

| Silver Bloom Properties Limited (3) | |

| 2,126,865,672 | | |

| 37.770% | | |

| – | | |

| – | |

| TRX Fundco Inc. (4) | |

| 875,000,000 | | |

| 15.128% | | |

| – | | |

| – | |

| FU Wah (2) | |

| 708,955,224 | | |

| 12.257% | | |

| – | | |

| – | |

| Lee Ying Chiu Herbert (5) | |

| – | | |

| – | | |

| 30,000,000 | | |

| 100% | |

| All 5% or Greater Stockholders | |

| 3,710,820,896 | | |

| 65.155% | | |

| 30,000,000 | | |

| 100% | |

________________

| (1) |

|

Applicable percentage ownership is based on 6,650,786,818 shares of common stock outstanding as of January 22, 2025, together with securities exercisable or convertible into shares of common stock within 60 days of January 22, 2025. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that a person has the right to acquire beneficial ownership of upon the exercise or conversion of options, convertible stock, warrants or other securities that are currently exercisable or convertible or that will become exercisable or convertible within 60 days of January 22, 2025, are deemed to be beneficially owned by the person holding such securities for the purpose of computing the number of shares beneficially owned and percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| (2) |

|

Fu Wah served as our Chief Executive Officer, Secretary and director from December 15, 2021,to April 12, 2024. |

| (3) |

|

Lung Yuen is the sole shareholder and director of Silver Bloom Properties Limited. |

| (4) |

|

Kevin Price is the Chief Executive Officer of TRX Fundco Inc. |

| (5) |

|

Lee Ying Chiu Herbert holds 30,000,000 shares of our Series C Preferred Stock. Each one share of Series C Preferred Stock converts into 100 shares of common stock of the Company at the election of the holder, subject to equitable adjustments. |

FORWARD-LOOKING STATEMENTS

This Information Statement

may contain certain “forward-looking” statements (as that term is defined in the Private Securities Litigation Reform Act

of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing our expectations or beliefs

regarding our company. These forward- looking statements include, but are not limited to, statements regarding our business,

anticipated financial or operational results and objectives. For this purpose, any statements contained herein that are not

statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words

such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,”

“could,” “estimate,” “might,” or “continue” or the negative or other variations thereof

or comparable terminology are intended to identify forward-looking statements. These statements, by their nature, involve substantial

risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important

factors, including factors discussed in this and other filings of ours with the Securities and Exchange Commission.

GENERAL INFORMATION

KRFG will pay all costs associated

with the distribution of this Information Statement, including the costs of printing and mailing. KRFG will reimburse brokerage firms

and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial

owners of KRFG’s common stock.

KRFG will deliver only one

Information Statement to multiple security holders sharing an address unless KRFG has received contrary instructions from one or more

of the security holders. Upon written or oral request, KRFG will promptly deliver a separate copy of this Information Statement and any

future annual reports and information statements to any security holder at a shared address to which a single copy of this Information

Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements

to any security holder or holders sharing an address to which multiple copies are now delivered. You should direct any such

requests to the following address: c/o King Resources, Inc., Unit 1813, 18/F, Fo Tan Industrial Centre, 26-28 Au Pui Wan Street,

Fo Tan, Hong Kong, Attn: Secretary. The Secretary may also be reached by telephone at +852 3585 8905.

ADDITIONAL AND AVAILABLE INFORMATION

KRFG is subject to the informational

filing requirements of the Exchange Act and, in accordance therewith, is required to file periodic reports, proxy statements and other

information with the SEC relating to its business, financial condition and other matters. Such reports, proxy statements and other information

can be inspected and copied at the public reference facility maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Information

regarding the public reference facilities may be obtained from the SEC by telephoning 1-800-SEC-0330. Our filings are also

available to the public on the SEC’s website (www.sec.gov).

| Dated: February 6,

2025 |

By order of the Board of Directors

/s/ WONG Nga Yin Polin

By: WONG Nga Yin Polin

Its: Chief Executive Officer, Secretary and Director |

Exhibit 1: Form of Certificate of Amendment of the Company*.

* Filed herewith

Exhibit 1

STATE

OF DELAWARE

CERTIFICATE

OF AMENDMENT

OF THE

AMENDED AND RESTATED Certificate OF INCORPORATION

OF

ONESOLUTION

TECHNOLOGY INC.

(Pursuant to Section 242 of the

General Corporation Law of the State of Delaware)

OneSolution Technology Inc.,

a corporation organized and existing under and by virtue of the provisions of the General Corporation Law of the State of Delaware (the

“General Corporation Law”),

DOES HEREBY CERTIFY:

FIRST: That resolutions

were duly adopted by the Board of Directors of the Corporation setting forth a proposed amendment to the Amended and Restated Certificate

of Incorporation of the Corporation, and declaring said amendment to be advisable and recommended for approval by the stockholders of

the Corporation. The resolutions setting forth the proposed amendment are as follows:

RESOLVED FURTHER,

that Article I of the Amended and Restated Certificate of Incorporation of the Corporation shall be amended and restated as follows:

The name of this

corporation is King Resources, Inc. (the “Corporation”).

RESOLVED FURTHER,

that Article IV of the Amended and Restated Certificate of Incorporation of the Corporation shall be amended by adding the following

immediately after the first paragraph of Article IV:

Upon the filing

and effectiveness (the “Effective Time”) pursuant to the Delaware General Corporation Law of this Certificate of Amendment

to the Amended and Restated Certificate of Incorporation of the Corporation, each ten thousand (10,000) shares of Common Stock issued

and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders

thereof, be combined and converted into one (1) share of Common Stock (the “Reverse Stock Split”). No fractional shares shall

be issued in connection with the Reverse Stock Split but shall be rounded up to the nearest whole number. Each record that immediately

prior to the Effective Time represented shares of Common Stock (“Old Records”), shall thereafter represent that number of

shares of Common Stock into which the shares of Common Stock represented by the Old Records shall have been combined, subject to the elimination

of fractional share interests as described above. The Reverse Stock Split shall have no effect on the authorized amount or par value of

the Common Stock.

SECOND: That pursuant

to resolution of its Board of Directors, the written consent of the stockholders of the Corporation was obtained in accordance with Section 228

of the General Corporation Law of the State of Delaware, and the necessary number of shares as required by applicable law were voted in

favor of the amendment.

THIRD: That said amendment

was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF,

OneSolution Technology Inc., has caused this Certificate of Amendment to be executed by the undersigned, its authorized officer, on this

___th day of March 2025.

| |

|

| |

/s/ WONG Nga Yin Polin |

| |

WONG Nga Yin Polin

Chief Executive Officer, Chief Financial Officer and Secretary |

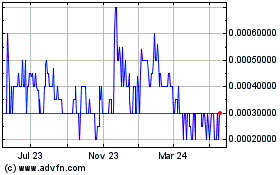

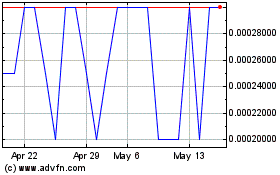

King Resources (PK) (USOTC:KRFG)

Historical Stock Chart

From Jan 2025 to Feb 2025

King Resources (PK) (USOTC:KRFG)

Historical Stock Chart

From Feb 2024 to Feb 2025