Logansport Financial Corp. Reports Earnings for the Three and Twelve Months Ended December 31, 2014

12 February 2015 - 7:46AM

Business Wire

Logansport Financial Corp., (OTCBB- LOGN), parent company of

Logansport Savings Bank, reported net earnings for the three and

twelve months ended December 31, 2014.

Net earnings for the three months ended December 31, 2014

totaled $445,000, compared to the $412,000 in net earnings reported

for the three months ended December 31, 2013.

Net earnings for the year ended December 31, 2014 totaled

$1,818,000, compared to the $1,686,000 reported for the year ended

December 31, 2013. Earnings per share were $2.78 for December 31,

2014, compared to $2.58 for December 31, 2013.

The statements contained in this press release contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, which involves a number

of risks and uncertainties. A number of factors could cause results

to differ materially from the objectives and estimates expressed in

such forward-looking statements. These factors include, but are not

limited to, changes in the financial condition of issuers of the

Company’s investments and borrowers, changes in economic conditions

in the Company’s market area, changes in policies of regulatory

agencies, fluctuations in interest rates, demand for loans in the

Company’s market area, changes in the position of banking

regulators on the adequacy of our allowance for loan losses, and

competition, all or some of which could cause actual results to

differ materially from historical earnings and those presently

anticipated or projected. These factors should be considered in

evaluation any forward-looking statements, and undue reliance

should not be placed on such statements. The Company does not

undertake and specifically disclaims any obligation to update any

forward-looking statements to reflect occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements.

LOGANSPORT FINANCIAL CORP.

SELECTED FINANCIAL DATA

(Dollars in thousands except for share

data)

12/31/14

12/31/13

Total assets $ 159,697 $ 165,994 Loans receivable,

net 110,455 113,697 Allowance for loan losses 1,818 1,919 Cash and

cash equivalents 3,237 3,710 Securities available for sale 37,961

39,848 Federal Home Loan Bank stock 1,233 1,640 Equity Investment

192 252 Deposits 136,640 134,365 FHLB borrowings and note payable

1,000 12,000 Shareholders’ equity 20,976 18,527 Shares O/S end of

period 653,677 654,408 Nonperforming loans 1,391 824 Real Estate

Owned 173 203

Quarter ended 12/31

Year ended 12/31

2014

2013

2014

2013

Interest income $ 1,691 $ 1,740 $ 6,794 $ 7,023 Interest

expense 169 225 782 979 Net interest income 1,522 1,515 6,012 6,044

Provision for loan losses 45 45 75 300 Net interest income after

provision 1,477 1,470 5,937 5,744 Gain on sale of investment/assets

16 - 16 27 Gain/Loss on sale of REO - - 3 18 Gain on sale of loans

43 76 115 146 Loss on equity investment (15) (6) (60) (24) Other

income 155 71 618 514 Total general, admin & other expense

1,006 954 3,887 3,885 Earnings before income taxes 670 657 2,742

2,540 Income tax expense 225 245 924 854 Net earnings $ 445 $ 412 $

1,818 $ 1,686

Logansport Financial Corp.Chad Higgins, Chief Financial

OfficerPhone - 574-722-3855Fax - 574-722-3857

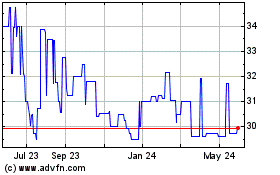

Logansport Financial (QB) (USOTC:LOGN)

Historical Stock Chart

From Jan 2025 to Feb 2025

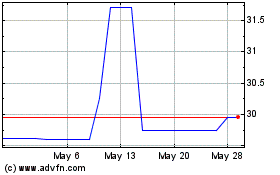

Logansport Financial (QB) (USOTC:LOGN)

Historical Stock Chart

From Feb 2024 to Feb 2025