Filed Pursuant to Rule 424(b)(2)

Registration No. 333-195271

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 14, 2014)

METHES ENERGIES INTERNATIONAL LTD.

2,300,000 Shares of Common Stock

Warrants to Purchase 1,781,292 Shares of Common Stock

We are offering up to 2,300,000 shares of our common stock, par value $.001 per share (“Common Stock”) and warrants to purchase up to 1,781,292 shares of our Common Stock in this offering (and the shares of Common Stock issuable from time to time upon exercise of these warrants). The Common Stock and warrants will be sold in units (each a “Unit”), with each Unit consisting of one share of Common Stock and a warrant to purchase 0.7745 of one share of Common Stock at an exercise price of $0.882 per share of Common Stock (“Warrant”). Each Unit will be sold at a negotiated price of $0.5435 per Unit. The shares of Common Stock and Warrants will be issued separately but can only be purchased together in this offering. Units will not be issued or certificated.

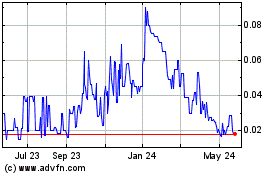

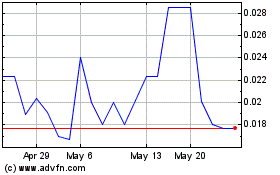

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “MEIL.” The last reported sale price of our Common Stock on June 29, 2015 was $0.77 per share. One-third of the aggregate market value of the Common Stock held by non-affiliates, computed by reference to the highest price at which a share of Common Stock was last sold within the 60-day period ending on the date hereof was $11,824,407 based on 9,853,673 outstanding shares of Common Stock held by non-affiliates. We have not sold any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on and includes the date hereof.

Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus and all information incorporated by reference therein. These documents contain information you should consider when making your investment decision.

Investing in these securities involves significant risks. Please read “Risk Factors” on page S-6 of this prospectus supplement, on page 3 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

We have retained Chardan Capital Markets, LLC to act as our exclusive placement agent in connection with the arrangement of this transaction. We have agreed to pay the placement agent the placement agent fee set forth in the table below, which assumes that we sell all of the Units we are offering. The placement agent is not required to arrange for the sale of any specific number of Units or dollar amount but will use its “reasonable best efforts” to arrange for the sale of the Units.

|

|

|

Per Share

|

|

|

Total

|

|

|

Offering price

|

|

$ |

0.5435 |

|

|

$ |

1,250,050 |

|

|

Placement agent fees (1)

|

|

$ |

0.04348 |

|

|

$ |

100,004 |

|

|

Proceeds, before expenses, to us

|

|

$ |

0.50002 |

|

|

$ |

1,115,046 |

|

| (1) |

We have agreed to reimburse the placement agent for its expenses up to an amount equal to $25,000. In addition, we have agreed to pay the placement agent a cash fee equal to 8% of the gross proceeds received in this offering. See “Plan of Distribution” on page S-12 of this prospectus supplement for more information regarding these arrangements.

|

We estimate the total expenses of this offering, excluding the placement agent fees, will be approximately $70,000. Because there is no minimum offering amount required as a condition to closing in this offering, the actual offering amount, the placement agent fees and net proceeds to us, if any, in this offering may be substantially less than the maximum offering amounts set forth above.

We expect to deliver the securities being offered pursuant to this prospectus supplement on or about June 30, 2015.

Chardan Capital Markets, LLC

The date of this prospectus supplement is June 29, 2015.

TABLE OF CONTENTS

Prospectus Supplement

| |

|

|

Page |

|

|

ABOUT THIS PROSPECTUS SUPPLEMENTS

|

|

|

S-1 |

|

| |

|

|

|

|

|

CAUTIONARY STATEMENT ABOUT FORWARD LOOKING INFORMATION

|

|

|

S-2 |

|

| |

|

|

|

|

|

PROSPECTUS SUMMARY

|

|

|

S-3 |

|

| |

|

|

|

|

|

THE OFFERING

|

|

|

S-4 |

|

| |

|

|

|

|

|

RISK FACTORS

|

|

|

S-6 |

|

| |

|

|

|

|

|

USE OF PROCEEDS

|

|

|

S-9 |

|

| |

|

|

|

|

|

DILUTION

|

|

|

S-10 |

|

| |

|

|

|

|

|

DESCRIPTION OF SECURITIES

|

|

|

S-11 |

|

| |

|

|

|

|

|

PLAN OF DISTRIBUTION

|

|

|

S-12 |

|

| |

|

|

|

|

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

|

|

S-14 |

|

| |

|

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

S-14 |

|

| |

|

|

|

|

|

INFORMATION INCORPORATED BY REFERENCE

|

|

|

S-15 |

|

TABLE OF CONTENTS

Prospectus

| |

|

|

Page |

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

1 |

|

| |

|

|

|

|

|

FORWARD-LOOKING STATEMENTS

|

|

|

2 |

|

| |

|

|

|

|

|

PROSPECTUS SUMMARY

|

|

|

2 |

|

| |

|

|

|

|

|

RISK FACTORS

|

|

|

3 |

|

| |

|

|

|

|

|

THE COMPANY

|

|

|

3 |

|

| |

|

|

|

|

|

USE OF PROCEEDS

|

|

|

4 |

|

| |

|

|

|

|

|

DESCRIPTION OF DEBT SECURITIES WE MAY OFFER

|

|

|

4 |

|

| |

|

|

|

|

|

DESCRIPTION OF PREFERRED STOCK WE MAY OFFER

|

|

|

11 |

|

| |

|

|

|

|

|

DESCRIPTION OF COMMON STOCK WE MAY OFFER

|

|

|

13 |

|

| |

|

|

|

|

|

DESCRIPTION OF WARRANTS WE MAY OFFER

|

|

|

14 |

|

| |

|

|

|

|

|

DESCRIPTION OF UNITS WE MAY OFFER

|

|

|

15 |

|

| |

|

|

|

|

|

PLAN OF DISTRIBUTION

|

|

|

15 |

|

| |

|

|

|

|

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

|

|

16 |

|

| |

|

|

|

|

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

|

|

17 |

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the “SEC,” using a “shelf” registration process. This document contains two parts. The first part consists of this prospectus supplement, which provides you with specific information about this offering. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined.

In this prospectus supplement, the “Company,” “Methes,” “we,” “us” and “our” and similar terms refer to Methes Energies International Ltd. and its subsidiaries. References to our “common stock” refer to the common stock of Methes Energies International Ltd.

This prospectus supplement, and the information incorporated herein by reference, may add, update or change information in the accompanying prospectus. You should read both this prospectus supplement and the accompanying prospectus together with additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” If there is any inconsistency between the information in this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference to this prospectus supplement and the accompanying prospectus. Neither we nor the underwriter have authorized any other person to provide information different from that contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in the prospectus and this prospectus supplement is accurate as of the dates on their respective covers, regardless of time of delivery of the prospectus and this prospectus supplement or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

All references in this prospectus supplement to our consolidated financial statements include, unless the context indicates otherwise, the related notes.

The industry and market data and other statistical information contained in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe these sources are reliable, we have not independently verified the information. None of the independent industry publications used in this prospectus supplement, the accompanying prospectus or the documents we incorporate by reference were prepared on our or our affiliates’ behalf and none of the sources cited by us consented to the inclusion of any data from its reports, nor have we sought their consent.

CAUTIONARY STATEMENT ABOUT FORWARD LOOKING INFORMATION

Certain information set forth in this prospectus supplement, set forth in the accompanying prospectus or incorporated by reference herein or therein, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “would,” “could,” “seek,” “intend,” “plan,” “estimate,” “goal,” “anticipate,” “project” or other comparable terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including those risks and uncertainties included in this prospectus supplement under the caption “Risk Factors,” and those risks and uncertainties described in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. We urge you to consider those risks and uncertainties in evaluating our forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. We further caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. Except as otherwise required by the federal securities laws, we disclaim any obligation or undertaking to publicly release any updates or revisions to any forward-looking statement contained herein or in the accompanying prospectus (or elsewhere) to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

|

|

PROSPECTUS SUMMARY

The information below is only a summary of more detailed information included elsewhere in or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary may not contain all the information that is important to you or that you should consider before making a decision to invest in our common stock. Please read this entire prospectus supplement and the accompanying prospectus, including the risk factors, as well as the information incorporated by reference in this prospectus supplement and the accompanying prospectus, carefully.

About Methes Energies International Ltd.

Methes Energies International Ltd. (NASDAQ: MEIL) is a renewable energy company that offers a variety of products and services to biodiesel fuel producers, including Denami® biodiesel processors that are unique, compact, fully automated and state-of-the-art, which can produce biodiesel from a wide variety of feedstocks in a continuous flow process. It also offers pre-treatment equipment and its proprietary PP-MEC Catalyst that enable various feedstocks, including non-food grade corn oil, to be converted into biodiesel more efficiently, with less catalyst, increased yields and without separate degumming or wax removal, than other pre-treatment processes. In the case of biodiesel produced from corn oil, PP-MEC Catalyst also eliminates the red coloration, an undesirable feature causing confusion between red biodiesel for off-road use and biodiesel saleable for use in on-road vehicles. In addition, Methes expects to start offering Epoxidized Soybean Oil (“ESO”) and natural polyol before the end of 2015.

Methes markets and sells biodiesel fuel produced at its 13 million gallons per year (mgy) facility in Sombra, Ontario, to customers in U.S. and Canada, as well as providing multiple biodiesel fuel solutions to its clientele. Among Methes’ services are selling commodities to its network of biodiesel producers, selling their biodiesel production, providing clients with proprietary software to operate and control their processors. Methes also remotely monitors the quality and characteristics of its clients' biodiesel production, upgrades and repairs their processors and advises clients on adjusting their processes to use varying feedstock to improve the quality of their biodiesel.

Network members produce biodiesel through use of Denami 600 processors purchased from Methes, which have a maximum rated capacity of 1.3 mgy of biodiesel. Methes now offers new network members its Denami3000 processors, designed to produce up to 6.5 mgy of biodiesel. Denami processors are designed to meet the needs of 2 to 20 mgy biodiesel producers. Methes believes that these small and medium-scale producers will be the fastest growing segment of the biodiesel market. Its processors are flexible and can use a variety of virgin vegetable oils, used vegetable oil and rendered animal fat feedstock, allowing operators to take advantage of feedstock buying opportunities and, through use of the PP-MEC Catalyst can more efficiently convert certain feedstocks into biodiesel. Denami processors can be easily retrofitted to take full advantage of the PP-MEC Catalyst, have low production and labor costs, minimize electrical use and utilize water only in closed loop components for cooling purposes. The absence of waste water discharge has facilitated obtaining environmental permits for Methes’ facilities and those of its customers.

Currently, Methes’ Sombra facility is idle because of a lack of demand for biodiesel at favorable prices. On May 29, 2015, the U.S. Environmental Protection Agency (EPA) announced new preliminary requirements for use of biodiesel in 2015, 2016 and 2017. Methes believes that when these minimum requirements are finalized later this year, it will increase demand for biodiesel and may improve market prices.

ESO and Natural Polyol

Methes expects to start producing and offering ESO and natural polyol from its Sombra facility before the end of 2015. The Denami 3000 processors at its Sombra facility are being adapted for the production of ESO and natural polyol with minimal capital expenditure. Methes believes that the demand for both ESO and natural polyol are increasing and now accounts for a combined market value in excess of one Billion dollars in North America. Both ESO and natural polyol help address growing global demand for the replacement of non-sustainable products, with natural or “green” products across a wide range of industries. ESO can be used, among other things, in the production of polyvinyl chloride (PVC) plastics and natural polyol in the production of paints, coatings, moldings (cast plastic parts or items) as well as insulating foams.

Recent Sale of Denami 600 and PP-MEC Pre-treatment System

In March 2015, Methes sold the Denami 600 biodiesel processor located at its Mississauga facility and a PP-MEC pre-treatment system to an Ontario based biodiesel producer. Upon completion of installation at the purchaser’s facility, the equipment will be the first fully operational Denami processor with a PP-MEC pre-treatment system. The purchaser has agreed to allow Methes to use its facility as a demonstration site to promote future sales of the Denami processors with the PP-MEC pre-treatment system.

Corporate Information

Methes was organized as Global Biodiesel Ltd. on June 27, 2007 under the laws of the state of Nevada. On September 5, 2007, Methes purchased all the outstanding shares of Methes Energies Canada, Inc. (“Methes Canada”), an Ontario (Canada) corporation incorporated in December 2004 in exchange for 1,303,781 shares of its common stock, plus an additional 441,982 shares issued to retire debt of that corporation. On October 11, 2007 Global Biodiesel Ltd. changed its name to Methes Energies International, Ltd.

Our principal executive office is located at 3651 Lindell Road, Suite D-272, Las Vegas, Nevada, 89103 and our telephone number is (702) 932-9964. Our web address is www.methes.com. None of the information on our website is part of this prospectus.

|

|

|

THE OFFERING

|

| |

Issuer:

|

|

Methes Energies International Ltd.

|

|

| |

|

|

|

|

| |

Shares of Common Stock offered by us:

|

|

2,300,000 shares.

|

|

| |

Shares of Common Stock outstanding after the offering (1):

|

|

13,810,431 shares.

|

|

| |

Warrants offered by us:

|

|

Warrants to purchase 1,781,292 shares of Common Stock will be offered in this offering. The Warrants will be exercisable during the period commencing six months after the date of original issuance and ending 5 years from the initial date that the Warrants become exercisable, with the exercise price being $0.882 per share of Common Stock. This prospectus supplement also relates to the offering of the shares of Common Stock issuable upon exercise of the Warrants.

|

|

| |

Use of proceeds:

|

|

Any net proceeds we may receive will be used for working capital and general corporate purposes. See “Use of Proceeds.”

|

|

| |

NASDAQ Listing:

|

|

Our Common Stock is listed on the Nasdaq Capital Market under the symbol "MEIL."

|

|

| |

Risk factors:

|

|

Investing in our Common Stock involves a high degree of risk and purchasers of our Common Stock may lose their entire investment. See “Risk Factors” and the other information included and incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of risk factors you should carefully consider before deciding to invest in our securities.

|

|

| |

(1)

|

The number of shares of our Common Stock to be outstanding after this offering is based on 11,510,431 shares of our Common Stock outstanding as of June 29, 2015. This number does not include:

|

|

| |

●

|

91,264 shares of our Common Stock issuable upon exercise of warrants at an exercise price of $5.00 per share;

|

|

| |

●

|

286,829 shares of our Common Stock issuable upon exercise of stock options granted under our 2008 Amended and Restated Directors, Officers and Employees Stock Option Plan at an exercise price of $3.84 per share;

|

|

| |

●

|

39,986 shares of our Common Stock issuable upon exercise of stock options granted under our 2008 Amended and Restated Directors, Officers and Employees Stock Option Plan, at an exercise price of $7.67 per share;

|

|

| |

●

|

100,000 shares of our Common Stock issuable upon exercise of stock options granted under our 2012 Amended and Restated Directors, Officers and Employees Stock Option Plan, at an exercise price of $3.94 per share;

|

|

| |

●

|

1,627,191 shares of our Common Stock issuable upon exercise of warrants at an exercise price of $4.00 per share;

|

|

| |

●

|

the shares which may be issued upon the exercise of warrants for an aggregate of 106,116 Common Stock Units (each a “Common Stock Unit”), at an exercise price of $2.00 per Common Stock Unit, which were issued to the placement agents for our private offering in November. Each Common Stock Unit consists of one share of Common Stock and one warrant to purchase one share of Common Stock at an exercise price of $4.00;

|

|

| |

●

|

the shares of our Common Stock issuable upon exercise of warrants to for an aggregate of 56,000 Units (each an “IPO Unit”), at an exercise price of $6.00 per IPO Unit, which were issued to the underwriters of the initial public offering we consummated in October 2012. Each IPO Unit consists of (i) one share of our Common Stock, (ii) one Class A warrant to purchase one share of our Common Stock at an exercise price of $7.50 (“Class A Warrant”) and one Class B warrant to purchase one share of our Common Stock at an exercise price of $10.00 (“Class B Warrant”);

|

|

| |

|

|

|

| |

●

|

the shares of our Common Stock issuable upon exercise of Class A Warrants for an aggregate of 987,000 shares at an exercise price of $7.50 per share;

|

|

| |

●

|

the shares of our Common Stock issuable upon exercise of Class B Warrants for an aggregate of 987,000 shares at an exercise price of $10.00 per share;

|

|

| |

●

|

the shares of our Common Stock issuable upon exercise of warrants to for an aggregate of 42,500 Units (each a “Private Placement Unit”), at an exercise price of $4.20 per Private Placement Unit, which were issued to the underwriters of the private offering we consummated in February 2013. Each Private Placement Unit consists of (i) one share of our Common Stock, (ii) one Class A Warrant and one Class B Warrant;

|

|

| |

●

|

the shares of our Common Stock issuable upon conversion of 84,033 outstanding shares of Methes’ Series A-1 10% Cumulative Convertible Preferred Stock (“Series A-1 Preferred Stock”);

|

|

| |

●

|

the shares of our Common Stock issuable upon conversion of 101,252 outstanding shares of Methes’ Series A-2 10% Cumulative Convertible Preferred Stock (“Series A-2 Preferred Stock”);

|

|

| |

●

|

the shares of our Common Stock issuable upon exercise of warrants to purchase 13,865 Series A-1 Preferred Stock units at an exercise price of $2.38 per unit, each unit consisting of one share of Series A-1 Preferred Stock and one warrant exercisable for one share of Common Stock at an exercise price of $4.00 per share; and

|

|

| |

●

|

the shares of our Common Stock issuable upon exercise of warrants to purchase 12,213 Series A-2 Preferred Stock unit at an exercise price of $2.40 per unit, each consisting of one share of Series A-2 Preferred Stock and one warrant exercisable for one share of Common Stock at an exercise price of $4.00 per share.

|

|

| |

|

|

RISK FACTORS

Investing in our securities involves risk. See the risk factors described in our Annual Report on Form 10-K for our most recent fiscal year (together with any material changes thereto contained in subsequent filed Quarterly Reports on Form 10-Q) those contained in our other filings with the SEC, which are incorporated by reference in this prospectus supplement and the risks described below.

Our management team has no experience in the production or sale of natural polyol or ESO which increases the risk that we will not be able to produce and sell these compounds successfully.

Our current business plan contemplates that we will begin producing and selling ESO and natural polyol before the end of 2015. We are highly dependent on our management team to adapt our Sombra plant to the production of these compounds and to produce ESO that conforms to specified standards for this commodity and natural polyol formulated to meet the specific needs of customers wishing to use natural polyol rather than natural polyol produced from petroleum based compounds. Though our management team believes that the Denami 3000 processors at our Sombra facility can be easily adapted to the production ESO and natural polyol at very limited capital cost, they have no background or experience in such adaptation and there is a high level of risk that our equipment cannot be adapted to produce products meeting industry standards or customer needs and that our management may not be successful in overseeing and managing the production process.

There is currently only a limited market for natural or “green” polyol and we may be unable to find customers to buy the natural polyol that we are capable to producing.

Polyol, a widely used industrial compound, is generally produced from petroleum compounds. The market for natural or green polyol is currently limited and customer requirements are largely met with natural polyol imported from a single German producer. While management believes that there is growing demand for natural polyol and that increasing numbers of producers of certain molded plastic products, paints and coating will seek to substitute natural polyol for petroleum based polyol there can be no assurance that this will occur. While Methes has retained consultants to identify customers and potential customers for natural polyol, their efforts may not be successful and Methes may be unable to sell the natural polyol that it can produce.

Resales of our Common Stock in the public market during this offering by our stockholders may cause the market price of our Common Stock to fall.

The issuance of new shares of our Common Stock in this offering could result in resales of our Common Stock by our current stockholders concerned about the potential dilution of their holdings. In turn, these resales could have the effect of depressing the market price for our Common Stock. A substantial majority of the outstanding shares of our Common Stock are, and all of the shares sold in this offering upon issuance will be, freely tradable without restriction or further registration under the Securities Act.

Future sales of our Common Stock could cause our stock price to decline.

If our stockholders sell substantial amounts of our Common Stock in the public market, the market price of our Common Stock could decrease significantly. The perception in the public market that our stockholders might sell shares of our Common Stock could also depress the market price of our Common Stock. We have registered $8,423,202 in total aggregate value of securities pursuant to a Form S-3 filing (which includes the securities being offered herein), which will be eligible for sale in the public markets from time to time, when sold and issued by us. Additionally, if our existing stockholders sell, or indicate an intent to sell, substantial amounts of our Common Stock in the public market, the trading price of our Common Stock could decline significantly. The market price for shares of our Common Stock may drop significantly when such securities are sold in the public markets. A decline in the price of shares of our Common Stock might impede our ability to raise capital through the issuance of additional shares of our Common Stock or other equity securities.

As a new investor, you will incur substantial dilution as a result of this offering and future equity issuances, and as a result, our stock price could decline.

The offering price is substantially higher than the net tangible book value per share of our outstanding Common Stock. As a result, based on our net tangible book value as of February 28, 2015 of approximately $3.9 million or $0.34 per share of Common Stock, investors purchasing Common Stock in this offering will incur immediate dilution of $0.1817 per share of Common Stock purchased. See “Dilution” on page S-10 of this prospectus supplement for a more detailed discussion of the dilution you will incur in this offering.

We are generally not restricted from issuing additional Common Stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, Common Stock. The market price of our Common Stock could decline as a result of sales of Common Stock or securities that are convertible into or exchangeable for, or that represent the right to receive, Common Stock after this offering or the perception that such sales could occur.

You may experience future dilution as a result of future equity offerings or other equity issuances.

We may in the future issue additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock. We cannot assure you that we will be able to sell shares or other securities in any other offering or other transactions at a price per share that is equal to or greater than the price per share paid by investors in this offering. The price per share at which we sell additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock in future transactions may be higher or lower than the price per share in this offering.

We currently have a sporadic, illiquid and volatile market for our Common Stock, and the market for our Common Stock is and may remain sporadic, illiquid and volatile in the future.

We currently have a highly sporadic, illiquid and volatile market for our Common Stock, which market is anticipated to remain sporadic, illiquid and volatile in the future. Factors that could affect our stock price or result in fluctuations in the market price or trading volume of our Common Stock include:

● quarterly variations in the rate of growth of our financial indicators, such as net income per share, net income and cash flows, or those of companies that are perceived to be similar to us;

● changes in revenue, cash flows or earnings estimates or publication of reports by equity research analysts;

● speculation in the press or investment community;

● public reaction to our press releases, announcements and filings with the SEC;

● sales of our Common Stock by us or other stockholders, or the perception that such sales may occur;

● the realization of any of the risk factors presented in this prospectus;

● the recruitment or departure of key personnel;

● commencement of, or involvement in, litigation;

● changes in market valuations of companies similar to ours; and

● domestic and international economic, legal and regulatory factors unrelated to our performance.

Our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. The stock markets in general have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our Common Stock. Additionally, general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations may adversely affect the market price of our Common Stock. Due to the limited volume of our shares which trade, we believe that our stock prices (bid, ask and closing prices) may not be related to our actual value, and not reflect the actual value of our Common Stock. Stockholders and potential investors in our Common Stock should exercise caution before making an investment in us.

Additionally, as a result of the illiquidity of our Common Stock, investors may not be interested in owning our Common Stock because of the inability to acquire or sell a substantial block of our Common Stock at one time. Such illiquidity could have an adverse effect on the market price of our Common Stock. In addition, a stockholder may not be able to borrow funds using our Common Stock as collateral because lenders may be unwilling to accept the pledge of securities having such a limited market. We cannot assure you that an active trading market for our Common Stock will develop or, if one develops, be sustained.

An active liquid trading market for our Common Stock may not develop in the future.

Our Common Stock currently trades on the NASDAQ, although our Common Stock’s trading volume is very low (the average daily volume was approximately 59,000 shares for the prior three months). Liquid and active trading markets usually result in less price volatility and more efficiency in carrying out investors’ purchase and sale orders. However, our Common Stock may continue to have limited trading volume, and many investors may not be interested in owning our Common Stock because of the inability to acquire or sell a substantial block of our Common Stock at one time. Such illiquidity could have an adverse effect on the market price of our Common Stock. In addition, a stockholder may not be able to borrow funds using our Common Stock as collateral because lenders may be unwilling to accept the pledge of securities having such a limited market. We cannot assure you that an active trading market for our Common Stock will develop or, if one develops, be sustained.

We have broad discretion in how we use the net proceeds of this offering, and we may not use these proceeds effectively or in ways with which you agree.

Our management will have broad discretion as to the application of the net proceeds of this offering and could use them for purposes other than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase the market price of our Common Stock.

Because we are a small company, the requirements of being a public company, including compliance with the reporting requirements of the Exchange Act and the requirements of the Sarbanes-Oxley Act and the Dodd-Frank Act, may strain our resources, increase our costs and distract management, and we may be unable to comply with these requirements in a timely or cost-effective manner.

As a public company with listed equity securities, we must comply with the federal securities laws, rules and regulations, including certain corporate governance provisions of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and the Dodd-Frank Act, related rules and regulations of the SEC and the NASDAQ, with which a private company is not required to comply. Complying with these laws, rules and regulations will occupy a significant amount of time of our Board of Directors and management and will significantly increase our costs and expenses, which we cannot estimate accurately at this time. Among other things, we must:

● establish and maintain a system of internal control over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the related rules and regulations of the SEC and the Public Company Accounting Oversight Board;

● comply with rules and regulations promulgated by the NASDAQ;

● prepare and distribute periodic public reports in compliance with our obligations under the federal securities laws;

● maintain various internal compliance and disclosures policies, such as those relating to disclosure controls and procedures and insider trading in our Common Stock;

● involve and retain to a greater degree outside counsel and accountants in the above activities;

● maintain a comprehensive internal audit function; and

● maintain an investor relations function.

Securities analysts may not cover our Common Stock and this may have a negative impact on our Common Stock’s market price.

The trading market for our Common Stock will depend, in part, on the research and reports that securities or industry analysts publish about us or our business. We do not have any control over independent analysts (provided that we have engaged various non-independent analysts). We do not currently have and may never obtain research coverage by independent securities and industry analysts. If no independent securities or industry analysts commence coverage of us, the trading price for our Common Stock would be negatively impacted. If we obtain independent securities or industry analyst coverage and if one or more of the analysts who covers us downgrades our Common Stock, changes their opinion of our shares or publishes inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for our Common Stock could decrease and we could lose visibility in the financial markets, which could cause our stock price and trading volume to decline.

USE OF PROCEEDS

We intend to use the estimated net proceeds from the sale of these securities to market and sell our PP-MEC Pre-Treatment Systems and to adapt our Sombra plant for the production of ESO and natural polyol, and for working capital and general corporate purposes. General corporate purposes may include capital expenditures, development costs, strategic investments, regularly scheduled debt payments or possible acquisitions. We have not yet determined the amount of net proceeds to be used specifically for any particular purposes or the timing of these expenditures. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds from the sale of these securities.

DILUTION

Our net tangible book value as of February 28, 2015, was approximately $3.9 million or $0.34 per share of Common Stock. Net tangible book value per share represents total tangible assets less total liabilities, divided by the number of shares of Common Stock outstanding. After giving effect to our sale of 2,300,000 shares of Common Stock in this offering at the public offering price of $0.5435 per share, and after deduction of the placement agent’s fees and estimated offering expenses payable by us, our net tangible book value as of February 28, 2015, would have been approximately $4,995,952, or $0.36 per share. This represents an immediate increase in net tangible book value of $0.02 per share to existing stockholders and an immediate dilution in net tangible book value of $0.1817 per share to purchasers of Common Stock in this offering. The following table illustrates this calculation.

|

Public offering price per share of Common Stock

|

|

|

|

|

$

|

0.5435

|

|

|

Net tangible book value per share as of February 28, 2015

|

|

$

|

0.34

|

|

|

|

|

|

|

Increase per share attributable to this offering

|

|

$

|

0.02

|

|

|

|

|

|

|

As adjusted tangible book value per share after this offering

|

|

|

|

|

|

$

|

0.36

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

|

|

$

|

0.1817

|

|

The number of shares of Common Stock outstanding in the table and calculations above is based on 11,510,431 shares outstanding as of February 28, 2015.

DESCRIPTION OF SECURITIES

In this offering, we are offering a maximum of 2,300,000 Units, each consisting of (i) one share of our Common Stock and (ii) a Warrant to purchase 0.7745 shares of our Common Stock at an exercise price of $0.882 per share.

Units will not be issued or certificated. The shares of Common Stock and Warrants are immediately separable and will be issued separately. This prospectus supplement also relates to the offering of shares of our Common Stock issuable upon exercise, if any, of the Warrants.

Common Stock

The description of our Common Stock is contained in our Registration Statement on Form S-1, filed on June 22, 2012, including any further amendment or report filed hereafter for the purpose of updating such description.

Warrants

The following is a brief summary of the material terms of the Warrant and is subject in all respects to the provisions contained in the Warrant. The form of Warrant will be filed with a Current Report on Form 8-K and reference is made thereto for a complete description of the Warrant.

Exercise Price. The exercise price per share of Common Stock purchasable upon exercise of the Warrants is $0.882 per share of Common Stock being purchased. If we, at any time while the warrants are outstanding, pay a stock dividend on our Common Stock or otherwise make a distribution on any class of capital stock that is payable in shares of our Common Stock, subdivide outstanding shares of our Common Stock into a larger number of shares or combine the outstanding shares of our Common Stock into a smaller number of shares, then, the number, class and type of shares available under the Warrants and the exercise price will be correspondingly adjusted to give the holder of the Warrant, on exercise for the same aggregate exercise price, the total number, class, and type of shares or other property as the holder would have owned had the Warrant been exercised prior to the event and had the holder continued to hold such shares until the event requiring adjustment.

Exercisability. Warrants may be exercised beginning on the date that is six months after the date of original issuance and at any time up to the date that is 5 years from the initial date that the warrants become exercisable.

Cashless Exercise. If at any time during the warrant exercisability period the fair market value of our Common Stock exceeds the exercise price of the Warrant and the issuance of shares of our Common Stock upon exercise of the Warrant is not covered by an effective registration statement, the holder is permitted to effect a cashless exercise of the Warrant (in whole or in part) by having the holder surrendering the Warrant to us, together with delivery to us of a duly executed exercise notice, canceling a portion of the Warrant in payment of the purchase price payable in respect of the number of shares of our Common Stock purchased upon such exercise.

Transferability. The Warrant may be transferred at the option of the holder upon surrender of the Warrant with the appropriate instruments of transfer.

Exchange Listing. We do not plan on making an application to list the Warrants on the NASDAQ Capital Market, any national securities exchange or other nationally recognized trading system.

Rights as a Stockholder. Except by virtue of such holder’s ownership of shares of our Common Stock, the holders of the Warrants do not have the rights or privileges of holders of our Common Stock, including any voting rights, until they exercise their Warrants; provided, however, that if we choose to engage in a rights offering or make a distribution of our assets to our common stockholders as a class, the holders of the Warrants will have the right to participate in such distributions as if they had exercised the warrants.

Fundamental Transactions. The Warrants will survive our acquisition or similar fundamental change of control transaction. In addition, if we are acquired, the holders of the Warrants will have the right to require us or our successor to repurchase the Warrants at their then-current Black-Scholes option value.

Limits on Exercise of Warrants. Except upon at least 61 days’ prior notice from the holder to us, the holder will not have the right to exercise any portion of the Warrant if the holder, together with its affiliates, would beneficially own in excess of 4.99% of the number of shares of our Common Stock (including securities convertible into Common Stock) outstanding immediately after the exercise; provided, however, that the holder may not increase this limitation at any time in excess of 9.99%.

PLAN OF DISTRIBUTION

Pursuant to a placement agency agreement between us and Chardan Capital Markets, LLC (“Chardan Capital”) we have engaged Chardan Capital as our exclusive placement agent to solicit offers to purchase the Units in this offering. The placement agent is not purchasing or selling any of the Units we are offering, and it is not required to arrange the purchase or sale of any specific number of Units or dollar amount, but it has agreed to use commercially reasonable efforts to arrange for the sale of the Units. The placement agent may retain sub-agents and selected dealers in connection with this offering.

The placement agent proposes to arrange for the sale of the Units we are offering pursuant to this prospectus supplement to one or more investors through securities purchase agreements directly between the purchasers and us. All of the Units will be sold at the same price and, we expect, at a single closing. We established the price following negotiations with prospective investors and the placement agent and with reference to the prevailing market price of our Common Stock, recent trends in such price and other factors. It is possible that not all of the Units we are offering pursuant to this prospectus supplement will be sold at the closing, in which case our net proceeds would be reduced. We anticipate that the sale of the Units will be completed on the date indicated on the cover page of this prospectus supplement, subject to customary closing conditions. On the closing date, the following will occur:

| |

●

|

we will receive funds in the amount of the aggregate purchase price;

|

| |

●

|

Chardan Capital, as placement agent, will receive the placement agent fees in accordance with the terms of the placement agency agreement; and

|

| |

●

|

we will deliver the shares and warrants to the investors.

|

In connection with this offering, the placement agent may distribute this prospectus supplement and the accompanying prospectus electronically.

We will pay the placement agent cash fees equal to (i) eight percent (8%) of the gross proceeds from the sale of the Units in this offering. We have also agreed to reimburse Chardan Capital for its expenses in connection with this offering up to $25,000 if this offering is completed, and up to $2,500 if this offering is not completed. The following table shows the per share and total placement agent fee we will pay to the placement agent in connection with the sale of the Units, assuming the purchase of all of the Units we are offering.

Per unit $ 0.04348

Total $ 100,004

The estimated offering expenses payable by us, excluding the placement agent fees, will be approximately $70,000, which includes legal and printing costs and various other fees associated with registering and listing the Common Stock. After deducting certain fees due to the placement agent and our estimated offering expenses, we expect the net proceeds from this offering to be approximately $1.1 million.

We have agreed to indemnify the placement agent against certain liabilities, including liabilities under the Securities Act of 1933, as amended, and liabilities arising from breaches and representations and warranties contained in the placement agency agreement. We have also agreed to contribute to payments the placement agent may be required to make in respect of such liabilities.

The placement agency agreement is included as an exhibit to our Current Report on Form 8-K that we will file with the Commission in connection with this offering.

Chardan Capital may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, Chardan Capital would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by Chardan Capital acting as principal. Under these rules and regulations, Chardan Capital:

|

●

|

may not engage in any stabilization activity in connection with our securities; and

|

|

●

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

Electronic Distribution

A prospectus supplement in electronic format may be made available on websites or through other online services maintained by the placement agent of the offering, or by its affiliates. Other than the prospectus supplement in electronic format, the information on the placement agent’s websites and any information contained in any other website maintained by the placement agent is not part of this prospectus supplement or the registration statement of which this prospectus supplement forms a part, has not been approved and/or endorsed by us or the placement agent in its capacity as placement agent and should not be relied upon by investors.

Listing

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “MEIL.” We do not intend to list the Warrants on any market.

Selling Restrictions

No action has been taken in any jurisdiction (except in the United States) that would permit a public offering of our Common Stock, or the possession, circulation or distribution of this prospectus supplement, the accompanying prospectus or any other material relating to us or our Common Stock in any jurisdiction where action for that purpose is required. Accordingly, our Common Stock may not be offered or sold, directly or indirectly, and none of this prospectus supplement, the accompanying prospectus or any other offering material or advertisements in connection with our Common Stock may be distributed or published, in or from any country or jurisdiction, except in compliance with any applicable rules and regulations of any such country or jurisdiction.

The placement agent may arrange to sell Common Stock offered hereby in certain jurisdictions outside the United States, either directly or through affiliates, where they are permitted to do so.

Affiliations

The placement agent and its affiliates have provided, and may in the future provide, various investment banking, financial advisory and other financial services to us and our affiliates for which they have received, and in the future may receive, advisory or transaction fees, as applicable. We have not paid the placement agent any compensation in the 180 days prior to the date of this prospectus supplement, and we have no current arrangements to pay the placement agent any further sums except as set forth with respect to this offering.

INTERESTS OF NAMED EXPERTS AND COUNSEL

The validity of the securities being offered by this prospectus will be passed upon for us by Morse, Zelnick, Rose & Lander, LLP, 825 Third Avenue, New York, NY 10022. A member of Morse, Zelnick, Rose & Lander, LLP, owns 50,000 shares of our Common Stock and warrants to purchase 50,000 shares of our Common Stock. Ellenoff Grossman & Schole LLP has acted as counsel to the placement agent.

MNP LLP, an independent registered public accounting firm, has audited our consolidated financial statements for 2014 and 2013 included in our 2014 Annual Report, as set forth in their report, which is incorporated by reference in this Prospectus and elsewhere in the registration statement. Our consolidated financial statements for 2014 and 2013 are incorporated by reference in reliance on MNP LLP’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and the accompanying prospectus are part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and do not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus supplement or the accompanying prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a copy of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus. Information contained in this prospectus supplement and the accompanying prospectus and information that we file with the SEC in the future and incorporate by reference into this prospectus supplement and the accompanying prospectus will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings (other than Current Reports on Form 8-K furnished under Item 2.02 or Item 7.01 and exhibits filed on such form that are related to such items) we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and before the sale of all the securities covered by this prospectus supplement:

| |

●

|

our Annual Report on Form 10-K for the fiscal year ended November 30, 2014, as filed on February 25, 2015;

|

| |

●

|

our Quarterly Report on Form 10-Q for the quarter ended February 28, 2015, as filed on April 13, 2015; and

|

|

|

●

|

the description of the our Common Stock is contained in our Registration Statement on Form S-1, filed on June 22, 2012, including any further amendment or report filed hereafter for the purpose of updating such description.

|

We will provide, upon written or oral request, without charge to you, including any beneficial owner to whom this prospectus is delivered, a copy of any or all of the documents incorporated herein by reference other than the exhibits to those documents, unless the exhibits are specifically incorporated by reference into the information that this prospectus incorporates. You should direct a request for copies to us at Attention: Michel G. Laporte, CEO, Methes Energies International Ltd, 3651 Lindell Road, Suite D-272 Las Vegas, Nevada, 89103 or you may call us at (702) 932-9964.

$8,423,202

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

This prospectus relates to common stock, preferred stock, debt securities, warrants and units that we may sell from time to time in one or more offerings up to a total public offering price of $8,423,202 on terms to be determined at the time of sale. We will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement for those securities.

Our common stock is listed on the Nasdaq Capital Market under the symbol “MEIL”. As of April 14, 2014, the aggregate market value of our outstanding common stock held by non-affiliates was $16,480,178 based on 8,526,266 shares of outstanding common stock, of which 6,462,815 shares are held by non-affiliates, and a per share price of $2.55 which was the closing sale price of our common stock as quoted on the Nasdaq Capital Market on April 14, 2014. We have not sold any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on and includes the date hereof.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through a combination of these methods. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of these securities in any applicable prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

Investing in our securities involves certain risks. See “Risk Factors” beginning on page 3 of this prospectus and in any prospectus supplement before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 14, 2014.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). You can inspect and copy these reports, proxy statement and other information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D. C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The SEC also maintains a web site that contains reports, proxy and information statements and other information regarding issuers, such as Methes Energies International Ltd. (www.sec.gov). Our web site is located at www.methes.com. The information contained on our web site is not part of this prospectus.

This prospectus “incorporates by reference” certain information that we have filed with the SEC under the Securities Exchange Act of 1934. This means we are disclosing important information to you by referring you to those documents. We incorporate by reference the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until the offering is terminated:

|

● Annual Report on Form 10-K for the fiscal year ended November 30, 2013 as filed on February 25, 2014;

|

|

● Quarterly Report on Form 10-Q for the quarter ended February 28, 2014 as filed on April 11, 2014; and

|

|

● The description of the Company’s Common Stock contained in the Company’s Registration Statement on Form S-1, filed on June 22, 2012, including any further amendment or report filed hereafter for the purpose of updating such description.

|

You should rely only on the information incorporated by reference or provided in this prospectus. We have authorized no one to provide you with different information. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this document. All documents that we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus or after the date of the registration statement of which this prospectus forms a part and prior to the termination of the offering will be deemed to be incorporated in this prospectus by reference and will be a part of this prospectus from the date of the filing of the document. Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement that is modified or superseded will not constitute a part of this prospectus, except as modified or superseded.

We will provide, upon written or oral request, without charge to you, including any beneficial owner to whom this prospectus is delivered, a copy of any or all of the documents incorporated herein by reference other than the exhibits to those documents, unless the exhibits are specifically incorporated by reference into the information that this prospectus incorporates. You should direct a request for copies to us at Attention: Michel G. Laporte, CEO, Methes Energies International Ltd, 3651 Lindell Road, Suite D-272 Las Vegas, Nevada, 89103 or you may call us at (702) 932-9964.

FORWARD-LOOKING STATEMENTS

Certain information set forth in this prospectus or incorporated by reference in this prospectus may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “would,” “could,” “seek,” “intend,” “plan,” “estimate,” “goal,” “anticipate,” “project” or other comparable terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including those risks and uncertainties included in this prospectus under the caption “Risk Factors,” and those risks and uncertainties described in the documents incorporated by reference into this prospectus. We urge you to consider those risks and uncertainties in evaluating our forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. We further caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. Except as otherwise required by the federal securities laws, we disclaim any obligation or undertaking to publicly release any updates or revisions to any forward-looking statement contained herein or in the accompanying prospectus (or elsewhere) to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

PROSPECTUS SUMMARY

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC utilizing a “shelf” registration process. Under this shelf process, we may from time to time, sell any combination of securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the securities being offered.

We may add or modify in a prospectus supplement any of the information contained in this prospectus or in the documents that we have incorporated into this prospectus by reference. If there is any inconsistency between the information in this prospectus and a prospectus supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus and any applicable prospectus supplement together with additional information described above under the heading “Where You Can Find More Information.”

When acquiring any securities discussed in this prospectus, you should rely on the information provided in this prospectus and the prospectus supplement, including the information incorporated by reference. Neither we, nor any underwriters or agents, have authorized anyone to provide you with different information. We are not offering the securities in any state where such an offer is prohibited. You should not assume that the information in this prospectus, any prospectus supplement, or any document incorporated by reference, is truthful or complete at any date other than the date mentioned on the cover page of those documents. You should also carefully review the section entitled “Risk Factors”, which highlights certain risks associated with an investment in our securities, to determine whether an investment in our securities is appropriate for you.

References in this prospectus to “Methes”, the “Company”, “we”, “us” and “our” are to Methes Energies International Ltd. and its subsidiaries.

RISK FACTORS

Investing in our securities involves risk. See the risk factors described in our Annual Report on Form 10-K for our most recent fiscal year (together with any material changes thereto contained in subsequently filed Quarterly Reports on Form 10-Q) and those contained in our other filings with the SEC, which are incorporated by reference in this prospectus and any accompanying prospectus supplement.

The prospectus supplement applicable to each type or series of securities we offer may contain a discussion of risks applicable to the particular types of securities that we are offering under that prospectus supplement. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the caption “Risk Factors” in the applicable prospectus supplement, together with all of the other information contained in the prospectus supplement or appearing or incorporated by reference in this prospectus. These risks could materially affect our business, results of operations or financial condition and cause the value of our securities to decline. You could lose all or part of your investment.

THE COMPANY

Overview

We are a renewable energy company that offers an array of products and services to a network of biodiesel fuel producers. We also market and sell in the U.S. and Canada biodiesel fuel produced at our small-scale production and demonstration facility in Mississauga, Ontario, Canada and at our new intermediate scale biodiesel production facility in Sombra, Ontario, Canada. The first of two Denami 3000 processors, designed to produce up to 6.5 million gallons per year, or mgy, of biodiesel, was placed in substantially full time production in the fourth quarter of fiscal 2013. In October 2013 we shipped more than 18 railcars (over 485,000 gallons) of biodiesel from our Sombra facility which is significantly higher than our previous highest monthly total of 8 railcars in April 2013. In fiscal 2012 and 2013, our largest source of revenue was from the sale of biodiesel fuel.

Among other services, we sell feedstock to our network of biodiesel producers, sell their output in the U.S. and Canada, provide them with proprietary software used to operate and control their processors, remotely monitor the quality and characteristics of their output, upgrade and repair their processors, and advise them on adjusting their processes to use varying feedstock and improve their output. Through the accumulation of production data from our network, we are equipped to provide consulting services to network members and other producers for operating their facilities, maintaining optimum production and solving production problems. In addition, we provide assistance to network members and others in production site selection, site development, installation of equipment and commissioning of processors. For our network services and the license of our operating and communications software, we receive a royalty from some network members based on gallons of biodiesel produced.

Network members currently produce biodiesel through use of Denami 600 processors purchased from us, which have a maximum rated capacity of 1.3 million gallons per year “mgy”, of biodiesel, and starting in fiscal 2014 some new clients may purchase one or more of our new Denami 3000 processors designed to produce up to 6.5 mgy of biodiesel. We market Denami processors designed to meet the needs of 2 to 20 mgy biodiesel producers. We believe that small and medium-scale producers will be the fastest growing segment of the biodiesel market. Our processors are flexible and can use a variety of virgin vegetable oils, used vegetable oil and rendered animal fat feedstock, allowing operators to take advantage of feedstock buying opportunities. Our Denami processors operate automatically in a continuous flow mode and can be rapidly fine-tuned to adjust to feedstock and production variables. In addition to low production and labor costs, our processors minimize electrical use and utilize water only in closed loop components for cooling purposes. The absence of waste water discharge has facilitated obtaining environmental permits for our facilities and those of our customers.

We expect to achieve economies of scale for our network members by bulk purchasing feedstock, methanol, catalyst and other biodiesel related products and negotiating more favorable sales prices through the sale of larger quantities of biodiesel and glycerin for these members. Achieving our growth plan will enable us to spread fixed overhead costs over a larger revenue base.

In May 2012, we completed construction and installation of two of our new intermediate-scale Denami 3000 processors at our Sombra facility. Currently, only one of our Denami 3000 processors at the Sombra plant has been put into full-scale operations and we expect that the second one will be placed into full-scale operations in the second half of fiscal 2014.

Corporate Information

Methes was organized as Global Biodiesel Ltd. on June 27, 2007 under the laws of the state of Nevada. On September 5, 2007, Methes purchased all the outstanding shares of Methes Energies Canada, Inc. (“Methes Canada”), an Ontario (Canada) corporation incorporated in December 2004 in exchange for 1,303,781 shares of its common stock, plus an additional 441,982 shares issued to retire debt of that corporation. On October 11, 2007 Global Biodiesel Ltd. changed its name to Methes Energies International, Ltd.

Our principal executive office is located at 3651 Lindell Road, Suite D-272, Las Vegas, Nevada, 89103 and our telephone number is (702) 932-9964. Our web address is www.methes.com. None of the information on our website is part of this prospectus.

USE OF PROCEEDS

We currently intend to use the estimated net proceeds from the sale of these securities for general corporate and working capital purposes, including the funding of strategic initiatives that we may undertake from time to time. We have not yet determined the amount of net proceeds to be used specifically for any of the foregoing purposes. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds from the sale of these securities. Our plans to use the estimated net proceeds from the sale of these securities may change, and if they do, we will update this information in a prospectus supplement.

DESCRIPTION OF DEBT SECURITIES WE MAY OFFER

We may sell the securities being offered pursuant to this prospectus directly to purchasers, to or through underwriters, through dealers or agents, or through a combination of such methods. The prospectus supplement with respect to the securities being offered will set forth the terms of the offering of those securities, including the names of the underwriters, dealers or agents, if any, the purchase price, the net proceeds to us, any underwriting discounts and other items constituting underwriters’ compensation, the initial public offering price, any discounts or concessions allowed or reallowed or paid to dealers and any securities exchanges on which such securities may be listed.

General

The debt securities that we may issue will constitute debentures, notes, bonds or other evidences of indebtedness of Methes, to be issued in one or more series, which may include senior debt securities, subordinated debt securities and senior subordinated debt securities. The particular terms of any series of debt securities we offer, including the extent to which the general terms set forth below may be applicable to a particular series, will be described in a prospectus supplement relating to such series.

Debt securities that we may issue will be issued under an indenture between us and a trustee qualified to act as such under the Trust Indenture Act of 1939. We have filed the form of the indenture as an exhibit to the registration statement of which this prospectus is a part. When we refer to the “indenture” in this prospectus, we are referring to the indenture under which your debt securities are issued as supplemented by any supplemental indenture applicable to your debt securities. We will provide the name of the trustee in any prospectus supplement related to the issuance of debt securities, and we will also provide certain other information related to the trustee, including describing any relationship we have with the trustee, in such prospectus supplement.

THE FOLLOWING DESCRIPTION IS A SUMMARY OF THE MATERIAL PROVISIONS OF THE INDENTURE. IT DOES NOT RESTATE THE INDENTURE IN ITS ENTIRETY. THE INDENTURE IS GOVERNED BY THE TRUST INDENTURE ACT OF 1939. THE TERMS OF THE DEBT SECURITIES INCLUDE THOSE STATED IN THE INDENTURE AND THOSE MADE PART OF THE INDENTURE BY REFERENCE TO THE TRUST INDENTURE ACT. WE URGE YOU TO READ THE INDENTURE BECAUSE IT, AND NOT THIS DESCRIPTION, DEFINES YOUR RIGHTS AS A HOLDER OF THE DEBT SECURITIES.

Information You Will Find In The Prospectus Supplement

The indenture provides that we may issue debt securities from time to time in one or more series and that we may denominate the debt securities and make them payable in foreign currencies. The indenture does not limit the aggregate principal amount of debt securities that can be issued thereunder. The prospectus supplement for a series of debt securities will provide information relating to the terms of the series of debt securities being offered, which may include:

|

|

●

|

the title and denominations of the debt securities of the series; |

|

|

●

|

any limit on the aggregate principal amount of the debt securities of the series; |

|

|

●

|

the date or dates on which the principal and premium, if any, with respect to the debt securities of the series are payable or the method of determination thereof;

|

|

|

●

|

the rate or rates, which may be fixed or variable, at which the debt securities of the series shall bear interest, if any, or the method of calculating and/or resetting such rate or rates of interest;

|

|

|

●

|

the dates from which such interest shall accrue or the method by which such dates shall be determined and the duration of the extensions and the basis upon which interest shall be calculated;

|

|

|

●

|

the interest payment dates for the series of debt securities or the method by which such dates will be determined, the terms of any deferral of interest and any right of ours to extend the interest payments periods;

|

|

|

●

|

the place or places where the principal and interest on the series of debt securities will be payable;

|

|

|

●

|