By Joe Wallace and Ryan Dezember

The deep freeze that plunged millions of Texans into darkness is

rippling through energy markets in unexpected ways, producing a

financial windfall for an Australian bank and severe pain for other

companies caught up in the disruption.

The extreme weather froze wind turbines and oil-and-gas wells,

closed oil refiners and prompted power stations to trip offline,

sending a jolt through energy markets. Wholesale power prices

rocketed, as did spot prices for natural gas in Texas, Oklahoma,

Kansas and Arkansas.

The turbulence led to a bonanza for commodity traders at

Australia's Macquarie Group Ltd., whose ability to funnel gas and

electricity around the country enabled them to capitalize on

soaring demand and prices in states such as Texas.

The bank bumped up its guidance Monday for earnings in the year

through March to reflect the windfall. It said that net profit

after tax would be 5% to 10% higher than in the 2020 fiscal year.

That equates to an increase of up to 273.1 million Australian

dollars, equivalent to around $215 million. In its previous

guidance, issued Feb. 9, Macquarie said it expected profits to be

slightly down on 2020.

"Extreme winter weather conditions in North America have

significantly increased short-term client demand for Macquarie's

capabilities in maintaining critical physical supply across the

commodity complex, and particularly in relation to gas and power,"

the bank said.

Macquarie's windfall shows how big profits can be made wagering

on relative scarcity of natural gas in a country awash in the

fuel.

The U.S. shale-drilling boom unleashed so much gas over the past

decade that prices have been depressed to the point that producers

with gushers have gone bankrupt. Yet gas buyers, such as power

plants and manufacturers, are routinely left paying surging prices

when demand peaks during winter storms.

Behind such instances of energy feast and famine is a gas

infrastructure system that has failed to keep up with all the

drilling. Pipelines laid decades before the shale boom are often in

the wrong places, or too small to meet today's demand. Having space

reserved on certain pipelines can become incredibly lucrative when

uncharacteristic weather causes swells in demand.

Scarcity in Texas and the Great Plains was amplified last week

when temperatures dropped low enough to freeze shut many of the

region's gas wells and other energy infrastructure. Capacity on

pipelines into the region became precious. Traders and energy firms

that had paid in advance for the right to use these supply routes

were suddenly in position to rake in huge profits as utilities vied

for fuel deliveries.

Macquarie describes itself as the second-largest marketer of

physical gas in North America behind BP PLC, with a team in Houston

and access to 80% of pipelines spanning the U.S., according to a

person familiar with the matter. The business, which Macquarie has

built out for over a decade, received a boost from the acquisition

of Cargill Inc.'s North America power and gas division in 2017.

The Australian bank rents access to natural-gas pipelines and

electricity networks across the U.S., enabling it to profit when

prices in some regions are significantly higher than in others and

when consumers are in urgent need of fuel or power. That was the

case last week, when frozen energy infrastructure and the closure

of oil-and-gas wells set off a race for natural gas among Texas

power plants and other consumers.

Macquarie sent large volumes of gas from the north of the U.S.

to the south, where the cold weather sent prices soaring last week,

the person familiar with the matter said. It supplied electricity

in Texas as well as gas to generate electrical power.

At one point, natural gas changed hands for more than $900 per

million British thermal units at the ONEOK Gas Transportation hub

in Oklahoma, according to commodities data provider S&P Global

Platts. By Friday, prices at the hub had fallen back to about $14

per million British thermal units. That was still comparatively

high: Benchmark futures for U.S. natural gas, which are tied to

delivery at Henry Hub in Louisiana, have generally cost between

$2.50 and $3.50 per million British thermal units in recent

months.

Shares of Macquarie rose 3.4% in Sydney on Monday after the

company raised its profit outlook. They are now down 2.8% over the

past 12 months.

Millions were left without power and heat in Texas last week as

the lowest temperatures in decades wreaked havoc on the state's

utilities. Frozen water lines burst and left big residents in

cities without safe drinking water. Stores closed because they had

no power, which made food and water even more scarce.

Roughly 70 deaths, mostly in Texas, have been attributed to the

cold weather, according to the Associated Press. Some are believed

to have frozen to death in their homes.

Macquarie last year provided an undisclosed amount of investment

capital to upstart Houston-based utility Griddy Energy LLC, whose

business model is to pass variable wholesale electricity prices

through to customers. Griddy customers complained of paying lofty

sums when power prices shot up to thousands of dollars per megawatt

hour last week, according to local Texas media reports.

One customer told the Dallas Morning News that his electric bill

for five days stood at $5,000, the amount he would normally pay for

several years of power. Another told the Dallas-Fort Worth NBC

affiliate that he had been charged more than $16,000 for

February.

A Griddy spokeswoman said an order by the state utility agency

to the operator of the electricity grid to make market prices

reflect the scarcity of power pushed up prices for its customers.

On Feb. 12, the company started emailing and texting customers to

say they might be better off switching providers for a short time

to avoid exposure to wholesale prices, she said.

Corporate casualties from the freeze are also starting to

emerge. Just Energy Group Inc., a Canada-based energy supplier, on

Monday said it faced a financial hit of about $250 million, in part

from buying electricity at sky-high prices in Texas during the cold

blast. The company, which said the blow could stop it from

continuing as a going concern, saw its shares slump 31%.

In another instance, shares of Atmos Energy Corp. fell 4.4%

Monday after the Dallas-based gas supplier said it would have to

pay between $2.5 billion and $3.5 billion for gas it bought at

elevated prices in Texas, Colorado and Kansas. Atmos may issue

stock or raise debt to help to pay for the purchases, it said

Friday.

German energy company RWE AG said its 2021 earnings would be hit

by outages at the company's wind turbines, as well as from high

prices for electricity.

Write to Joe Wallace at Joe.Wallace@wsj.com and Ryan Dezember at

ryan.dezember@wsj.com

(END) Dow Jones Newswires

February 22, 2021 18:07 ET (23:07 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

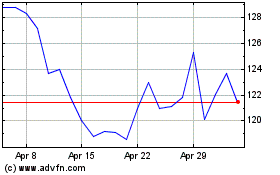

Macquarie (PK) (USOTC:MQBKY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Macquarie (PK) (USOTC:MQBKY)

Historical Stock Chart

From Jan 2024 to Jan 2025