- Current report filing (8-K)

04 June 2012 - 10:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 22, 2012

|

Marketing Worldwide Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

000-50586

|

|

68-0566295

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

2212 Grand Commerce Dr., Howell, Michigan 48855

|

|

(Address of principal executive offices) (Zip Code)

|

Registrant's telephone number, including area code: (517) 540-0045

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2 below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 3.03. Material Modification to Rights of Security

Holders

On May 22, 2012, Marketing Worldwide

Corporation (the “Company”) entered a Securities Exchange Agreement with two investors. The Company exchanged the remaining

outstanding shares of Series A Convertible Preferred Stock (

1,691,901

shares) and Series

B Convertible Preferred Stock (

1,192,308 shares) for

11,923 shares of the Company’s Series

E 6% Convertible Preferred Stock. A copy of the Certificate of Designation of the Company’s Series E 6% Convertible Preferred

Stock is included as Exhibit 1. In 2007, the Company sold 3,500,000 shares of Series A Convertible Preferred Stock and issued 15,500,000

warrants to Vision Opportunity Master Fund, Ltd. for gross proceeds of $3,500,000. The Series A paid dividends of 9% per year.

In 2008, the Company issued

1,192,308 shares of

Series B Convertible Preferred Stock to Vision

Opportunity Master Fund, Ltd. for the cancellation of 15,500,000 warrants. At September 30, 2011 and March 31, 2012, the Series

A was listed as temporary equity on the Company’s balance sheet as $3,499,950 and $1,691,851, respectively. Between September

30, 2011 and March 31, 2012, a portion of the Series A was converted into common stock to eliminate $1,808,099 of temporary equity.

The

Securities Exchange Agreement eliminates the remaining

$1,691,851 of temporary equity on

the balance sheet attributed to the Series A.

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws;

Change in Fiscal Year

|

In connection with the Securities Exchange Agreement discussed

above, the Company filed the Certificate of Designation of the Company’s Series E 6% Convertible Preferred Stock. A copy

of the Certificate of Designation of the Company’s Series E 6% Convertible Preferred Stock is included as Exhibit 1. The

Series E consists of 15,000 shares with a stated value of $100 per share and pays a 6% annual dividend. Each share of Series E

can convert into shares of common stock at the Conversion Price. The Conversion Price is determined prior to submitting a Conversion

Notice and is calculated using 50% of the lowest closing bid price during the 5 trading days prior to the Conversion Notice. The

Company issued 11,923 shares of Series E to eliminate

the remaining

outstanding shares of Series

A Convertible Preferred Stock (

1,691,901

shares) and Series B Convertible Preferred Stock (

1,192,308

shares).

The Company obtained $160,000 from the sale of Promissory Notes

due December 31, 2012. The form of the Promissory Note due December 31, 2012 is included as Exhibit 2. The Promissory Note can

convert into common stock at a discount to the market price of the Company’s common stock. The Conversion Price is calculated

using 50% of the lowest closing bid price during the 5 trading days prior to conversion.

The Company’s board of directors and management are taking

actions based upon their informed business judgment to continue operations for the benefit of the creditors and shareholders of

the Company. Since the Company is in the zone of insolvency, the Company must consider the interests of both shareholders and creditors.

As the Company strives to repay its debt and secure capital to support higher revenue in future periods, there will be dilution

to existing stockholders caused by the issuance of common stock for cash and in exchange for debt. While management seeks to minimize

the dilution to existing stockholders, multiple factors beyond management’s control, such as general economic conditions,

the availability of and terms available for debt and equity funding, and the trading price of the Company’s common stock,

have a significant impact on this effort. The Company’s effort to restructure its operations and to report positive cash

flow and profits is expected to take 6-18 months. Investors are cautioned that these efforts may not be successful.

|

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

Exhibit #

|

|

Description

|

|

Exhibit 1

|

|

Certificate of Designation of the Series E 6% Convertible Preferred Stock

|

|

Exhibit 2

|

|

Form of Promissory Note due December 31, 2012

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 31, 2012

|

|

Marketing Worldwide Corporation

|

|

|

|

|

|

|

|

/s/ Charles Pinkerton

|

|

|

|

Charles Pinkerton

|

|

|

|

Chief Executive Officer

|

|

|

Exhibit 1

|

Certificate of Designation of the Series E 6% Convertible Preferred Stock

|

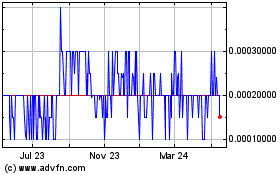

Marketing Worldwide (PK) (USOTC:MWWC)

Historical Stock Chart

From Mar 2025 to Apr 2025

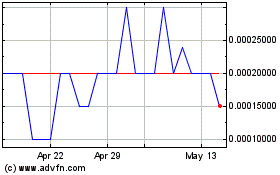

Marketing Worldwide (PK) (USOTC:MWWC)

Historical Stock Chart

From Apr 2024 to Apr 2025