- Current report filing (8-K)

11 September 2012 - 4:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 6, 2012

Marketing Worldwide Corporation

(Exact name of registrant as specified

in its charter)

|

Delaware

|

000-50586

|

68-0566295

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

2212 Grand Commerce Dr., Howell, Michigan

48855

(Address of principal executive offices)

(Zip Code)

Registrant's telephone number, including area code: (517) 540-0045

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2 below):

¨

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 3.02. UNREGISTERED SALES OF

EQUITY SECURITIES

On September 6, 2012, Marketing Worldwide Corporation (the “Company”)

issued 28,770,000 shares of its common stock at to certain employees, consultants and advisors in order to retain the services

of these 26 individuals. The Company will record a non-cash charge for the retention payments of $.006 per share (based upon closing

bid price on August 16, 2012) or $172,620. There was no underwriter, no underwriting discounts or commissions, no general solicitation,

no advertisement, and resale restrictions were imposed by placing a Rule 144 legend on the certificates. The persons who received

securities have such knowledge in business and financial matters that he/she/it is capable of evaluating the merits and risks of

the transaction. This transaction was exempt from registration under the Securities Act of 1933, based upon Section 4(2) for transactions

by the issuer not involving any public offering.

At the close of business on September 6, 2012, the Company had

34,481,956 shares common stock issued and outstanding.

ITEM 8.01. OTHER EVENTS

Subsequent to July 12, 2012, the effective date of the Company’s

reverse stock split, the Company issued 2,040,539 shares of its common stock pursuant to the conversion terms of the Company’s

outstanding securities, which includes shares Series E Convertible Preferred Stock and Convertible Notes. The shares of common

stock were issued without registration under the Securities Act of 1933 based upon legal opinions provided to the Company and its

transfer agent that registration was not required.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 7, 2012

|

|

|

Marketing Worldwide Corporation

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Charles Pinkerton

|

|

|

|

|

Charles Pinkerton

|

|

|

|

Chief Executive Officer

|

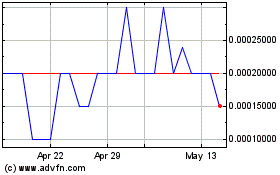

Marketing Worldwide (PK) (USOTC:MWWC)

Historical Stock Chart

From Feb 2025 to Mar 2025

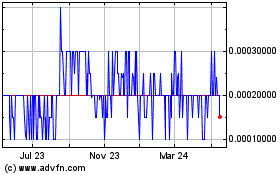

Marketing Worldwide (PK) (USOTC:MWWC)

Historical Stock Chart

From Mar 2024 to Mar 2025