0000720762

false

FY

NON INVASIVE MONITORING SYSTEMS INC /FL/

0000720762

2022-08-01

2023-07-31

0000720762

2023-01-31

0000720762

2023-10-30

0000720762

2023-07-31

0000720762

2022-07-31

0000720762

us-gaap:RelatedPartyMember

2023-07-31

0000720762

us-gaap:RelatedPartyMember

2022-07-31

0000720762

us-gaap:SeriesBPreferredStockMember

2023-07-31

0000720762

us-gaap:SeriesBPreferredStockMember

2022-07-31

0000720762

2021-08-01

2022-07-31

0000720762

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2021-07-31

0000720762

us-gaap:CommonStockMember

2021-07-31

0000720762

us-gaap:AdditionalPaidInCapitalMember

2021-07-31

0000720762

us-gaap:RetainedEarningsMember

2021-07-31

0000720762

2021-07-31

0000720762

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-07-31

0000720762

us-gaap:CommonStockMember

2022-07-31

0000720762

us-gaap:AdditionalPaidInCapitalMember

2022-07-31

0000720762

us-gaap:RetainedEarningsMember

2022-07-31

0000720762

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2021-08-01

2022-07-31

0000720762

us-gaap:CommonStockMember

2021-08-01

2022-07-31

0000720762

us-gaap:AdditionalPaidInCapitalMember

2021-08-01

2022-07-31

0000720762

us-gaap:RetainedEarningsMember

2021-08-01

2022-07-31

0000720762

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-08-01

2023-07-31

0000720762

us-gaap:CommonStockMember

2022-08-01

2023-07-31

0000720762

us-gaap:AdditionalPaidInCapitalMember

2022-08-01

2023-07-31

0000720762

us-gaap:RetainedEarningsMember

2022-08-01

2023-07-31

0000720762

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-07-31

0000720762

us-gaap:CommonStockMember

2023-07-31

0000720762

us-gaap:AdditionalPaidInCapitalMember

2023-07-31

0000720762

us-gaap:RetainedEarningsMember

2023-07-31

0000720762

us-gaap:RelatedPartyMember

2022-08-01

2023-07-31

0000720762

us-gaap:RelatedPartyMember

2021-08-01

2022-07-31

0000720762

NIMU:FrostGammaNoteMember

us-gaap:SubsequentEventMember

2023-08-14

2023-08-15

0000720762

NIMU:FrostGammaMember

us-gaap:SubsequentEventMember

2023-08-15

0000720762

NIMU:DrPhillipFrostMember

NIMU:FrostGammaNoteMember

us-gaap:SubsequentEventMember

2023-08-14

2023-08-15

0000720762

NIMU:CostSharingArrangementMember

NIMU:CocrystalPharmaIncMember

2021-08-01

2022-07-31

0000720762

NIMU:CostSharingArrangementMember

NIMU:AsensusSurgicalIncMember

2022-08-01

2023-07-31

0000720762

NIMU:CostSharingArrangementMember

NIMU:AsensusSurgicalIncMember

2021-08-01

2022-07-31

0000720762

NIMU:CostSharingArrangementMember

NIMU:AsensusSurgicalIncMember

2023-07-31

0000720762

NIMU:CostSharingArrangementMember

NIMU:AsensusSurgicalIncMember

2022-07-31

0000720762

NIMU:DrPhillipFrostMember

2008-01-01

0000720762

NIMU:DrPhillipFrostMember

2007-12-30

2008-01-01

0000720762

NIMU:DrPhillipFrostMember

2016-02-01

2016-02-29

0000720762

NIMU:DrPhillipFrostMember

2022-08-01

2023-07-31

0000720762

NIMU:DrPhillipFrostMember

2021-08-01

2022-07-31

0000720762

NIMU:TwoPromissoryNotesMember

2022-09-15

2022-09-16

0000720762

NIMU:TwoPromissoryNotesMember

2022-09-16

0000720762

NIMU:TwoPromissoryNotesMember

2021-10-03

2021-10-04

0000720762

NIMU:TwoPromissoryNotesMember

2021-10-04

0000720762

NIMU:FederalAndStateTaxAuthorityMember

2023-07-31

0000720762

NIMU:ForeignTaxAuthorityMember

2023-07-31

0000720762

NIMU:PromissoryNoteMember

us-gaap:SubsequentEventMember

2023-08-15

2023-08-15

0000720762

NIMU:PromissoryNoteMember

us-gaap:SubsequentEventMember

NIMU:DrPhillipFrostMember

2023-08-15

0000720762

NIMU:PromissoryNoteMember

us-gaap:SubsequentEventMember

2023-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC. 20549

FORM

10-K

(Mark

One)

| ☒ |

Annual

report pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934 |

| |

|

| |

For

the fiscal year ended July 31, 2023 |

or

| ☐ |

Transition

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| |

For

the Transition Period from _____________________ to ____________________ |

Commission

File Number 000-13176

| NON-INVASIVE

MONITORING SYSTEMS, INC. |

| (Exact

name of registrant as specified in its charter) |

| Florida |

|

59-2007840 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

employer

identification

no.) |

4400

Biscayne Blvd., Suite 180, Miami, Florida 33137

(Address

of principal executive offices) (Zip code)

Registrant’s

telephone number, including area code: (305) 575-4200

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Common

Stock $0.01 par value per share |

|

NIMU |

|

OTC

Pink |

Indicate

by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such fi les). Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| Emerging

growth company |

☐ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13 of the Exchange Act. ☐

Indicate by check mark whether the registrant has

filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its

audit report. ☒

If securities are registered pursuant to Section 12(b)

of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☒ No

☐

The

aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and

asked price of such common equity, as of January 31, 2023 was: $2.3 million.

As

of October 30, 2023, there were 154,810,655

shares of common stock, $0.01 par value outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE: None

Non-Invasive

Monitoring Systems, INC.

TABLE

OF CONTENTS FOR FORM 10-K

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains, in addition to historical information, certain forward-looking statements about our expectations,

beliefs or intentions regarding, among other things, our business, financial results, strategies or prospects. You can identify forward-looking

statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements

relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements

relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our

actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could

cause our actual activities or results to differ materially from the activities and results described in forward-looking statements.

These factors include those set forth below as well as those contained in “Item 1A - Risk Factors” of this Annual Report

on Form 10-K and our other filings with the Securities and Exchange Commission (“SEC”). We do not undertake any obligation

to update forward-looking statements, except as required by applicable law. These forward-looking statements reflect our views only as

of the date they are made with respect to future events and financial performance.

Risks

and uncertainties, the occurrence of which could adversely affect our business, include the following:

| |

● |

We

have a history of operating losses, we do not expect to become profitable in the near future and absent additional equity or debt

financing, we may be unable to continue as a going concern. |

| |

|

|

| |

● |

We

will require additional funding, which may not be available to us on acceptable terms, or at all. |

| |

|

|

| |

● |

We

do not anticipate paying dividends on our common stock in the foreseeable future. |

| |

|

|

| |

● |

Because

our common stock is a “penny stock,” it may be more difficult for investors to sell shares of our Common Stock, and the

market price of our common stock may be adversely affected. |

| |

|

|

| |

● |

Our

stock price has been volatile and there may not be an active, liquid trading market for our common stock. |

| |

|

|

| |

● |

Our

quarterly results of operations will fluctuate, and these fluctuations could cause our stock price to decline. |

| |

|

|

| |

● |

Shareholders

may experience dilution of ownership interests because of the future issuance of additional shares of our common stock and our preferred

stock. |

*

* * * *

PART

I

Item

1. Business.

General

Non-Invasive

Monitoring Systems, Inc. (together with its consolidated subsidiaries, the “Company,” “NIMS,” “we,”

“us” or “our”) was incorporated under the laws of the State of Florida on July 16, 1980. The Company’s

offices are located at 4400 Biscayne Boulevard, Miami, Florida, 33137 and its telephone number is (305) 575-4200.

Company

Overview

Our

primary business previously consisted of research, development, manufacturing, marketing and sales of non-invasive, motorized, whole

body periodic acceleration (“WBPA”) platforms. These therapeutic acceleration platforms are intended as aids to temporarily

increase local circulation for temporary relief of minor aches and pains, produce local muscle relaxation and reduce morning stiffness.

In

May 2019, we effectively discontinued operations. The Company is a shell company as defined in Rule 12b-2 of the Exchange Act.

Products

We

currently have no inventory and do not have any of our products available for sale.

Item

1A. Risk Factors.

Our

future operating results may vary substantially from anticipated results due to a number of factors, many of which are beyond our control.

The following discussion highlights some of these factors and the possible impact of these factors on our future results of operations.

If any of the following events actually occurs, our business, financial condition or results of operations could be materially harmed.

In that case, the value of our common stock could decline substantially.

Risks

Relating to Our Business.

We

have a history of operating losses, we do not expect to become profitable in the near future and absent additional equity or debt financing,

we may be unable to continue as a going concern.

Our

consolidated financial statements for the years ended July 31, 2023 and 2022 were prepared on a “going concern” basis; however

substantial doubt exists about our ability to continue as a going concern as a result of recurring losses and an accumulated deficit.

We are not profitable and have been incurring material losses. Our net losses for our fiscal years ended July 31, 2023 and 2022 were

$0.2 million and $0.2 million respectively. As of July 31, 2023, we had an accumulated deficit of $28.7 million. The Company had $7,000

of cash at July 31, 2023 and negative working capital of approximately $268,000. Absent additional equity or debt financing, we will

be unable to continue as a going concern, and you may lose all your investment in us.

We

will require additional funding, which may not be available to us on acceptable terms, or at all.

We

will need to raise additional capital in order for us to continue as a going concern. We will need to finance future cash needs primarily

through public or private equity offerings, debt financings, mergers or acquisitions. We do not know whether additional funding will

be available on acceptable terms, or at all. We cannot assure you that we could obtain such approval. To the extent that we raise additional

funds by issuing equity securities, our shareholders may experience significant dilution, and debt financing, if available, may require

that we agree to covenants that restrict our operations. To the extent that we raise additional funds through collaboration and licensing

arrangements, it may be necessary to relinquish some rights to our products or grant licenses on terms that may not be favorable to us.

We

may be exposed to risks relating to management’s assessment of our disclosure controls and procedures and internal controls over

financial reporting.

If we fail

to maintain proper and effective internal controls, our ability to produce accurate financial statements on a timely basis could be impaired.

We have identified material weaknesses in our internal controls, and we cannot provide assurances that these material weaknesses

will be effectively remediated, or that additional material weaknesses will not occur in the future.

We are subject to the reporting requirements of the

Exchange Act, and the Sarbanes-Oxley Act. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls

and procedures and internal control over financial reporting. Effective internal control over financial reporting is necessary for us

to provide reliable financial reports and, together with adequate disclosure controls and procedures, is designed to prevent fraud. Any

failure to implement required new or improved controls, or difficulties encountered in their implementation could cause us to fail to

meet our reporting obligations.

Furthermore, we cannot be certain that our efforts

will be sufficient to remediate current or prevent future material weaknesses or significant deficiencies from occurring.

The internal control procedures over the completeness and accuracy of the

general ledger information and the risk assessment process are not formally documented and may not be designed and operate with a level

of precision adequate to prevent or detect misstatements.

Risks

Relating to Corporate Governance

Because

we do not currently have an audit or compensation committee made up of independent directors, shareholders will have to rely on our directors,

only one of whom is independent, to perform these functions.

Currently, we do not have an independent audit committee. Our one independent

director along with the other Directors functions as our audit committee and is comprised of four directors, three of whom are not considered

to be “independent” in accordance with the requirements of Rule 10A-3 under the Securities Exchange Act of 1934. An independent

audit committee plays a crucial role in the corporate governance process, assessment of the Company’s processes relating to its

risks and control environment, oversight of financial reporting, and evaluation of internal and independent audit processes. The lack

of an independent audit committee may prevent the Board of Directors from being independent in its judgments and its ability to pursue

the committee’s responsibilities, this could compromise management of our business.

We

do not have a functioning compensation committee comprised of independent directors. The Board of Directors performs these functions

as a whole. Thus, there is a potential conflict in that board members

who are also part of management will participate in discussions concerning management compensation and audit issues that may affect management

decisions.

Risks

Relating to Our Stock.

We

do not anticipate paying dividends on our common stock in the foreseeable future.

We

have not declared and paid cash dividends on our common stock in the past, and we do not anticipate paying any cash dividends in the

foreseeable future. We intend to retain all of our earnings, if any, for the foreseeable future to finance the operation and expansion

of our business. As a result, you may only receive a return on your investment in our common stock if the market price of our common

stock increases and you sell your shares.

Because

our common stock is a “penny stock,” it may be more difficult for investors to sell shares of our common stock, and the market

price of our common stock may be adversely affected.

Our

common stock, which trades on the OTC PINK, is a “penny stock” since, among other things, the stock price is below $5.00

per share, it is not listed on a national securities exchange, and it has not met certain net tangible asset or average revenue requirements.

Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk-disclosure document prepared by

the SEC. This document provides information about penny stocks and the nature and level of risks involved in investing in the penny-stock

market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding broker and salesperson

compensation, make a written determination that the penny stock is a suitable investment for the purchaser and obtain the purchaser’s

written agreement to the purchase. Broker-dealers must also provide customers that hold penny stock in their accounts with such broker-dealer

a monthly statement containing price and market information relating to the penny stock. If a penny stock is sold to an investor in violation

of the penny stock rules, the investor may be able to cancel its purchase and get its money back.

If

applicable, the penny stock rules may make it difficult for investors to sell their shares of our common stock. Because of the rules

and restrictions applicable to a penny stock, there is less trading in penny stocks and the market price of our common stock may be adversely

affected. Also, many brokers choose not to participate in penny stock transactions. Accordingly, investors may not always be able to

resell their shares of our common stock publicly at times and prices acceptable to them.

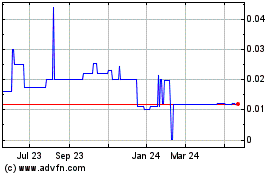

Our

stock price has been volatile and there may not be an active, liquid trading market for our common stock.

Our

stock price has experienced significant price and volume fluctuations and may continue to experience volatility in the future. The price

of our common stock has ranged between $0.01 and $0.04 for the 52-week period ended July 31, 2023. Many factors, including those described

in this report and others, have a significant impact on the price of our common stock. Also, you may not be able to sell your shares

at the best market price if trading in our stock in not active or if the volume is low. There is no guarantee that an active trading

market for our common stock will be maintained on the OTC PINK or elsewhere.

Our

quarterly results of operations may fluctuate, and these fluctuations could cause our stock price to decline.

Our

quarterly operating results may fluctuate in the future. These fluctuations could cause our stock price to decline. As a result, in some

future quarters our financial or operating results may not meet the expectations of potential securities analysts and investors which

could result in a decline in the price of our stock.

Shareholders

may experience dilution of ownership interests because of the future issuance of additional shares of our common stock and our preferred

stock.

In

the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests

of our present shareholders. We are currently authorized to issue an aggregate of 401,000,000 shares of capital stock, consisting of

400,000,000 shares of common stock and 1,000,000 designated shares of preferred stock with preferences and rights to be determined by

our Board of Directors. As of October 30, 2023, there were outstanding 154,810,655 shares of our common stock, 100 shares of our

Series B preferred stock and there were no outstanding options to purchase shares of our common stock. We may also issue additional shares

of our common stock or other securities that are convertible into or exercisable for common stock in connection with hiring or retaining

employees, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. The future

issuance of any such additional shares of our common stock may create downward pressure on the trading price of the common stock. We

may issue additional shares, warrants or other convertible securities in the future in conjunction with capital raising efforts, including

at a price (or exercise price) below the price at which shares of our common stock are then currently traded on the OTC PINK.

Item

2. Properties.

Our

principal corporate office is located at 4400 Biscayne Blvd., Miami, Florida. We occupy this space from Frost Real Estate Holdings, LLC,

which is a company controlled by Dr. Phillip Frost, a member of the Board of Directors and one of our largest beneficial shareholders.

We previously leased the approximately 1,800 square feet under a lease agreement, which commenced with a five-year term on January 1,

2008 and expired on December 31, 2012, and then we went on a month-to-month basis and then in February 2016 the office space rent was

reduced to $0 per month.

Item

3. Legal Proceedings.

None.

Item

4. Mine Safety Disclosures.

Not

applicable.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market

for common stock

Our

common stock is quoted on the OTC PINK under the symbol NIMU.OB. The table below sets forth, for the respective periods indicated, the

high and low bid prices for the Company’s common stock as reported by the OTC PINK. The following bid quotations represent inter-dealer

prices, without adjustments for retail mark-ups, mark-downs or commissions and may not necessarily represent actual transactions.

| Quarter Ended | |

High | | |

Low | |

| October 31, 2021 | |

$ | 0.04 | | |

$ | 0.02 | |

| January 31, 2022 | |

$ | 0.04 | | |

$ | 0.02 | |

| April 30, 2022 | |

$ | 0.03 | | |

$ | 0.01 | |

| July 31, 2022 | |

$ | 0.02 | | |

$ | 0.01 | |

| October 31, 2022 | |

$ | 0.02 | | |

$ | 0.01 | |

| January 31, 2023 | |

$ | 0.04 | | |

$ | 0.01 | |

| April 30, 2023 | |

$ | 0.04 | | |

$ | 0.02 | |

| July 31, 2023 | |

$ | 0.03 | | |

$ | 0.02 | |

Since

our inception, we have not paid any dividends on our common stock, and we do not anticipate that we will pay dividends in the foreseeable

future. At July 31, 2023, we had 1,389 shareholders of record based on information provided by our transfer agent, Equity Stock Transfer.

We believe that the actual number of beneficial shareholders is considerably higher.

Item

6. Selected Financial Data.

As

a smaller reporting company as defined in Rule 12b-2 of the Exchange Act, we are not required to include information otherwise required

by this item.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This

Annual Report on Form 10-K contains, in addition to historical information, certain forward-looking statements about our expectations,

beliefs or intentions regarding, among other things, our business, financial condition, results of operations, strategies or prospects.

You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters.

Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made.

Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and

uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking

statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated

in forward-looking statements. These factors include those set forth below as well as those contained in “Item 1A - Risk Factors”

of this Annual Report on Form 10-K. We do not undertake any obligation to update forward-looking statements, except as required by applicable

law. These forward-looking statements reflect our views only as of the date they are made with respect to future events and financial

performance.

Overview

We

previously were engaged in the development, manufacture and marketing of non-invasive, whole body periodic acceleration (“WBPA”)

therapeutic platforms, which are motorized platforms that move a subject repetitively head to foot. The Company discontinued operations

in May 2019, accordingly, certain assets, liabilities and expenses are classified as discontinued operations.

Critical

Accounting Policies and Estimates

Our

discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which

have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these consolidated

financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities and

expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those

related to income taxes and contingencies. We base our estimates on historical experience and on various other assumptions that are believed

to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets

and liabilities that are not readily apparent from other sources. A more detailed discussion on the application of these and other accounting

policies can be found in Note 2 in the Notes to the Consolidated Financial Statements set forth in Item 8 of this Annual Report on Form

10-K. While we believe that the factors we evaluate provide us with a meaningful basis for establishing and applying sound accounting

policies, we cannot guarantee that the results will always be accurate. Since the determination of these estimates requires the exercise

of judgment, actual results could differ from such estimates.

Results

of Operations

We

have discontinued operations in May 2019. The Company is assessing potential mergers and acquisitions.

Year

Ended July 31, 2023 Compared to Year Ended July 31, 2022

General

and administrative costs and expenses. General and administrative (“G&A”) costs and expenses was $169,000 for the

year ended July 31, 2023, as compared to $159,000 for the year ended July 31, 2022. This $10,000 net increase was primarily associated

with professional fees incurred in the year ended July 31, 2023.

Total

operating costs and expenses. Total operating costs and expenses from continuing operations was $169,000 for the year ended July

31, 2023, as compared to $159,000 for the year ended July 31, 2022. This $10,000 increase is primarily attributable to G&A noted above.

Interest

expense. Net interest expense was $30,000 for the

year ended July 31, 2023, as compared to $14,000 for the year ended July 31, 2022. The interest

expense is related to the Promissory Notes described in Note 8 to the accompanying consolidated financial statements.

Net

loss. Net loss was $199,000 for the year ended July 31, 2023, as compared to $173,000 for the year ended July 31, 2022. This $26,000

increase is primarily attributable to interest expense and professional fees as noted above.

Liquidity

and Capital Resources

Our

operations have been primarily financed through private sales of our equity securities and notes received from related parties.

At

July 31, 2023, we had cash of $7,000 and negative working capital of approximately $268,000. We expect that our existing funds will not

be sufficient to support our current operations over the next twelve months. No assurance can be given that such additional financing

will be available on acceptable terms or at all. Our ability to sell additional shares of our stock and/or borrow cash could be materially

adversely affected by the economic uncertainty in the global equity and credit markets. Current economic conditions have been, and continue

to be, volatile, and continued instability in these market conditions may limit our ability to access the capital necessary to fund and

grow our business and to replace, in a timely manner, maturing liabilities.

Net

cash used in operating activities decreased to $158,000 for the year ended July 31, 2023 as compared to $190,000 for the year ended

July 31, 2022. This $32,000 decrease was principally due to decreases in cash used by accounts payable and accrued

expenses.

On

August 15, 2023, we entered into a Promissory Note in the principal amount of $200,000 with Frost Gamma Investments Trust (the “2023

Frost Gamma Note”), a trust controlled by Dr. Phillip Frost, a current director, which beneficially owns in excess of 10% of NIMS’

common stock. The interest rate payable by NIMS on the 2023 Frost Gamma Note is 11% per annum, payable on the maturity date of July 31,

2025 (the “Maturity Date”). The 2023 Frost Gamma Note may be prepaid in advance of the Maturity Date without penalty.

On

September 16, 2022, we entered into two Promissory Notes in the principal amount of $75,000 each with Frost Gamma Investments Trust (the

“2022 Frost Gamma Note), a trust controlled by Dr. Phillip Frost, a current director, and with Jane Hsiao, Ph.D., the Company’s

Chairman and Interim CEO (the “2022 Hsiao Note”), both which beneficially own in excess of 10% of NIMS’ common stock.

The interest rate payable by NIMS on the 2022 Frost Gamma Note and 2022 Hsiao Note 2 is 11% per annum, payable on the Maturity Date of

July 31, 2025, as amended on August 15, 2023. The 2022 Frost Gamma Note and 2022 Hsiao Note may be prepaid in advance of the Maturity

Date without penalty.

On

October 4, 2021, we entered into two Promissory Notes in the principal amount of $75,000 each with Frost Gamma Investments Trust (the

“2021 Frost Gamma Note”), a trust controlled by Dr. Phillip Frost, a current director, and with Jane Hsiao, Ph.D., the Company’s

Chairman and Interim CEO (the “2021 Hsiao Note”), both which beneficially own in excess of 10% of NIMS’ common stock.

The interest rate payable by NIMS on the 2021 Frost Gamma Note and 2021 Hsiao Note is 11% per annum, payable on the Maturity Date of

July 31, 2025, as amended on August 15, 2023. The 2021 Frost Gamma Note and 2021 Hsiao Note may be prepaid in advance of the Maturity

Date without penalty.

Our

plans include assessing potential mergers and acquisitions. We will need to raise additional capital.

There can be no assurance that we will be able to raise additional capital on terms acceptable to us or at all.

Item

7A. Quantitative and Qualitative Disclosures About Market Risk.

As

a smaller reporting company as defined in Rule 12b-2 of the Exchange Act, we are not required to include the information otherwise required

by this item.

Item

8. Financial Statements and Supplementary Data.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Board of Directors and Stockholders of

Non-Invasive

Monitoring Systems, Inc. and Subsidiaries

Opinion

on the Financial Statements

We

have audited the accompanying consolidated balance sheets of Non-Invasive Monitoring Systems, Inc. and Subsidiaries (the “Company”)

as of July 31, 2023 and 2022, and the related consolidated statements of operations, changes in shareholders’ deficit, and cash

flows for each of the years then ended, and the related notes (collectively referred to as the “financial statements”). In

our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of July 31,

2023 and 2022, and the results of their operations and their cash flows for each of the years then ended, in conformity with accounting

principles generally accepted in the United States of America.

Going

Concern

The

accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in

Note 1 to the financial statements, the Company has experienced recurring net losses, cash outflows from operating activities and

has an accumulated deficit and these conditions raise substantial doubt about its ability to continue as a going concern.

Management’s plans in regard to these matters are also described in Note 1. The financial statements do not include any

adjustments that might result from the outcome of this uncertainty.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s

financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal

securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits,

we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion

on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our

audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error

or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding

the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits

provide a reasonable basis for our opinion.

Critical

Audit Matters

Critical

audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be

communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and

(2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters.

We

have served as the Company’s auditor since 2018.

EISNERAMPER

LLP

Fort

Lauderdale, FL

October

30, 2023

NON-INVASIVE

MONITORING SYSTEMS, INC.

CONSOLIDATED

BALANCE SHEETS

(In

thousands, except share and per share data)

| | |

July 31, 2023 | | |

July 31, 2022 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 7 | | |

$ | 15 | |

| Prepaid expenses | |

| 16 | | |

| 6 | |

| Total current assets | |

| 23 | | |

| 21 | |

| | |

| | | |

| | |

| Total assets | |

$ | 23 | | |

$ | 21 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 240 | | |

$ | 219 | |

| Current liabilities - discontinued operations | |

| 51 | | |

| 51 | |

| Total current liabilities | |

| 291 | | |

| 270 | |

| | |

| | | |

| | |

| Notes payable – related parties | |

| 300 | | |

| 150 | |

| Accrued interest – related parties | |

| 44 | | |

| 14 | |

| Total liabilities | |

| 635 | | |

| 434 | |

| | |

| | | |

| | |

| Commitments and Contingencies (Note 8) | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ deficit | |

| | | |

| | |

| Series B Preferred Stock, par value $1.00 per share; 100 shares authorized, issued and outstanding; liquidation preference $10 | |

| - | | |

| - | |

| Common Stock, par value $0.01 per share; 400,000,000 shares authorized; 154,810,655 shares issued and outstanding as of July 31, 2023 and 2022, respectively | |

| 1,548 | | |

| 1,548 | |

| Additional paid in capital | |

| 26,574 | | |

| 26,574 | |

| Accumulated deficit | |

| (28,734 | ) | |

| (28,535 | ) |

| | |

| | | |

| | |

| Total shareholders’ deficit | |

| (612 | ) | |

| (413 | ) |

| Total liabilities and shareholders’ deficit | |

$ | 23 | | |

$ | 21 | |

The

accompanying notes are an integral part of these consolidated financial statements.

NON-INVASIVE

MONITORING SYSTEMS, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

Years

ended July 31, 2023 and 2022

(In

thousands, except per share data)

| | |

2023 | | |

2022 | |

| Operating costs and expenses | |

| | | |

| | |

| General and administrative | |

$ | 169 | | |

$ | 159 | |

| | |

| | | |

| | |

| Total operating costs and expenses | |

| 169 | | |

| 159 | |

| | |

| | | |

| | |

| Operating loss | |

| (169 | ) | |

| (159 | ) |

| | |

| | | |

| | |

| Interest expense | |

| (30 | ) | |

| (14 | ) |

| | |

| | | |

| | |

| Net loss | |

$ | (199 | ) | |

$ | (173 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding - basic and diluted | |

$ | 154,811 | | |

$ | 154,811 | |

| | |

| | | |

| | |

| Basic and diluted loss per common share | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

The

accompanying notes are an integral part of these consolidated financial statements.

NON-INVASIVE

MONITORING SYSTEMS, INC.

CONSOLIDATED

STATEMENTS OF CHANGES IN SHAREHOLDERS’ DEFICIT

Years

ended July 31, 2023 and 2022 (Dollars in thousands, except share amounts)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| | |

Preferred Stock | | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Series B | | |

Common Stock | | |

Paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at July 31, 2021 | |

| 100 | | |

$ | - | | |

| 154,810,655 | | |

$ | 1,548 | | |

$ | 26,574 | | |

$ | (28,362 | ) | |

| (240 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (173 | ) | |

| (173 | ) |

| Balance at July 31, 2022 | |

| 100 | | |

| - | | |

| 154,810,655 | | |

| 1,548 | | |

| 26,574 | | |

| (28,535 | ) | |

$ | (413 | ) |

| Balance, value | |

| 100 | | |

| - | | |

| 154,810,655 | | |

| 1,548 | | |

| 26,574 | | |

| (28,535 | ) | |

$ | (413 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (199 | ) | |

| (199 | ) |

| Balance at July 31, 2023 | |

| 100 | | |

$ | - | | |

| 154,810,655 | | |

$ | 1,548 | | |

$ | 26,574 | | |

$ | (28,734 | ) | |

$ | (612 | ) |

| Balance, value | |

| 100 | | |

$ | - | | |

| 154,810,655 | | |

$ | 1,548 | | |

$ | 26,574 | | |

$ | (28,734 | ) | |

$ | (612 | ) |

The

accompanying notes are an integral part of these consolidated financial statements.

NON-INVASIVE

MONITORING SYSTEMS, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

Years

ended July 31, 2023 and 2022

(Dollars

in thousands)

| | |

2023 | | |

2022 | |

| Operating activities | |

| | | |

| | |

| Net loss | |

$ | (199 | ) | |

$ | (173 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Prepaid expenses | |

| (10 | ) | |

| (2 | ) |

| Accounts payable and accrued expenses | |

| 21 | | |

| (29 | ) |

| Accrued interest – related parties | |

| 30 | | |

| 14 | |

| Net cash used in operating activities | |

| (158 | ) | |

| (190 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Proceeds from notes payable – related parties | |

| 150 | | |

| 150 | |

| Net cash provided by financing activities | |

| 150 | | |

| 150 | |

| | |

| | | |

| | |

| Net decrease in cash | |

| (8 | ) | |

| (40 | ) |

| Cash, beginning of year | |

| 15 | | |

| 55 | |

| Cash, end of year | |

$ | 7 | | |

$ | 15 | |

The

accompanying notes are an integral part of these consolidated financial statements.

NON-INVASIVE

MONITORING SYSTEMS, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

1.

ORGANIZATION AND BUSINESS

Organization.

Non-Invasive Monitoring Systems, Inc., a Florida corporation (together with its consolidated subsidiaries, the “Company”

or “NIMS”). The Company previously developed and marketed its Exer-Rest® line of acceleration therapeutic

platforms based upon unique, patented whole body periodic acceleration (“WBPA”) technology of which the Company maintains

patents. The Company maintains limited administration, but does not have any operations or inventory.

Business.

The Company is currently a shell company (as defined in Rule 12b-2 of the Exchange Act).

Going

Concern. The Company’s consolidated financial statements have been prepared and presented on a basis assuming it will continue

as a going concern. As reflected in the accompanying consolidated financial statements, the Company had net losses from continuing operations

of approximately $0.2 million for each of the years ended July 31, 2023 and 2022 and has experienced cash outflows from operating activities.

The Company also has an accumulated deficit of $28.7 million as of July 31, 2023. The Company had $7,000 of cash at July 31, 2023 and

negative working capital of approximately $268,000. These matters raise substantial doubt about the Company’s ability to continue

as a going concern.

On August 15,

2023, the Company entered into a Promissory Note in the principal amount of $200,000 with Frost Gamma Investments Trust (the “2023

Frost Gamma Note”), a trust controlled by Dr. Phillip Frost, which beneficially owns in excess of 10% of the Company’s common

stock. The interest rate payable by NIMS on the 2023 Frost Gamma Note is 11% per annum, payable on the maturity date of July 31, 2025

(the “Maturity Date”). The 2023 Frost Gamma Note may be prepaid in advance of the Maturity Date without penalty.

The

Company is seeking potential mergers, acquisitions and strategic collaborations. There is no assurance that the Company will be successful

in this regard, and, if not successful, that it will be able to continue its business activities. The accompanying consolidated financial

statements do not include any adjustments that might be necessary from the outcome of this uncertainty.

Discontinued

Operations. On May 3, 2019, the Company exchanged inventory for forgiveness of accrued unpaid rent. The Company has no inventory,

no immediate plans to replenish inventory and has no current plans to develop or market new products.

Accordingly,

the Company determined that the assets and liabilities met the discontinued operations criteria in Accounting Standards Codification

205-20-45 and were classified as discontinued operations at May 3, 2019. See Discontinued Operations Note 3.

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Consolidation.

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Non-Invasive Monitoring

Systems of Florida, Inc., which has no current operations, and NIMS of Canada, Inc., a Canadian corporation, which has no current operations.

All inter-company accounts and transactions have been eliminated in consolidation.

Discontinued

Operations. For the years ended July 31, 2023 and 2022, results from operations for our Exer-Rest Business are classified as

discontinued operations. The carve out of the discontinued operations (i) were prepared in accordance with the SEC’s carve out

rules under Staff Accounting Bulletin (“SAB”) Topic 1B1 and (ii) are derived from identifying and carving out the specific

assets, liabilities, operating expenses and interest expense associated with the Exer-Rest Business’s operations (see Note 3).

Use

of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America (“GAAP”) requires management to make estimates and assumptions, such as deferred taxes as estimates, that

affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated

financial statements and reported amounts of expenses during the reporting period. Actual results could differ materially from these

estimates.

Cash

and Cash Equivalents. The Company considers all highly liquid short-term investments purchased with an original maturity date

of three months or less to be cash equivalents. The Company had approximately $7,000 and $15,000, on deposit in bank operating accounts

at July 31, 2023 and July 31, 2022, respectively.

Income

Taxes. The Company uses the asset and liability method to determine the income

tax expense or benefit. Deferred tax assets and liabilities are computed based on temporary differences between the financial reporting

and tax bases of assets and liabilities and are measured using the enacted tax rates that are expected to be in effect when the differences

are expected to recovered or settled. Any resulting net deferred tax assets are evaluated for recoverability and, accordingly, a valuation

allowance is provided when it is more likely than not that all or some portion of the deferred tax asset will not be realized.

The

Company files its tax returns as prescribed by the laws of the jurisdictions in which it operates. Tax years ranging from 2019 to 2023

remain open to examination by various taxing jurisdictions as the statute of limitations has not expired. The net operating losses are generally subject to examination up to three

years after the utilization of such losses. It is the Company’s policy

to include income tax interest and penalty expense in its tax provision.

Fair

Value of Financial Instruments. Fair value estimates discussed herein are based upon certain market assumptions and pertinent

information available to management as of July 31, 2023 and 2022. The respective carrying value of certain on-balance-sheet financial

instruments such as cash, prepaid expenses and accounts payable and accrued expenses approximate fair values because they are short term

in nature.

Loss

Contingencies. We recognize contingent losses that are both probable and estimable. In this context, we define probability as

circumstances under which events are likely to occur. In regard to legal costs, we record such costs as incurred.

Related

Parties. The Company follows ASC 850 “Related Party Disclosures,” for the identification of related parties and disclosure

of related party transactions.

Recent

Accounting Pronouncements. The Company considers the applicability and impact of all relevant Accounting Standard Updates (“ASU’s”).

Our conclusion was that they did not have any material effect on the consolidated financial statements.

3.

DISCONTINUED OPERATIONS

On

May 3, 2019, the Company exchanged its inventory for forgiveness of accrued unpaid rent. Concurrent with the exchange management with

the appropriate level of authority determined to discontinue the operations of the product segment.

The

detail of the consolidated balance sheets for discontinued operations is as stated below (in thousands):

SCHEDULE OF BALANCE SHEETS OF DISCONTINUED OPERATIONS

| | |

As of July 31, 2023 | | |

As of July 31, 2022 | |

| | |

| | |

| |

| Current liabilities – discontinued operations | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 51 | | |

$ | 51 | |

| Total current liabilities – discontinued operations | |

| 51 | | |

| 51 | |

| Total liabilities – discontinued operations | |

$ | 51 | | |

$ | 51 | |

4.

SHAREHOLDERS’ EQUITY

The

Company has one class of Preferred Stock. Holders of Series B Preferred Stock are entitled to vote with the holders of common stock as

a single class on all matters. We are currently authorized to issue an aggregate of 401,000,000 shares of capital stock, consisting of

400,000,000 shares of common stock and 1,000,000 designated shares of preferred stock with preferences and rights to be determined by

our Board of Directors.

Series

B Preferred Stock is not redeemable by the Company and has a liquidation value of $100 per share, plus declared and unpaid dividends,

if any. Dividends are non-cumulative, and are at the rate of $10 per share, if declared.

No

preferred stock dividends were declared for the years ended July 31, 2023 and 2022.

The

Company did not issue any shares of the Company’s common stock during the

years ended July 31, 2023 and 2022.

5.

BASIC AND DILUTED LOSS PER SHARE

Basic

net loss per common share is computed by dividing net loss attributable to common shareholders by the weighted average number of common

shares outstanding during the period. Diluted net loss per common share is computed giving effect to all dilutive potential common shares

that were outstanding during the period. Diluted potential common shares consist of incremental shares issuable upon conversion of preferred

stock. In computing diluted net loss per share for the years ended July 31, 2023 and 2022, no dilution adjustment has been made to the

weighted average outstanding common shares because the assumed conversion of preferred stock would be anti-dilutive.

6.

RELATED PARTY TRANSACTIONS

Dr.

Hsiao and directors Dr. Frost and Rao Uppaluri and former director Steve Rubin are each stockholders, current or former officers

and/or directors or former directors of Asensus Surgical, Inc. (formerly TransEnterix, Inc.) (“Asensus”), a

publicly-traded medical device company. Dr. Frost is a director and over 5% shareholder of Cocrystal Pharma, Inc. (“Cocrystal

Pharma”), a clinical stage Nasdaq listed biotechnology company. The Company’s Chief Financial Officer also serves as the

Chief Financial Officer and Co-Chief Executive Officer of Cocrystal Pharma, and in which former director Steve Rubin serves on the Board. From December 2009 until August 31, 2021, the Company’s

Chief Legal Officer had served under a cost sharing arrangement as the Chief Legal Officer of Asensus. The Company recorded

additions to general and administrative costs and expenses to account for the sharing of costs under this arrangement of $0

and $400

for the years ended July 31, 2023 and 2022, respectively. There was no

accounts payable due to Asensus at July 31, 2023 and 2022, respectively.

The

Company signed a five year lease for administrative office space in Miami, Florida with a company controlled by Dr. Phillip Frost, a

current director and who is the beneficial owner of more than 10% of the Company’s common stock. The rental payments under the

Miami office lease, which commenced January 1, 2008 and expired on December 31, 2012, were approximately $1,250 per month and then continued

on a month-to-month basis. In February 2016 the rent was reduced to $0 per month. For the years ended July 31, 2023 and 2022, the Company

did not record any rent expense related to the Miami lease. At July 31, 2023 and 2022 there was $0 rent payable.

The

Company is under common control with multiple entities and the existence of that control could result in operating results or financial

position of each individual entity significantly different from those that would have been obtained if the entities were autonomous.

One of those related parties, OPKO Health, Inc. (“OPKO”) and the Company are under common control and OPKO has a one percent

ownership interest in the Company that OPKO has accounted for as an equity method investment due to the ability to significantly influence

the Company.

7.

NOTES PAYABLE – RELATED PARTY

On

September 16, 2022, the Company entered into two Promissory Notes in the principal amount of $75,000 each with Frost Gamma Investments

Trust (the “2022 Frost Gamma Note”), a trust controlled by Dr. Phillip Frost, a current director, and with Jane Hsiao, Ph.D.,

the Company’s Chairman and Interim CEO (the “2022 Hsiao Note”), both which beneficially own in excess of 10% of NIMS’

common stock. The interest rate payable by NIMS on the 2022 Frost Gamma Note and 2022 Hsiao Note is 11% per annum, payable on the Maturity

Date of July 31, 2025, as amended on August 15, 2023. The 2022 Frost Gamma Note and 2022 Hsiao Note may be prepaid in advance of the

Maturity Date without penalty.

On

October 4, 2021, the Company entered into two Promissory Notes in the principal amount of $75,000 each with Frost Gamma Investments Trust

(the “2021 Frost Gamma Note”), a trust controlled by Dr. Phillip Frost, a current director, and with Jane Hsiao, Ph.D., the

Company’s Chairman and Interim CEO (the “2021 Hsiao Note”), both which beneficially own in excess of 10% of NIMS’

common stock. The interest rate payable by NIMS on the 2021 Frost Gamma Note and 2021 Hsiao Note is 11% per annum, payable on the Maturity

Date of July 31, 2025, as amended on August 15, 2023. The 2021 Frost Gamma Note and 2021 Hsiao Note may be prepaid in advance of the

Maturity Date without penalty.

8.

COMMITMENTS AND CONTINGENCIES

Leases.

The

Company was under an operating lease agreement for our corporate office space that expired in 2012. The lease currently continues on

a month to month basis at no cost.

9.

ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts

payable and accrued expenses from continuing operations are summarized in the following table (in thousands):

SCHEDULE OF ACCOUNTS PAYABLE AND ACCRUED EXPENSES

| | |

July 31, 2023 | | |

July 31, 2022 | |

| Accounts payable | |

$ | 209 | | |

$ | 203 | |

| Accrued redemption | |

| 10 | | |

| 10 | |

| Accrued other | |

| 21 | | |

| 6 | |

| Total | |

$ | 240 | | |

$ | 219 | |

10.

INCOME TAXES

The

Company accounts for income taxes using the asset and liability method. Pursuant to this method, deferred tax assets and liabilities

are established for the differences between the financial reporting and the tax bases of the Company’s assets and liabilities and

net operating loss carryforwards at enacted tax rates expected to be in effect when such amounts are realized or settled. A valuation

allowance related to deferred tax assets is recorded when it is more likely than not that some portion or all of the deferred tax assets

will not be realized.

The

accounting for uncertain tax positions guidance under ASC 740 requires that we recognize the financial statement benefit of a tax position

only after determining that the relevant tax authority would more likely than not sustain the position following an audit. For tax positions

meeting the more-likely-than-not threshold, the amount recognized in the financial statements is the largest benefit that has a greater

than 50 percent likelihood of being realized upon ultimate settlement with the relevant tax authority. The application of this guidance

does not affect the Company’s financial position, results of operations or cash flows for the years ended July 31, 2023 and 2022.

The

Company files its tax returns in the U.S. federal jurisdiction and with U.S. states. The Company is subject to tax audits in all jurisdictions

for which it files tax returns. Tax audits by their very nature are often complex and can require several years to complete. There are

currently no tax audits that have commenced with respect to income tax or any other returns in any jurisdiction. Tax years ranging from

2019 to 2023 remain open to examination by various taxing jurisdictions as the statute of limitations has not expired. Because the Company

is carrying forward income tax attributes, such as net operating losses and tax credits from 2018 and earlier tax years, these attributes

can still be audited when utilized on returns filed in the future. It is the Company’s policy to include income tax interest and

penalties expense in its tax provision.

The

difference between income taxes at the statutory federal income tax rate of 21% in 2023 and 2022 and income taxes reported in the consolidated

statements of operations are attributable to the following (in thousands):

SCHEDULE OF FEDERAL INCOME TAX RATE AND INCOME TAXES

| | |

July 31, 2023 | | |

% | | |

July 31, 2022 | | |

% | |

| Income tax benefit at the federal statutory rate from continuing operations | |

$ | (42 | ) | |

| 21.0 | | |

$ | (36 | ) | |

| 21.0 | |

| State income taxes, net of effect of federal taxes | |

| (9 | ) | |

| 4.5 | | |

| (7 | ) | |

| 4.3 | |

| Expired net operating losses | |

| 364 | | |

| (182.8 | ) | |

| 282 | | |

| (164.3 | ) |

| Change in valuation allowance | |

| (313 | ) | |

| 157.3 | | |

| (239 | ) | |

| 139.0 | |

| Total | |

$ | - | | |

| - | | |

$ | - | | |

| - | |

The

tax effects of temporary differences that give rise to significant portions of the deferred tax assets consist of the following (in thousands):

SCHEDULE OF DEFERRED TAX ASSETS

| | |

July 31, 2023 | | |

July 31, 2022 | |

| Federal and State net operating loss | |

$ | 3,768 | | |

$ | 4,081 | |

| Foreign net operating loss | |

| 18 | | |

| 18 | |

| Other | |

| 3 | | |

| 3 | |

| Deferred tax assets gross,total | |

| 3,789 | | |

| 4,102 | |

| Less: Valuation allowance | |

| (3,789 | ) | |

| (4,102 | ) |

| Net deferred tax asset | |

$ | - | | |

$ | - | |

At

July 31, 2023, the Company had available Federal and State net operating loss carry forwards of approximately $14.8 million and foreign

net operating loss carry forwards of approximately $0.1 million which expire in various years beginning in 2023. Net operating loss carry

forwards generated in 2019 and later years never expire. However, these net operating losses can only be used to reduce taxable income

by 80 percent. The net operating loss carry forwards may be subject to limitation due to change of ownership provisions under section

382 of the Internal Revenue Code and similar state provisions. The Company has not conducted a study to determine if any changes in ownership

has occurred or the potential value of such net operating losses if a change occurs.

A

valuation allowance is required to reduce the deferred tax assets reported if, based on the weight of the evidence, it is more likely

than not that some portion or all of the deferred tax assets will not be realized. After consideration of all the evidence, both positive

and negative, management has determined that a full $3.8 million valuation allowance at July 31, 2023 ($4.1 million at July 31, 2022)

was necessary. The valuation allowance decreased by $313,000 and decreased by $239,000 for the years ended July 31, 2023 and 2022, respectively.

The Company paid no taxes for the years 2022 or 2021.

11.

SUBSEQUENT EVENTS

On

August 15, 2023, the Company entered into a Promissory Note in the principal amount of $200,000 with Frost Gamma Investments Trust

(the “2023 Frost Gamma Note”), a trust controlled by Dr. Phillip Frost, which beneficially owns in excess of 10% of the Company’s

common stock. The interest rate payable by NIMS on the 2023 Frost Gamma Note is 11% per annum, payable on the maturity date of July 31,

2025 (the “Maturity Date”). The 2023 Frost Gamma Note may be prepaid in advance of the Maturity Date without penalty.

Item

9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item

9A. Controls and Procedures.

The

Company’s management, with the participation of its Interim Chief Executive Officer and Chief Financial Officer, evaluated the

effectiveness of the design and operation of the Company’s disclosure controls and procedures (as defined in Exchange Act Rules

13a-15(e) or 15d-15(e)) as of July 31, 2023. Based upon that evaluation, the Interim Chief Executive Officer and Chief Financial Officer

concluded that, as of that date, the Company’s disclosure controls and procedures were not effective due to the material weakness

identified below.

Management’s

Report on Internal Control over Financial Reporting

Management

is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting

is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally accepted accounting principles. Internal control over financial reporting

includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail accurately and fairly

reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded

as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts

and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

(iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s

assets that could have a material effect on the financial statements.

A

material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a

reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented

or detected on a timely basis. In its assessment of the effectiveness of internal control over financial reporting as of July 31, 2023,

the Company determined that there were control deficiencies that constituted material weaknesses, as described below.

| |

|

Process

and procedures – The Company does not employ a sufficient number of individuals to maintain optimal segregation of duties. The

internal control procedures over the completeness and accuracy of the general ledger information and the risk assessment process are

not formally documented and may not be designed and operate with a level of precision adequate to prevent or detect

misstatements. Since internal control procedures are not formally documented, management cannot monitor their effectiveness. |

Accordingly,

the Company concluded that these control deficiencies resulted in a reasonable possibility that a material misstatement of the annual

or interim financial statements will not be prevented or detected on a timely basis by the Company’s internal controls.

As

a result of the material weaknesses described above, management has concluded that the Company did not maintain effective internal control

over financial reporting as of July 31, 2023 based on criteria established in Internal Control—Integrated Framework issued by the

Committee of Sponsoring Organizations of the Treadway Commission (“COSO”).

Notwithstanding

the existence of these material weaknesses in the Company’s internal control over financial reporting, the Company’s management

believes that the consolidated financial statements included in this Form 10-K fairly present in all material respects the Company’s

financial condition, results of operations and cash flows for the periods presented.

Changes

in Internal Control Over Financial Reporting

There

were no changes in the Company’s internal control over financial reporting during the last quarter that have materially affected,

or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

Item

9B. Other Information.

None.

PART

III

Item

10. Directors, Executive Officers and Corporate Governance.

We

believe that the combination of the respective qualifications, skills and experience of our directors contribute to an effective and

well-functioning board and that, individually and as a whole, our directors possess the necessary qualifications to provide effective

oversight of our business and quality advice to our management. Our directors are elected annually and serve until the next annual meeting

of shareholders and until their successors are elected and appointed, or until his or her earlier resignation, removal from office or

death. Information regarding the age, experience and qualifications of each director is set forth below.

| Name | |

Age | |

| Jane H. Hsiao, Ph.D., MBA | |

| 76 | |

| Subbarao V. Uppaluri, Ph.D. | |

| 74 | |

| Philip Frost, M.D | |

| 86 | |

| James Martin, CPA, MBA | |

| 57 | |

Jane

H. Hsiao, Ph.D., MBA. Dr. Hsiao has served as a Director and Chairman of the Board of Directors (the “Board”) of

the Company since October 2008 and as Interim Chief Executive Officer since February 2012. Dr. Hsiao has served as Vice Chairman and

Chief Technical Officer of OPKO Health, Inc. (“OPKO”) (NASDAQ: OPK), a specialty healthcare company, since May 2007 and as

a director since February 2007. Dr. Hsiao previously served as a director of each of Asensus Surgical, Inc. (NYSE American: ASXC), a

medical device company, Cocrystal Pharma, Inc. (NASDAQ: COCP), a biotechnology company developing antiviral therapeutics for human diseases,

Neovasc, Inc. (NASDAQ: NVCN), a company developing and marketing medical specialty vascular devices. Dr. Hsiao served as the Vice Chairman-Technical

Affairs of IVAX from 1995 to January 2006. Dr. Hsiao served as Chairman, Chief Executive Officer and President of IVAX Animal Health,

IVAX’s veterinary products subsidiary, from 1998 to 2006.

Dr.

Hsiao’s background in medical device and pharmaceutical industry, as well as her senior management experience, allow her to play

an integral role in overseeing our product development and regulatory affairs and in navigating the regulatory pathways for our products

and product candidates. In addition, as a result of her role as director and/or chairman of other companies in the biotechnology and

life sciences space, she also has a keen understanding and appreciation of the many regulatory and development issues confronting pharmaceutical

and biotechnology companies.

Phillip

Frost, M.D. Dr. Frost has served as a Director

of the Company since June 2023. Dr. Frost been the Chief Executive Officer and Chairman of the

Board of Opko Health, Inc. (NASDAQ:OPK), a multi-national pharmaceutical and diagnostics company since March 2007. Dr.

Frost serves as a director for Cocrystal Pharma, Inc. (NASDAQ:COCP), a biotechnology company developing new treatments for viral diseases.

He also currently serves on the board of Grove Bank & Trust and Morgan Solar. He has been a member of the Board of Trustees of the

University of Miami since 1983 and was Chairman from 2001 to 2004. He is on the Advisory Board of the Shanghai Institute for Advanced

Immunochemical Studies in China, is a member of The Florida Council of 100 and is a trustee of the Miami Jewish Home for the Aged and

serves on the Executive Committee of the Board of Mount Sinai Medical Center. He serves as Chairman of Temple Emanu-El, Governor of Tel

Aviv University and is a member of the Executive Committee of The Phillip and Patricia Frost Museum of Science. Dr. Frost served as a

director of Ladenburg Thalmann Financial Services Inc. from 2004 to 2006 and as Chairman from July 2006 until September 2018. Dr. Frost

previously served as a director for Castle Brands (NYSE:ROX). Dr. Frost had served as Chairman of the Board of Directors and Chief Executive

Officer of IVAX Corporation (“IVAX”) from 1987 until its acquisition by Teva in January 2006. Dr. Frost was Chairman of the

Board of Directors of Key Pharmaceuticals, Inc. from 1972 until its acquisition by Schering Plough Corporation in 1986. Dr. Frost was

a Governor of the American Stock Exchange from 1992 to 2008 and Co-Vice Chairman from 2001 until its merger with the New York Stock Exchange.

Dr.

Frost has successfully founded several companies and overseen the development and commercialization of a multitude of products. This

combined with his experience as a physician and chairman and/or chief executive officer of large pharmaceutical companies has given him

insight into virtually every facet of business. He is a demonstrated leader with keen business understanding and is uniquely positioned

to help guide our Company.

Subbarao

V. Uppaluri, Ph.D. Dr. Uppaluri has served as a Director of the Company since October 2008. Dr. Uppaluri served as Senior Vice

President and Chief Financial Officer of OPKO from May 2007 until July 2012 and as a consultant of OPKO until February 2014. Dr. Uppaluri served as the Vice President, Strategic Planning and Treasurer of IVAX from 1997 until December

2006. Before joining IVAX, from 1987 to August 1996, Dr. Uppaluri was Senior Vice President, Senior Financial Officer and Chief Investment

Officer with Intercontinental Bank, a publicly traded commercial bank in Florida. In addition, he served in various positions, including

Senior Vice President, Chief Investment Officer and Controller, at Peninsula Federal Savings & Loan Association, a publicly traded

Florida S&L, from October 1983 to 1987. His prior employment, during 1974 to 1983, included engineering, marketing and research positions

with multinational companies and research institutes in India and the United States. Dr. Uppaluri previously served on the boards of

OPKO, Winston Pharmaceuticals Inc., Ideation Acquisition Corp., Tiger X Medical, Inc. and Kidville.

Dr.