0001132509false0.0010.00150000000017500000017500000001310869P12M0.211021486900011325092021-01-012021-12-310001132509nnax:MajorCustomersMember2020-01-012020-12-310001132509nnax:MajorvendorsMember2020-01-012020-12-310001132509nnax:MajorCustomersMember2021-01-012021-12-310001132509nnax:MajorvendorsMember2021-01-012021-12-310001132509nnax:SinceFebruaryOneTwoZeroOneSixMembernnax:CooperationPartnershipWithJjExplorerMember2021-12-310001132509nnax:SinceFebruaryOneTwoZeroOneSixMembernnax:CooperationPartnershipWithJjExplorerMember2020-01-012020-12-310001132509nnax:SinceFebruaryOneTwoZeroOneSixMembernnax:CooperationPartnershipWithJjExplorerMember2021-01-012021-12-310001132509nnax:HongKongsMember2021-01-012021-12-310001132509nnax:UnitedStateofAmericaMember2021-01-012021-12-310001132509nnax:UnitedStateofAmericaMember2021-12-310001132509nnax:HongKongsMember2021-12-310001132509nnax:HongKongsMember2020-12-310001132509nnax:UnitedStateMember2021-12-310001132509nnax:UnitedStateMember2020-12-310001132509nnax:SingaporesMember2020-12-310001132509nnax:SingaporesMember2021-12-310001132509nnax:IncomeTaxExpanseMember2020-01-012020-12-310001132509nnax:IncomeTaxExpanseMember2021-01-012021-12-310001132509nnax:ForeignMember2020-01-012020-12-310001132509nnax:ForeignMember2021-01-012021-12-310001132509nnax:DomesticMember2021-01-012021-12-310001132509nnax:DomesticMember2020-01-012020-12-310001132509nnax:ClassAPreferredStockMember2020-12-310001132509nnax:ClassAPreferredStockMember2021-12-3100011325092021-04-182021-04-190001132509nnax:StockOptionPlanMember2020-10-190001132509nnax:ConsultantsAndServiceProvidersMember2020-10-230001132509nnax:ConsultantsAndServiceProvidersMember2021-12-310001132509nnax:EmaFinancialLlcMember2021-07-262021-07-270001132509us-gaap:PreferredClassAMember2021-04-130001132509nnax:MrLeungMember2021-04-1300011325092021-04-1900011325092021-11-012021-11-2800011325092021-03-012021-03-1100011325092021-11-280001132509nnax:SecuritiesPurchaseAgreementMember2020-10-012020-10-270001132509nnax:SecuritiesPurchaseAgreementMember2020-10-270001132509nnax:DirectorsMember2021-12-310001132509nnax:DirectorsMember2020-12-310001132509nnax:GoingConcernMember2021-12-310001132509nnax:NemoHoldingCompanyalimitedMember2020-07-012020-07-060001132509nnax:LeungTinLungDavidMember2020-07-012020-07-060001132509nnax:LeungTinLungDavidMember2020-07-060001132509nnax:BeyondBlueLimitedMember2021-01-012021-12-310001132509nnax:JPOPCOINLimitedMember2021-01-012021-12-310001132509nnax:NewMomentumAsiaPteLtdMember2021-01-012021-12-310001132509nnax:GagfareLimitedMember2021-01-012021-12-310001132509nnax:NemoHoldingCompanyalimitedMember2021-01-012021-12-310001132509us-gaap:RetainedEarningsMember2021-12-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001132509us-gaap:AdditionalPaidInCapitalMember2021-12-310001132509nnax:SeriesAPreferredsStockMember2021-12-310001132509us-gaap:CommonStockMember2021-12-310001132509us-gaap:RetainedEarningsMember2021-01-012021-12-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001132509us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001132509nnax:SeriesAPreferredsStockMember2021-01-012021-12-310001132509us-gaap:CommonStockMember2021-01-012021-12-310001132509us-gaap:RetainedEarningsMember2020-12-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001132509us-gaap:AdditionalPaidInCapitalMember2020-12-310001132509nnax:SeriesAPreferredsStockMember2020-12-310001132509us-gaap:CommonStockMember2020-12-310001132509us-gaap:RetainedEarningsMember2020-01-012020-12-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001132509us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001132509nnax:SeriesAPreferredsStockMember2020-01-012020-12-310001132509us-gaap:CommonStockMember2020-01-012020-12-310001132509us-gaap:RetainedEarningsMember2019-12-310001132509us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001132509us-gaap:AdditionalPaidInCapitalMember2019-12-310001132509nnax:SeriesAPreferredsStockMember2019-12-310001132509us-gaap:CommonStockMember2019-12-3100011325092019-12-3100011325092020-01-012020-12-310001132509us-gaap:PreferredClassAMember2021-12-310001132509us-gaap:PreferredClassAMember2020-12-3100011325092020-12-3100011325092021-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

As filed with the Securities and Exchange Commission on May 6, 2022

Registration No. 333-257302

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

to

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NEW MOMENTUM CORPORATION |

(Exact name of registrant as specified in its charter) |

Nevada | | 2080 | | 88-0435998 |

(State or Other Jurisdiction of | | (Primary Standard Industrial | | (IRS Employer |

Incorporation or Organization) | | Classification Number) | | Identification Number) |

New Momentum Corporation 150 Cecil Street, #08-01 Singapore 069543 +65 3105-4128 |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

Leung Tin Lung David

President and Chief Executive Officer

New Momentum Corporation

150 Cecil Street, #08-01

Singapore 069543

+65 3105-4128

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant Section 7(a)(2)(B) of the Exchange Act. ☒

Calculation of Registration Fee

Title of Securities To Be Registered | | Amount to be Registered | | | Proposed Maximum Offering Price Per Share | | | Proposed Maximum Aggregate Offering Price | | | Registration Fee | |

Common Stock, par value $0.001 per share, issuable pursuant to Investment Agreement (1) | | | 5,000,000 | (1) | | $ | 1.000 | (3) | | $ | 5,000,000 | | | $ | 545.50 | |

Common Stock, par value $0.001 per share, issuable upon conversion of 10% Convertible Note (2) | | | 182,617 | (2) | | $ | 1.00 | (3) | | $ | 182,617 | | | $ | 19.92 | |

Total | | | 5,182,617 | (3) | | $ | 1.000 | (3) | | $ | 5,182,617 | | | $ | 565.42 | |

_____________

(1) | Represents the number of shares of common stock of the Registrant that we will put (“Put Shares”) to Strattner Alternative Credit Fund LP, a Delaware limited partnership (“Strattner”), pursuant to that certain Investment Agreement (the “Investment Agreement”) by and between Strattner and the Registrant, effective on April 16, 2021. In the event that adjustment provisions of the Investment Agreement require the Company to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the Company will file a new registration statement to register those additional shares. |

| |

(2) | Represents the number of shares of common stock of the Registrant underlying that certain 10% Convertible Note (the “Note”), dated October 27, 2020, and made to EMA Financial, LLC. The Note is due July 27, 2021, and carries interest at a rate of 10% per annum. |

| |

(3) | This offering price has been estimated solely for the purpose of computing the registration fee in accordance with Rule 457(c) of the Securities Act on the basis of the average of the high and low prices of the common stock of the Company as reported on the Pink tier of the OTC Markets Group, Inc. on June 15, 2021. |

In the event of stock splits, stock dividends, or similar transactions involving the Registrant’s common stock, the number of Shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION ON MAY 6, 2022

NEW MOMENTUM CORPORATION

5,182,617 SHARES OF COMMON STOCK

This prospectus relates to the resale of shares of our common stock, par value $0.001 per share, by (i) Strattner Alternative Credit Fund LP (“Strattner”) of 5,000,000 Put Shares that we will put to Strattner pursuant to the Investment Agreement, and (ii) 182,617 shares of common stock underlying that certain 10% Convertible Note (the “Note”), dated October 27, 2020, and made to EMA Financial, LLC, a Delaware limited liability company (“EMA Financial”). Strattner and EMA Financial are collectively referred to herein as the “Selling Security Holders.”

The Investment Agreement with Strattner provides that Strattner is committed to purchase up to $5,000,000 of our common stock. We may draw on the facility from time to time, as and when we determine appropriate in accordance with the terms and conditions of the Investment Agreement.

The terms and conditions of the Note provide registration rights for the shares (the “Note Shares”) underlying the Note to EMA Financial.

The Selling Security Holders are “underwriters” within the meaning of the Securities Act in connection with the resale of our common stock under the Investment Agreement and the Note. No other underwriter or person has been engaged to facilitate the sale of shares of our common stock in this offering. This offering will terminate on October 22, 2022. The per share purchase price for the Put Shares shall be equal to 85% of volume weighted average price (“VWAP”) for the five (5) consecutive trading days including and immediately after the date on which the Company submits a put notice to Strattner.

The conversion price of the Note Shares is equal to the lower of: (i) the lowest closing price of the Common Stock during the preceding twenty (20) trading day period ending on the latest complete trading day prior to the Issue Date of this Note or (ii) 55% of the lowest trading price for the Common Stock on the Principal Market during the twenty (20) consecutive trading days including and immediately preceding the Conversion Date.

We will not receive any proceeds from the sale of the shares of common stock offered by the Selling Security Holders. We may receive proceeds of up to $5,000,000 from the sale of our Put Shares under the Investment Agreement. The proceeds will be used for working capital or general corporate purposes. We will bear all costs associated with this registration.

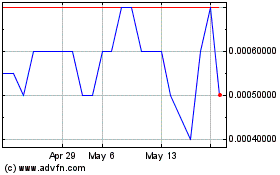

Our common stock is quoted on the OTCQB tier of the OTC Markets Group, Inc. (the “OTC Markets”) under the symbol “NNAX.” The shares of our common stock registered hereunder are being offered for sale by Selling Security Holders at prices established on the OTC Markets during the term of this offering. On May 5, 2022, the closing price of our common stock was $0.016 per share. These prices will fluctuate based on the demand for our common stock.

While our principal administrative offices are located in Singapore, the majority of our operations are conducted in Hong Kong, three of our subsidiaries are Hong Kong entities, and as such, we are subject to emerging legal and operational risks associated with having the majority of our operations in Hong Kong corporations and thereby subject to political and economic influence from China. These risks could result in a material change in our operations and/or the value of our common stock. These risks could also significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Recent statements and regulatory actions by the Chinese government, such as those related to data security, anti-monopoly concerns, entertainment, education, finance, real estate, video gaming, advertising, casino operations, social mores, healthcare and China’s extension of authority into Hong Kong, has or may impact our ability to conduct our business, accept foreign investments, or list on a U.S. or other foreign exchange. Under current regulatory conditions in China and Hong Kong, virtually no aspect of society is being left unaffected by these changes; therefore we expect that our business and operations will also be affected by China and/or Hong Kong regulatory actions in the future. For example, it travel or movement of peoples in China and/or Hong Kong is restricted, our business will be adversely effected. Furthermore, the policies of the Chinese government, including the implementation of the National Security Law in Hong Kong, recent legislative and government policy changes, including the redistribution of wealth, may impact our ability to operate with legal certainty.

The Company’s auditors, J&S Associate, is a PCAOB-registered independent public accounting firm, based in Malaysia. Under the Holding Foreign Companies Accountable Act (the “HFCAA”), the PCAOB is permitted to inspect our independent public accounting firm. There is no guarantee that future audit reports will be prepared by auditors that are completely inspected by the PCAOB, and, as such, future investors may be deprived of such inspections, which could result in limitations or restrictions to our access of the U.S. capital markets. Furthermore, trading in our securities may be prohibited under the HFCAA or the Accelerating Holding Foreign Companies Accountable Act, if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and, as a result, our securities may be removed from quotation and further trading on the over-the-counter markets, where our shares of common stock are currently quoted. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCAA to reduce the number of non-inspection years from three to two years and, thus, would reduce the time before our securities may be prohibited from trading or be delisted. On December 2, 2021, the SEC adopted amendments to finalize rules implementing the HFCAA requiring the SEC to prohibit an issuer’s securities from trading on any U.S. securities exchange and on the over-the-counter market, if the auditor is not subject to PCAOB inspections for three consecutive years and this ultimately could result in our ordinary shares being delisted. On December 16, 2021, the PCAOB issued its HFCAA Determination Report to notify the SEC that it was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and in Hong Kong because of the positions taken by authorities in mainland China and Hong Kong. As stated above, our current auditors are based in Malaysia and the PCAOB is permitted to inspect and investigate them.

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” to read about factors you should consider before buying shares of our Common Stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such state.

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

PART I - INFORMATION REQUIRED IN PROSPECTUS

PROSPECTUS SUMMARY

You should read the following summary together with the more detailed information and the financial statements appearing elsewhere in this Prospectus. This Prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under “Risk Factors” and elsewhere in this Prospectus. Unless the context indicates or suggests otherwise, references to “we,” “our,” “us,” the “Company,” “New Momentum” or the “Registrant” refer to New Momentum Corporation, a Nevada corporation and its wholly owned subsidiary, GridIron Ventures, Inc., a Nevada corporation.

OUR COMPANY

Overview of New Momentum

We intend to develop travel services businesses, including “Gagfare,” an online ticketing platform that provides travelers a “Book Now, Pay Later” business model allowing travelers to secure the best fares and reserve flights well ahead of time. The Company intends to also become the driving force behind a bold new hospitality concept that takes nature lovers and intrepid travelers to exciting new and established destinations. The Company intends to curate a collection of boutique properties, each with a focus on diving, sustainability, conservation, and cultural authenticity, offering a thoroughly contemporary travel experience that is intrinsically linked to the destination, its heritage and its culture.

Our fiscal year-end date is December 31.

Our board of directors consists of one person: Leung Tin Lung David. Mr. Leung also serves as our sole officer, holding the offices of President, Secretary and Treasurer.

Our principal administrative offices are located at 150 Cecil Street, #08-01, Singapore 069543. Our website is www.gagfare.com. We do not incorporate the information on or accessible through our website into this Prospectus, and you should not consider any information on, or that can be accessed through, our websites a part of this Prospectus.

Recent Developments

Share Exchange Agreement

On July 6, 2020, the Company entered into a Share Exchange Agreement (the “Share Exchange Agreement”), by and among the Company, Nemo Holding Company Limited, a British Virgin Islands corporation (“Nemo Holding”), and the holders of common shares of Nemo Holding. The holders of the common stock of Nemo Holding consisted of 29 stockholders.

Under the terms and conditions of the Share Exchange Agreement, the Company offered, sold and issued 10,000,000 shares of common stock in consideration for all the issued and outstanding shares in Nemo Holding. Leung Tin Lung David, the Company’s sole officer and director, became the beneficial holder of 6,000,000 common shares, or 60%, of the issued and outstanding shares of Nemo Holding. The effect of the issuance of the 10,000,000 shares issued under the Share Exchange Agreement represents 10.8% of the issued and outstanding shares of common stock of the Company.

Immediately prior to the closing of the transactions under the Share Exchange Agreement, Mr. Leung was the holder of 233,813,213 shares of common stock, or 75.2%, of the issued and outstanding shares of common stock of the Company. Giving effect to the closing of the transactions under the Share Exchange Agreement, Mr. Leung acquired 6,000,000 shares of common stock of the Company, by virtue of his 60% beneficial ownership of Nemo Holding. The remaining 28 common shareholders of Nemo Holding acquired 4,000,000 shares of common stock under the Share Exchange Agreement, by virtue of their aggregate of 40% beneficial ownership of Nemo Holding.

As a result of the share exchange, Nemo Holding became a wholly-owned subsidiary of the Company.

The share exchange transaction with Nemo Holding was treated as a reverse acquisition, with Nemo Holding as the acquiror and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this Form 8-K to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Nemo Holding.

Cooperation Agreement

Pursuant to Cooperation Agreement, dated February 1, 2016, by and between Gagfare Limited, a Hong Kong corporation and wholly owned subsidiary of the Company, and JJ Explorer Tours Limited, a Hong Kong corporation (“JJ Explorer”), controlled by our chief executive officer, JJ Explorer develops and maintains website and mobile application platforms the Company uses in the operation of its business in exchange for 50% of the net earnings the Company earns through its Gagfare website and mobile application platforms for a term of five years, to be expired on January 31, 2021. For the years ended December 31, 2021 and 2020, the Company did not pay or transfer any cash to JJ Explorer, because there were no net earnings during the reporting periods. Hence, no transfers, dividends, or distributions have been made to date, including the transfers to JJ Explorer during the reporting periods.

10% Convertible Note

On October 27, 2020, the Registrant offered and sold the Note, dated October 27, 2020, to EMA Financial for aggregate proceeds of $33,000. As of June 9, 2021, there was $35,000 in principal and $2,042 in interest due and owing under the Note. The Note is due July 27, 2021, and carries interest at a rate of 10% per annum. The conversion price of the Note Shares is equal to the lower of: (i) the lowest closing price of the Common Stock during the preceding twenty (20) trading day period ending on the latest complete trading day prior to the Issue Date of this Note or (ii) 55% of the lowest trading price for the Common Stock on the Principal Market during the twenty (20) consecutive trading days including and immediately preceding the Conversion Date. We will not receive any proceeds from the sale of the shares of common stock offered by EMA Financial. The terms and conditions of the Note provide registration rights for the Note Shares.

Stock Purchase Agreement

On April 13, 2021, the Company entered into a Stock Purchase Agreement with Leung Tin Lung David, the Company’s sole director, President, and majority stockholder, pursuant to which the Company sold to Mr. Leung one share of Series A Preferred Stock in exchange for 169,000,000 shares of common stock of the Company. The Company subsequently canceled and returned to its authorized capital stock the 169,000,000 shares of common stock purchased from Mr. Leung. The holder of the one share of Series A Preferred Stock (i) has voting power equal to 110% of the total voting rights of the Company’s common stock, (ii) the right to appoint a designee to the board of directors, and (ii) requires the consent of the holder of the Series A Preferred Stock for any major corporate actions, including but not limited to changing the Articles of Incorporation or Bylaws of the Company, changing the business of the Company, issuing securities and or nominating a person as President or Chief Executive Office of the Company. As a result, Mr. Leung has controlling voting power in all matters submitted to our stockholders for approval including:

| · | The election of our board of directors; |

| · | The amendment of our Articles of Incorporation or bylaws; |

| · | The adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

As a result of his ownership and position, Mr. Leung is able to substantially influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. Mr. Leung’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Investment Agreement with Strattner Alternative Credit Fund LP

On April 16, 2021, the Company entered into an Investment Agreement dated as of April 16, 2021 (the “Investment Agreement”) with Strattner. The Investment Agreement provides that, upon the terms and subject to the conditions set forth therein, Strattner is committed to purchase up to $5,000,000 (the “Total Commitment”) worth of the Company’s common stock, $0.001 par value, over the 36-month term of the Investment Agreement.

From time to time over the term of the Investment Agreement, commencing on the trading day immediately following the date on which the initial registration statement is declared effective by the Securities and Exchange Commission (the “Commission”), as further discussed below, the Company may, in its sole discretion, provide Strattner with draw down notices (each, a “Draw Down Notice”) to purchase a specified dollar amount of the Put Shares (the “Draw Down Amount”) over a 10 consecutive trading day period, commencing on the trading day specified in the applicable Draw Down Notice (the “Pricing Period”), with each draw down subject to the limitations discussed below. The maximum amount of Shares requested to be purchased pursuant to any single Draw Down Notice cannot exceed 200% of the average daily trading volume of the Company’s common stock for the ten trading days immediately preceding the date of the Draw Down Notice (the “Maximum Draw Down Amount”).

Once presented with a Draw Down Notice, Strattner is required to purchase the number of Put Shares underlying the Draw Down Notice. The per share purchase price for the Shares subject to a Draw Down Notice shall be equal to 85% of the arithmetic average of the lowest VWAPs during the applicable Pricing Period Each purchase pursuant to a draw down shall reduce, on a dollar-for-dollar basis, the Total Commitment under the Investment Agreement.

The Company is prohibited from issuing a Draw Down Notice if (i) the amount requested in such Draw Down Notice exceeds the Maximum Draw Down Amount, (ii) the sale of Shares pursuant to such Draw Down Notice would cause the Company to issue or sell or Strattner to acquire or purchase an aggregate dollar value of Shares that would exceed the Total Commitment, or (iii) the sale of Shares pursuant to the Draw Down Notice would cause the Company to sell or Strattner to purchase an aggregate number of shares of the Company’s common stock which would result in beneficial ownership by Strattner of more than 9.99% of the Company’s common stock (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder). The Company cannot make more than one draw down in any Pricing Period and must allow 10 days to elapse between the completion of the settlement of any one draw down and the commencement of a Pricing Period for any other draw down.

Additionally, the Company paid to Strattner a commitment fee equal in the form of 250,000 restricted shares of the Company’s common stock (the “Initial Commitment Shares”).

Registration Rights Agreement with Strattner Alternative Credit Fund LP

In connection with the execution of the Investment Agreement, on April 16, 2021, the Company and Strattner also entered into a Registration Rights Agreement (the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, the Company has agreed to file an initial registration statement (“Registration Statement”) with the Commission to register an agreed upon number of Put Shares, on or prior to July 16, 2021 (the “Filing Deadline”) and have it declared effective on or before the 150th calendar day the Company has filed the Registration Rights Agreement (the “Effectiveness Deadline”).

If at any time all of the Registrable Securities (as defined in the Registration Rights Agreement) are not covered by the initial Registration Statement, the Company has agreed to file with the Commission one or more additional Registration Statements so as to cover all of the Registrable Securities not covered by such initial Registration Statement, in each case, as soon as practicable, but in no event later than the applicable filing deadline for such additional Registration Statements as provided in the Registration Rights Agreement.

Emerging risks for us being based in and having the majority of our operations in Hong Kong, China.

We are a Hong Kong, China-based company and we may face risks and uncertainties in doing business in China, including:

| · | The Peoples Republic of China (“PRC”) government has sovereignty of Hong Kong, and Hong Kong’s legislature adopts laws that are congruent with PRC government policies, laws and regulations. Because of the majority of our operations are in the Hong Kong, economic, political and legal developments in the PRC will significantly affect our business, financial condition, results of operations and prospects; |

| | |

| · | Government policies, laws and regulations in the PRC can change very quickly with little advance notice; |

| | |

| · | The PRC government may intervene or influence our operations in Hong Kong at any time and may exert more control over offerings conducted overseas and/or foreign investment in Hong Kong-based issuers, which could result in a material change in our operations and/or the value of our common stock, and could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our common stock and other securities to significantly decline or be worthless; |

| | |

| · | Changes in China’s economic, political or social conditions or government policies, especially over the movement of people and travel, could materially and adversely affect our business and results of operations; |

| | |

| · | The legal system in China embodies uncertainties which could limit the legal protections available to us or impose additional requirements and obligations on our business, which may materially and adversely affect our business, financial condition, and results of operations; |

| | |

| · | The current tensions in international trade and rising political tensions, particularly between the United States and China, may adversely impact our business, financial condition, and results of operations; and |

| | |

| · | It may be difficult for overseas regulators to conduct investigations or collect evidence within China. |

Permissions under Hong Kong Law and PRC Law

We are currently not required to obtain permission from any of the PRC authorities to operate and issue our common stock to foreign investors. In addition, we and our subsidiaries are not required to obtain permission or approval from the Hong Kong and PRC authorities, including China Securities Regulatory Commission (“CSRC”), Cyberspace Administration of China (“CAC”) and/or any other entity that is required to approve our operations other than the standard annual check with local administration bureau. This is subject to the uncertainty of different interpretation and implementation of the rules and regulations in the PRC that could be potentially adverse to us, which may take place quickly with little advance notice.

Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severe and Lawful Crackdown on Illegal Securities Activities, which was available to the public on July 6, 2021. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies. The PRC government also initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on an U.S. exchange. On July 10, 2021, the State Internet Information Office issued the Measures of Cybersecurity Review (Revised Draft for Comments, not yet effective), which requires operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity review with the Office of Cybersecurity Review. As of the date of this prospectus, our Company and its subsidiaries have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice or sanction. We do not believe that our existing business will require such regulatory review. As of the date of this prospectus, our Company its subsidiaries have not received any inquiry, notice, warning or sanctions regarding our planned overseas listing from the China Securities Regulatory Commission or any other PRC governmental authorities.

The PRC National Security Law

On June 30, 2020, the PRC government’s National People’s Congress Standing Committee passed a national security law (the “National Security Law”) for the Hong Kong Special Administrative Region (“Hong Kong”). The National Security Law criminalizes, and otherwise gives the PRC government board broad powers to find unlawful, a broad variety of political crimes, including separatism, and collusion with a foreign country or with external elements to endanger national security in relation to the Hong Kong. The PRC government can, at its or the Hong Kong government’s discretion, exercise jurisdiction over alleged violations of the law and prosecute and adjudicate the cases in mainland China. The law can apply to alleged violations committed by anyone, anywhere in the world, including in the United States. We do not believe that we violate or have violated the National Security Law, but in light of the PRC government’s current and rapidly changing policies regarding PRC and Hong businesses operations, our business operations could in the future be subject to the National Security Law, if the PRC or Hong Kong government believes that it should. Additionally, regulations announced by the Cyberspace Administration of China on January 4, 2022, The Cybersecurity Review Measures (2021) (the “Measures”), became effective on February 15, 2022. According to the Measures, to go public abroad, an online platform operator that possesses the personal information of more than 1,000,000 users must seek cybersecurity review from the Office of Cybersecurity Review. Currently, we have not been involved in any investigations on cybersecurity review initiated by the CAC or related governmental regulatory authorities, and we have not received any inquiry, notice, warning, or sanction in such respect.

We are a “Smaller Reporting Company”

We are a “smaller reporting company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have (i) a public float of less than $250 million or (ii) annual revenues of less than $100 million during the most recently completed fiscal year and no public float, or a public float of less than $700 million. As a “smaller reporting company,” the disclosure we will be required to provide in our SEC filings are less than it would be if we were not considered a “smaller reporting company.” Specifically, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act of 2002 requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being permitted to provide two years of audited financial statements in annual reports rather than three years. Decreased disclosures in our SEC filings due to our status as a “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

Emerging Growth Company

We are an ‘‘emerging growth company’’ within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “Risk Factors—Risks Related to this Offering and our Common Stock – We are an ‘emerging growth company’ and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors” on page 8 of this prospectus.

Our fiscal year end is December 31. Our audited financial statements for the year ended December 31, 2021, were prepared assuming that we will continue our operations as a going concern. Our accumulated loss for the period from March 15, 2016 (inception) to the fiscal quarter ended September 30, 2021 was $4,716,695. For the nine months ended September 30, 2021, we earned revenues of $968,271, from ticketing sales, with the cost of such revenue being $964,540.

Due to the uncertainty of our ability to meet our current operating and capital expenses, our independent auditors have included a going concern opinion in their report on our audited financial statements for the period ended December 31, 2021. The notes to our financial statements contain additional disclosure describing the circumstances leading to the issuance of a going concern opinion by our auditors.

THE OFFERING

This Prospectus relates to the resale of up to 5,182,617 shares of our Common Stock, issuable to Strattner, pursuant to that certain Investment Agreement (the “Investment Agreement”), dated April 16, 2021, by and between the Company and to Strattner, and 182,617 shares of common stock underlying that certain 10% Convertible Note (the “note”), dated October 27, 2020, and made to EMA Financial.

The Offering

Common Stock offered by Selling Security Holders: | | This Prospectus relates to the resale of 5,000,000 shares of our Common Stock, issuable to the Selling Security Holders. |

| | |

Common Stock outstanding before the Offering: | | 176,168,548 shares of Common Stock as of the date of this Prospectus. |

| | |

Common Stock outstanding after the Offering: | | 181,168,548 shares of Common Stock (1) |

| | |

Terms of the Offering: | | The Selling Security Holders will determine when and how it will sell the Common Stock offered in this Prospectus. The prices at which the Selling Security Holders may sell the shares of Common Stock in this Offering will be determined by the prevailing market price for the shares of Common Stock or in negotiated transactions. |

| | |

Termination of the Offering | | The Offering will conclude upon such time as all of the Common Stock has been sold pursuant to the Registration Statement. |

| | |

Trading Market | | Our Common Stock is subject to quotation on the OTC Markets under the symbol “NNAX.” |

| | |

Use of proceeds | | The Company is not selling any shares of the Common Stock covered by this Prospectus. As such, we will not receive any of the Offering proceeds from the registration of the shares of Common Stock covered by this Prospectus. See “Use of Proceeds.” |

| | |

Risk Factors | | The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of his/her/its entire investment. See “Risk Factors”. |

(1) This total reflects the number of shares of Common Stock that will be outstanding assuming that the Selling Security Holders purchase all of the 5,000,000 shares of our common stock under the Investment Agreement.

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the fiscal year ended December 31, 2021. Our working capital deficit as at December 31, 2021 was $(283,856).

| | For the Fiscal Year December 31, 2021 | |

| | | |

Financial Summary (Audited) | | | |

Cash and Deposits | | $ | 15,609 | |

Total Assets | | | 76,150 | |

Total Liabilities | | | 384,249 | |

Total Stockholder’s Equity (Deficit) | | $ | 384,249 | |

| | For the Fiscal Year ended December 31, 2021 | |

| | | |

Consolidated Statements of Expenses and Net Loss | | | |

Total Operating Expenses | | $ | 295,409 | |

Net Loss for the Period | | $ | (287,763 | ) |

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

RISKS RELATING TO OUR COMPANY

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our audited financial statements for the period from March 15, 2016 (inception) through December 31, 2021 were prepared assuming that we will continue our operations as a going concern. Our wholly-owned subsidiary, Nemo Holding Company Limited, was incorporated on April 16, 2016, and does not have a history of earnings. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

If our estimates related to future expenditures are erroneous or inaccurate, our business will fail and you could lose your entire investment.

Our success is dependent in part upon the accuracy of our management’s estimates of our future cost expenditures for legal and accounting services (including those we expect to incur as a publicly reporting company), for website marketing and development expenses, and for administrative expenses, which management estimates to be approximately $10,000,000 over the next twelve months. If such estimates are erroneous or inaccurate, or if we encounter unforeseen costs, we may not be able to carry out our business plan, which could result in the failure of our business and the loss of your entire investment.

If we are not able to develop our business as anticipated, we may not be able to generate revenues or achieve profitability and you may lose your investment.

Our wholly-owned subsidiary, Nemo Holding Company Limited, was incorporated on April 16, 2020, and our net loss for the period from inception (March 15, 2016) to December 31, 2021 was $(4,824,608). We have few customers, and we have not earned substantive revenues to date. Our business prospects are difficult to predict because of our limited operating history, and unproven business strategy. Our primary business activities will be focused on the commercialization of licensing our New Momentum brand. Although we believe that our business plan has significant profit potential, we may not attain profitable operations and our management may not succeed in realizing our business objectives. If we are not able to develop out business as anticipated, we may not be able to generate revenues or achieve profitability and you may lose your entire investment.

Potential disputes related to the existing agreement pursuant to which we purchased the intellectual property rights underlying our business could result in the loss of rights that are material to our business.

The acquisition of the intellectual property of New Momentum, by way of the Share Exchange Agreement, by and among the Company, New Momentum Corporation, and the holders of common stock of New Momentum, is of critical importance to our business and involves complex legal, business, and scientific issues. Although we have clear title to and no restrictions to use our intellectual property, disputes may arise regarding the Share Exchange Agreement, including but not limited to, the breaches of representations or other interpretation-related issues. If disputes over intellectual property that we have acquired under the Share Exchange Agreement prevent or impair our ability to maintain our current intellectual property, we may be unable to successfully develop and commercialize our business.

We expect to suffer losses in the immediate future that may cause us to curtail or discontinue our operations.

We expect to incur operating losses in future periods. These losses will occur because we do not yet have substantive revenues to offset the expenses associated with the development of brand and our business operations, generally. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will almost certainly fail.

We may not be able to execute our business plan or stay in business without additional funding.

Our ability to generate future operating revenues depends in part on whether we can obtain the financing necessary to implement our business plan. We will likely require additional financing through the issuance of debt and/or equity in order to establish profitable operations, and such financing may not be forthcoming. As widely reported, the global and domestic financial markets have been extremely volatile in recent months. If such conditions and constraints continue or if there is no investor appetite to finance our specific business, we may not be able to acquire additional financing through credit markets or equity markets. Even if additional financing is available, it may not be available on terms favorable to us. At this time, we have not identified or secured sources of additional financing. Our failure to secure additional financing when it becomes required will have an adverse effect on our ability to remain in business.

Any significant disruption in our website and mobile application presence or services could result in a loss of customers.

Our plans call for our customers to access our service through our website, www.gagfare.com and our mobile applications. Our reputation and ability to attract, retain and serve our customers will be dependent upon the reliable performance of our website, network infrastructure and fulfillment processes (how we deliver services purchased by our customers). Prolonged or frequent interruptions in any of these systems could make our website unavailable or unusable, which could diminish the overall attractiveness of our subscription service to existing and potential customers.

Our servers will likely be vulnerable to computer viruses, physical or electronic break-ins and similar disruptions, which could lead to interruptions and delays in our service and operations and loss, misuse or theft of data. It is likely that our website will periodically experience directed attacks intended to cause a disruption in service, which is not uncommon for web-based businesses. Any attempts by hackers to disrupt our website service or our internal systems, if successful, could harm our business, be expensive to remedy and damage our reputation. Efforts to prevent hackers from entering our computer systems are expensive to implement and may limit the functionality of our services. Any significant disruption to our website or internal computer systems could result in a loss of subscribers and adversely affect our business and results of operations.

Our connections to the airline booking systems may be interrupted and causing delays or unavailability to search and book the flight tickets, which may affect the user experiences and trust significantly.

Technology changes rapidly in our business and if we fail to anticipate or successfully implement new technologies or the manner in which use our products and services, the quality, timeliness and competitiveness of our products and services will suffer.

Rapid technology changes in our industry require us to anticipate, sometimes years in advance, which technologies we must implement and take advantage of in order to make our products and services competitive in the market. Therefore, we must start our product development with a range of technical development goals that we hope to be able to achieve. We may not be able to achieve these goals, or our competition may be able to achieve them more quickly and effectively than we can. In either case, our products and services may be technologically inferior to our competitors’, less appealing to consumers, or both. If we cannot achieve our technology goals within the original development schedule of our products and services, then we may delay their release until these technology goals can be achieved, which may delay or reduce revenue and increase our development expenses. Alternatively, we may increase the resources employed in research and development in an attempt to accelerate our development of new technologies, either to preserve our product or service launch schedule or to keep up with our competition, which would increase our development expenses. Any such failure to adapt to, and appropriately allocate resources among, emerging technologies would harm our competitive position, reduce our market share and significantly increase the time we take to bring our product to market.

Our potential customers will require a high degree of reliability in the delivery of our services, and if we cannot meet their expectations for any reason, demand for our products and services will suffer.

Our success depends in large part on our ability to assure generally error-free services, uninterrupted operation of our network and software infrastructure, and a satisfactory experience for our customers’ end users when they use Internet-based communications services. To achieve these objectives, we depend on the quality, performance and scalability of our products and services, the responsiveness of our technical support and the capacity, reliability and security of our network operations. We also depend on third parties over which we have no control. For example, our ability to serve our customers is based solely on our network access agreement with one service provider and on that service provider’s ability to provide reliable Internet access. Due to the high level of performance required for critical communications traffic, any failure to deliver a satisfactory experience to end users, whether or not caused by our own failures could reduce demand for our products and services.

If we fail to promote and maintain our brand in an effective and cost-efficient way, our business and results of operations may be harmed.

We believe that developing and maintaining awareness of our brand effectively is critical to attracting new and retaining existing customers. Successful promotion of our brand and our ability to attract customers depends largely on the effectiveness of our marketing efforts and the success of the channels we use to promote our services. It is likely that our future marketing efforts will require us to incur significant additional expenses. These efforts may not result in increased revenues in the immediate future or at all and, even if they do, any increases in revenues may not offset the expenses incurred. If we fail to successfully promote and maintain our brand while incurring substantial expenses, our results of operations and financial condition would be adversely affected, which may impair our ability to grow our business.

Declines or disruptions in the travel industry could adversely affect our business and financial performance.

Our financial results and prospects are almost entirely dependent upon the sale of travel services. Travel, including accommodation (including hotels, motels, resorts, homes, apartments and other unique places to stay), rental car and airline ticket reservations, is significantly dependent on discretionary spending levels. As a result, sales of travel services tend to decline during general economic downturns and recessions and times of political or economic uncertainty as consumers engage in less discretionary spending, are concerned about unemployment or inflation, have reduced access to credit or experience other concerns or effects that reduce their ability or willingness to travel.

Perceived or actual adverse economic conditions, including slow, slowing or negative economic growth, high or rising unemployment rates, inflation and weakening currencies, and concerns over government responses such as higher taxes or tariffs, increased interest rates and reduced government spending, could impair consumer spending and adversely affect travel demand.

These and other macro-economic uncertainties, such as oil prices, geopolitical tensions and differing central bank monetary policies, have led to significant volatility in the exchange rates between the U.S. Dollar and the Euro, the British Pound Sterling and other currencies. Significant fluctuations in foreign currency exchange rates, stock markets and oil prices can also impact consumer travel behavior. For example, although lower oil prices may lead to increased travel activity as consumers have more discretionary funds and airline fares decrease, declines in oil prices may be indicative of broader macro-economic weakness, which in turn could negatively affect the travel industry, our business and results of operations. Conversely, higher oil prices may result in higher airfares and decreased travel activity, which can negatively affect our business and results of operations.

The uncertainty of macro-economic factors and their impact on consumer behavior, which may differ across regions, makes it more difficult to forecast industry and consumer trends and the timing and degree of their impact on our markets and business, which in turn could adversely affect our ability to effectively manage our business and adversely affect our results of operations.

In addition, events beyond our control, such as oil prices, stock market volatility, terrorist attacks, unusual or extreme weather or natural disasters such as earthquakes, hurricanes, tsunamis, floods, fires, droughts and volcanic eruptions, travel-related health concerns including pandemics and epidemics such as coronaviruses, Ebola and Zika, political instability, changes in economic conditions, wars and regional hostilities, imposition of taxes, tariffs or surcharges by regulatory authorities, changes in trade policies or trade disputes, changes in immigration policies, travel-related accidents or increased focus on the environmental impact of travel, have previously and may in the future disrupt travel, limit the ability or willingness of travelers to visit certain locations or otherwise result in declines in travel demand and adversely affect our business and results of operations. Because these events or concerns, and the full impact of their effects, are largely unpredictable, they can dramatically and suddenly affect travel behavior by consumers, and therefore demand for our services and our relationships with travel service providers and other partners, any of which can adversely affect our business and results of operations. Certain jurisdictions, particularly in Europe, are considering regulations intended to address the issue of “overtourism,” including by restricting access to city centers or popular tourist destinations or limiting accommodation offerings in surrounding areas, such as by restricting construction of new hotels or the renting of homes or apartments. Such regulations could adversely affect travel to, or our ability to offer accommodations in, such markets, which could negatively impact our business, growth and results of operations. The United States has implemented or proposed, or is considering, various travel restrictions and actions that could affect U.S. trade policy or practices, which could also adversely affect travel to or from the United States.

As a result of the recent coronavirus outbreak, the travel industry to experience, and continue to experience, a significant decline in travel demand and increase in customer cancellations predominantly related to travel to, from or in China and certain other Asian markets, though concerns about the coronavirus are also negatively impacting travel demand (and therefore our business) generally. Some countries have implemented travel bans or restrictions and some airlines have suspended or limited flights to or from China. In addition, like many other companies, we have instructed or allowed employees in high-risk areas to work from home or not report to work, which, especially if this persists for a prolonged period of time, may have an adverse impact on our employees, ability to service travelers, operations and systems. The ultimate extent of the coronavirus outbreak and its impact on travel in currently affected countries or more broadly is unknown and impossible to predict with certainty. As a result, the full extent to which the coronavirus will impact our business and results of operations is unknown. However, decreased travel demand resulting from the outbreak has had a negative impact, and is likely to have a negative and material impact, on our business, growth and results of operations. In addition, we may incur additional customer service costs in connection with servicing travelers affected by the outbreak, which would also have a negative impact on our results of operations.

The loss of the services of Leung Tin Lung David, our sole director and officer, and majority shareholder, or our failure to timely identify and retain competent personnel could negatively impact our ability to develop our website and sell our services.

We are highly dependent on Leung Tin Lung David, who is our sole director and officer, and controlling stockholder. The development of our business will continue to place a significant strain on our limited personnel, management, and other resources. Our future success depends upon the continued services of our executive officers who are developing our business, and on our ability to identify and retain competent consultants and employees with the skills required to execute our business objectives. The loss of the services of Jing Li or our failure to timely identify and retain competent personnel would negatively impact our ability to develop our business and license our brand, which could adversely affect our financial results and impair our growth.

Leung Tin Lung David, our President and sole director, beneficially owns approximately or has the right to vote 41.3% of our outstanding common stock and 100% of our Series A Preferred Stock, which has voting power equal to 110% of our issued and outstanding common stock. As a result, Mr. Leung has a substantial voting power in all matters submitted to our stockholders for approval including:

| · | Election of our board of directors; |

| · | Removal of any of our directors or officers; |

| · | Amendment of our Articles of Incorporation or Bylaws; |

| · | Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

As a result of his ownership and position, Mr. Leung is able to substantially influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by him could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in our company may decrease. Mr. Leung’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

We are an independent travel services, with little experience in the market, and failure to successfully compensate for this inexperience may adversely impact our operations and financial position.

We operate as an independent business, whose existence is predicated on the brand name Gagfare, and we have no substantial tangible assets in a highly competitive industry. We have little operating history, no customer base and little revenue to date. This makes it difficult to evaluate our future performance and prospects. Our business must be considered in light of the risks, expenses, delays and difficulties frequently encountered in establishing a new business in an emerging and evolving industry characterized by intense competition, including:

| · | our business model and strategy are still evolving and are continually being reviewed and revised; |

| · | we may not be able to raise the capital required to develop our initial customer base and reputation; |

| · | we may not be able to successfully implement our business model and strategy; and |

| · | our management consists is conducted by one persons, Leung Tin Lung David, our President and a director. |

We cannot be sure that we will be successful in meeting these challenges and addressing these risks and uncertainties. If we are unable to do so, our business will not be successful and the value of your investment in our company will decline.

Our failure to protect our intellectual property and proprietary technology may significantly impair our competitive advantage.

Our success and ability to compete depends in large part upon protecting our proprietary technology. We rely on a combination of patent, trademark and trade secret protection, nondisclosure and nonuse agreements to protect our proprietary rights. The steps we have taken may not be sufficient to prevent the misappropriation of our intellectual property, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. The patent and trademark law and trade secret protection may not be adequate to deter third party infringement or misappropriation of our patents, trademarks and similar proprietary rights.

We may in the future initiate claims or litigation against third parties for infringement of our proprietary rights in order to determine the scope and validity of our proprietary rights or the proprietary rights of our competitors. These claims could result in costly litigation and the diversion of our technical and management personnel.

We may face costly intellectual property infringement claims, the result of which would decrease the amount of cash we would anticipate to operate and complete our business plan.

We anticipate that from time to time we will receive communications from third parties asserting that we are infringing certain copyright, trademark and other intellectual property rights of others or seeking indemnification against alleged infringement. If anticipated claims arise, we will evaluate their merits. Any claims of infringement brought of third parties could result in protracted and costly litigation, damages for infringement, and the necessity of obtaining a license relating to one or more of our products or current or future technologies, which may not be available on commercially reasonable terms or at all. Litigation, which could result in substantial cost to us and diversion of our resources, may be necessary to enforce our patents or other intellectual property rights or to defend us against claimed infringement of the rights of others. Any intellectual property litigation and the failure to obtain necessary licenses or other rights could have a material adverse effect on our business, financial condition and results of operations.

We incur costs associated with SEC reporting compliance, which may significantly affect our financial condition.

The Company made the decision to become an SEC “reporting company” in order to comply with applicable laws and regulations. We incur certain costs of compliance with applicable SEC reporting rules and regulations including, but not limited to attorneys’ fees, accounting and auditing fees, other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately $50,000 per year. On balance, the Company determined that the incurrence of such costs and expenses was preferable to the Company being in a position where it had very limited access to additional capital funding.

We may be required to incur significant costs and require significant management resources to evaluate our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act, and any failure to comply or any adverse result from such evaluation may have an adverse effect on our stock price.

As a smaller reporting company as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, we are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). Section 404 requires us to include an internal control report with our Annual Report on Form 10-K. This report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our equity securities. Achieving continued compliance with Section 404 may require us to incur significant costs and expend significant time and management resources. No assurance can be given that we will be able to fully comply with Section 404 or that we and our independent registered public accounting firm would be able to conclude that our internal control over financial reporting is effective at fiscal year-end. As a result, investors could lose confidence in our reported financial information, which could have an adverse effect on the trading price of our securities, as well as subject us to civil or criminal investigations and penalties. In addition, our independent registered public accounting firm may not agree with our management’s assessment or conclude that our internal control over financial reporting is operating effectively.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $250 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $250 million.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

We face risks related to the Novel Coronavirus (COVID-19) which could significantly disrupt our development, operations, sales, and financial results.

Our business will be adversely impacted by the effects of the Novel Coronavirus (COVID-19). In addition to global macroeconomic effects, the Novel Coronavirus (COVID-19) outbreak and any other related adverse public health developments will cause disruption to our operations and sales activities. Our third-party vendors, third-party distributors, and our customers have been and will be disrupted by worker absenteeism, quarantines and restrictions on employees’ ability to work, office and factory closures, disruptions to ports and other shipping infrastructure, border closures, or other travel or health-related restrictions. Depending on the magnitude of such effects on our activities or the operations of our third-party vendors and third-party distributors, the supply of our products will be delayed, which could adversely affect our business, operations and customer relationships. In addition, the Novel Coronavirus (COVID-19) or other disease outbreak will in the short-run and may over the longer term adversely affect the economies and financial markets of many countries, resulting in an economic downturn that will affect demand for our products and services and impact our operating results. There can be no assurance that any decrease in sales resulting from the Novel Coronavirus (COVID-19) will be offset by increased sales in subsequent periods. Although the magnitude of the impact of the Novel Coronavirus (COVID-19) outbreak on our business and operations remains uncertain, the continued spread of the Novel Coronavirus (COVID-19) or the occurrence of other epidemics and the imposition of related public health measures and travel and business restrictions will adversely impact our business, financial condition, operating results and cash flows. In addition, we have experienced and will experience disruptions to our business operations resulting from quarantines, self-isolations, or other movement and restrictions on the ability of our employees to perform their jobs that may impact our ability to develop and design our products and services in a timely manner or meet required milestones or customer commitments.

It will be extremely difficult to acquire jurisdiction and enforce liabilities against our officers, directors and assets outside the United States.

Substantially all of our assets are currently located outside of the United States. Additionally, our sole director and officer resides outside of the United States, in Singapore. As a result, it may not be possible for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under Federal securities laws. Moreover, we have been advised Singapore does not have a treaty providing for the reciprocal recognition and enforcement of judgments of courts with the United States.

RISKS RELATED TO DOING BUSINESS IN THE PEOPLE’S REPUBLIC OF CHINA

Changes in the political and economic policies of the PRC government may materially and adversely affect our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies.

New Momentum Corporation, is a holding company that, through Gagfare Limited, a Hong Kong entity, and Beyond Blue Limited, Hong Kong entity, both wholly-owned subsidiaries, operates our online ticketing platform that provides travelers a “Book Now, Pay Later” business model. The PRC government has sovereignty of Hong Kong, and Hong Kong’s legislature adopts laws that are congruent with PRC government policies and laws. Because of the majority of our operations are in the Hong Kong, economic, political and legal developments in the PRC will significantly affect our business, financial condition, results of operations and prospects.

The PRC economy differs from the economies of most developed countries in many respects, including the extent of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth by allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, regulating financial services and institutions and providing preferential treatment to particular industries or companies.