false

0000071557

0000071557

2025-02-28

2025-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

February 28, 2025

Date of report (Date of earliest event reported)

NUVERA COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

|

Minnesota

|

0-3024

|

41-0440990

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

27 North Minnesota Street

New Ulm, MN 56073

(Address of principal executive offices, including zip code)

(507) 354-4111

(Registrant's telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: None

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§230.12b-2 of this chapter). Emerging growth company Yes ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

2015 Employee Stock Plan

On February 28, 2025, the Board of Directors of Nuvera Communications, Inc. (the “Company”), upon the recommendation of the Board’s Compensation Committee, adopted amendments to the Nuvera Communications, Inc. 2015 Employee Stock Plan (the “Plan”). The Plan was adopted by the Board and approved by the Company’s shareholders in 2016 to provide payment of incentives under the 2006 Annual Plan, or any successor or any incentive plan under which payments are based upon achievement of Company-defined objectives. These amendments, among other things, (a) conform the Plan document to reflect the 2018 change in the Company’s name, (b) clarify that awards under the Plan, including the grant of stock appreciation rights, may be granted under Company incentive plans that provide for payment upon achievement of Company-defined objectives, (c) extend the term of the Plan to coincide with the expiration of the Company’s 2017 Omnibus Stock Plan, and (d) establish share counting rules. The amendments, which do require Company shareholder approval, do not increase the number of shares that may be issued under the Plan.

Summary Descriptions

The description of the Plan and the amendments do not purport to be complete and are qualified in their entirety by reference to the full text of the 2015 Employee Stock Plan, which is attached to this report as Exhibit 10.1 and is incorporated by reference into this Item 5.02

Section 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No.

|

Description

|

|

10.1

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: March 4, 2025

|

Nuvera Communications, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Curtis Kawlewski

|

|

|

|

|

Curtis Kawlewski

|

|

|

|

Its:

|

Chief Financial Officer

|

|

EXHIBIT 10.1

NUVERA COMMUNICATIONS, INC.

2015 EMPLOYEE STOCK PLAN

(As Amended February 28, 2025)

|

1.

|

General Purpose of Plan; Definitions

|

a. The name of this plan is the Nuvera Communications, Inc. 2015 Employee Stock Plan (the “Plan”). The purpose of the Plan is to enable Nuvera Communications, Inc. (the “Company”) and its Subsidiaries to attract and retain employees by aligning the financial interests of these individuals with the other shareholders of the Company. The Plan provides for the issuance of Company Common Stock upon the attainment of objectives under the Company’s 2006 Management Incentive Plan, as amended (“2006 Incentive Plan”) or successor plan or any incentive plan under which payments are based upon achievement of Company-defined objectives (each an “Eligible Plan”). The Plan is amended pursuant to the authority in Section 5.a. of the Plan.

b. For purposes of the Plan, the following terms are defined:

i. “Board” means the Board of Directors of the Company.

ii. “Committee” means the Committee referred to in Section 2 of the Plan. If at any time there is no Committee, then the functions of the Committee specified in the Plan will be exercised by the Board, unless the Plan specifically states otherwise.

iii. “Common Stock” means the Common Stock, $1.66 par value per share, of the Company.

iv. “Company” means Nuvera Communications, Inc., a corporation organized under the laws of the State of Minnesota, and any successor corporation.

v. “Employee” means an employee of the Company or any subsidiary of the Company.

c. “Fair Market Value” means the value of the Share of Common Stock on a given date as determined by the Committee in good faith using reasonable valuation methods.

a. The Board has the power to delegate, by resolution, all or any portion of its authority under this Plan to any committee of the Board. Until such time as the Board delegates its authority under this Section 2, the Plan will be administered by the Board of Directors of the Company acting as a Committee of the Whole.

b. The Committee will have the power and authority to designate by resolution to determine:

i. The terms under which Common Stock may be issued under the Eligible Plans, are based upon achievement of Company-defined objectives, which objectives may include the appreciation in Company Common Stock value or related criteria, and may include the ability of Employees to elect to receive Common Stock.

ii. The maximum percentage, if any, of the payout that Employee can elect to receive in Common Stock or the discretion of the Board to pay any earned incentive in cash or Common Stock, provided that these incentives will be paid in cash to the extent the Board determines incentives will not be paid in Common Stock.

iii. The date or dates on which any Employee must elect whether to receive a payout under the Eligible Plans in Common Stock, which date or dates may be different for Employees that are executive officers of the Company or otherwise Reporting Persons subject to Section 16(a) of the Securities Exchange of 1934.

c. The Committee also has the authority to:

i. Adopt, alter and repeal administrative rules, guidelines and practices governing the Plan as it, from time to time, deems advisable;

ii. Interpret the terms and provisions of the Plan; and

iii. Otherwise supervise the administration of the Plan.

d. All shares of Common Stock issued under the Plan are to be issued at Fair Market Value.

a. The total number of shares of Common Stock reserved and available for issue under the Plan will be 200,000. If any Common Stock under this Plan is forfeited, or if an incentive terminates, or is cancelled without the delivery of any Common Stock, these shares will be added back to the limits described in this Plan and are again available for awards under the Plan. Common Stock withheld by the Company to satisfy the tax withholding obligation will not be added back to the applicable limit and any stock appreciation right that is settled in Common Stock will reduce the limit by the number of shares actually issued.

b. Shares may be issued under the Plan only for achievement of objectives under the Eligible Plans, as operated by the Company on an annual or longer period.

c. In the event of any merger, reorganization, consolidation, recapitalization, stock dividend, other change in corporate structure affecting the Common Stock, or spin-off or other distribution of assets to shareholders, the Board will have the power to make such substitution or adjustment in the aggregate number of shares reserved for issuance under the Plan, and in the number of outstanding unvested shares granted under the Plan, as may be determined to be appropriate by the Board, in its sole discretion.

a. Only Employees participating in the Eligible Plans, are eligible to receive Common Stock under the Plan.

|

5.

|

Amendments and Termination

|

a. This Plan may be amended by the Board from time to time to the extent that the Committee deems necessary or appropriate. No amendment may be made without the approval of the shareholders of the Company however, if the amendment would increase the number of shares reserved under Section 3(a).

b. No shares may be issued under the Plan for any purpose other than for issuance under the Eligible Plans.

a. Common Stock delivered under the Plan will be subject to such restrictions, if any, as the Committee may deem advisable under the rules, regulations, and other requirements of the Securities and Exchange Commission, any stock exchange upon which the Common Stock is then listed, and any applicable federal or state securities laws, and the Committee may cause a legend or legends to be put on any such certificates to make appropriate reference to these restrictions.

b. All shares received under this Plan will be subject to the Company’s Insider Trading Policy, as in effect from time to time.

c. Nothing contained in this Plan will prevent the Board of Directors from adopting other or additional employee compensation arrangements, subject to shareholder approval if required.

|

7.

|

Effective Date of Plan; Termination of Plan

|

a. The Plan will become effective on the date it is approved by a vote of the shareholders of the Company in accordance with Minnesota law. The amendments to the Plan are effective as of February 28, 2025.

b. The Plan will operate for a period of twelve years and will expire on May 31, 2027.

v3.25.0.1

Document And Entity Information

|

Feb. 28, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NUVERA COMMUNICATIONS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 28, 2025

|

| Entity, Incorporation, State or Country Code |

MN

|

| Entity, File Number |

0-3024

|

| Entity, Tax Identification Number |

41-0440990

|

| Entity, Address, Address Line One |

27 North Minnesota Street

|

| Entity, Address, City or Town |

New Ulm

|

| Entity, Address, State or Province |

MN

|

| Entity, Address, Postal Zip Code |

56073

|

| City Area Code |

507

|

| Local Phone Number |

354-4111

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000071557

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

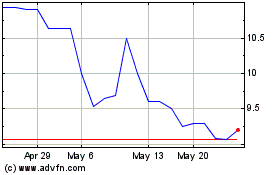

Nuvera Communications (QB) (USOTC:NUVR)

Historical Stock Chart

From Feb 2025 to Mar 2025

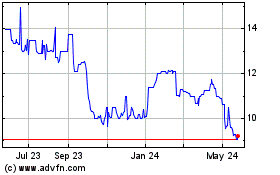

Nuvera Communications (QB) (USOTC:NUVR)

Historical Stock Chart

From Mar 2024 to Mar 2025