Valspar Reaffirmed at Neutral - Analyst Blog

21 February 2013 - 2:40AM

Zacks

We have retained our Neutral recommendation on paint and

coatings maker Valspar Corporation (VAL) following

our assessment of its first-quarter fiscal 2013 results. We remain

cautious given the uncertain demand environment.

Why

Maintained?

Both revenues and earnings for

the first quarter missed the Zacks Consensus Estimates, hurt by

weak market conditions. The company cut its earnings forecast for

fiscal 2013 citing a soft demand environment across some overseas

markets.

Valspar continues to see strength

in its coatings business as evidenced by new business wins. It has

a strong pipeline of new products and significant opportunities for

share gains in both its Paint and Coatings segments. The company

should also benefit from its restructuring actions in fiscal

2013.

Valspar is managing its cost well

and maintaining a cost structure that is appropriate for the

current external environment. Winning new businesses also remain a

company-wide focus that will position Valspar well for the future

and help offset lower demand in core markets. Its fastest growing

markets are the emerging economies. Valspar also remains committed

to boost shareholder return leveraging healthy cash flows.

However, Valspar’s paint segment

had a weak first quarter, partly due to depressed demand in

overseas markets. The segment’s growth has been hurt by a weak

residential housing market in Australia, which may continue to

affect sales moving ahead. The overall demand environment is

expected to be uneven in fiscal 2013.

We also remain concerned about

cost pressures associated with raw material inflation. Raw material

costs have been volatile and Valspar has experienced disruptions in

supplies of certain raw materials at various times, impacting its

ability to manufacture products.

Valspar currently carries a

short-term (1 to 3 months) Zacks Rank #3 (Hold).

Other Stocks to

Consider

Other companies in the specialty chemicals industry with

favorable Zacks Rank are Novozymes A/S (NVZMY),

Penford Corporation (PENX) and Chemtura

Corporation (CHMT). While both Novozymes and Penford

hold a Zacks Rank #1 (Strong Buy), Chemtura carries a Zacks Rank #2

(Buy).

CHEMTURA CORP (CHMT): Free Stock Analysis Report

NOVOZYMES A/S (NVZMY): Get Free Report

PENFORD CORP (PENX): Free Stock Analysis Report

VALSPAR CORP (VAL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

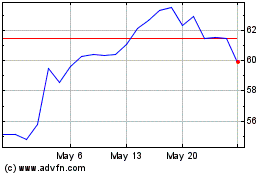

Novenesis AS (PK) (USOTC:NVZMY)

Historical Stock Chart

From Oct 2024 to Nov 2024

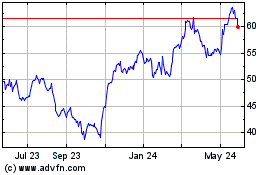

Novenesis AS (PK) (USOTC:NVZMY)

Historical Stock Chart

From Nov 2023 to Nov 2024