Current Report Filing (8-k)

02 September 2021 - 8:16PM

Edgar (US Regulatory)

0001679817

false

false

0001679817

2021-09-01

2021-09-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

September

1, 2021

Date

of Report

(Date

of earliest event reported)

OZOP

ENERGY SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55976

|

|

35-2540672

|

|

(State

or other jurisdiction

of

Incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

26

N. Main St.

Florida,

NY 10921

(Address

of principal executive offices, including zip code)

(845)

544-5112

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

None

|

|

N/A

|

|

N/A

|

Item

1.01 Entry into a Material Definitive Agreement.

On

September 1, 2021, Ozop Capital Partners Inc. (“Ozop Capital”), a majority owned subsidiary of Ozop Energy Solutions,

Inc. (the “Company”), entered into an advisory agreement (the “Agreement”) with Risk Management Advisors, Inc.

(“RMA”). Pursuant to the terms of the Agreement, RMA will assist Ozop Capital in analyzing, structuring, and coordinating

Ozop Capital’s participation in a captive insurance company. RMA will coordinate legal, accounting, tax, actuarial and other services

necessary to implement the Company’s participation in a captive insurance company, including, but not limited to, the preparation

of an actuarial feasibility study, filing of all required regulatory applications, domicile selection, structural selection, and coordination

of the preparation of legal documentation by retained counsel. In connection with the services listed above, Ozop Capital shall pay RMA

an upfront cash payment of Twenty-Five Thousand Dollars ($25,000) and shares of restricted common stock of the Company with a market

value of Twenty-Five Thousand Dollars ($25,000), which shall be due within three (3) days of the execution of the Agreement. An additional

cash payment of Twenty-Five Thousand Dollars ($25,000), and shares of restricted common stock of the Company with a market value of Twenty-Five

Thousand Dollars ($25,000) shall be due upon issuance of the captive insurance company’s certificate of authority from the state

of formation.

The

foregoing information is a summary of the Agreement described above, is not complete, and is qualified in its entirety by reference to

the full text of the Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K. Readers should review the Agreement

for a complete understanding of the terms and conditions of the transaction described above.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Report to be signed on its behalf by the

undersigned hereunto duly authorized.

Dated:

September 2, 2021

|

|

OZOP

ENERGY SOLUTIONS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Brian Conway

|

|

|

Name:

|

Brian Conway

|

|

|

Title:

|

Chief Executive Officer

|

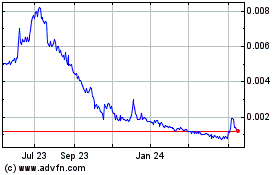

Ozop Energy Solutions (PK) (USOTC:OZSC)

Historical Stock Chart

From Dec 2024 to Jan 2025

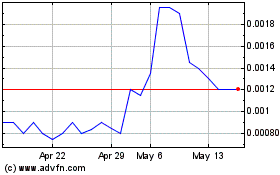

Ozop Energy Solutions (PK) (USOTC:OZSC)

Historical Stock Chart

From Jan 2024 to Jan 2025