false000113709100011370912024-08-122024-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): August 12, 2024

___________________________________

Power Solutions International, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation) | 001-35944 (Commission File Number) | 33-0963637 (I.R.S. Employer Identification No.) |

201 Mittel Drive Wood Dale, Illinois 60191 |

(Address of principal executive offices and zip code) |

Registrant's telephone number, including area code: (630) 350-9400 |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| None | | — | | — |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 - Regulation FD Disclosure

On August 12, 2024, Power Solutions International, Inc. (the “Company”) issued a press release announcing second quarter 2024 financial results and containing its outlook for 2024.

In accordance with General Instruction B.2. of Form 8-K, the information contained under Item 2.02 in this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 - Financial Statements and Exhibits.

(d): The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 12th day of August, 2024.

| | | | | |

| POWER SOLUTIONS INTERNATIONAL, INC. |

| |

By: | /s/ Xun Li |

| Xun Li |

| Chief Financial Officer |

Power Solutions International Announces Record Second Quarter 2024

Financial Results

Net Income was $21.5 million, an increase of 236% from a year earlier,

Gross Margin was 31.8%, an increase of 9.7% from a year earlier,

EPS were $0.94, an increase of $0.66 from a year earlier,

Debt decreased $5.0 million,

Shareholder Equity increased to $24.8 million.

WOOD DALE, Ill., August 12, 2024 – Power Solutions International, Inc. (the “Company” or “PSI”) (OTC Pink: PSIX), a leader in the design, engineering and manufacture of emission-certified engines and power systems, announces second quarter 2024 financial results.

Second Quarter 2024 Results

Today, Power Solutions International, Inc., reported record profit for the three months ended June 30, 2024, with net income of $21.5 million and diluted earnings per share of $0.94, compared to net income of $6.4 million and diluted earnings per share of $0.28 for the second quarter of 2023.

Dino Xykis, Chief Executive Officer, commented, "I am pleased to report that in the second quarter, we achieved record-breaking results with a gross margin of 31.8% and net profit of $21.5 million. Our sales performance was driven by high demand in the power systems market, offset by the decrease in sales from some of our transportation customers and the softness we observed in the industrial market. Our team has demonstrated remarkable dedication to profit maximization and cost management, which has significantly bolstered margin, profitability and shareholder equity this quarter."

Xykis continued, “Looking ahead, we remain optimistic about sales increase for the remainder of the year, thanks to the continued robust demand for products in the power systems, especially PSI products serving the growth of Data Center markets that PSI has been actively pursuing since last year. We have successfully secured and are in the process of finalizing several major multi-year sales agreements with key customers for Data Center applications. These strategic partnerships are poised to drive future growth in this segment now and in the future. Our focus remains on leveraging these opportunities to drive further profitable growth and deliver sustained value to our shareholders.”

Sales for the second quarter of 2024 were $110.6 million, a decrease of $11.3 million, or 9%, compared to the second quarter of 2023, as a result of lower sales of $14.1 million and $15.8 million within the industrial and transportation end markets, respectively, partially offset by an increase of $18.6 million in the power systems end market. Higher power systems end market sales are primarily due to increased demand for products across various applications, with the largest increases attributable to products used

within the packaging market such as enclosures serving the fast-growing Data Center market, as well as oil and gas products and demand response products. We are strategically prioritizing the rapidly expanding Data Center sector, improving and increasing our manufacturing capacity and capabilities to meet and exceed our customers’ evolving demand for our products. The decreased sales within the transportation end market were primarily attributable to lower sales in the truck and school bus market as customer products have evolved, and new compliance and regulatory requirements have changed engine product offerings. Decreased industrial end market sales are primarily due to decreases in demand for products used within the material handling and arbor care markets, as well as the direct effects of enforcement of the Uyghur Forced Labor Prevention Act (“UFLPA”), which limited the Company’s ability to import certain raw materials in early 2024.

Gross profit increased by $8.2 million, or 31%, during the second quarter of 2024 as compared to the same period in the prior year. Gross margin in the second quarter of 2024 was 31.8%, an increase of 9.7 percentage points compared to 22.1% in the same period last year, primarily due to improved mix, pricing actions, higher operating efficiencies, lower warranty costs primarily attributable to the Company's sales shift away from some of our transportation customers.

Selling, general and administrative expenses decreased during the second quarter of 2024 by $6.0 million, or 57%, compared to the same period in the prior year, mostly attributable to a decrease in the legal reserve, lower professional fees, and the decrease selling expenses associated with decreased sales in the transportation segment.

Interest expense was $2.9 million in the second quarter of 2024 as compared to $4.6 million in the same period in the prior year, largely due to reduced outstanding debt, partially offset by higher overall effective interest rates.

Net income was $21.5 million, or net income per share of $0.94 in the second quarter of 2024, compared to net income of $6.4 million, or net income per share of $0.28 for the second quarter of 2023.

Debt Update

The Company’s total debt was approximately $135.1 million at June 30, 2024, while cash and cash equivalents were approximately $28.8 million. This compares to total debt of approximately $145.2 million and cash and cash equivalents of approximately $22.8 million at December 31, 2023. Included in the Company’s total debt at June 30, 2024, were borrowings of $40.0 million under the Uncommitted Revolving Credit Agreement (“Credit Agreement”) with Standard Chartered Bank, borrowings of $25.0 million, $50.0 million, and $19.8 million respectively, under the various Shareholder Loan Agreements, with Weichai America Corp., its majority stockholder, as described in more detail in the Company's Form 10-Q for the first quarter of 2024. The Company made payments totaling $5.0 million related to the Credit Agreement, during the second quarter of 2024. The Company is proactively seeking opportunities to optimize and strengthen our debt structure.

Outlook for 2024

The Company expects its sales in 2024 to increase by approximately 3% versus 2023 levels, a result of expectations for strong growth in the power systems end market paired with flat sales in the industrial end market and a forecasted reduction in the transportation end markets. Notwithstanding this outlook, which is being driven in part by expectations for continuous improvement in supply chain dynamics, including timelier availability of parts and a continuation of favorable economic conditions within the United States and across the Company’s various markets, the Company cautions that significant uncertainty remains as a

result of supply chain challenges, inflationary costs, commodity volatility, and the impact on the global economy of the war in Ukraine and Israel, among other factors.

About Power Solutions International, Inc.

Power Solutions International, Inc. (PSI) is a leader in the design, engineering and manufacture of a broad range of advanced, emission-certified engines and power systems. PSI provides integrated turnkey solutions to leading global original equipment manufacturers and end-user customers within the power systems, industrial and transportation end markets. The Company’s unique in-house design, prototyping, engineering and testing capabilities allow PSI to customize clean, high-performance engines using a fuel agnostic strategy to run on a wide variety of fuels, including natural gas, propane, gasoline, diesel and biofuels.

PSI develops and delivers complete power systems that are used worldwide in stationary and mobile power generation applications supporting standby, prime, demand response, microgrid, and co-generation power (CHP) applications; and industrial applications that include forklifts, agricultural and turf, arbor care, industrial sweepers, aerial lifts, irrigation pumps, ground support, and construction equipment. In addition, PSI develops and delivers powertrains purpose-built for medium-duty trucks and buses including school and transit buses, work trucks, terminal tractors, and various other vocational vehicles. For more information on PSI, visit www.psiengines.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements regarding the current expectations of the Company about its prospects and opportunities. These forward-looking statements are entitled to the safe-harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements may involve risks and uncertainties. These statements often include words such as “anticipate,” “believe,” “budgeted,” “contemplate,” “estimate,” “expect,” “forecast,” “guidance,” “may,” “outlook,” “plan,” “projection,” “should,” “target,” “will,” “would” or similar expressions, but these words are not the exclusive means for identifying such statements. These statements are not guarantees of performance or results, and they involve risks, uncertainties and assumptions. Although the Company believes that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect the Company’s results of operations and liquidity and could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the Company’s forward-looking statements.

The Company cautions that the risks, uncertainties and other factors that could cause its actual results to differ materially from those expressed in, or implied by, the forward-looking statements include, without limitation: the impact of the macro-economic environment in both the U.S. and internationally on our business and expectations regarding growth of the industry; uncertainties arising from global events (including the Russia-Ukraine and Israel-Hamas conflicts), natural disasters or pandemics, and their impact on material prices; the effects of strategic investments on our operations, including our efforts to expand our global market share and actions taken to increase sales growth; the ability to develop and successfully launch new products; labor costs and other employment-related costs; loss of suppliers and disruptions in the supply of raw materials; the Company’s ability to continue as a going concern; the Company’s ability to raise additional capital when needed and its liquidity; uncertainties around the Company’s ability to meet funding conditions under its financing arrangements and access to capital thereunder; the potential acceleration of the maturity at any time of the loans under the Company’s uncommitted senior secured revolving credit facility through the exercise by Standard Chartered Bank of its demand right; the impact of rising interest rates; changes in economic conditions, including inflationary trends in the price of raw materials; our reliance on information technology and the associated risk involving potential security lapses and/or cyber-attacks; the ability of the Company to accurately forecast

sales, and the extent to which sales result in recorded revenues; changes in customer demand for the Company’s products; volatility in oil and gas prices; the impact of U.S. tariffs on imports, the impact of supply chain interruptions and raw material shortages, including compliance disruptions such as the UFLPA delaying goods from China; the potential impact of higher warranty costs and the Company’s ability to mitigate such costs; any delays and challenges in recruiting and retaining key employees consistent with the Company’s plans; any negative impacts from delisting of the Company’s common stock par value $0.001 from the NASDAQ Stock Market and any delays and challenges in obtaining a re-listing on a stock exchange; and the risks and uncertainties described in reports filed by the Company with the SEC, including without limitation its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the Company’s subsequent filings with the SEC.

The Company’s forward-looking statements are presented as of the date hereof. Except as required by law, the Company expressly disclaims any intention or obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact:

Power Solutions International, Inc.

Randall D. Lehner

General Counsel

630-373-1637

rlehner@psiengines.com

Results of operations for the three and six months ended June 30, 2024, compared with the three and six months ended June 30, 2023 (UNAUDITED):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share amounts) | | For the Three Months Ended June 30, | | | | | | For the Six Months Ended June 30, | | | | |

| | 2024 | | 2023 | | Change | | % Change | | 2024 | | 2023 | | Change | | % Change |

Net sales (from related parties $253 and $1,000 for the three months ended June 30, 2024 and June 30, 2023, respectively, $453 and $2,100 for the six months ended June 30, 2024 and June 30, 2023, respectively) | | $ | 110,586 | | | $ | 121,865 | | | $ | (11,279) | | | (9) | % | | $ | 205,826 | | | $ | 238,334 | | | $ | (32,508) | | | (14) | % |

Cost of sales (from related parties $176 and $600 for the three months ended June 30, 2024 and June 30, 2023, respectively, and $329 and $1,500 for the six months ended June 30, 2024 and June 30, 2023, respectively) | | 75,398 | | | 94,911 | | | (19,513) | | | (21) | % | | 144,882 | | | 187,911 | | | (43,029) | | | (23) | % |

| Gross profit | | 35,188 | | | 26,954 | | | 8,234 | | | 31 | % | | 60,944 | | | 50,423 | | | 10,521 | | | 21 | % |

| Gross margin % | | 31.8 | % | | 22.1 | % | | 9.7 | % | | | | 29.6 | % | | 21.2 | % | | 8.5 | % | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Research and development expenses | | 4,959 | | | 4,662 | | | 297 | | | 6 | % | | 10,156 | | | 9,266 | | | 890 | | | 10 | % |

| Research and development expenses as a % of sales | | 4.5 | % | | 3.8 | % | | 0.7 | % | | | | 4.9 | % | | 3.9 | % | | 1.0 | % | | |

| Selling, general and administrative expenses | | 4,520 | | | 10,550 | | | (6,030) | | | (57) | % | | 14,052 | | | 20,455 | | | (6,403) | | | (31) | % |

| Selling, general and administrative expenses as a % of sales | | 4.1 | % | | 8.7 | % | | (4.6) | % | | | | 6.8 | % | | 8.6 | % | | (1.8) | % | | |

| | | | | | | | | | | | | | | | |

| Amortization of intangible assets | | 365 | | | 437 | | | (72) | | | (16) | % | | 730 | | | 873 | | | (143) | | | (16) | % |

| Total operating expenses | | 9,844 | | | 15,649 | | | (5,805) | | | (37) | % | | 24,938 | | | 30,594 | | | (5,656) | | | (18) | % |

| Operating income | | 25,344 | | | 11,305 | | | 14,039 | | | 124 | % | | 36,006 | | | 19,829 | | | 16,177 | | | 82 | % |

| | | | | | | | | | | | | | | | |

Interest expense (from related parties $2,216 and $1,816 for the three months ended June 30, 2024 and 2023, respectively, and 4,438 and 3,799 for the six months ended June 30, 2024 and June 30, 2023, respectively) | | 2,909 | | | 4,645 | | | (1,736) | | | (37) | % | | 6,255 | | | 9,310 | | | (3,055) | | | (33) | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Income before income taxes | | 22,435 | | | 6,660 | | | 15,775 | | | NM | | 29,751 | | | 10,519 | | | 19,232 | | | 183 | % |

| Income tax expense | | 895 | | | 243 | | | 652 | | | NM | | 1,096 | | | 378 | | | 718 | | | 190 | % |

| Net income | | $ | 21,540 | | | $ | 6,417 | | | $ | 15,123 | | | 236 | % | | $ | 28,655 | | | $ | 10,141 | | | $ | 18,514 | | | 183 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Earnings per common share: | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.94 | | | $ | 0.28 | | | $ | 0.66 | | | NM | | $ | 1.25 | | | $ | 0.44 | | | $ | 0.81 | | | 184 | % |

| Diluted | | $ | 0.94 | | | $ | 0.28 | | | $ | 0.66 | | | NM | | $ | 1.25 | | | $ | 0.44 | | | $ | 0.81 | | | 184 | % |

| | | | | | | | | | | | | | | | |

| Non-GAAP Financial Measures: | | | | | | | | | | | | | | | | |

| Adjusted net income * | | $ | 16,559 | | | $ | 6,357 | | | $ | 10,202 | | | 160 | % | | $ | 23,600 | | | $ | 10,168 | | | $ | 13,432 | | | 132 | % |

| Adjusted net income per share – diluted* | | $ | 0.72 | | | $ | 0.28 | | | $ | 0.44 | | | 157 | % | | $ | 1.04 | | | $ | 0.44 | | | $ | 0.60 | | | 136 | % |

| EBITDA * | | $ | 26,662 | | | $ | 12,707 | | | $ | 13,955 | | | 110 | % | | $ | 38,641 | | | $ | 22,677 | | | $ | 15,964 | | | 70 | % |

| Adjusted EBITDA * | | $ | 21,681 | | | $ | 12,647 | | | $ | 9,034 | | | 71 | % | | $ | 33,586 | | | $ | 22,704 | | | $ | 10,882 | | | 48 | % |

NM Not meaningful

* See reconciliation of non-GAAP financial measures to GAAP results below

POWER SOLUTIONS INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | |

| (in thousands, except par values) | | As of June 30, 2024 (unaudited) | | As of December 31, 2023 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 28,801 | | | $ | 22,758 | |

| Restricted cash | | 3,191 | | | 3,836 | |

Accounts receivable, net of allowances of $5,367 and $5,975 as of June 30, 2024 and December 31, 2023, respectively; (from related parties $818 and $777 as of June 30, 2024 and December 31, 2023, respectively) | | 64,260 | | | 66,979 | |

| Income tax receivable | | 293 | | | 550 | |

| Inventories, net | | 93,446 | | | 84,947 | |

| Prepaid expenses and other current assets | | 41,613 | | | 26,312 | |

| | | | |

| Total current assets | | 231,604 | | | 205,382 | |

| Property, plant and equipment, net | | 14,625 | | | 14,928 | |

| Right-of-use assets, net | | 25,343 | | | 27,145 | |

| Intangible assets, net | | 3,184 | | | 3,914 | |

| Goodwill | | 29,835 | | | 29,835 | |

| | | | |

| Other noncurrent assets | | 2,971 | | | 3,099 | |

| TOTAL ASSETS | | $ | 307,562 | | | $ | 284,303 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | |

| Current liabilities: | | | | |

Accounts payable (to related parties $25,500 and $24,496 as of June 30, 2024 and December 31, 2023, respectively) | | $ | 66,945 | | | $ | 67,355 | |

| Current maturities of long-term debt | | 96 | | | 139 | |

| Revolving line of credit | | 40,000 | | | 50,000 | |

| Finance lease liability, current | | 77 | | | 76 | |

| Operating lease liability, current | | 4,246 | | | 3,912 | |

Other short-term financing (from related parties $94,820 as of both June 30, 2024 and December 31, 2023) | | 94,820 | | | 94,820 | |

Other accrued liabilities (to related parties $2,216 and $1,833 as of June 30, 2024 and December 31, 2023, respectively) | | 37,659 | | | 31,999 | |

| Total current liabilities | | 243,843 | | | 248,301 | |

| | | | |

| Deferred income taxes | | 1,586 | | | 1,478 | |

| Long-term debt, net of current maturities | | 64 | | | 90 | |

| Finance lease liability, long-term | | 55 | | | 94 | |

| Operating lease liability, long-term | | 23,004 | | | 25,070 | |

| Noncurrent contract liabilities | | 2,042 | | | 2,401 | |

| Other noncurrent liabilities | | 12,203 | | | 10,786 | |

| TOTAL LIABILITIES | | $ | 282,797 | | | $ | 288,220 | |

| | | | |

| Commitments and Contingencies (Note 9) | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| STOCKHOLDERS’ EQUITY (DEFICIT) | | | | |

Preferred stock – $0.001 par value. Shares authorized: 5,000. No shares issued and outstanding at all dates. | | $ | — | | | $ | — | |

Common stock – $0.001 par value; 50,000 shares authorized; 23,117 shares issued; 22,975 and 22,968 shares outstanding at June 30, 2024 and December 31, 2023, respectively | | 23 | | | 23 | |

| Additional paid-in capital | | 157,737 | | | 157,770 | |

| Accumulated deficit | | (132,135) | | | (160,790) | |

Treasury stock, at cost, 142 and 149 shares at June 30, 2024 and December 31, 2023, respectively | | (860) | | | (920) | |

| TOTAL STOCKHOLDERS’ EQUITY (DEFICIT) | | 24,765 | | | (3,917) | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | $ | 307,562 | | | $ | 284,303 | |

See Notes to Consolidated Financial Statements

POWER SOLUTIONS INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cash provided by operating activities | | | | | | | | |

| Net income | | $ | 21,540 | | | $ | 6,417 | | | $ | 28,655 | | | $ | 10,141 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| Amortization of intangible assets | | 365 | | | 437 | | | 730 | | | 873 | |

| Depreciation | | 953 | | | 965 | | | 1,905 | | | 1,975 | |

| | | | | | | | |

| Stock-based compensation expense | | 22 | | | 37 | | | 48 | | | 106 | |

| Amortization of financing fees | | 29 | | | 245 | | | 273 | | | 694 | |

| Deferred income taxes | | 54 | | | 26 | | | 108 | | | 87 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| (Credit) for losses in accounts receivable | | (109) | | | (4,114) | | | (608) | | | (3,704) | |

| Increase in allowance for inventory obsolescence | | 405 | | | 914 | | | 1,351 | | | 1,798 | |

| | | | | | | | |

| Other adjustments, net | | 51 | | | (11) | | | 51 | | | (8) | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | (14,860) | | | 8,995 | | | 3,327 | | | 15,402 | |

| Inventories | | (5,052) | | | 18,140 | | | (9,850) | | | 5,547 | |

| Prepaid expenses, right-of-use assets and other assets | | (6,190) | | | 1,088 | | | (12,388) | | | 510 | |

| Accounts payable | | (5,883) | | | (8,872) | | | (538) | | | (5,433) | |

| Income taxes receivable | | 119 | | | — | | | 257 | | | — | |

| Accrued expenses | | 8,986 | | | (2,220) | | | 5,458 | | | (1,754) | |

| Other noncurrent liabilities | | 1,104 | | | (474) | | | (1,615) | | | 340 | |

| Net cash provided by operating activities | | 1,534 | | | 21,573 | | | 17,164 | | | 26,574 | |

| Cash used in investing activities | | | | | | | | |

| Capital expenditures | | (712) | | | (642) | | | (1,527) | | | (1,254) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash used in investing activities | | (712) | | | (642) | | | (1,527) | | | (1,254) | |

| Cash used in financing activities | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Repayment of long-term debt and lease liabilities | | (51) | | | (47) | | | (102) | | | (100) | |

| Repayment of short-term financings | | (5,000) | | | (20,000) | | | (10,000) | | | (20,594) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Payments of deferred financing costs | | 13 | | | 2 | | | (117) | | | (984) | |

| Tax benefit from exercise of stock based compensation | | (20) | | | — | | | (20) | | | — | |

| | | | | | | | |

| | | | | | | | |

| Net cash used in financing activities | | (5,058) | | | (20,045) | | | (10,239) | | | (21,678) | |

| Net increase in cash, cash equivalents, and restricted cash | | (4,236) | | | 886 | | | 5,398 | | | 3,642 | |

| Cash, cash equivalents, and restricted cash at beginning of the period | | 36,228 | | | 30,656 | | | 26,594 | | | 27,900 | |

| Cash, cash equivalents, and restricted cash at end of the period | | $ | 31,992 | | | $ | 31,542 | | | $ | 31,992 | | | $ | 31,542 | |

Non-GAAP Financial Measures

In addition to the results provided in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) above, this press release also includes non-GAAP (adjusted) financial measures. Non-GAAP financial measures provide insight into selected financial information and should be evaluated in the context in which they are presented. These non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP, and non-GAAP financial measures as reported by the Company may not be comparable to similarly titled amounts reported by other companies. The non-GAAP financial measures should be considered in conjunction with the consolidated financial statements, including the related notes, and Management’s Discussion and Analysis of Financial Condition and Results of Operations within the Company’s Form 10-Q for the quarter ended June 30, 2024. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated below.

| | | | | |

| Non-GAAP Financial Measure | Comparable GAAP Financial Measure |

| Adjusted net income | Net income |

| Adjusted net income per share – diluted | Net income per share – diluted |

| EBITDA | Net income |

| Adjusted EBITDA | Net income |

The Company believes that Adjusted net income, Adjusted net income per share – diluted, EBITDA, and Adjusted EBITDA provide relevant and useful information, which is widely used by analysts, investors and competitors in its industry as well as by the Company’s management in assessing the performance of the Company. Adjusted net income is defined as net income as adjusted for certain items that the Company believes are not indicative of its ongoing operating performance. Adjusted net income per share – diluted is a measure of the Company’s diluted earnings per common share adjusted for the impact of special items. EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes. Adjusted EBITDA further excludes the effects of other non-cash charges and certain other items that do not reflect the ordinary earnings of the Company’s operations.

Adjusted net income, Adjusted net income per share – diluted, EBITDA, and Adjusted EBITDA are used by management for various purposes, including as a measure of performance of the Company’s operations and as a basis for strategic planning and forecasting. Adjusted net income, Adjusted net income per share – diluted, and Adjusted EBITDA may be useful to an investor because these measures are widely used to evaluate companies’ operating performance without regard to items excluded from the calculation of such measures, which can vary substantially from company to company depending on the accounting methods, the book value of assets, the capital structure and the method by which the assets were acquired, among other factors. They are not, however, intended as alternative measures of operating results or cash flow from operations as determined in accordance with U.S. GAAP.

The following table presents a reconciliation from Net income to Adjusted net income for the three and six months ended June 30, 2024 and 2023 (UNAUDITED):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 21,540 | | | $ | 6,417 | | | $ | 28,655 | | | $ | 10,141 | |

| | | | | | | | |

Stock-based compensation 1 | | 22 | | | 37 | | | 48 | | | 106 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Other legal matters 2 | | (5,003) | | | 3 | | | (5,103) | | | 21 | |

Insurance proceeds 3 | | — | | | (100) | | | — | | | (100) | |

| | | | | | | | |

| | | | | | | | |

| Adjusted net income | | $ | 16,559 | | | $ | 6,357 | | | $ | 23,600 | | | $ | 10,168 | |

The following table presents a reconciliation from Net income per share – diluted to Adjusted net income per share – diluted for the three and six months ended June 30, 2024 and 2023 (UNAUDITED):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income per share – basic | | $ | 0.94 | | | $ | 0.28 | | | $ | 1.25 | | | $ | 0.44 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Other legal matters 2 | | (0.22) | | | — | | | (0.21) | | | — | |

| | | | | | | | |

| | | | | | | | |

| Adjusted net income per share – diluted | | $ | 0.72 | | | $ | 0.28 | | | $ | 1.04 | | | $ | 0.44 | |

| | | | | | | | |

| Diluted shares (in thousands) | | 22,993 | | 22,966 | | 22,983 | | 22,967 |

The following table presents a reconciliation from Net income to EBITDA and Adjusted EBITDA for the three and six months ended June 30, 2024 and 2023 (UNAUDITED):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | For the Three Months Ended June 30, | | For the Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 21,540 | | | $ | 6,417 | | | $ | 28,655 | | | $ | 10,141 | |

| Interest expense | | 2,909 | | | 4,645 | | | 6,255 | | | 9,310 | |

| Income tax expense | | 895 | | | 243 | | | 1,096 | | | 378 | |

| Depreciation | | 953 | | | 965 | | | 1,905 | | | 1,975 | |

| Amortization of intangible assets | | 365 | | | 437 | | | 730 | | | 873 | |

| EBITDA | | 26,662 | | | 12,707 | | | 38,641 | | | 22,677 | |

| | | | | | | | |

Stock-based compensation 1 | | 22 | | | 37 | | | 48 | | | 106 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Other legal matters 2 | | (5,003) | | | 3 | | | (5,103) | | | 21 | |

Insurance proceeds 3 | | — | | | (100) | | | — | | | (100) | |

| Adjusted EBITDA | | $ | 21,681 | | | $ | 12,647 | | | $ | 33,586 | | | $ | 22,704 | |

1.Amounts reflect non-cash stock-based compensation expense and have no material impact on the Adjusted net income per share – diluted for the three and six months ended June 30, 2024 and 2023.

2.Amounts include legal settlements for the three and six months ended June 30, 2024 and 2023.

3.Amounts include insurance recoveries related to a prior year incident and have no material impact on the Adjusted net income per share – diluted for the three and six months ended June 30, 2024 and 2023.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

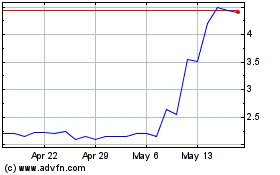

Power Solutions (PK) (USOTC:PSIX)

Historical Stock Chart

From Dec 2024 to Dec 2024

Power Solutions (PK) (USOTC:PSIX)

Historical Stock Chart

From Dec 2023 to Dec 2024